Key Insights

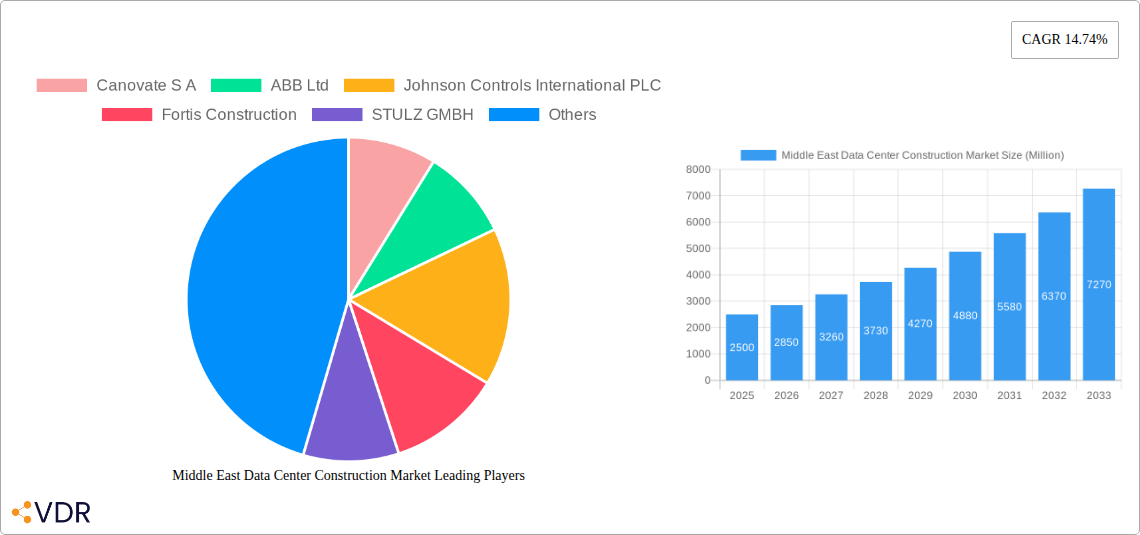

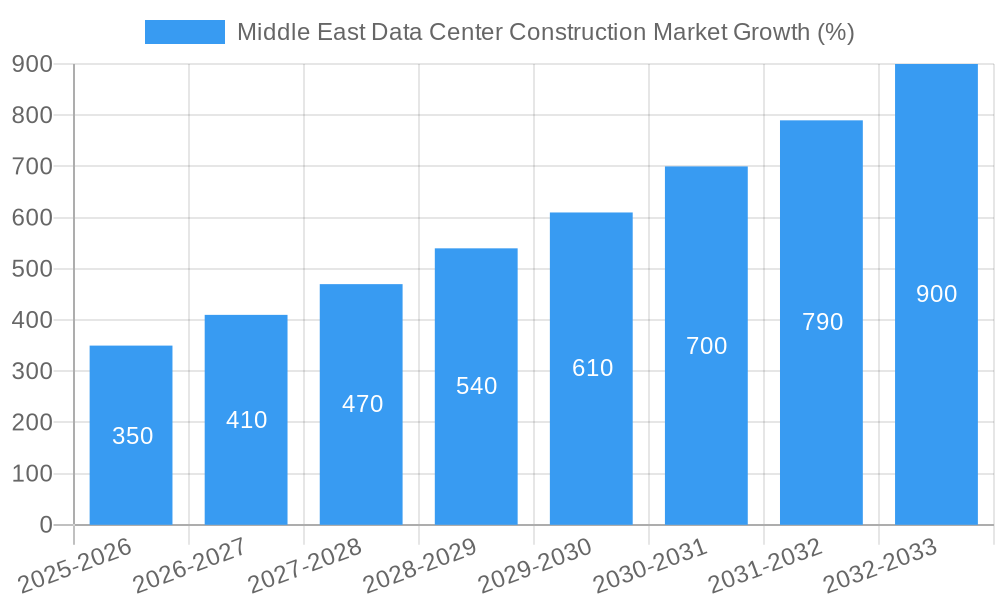

The Middle East data center construction market is experiencing robust growth, driven by the region's burgeoning digital economy, increasing cloud adoption, and government initiatives promoting digital transformation. A 14.74% CAGR from 2019-2024 suggests a significant market expansion, projected to continue throughout the forecast period (2025-2033). Key drivers include the rapid growth of e-commerce, the expansion of 5G networks, and the increasing demand for big data analytics and artificial intelligence applications. The rising need for secure and reliable data storage solutions across sectors like IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), and government is further fueling market expansion. Market segmentation reveals a diverse landscape, with significant demand across various data center sizes (small to massive), infrastructure components (cooling, power, security), and end-user industries. While the exact market size for 2025 is not provided, based on the CAGR and a reasonable estimation considering the regional growth trends, we can assume the market size in 2025 is approximately $X billion (this value needs to be estimated based on publicly available market research or reasonable extrapolation from available data). This substantial size, coupled with the continued technological advancements and infrastructural developments, positions the Middle East as a key player in the global data center industry.

The market is segmented by tier type (Tier 1-4), data center size (small, medium, large, mega, massive), and infrastructure components (cooling, power distribution, racks, servers, networking, security, design & consulting). Significant growth is anticipated in cooling infrastructure, driven by the need for efficient thermal management in increasingly dense data centers. Power infrastructure, including Power Distribution Units (PDUs), is another critical growth area. Furthermore, the increasing adoption of advanced security measures and the rising need for specialized design and consulting services contribute to the market's expansion. However, challenges remain, including potential regulatory hurdles, high energy costs in certain regions, and the need for skilled labor to manage and maintain these sophisticated facilities. Competitive dynamics are shaped by a mix of international players and regional contractors, leading to a dynamic and evolving market landscape. The continued focus on digital transformation across various sectors will drive further investment in data center construction within the Middle East throughout the forecast period, potentially leading to even higher than projected growth.

Middle East Data Center Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East data center construction market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base year, this report dissects market dynamics, growth trends, key players, and future opportunities within this rapidly expanding sector. The report segments the market by Tier Type (Tier 1, Tier 2, Tier 3, Tier 4), Data Center Size (Small, Medium, Large, Mega, Massive), Infrastructure (Cooling, Power, Racks & Cabinets, Security, Design & Consulting, Other), and End-User (IT & Telecommunication, BFSI, Government, Healthcare, Other).

Middle East Data Center Construction Market Dynamics & Structure

The Middle East data center construction market exhibits a moderately concentrated structure, with a few major international players and several regional companies vying for market share. Technological innovation, driven by the need for greater efficiency and sustainability, is a primary growth driver. Stringent regulatory frameworks regarding data security and energy consumption are shaping market practices. While traditional construction methods still dominate, modular and prefabricated data centers are gaining traction, presenting a viable substitute. The market is witnessing a surge in M&A activity, reflecting the consolidation trend and the pursuit of economies of scale.

- Market Concentration: xx% held by top 5 players in 2024.

- Technological Innovation: Focus on AI-powered cooling, renewable energy integration, and advanced security systems.

- Regulatory Landscape: Stringent data privacy regulations and energy efficiency standards are impacting construction practices.

- M&A Activity: xx deals recorded between 2019 and 2024, with an estimated value of xx million.

- End-User Demographics: Significant growth driven by the IT & Telecommunication and BFSI sectors.

Middle East Data Center Construction Market Growth Trends & Insights

The Middle East data center construction market experienced robust growth during the historical period (2019-2024), fueled by increasing digitalization, cloud adoption, and government initiatives promoting digital transformation. The market size expanded from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, driven by factors such as rising data traffic, the proliferation of 5G networks, and the expanding e-commerce sector. Technological disruptions, such as the adoption of edge computing and AI, are further accelerating market expansion. Shifting consumer behavior towards digital services and the increasing demand for high-speed internet access are key factors driving this growth.

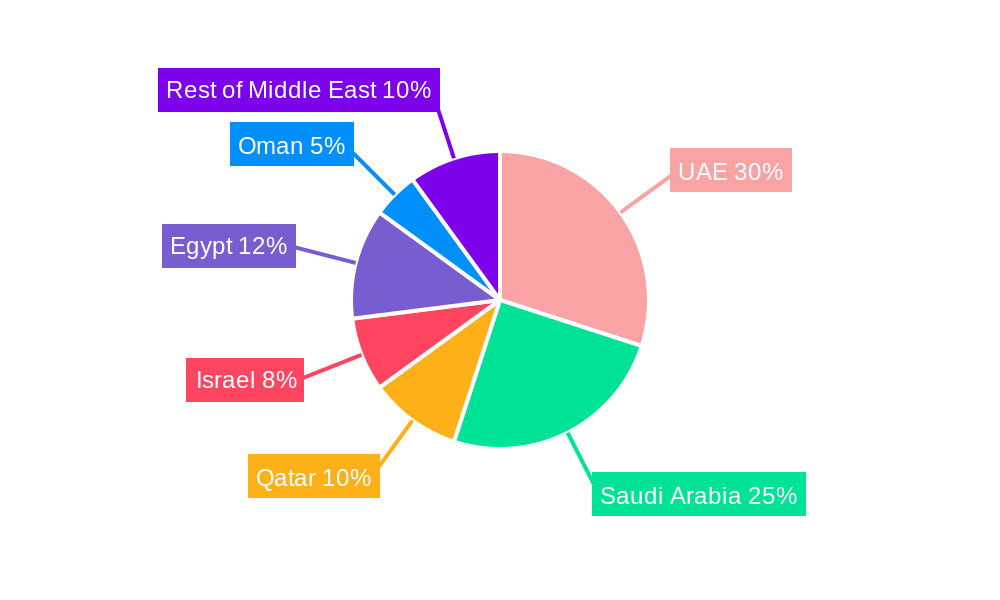

Dominant Regions, Countries, or Segments in Middle East Data Center Construction Market

The UAE and Saudi Arabia are the leading markets in the Middle East data center construction sector, driven by strong government support for digital transformation initiatives, substantial investments in infrastructure development, and a burgeoning IT sector. Within the segment breakdown, the demand for Tier III and Tier IV data centers is significantly high, owing to their enhanced reliability and scalability. Large and Mega data centers dominate the size segment due to the needs of hyperscale cloud providers and large enterprises. Cooling infrastructure, including evaporative cooling systems, is a significant market segment due to the region's climate.

- Key Drivers: Government investments in digital infrastructure, supportive regulatory frameworks, and favorable economic conditions.

- UAE & Saudi Arabia Dominance: These countries account for xx% of the total market share, driven by significant investments in digital infrastructure.

- High Demand for Tier III & IV Data Centers: Driven by reliability and scalability requirements.

- Large Data Center Size Dominance: Driven by hyperscale cloud providers and large enterprises.

- Cooling Infrastructure Growth: Driven by the region's hot and arid climate.

Middle East Data Center Construction Market Product Landscape

The market showcases a diverse range of products, including cutting-edge cooling technologies (e.g., liquid cooling, free cooling), advanced power distribution units (PDUs), robust security systems, and efficient rack and cabinet solutions. These products are characterized by increased energy efficiency, enhanced reliability, and advanced monitoring capabilities. Technological advancements focus on minimizing environmental impact, optimizing energy consumption, and enhancing data center uptime. Unique selling propositions include modular designs for faster deployment, AI-driven predictive maintenance, and seamless integration with cloud platforms.

Key Drivers, Barriers & Challenges in Middle East Data Center Construction Market

Key Drivers: Increasing digitalization, government initiatives promoting cloud adoption, growth of e-commerce and fintech sectors, and the expanding need for reliable data storage and processing capabilities in the region.

Challenges & Restraints: High initial investment costs, skilled labor shortages, reliance on imported technologies, and potential supply chain disruptions. Stringent regulatory compliance requirements and power supply limitations pose additional hurdles, impacting project timelines and profitability. Competition from established international players can affect market growth rates.

Emerging Opportunities in Middle East Data Center Construction Market

The market presents significant opportunities in areas such as edge computing deployments, the adoption of sustainable and green data center technologies, and the expansion into smaller markets within the Middle East. The increasing demand for colocation services presents a substantial opportunity for data center construction companies. Furthermore, opportunities exist in developing specialized data centers for industries such as healthcare and finance, which demand higher security and compliance standards.

Growth Accelerators in the Middle East Data Center Construction Market Industry

Technological advancements in cooling, power distribution, and security solutions are accelerating market growth. Strategic partnerships between technology providers and construction companies are facilitating innovation and market expansion. Government incentives and supportive policies are boosting investments in data center infrastructure. The growing adoption of sustainable practices, such as renewable energy integration, is driving the adoption of eco-friendly data center designs.

Key Players Shaping the Middle East Data Center Construction Market Market

- Canovate S A

- ABB Ltd

- Johnson Controls International PLC

- Fortis Construction

- STULZ GMBH

- Delta Group

- Schneider Electric SE

- Turner Construction Co

- DPR Construction Inc

- Caterpillar Inc

- Airedale International Air Conditioning Ltd

- Cummins Inc

- AECOM Limited

- Legrand

- CyrusOne Inc

- Future Digital data Systems

- Ashi & Bushnag Co Ltd

- EAE Group

- Alfa Laval AB

- Saan Zahav Ltd

Notable Milestones in Middle East Data Center Construction Market Sector

- October 2022: Launch of M-VAULT 4's fourth data center building in Qatar, expanding cloud service access.

- October 2022: Agreement to build a solar PV plant to power Khazna Data Centers' new facility in Masdar City, promoting sustainable data center operations.

In-Depth Middle East Data Center Construction Market Outlook

The Middle East data center construction market is poised for sustained growth, driven by ongoing digital transformation, increasing cloud adoption, and the region's strategic focus on technological advancement. Significant investment opportunities exist for companies offering sustainable and energy-efficient solutions, catering to the growing demand for environmentally responsible data center construction. The market's future trajectory is bright, promising considerable returns for players who can effectively navigate the regulatory landscape and leverage technological advancements to meet the escalating needs of the region's rapidly expanding digital economy.

Middle East Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Distribution Solutions

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-Voltage

- 2.1.3.2. Medium-Voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Distribution Solutions

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Basic & Smart - Metered & Switched Solutions

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-Voltage

- 3.3.2. Medium-Voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Distribution Solutions

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-To-Chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-Row and In-Rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-To-Chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-Row and In-Rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

- 21. United Arab Emirates

- 22. Saudi Arabia

- 23. Israel

- 24. Qatar

- 25. Oman

Middle East Data Center Construction Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments

- 3.3. Market Restrains

- 3.3.1. Security Challenges in Data Centers; Location Constraints on the Development of Data Centers

- 3.4. Market Trends

- 3.4.1. End-User Outlook

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Distribution Solutions

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-Voltage

- 5.2.1.3.2. Medium-Voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Distribution Solutions

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-Voltage

- 5.3.3.2. Medium-Voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Distribution Solutions

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-To-Chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-Row and In-Rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-To-Chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-Row and In-Rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by United Arab Emirates

- 5.22. Market Analysis, Insights and Forecast - by Saudi Arabia

- 5.23. Market Analysis, Insights and Forecast - by Israel

- 5.24. Market Analysis, Insights and Forecast - by Qatar

- 5.25. Market Analysis, Insights and Forecast - by Oman

- 5.26. Market Analysis, Insights and Forecast - by Region

- 5.26.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. United Arab Emirates Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Canovate S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Johnson Controls International PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fortis Construction

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 STULZ GMBH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Delta Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Schneider Electric SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Turner Construction Co

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DPR Construction Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Caterpillar Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Airedale International Air Conditioning Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Cummins Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 AECOM Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Legrand

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 CyrusOne Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Future Digital data Systems

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Ashi & Bushnag Co Ltd

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 EAE Group

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Alfa Laval AB

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Saan Zahav Ltd

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.1 Canovate S A

List of Figures

- Figure 1: Middle East Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 4: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 5: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 6: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 8: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 9: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 10: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 11: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 12: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 14: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 15: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 16: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 18: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 19: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 20: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 21: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 22: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 23: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 24: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 25: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 26: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 27: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 28: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Egypt Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Middle East Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 37: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 38: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 39: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 40: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 41: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 42: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 43: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 44: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 45: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 46: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 47: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 48: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 49: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 50: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 51: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 52: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 53: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 54: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 55: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 56: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 57: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 58: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 59: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 60: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 61: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Kuwait Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Bahrain Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Jordan Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Lebanon Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Construction Market?

The projected CAGR is approximately 14.74%.

2. Which companies are prominent players in the Middle East Data Center Construction Market?

Key companies in the market include Canovate S A, ABB Ltd, Johnson Controls International PLC, Fortis Construction, STULZ GMBH, Delta Group, Schneider Electric SE, Turner Construction Co, DPR Construction Inc, Caterpillar Inc, Airedale International Air Conditioning Ltd, Cummins Inc, AECOM Limited, Legrand, CyrusOne Inc, Future Digital data Systems, Ashi & Bushnag Co Ltd, EAE Group, Alfa Laval AB, Saan Zahav Ltd.

3. What are the main segments of the Middle East Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users, United Arab Emirates, Saudi Arabia, Israel, Qatar, Oman.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments.

6. What are the notable trends driving market growth?

End-User Outlook.

7. Are there any restraints impacting market growth?

Security Challenges in Data Centers; Location Constraints on the Development of Data Centers.

8. Can you provide examples of recent developments in the market?

October 2022: Mohamed bin Ali bin Mohamed Al-Mannai, Minister of Communications and Information Technology, launched the M-VAULT 4's fourth data center building. Customers in Qatar can access cloud services through the Microsoft Cloud data center region housed in the new data center facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence