Key Insights

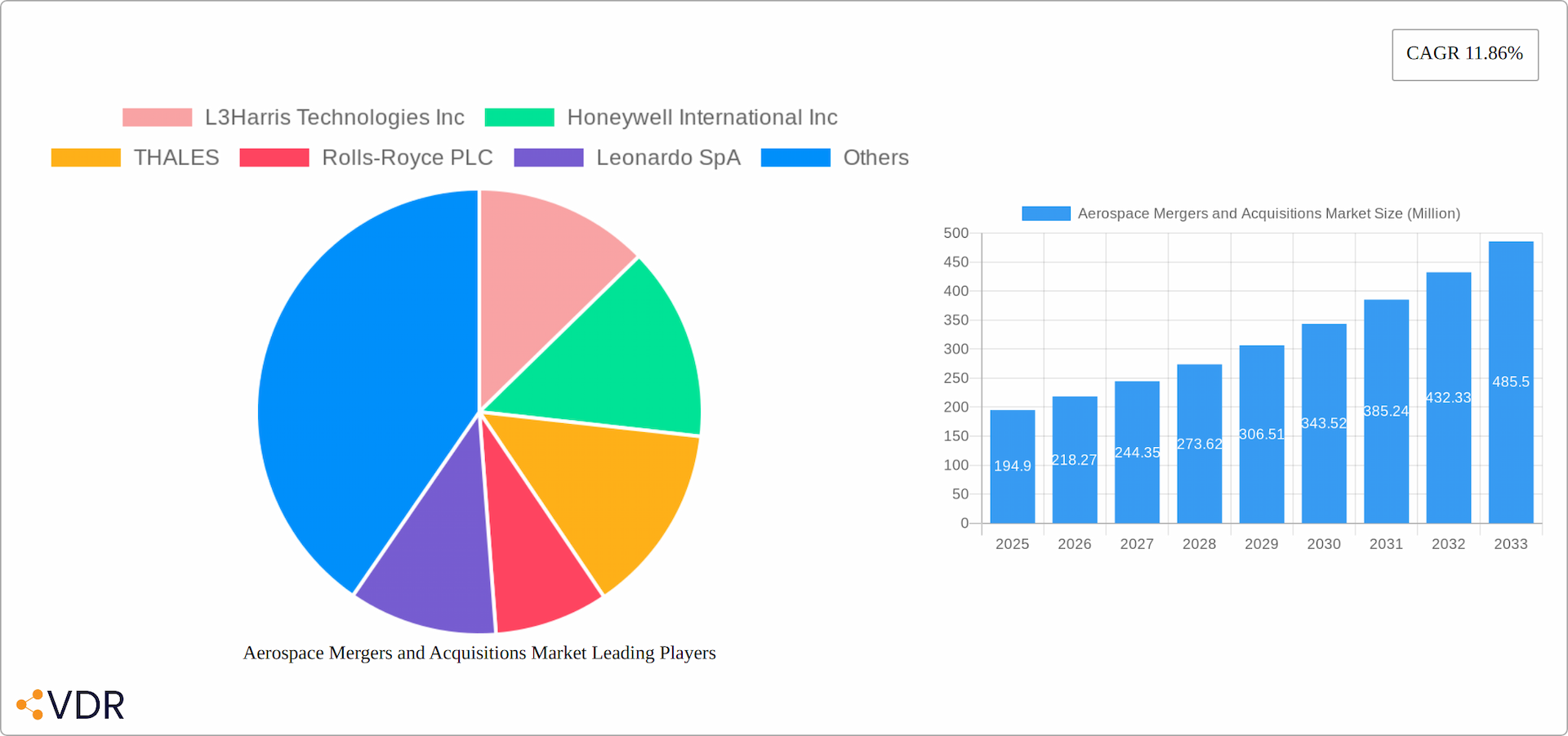

The Aerospace Mergers and Acquisitions (M&A) market, valued at $194.90 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 11.86% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for advanced technologies like autonomous flight systems and improved aircraft efficiency is pushing companies to acquire specialized firms with cutting-edge capabilities. Secondly, consolidation within the industry allows major players like Boeing, Airbus, and others to expand their product portfolios, enhance their technological prowess, and achieve greater economies of scale. This strategic consolidation reduces competition and allows for quicker market penetration of new technologies. Furthermore, government defense budgets, particularly in North America and Europe, significantly impact the M&A activity in the aerospace sector. The need to modernize defense capabilities and enhance national security fuels substantial investment and acquisition activity.

Aerospace Mergers and Acquisitions Market Market Size (In Million)

However, the market is not without its challenges. Geopolitical instability and global economic fluctuations can significantly influence investment decisions and slow down M&A activity. Regulatory hurdles and lengthy approval processes can also create bottlenecks and delays. Despite these potential restraints, the long-term outlook for the Aerospace M&A market remains positive. The continuous drive for innovation, coupled with increasing defense spending and a focus on strategic partnerships, will likely sustain the high growth trajectory projected for the coming decade. The key players listed—L3Harris Technologies Inc, Honeywell International Inc, Thales, Rolls-Royce PLC, and others—will continue to shape the market landscape through strategic acquisitions and mergers. Competition among these giants will likely further accelerate the pace of M&A activity within the sector.

Aerospace Mergers and Acquisitions Market Company Market Share

Aerospace Mergers and Acquisitions Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Aerospace Mergers and Acquisitions market, encompassing both the parent market (Aerospace & Defense) and its key segments. The study period spans from 2019 to 2033, with a focus on the forecast period of 2025-2033, utilizing 2025 as the base year and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic landscape. The market size is projected to reach xx Million by 2033.

Aerospace Mergers and Acquisitions Market Dynamics & Structure

This section analyzes the competitive landscape of the Aerospace Mergers and Acquisitions market, focusing on market concentration, technological innovation, regulatory influences, and prevailing M&A trends. The analysis considers factors such as the increasing demand for advanced aerospace technologies, stringent regulatory approvals, and the growing importance of strategic partnerships to drive growth.

- Market Concentration: The market is moderately consolidated, with key players holding significant market share. The top 5 players account for approximately 60% of the market, while a large number of smaller companies compete in niche segments.

- Technological Innovation Drivers: Advancements in areas such as artificial intelligence (AI), autonomous systems, and lightweight materials are driving M&A activity as companies seek to acquire cutting-edge technologies.

- Regulatory Frameworks: Stringent regulations surrounding aerospace safety and security significantly influence M&A transactions, often leading to extended review periods.

- Competitive Product Substitutes: The lack of direct substitutes for many aerospace products and services limits competitive pressure but innovation in adjacent industries can influence the landscape.

- End-User Demographics: The primary end-users include government agencies (military and civilian), airlines, and commercial aerospace manufacturers. Government spending patterns significantly impact market dynamics.

- M&A Trends: Consolidation is a dominant trend, with larger companies acquiring smaller firms to expand their product portfolios and gain technological capabilities. The average deal size has increased steadily over the past few years.

Aerospace Mergers and Acquisitions Market Growth Trends & Insights

This in-depth analysis of the Aerospace Mergers and Acquisitions market leverages extensive market research and data analysis to illuminate its growth trajectory. The report meticulously analyzes historical market size and projects future growth using sophisticated predictive models, factoring in both macroeconomic trends and industry-specific dynamics. Key growth drivers include rapid technological advancements, escalating defense spending globally, and a continuously rising demand for air travel, particularly in emerging economies. Sustainability concerns are also significantly shaping the market landscape.

The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This robust growth is projected to continue throughout the forecast period (2025-2033), albeit at a slightly moderated pace, with an estimated CAGR of xx%. This moderation reflects a natural maturation of the market and the increasing complexity of large-scale mergers and acquisitions. However, the market penetration of transformative technologies, such as AI-powered systems and advanced materials, is expected to fuel significant growth spurts within specific segments. Furthermore, a notable shift in consumer behavior towards more sustainable air travel options is creating exciting new opportunities for companies focused on eco-friendly technologies and practices. This report offers a comprehensive explanation of these figures and provides insightful commentary on the underlying factors driving market dynamics.

Dominant Regions, Countries, or Segments in Aerospace Mergers and Acquisitions Market

North America currently holds the dominant position in the Aerospace Mergers and Acquisitions market, fueled by substantial defense spending, a robust presence of major aerospace companies, and a culture of innovation. Europe maintains its position as a significant market player, benefiting from a strong aerospace industry, collaborative efforts among nations, and a focus on advanced technological capabilities. The Asia-Pacific region is demonstrating the most rapid growth, driven by increasing investments in infrastructure, a burgeoning middle class with increased disposable income, and a corresponding surge in demand for air travel.

- Key Drivers in North America: Robust government investment in defense, a high concentration of established aerospace companies, and a culture of continuous technological innovation.

- Key Drivers in Europe: Strong collaborative initiatives among European nations, cutting-edge technological capabilities, and a well-defined regulatory framework.

- Key Drivers in Asia-Pacific: Rapid economic expansion, escalating demand for air travel, and substantial investments in modern airport infrastructure.

The report provides granular market share data for each region and offers a detailed analysis of their respective growth potentials, including an assessment of regional risks and opportunities.

Aerospace Mergers and Acquisitions Market Product Landscape

The aerospace mergers and acquisitions market encompasses a diverse range of products and services, including aircraft, engines, avionics, and related technologies. Innovations focus on improving efficiency, reducing emissions, and enhancing safety. The report details the key products and services traded within these mergers and acquisitions, highlighting competitive advantages of leading players.

Key Drivers, Barriers & Challenges in Aerospace Mergers and Acquisitions Market

Key Drivers: The global increase in defense budgets, technological advancements necessitating modernization across the aerospace sector, and the strategic pursuit of competitive advantages through acquisitions remain primary drivers of market activity. Furthermore, the growing importance of space exploration is creating new avenues for mergers and acquisitions.

Key Barriers and Challenges: Stringent regulatory approvals, substantial transaction costs, the complexities of post-acquisition integration, and persistent geopolitical uncertainties pose significant challenges. Supply chain disruptions continue to impact deal timelines and valuations, with estimated cost overruns reaching xx Million in the past year. Competition for skilled talent also adds a layer of complexity to successful M&A activities.

Emerging Opportunities in Aerospace Mergers and Acquisitions Market

Emerging opportunities lie in areas such as unmanned aerial vehicles (UAVs), space exploration, and sustainable aviation technologies. The expanding use of AI and machine learning in aerospace creates new avenues for M&A activity. Developing markets in Asia and Africa also present significant growth potential.

Growth Accelerators in the Aerospace Mergers and Acquisitions Market Industry

Long-term growth will be significantly influenced by continued technological advancements such as hypersonic technology, the widespread adoption of sustainable aviation fuels (SAFs), the expansion of space-based services, and the increasing use of artificial intelligence and machine learning in aerospace design and operations. Strategic partnerships and joint ventures will play a pivotal role in accelerating growth and mitigating the risks associated with large-scale projects.

Key Players Shaping the Aerospace Mergers and Acquisitions Market Market

Notable Milestones in Aerospace Mergers and Acquisitions Market Sector

- 2022-Q4: RTX Corporation's acquisition of a smaller avionics company broadened its product portfolio and enhanced its technological capabilities.

- 2023-Q1: The joint venture announced by Airbus SE and Safran SA to develop next-generation aircraft engines showcases a strategic move to leverage combined expertise and resources.

- 2023-Q3: Significant regulatory approval delays impacted the merger between two major defense contractors, highlighting the regulatory hurdles inherent in large-scale aerospace M&A activity. (Further details are provided within the full report.)

In-Depth Aerospace Mergers and Acquisitions Market Outlook

The future of the Aerospace Mergers and Acquisitions market appears positive, driven by continuous technological advancements, strategic partnerships, and sustained government investment. The market is poised for significant growth, presenting lucrative opportunities for both established players and new entrants. The report concludes with strategic recommendations to capitalize on emerging trends and navigate the challenges within this complex and ever-evolving sector.

Aerospace Mergers and Acquisitions Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Aerospace Mergers and Acquisitions Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aerospace Mergers and Acquisitions Market Regional Market Share

Geographic Coverage of Aerospace Mergers and Acquisitions Market

Aerospace Mergers and Acquisitions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Aerospace Segment is Projected to Witness the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Mergers and Acquisitions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Aerospace Mergers and Acquisitions Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Aerospace Mergers and Acquisitions Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Aerospace Mergers and Acquisitions Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Aerospace Mergers and Acquisitions Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Aerospace Mergers and Acquisitions Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rolls-Royce PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leonardo SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elbit Systems Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Airbus SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Safran SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 RTX Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rheinmetall A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 General Electric Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Parker Hannifin Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 The Boeing Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Aerospace Mergers and Acquisitions Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aerospace Mergers and Acquisitions Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Aerospace Mergers and Acquisitions Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Aerospace Mergers and Acquisitions Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Aerospace Mergers and Acquisitions Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Aerospace Mergers and Acquisitions Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Aerospace Mergers and Acquisitions Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Aerospace Mergers and Acquisitions Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Aerospace Mergers and Acquisitions Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Aerospace Mergers and Acquisitions Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Aerospace Mergers and Acquisitions Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Aerospace Mergers and Acquisitions Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Aerospace Mergers and Acquisitions Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Aerospace Mergers and Acquisitions Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Aerospace Mergers and Acquisitions Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Aerospace Mergers and Acquisitions Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Aerospace Mergers and Acquisitions Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Aerospace Mergers and Acquisitions Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Aerospace Mergers and Acquisitions Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Aerospace Mergers and Acquisitions Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Aerospace Mergers and Acquisitions Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Aerospace Mergers and Acquisitions Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Aerospace Mergers and Acquisitions Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Aerospace Mergers and Acquisitions Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Aerospace Mergers and Acquisitions Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Aerospace Mergers and Acquisitions Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Aerospace Mergers and Acquisitions Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Aerospace Mergers and Acquisitions Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Aerospace Mergers and Acquisitions Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Mergers and Acquisitions Market?

The projected CAGR is approximately 11.86%.

2. Which companies are prominent players in the Aerospace Mergers and Acquisitions Market?

Key companies in the market include L3Harris Technologies Inc, Honeywell International Inc, THALES, Rolls-Royce PLC, Leonardo SpA, Elbit Systems Ltd, Airbus SE, Safran SA, BAE Systems PLC, RTX Corporation, Rheinmetall A, General Electric Company, Parker Hannifin Corporation, The Boeing Company.

3. What are the main segments of the Aerospace Mergers and Acquisitions Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 194.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Aerospace Segment is Projected to Witness the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Mergers and Acquisitions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Mergers and Acquisitions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Mergers and Acquisitions Market?

To stay informed about further developments, trends, and reports in the Aerospace Mergers and Acquisitions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence