Key Insights

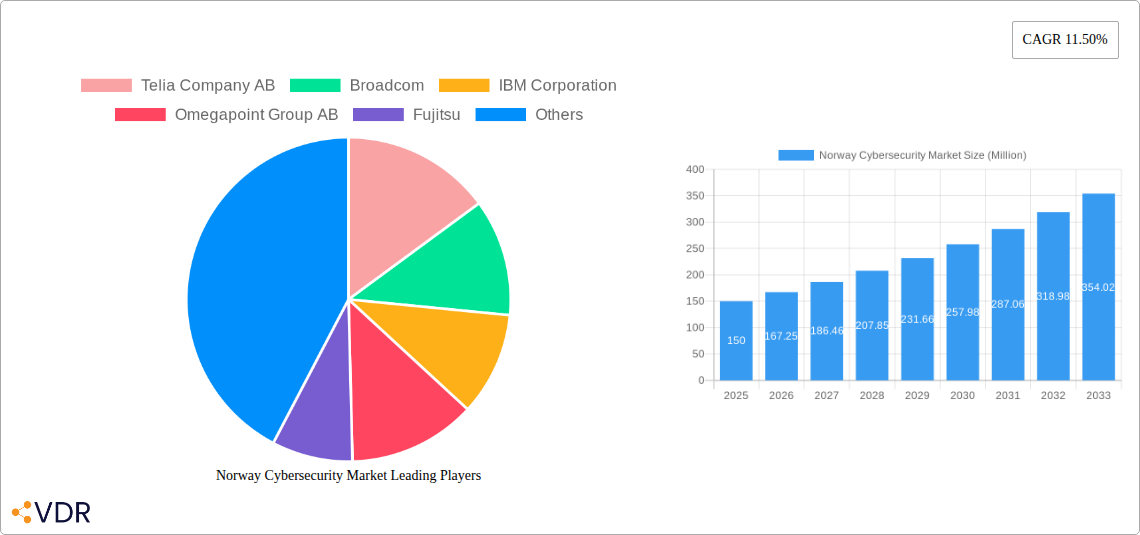

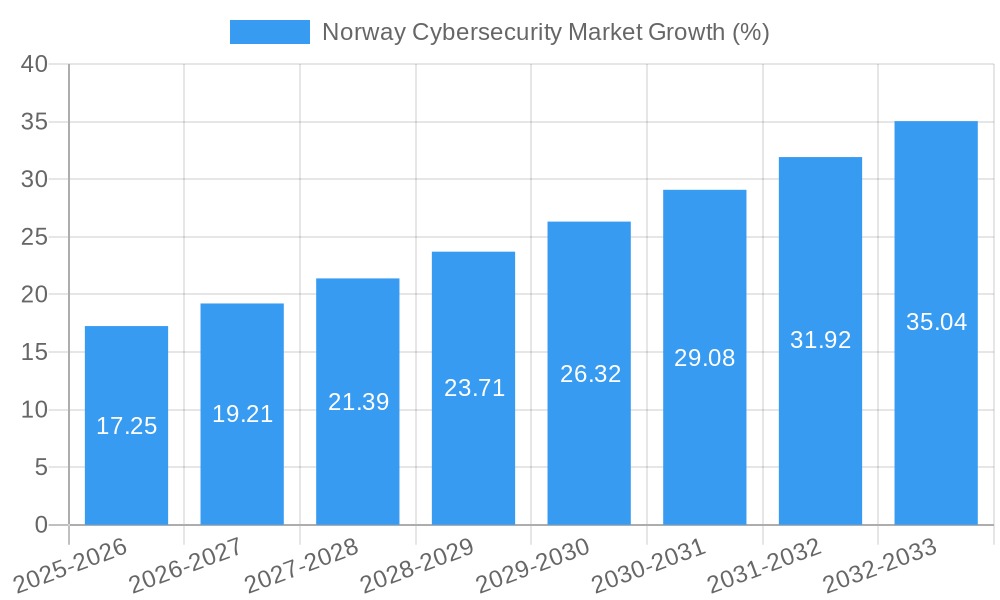

The Norway cybersecurity market, valued at approximately 150 million USD in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing digitalization across various sectors, including BFSI, healthcare, and government, necessitates robust cybersecurity measures to protect sensitive data and critical infrastructure from evolving cyber threats. The rising prevalence of sophisticated cyberattacks, ransomware, and data breaches further underscores the need for advanced security solutions. Furthermore, stringent government regulations and compliance mandates are pushing organizations to adopt more comprehensive cybersecurity strategies, driving market growth. The market is segmented by offering (security type and services), deployment (cloud and on-premise), and end-user industries. The cloud deployment segment is expected to dominate due to its scalability and cost-effectiveness. Significant investments in research and development by major players like Telia Company AB, Broadcom, IBM, and others are contributing to innovation in areas such as AI-powered threat detection and endpoint security.

While the market presents significant opportunities, certain restraints exist. The high cost of implementing and maintaining advanced cybersecurity solutions can be a barrier for smaller organizations. Additionally, a shortage of skilled cybersecurity professionals in Norway poses a challenge to effective implementation and management of security systems. However, government initiatives aimed at improving cybersecurity education and training, coupled with increasing awareness of cyber risks, are expected to mitigate these challenges over the forecast period. The strong presence of established technology companies and a technologically advanced infrastructure within Norway provide a fertile ground for continued growth in the cybersecurity market. The market's future trajectory is promising, underpinned by consistent technological advancements, escalating cyber threats, and increasing regulatory pressures.

Norway Cybersecurity Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Norway cybersecurity market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report delves into parent and child market segments, offering granular insights into the evolving landscape of cybersecurity in Norway. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Norway Cybersecurity Market Dynamics & Structure

The Norwegian cybersecurity market is characterized by a moderately concentrated landscape with several major international and domestic players competing for market share. Technological innovation, driven by increasing sophistication of cyber threats and government initiatives, is a key driver. Stringent data privacy regulations (GDPR compliance) and national security concerns influence market structure. The market experiences consistent M&A activity as larger players acquire smaller companies to expand their capabilities and market reach. Competitive product substitutes, such as open-source security solutions, also influence market dynamics. End-user demographics show strong demand from Government & Defense, BFSI, and IT & Telecommunication sectors, while others, such as Healthcare and Manufacturing are experiencing significant growth.

- Market Concentration: Moderate, with a few dominant players and several niche players. The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Driven by AI, machine learning, and cloud-based security solutions. Barriers to innovation include high R&D costs and talent acquisition challenges.

- Regulatory Framework: Stringent data privacy regulations (GDPR) and national cybersecurity strategies significantly impact market growth and security practices.

- Competitive Substitutes: Open-source solutions pose a competitive threat to proprietary software.

- M&A Activity: Significant M&A activity observed in the historical period (2019-2024), with xx deals recorded, primarily focused on expanding service offerings and geographic reach.

- End-User Demographics: Government & Defense, BFSI, and IT & Telecommunication sectors are the largest consumers of cybersecurity solutions in Norway.

Norway Cybersecurity Market Growth Trends & Insights

The Norway cybersecurity market exhibits robust growth, driven by increasing digitalization, rising cyber threats, and government initiatives promoting digital security. The market size witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising adoption rates of cloud-based security solutions and increasing awareness of cybersecurity risks among organizations across various sectors. Technological disruptions, such as the adoption of AI and IoT devices, both present opportunities and new challenges for the market. Consumer behavior shifts towards increased reliance on digital services further accelerate market growth, increasing demand for robust cybersecurity measures. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Norway Cybersecurity Market

The Oslo region dominates the Norwegian cybersecurity market due to its concentration of major businesses, government agencies, and technological infrastructure. Within the market segments, the Government & Defence sector demonstrates significant growth potential, driven by substantial investments in digital transformation and national security initiatives. The Cloud deployment model is experiencing rapid adoption due to its scalability and cost-effectiveness. Within security types, solutions focusing on data loss prevention (DLP) and endpoint detection and response (EDR) are experiencing particularly high demand.

- Key Drivers:

- Government investments in digital infrastructure and cybersecurity.

- Increasing adoption of cloud computing and IoT devices.

- Growing awareness of cybersecurity risks across industries.

- Dominance Factors:

- High concentration of businesses and IT infrastructure in the Oslo region.

- Strong regulatory environment promoting data security.

- Increased government spending on cybersecurity solutions.

Norway Cybersecurity Market Product Landscape

The Norwegian cybersecurity market offers a diverse range of products and services, including network security solutions, endpoint security, data loss prevention (DLP), security information and event management (SIEM), and managed security services. Recent innovations involve the integration of AI and machine learning for advanced threat detection and response. Cloud-based security solutions are gaining popularity, offering scalability and flexibility. Unique selling propositions often center around specialized expertise in specific sectors or highly customized solutions to meet unique organizational needs.

Key Drivers, Barriers & Challenges in Norway Cybersecurity Market

Key Drivers: Increased digitalization across all sectors, stringent data privacy regulations (GDPR), rising cyber threats, and significant government investments in cybersecurity infrastructure. The 2022 government allocation of NOK 200 million to enhance digital security strongly supports market growth.

Key Challenges: High implementation costs, skill shortages in cybersecurity expertise, and integration complexities of different security solutions. Supply chain disruptions can impact the availability of hardware and software components, potentially hindering market growth. Competitive pressure from international and domestic players necessitates continuous innovation.

Emerging Opportunities in Norway Cybersecurity Market

Growing adoption of IoT devices presents opportunities for specialized IoT security solutions. The increasing demand for cloud-based security services creates potential for cloud security providers. Furthermore, rising cyber insurance penetration and evolving consumer preferences for robust digital security practices are also key drivers of market expansion. Untapped markets exist in smaller, more specialized industries.

Growth Accelerators in the Norway Cybersecurity Market Industry

Strategic partnerships between cybersecurity firms and telecommunication providers, such as the Cisco-Telenor collaboration (April 2022), significantly accelerate market growth by expanding service offerings and enhancing customer reach. Continuous technological breakthroughs in areas like AI-powered threat detection and quantum-resistant cryptography are key long-term growth catalysts. Government initiatives promoting digital transformation and cybersecurity awareness further contribute to the overall expansion of the market.

Key Players Shaping the Norway Cybersecurity Market Market

- Telia Company AB

- Broadcom

- IBM Corporation

- Omegapoint Group AB

- Fujitsu

- Cisco Systems Inc

- Thales

- Dell Inc

- Palo Alto Networks

- ABB

Notable Milestones in Norway Cybersecurity Market Sector

- April 2022: Cisco and the Telenor Group announced an extended collaboration to improve cybersecurity for companies and address the digital divide. This partnership is expected to significantly expand the market for "as-a-service" cybersecurity solutions.

- April 2022: The Norwegian Government allocated NOK 200 million to boost digital security, including NOK 15 million to strengthen NSM's cyberattack capabilities and NOK 40 million for digital intruder alerts.

In-Depth Norway Cybersecurity Market Market Outlook

The Norwegian cybersecurity market is poised for continued strong growth, driven by sustained government investment, the increasing sophistication of cyber threats, and the ongoing digital transformation across all sectors. The market offers significant opportunities for companies specializing in cloud security, AI-powered threat detection, and managed security services. Strategic partnerships and further technological advancements will continue to shape the market landscape, offering substantial potential for growth and innovation in the coming years.

Norway Cybersecurity Market Segmentation

-

1. Offering

- 1.1. Security Type

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Norway Cybersecurity Market Segmentation By Geography

- 1. Norway

Norway Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks

- 3.2.2 the evolution of MSSPs

- 3.2.3 and adoption of cloud-first strategy

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Digitalization and Scalable IT Infrastructure drive the Norway Cybersecurity Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Telia Company AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Broadcom

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omegapoint Group AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujitsu

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dell Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Palo Alto Networks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ABB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Telia Company AB

List of Figures

- Figure 1: Norway Cybersecurity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Cybersecurity Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Cybersecurity Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Norway Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Norway Cybersecurity Market Volume K Unit Forecast, by Offering 2019 & 2032

- Table 5: Norway Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 6: Norway Cybersecurity Market Volume K Unit Forecast, by Deployment 2019 & 2032

- Table 7: Norway Cybersecurity Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Norway Cybersecurity Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Norway Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Norway Cybersecurity Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Norway Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Norway Cybersecurity Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Norway Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 14: Norway Cybersecurity Market Volume K Unit Forecast, by Offering 2019 & 2032

- Table 15: Norway Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Norway Cybersecurity Market Volume K Unit Forecast, by Deployment 2019 & 2032

- Table 17: Norway Cybersecurity Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Norway Cybersecurity Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Norway Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Norway Cybersecurity Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Cybersecurity Market?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Norway Cybersecurity Market?

Key companies in the market include Telia Company AB, Broadcom, IBM Corporation, Omegapoint Group AB, Fujitsu, Cisco Systems Inc, Thales, Dell Inc, Palo Alto Networks, ABB.

3. What are the main segments of the Norway Cybersecurity Market?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks. the evolution of MSSPs. and adoption of cloud-first strategy.

6. What are the notable trends driving market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure drive the Norway Cybersecurity Market.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

April 2022 - Cisco and the Telenor Group announced an extended collaboration through the fourth iteration of their JPA to address opportunities like digital transformation, cyber security for companies, and the digital divide. The companies intend to enhance Telenor's offerings beyond connection for corporate clients and design more cyber secure, scalable, and adaptable "as-a-service" solutions to meet customers' demands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Norway Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence