Key Insights

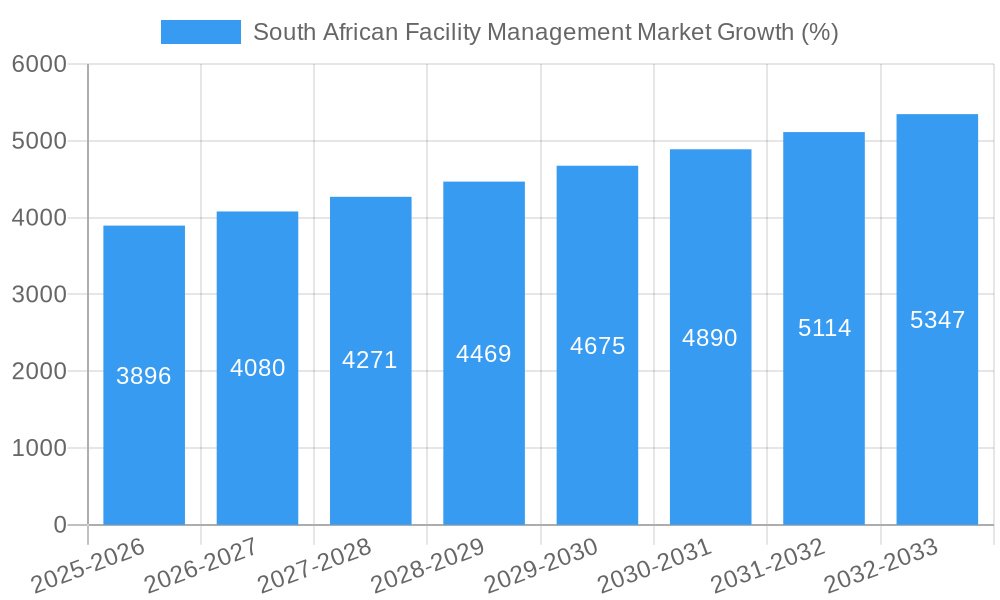

The South African facility management (FM) market, valued at approximately ZAR 80 billion in 2025, is experiencing robust growth, projected at a compound annual growth rate (CAGR) of 4.62% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a burgeoning commercial real estate sector, fueled by both domestic and foreign investment, necessitates efficient and professional FM services. Secondly, increasing awareness among businesses of the strategic importance of FM in optimizing operational efficiency, reducing costs, and enhancing employee productivity is driving demand. Thirdly, the growing adoption of smart building technologies and sustainable practices within the FM sector presents further opportunities for market expansion. The market is segmented by type (in-house versus outsourced FM), offering type (hard FM encompassing technical services like HVAC and soft FM encompassing administrative services), and end-user (commercial, institutional, public/infrastructure, industrial). Outsourced FM currently holds a larger market share, reflecting a trend towards specialization and outsourcing non-core functions. Within offerings, hard FM currently dominates, but soft FM is witnessing faster growth, driven by rising focus on employee well-being and workplace experience. Major players like Tsebo Facilities Solutions, Bidvest Facilities Management, and others are driving innovation and consolidation within the market.

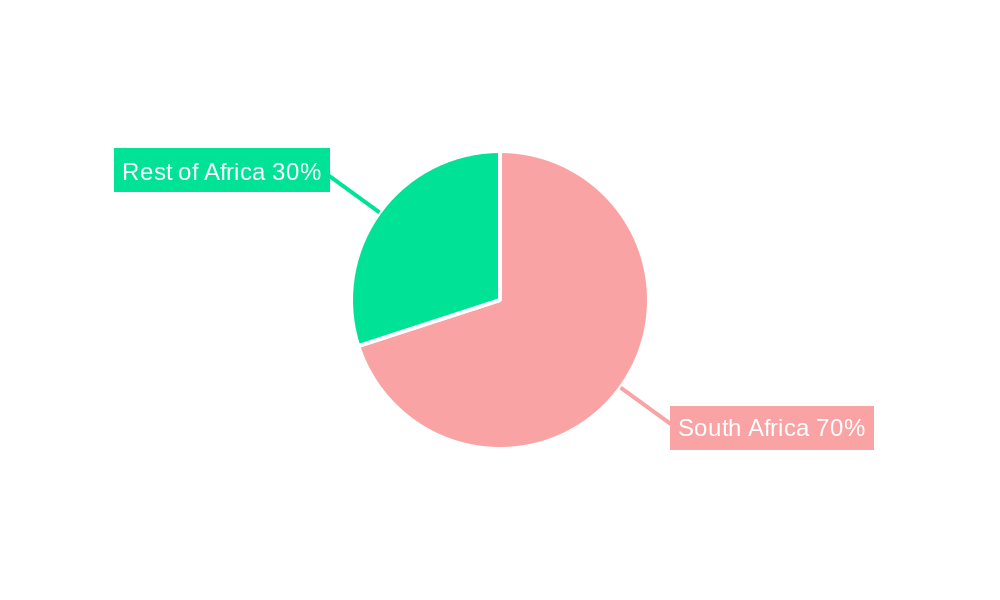

Challenges to market growth include a shortage of skilled FM professionals, particularly in specialized areas. Furthermore, economic fluctuations and potential infrastructure constraints could moderately impact market expansion. However, the long-term outlook remains positive, with significant opportunities for growth across all segments. The increasing adoption of technology, a focus on sustainability, and the evolving needs of diverse end-users will shape the future of the South African FM market, paving the way for innovative service offerings and strategic partnerships. Expanding into underserved regions within South Africa and other African nations presents significant untapped potential for FM providers.

South African Facility Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South African facility management market, encompassing market dynamics, growth trends, key players, and future projections. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for industry professionals, investors, and stakeholders seeking to understand this dynamic sector. The market is segmented by type (Inhouse Facility Management, Outsourced Facility Management), offering type (Hard FM, Soft FM), and end-user (Commercial, Institutional, Public/Infrastructure, Industrial, Others). The market size in 2025 is estimated to be xx Million.

South African Facility Management Market Dynamics & Structure

The South African facility management market exhibits a moderately concentrated structure with a few large players and numerous smaller firms competing for market share. Market growth is driven by technological advancements, particularly in areas such as smart building technology and IoT-enabled solutions. Stringent regulatory frameworks concerning health and safety standards also play a role, driving demand for professional facility management services. While some substitution exists with in-house teams managing simpler tasks, specialized and complex services remain largely dependent on outsourced providers. The end-user demographic is diverse, spanning commercial, institutional, industrial, and public sectors, each with unique needs. M&A activity is moderate, with consolidation expected to continue as larger firms seek to expand their service portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with a few dominant players holding a significant market share (estimated at xx%).

- Technological Innovation: Strong driver, with adoption of IoT, smart building technology, and data analytics improving efficiency and decision-making. However, barriers include high initial investment costs and a lack of skilled workforce.

- Regulatory Framework: Strict health and safety regulations mandate professional FM services, creating demand but also increasing operational complexity.

- Competitive Product Substitutes: Limited for specialized services; in-house teams partially substitute for basic tasks.

- End-User Demographics: Diverse across sectors (Commercial – xx%, Institutional – xx%, Public/Infrastructure – xx%, Industrial – xx%, Others – xx%), each with specific requirements.

- M&A Trends: Moderate activity observed, driven by strategic expansion and consolidation. Estimated xx M&A deals in the past 5 years.

South African Facility Management Market Growth Trends & Insights

The South African facility management market has witnessed consistent growth over the past five years, driven by factors like increasing urbanization, expansion of commercial real estate, and the rising need for efficient and sustainable building operations. XXX (insert source of data, e.g., market research firm) projects a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market size of xx Million by 2033. Market penetration is highest in the commercial sector, but significant growth potential exists in the public and industrial sectors. Technological advancements, particularly in building automation systems and energy management, are shaping consumer behavior, pushing the adoption of more sophisticated and data-driven solutions. This shift necessitates enhanced FM services encompassing building analytics and predictive maintenance.

Dominant Regions, Countries, or Segments in South African Facility Management Market

The Gauteng province leads the South African facility management market, driven by the high concentration of commercial and industrial activities. Within the market segments, outsourced facility management is the fastest-growing segment owing to cost-efficiency and access to specialized expertise. In terms of offering types, Hard FM currently holds a larger market share, but Soft FM is experiencing accelerated growth with increased emphasis on workplace experience and employee wellbeing. The Commercial sector is the largest end-user segment, exhibiting strong demand across various building types (office spaces, retail complexes, etc.).

- Leading Region: Gauteng Province due to high concentration of commercial, industrial, and institutional facilities.

- Fastest-Growing Segment (By Type): Outsourced Facility Management, attributed to cost-effectiveness and specialized skills.

- Fastest-Growing Segment (By Offering Type): Soft FM, reflecting a focus on employee wellness and experience.

- Largest End-User Segment: Commercial, encompassing diverse building types with varying facility management needs.

- Key Drivers: Urbanization, economic growth, increasing demand for sustainability and efficiency.

South African Facility Management Market Product Landscape

The South African facility management market showcases a range of products and services, from traditional cleaning and security to sophisticated building management systems (BMS) and energy-efficient technologies. Innovative solutions include integrated workplace management systems (IWMS), which centralize various facility management functions. Performance metrics emphasize operational efficiency, cost reduction, and enhanced sustainability. Key selling propositions focus on improved building operations, reduced energy consumption, and enhanced occupant experience. Integration of IoT sensors and data analytics offers a competitive edge, enabling predictive maintenance and optimized resource allocation.

Key Drivers, Barriers & Challenges in South African Facility Management Market

Key Drivers: Growing urbanization, expanding commercial real estate, increasing focus on sustainability, government regulations promoting energy efficiency. The rise of smart building technologies and the need for improved workplace experiences are strong catalysts.

Key Challenges: Skill shortages in specialized areas like BMS management and data analytics. High initial investment costs associated with implementing new technologies. Economic volatility and fluctuations in exchange rates can impact the cost of goods and services.

Emerging Opportunities in South African Facility Management Market

Emerging opportunities include a growing focus on sustainability initiatives, the increasing adoption of smart building technologies, and the demand for integrated workplace management solutions. Untapped potential exists in the public sector, which often lacks the resources and expertise to manage facilities effectively. Expanding into specialized segments, such as healthcare or data centers, presents further opportunities.

Growth Accelerators in the South African Facility Management Market Industry

Technological breakthroughs in areas like AI, IoT, and data analytics are crucial growth accelerators. Strategic partnerships between FM providers and technology companies facilitate innovation and market expansion. Government initiatives promoting sustainable building practices and energy efficiency further propel market growth.

Key Players Shaping the South African Facility Management Market Market

- TROX South Africa (Pty) Ltd

- Chiefton Facilities Management (Pty) Ltd

- SSG Holdings

- Tsebo Facilities Solutions

- Matrix Consulting Services

- SGS SA

- Akweni Group Property Solutions (Pty) Ltd

- Excellerate Services

- Bidvest Facilities Management

- AFMS Group (Pty) Ltd

- Integrico (Pty) Ltd

- Facilities Management Solutions (Pty) Ltd

Notable Milestones in South African Facility Management Market Sector

- March 2023: Red Rocket's 373MW wind turbine contract with Vestas signifies increased investment in renewable energy infrastructure, requiring specialized FM services for operation and maintenance.

- September 2022: Juwi South Africa's O&M contract for the De Aar 1 solar plant highlights the growing outsourcing trend in renewable energy sector FM.

- April 2022: Securex South Africa 2022, co-located with the Facilities Management Expo, facilitated networking and showcased latest offerings in the FM sector.

In-Depth South African Facility Management Market Market Outlook

The South African facility management market is poised for sustained growth, driven by technological advancements, increasing urbanization, and the growing need for efficient and sustainable building operations. Strategic opportunities lie in leveraging technological innovations to enhance service offerings, targeting underserved segments, and forming strategic partnerships to expand market reach. The focus on sustainability presents a significant growth avenue, and proactive adaptation to evolving client needs will be crucial for continued success.

South African Facility Management Market Segmentation

-

1. Type

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End Users

South African Facility Management Market Segmentation By Geography

- 1. South Africa

South African Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Infrastructural Developments and Growing Retail Sector; Rising Developments in Public and Private Infrastructure

- 3.3. Market Restrains

- 3.3.1. Fragmented Market with Several Local Vendors

- 3.4. Market Trends

- 3.4.1. Outsourced FM is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South African Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa South African Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South African Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South African Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South African Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South African Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South African Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 TROX South Africa (Pty) Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chiefton Facilities Management (Pty) Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SSG Holdings

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tsebo Facilities Solutions

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Matrix Consulting Services

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SGS SA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Akweni Group Property Solutions (Pty) Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Excellerate Services

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bidvest Facilities Managemen

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AFMS Group (Pty) Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Integrico (Pty) Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Facilities Management Solutions (Pty) Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 TROX South Africa (Pty) Ltd

List of Figures

- Figure 1: South African Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South African Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: South African Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South African Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South African Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: South African Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: South African Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South African Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa South African Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan South African Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda South African Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania South African Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya South African Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa South African Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South African Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: South African Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 15: South African Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: South African Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South African Facility Management Market?

The projected CAGR is approximately 4.62%.

2. Which companies are prominent players in the South African Facility Management Market?

Key companies in the market include TROX South Africa (Pty) Ltd, Chiefton Facilities Management (Pty) Ltd, SSG Holdings, Tsebo Facilities Solutions, Matrix Consulting Services, SGS SA, Akweni Group Property Solutions (Pty) Ltd, Excellerate Services, Bidvest Facilities Managemen, AFMS Group (Pty) Ltd, Integrico (Pty) Ltd, Facilities Management Solutions (Pty) Ltd.

3. What are the main segments of the South African Facility Management Market?

The market segments include Type, Offering Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Infrastructural Developments and Growing Retail Sector; Rising Developments in Public and Private Infrastructure.

6. What are the notable trends driving market growth?

Outsourced FM is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Fragmented Market with Several Local Vendors.

8. Can you provide examples of recent developments in the market?

March 2023 - Red Rocket, a South African independent power producer, has placed a 373MW wind turbine contract with the Danish wind turbine manufacturer Vestas. The business will deliver 64 of its V150-4.5MW wind turbines, 12 of its V163-4.5MW turbines, and five of its V162-6.2MW Enventus turbines. The Brandvalley, Rietkloof, and Wolf wind parks, located in South Africa's Western and Eastern Capes, will host the installation of the turbines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South African Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South African Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South African Facility Management Market?

To stay informed about further developments, trends, and reports in the South African Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence