Key Insights

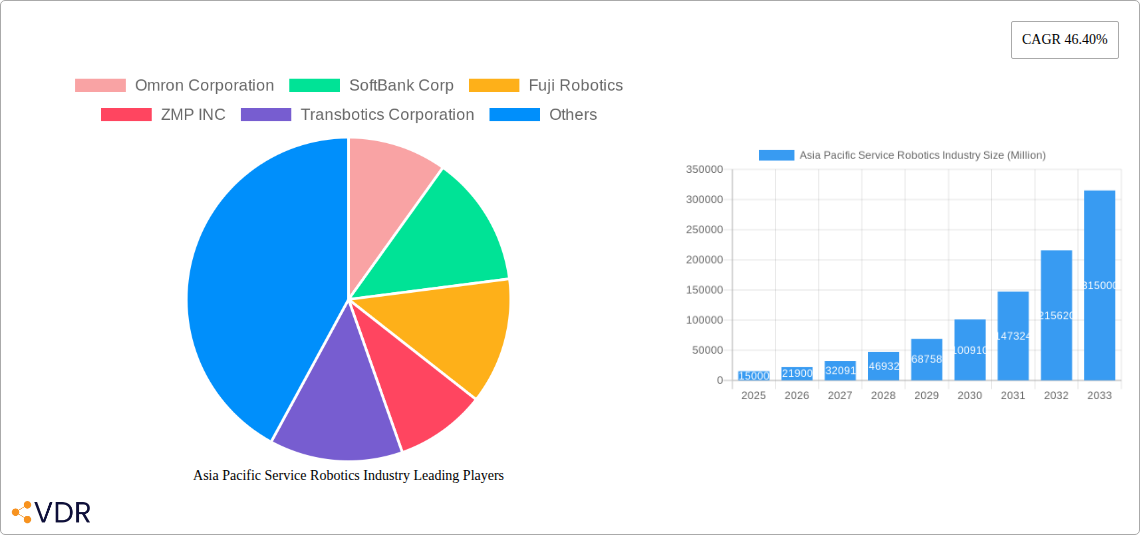

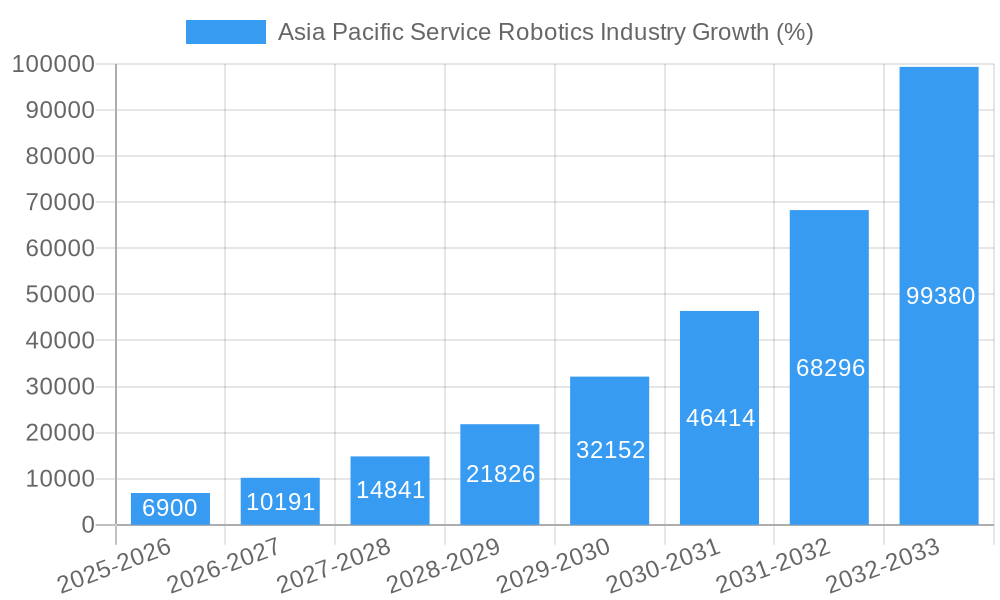

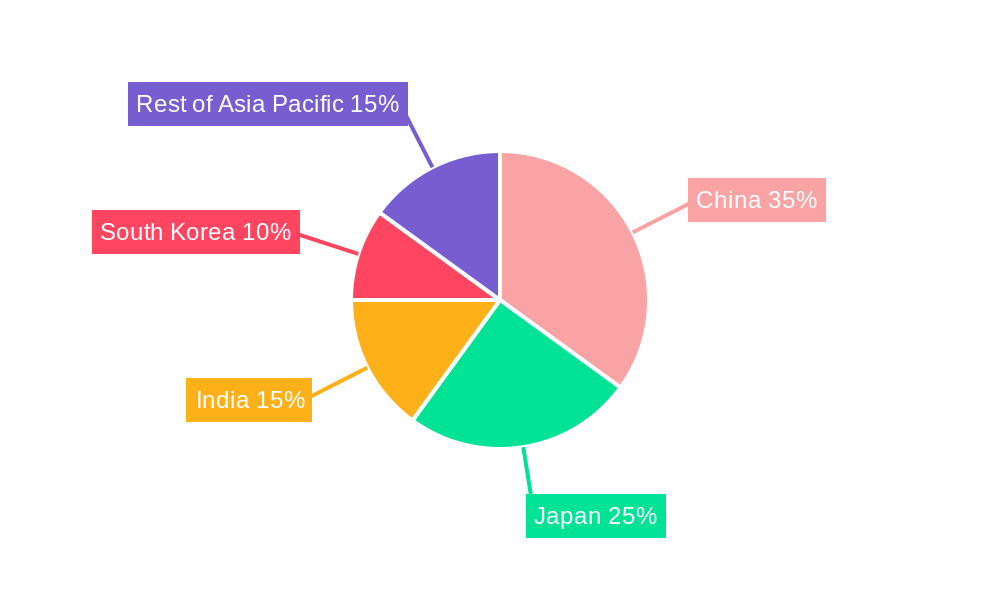

The Asia-Pacific service robotics market is experiencing explosive growth, projected to reach a substantial market size driven by increasing automation across diverse sectors. A 46.40% CAGR from 2019 to 2024 indicates a rapidly expanding market, fueled by several key factors. The rising adoption of robots in healthcare (e.g., surgical robots, elderly care assistance), logistics (e.g., automated warehousing and delivery), and the booming e-commerce sector are major contributors. Furthermore, governments across the region are actively promoting technological advancements and automation through supportive policies and initiatives, further accelerating market expansion. China, Japan, South Korea, and India are leading the charge, with significant investments in research and development and a growing demand for efficient and cost-effective robotic solutions. The segmentation into professional and personal robots reveals a diversified market, with professional robots dominating the current landscape due to widespread adoption in industries like manufacturing, healthcare and logistics, though personal robotics is poised for considerable future expansion. While challenges remain, such as high initial investment costs and concerns over job displacement, the long-term growth trajectory remains incredibly positive.

The market segmentation reveals further opportunities. Within applications, military and defense, agriculture (particularly in labor-intensive farming), and construction and mining are showcasing the highest growth potential, driven by the need for increased productivity and safety. Transportation and logistics benefit from the efficiency gains offered by automated systems, particularly in last-mile delivery and warehousing. The 'other applications' segment highlights the emerging uses of service robots in diverse areas, promising further expansion. Key players like Omron, SoftBank, and others are strategically positioned to capitalize on this growth, with ongoing innovation in robotic design, AI integration, and connectivity fueling the expansion. While data limitations prevent precise numerical projections, the dynamic interplay of technological advancements, supportive government policies, and evolving consumer preferences paints a vibrant picture of future market expansion in the Asia-Pacific region.

This comprehensive report provides an in-depth analysis of the Asia Pacific service robotics industry, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes both parent markets (service robotics) and child markets (professional and personal robots across various applications) to provide a complete understanding of this rapidly evolving sector. Market values are presented in Million units.

Asia Pacific Service Robotics Industry Market Dynamics & Structure

This section analyzes the market structure of the Asia Pacific service robotics industry, considering market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A activity. The market is characterized by a moderately concentrated landscape with several key players holding significant market share. Technological innovation is a crucial driver, with continuous advancements in AI, robotics, and sensor technologies shaping product development and applications. Regulatory frameworks vary across countries, influencing market access and adoption. The competitive landscape includes both established robotics companies and emerging startups.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Key drivers include advancements in AI, computer vision, and sensor technologies.

- Regulatory Landscape: Varying regulations across countries impact market entry and product approvals.

- Competitive Substitutes: Traditional manual labor and simpler automated systems pose competition in certain segments.

- End-User Demographics: Growth is driven by increasing demand from healthcare, logistics, and manufacturing sectors.

- M&A Activity: An estimated xx M&A deals occurred between 2019-2024, indicating significant consolidation in the market.

Asia Pacific Service Robotics Industry Growth Trends & Insights

This section analyzes the historical and projected growth trajectory of the Asia Pacific service robotics market. The market exhibits significant growth potential, driven by factors such as increasing automation needs across various industries, rising labor costs, and technological advancements. The analysis includes detailed metrics like CAGR and market penetration for key segments. Factors such as consumer adoption rates, technological disruption, and evolving consumer behavior are deeply explored. Analysis incorporates data from industry reports, market research, and company filings. xx illustrates the expected market size evolution and adoption rates throughout the forecast period, highlighting technological disruption and its impact on market dynamics.

- CAGR (2025-2033): xx%

- Market Size (2025): xx Million Units

- Market Size (2033): xx Million Units

- Market Penetration (2025): xx%

Dominant Regions, Countries, or Segments in Asia Pacific Service Robotics Industry

This section pinpoints the leading regions, countries, and segments within the Asia Pacific service robotics market driving overall growth. China and Japan are expected to remain dominant due to robust manufacturing sectors, technological advancements, and government support. The healthcare and logistics segments show exceptional growth potential.

- Leading Region: China

- Leading Country: China

- Leading Segment (Type): Professional Robots

- Leading Segment (Application): Logistics and Healthcare

- Key Drivers (China): Strong government initiatives promoting automation, a large manufacturing base, and a growing middle class.

- Key Drivers (Japan): Advanced robotics technology, skilled workforce, and focus on automation in aging society.

- Key Drivers (Healthcare Segment): Increasing demand for elderly care, surgical robots, and improved healthcare efficiency.

- Key Drivers (Logistics Segment): E-commerce growth, demand for efficient delivery systems, and supply chain optimization.

Asia Pacific Service Robotics Industry Product Landscape

The Asia Pacific service robotics market showcases a diverse range of products, including professional service robots for industrial and commercial use, and personal service robots for domestic applications. Advancements in AI, computer vision, and sensor technologies are continuously improving robot performance, autonomy, and user-friendliness. Products are differentiated by features such as payload capacity, dexterity, navigation systems, and specific functionalities tailored to particular applications. Innovative features, such as advanced AI algorithms for improved decision-making and human-robot interaction capabilities, are key selling points.

Key Drivers, Barriers & Challenges in Asia Pacific Service Robotics Industry

Key Drivers:

- Increasing automation needs across industries.

- Rising labor costs and labor shortages.

- Technological advancements in AI, robotics, and sensor technologies.

- Government support and initiatives promoting automation.

Key Barriers and Challenges:

- High initial investment costs for robotics systems.

- Concerns about job displacement due to automation.

- Lack of skilled workforce to operate and maintain robots.

- Regulatory hurdles and safety concerns. These issues contribute to approximately xx% of delayed deployments.

Emerging Opportunities in Asia Pacific Service Robotics Industry

The Asia Pacific service robotics market presents several emerging opportunities. Untapped markets in developing countries present significant growth potential. Innovative applications in agriculture, healthcare, and elder care are expected to drive demand. Evolving consumer preferences for convenience and automation create new market segments for personal robots.

Growth Accelerators in the Asia Pacific Service Robotics Industry

Several factors will accelerate long-term growth. Technological breakthroughs in AI, machine learning, and sensor fusion will enhance robot capabilities. Strategic partnerships between robotics companies and end-users will facilitate wider adoption. Market expansion strategies targeting underserved segments and regions will fuel market expansion.

Key Players Shaping the Asia Pacific Service Robotics Industry Market

- Omron Corporation

- SoftBank Corp

- Fuji Robotics

- ZMP INC

- Transbotics Corporation

- CtrlWorks Pte Ltd

- Aubot Pty Ltd

- SIASUN Robot & Automation Co Ltd

- Yukai Engineering Inc

- iRobot Corporation

- Minirobot

- Hyundai Robotics

- LG Electronics Inc

- Inbot Technology Ltd

- Ecovacs Robotics Co Ltd

- FBR Ltd

- Robomation

- UBTECH Robotics Inc

- Machine Development Technology Co Ltd

- Hanwha Corporation

- Shandong Guoxing Intelligent Technology Co Ltd

- Robosoft Technologies Private Limited

- Milagrow HumanTech

- AiTreat

- Rainbow Robotics Co Ltd

Notable Milestones in Asia Pacific Service Robotics Industry Sector

- 2020: Launch of a new generation of collaborative robots by xx company.

- 2021: Significant investment in AI-powered robotics by xx government agency.

- 2022: Acquisition of xx robotics company by xx larger corporation.

- 2023: Introduction of new regulations impacting the service robotics market in xx country.

- 2024: Successful field trials of autonomous delivery robots in xx city.

In-Depth Asia Pacific Service Robotics Industry Market Outlook

The Asia Pacific service robotics market presents a strong outlook for future growth. Continued technological advancements, strategic partnerships, and expanding applications will drive market expansion. New opportunities exist in emerging economies and underserved sectors, creating a dynamic and promising landscape for industry players. The market is poised for significant growth, presenting substantial opportunities for investment and innovation.

Asia Pacific Service Robotics Industry Segmentation

-

1. Type

-

1.1. Professional Robots

- 1.1.1. Logistic systems

- 1.1.2. Medical robots

- 1.1.3. Powered Human Exoskeletons

- 1.1.4. Public relation robots

-

1.2. Personal Robots

- 1.2.1. Domestic

- 1.2.2. Entertainment

- 1.2.3. Elderly and Handicap Assistance

-

1.1. Professional Robots

-

2. Application

- 2.1. Military and Defense

- 2.2. Agriculture, Construction, and Mining

- 2.3. Transportation and Logistics

- 2.4. Healthcare

- 2.5. Government

- 2.6. Other Applications

Asia Pacific Service Robotics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Service Robotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 46.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Automated Solutions from Dynamic Industries and Robot Innovations; Increased Demand for Professional Robots in Healthcare

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Installation

- 3.4. Market Trends

- 3.4.1. Logistic Systems is Expected to Witness Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Professional Robots

- 5.1.1.1. Logistic systems

- 5.1.1.2. Medical robots

- 5.1.1.3. Powered Human Exoskeletons

- 5.1.1.4. Public relation robots

- 5.1.2. Personal Robots

- 5.1.2.1. Domestic

- 5.1.2.2. Entertainment

- 5.1.2.3. Elderly and Handicap Assistance

- 5.1.1. Professional Robots

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military and Defense

- 5.2.2. Agriculture, Construction, and Mining

- 5.2.3. Transportation and Logistics

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Service Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Omron Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 SoftBank Corp

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fuji Robotics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ZMP INC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Transbotics Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 CtrlWorks Pte Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Aubot Pty Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 SIASUN Robot & Automation Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Yukai Engineering Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 iRobot Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Minirobot

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Hyundai Robotics

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 LG Electronics Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Inbot Technology Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Ecovacs Robotics Co Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 FBR Ltd

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Robomation

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 UBTECH Robotics Inc

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Machine Development Technology Co Ltd

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Hanwha Corporation

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 Shandong Guoxing Intelligent Technology Co Ltd

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.22 Robosoft Technologies Private Limited

- 13.2.22.1. Overview

- 13.2.22.2. Products

- 13.2.22.3. SWOT Analysis

- 13.2.22.4. Recent Developments

- 13.2.22.5. Financials (Based on Availability)

- 13.2.23 Milagrow HumanTech

- 13.2.23.1. Overview

- 13.2.23.2. Products

- 13.2.23.3. SWOT Analysis

- 13.2.23.4. Recent Developments

- 13.2.23.5. Financials (Based on Availability)

- 13.2.24 AiTreat

- 13.2.24.1. Overview

- 13.2.24.2. Products

- 13.2.24.3. SWOT Analysis

- 13.2.24.4. Recent Developments

- 13.2.24.5. Financials (Based on Availability)

- 13.2.25 Rainbow Robotics Co Ltd

- 13.2.25.1. Overview

- 13.2.25.2. Products

- 13.2.25.3. SWOT Analysis

- 13.2.25.4. Recent Developments

- 13.2.25.5. Financials (Based on Availability)

- 13.2.1 Omron Corporation

List of Figures

- Figure 1: Asia Pacific Service Robotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Service Robotics Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Asia Pacific Service Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Service Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Service Robotics Industry?

The projected CAGR is approximately 46.40%.

2. Which companies are prominent players in the Asia Pacific Service Robotics Industry?

Key companies in the market include Omron Corporation, SoftBank Corp, Fuji Robotics, ZMP INC, Transbotics Corporation, CtrlWorks Pte Ltd, Aubot Pty Ltd, SIASUN Robot & Automation Co Ltd, Yukai Engineering Inc, iRobot Corporation, Minirobot, Hyundai Robotics, LG Electronics Inc, Inbot Technology Ltd, Ecovacs Robotics Co Ltd, FBR Ltd, Robomation, UBTECH Robotics Inc, Machine Development Technology Co Ltd, Hanwha Corporation, Shandong Guoxing Intelligent Technology Co Ltd, Robosoft Technologies Private Limited, Milagrow HumanTech, AiTreat, Rainbow Robotics Co Ltd.

3. What are the main segments of the Asia Pacific Service Robotics Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Automated Solutions from Dynamic Industries and Robot Innovations; Increased Demand for Professional Robots in Healthcare.

6. What are the notable trends driving market growth?

Logistic Systems is Expected to Witness Significant Growth Rate.

7. Are there any restraints impacting market growth?

; High Cost of Installation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Service Robotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Service Robotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Service Robotics Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Service Robotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence