Key Insights

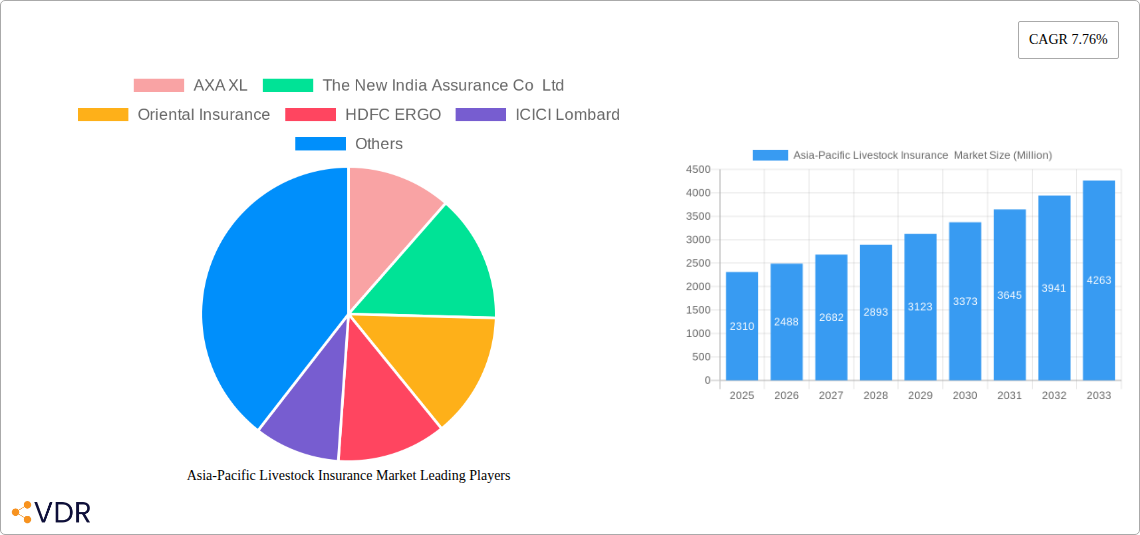

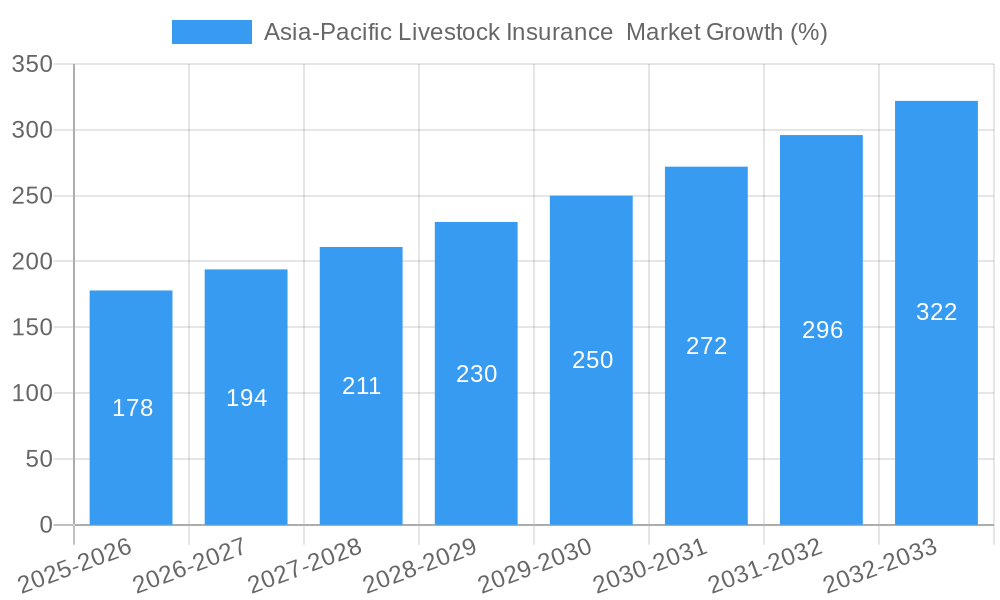

The Asia-Pacific livestock insurance market, valued at $2.31 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 7.76% from 2025 to 2033. This expansion is fueled by several key factors. Increasing awareness among livestock farmers about the risks associated with disease outbreaks, climate change impacts (such as droughts and floods), and theft is leading to higher demand for insurance coverage. Government initiatives promoting agricultural insurance schemes and providing subsidies are further stimulating market growth. Technological advancements, including the use of data analytics and remote sensing technologies for risk assessment and claim processing, are streamlining operations and improving efficiency. The rising adoption of precision livestock farming, which enhances animal health management and productivity, indirectly boosts the demand for insurance as farmers invest more in their livestock. Furthermore, the increasing integration of insurance products with other agricultural services, such as credit and veterinary care, is facilitating broader market penetration.

However, challenges remain. The penetration rate of livestock insurance in the Asia-Pacific region is still relatively low compared to other developed markets. This is partly due to factors such as low farmer incomes, limited access to financial services in rural areas, and a lack of awareness among farmers about the benefits of insurance. The complexities involved in assessing and managing risks associated with livestock, such as disease outbreaks and unpredictable weather patterns, also pose significant challenges to insurers. Despite these hurdles, the long-term outlook for the Asia-Pacific livestock insurance market remains positive, with significant opportunities for growth across various segments and regions within the Asia-Pacific. Key players like AXA XL, The New India Assurance Co Ltd, and others are strategically positioned to capitalize on this growth.

Asia-Pacific Livestock Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific livestock insurance market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, and future opportunities across various segments and geographies. The report also includes a granular analysis of key players, notable milestones, and emerging opportunities within the parent market of agricultural insurance and the child market of livestock specific insurance.

Asia-Pacific Livestock Insurance Market Dynamics & Structure

The Asia-Pacific livestock insurance market is characterized by a moderately concentrated landscape, with key players such as AXA XL, The New India Assurance Co Ltd, and Zurich Insurance PLC holding significant market share. The market's structure is influenced by several factors:

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: Adoption of digital technologies like telematics and AI-powered risk assessment is driving innovation, but high initial investment costs and data accessibility challenges remain barriers.

- Regulatory Frameworks: Varying regulatory landscapes across different countries within the Asia-Pacific region influence market growth and product offerings. Streamlining regulations and promoting cross-border insurance solutions could boost market expansion.

- Competitive Product Substitutes: Traditional risk-mitigation strategies, such as community-based risk sharing, pose competition. However, insurance offers a more structured and financially sound approach to risk management.

- End-User Demographics: The market is primarily driven by smallholder farmers and commercial livestock producers. Reaching and educating diverse farming communities is crucial for market expansion.

- M&A Trends: A modest number of M&A deals (xx in 2024) have been observed in recent years, indicating strategic consolidation within the market. Further consolidation is anticipated, driven by economies of scale and expansion strategies.

Asia-Pacific Livestock Insurance Market Growth Trends & Insights

The Asia-Pacific livestock insurance market is projected to witness robust growth, with a CAGR of xx% from 2025 to 2033. This growth is fueled by several factors: rising livestock populations, increasing awareness of insurance benefits, supportive government policies, and technological advancements that improve risk assessment and claims processing. Market penetration remains relatively low in several countries, signifying substantial untapped potential. Consumer behavior is gradually shifting towards greater adoption of insurance, particularly among commercial livestock farmers seeking risk mitigation. Technological disruptions, including the use of IoT devices for livestock monitoring, will significantly impact risk assessment and pricing strategies. The market size is expected to reach xx Million by 2033, up from xx Million in 2025.

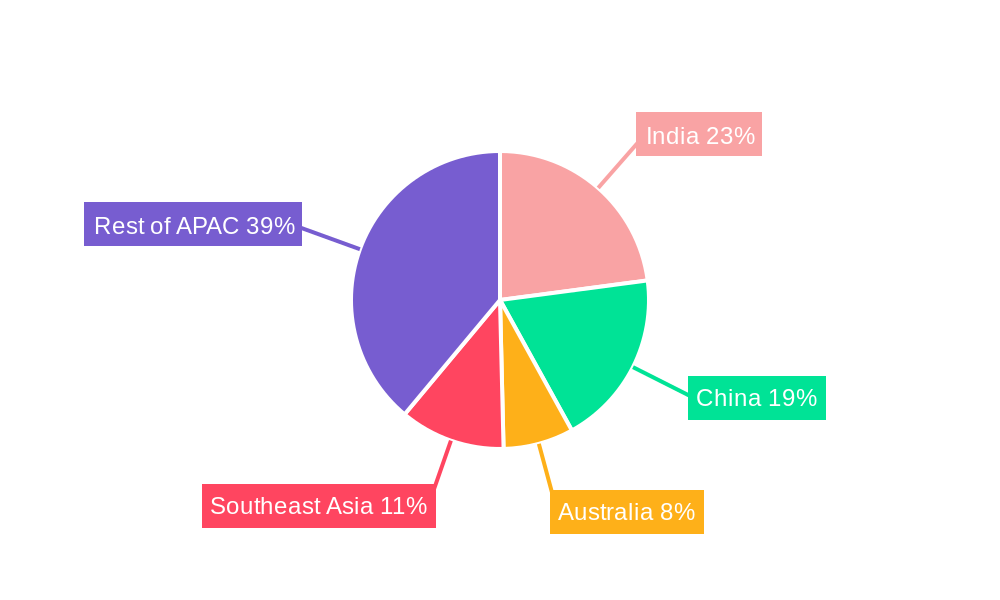

Dominant Regions, Countries, or Segments in Asia-Pacific Livestock Insurance Market

India and China are currently the dominant markets, owing to their large livestock populations and evolving agricultural landscapes. However, other countries like Bangladesh, Vietnam, and Australia exhibit significant growth potential. Factors contributing to regional dominance include:

- India: Strong government support through schemes like Pradhan Mantri Fasal Bima Yojana (PMFBY), expanding to livestock insurance.

- China: Increasing demand from commercial farms and government initiatives aimed at modernizing agriculture.

- Bangladesh: Recent investments in livestock identification systems (BINLI) and increasing awareness of insurance benefits.

- Other countries: Growing middle class, increased disposable income, and favorable government policies in developing nations are driving growth.

Further segmentation by livestock type (e.g., poultry, cattle, swine) reveals varying growth rates, with poultry insurance exhibiting comparatively higher adoption rates due to its high concentration and vulnerability to diseases.

Asia-Pacific Livestock Insurance Market Product Landscape

The product landscape is diversifying, with offerings ranging from traditional mortality and morbidity insurance to parametric products that offer coverage based on pre-defined weather events. Innovative products utilize telematics and remote sensing technologies to provide accurate risk assessment and efficient claims processing. Unique selling propositions include tailored coverage based on specific livestock breeds, disease prevalence, and geographical location. Technological advancements in data analytics and machine learning are revolutionizing risk profiling, pricing, and claims management, leading to more efficient and customized insurance solutions.

Key Drivers, Barriers & Challenges in Asia-Pacific Livestock Insurance Market

Key Drivers:

- Rising livestock populations and value: Increasing livestock numbers raise the potential for economic losses, fueling insurance demand.

- Government initiatives and subsidies: Government support through insurance schemes increases farmer participation.

- Technological advancements: Improved risk assessment and claims processing through technology.

Key Challenges and Restraints:

- Data scarcity and inaccuracy: Insufficient and reliable data on livestock populations and disease prevalence hinder accurate risk assessment.

- High administrative costs: Managing claims for numerous smallholder farmers can lead to high operational costs.

- Lack of awareness among farmers: Limited awareness of the benefits of livestock insurance limits market penetration. Furthermore, limited access to financial services and literacy pose significant obstacles.

Emerging Opportunities in Asia-Pacific Livestock Insurance Market

- Untapped potential in Southeast Asia: Significant growth opportunities exist in Southeast Asian countries with rapidly expanding livestock sectors.

- Development of microinsurance products: Tailored insurance products for smallholder farmers, addressing affordability and accessibility.

- Integration with technology platforms: Utilizing mobile technology for distribution and claims processing.

Growth Accelerators in the Asia-Pacific Livestock Insurance Market Industry

Long-term growth will be fueled by strategic partnerships between insurance companies, technology providers, and government agencies. Investments in data infrastructure and technological innovation will play a vital role in expanding market penetration. Developing customized insurance products tailored to specific needs and risk profiles will further enhance market growth. Furthermore, educating farmers about the benefits of livestock insurance is crucial for long-term success.

Key Players Shaping the Asia-Pacific Livestock Insurance Market Market

- AXA XL

- The New India Assurance Co Ltd

- Oriental Insurance

- HDFC ERGO

- ICICI Lombard

- Chubb

- QBE Insurance Group

- Zurich Insurance PLC

- Reliance General Insurance

- Royal Sundaram

Notable Milestones in Asia-Pacific Livestock Insurance Market Sector

- May 2024: Bangladesh launches BINLI, an online cattle identification and registration system, improving data accessibility for livestock insurance. This system aims to register 50,000 cattle by 2025.

- April 2023: The Agriculture Insurance Company of India Limited (AIC) expands into livestock insurance with products like 'Saral Krishi Bima' and 'Sampoorna Pasudhan Kavach,' increasing coverage and demonstrating innovation in parametric insurance.

In-Depth Asia-Pacific Livestock Insurance Market Outlook

The Asia-Pacific livestock insurance market presents significant growth opportunities, driven by favorable demographics, increasing livestock value, technological advancements, and supportive government policies. Strategic investments in data infrastructure, product innovation, and farmer education are key to unlocking the market's full potential. The focus on developing tailored insurance solutions and leveraging technology for efficient risk assessment and claims processing will be crucial for market leaders. The market is expected to experience sustained growth throughout the forecast period, driven by expansion into underserved markets and the development of innovative products.

Asia-Pacific Livestock Insurance Market Segmentation

-

1. Coverage

- 1.1. Mortality

- 1.2. Revenue

- 1.3. Other Types of Coverages

-

2. Animal Type

- 2.1. Bovine

- 2.2. Swine

- 2.3. Other Animal Types

-

3. Distribution

- 3.1. Direct Sales

- 3.2. Agent & Brokers

- 3.3. Bancassurance

- 3.4. Other Distribution Modes

Asia-Pacific Livestock Insurance Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Livestock Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture

- 3.3. Market Restrains

- 3.3.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture

- 3.4. Market Trends

- 3.4.1. APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Mortality

- 5.1.2. Revenue

- 5.1.3. Other Types of Coverages

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Bovine

- 5.2.2. Swine

- 5.2.3. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution

- 5.3.1. Direct Sales

- 5.3.2. Agent & Brokers

- 5.3.3. Bancassurance

- 5.3.4. Other Distribution Modes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AXA XL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The New India Assurance Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oriental Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HDFC ERGO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICICI Lombard

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QBE Insurance Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zurich Insurance PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reliance General Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Sundaram

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AXA XL

List of Figures

- Figure 1: Asia-Pacific Livestock Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Livestock Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 4: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Coverage 2019 & 2032

- Table 5: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 6: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Animal Type 2019 & 2032

- Table 7: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 8: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Distribution 2019 & 2032

- Table 9: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 12: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Coverage 2019 & 2032

- Table 13: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 14: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Animal Type 2019 & 2032

- Table 15: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 16: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Distribution 2019 & 2032

- Table 17: Asia-Pacific Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: China Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Japan Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: South Korea Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: India Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Australia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: New Zealand Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: New Zealand Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Indonesia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Indonesia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Malaysia Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Malaysia Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Singapore Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Singapore Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Thailand Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Thailand Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Vietnam Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Vietnam Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Philippines Asia-Pacific Livestock Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Philippines Asia-Pacific Livestock Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Livestock Insurance Market?

The projected CAGR is approximately 7.76%.

2. Which companies are prominent players in the Asia-Pacific Livestock Insurance Market?

Key companies in the market include AXA XL, The New India Assurance Co Ltd, Oriental Insurance, HDFC ERGO, ICICI Lombard, Chubb, QBE Insurance Group, Zurich Insurance PLC, Reliance General Insurance, Royal Sundaram.

3. What are the main segments of the Asia-Pacific Livestock Insurance Market?

The market segments include Coverage, Animal Type, Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.31 Million as of 2022.

5. What are some drivers contributing to market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture.

6. What are the notable trends driving market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience.

7. Are there any restraints impacting market growth?

APAC Governments Enhance Livestock Insurance Schemes to Bolster Agricultural Resilience; Mitigating Climate Risks in Agriculture.

8. Can you provide examples of recent developments in the market?

May 2024: Bangladesh launched an online cattle identification and registration system. The system allows customers to access detailed information about their livestock via barcode scanning. By 2025, 50,000 cattle are expected to be registered, each tagged with a barcode. The Bangladesh Integrated Network for Livestock Information (BINLI) is led by the Department of Livestock Services under the Livestock and Dairy Development Project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Livestock Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Livestock Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Livestock Insurance Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Livestock Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence