Key Insights

The United States botanical supplements market is poised for significant expansion, projected to reach $7.7 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.7%. This growth is propelled by heightened consumer focus on health and wellness, a growing preference for natural health solutions, and the increasing availability of diverse botanical formulations. Powdered supplements and capsules/tablets lead in market preference due to their convenience. Key distribution channels include supermarkets, pharmacies, and online retail. Major industry players such as GNC Holdings Inc., Herbalife International of America Inc., and Nature's Bounty Co. are actively innovating and expanding their reach to capture this expanding market, supported by positive consumer perceptions of efficacy and safety.

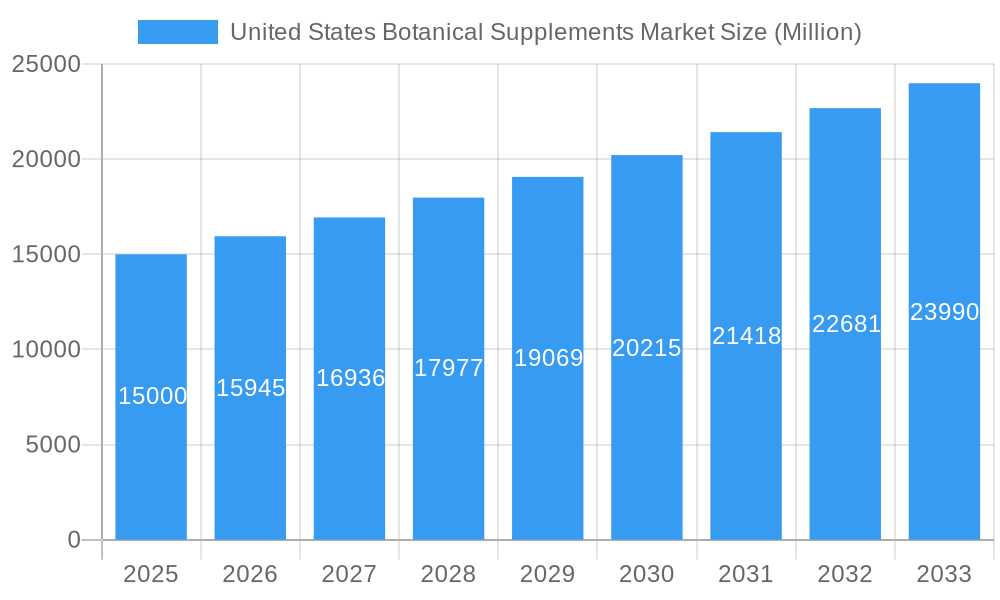

United States Botanical Supplements Market Market Size (In Billion)

Challenges to sustained growth include regulatory scrutiny, product quality concerns, and the threat of counterfeit products. Transparency, consistent quality control, and effective regulatory measures are crucial for maintaining consumer trust and market stability. The burgeoning e-commerce segment presents substantial growth opportunities, necessitating strategic online retail partnerships and direct-to-consumer marketing initiatives.

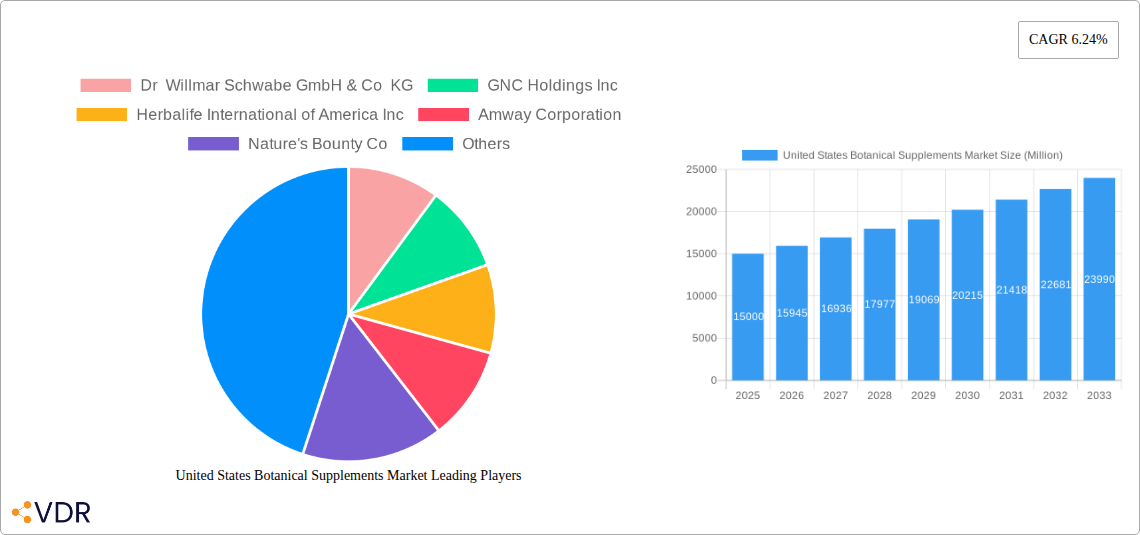

United States Botanical Supplements Market Company Market Share

This report delivers an in-depth analysis of the U.S. botanical supplements market, covering market dynamics, growth trajectories, regional trends, product offerings, key stakeholders, and future projections from 2019 to 2033, with a primary focus on the 2025 base year and the forecast period of 2025-2033. Market segmentation includes product form (powdered, capsules/tablets, others) and distribution channels (supermarkets/hypermarkets, pharmacies/drug stores, online retail, others). The estimated market size for 2025 is $7.7 billion.

United States Botanical Supplements Market Dynamics & Structure

This section delves into the intricate structure and driving forces of the US botanical supplements market. We analyze market concentration, revealing the share held by key players such as Dr Willmar Schwabe GmbH & Co KG, GNC Holdings Inc, Herbalife International of America Inc, Amway Corporation, Nature's Bounty Co, NOW Foods, and Gaia Herbs LLC (list not exhaustive). Technological innovation, particularly in extraction methods and delivery systems, is examined, along with the impact of regulatory frameworks like the Dietary Supplement Health and Education Act (DSHEA). The competitive landscape, including the presence of synthetic vitamin alternatives, is thoroughly assessed. Furthermore, we analyze end-user demographics, identifying key consumer segments and their preferences. Finally, we explore M&A activity within the sector, quantifying deal volumes and analyzing their impact on market consolidation.

- Market Concentration: The US botanical supplements market exhibits a [High/Medium/Low] level of concentration, with the top 5 players holding an estimated XX% market share in 2025.

- Technological Innovation: Advancements in extraction techniques (e.g., supercritical CO2 extraction) and formulation (e.g., liposomal delivery) are driving product differentiation and premiumization.

- Regulatory Landscape: The DSHEA significantly impacts market operations, influencing labeling, safety standards, and claims allowed on products.

- Competitive Substitutes: Synthetic vitamins and minerals pose a competitive threat, particularly in price-sensitive segments.

- End-User Demographics: The primary consumer base comprises health-conscious individuals, aged 35-65, with a higher-than-average disposable income. Growth is also seen in younger demographics interested in preventative health.

- M&A Trends: The number of M&A deals in the sector from 2019-2024 totaled approximately XX, indicating [high/moderate/low] consolidation activity.

United States Botanical Supplements Market Growth Trends & Insights

This section provides a comprehensive analysis of the market's growth trajectory, leveraging extensive data analysis to project future trends. We examine the historical market size from 2019 to 2024, highlighting significant growth spurts and periods of stagnation. The report also projects market size from 2025-2033, providing detailed CAGR (Compound Annual Growth Rate) projections for the forecast period. Adoption rates for different product forms and distribution channels are analyzed, alongside the impact of technological disruptions and shifting consumer behavior, such as increased online purchasing and demand for organic and sustainably sourced supplements. Specific market penetration rates for key segments are presented.

[Insert 600-word analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Include specific metrics (e.g., CAGR, market penetration) for deeper insights.]

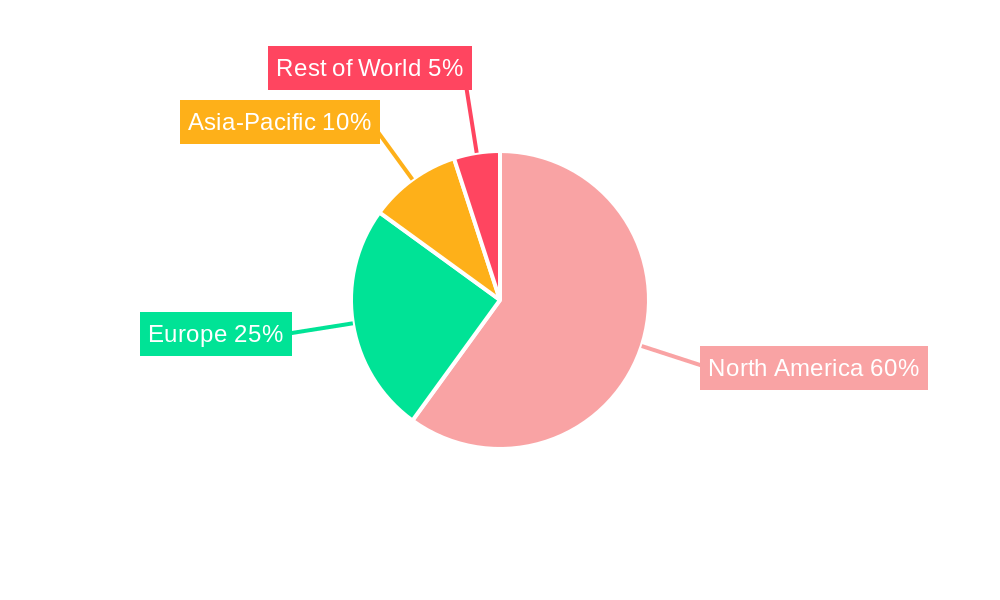

Dominant Regions, Countries, or Segments in United States Botanical Supplements Market

This section pinpoints the leading regions, countries, or segments driving market growth within the US. We analyze the performance of different segments, including powdered supplements, capsules and tablets, and other forms, as well as the various distribution channels (supermarket/hypermarket, pharmacies/drug stores, online retail stores, and other channels). We identify the dominant segment(s) and provide a detailed explanation of the factors underpinning their leading position, encompassing market share, growth potential, and specific drivers.

- Leading Segment by Form: Capsules and tablets dominate the market due to [reasons].

- Leading Segment by Distribution Channel: Online retail stores are experiencing rapid growth due to [reasons].

- Regional Variations: [Specific regional variations in market share and growth]

[Insert 600-word analysis detailing dominance factors, including market share and growth potential, using bullet points for key drivers and paragraphs for analysis.]

United States Botanical Supplements Market Product Landscape

This section offers a concise overview of product innovations, applications, and performance metrics within the US botanical supplements market. We detail unique selling propositions (USPs), such as patented extraction methods or clinically proven efficacy, and discuss technological advancements that enhance product quality, efficacy, and bioavailability. We also touch upon the various applications of botanical supplements, ranging from general wellness to targeted health benefits.

[Insert 100-150 word paragraph detailing product innovations, applications, and performance metrics.]

Key Drivers, Barriers & Challenges in United States Botanical Supplements Market

This section outlines the key factors propelling market growth, including technological advancements (e.g., improved extraction techniques, personalized formulations), economic factors (e.g., rising disposable incomes, increased health consciousness), and favorable policy environments. It also examines key challenges and restraints, such as supply chain disruptions, regulatory hurdles (e.g., stringent labeling requirements), and intense competition. Quantifiable impacts of these factors are provided where possible.

Key Drivers:

[Insert 150 words outlining key drivers using paragraphs or bullet points.]

Key Challenges:

[Insert 150 words analyzing key challenges and restraints.]

Emerging Opportunities in United States Botanical Supplements Market

This section highlights emerging trends and opportunities in the US botanical supplements market. We explore untapped market segments, innovative applications of botanical ingredients (e.g., in cosmeceuticals), and evolving consumer preferences, such as demand for personalized nutrition and functional foods containing botanical extracts.

[Insert 150 words highlighting emerging trends and opportunities.]

Growth Accelerators in the United States Botanical Supplements Market Industry

This section discusses the catalysts driving long-term growth in the US botanical supplements market, focusing on factors expected to fuel expansion over the next decade. We emphasize the role of technological breakthroughs, strategic partnerships (e.g., collaborations between supplement brands and healthcare providers), and market expansion strategies (e.g., entering new distribution channels, targeting international markets).

[Insert 150-word paragraph discussing long-term growth catalysts.]

Key Players Shaping the United States Botanical Supplements Market Market

- Dr Willmar Schwabe GmbH & Co KG

- GNC Holdings Inc

- Herbalife International of America Inc

- Amway Corporation

- Nature's Bounty Co

- NOW Foods

- Gaia Herbs LLC

- *List Not Exhaustive

Notable Milestones in United States Botanical Supplements Market Sector

[Insert bullet-point list of notable milestones with year/month and impact on market dynamics.]

In-Depth United States Botanical Supplements Market Market Outlook

This section summarizes the growth accelerators identified throughout the report and provides a concise outlook on the future potential of the US botanical supplements market. We highlight strategic opportunities for businesses operating in or seeking to enter this dynamic sector, emphasizing the long-term prospects for growth and innovation.

[Insert 150-word paragraph summarizing growth accelerators and future market potential.]

United States Botanical Supplements Market Segmentation

-

1. Form

- 1.1. Powdered Supplements

- 1.2. Capsules and Tablets

- 1.3. Other Forms

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Pharmacies/ Drug Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

United States Botanical Supplements Market Segmentation By Geography

- 1. United States

United States Botanical Supplements Market Regional Market Share

Geographic Coverage of United States Botanical Supplements Market

United States Botanical Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. The Growing Popularity of Plant Sourced Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powdered Supplements

- 5.1.2. Capsules and Tablets

- 5.1.3. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Pharmacies/ Drug Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dr Willmar Schwabe GmbH & Co KG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GNC Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Herbalife International of America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nature's Bounty Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NOW Foods

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gaia Herbs LLC*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Dr Willmar Schwabe GmbH & Co KG

List of Figures

- Figure 1: United States Botanical Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Botanical Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: United States Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Botanical Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: United States Botanical Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Botanical Supplements Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the United States Botanical Supplements Market?

Key companies in the market include Dr Willmar Schwabe GmbH & Co KG, GNC Holdings Inc, Herbalife International of America Inc, Amway Corporation, Nature's Bounty Co, NOW Foods, Gaia Herbs LLC*List Not Exhaustive.

3. What are the main segments of the United States Botanical Supplements Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

The Growing Popularity of Plant Sourced Products.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Botanical Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Botanical Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Botanical Supplements Market?

To stay informed about further developments, trends, and reports in the United States Botanical Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence