Key Insights

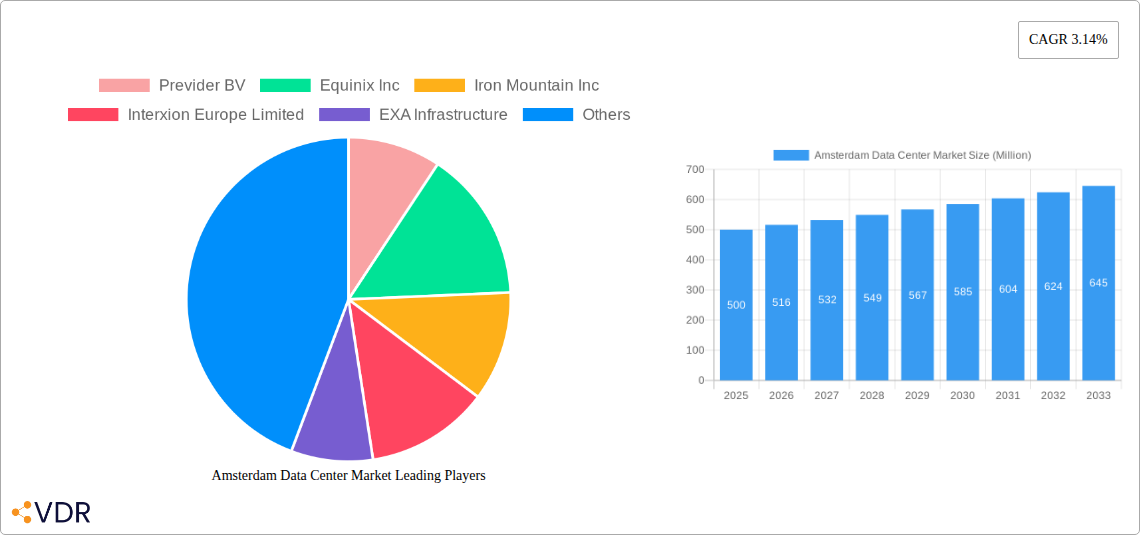

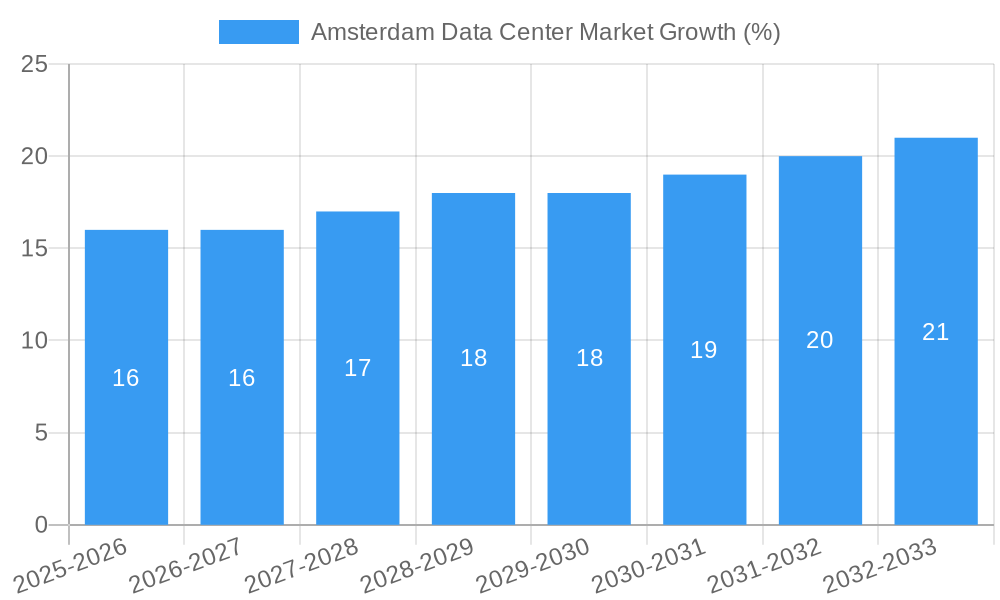

The Amsterdam data center market is experiencing robust growth, driven by increasing digitalization, the rise of cloud computing, and the strategic location of Amsterdam as a major European internet hub. The market's strong CAGR of 3.14% indicates a consistent upward trajectory, projected to continue throughout the forecast period (2025-2033). Significant drivers include the burgeoning e-commerce sector, the expansion of telecommunications infrastructure, and the growing demand for colocation services from various end-users including cloud providers, BFSI institutions, and media companies. The market is segmented by data center size (small to mega), tier type (Tier 1-4), absorption rate (utilized vs. non-utilized), colocation type (retail, wholesale, hyperscale), and end-user industry. The presence of major players like Equinix, Interxion, and Global Switch highlights the market's maturity and attractiveness to global investors. While specific market size figures for Amsterdam are not provided, considering the substantial growth of the European data center market and Amsterdam's position within it, we can infer a significant market value, likely in the hundreds of millions of euros, steadily expanding over the forecast period. The market's growth is expected to be somewhat constrained by factors such as energy costs and the need for sustainable data center solutions. However, the overall outlook remains positive, given the consistent demand for digital infrastructure and Amsterdam's advantageous geographical position.

The competitive landscape is characterized by a mix of established global players and regional providers. Competition is fierce, with companies focusing on differentiation strategies such as offering specialized services, superior connectivity, and sustainable infrastructure. Future growth will likely be influenced by investments in next-generation technologies like edge computing and the increasing adoption of sustainable practices within the data center industry. The Amsterdam market benefits from robust government support for technological innovation, further bolstering the positive growth trajectory. Understanding the specific segment performance within the Amsterdam data center market, particularly the utilization rates across different tiers and colocation types, will be crucial for strategic investment decisions and market positioning.

Amsterdam Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Amsterdam data center market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive market research and data analysis to provide actionable insights into this rapidly evolving sector. The Amsterdam data center market is segmented by DC size (Small, Medium, Large, Massive, Mega), Tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (Utilized, Non-utilized), colocation type (Retail, Wholesale, Hyperscale), and end-user (Cloud and IT, Telecom, Media and Entertainment, Government, BFSI, Manufacturing, E-commerce, Other).

Amsterdam Data Center Market Dynamics & Structure

The Amsterdam data center market exhibits a moderately concentrated structure, with several major players vying for market share. Technological innovation, particularly in areas like AI and edge computing, is driving growth, while stringent regulatory frameworks and evolving data privacy laws influence market dynamics. Competitive pressures from alternative cloud storage solutions and the increasing importance of sustainability are also notable factors. M&A activity has been significant, with several large deals shaping the competitive landscape. The market's growth is significantly influenced by the presence of several large hyperscale data center providers and a thriving digital economy.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on AI, edge computing, and sustainable cooling solutions.

- Regulatory Framework: Stringent data privacy regulations and energy efficiency standards.

- Competitive Substitutes: Cloud storage services, distributed ledger technologies.

- End-User Demographics: High concentration of tech companies, financial institutions, and media organizations.

- M&A Trends: Significant activity in the past 5 years, with xx major deals completed, valued at approximately xx Million. Examples include the Berenberg Digital Infrastructure Fund's investment in AMS3 Data Centre.

Amsterdam Data Center Market Growth Trends & Insights

The Amsterdam data center market has experienced robust growth over the historical period (2019-2024), driven by increasing data consumption, digital transformation initiatives, and the burgeoning presence of hyperscale cloud providers. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. This growth is further fueled by the increasing adoption of cloud services, the expansion of 5G networks, and the growing demand for low-latency data processing. Technological disruptions, such as the rise of edge computing, are creating new opportunities and reshaping consumer behavior, favoring solutions that prioritize speed and efficiency. Market penetration for colocation services is expected to increase from xx% in 2024 to xx% by 2033.

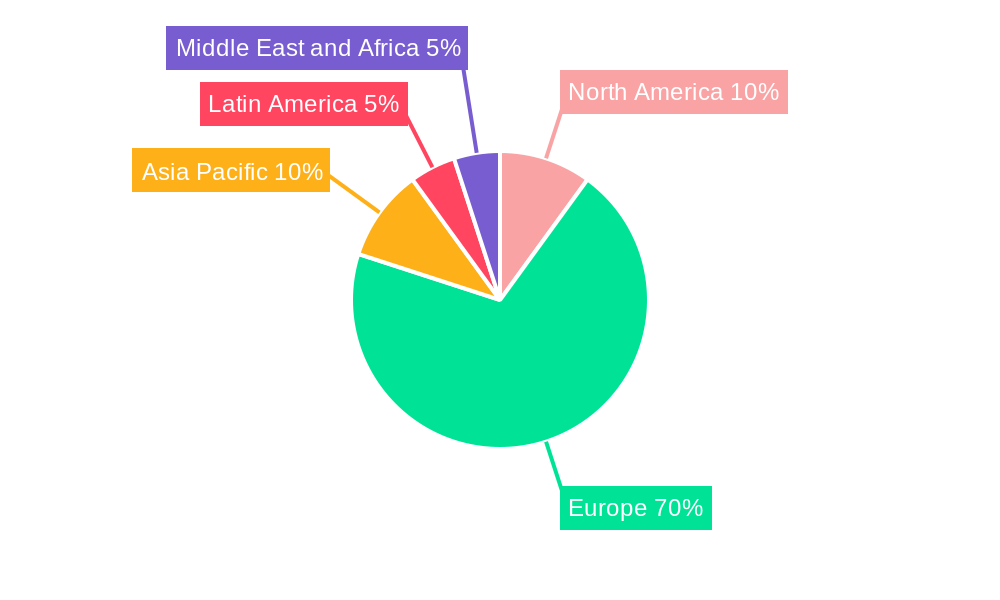

Dominant Regions, Countries, or Segments in Amsterdam Data Center Market

The Amsterdam metropolitan area dominates the Dutch data center market due to its robust digital infrastructure, strategic location, and strong regulatory environment. Within the Amsterdam market, the hyperscale segment is leading growth, driven by the demand from major cloud providers. The utilized absorption segment shows higher growth compared to the non-utilized. Within end-users, the cloud and IT sector holds the largest market share, followed by the financial services sector.

- Key Drivers:

- Strong digital infrastructure including high-speed connectivity and fiber optic networks.

- Attractive business environment with favorable government policies.

- Strategic location, acting as a gateway to Europe.

- Robust talent pool.

- Dominant Segments: Hyperscale colocation, Utilized Absorption, Cloud and IT End-users.

Amsterdam Data Center Market Product Landscape

The Amsterdam data center market offers a diverse range of products, including colocation services tailored to varying needs, ranging from small to massive facilities. Innovation focuses on increased energy efficiency, high-density deployments, and enhanced security features. Unique selling propositions include premium connectivity, flexible configurations, and sustainable designs. Technological advancements in cooling solutions and power management systems are driving improvements in operational efficiency.

Key Drivers, Barriers & Challenges in Amsterdam Data Center Market

Key Drivers: The growth of the digital economy, rising data consumption, and increasing demand for cloud services are primary drivers. Government initiatives to promote digital infrastructure are also contributing significantly. The strategic location of Amsterdam, its excellent connectivity, and the availability of skilled labor further accelerate the growth.

Challenges: Competition from established players and the increasing cost of energy and land are significant barriers. Meeting stringent environmental regulations and ensuring data security present substantial operational challenges. Supply chain disruptions can also impact project timelines and budgets.

Emerging Opportunities in Amsterdam Data Center Market

The increasing adoption of edge computing, the demand for sustainable data centers, and the growth of the Internet of Things (IoT) are creating significant opportunities. The development of specialized data center solutions for specific industries, such as healthcare and finance, represents an emerging growth area.

Growth Accelerators in the Amsterdam Data Center Market Industry

Technological advancements in areas like AI-powered management systems, improved cooling technologies and increased energy efficiency are set to significantly accelerate growth. Strategic partnerships between data center providers and cloud service providers, along with the expansion of data center capacity through new construction and acquisitions, will further fuel market expansion.

Key Players Shaping the Amsterdam Data Center Market Market

- Previder BV

- Equinix Inc

- Iron Mountain Inc

- Interxion Europe Limited

- EXA Infrastructure

- NorthC Group BV

- Keppel Data Center Pte Ltd

- AtlasEdge LLC

- EdgeConneX Inc

- Switch Datacenters Group

- CyrusOne Inc

- Global Switch Holdings Limited

- ColoHouse LLC

- NTT Ltd

Notable Milestones in Amsterdam Data Center Market Sector

- December 2022: Equinix Inc. announced a commitment to reduce power consumption by optimizing thermal operations in its data centers, aiming for more efficient cooling and lower carbon footprints.

- May 2022: The Berenberg Digital Infrastructure Fund provided financing for the AMS3 Data Centre in Amsterdam.

In-Depth Amsterdam Data Center Market Market Outlook

The Amsterdam data center market is poised for continued strong growth, driven by technological innovation, increasing demand for digital services, and favorable regulatory conditions. Strategic investments in sustainable infrastructure, expansion into new market segments, and the development of innovative solutions will shape the future of this dynamic sector, presenting significant opportunities for market players and investors alike.

Amsterdam Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud and IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media and Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-utilized

-

3.1. Utilized

Amsterdam Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Amsterdam Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.14% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share

- 3.3. Market Restrains

- 3.3.1. Increasing Utilization of Blade Servers

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud and IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media and Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End User

- 6.3.1.2.1. Cloud and IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media and Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-commerce

- 6.3.1.2.8. Other End User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End User

- 7.3.1.2.1. Cloud and IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media and Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-commerce

- 7.3.1.2.8. Other End User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End User

- 8.3.1.2.1. Cloud and IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media and Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-commerce

- 8.3.1.2.8. Other End User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End User

- 9.3.1.2.1. Cloud and IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media and Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-commerce

- 9.3.1.2.8. Other End User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End User

- 10.3.1.2.1. Cloud and IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media and Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-commerce

- 10.3.1.2.8. Other End User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. North America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Amsterdam Data Center Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Previder BV

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Equinix Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Iron Mountain Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Interxion Europe Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 EXA Infrastructure

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 NorthC Group BV

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Keppel Data Center Pte Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AtlasEdge LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 EdgeConneX Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Switch Datacenters Group*List Not Exhaustive 7 2 Market Share Analysis (In terms of MW)7 3 List of Companie

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 CyrusOne Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Global Switch Holdings Limited

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 ColoHouse LLC

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 NTT Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Previder BV

List of Figures

- Figure 1: Global Amsterdam Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 13: North America Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 14: North America Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 15: North America Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 16: North America Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 17: North America Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 18: North America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 21: South America Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 22: South America Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 29: Europe Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 30: Europe Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 31: Europe Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 32: Europe Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 33: Europe Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 34: Europe Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 37: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 38: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 39: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 40: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 41: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 42: Middle East & Africa Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Amsterdam Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 45: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 46: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 47: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 48: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 49: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 50: Asia Pacific Amsterdam Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Amsterdam Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Amsterdam Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Global Amsterdam Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 17: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 18: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 19: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 24: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 25: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 31: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 32: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 33: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United Kingdom Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Benelux Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Nordics Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 44: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 45: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 46: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Turkey Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Israel Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: GCC Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: North Africa Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East & Africa Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Amsterdam Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 54: Global Amsterdam Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 55: Global Amsterdam Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 56: Global Amsterdam Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Japan Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Korea Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: ASEAN Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Oceania Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Amsterdam Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Amsterdam Data Center Market?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the Amsterdam Data Center Market?

Key companies in the market include Previder BV, Equinix Inc, Iron Mountain Inc, Interxion Europe Limited, EXA Infrastructure, NorthC Group BV, Keppel Data Center Pte Ltd, AtlasEdge LLC, EdgeConneX Inc, Switch Datacenters Group*List Not Exhaustive 7 2 Market Share Analysis (In terms of MW)7 3 List of Companie, CyrusOne Inc, Global Switch Holdings Limited, ColoHouse LLC, NTT Ltd.

3. What are the main segments of the Amsterdam Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Increasing Utilization of Blade Servers.

8. Can you provide examples of recent developments in the market?

December 2022: Equinix Inc., the world's digital infrastructure firm, announced the first pledge by a colocation data center operator to reduce overall power consumption by increasing operating temperature ranges within its data centers. Equinix will begin defining a multi-year global roadmap for thermal operations within its data centers immediately, aiming for much more efficient cooling and lower carbon footprints while maintaining the premium operating environment for which the company is recognized. This program is expected to help thousands of Equinix customers to reduce the Scope 3 carbon emissions connected with their data center operations over time as supply chain sustainability becomes an increasingly essential aspect of today's enterprises' total environmental activities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Amsterdam Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Amsterdam Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Amsterdam Data Center Market?

To stay informed about further developments, trends, and reports in the Amsterdam Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence