Key Insights

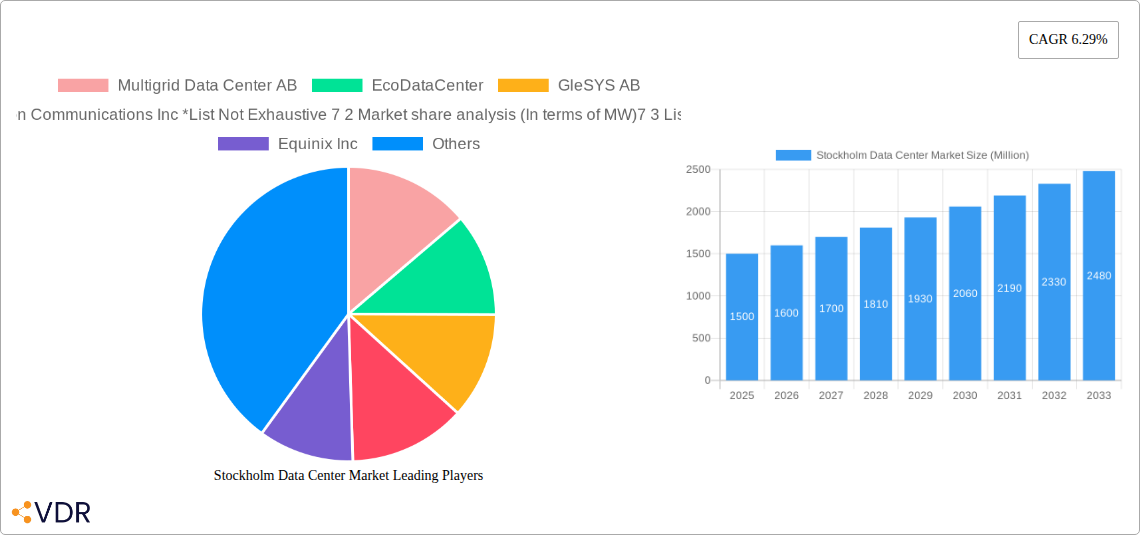

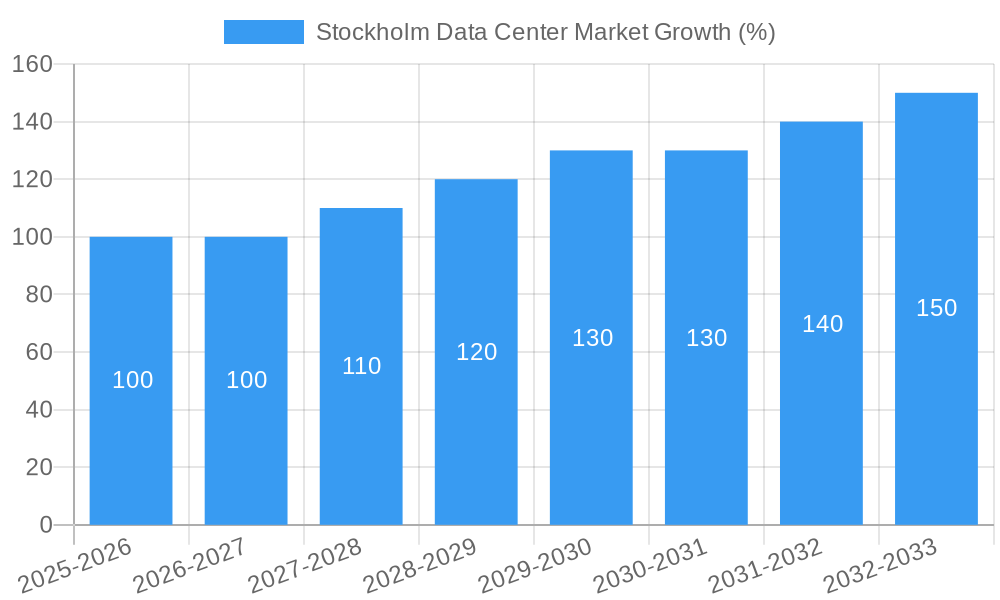

The Stockholm data center market is experiencing robust growth, driven by increasing digitalization, the expansion of cloud computing services, and a burgeoning need for reliable IT infrastructure within Sweden. The market's Compound Annual Growth Rate (CAGR) of 6.29% from 2019 to 2024 suggests a strong trajectory. Considering the continued expansion of e-commerce, the growing adoption of 5G technology, and the increasing focus on data sovereignty within the European Union, this growth is projected to continue through 2033. Segmentation reveals a diverse market, with demand spanning various DC sizes (from small to mega), tier types (Tier 1 through 3), absorption rates (utilized and colocation types), and end-user sectors (including cloud & IT, telecom, media & entertainment, and BFSI). The presence of both established international players like Equinix and Verizon, and regional providers such as Multigrid Data Center AB and Bahnhof AB, underscores the market's competitive landscape and its attractiveness to both domestic and foreign investment. Future growth will likely be influenced by factors such as energy costs, government regulations regarding data privacy and sustainability, and the availability of skilled labor. The market's significant concentration of hyperscale facilities in the Stockholm region indicates its importance as a key data hub in Northern Europe.

The competitive landscape includes a mix of global hyperscalers and smaller, specialized providers. This creates opportunities for both large-scale deployments and niche service offerings. Demand is being fueled by the growth of data-intensive industries, including FinTech and media. Furthermore, Sweden's commitment to renewable energy sources positions the Stockholm data center market favorably in terms of sustainability concerns – a critical factor increasingly influencing business location decisions. The diverse range of colocation options available, from retail to wholesale, allows businesses of all sizes to find suitable solutions. The continued investment in infrastructure upgrades and the expansion of connectivity options further enhance the market's appeal, attracting businesses seeking high-performance and resilient data center solutions. The current market size lacks explicit values, but based on similar markets with comparable growth rates, we can infer significant value in millions, consistently increasing year-over-year.

Stockholm Data Center Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Stockholm data center market, encompassing market dynamics, growth trends, key players, and future opportunities. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. It delves into various segments including DC size (Small, Medium, Large, Massive, Mega), Tier type (Tier 1, Tier 2, Tier 3, Tier 4), Colocation type (Retail, Wholesale, Hyperscale), and End-user sectors (Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, and Others). The report also analyzes market concentration, technological advancements, and regulatory influences impacting growth within the Stockholm data center market. Key players such as Multigrid Data Center AB, EcoDataCenter, GleSYS AB, and Verizon Communications Inc. are profiled, with a detailed market share analysis (in MW) included. Furthermore, the report explores significant industry developments and emerging opportunities to provide stakeholders with a complete understanding of the Stockholm data center landscape. The total market size is predicted to be xx Million USD in 2025.

Stockholm Data Center Market Dynamics & Structure

The Stockholm data center market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is [Insert Market Concentration Percentage]% with the top 5 players holding approximately xx Million USD of market share in 2025. Technological innovation, particularly in areas like sustainable energy solutions and advanced cooling technologies, is a major driver. The regulatory framework in Sweden, including policies related to data privacy and energy efficiency, plays a crucial role. Competitive product substitutes, such as cloud services, exert pressure on market growth.

- Market Concentration: [Insert Market Concentration Percentage]% in 2025; expected to [Increase/Decrease] to [Insert Projected Percentage]% by 2033.

- Technological Innovation: Focus on sustainable energy (e.g., Bahnhof's nuclear reactor plan), AI-powered management systems, and improved cooling efficiency.

- Regulatory Framework: Stringent data privacy regulations and incentives for energy-efficient data centers.

- Competitive Substitutes: Cloud computing and edge computing pose challenges to traditional colocation services.

- End-User Demographics: Growth driven by increasing demand from Cloud & IT, Telecom, and Media & Entertainment sectors.

- M&A Trends: Moderate M&A activity; xx deals recorded between 2019-2024, valued at xx Million USD. Expected increase in M&A activity due to consolidation and expansion plans.

Stockholm Data Center Market Growth Trends & Insights

The Stockholm data center market has experienced significant growth over the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is largely attributed to several factors, including the increasing adoption of cloud computing services, the rising demand for digital content and streaming, and the expansion of data-intensive industries. Technological disruptions, such as the advent of 5G and edge computing, are further accelerating market growth. Consumer behavior shifts, particularly the increased reliance on digital services, are fueling this expansion. The market size is projected to reach xx Million USD by 2033. Market penetration is expected to reach xx% by 2033, driven by increased adoption in various end-user sectors.

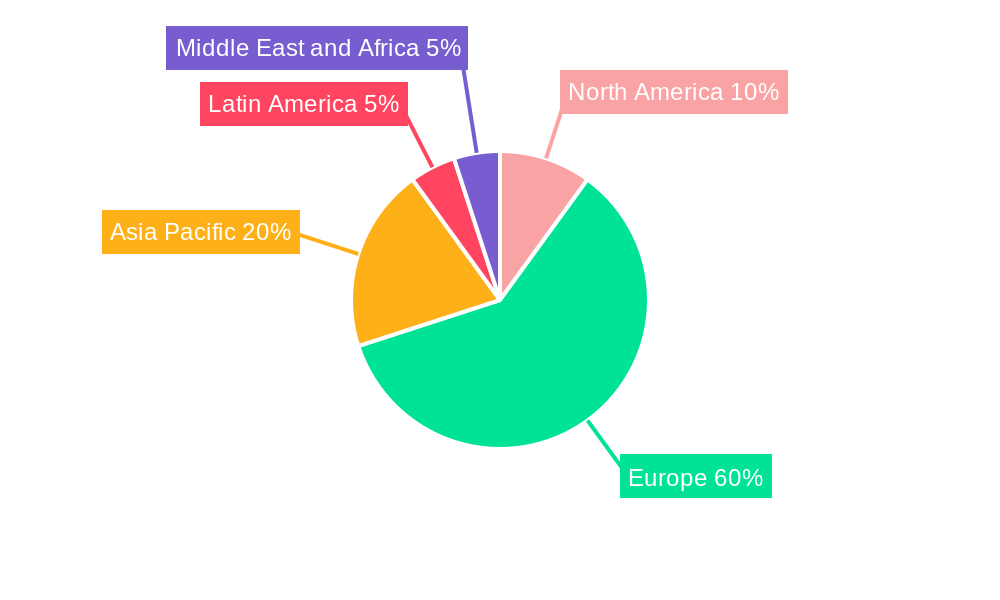

Dominant Regions, Countries, or Segments in Stockholm Data Center Market

Stockholm is the dominant region driving the growth of the Swedish data center market. This dominance is primarily attributed to factors such as the concentration of major businesses and significant IT infrastructure. The robust connectivity, well-established energy infrastructure, and supportive regulatory environment further contribute to the region's leading position. The Large and Mega DC size segments, and Tier 3 & 4 data centers dominate the market, driven by hyperscale providers’ need for substantial capacity. The utilized absorption segment shows a high occupancy rate, reflecting the strong demand for data center space. The retail colocation type constitutes a major part of the market.

- Key Drivers:

- Abundant and reliable energy resources.

- Established digital infrastructure.

- Supportive government policies.

- Strong presence of major technology companies.

- Market Share and Growth Potential: [Insert specific market share data for each segment]

Stockholm Data Center Market Product Landscape

The Stockholm data center market offers a range of products catering to diverse needs. This includes highly secure and resilient facilities, equipped with cutting-edge cooling and power systems, employing sustainable energy solutions and featuring modular designs for scalability and flexibility. Unique selling propositions include tailored solutions for specific industry verticals, advanced security features, and robust disaster recovery options. Technological advancements are driving increased efficiency, sustainability, and resilience.

Key Drivers, Barriers & Challenges in Stockholm Data Center Market

Key Drivers:

- Growing digital economy and increasing data consumption.

- Rise of cloud computing and data center virtualization.

- Government support for digital infrastructure development.

Challenges:

- High energy costs and the need for sustainable solutions.

- Limited land availability in strategic locations.

- Competition from other European data center hubs. This has resulted in a xx% reduction in profitability margins for smaller providers between 2021 and 2024.

Emerging Opportunities in Stockholm Data Center Market

- Expansion of edge computing deployments to support low-latency applications.

- Growth in demand for specialized facilities for specific industries (e.g., AI, healthcare).

- Increased investment in sustainable and energy-efficient data center technologies.

Growth Accelerators in the Stockholm Data Center Market Industry

The long-term growth of the Stockholm data center market is driven by several factors. These include technological breakthroughs in energy efficiency and sustainability, strategic partnerships between data center providers and technology companies, and the ongoing expansion of the digital economy. Further, the increasing focus on data sovereignty and security, along with favorable government policies, are also key growth drivers.

Key Players Shaping the Stockholm Data Center Market Market

- Multigrid Data Center AB

- EcoDataCenter

- GleSYS AB

- Verizon Communications Inc.

- Equinix Inc.

- Inleed

- HighSec Ltd

- Interxion (Digital Realty Trust Inc.)

- Seyoon Networks Limited

- SERVERCENTRALEN

- atNorth

- Bahnhof AB

- Stack Infrastructure Inc.

- Conapto (Designrepublic se)

- GlobalConnect AB

(Note: Market share analysis in MW for these companies would be presented within the full report)

Notable Milestones in Stockholm Data Center Market Sector

- April 2023: Conapto secures USD 40 million in debt funding, expanding its capacity by 20 MW in Stockholm. This signifies a significant investment in the Stockholm data center market and reflects growing confidence in the region.

- March 2023: Bahnhof announces plans to build a nuclear reactor to power a new data center, demonstrating a commitment to sustainable and reliable energy solutions. This groundbreaking initiative could reshape the landscape of data center power provision.

In-Depth Stockholm Data Center Market Outlook

The future of the Stockholm data center market appears bright, driven by continuous growth in data consumption, increasing demand for cloud services, and the focus on developing a more robust and sustainable digital infrastructure. Strategic investments in innovative technologies and sustainable practices will play a significant role in shaping future market dynamics. The potential for expansion into new market segments and partnerships with technology companies will further enhance market growth and present lucrative opportunities for stakeholders.

Stockholm Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Stockholm Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Stockholm Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in the Automotive Sector Fuel the Market; Growing Implementation of Light Sensors in Smartphones and PC Tablets

- 3.3. Market Restrains

- 3.3.1. Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. North America Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Stockholm Data Center Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Multigrid Data Center AB

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 EcoDataCenter

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 GleSYS AB

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Verizon Communications Inc *List Not Exhaustive 7 2 Market share analysis (In terms of MW)7 3 List of Companie

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Equinix Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Inleed

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 HighSec Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Interxion(Digital Realty Trust Inc )

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Seyoon Networks Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SERVERCENTRALEN

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 atNorth

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Bahnhof AB

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Stack Infrastructure Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Conapto (Designrepublic se)

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 GlobalConnect AB

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Multigrid Data Center AB

List of Figures

- Figure 1: Global Stockholm Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Stockholm Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 13: North America Stockholm Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 14: North America Stockholm Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 15: North America Stockholm Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 16: North America Stockholm Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 17: North America Stockholm Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 18: North America Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Stockholm Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 21: South America Stockholm Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 22: South America Stockholm Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Stockholm Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Stockholm Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Stockholm Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Stockholm Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 29: Europe Stockholm Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 30: Europe Stockholm Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 31: Europe Stockholm Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 32: Europe Stockholm Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 33: Europe Stockholm Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 34: Europe Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Stockholm Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 37: Middle East & Africa Stockholm Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 38: Middle East & Africa Stockholm Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 39: Middle East & Africa Stockholm Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 40: Middle East & Africa Stockholm Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 41: Middle East & Africa Stockholm Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 42: Middle East & Africa Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Stockholm Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 45: Asia Pacific Stockholm Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 46: Asia Pacific Stockholm Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 47: Asia Pacific Stockholm Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 48: Asia Pacific Stockholm Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 49: Asia Pacific Stockholm Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 50: Asia Pacific Stockholm Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Stockholm Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Stockholm Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Stockholm Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Global Stockholm Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Global Stockholm Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Global Stockholm Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Stockholm Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 17: Global Stockholm Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 18: Global Stockholm Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 19: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Stockholm Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 24: Global Stockholm Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 25: Global Stockholm Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Stockholm Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 31: Global Stockholm Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 32: Global Stockholm Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 33: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United Kingdom Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Benelux Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Nordics Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Stockholm Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 44: Global Stockholm Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 45: Global Stockholm Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 46: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Turkey Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Israel Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: GCC Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: North Africa Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East & Africa Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Stockholm Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 54: Global Stockholm Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 55: Global Stockholm Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 56: Global Stockholm Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Japan Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Korea Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: ASEAN Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Oceania Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Stockholm Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stockholm Data Center Market?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the Stockholm Data Center Market?

Key companies in the market include Multigrid Data Center AB, EcoDataCenter, GleSYS AB, Verizon Communications Inc *List Not Exhaustive 7 2 Market share analysis (In terms of MW)7 3 List of Companie, Equinix Inc, Inleed, HighSec Ltd, Interxion(Digital Realty Trust Inc ), Seyoon Networks Limited, SERVERCENTRALEN, atNorth, Bahnhof AB, Stack Infrastructure Inc, Conapto (Designrepublic se), GlobalConnect AB.

3. What are the main segments of the Stockholm Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in the Automotive Sector Fuel the Market; Growing Implementation of Light Sensors in Smartphones and PC Tablets.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality.

8. Can you provide examples of recent developments in the market?

April 2023: Conapto, a Nordic data center operator, has secured over USD 40 million in debt funding to help it grow its footprint in Sweden. Conapto, a Swedish data center provider, is adding an extra 20 MW of electricity capacity after getting SEK 400 million in debt financing from Kommunalkredit Austria AG, according to investment firm Marguerite. According to Marguerite, the investment will finance the first phase of a new 8,000-square-meter data center in Stockholm, Sweden, which will be connected to the district heating network to recover excess heat from its operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stockholm Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stockholm Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stockholm Data Center Market?

To stay informed about further developments, trends, and reports in the Stockholm Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence