Key Insights

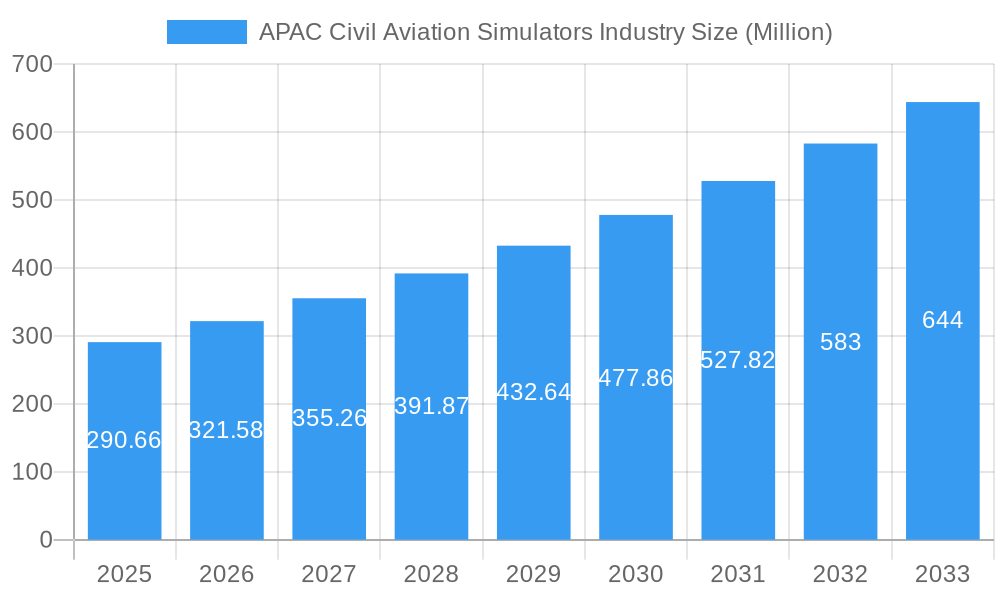

The Asia-Pacific (APAC) civil aviation simulators market is experiencing robust growth, projected to reach \$290.66 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.60% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's burgeoning air travel sector, driven by rapid economic growth and rising disposable incomes in countries like China and India, necessitates a substantial increase in pilot training capacity. This directly translates into higher demand for advanced flight simulators and training devices. Secondly, stringent safety regulations enforced by aviation authorities across APAC are pushing airlines and flight schools to adopt sophisticated simulation technologies for enhanced pilot training and proficiency. Technological advancements, such as the incorporation of virtual reality and augmented reality in simulators, are also contributing to market growth, offering more immersive and effective training experiences. Finally, the increasing adoption of Full Flight Simulators (FFS) over simpler Flight Training Devices (FTDs) reflects a commitment to higher training standards and more realistic simulation environments.

APAC Civil Aviation Simulators Industry Market Size (In Million)

The market segmentation reveals a strong preference for Full Flight Simulators (FFS), reflecting the need for highly realistic training environments. However, Flight Training Devices (FTDs) continue to hold a significant share, providing cost-effective training solutions for basic flight maneuvers. The competitive landscape is dominated by both international giants like CAE Inc., Boeing, and L3Harris Technologies, and regional players catering to specific training needs. Growth will be particularly strong in countries like China and India, given their expanding aviation industries and rapid infrastructure development. While challenges such as high initial investment costs associated with simulator acquisition and maintenance exist, the long-term benefits in terms of enhanced pilot safety and training efficiency are outweighing these considerations, ensuring a positive outlook for the APAC civil aviation simulators market.

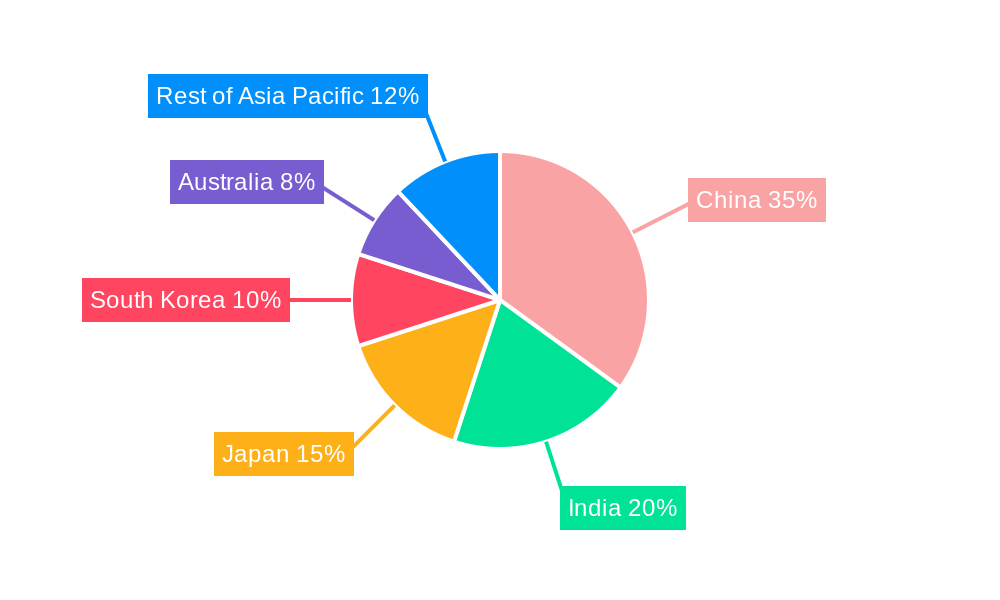

APAC Civil Aviation Simulators Industry Company Market Share

APAC Civil Aviation Simulators Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) civil aviation simulators industry, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth trends, key players, and future opportunities for industry professionals, investors, and strategic decision-makers. The report segments the market by simulator type (Full Flight Simulators (FFS), Flight Training Devices (FTD), Other Simulator Types) and analyzes leading regions and countries within APAC. The Base Year is 2025, with an Estimated Year of 2025 and a Forecast Period of 2025-2033. The Historical Period covered is 2019-2024. Market values are presented in million USD.

APAC Civil Aviation Simulators Industry Market Dynamics & Structure

The APAC civil aviation simulators market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, driven by advancements in simulation software, hardware, and visual systems, is a key growth driver. Stringent regulatory frameworks and safety standards, established by bodies such as the International Civil Aviation Organization (ICAO), shape industry practices. Competitive substitutes, such as online training programs, pose a challenge, but the need for realistic, hands-on training remains paramount. The end-user demographic comprises primarily airlines, flight schools, and military training institutions. Mergers and acquisitions (M&A) activity has been moderate, with larger companies strategically acquiring smaller firms to expand their product portfolios and geographical reach.

- Market Concentration: Moderate, with the top 5 players accounting for approximately xx% of the market in 2025.

- M&A Activity (2019-2024): xx deals, with an average deal value of xx million USD.

- Key Innovation Drivers: Advancements in VR/AR technology, AI-powered training programs, and improved visual systems.

- Regulatory Landscape: Stringent safety standards and certifications drive high capital expenditure and compliance costs.

- Competitive Substitutes: Online training programs and alternative training methods are gaining traction but FFS and FTD remain critical to training.

APAC Civil Aviation Simulators Industry Growth Trends & Insights

The APAC civil aviation simulators market experienced significant growth during the historical period (2019-2024), fueled by rising air travel demand, expansion of airline fleets, and a growing need for skilled pilots. The market size is projected to reach xx million USD in 2025 and continue its growth trajectory throughout the forecast period (2025-2033), driven by factors such as increasing air passenger traffic, robust economic growth in several APAC nations, and the growing adoption of advanced simulation technologies. The CAGR during the forecast period is estimated to be xx%. Increased adoption of FTDs, owing to their cost-effectiveness compared to FFS, is also contributing to market expansion. Technological disruptions, particularly in VR/AR and AI, are altering consumer behavior, leading to a demand for more immersive and personalized training experiences.

- Market Size (2025): xx million USD

- CAGR (2025-2033): xx%

- Market Penetration (FFS): xx% in 2025

- Market Penetration (FTD): xx% in 2025

Dominant Regions, Countries, or Segments in APAC Civil Aviation Simulators Industry

China and India are the dominant markets in the APAC civil aviation simulators industry, driven by rapid growth in their aviation sectors. Within simulator types, Full Flight Simulators (FFS) represent the largest segment, owing to their high fidelity and comprehensive training capabilities. However, the Flight Training Devices (FTD) segment is experiencing faster growth due to its cost-effectiveness.

- Leading Region: Greater China (China, Hong Kong, Taiwan)

- Leading Country: China

- Dominant Segment: Full Flight Simulators (FFS)

- Fastest-Growing Segment: Flight Training Devices (FTD)

- Key Drivers in China: Rapid expansion of domestic airlines, government investment in aviation infrastructure, and increasing demand for pilot training.

- Key Drivers in India: Growth of low-cost carriers, liberalization of the aviation sector, and government initiatives to improve aviation infrastructure.

APAC Civil Aviation Simulators Industry Product Landscape

The APAC civil aviation simulators market offers a diverse range of products, from basic flight training devices to highly sophisticated full-flight simulators. Key product innovations include advancements in visual systems, improved motion platforms, and the integration of AI-powered training scenarios. These innovations enhance training realism, improve pilot performance, and reduce training costs. Unique selling propositions often focus on customization capabilities, superior fidelity, and integration with existing training management systems.

Key Drivers, Barriers & Challenges in APAC Civil Aviation Simulators Industry

Key Drivers:

- Increased air passenger traffic and airline fleet expansion in APAC.

- Government initiatives to enhance aviation infrastructure and safety standards.

- Technological advancements leading to more realistic and effective simulations.

Key Challenges & Restraints:

- High initial investment costs associated with simulator procurement and maintenance.

- Stringent regulatory requirements for simulator certification and approval.

- Competitive pressures from established and emerging players.

- Supply chain disruptions impacting component availability and delivery times (estimated impact of xx% on 2025 production).

Emerging Opportunities in APAP Civil Aviation Simulators Industry

- Growth in the use of virtual reality (VR) and augmented reality (AR) technologies for flight training.

- Increasing demand for customized simulation solutions tailored to specific airline or training needs.

- Expansion into new markets within the APAC region, particularly in Southeast Asia.

Growth Accelerators in the APAC Civil Aviation Simulators Industry

Technological advancements, strategic partnerships between simulator manufacturers and airlines, and expansion into underserved markets will accelerate long-term growth. Innovation in AI-driven training scenarios and immersive VR/AR technologies will further enhance the value proposition of simulators and drive adoption rates.

Key Players Shaping the APAC Civil Aviation Simulators Industry Market

- Indra Sistemas SA

- L3Harris Technologies Inc

- Airbus SE

- Alpha Aviation Group

- ALSIM EMEA

- CAE Inc

- Avion Group

- TRU Simulation + Training Inc

- FlightSafety International Inc

- The Boeing Company

Notable Milestones in APAC Civil Aviation Simulators Industry Sector

- 2022 Q4: CAE Inc. announced a significant contract for the supply of flight simulators to a major Chinese airline.

- 2023 Q1: Indra Sistemas SA launched a new generation of FFS with enhanced VR capabilities.

- 2023 Q3: A merger between two regional simulator providers resulted in a strengthened market presence in Southeast Asia. (Further details unavailable, impact predicted to be xx% market share change in the next 5 years).

In-Depth APAC Civil Aviation Simulators Industry Market Outlook

The APAC civil aviation simulators market is poised for robust growth over the next decade, driven by sustained expansion in the air travel sector and the ongoing adoption of advanced simulation technologies. Strategic partnerships, investments in R&D, and expanding into new markets, particularly in the fast-growing Southeast Asian region, will present significant opportunities for players across the value chain. The increasing sophistication of simulation technology and the incorporation of AI will drive a shift towards more personalized and effective training methodologies.

APAC Civil Aviation Simulators Industry Segmentation

-

1. Simulator Type

- 1.1. Full Flight Simulator (FFS)

- 1.2. Flight Training Devices (FTD)

- 1.3. Other Simulator Types

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Rest of Asia-Pacific

-

2.1. Asia-Pacific

APAC Civil Aviation Simulators Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

APAC Civil Aviation Simulators Industry Regional Market Share

Geographic Coverage of APAC Civil Aviation Simulators Industry

APAC Civil Aviation Simulators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Full Flight Simulator (FFS) is Projected to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Civil Aviation Simulators Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 5.1.1. Full Flight Simulator (FFS)

- 5.1.2. Flight Training Devices (FTD)

- 5.1.3. Other Simulator Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Indra Sistemas SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 L3Harris Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alpha Aviation Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALSIM EMEA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CAE Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avion Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TRU Simulation + Training Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FlightSafety International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Indra Sistemas SA

List of Figures

- Figure 1: Global APAC Civil Aviation Simulators Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific APAC Civil Aviation Simulators Industry Revenue (Million), by Simulator Type 2025 & 2033

- Figure 3: Asia Pacific APAC Civil Aviation Simulators Industry Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 4: Asia Pacific APAC Civil Aviation Simulators Industry Revenue (Million), by Geography 2025 & 2033

- Figure 5: Asia Pacific APAC Civil Aviation Simulators Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Asia Pacific APAC Civil Aviation Simulators Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific APAC Civil Aviation Simulators Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Civil Aviation Simulators Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 2: Global APAC Civil Aviation Simulators Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global APAC Civil Aviation Simulators Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Civil Aviation Simulators Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 5: Global APAC Civil Aviation Simulators Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Civil Aviation Simulators Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China APAC Civil Aviation Simulators Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India APAC Civil Aviation Simulators Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan APAC Civil Aviation Simulators Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea APAC Civil Aviation Simulators Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia APAC Civil Aviation Simulators Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific APAC Civil Aviation Simulators Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Civil Aviation Simulators Industry?

The projected CAGR is approximately 10.60%.

2. Which companies are prominent players in the APAC Civil Aviation Simulators Industry?

Key companies in the market include Indra Sistemas SA, L3Harris Technologies Inc, Airbus SE, Alpha Aviation Grou, ALSIM EMEA, CAE Inc, Avion Group, TRU Simulation + Training Inc, FlightSafety International Inc, The Boeing Company.

3. What are the main segments of the APAC Civil Aviation Simulators Industry?

The market segments include Simulator Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 290.66 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Full Flight Simulator (FFS) is Projected to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Civil Aviation Simulators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Civil Aviation Simulators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Civil Aviation Simulators Industry?

To stay informed about further developments, trends, and reports in the APAC Civil Aviation Simulators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence