Key Insights

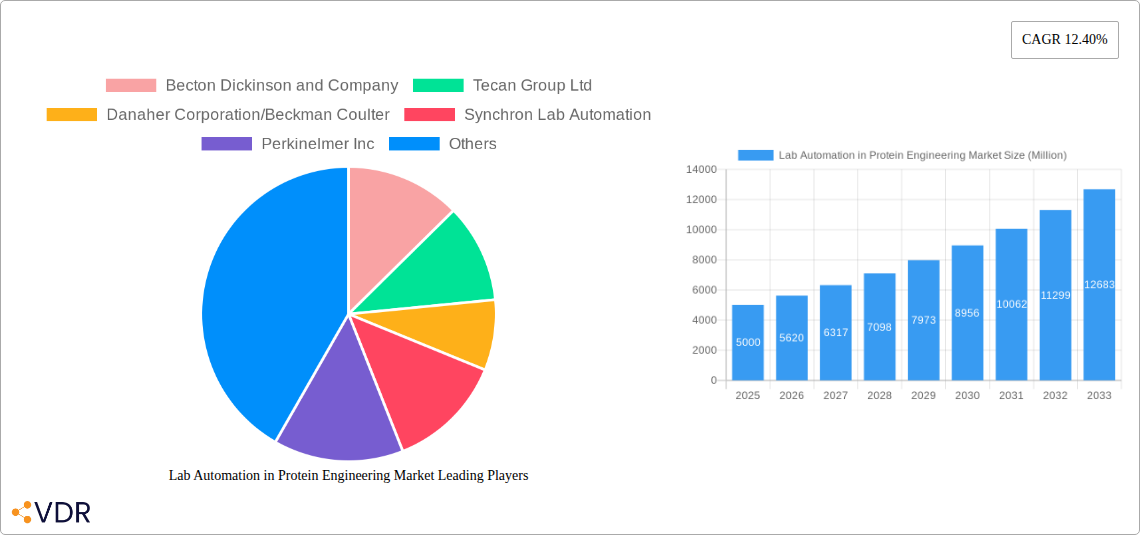

The Lab Automation in Protein Engineering market is experiencing robust growth, driven by the increasing demand for high-throughput screening and automation in drug discovery and development. The market's expansion is fueled by several key factors. Firstly, the rising prevalence of chronic diseases globally necessitates accelerated drug development, making automation crucial for efficiency and cost-effectiveness. Secondly, advancements in technologies like artificial intelligence (AI) and machine learning (ML) are integrating with lab automation systems, enhancing their capabilities and accuracy in protein engineering processes. This integration enables faster optimization of protein properties, such as stability, activity, and specificity, leading to the accelerated creation of novel biotherapeutics. Thirdly, the growing adoption of automation in academic research institutions and biotechnology companies further contributes to market expansion. While the specific market size (XX) isn't provided, considering a CAGR of 12.40% and a value unit of millions, and a reasonable starting point considering the growth of related markets, we can infer substantial growth from a 2019 base. The market is segmented by equipment type, encompassing automated liquid handlers, plate handlers, robotic arms, AS/RS, and other specialized equipment. Major players like Becton Dickinson, Tecan, Danaher, and Thermo Fisher Scientific are driving innovation and market competition through continuous product development and strategic partnerships.

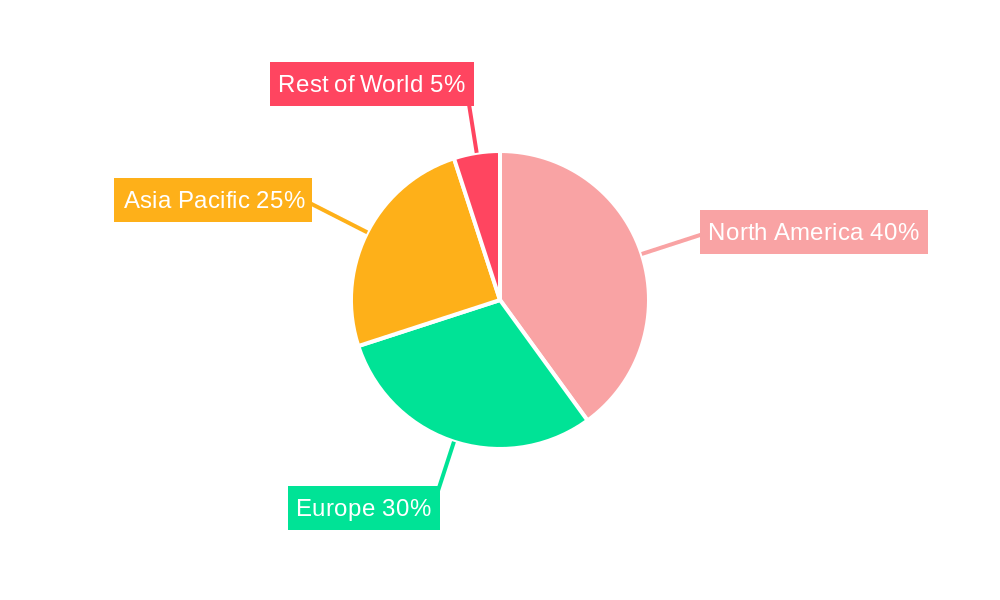

The market faces some challenges, including the high initial investment costs associated with implementing automated systems. However, the long-term cost savings and increased efficiency outweigh the initial investment for many organizations. Furthermore, the complexities involved in integrating diverse automation technologies and maintaining sophisticated equipment require skilled personnel and ongoing training, potentially hindering adoption in some regions. Nevertheless, the ongoing demand for faster and more efficient protein engineering processes, coupled with ongoing technological advancements, is expected to overcome these hurdles and fuel continued market growth throughout the forecast period (2025-2033). Geographic distribution shows a strong presence in North America and Europe, with the Asia-Pacific region exhibiting significant growth potential due to increased research and development activities in this area.

Lab Automation in Protein Engineering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Lab Automation in Protein Engineering market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and researchers seeking a thorough understanding of this dynamic market. The parent market is the broader laboratory automation sector, while the child market focuses specifically on applications within protein engineering. The market size is projected at xx Million in 2025 and is expected to reach xx Million by 2033.

Lab Automation in Protein Engineering Market Market Dynamics & Structure

The Lab Automation in Protein Engineering market is characterized by a moderately concentrated structure, with key players such as Becton Dickinson and Company, Tecan Group Ltd, Danaher Corporation/Beckman Coulter, and Thermo Fisher Scientific Inc holding significant market share. Market concentration is estimated at xx% in 2025. Technological innovation, particularly in areas like automated liquid handling and robotic systems, is a primary growth driver. Stringent regulatory frameworks governing laboratory procedures and data management influence market dynamics. Competitive substitutes include manual laboratory techniques, but automation offers significant advantages in terms of speed, accuracy, and throughput. The end-user demographic primarily comprises pharmaceutical and biotechnology companies, academic research institutions, and contract research organizations (CROs). M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: xx% in 2025 (estimated)

- Key Growth Drivers: Technological advancements, increasing demand for high-throughput screening, stringent regulatory compliance needs

- Competitive Landscape: Moderately concentrated, with ongoing innovation and strategic partnerships

- M&A Activity: Approximately xx deals (2019-2024)

Lab Automation in Protein Engineering Market Growth Trends & Insights

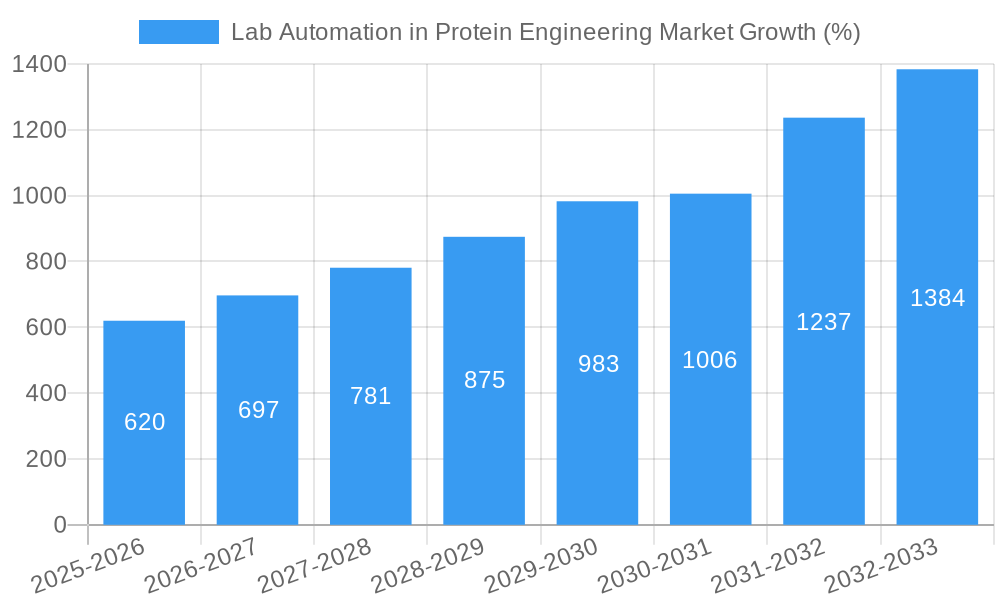

The Lab Automation in Protein Engineering market witnessed significant growth during the historical period (2019-2024), driven by factors such as the rising adoption of automation technologies in protein engineering research and development. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. This growth is fueled by several factors, including technological advancements leading to improved efficiency and accuracy in protein engineering processes, increased demand for high-throughput screening and automation in drug discovery and development, and the growing need for automation in personalized medicine. The market penetration of automated systems in protein engineering labs is gradually increasing, with a notable shift towards fully integrated and automated workflows. Consumer behavior is shifting towards automation solutions that offer enhanced data management capabilities, reduced human error, and improved reproducibility. The adoption rate is currently estimated at xx% and is projected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in Lab Automation in Protein Engineering Market

North America currently holds the largest market share in the Lab Automation in Protein Engineering market, driven by factors such as the presence of major pharmaceutical and biotechnology companies, robust research infrastructure, and favorable regulatory environment. Within the equipment segment, Automated Liquid Handlers represent the largest share due to their widespread use in various protein engineering applications. Europe follows as a significant market, with strong growth anticipated in the Asia-Pacific region due to increasing investments in R&D and growing pharmaceutical industry.

- North America: Dominant market share due to high R&D investments and the presence of key players.

- Europe: Strong market presence, particularly in Western Europe.

- Asia-Pacific: High growth potential fueled by increasing pharmaceutical and biotechnology investments.

- Automated Liquid Handlers: Largest segment within the equipment category.

- Key Drivers: Strong R&D spending, favorable regulatory frameworks, growing adoption of advanced technologies.

Lab Automation in Protein Engineering Market Product Landscape

The Lab Automation in Protein Engineering market features a wide array of automated equipment, including automated liquid handlers, automated plate handlers, robotic arms, and automated storage and retrieval systems (AS/RS). These systems are designed to automate various tasks involved in protein engineering workflows, such as sample preparation, protein expression, purification, and analysis. Recent innovations focus on improving speed, precision, and integration with other lab equipment. Unique selling propositions include increased throughput, improved data management, and reduced labor costs. Technological advancements are driving the development of miniaturized systems, AI-powered automation, and integrated platforms.

Key Drivers, Barriers & Challenges in Lab Automation in Protein Engineering Market

Key Drivers:

- High demand for increased throughput and efficiency in protein engineering workflows.

- Growing need for automation in drug discovery and personalized medicine.

- Advancements in robotics, AI, and software integration improving automation capabilities.

Challenges & Restraints:

- High initial investment costs associated with automated systems.

- Integration complexity with existing laboratory infrastructure.

- Need for skilled personnel to operate and maintain automated systems.

- Supply chain disruptions impacting the availability of components. This resulted in a xx% increase in equipment costs in 2022 (estimated).

Emerging Opportunities in Lab Automation in Protein Engineering Market

- Growing demand for automation in personalized medicine and targeted therapies.

- Expansion into emerging markets with growing pharmaceutical industries.

- Development of novel automation technologies for specific protein engineering applications.

- Increased adoption of cloud-based data management and analysis solutions.

Growth Accelerators in the Lab Automation in Protein Engineering Market Industry

Technological advancements, particularly in areas like artificial intelligence and machine learning, are accelerating market growth. Strategic partnerships between automation providers and protein engineering companies are leading to the development of innovative solutions tailored to specific needs. The expansion into new application areas, such as cell and gene therapy, is driving further growth.

Key Players Shaping the Lab Automation in Protein Engineering Market Market

- Becton Dickinson and Company

- Tecan Group Ltd

- Danaher Corporation/Beckman Coulter

- Synchron Lab Automation

- Perkinelmer Inc

- F Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc

- Eli Lilly and Company

- Siemens Healthineers AG

- Agilent Technologies Inc

- Hudson Robotics Inc

Notable Milestones in Lab Automation in Protein Engineering Market Sector

- October 2022: Thermo Fisher Scientific releases the EXTREVA ASE Accelerated Solvent Extractor, a fully automated sample preparation system.

- March 2022: Beckman Coulter Life Sciences launches the CellMek SPS, a fully automated sample preparation system for clinical flow cytometry.

In-Depth Lab Automation in Protein Engineering Market Market Outlook

The Lab Automation in Protein Engineering market is poised for robust growth over the forecast period, driven by the convergence of technological advancements, increasing demand for high-throughput screening, and the growing adoption of automation in various applications within protein engineering. Strategic partnerships and collaborations will play a significant role in shaping the market landscape, leading to the development of innovative solutions that improve efficiency and productivity. The market is expected to see significant expansion into emerging economies, coupled with continuous product innovation, creating lucrative opportunities for key players and new entrants alike.

Lab Automation in Protein Engineering Market Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Other Equipment

Lab Automation in Protein Engineering Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Protein Engineering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated

- 3.3. Market Restrains

- 3.3.1. Expensive Initial Setup

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handler Equipment Accounted for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Other Equipment

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Other Equipment

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Other Equipment

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Other Equipment

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. North America Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Becton Dickinson and Company

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tecan Group Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Danaher Corporation/Beckman Coulter

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Synchron Lab Automation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Perkinelmer Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 F Hoffmann-La Roche Ltd*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Thermo Fisher Scientific Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Eli Lilly and Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Siemens Healthineers AG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Agilent Technologies Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Hudson Robotics Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Lab Automation in Protein Engineering Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 11: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: North America Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 19: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 20: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 23: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 24: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 13: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 15: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 19: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Protein Engineering Market?

The projected CAGR is approximately 12.40%.

2. Which companies are prominent players in the Lab Automation in Protein Engineering Market?

Key companies in the market include Becton Dickinson and Company, Tecan Group Ltd, Danaher Corporation/Beckman Coulter, Synchron Lab Automation, Perkinelmer Inc, F Hoffmann-La Roche Ltd*List Not Exhaustive, Thermo Fisher Scientific Inc, Eli Lilly and Company, Siemens Healthineers AG, Agilent Technologies Inc, Hudson Robotics Inc.

3. What are the main segments of the Lab Automation in Protein Engineering Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated.

6. What are the notable trends driving market growth?

Automated Liquid Handler Equipment Accounted for the Largest Market Share.

7. Are there any restraints impacting market growth?

Expensive Initial Setup.

8. Can you provide examples of recent developments in the market?

October 2022 - Thermo Fisher Scientific releases the first fully automated, all-in-one sample preparation system. The new EXTREVA ASE Accelerated Solvent Extractor from Thermo Scientific is the first system to automatically extract and concentrate analytes of interest from solid and semi-solid samples, such as persistent organic pollutants (POPs), polycyclic aromatic hydrocarbons (PAHs), or pesticides, in a single instrument, obviating the need for manual sample transfer for a walk-away sample-to-vial workflow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Protein Engineering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Protein Engineering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Protein Engineering Market?

To stay informed about further developments, trends, and reports in the Lab Automation in Protein Engineering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence