Key Insights

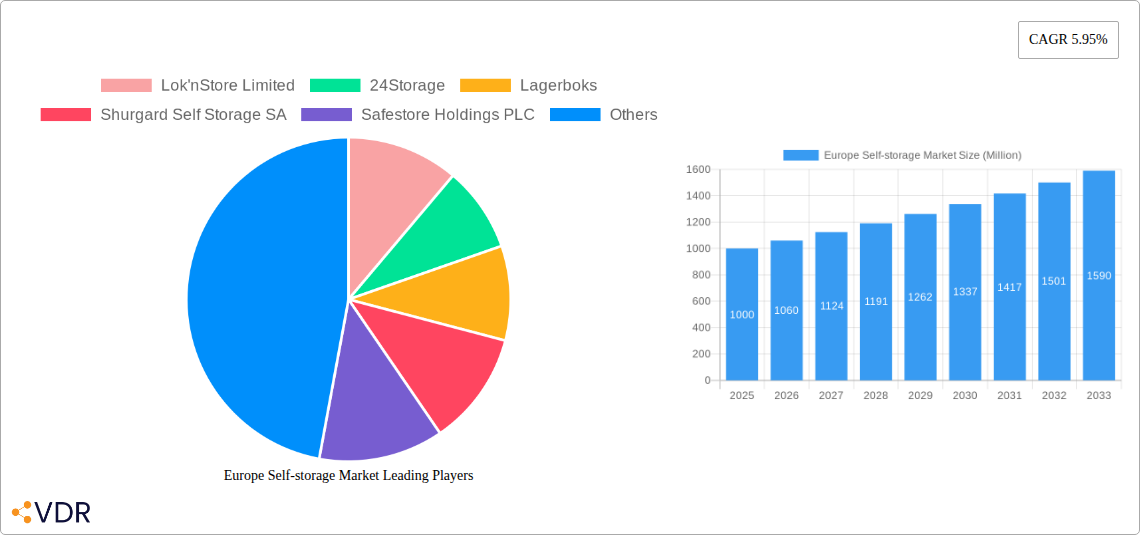

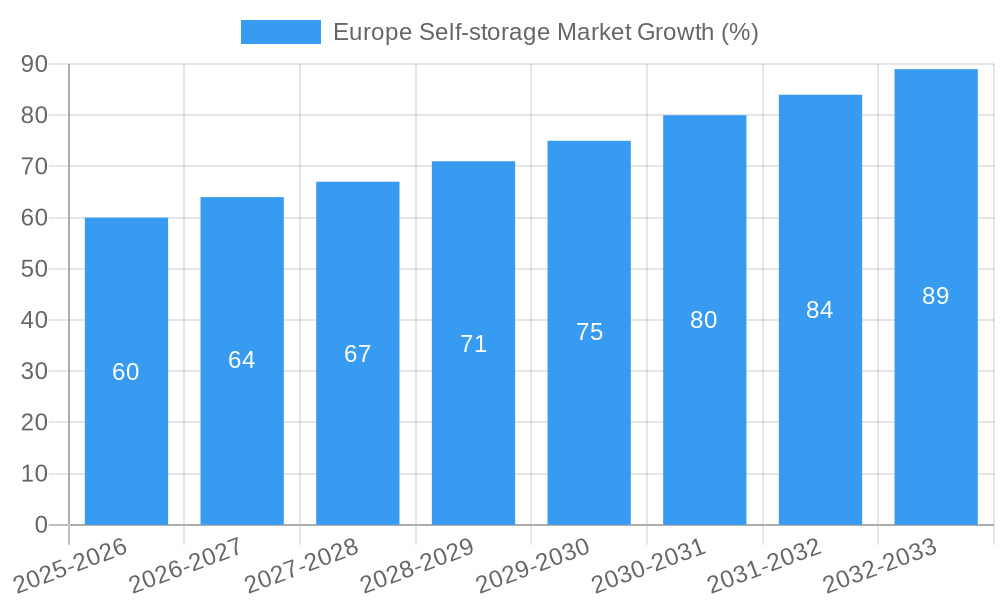

The European self-storage market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 5.95% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization across major European cities like London, Paris, and Berlin is leading to a surge in demand for flexible and convenient storage solutions, particularly among individuals and businesses. The rise of e-commerce and the associated need for efficient inventory management further fuels market growth, particularly impacting the business segment. Additionally, changing lifestyles, greater mobility, and the increasing popularity of downsizing are contributing to the rising demand for self-storage units. Germany, the United Kingdom, and France represent the largest national markets within Europe, benefiting from strong economies and high population density. However, regulatory hurdles in certain countries and potential economic downturns pose challenges to market growth. Competition among established players like Shurgard, Safestore, and Lok'nStore, alongside smaller regional operators, is intense, driving innovation in pricing, facility management, and service offerings.

The forecast period (2025-2033) will likely witness diversification in self-storage offerings, with the emergence of specialized facilities catering to specific needs such as climate-controlled storage for sensitive items or secure storage for high-value goods. Technological advancements, such as online booking platforms and smart access systems, are streamlining operations and enhancing customer experience. Sustainable practices, including energy-efficient facilities and environmentally friendly construction materials, are becoming increasingly important, attracting environmentally conscious customers and investors. Furthermore, strategic acquisitions and mergers are expected to reshape the market landscape, leading to consolidation among key players. The overall outlook for the European self-storage market remains positive, underpinned by favorable demographic trends, economic growth in key regions, and the ongoing evolution of the industry to meet evolving customer demands.

Europe Self-Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe self-storage market, covering market dynamics, growth trends, regional performance, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for self-storage operators, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic sector. The report segments the market by user type (personal and business) and country (Germany, United Kingdom, France, Netherlands, Italy, Spain, Norway, Denmark, Sweden, and Rest of Europe).

Europe Self-storage Market Market Dynamics & Structure

The European self-storage market is characterized by a moderately fragmented landscape, with a mix of large multinational operators and smaller regional players. Market concentration is relatively low, though larger companies such as Big Yellow Group PLC, Safestore Holdings PLC, and Shurgard Self Storage SA hold significant market share. The market is experiencing steady growth driven by several factors:

- Technological Innovation: The adoption of online booking platforms, automated storage systems, and enhanced security features is driving efficiency and customer satisfaction. However, barriers to innovation exist, including high initial investment costs and resistance to change among some operators.

- Regulatory Frameworks: Varying regulations across European countries regarding zoning, construction, and environmental standards impact market development. Streamlining regulatory processes could accelerate growth.

- Competitive Product Substitutes: Traditional storage solutions, such as attics, garages, and rented warehouses, provide competition. However, the convenience and security offered by professional self-storage facilities are gaining favor.

- End-User Demographics: Growth is fueled by urbanization, increasing mobility, and changing lifestyles. The rise of e-commerce and the gig economy also contributes to demand for storage space for both personal and business use.

- M&A Trends: Consolidation is evident, with larger players acquiring smaller operators to expand their footprint and market share. The number of M&A deals in the period 2019-2024 is estimated at xx, representing a xx% increase compared to the previous period.

Europe Self-storage Market Growth Trends & Insights

The Europe self-storage market has exhibited consistent growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This positive trend is projected to continue during the forecast period (2025-2033), with an anticipated CAGR of xx%. Market size in 2025 is estimated at xx Million units, and is expected to reach xx Million units by 2033. This expansion is driven by several key factors:

- Increasing urbanization and population density: This leads to a greater need for space-saving solutions among both private individuals and businesses.

- Rising e-commerce and the gig economy: These activities require additional space for inventory and equipment.

- Improved accessibility and convenience: The increasing availability of online booking systems and easily accessible storage units fuels market expansion.

- Growing awareness of self-storage as a viable solution: More people and businesses are seeing self-storage as a practical alternative to traditional storage methods.

Technological disruptions, such as the implementation of smart storage solutions and automated systems, are further accelerating growth by improving efficiency and customer experience. Changes in consumer behavior, such as a preference for shorter-term rental agreements and more flexible storage options, are also impacting market dynamics.

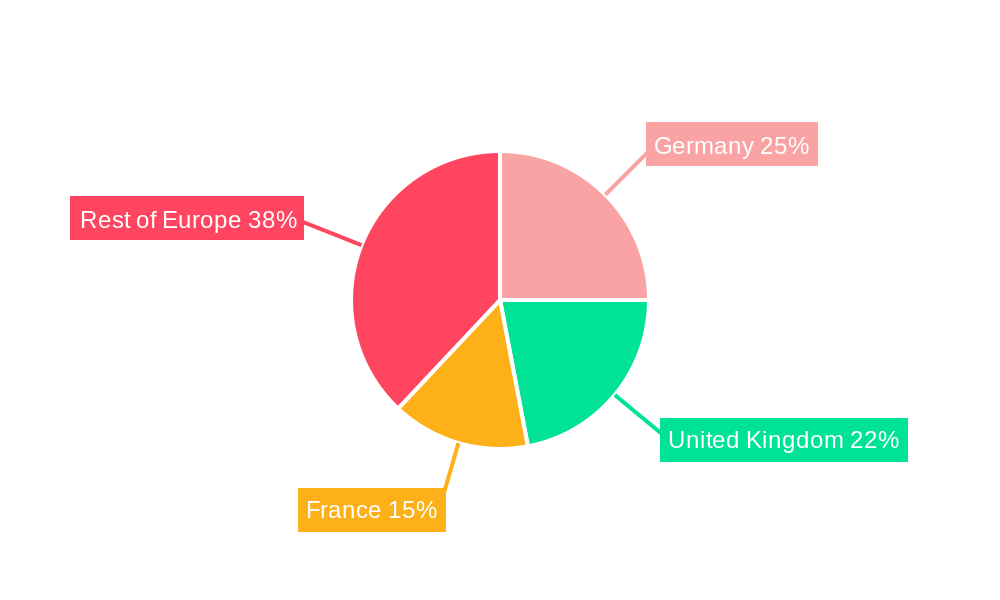

Dominant Regions, Countries, or Segments in Europe Self-storage Market

The United Kingdom currently holds the largest market share in the European self-storage market, followed by Germany and France. However, other countries show significant growth potential:

- United Kingdom: High population density, strong economy, and advanced self-storage infrastructure contribute to market leadership. Strong demand from both personal and business users drives significant growth.

- Germany: A robust economy and increasing urbanization are key growth drivers. The market is relatively mature but shows potential for further expansion, especially in urban centers.

- France: Similar to Germany, France benefits from a strong economy and urban population growth, creating a significant demand for self-storage solutions. However, the market is slightly less mature than that of the UK and Germany, indicating a substantial growth trajectory.

- Business Segment: The business segment is experiencing faster growth than the personal segment, driven by the rise of e-commerce and the need for additional storage space for inventory and equipment. This sector represents xx% of the total market in 2025, projected to increase to xx% by 2033.

Other countries such as the Netherlands, Spain, and the Nordics show promising growth potential due to favorable economic conditions and urbanization.

Europe Self-storage Market Product Landscape

The self-storage product landscape is evolving, with operators increasingly offering diverse storage unit sizes, climate-controlled units, and value-added services like packing supplies and delivery services. Technological advancements, such as access control systems utilizing smart technology and mobile apps for seamless booking and management, improve user experience and enhance security. Unique selling propositions include specialized storage for specific items (e.g., wine, archives) and flexible lease terms to cater to evolving consumer needs.

Key Drivers, Barriers & Challenges in Europe Self-storage Market

Key Drivers:

- Strong economic growth in several European countries.

- The increasing popularity of e-commerce and the gig economy are creating storage needs.

- Technological innovations resulting in improved security, efficiency, and convenience.

Challenges and Restraints:

- High land costs in urban areas make expansion challenging.

- Stringent building codes and regulations can increase the cost and complexity of new facility development.

- Intense competition among existing self-storage operators and alternative storage solutions. This competition may drive pricing pressure, affecting the profitability of the businesses.

Emerging Opportunities in Europe Self-storage Market

- Expansion into underserved markets: Smaller towns and rural areas offer opportunities for growth.

- Development of specialized storage solutions: Catering to specific needs (e.g., art storage, wine cellars) can attract new customer segments.

- Integration of technology: Smart storage solutions, mobile apps, and automated systems improve operational efficiency and customer experience.

Growth Accelerators in the Europe Self-storage Market Industry

Long-term growth will be driven by continued technological advancements that enhance security, accessibility, and convenience. Strategic partnerships between operators and logistics companies will broaden service offerings, while expansion into new markets and the development of specialized storage solutions will further stimulate growth. The increasing adoption of sustainable and eco-friendly practices within the industry will also play a crucial role in long-term success.

Key Players Shaping the Europe Self-storage Market Market

- Lok'nStore Limited

- 24Storage

- Lagerboks

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Pelican Self Storage

- Casaforte (SMC Self-Storage Management)

- Big Yellow Group PLC

- Nettolager

- W Wiedmer AG

- Self Storage Group ASA

- Access Self Storage

- SureStore Ltd

- W P Carey Inc

Notable Milestones in Europe Self-storage Market Sector

- October 2022: Big Yellow Group PLC opened two new stores in Harrow and Kingston North, adding over 1,000 storage units. This expansion demonstrates the company's commitment to growth and its confidence in market demand.

- October 2022: Padlock Partners UK Fund III and Cinch Self Storage acquired a facility near Watford for GBP 9 million (USD 10.79 billion), planning to open a large-scale storage facility in summer 2023. This demonstrates significant investment in the sector and anticipation of future demand.

In-Depth Europe Self-storage Market Market Outlook

The future of the European self-storage market is bright, with continued growth expected over the forecast period. Technological innovation, strategic acquisitions, and expansion into underserved markets will drive market expansion. Operators who can leverage technology to enhance efficiency and customer experience, and those who can adapt to evolving consumer preferences, are best positioned to succeed in this competitive but dynamic sector. The overall market shows robust potential for both organic growth and strategic investment opportunities.

Europe Self-storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

Europe Self-storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Self-storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. Business Storage Expected to Gain Market Popularity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. Germany Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lok'nStore Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 24Storage

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Lagerboks

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Shurgard Self Storage SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Safestore Holdings PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pelican Self Storage

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Casaforte (SMC Self-Storage Management)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Big Yellow Group PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nettolager

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 W Wiedmer AG*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Self Storage Group ASA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Access Self Storage

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 SureStore Ltd

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 W P Carey Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Lok'nStore Limited

List of Figures

- Figure 1: Europe Self-storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Self-storage Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Self-storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Self-storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 3: Europe Self-storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Self-storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Self-storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 13: Europe Self-storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Self-storage Market?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Europe Self-storage Market?

Key companies in the market include Lok'nStore Limited, 24Storage, Lagerboks, Shurgard Self Storage SA, Safestore Holdings PLC, Pelican Self Storage, Casaforte (SMC Self-Storage Management), Big Yellow Group PLC, Nettolager, W Wiedmer AG*List Not Exhaustive, Self Storage Group ASA, Access Self Storage, SureStore Ltd, W P Carey Inc.

3. What are the main segments of the Europe Self-storage Market?

The market segments include User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior.

6. What are the notable trends driving market growth?

Business Storage Expected to Gain Market Popularity.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

October 2022: Big Yellow Group PLC has announced the opening of two new stores in Harrow and Kingston North. The two recent locations offer over 1,000 safe and secure storage rooms ranging from 9 sq ft to 500 sq ft - introducing more space into those living and working in Harrow, Kingston North, and the immediate surrounding areas. From short-term storage when renovating or moving home to flourishing businesses needing more space to store merchandise, we welcome the use of our rooms for both personal and business purposes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Self-storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Self-storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Self-storage Market?

To stay informed about further developments, trends, and reports in the Europe Self-storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence