Key Insights

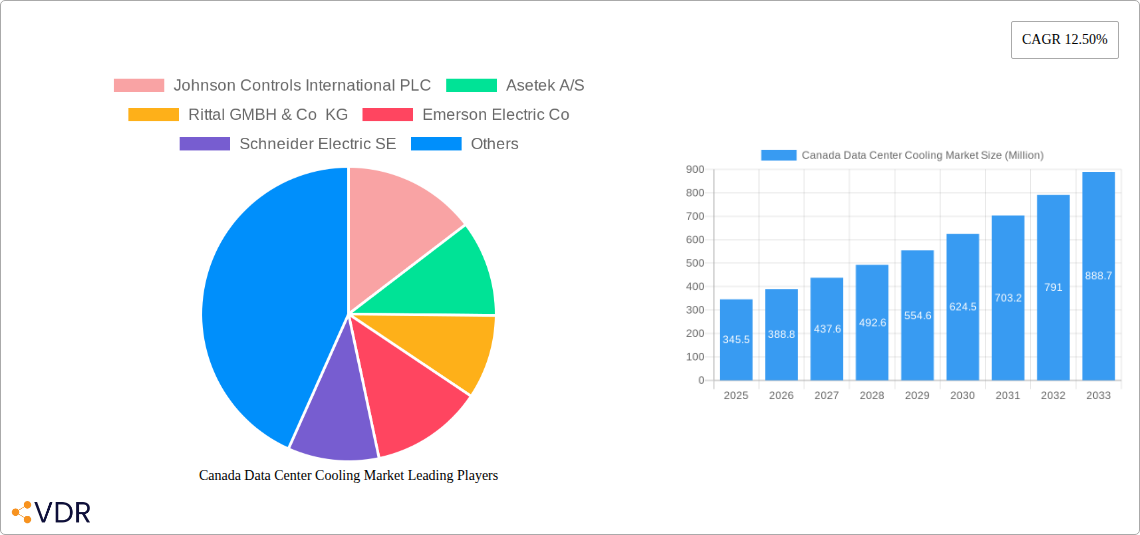

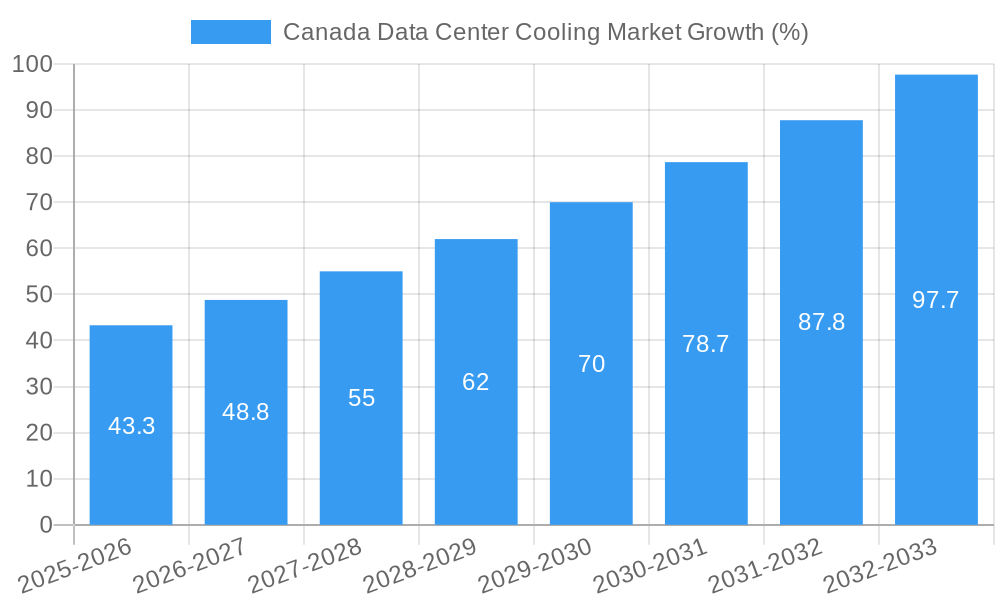

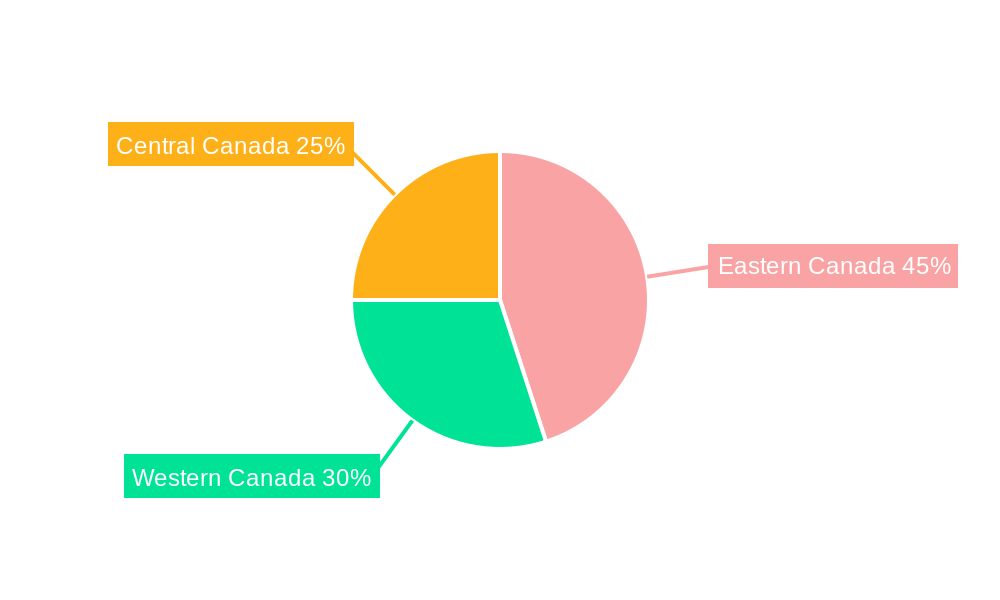

The Canada data center cooling market, valued at $345.5 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 12.50% from 2025 to 2033. This surge is primarily driven by the increasing adoption of cloud computing and big data analytics across various sectors, particularly IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), and the Government. The rising demand for high-performance computing and the need for efficient energy management within data centers are further fueling market expansion. The market is segmented by cooling technology (air-based and liquid-based) and end-user sectors. Air-based cooling currently dominates the market, but liquid-based cooling solutions are gaining traction due to their higher efficiency in managing heat dissipation from high-density server deployments. Regional variations exist within Canada, with Eastern Canada likely holding the largest market share due to higher concentrations of data centers and IT infrastructure. However, growth in Western and Central Canada is expected to accelerate as these regions continue to develop their digital infrastructure. Key players such as Johnson Controls, Asetek, Rittal, Emerson Electric, and Schneider Electric are actively competing to meet the growing demand, offering innovative cooling solutions to optimize performance and reduce operational costs for data center operators.

The forecast period of 2025-2033 presents significant opportunities for market expansion. However, challenges remain, including the high initial investment costs associated with implementing advanced cooling systems and concerns about the environmental impact of cooling technologies. The industry is responding to these challenges by developing more energy-efficient and sustainable solutions, such as utilizing free-cooling techniques and incorporating renewable energy sources into data center operations. Further segmentation analysis focusing on specific sub-sectors within IT & Telecommunication and BFSI, along with a more detailed regional breakdown across Eastern, Western, and Central Canada, would provide more granular insights into market opportunities and future growth potential. The competitive landscape is intense, with established players focusing on product innovation and strategic partnerships to maintain their market leadership.

Canada Data Center Cooling Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada Data Center Cooling market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and stakeholders seeking a clear understanding of this rapidly evolving market. The total market size in 2025 is estimated at xx Million.

Canada Data Center Cooling Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Canadian data center cooling market. The market is characterized by a moderate level of concentration, with key players holding significant market share. However, the emergence of innovative technologies and new entrants is fostering increased competition.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Advancements in liquid cooling, such as immersion cooling and direct-to-chip cooling, are driving market growth. However, high initial investment costs present a barrier to wider adoption.

- Regulatory Framework: Government regulations concerning energy efficiency and environmental sustainability are influencing the adoption of energy-efficient cooling solutions.

- Competitive Substitutes: While air-based cooling remains dominant, liquid-based cooling technologies are emerging as strong substitutes due to their superior cooling capacity.

- End-User Demographics: The IT & Telecommunication sector is the largest end-user segment, followed by BFSI and Government.

- M&A Trends: The number of M&A deals in the Canadian data center cooling market averaged xx per year during the historical period (2019-2024), indicating consolidation within the industry.

Canada Data Center Cooling Market Growth Trends & Insights

The Canada Data Center Cooling market experienced significant growth during the historical period (2019-2024), driven by factors such as increasing data center deployments, rising energy costs, and the adoption of high-density computing. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by the increasing demand for efficient cooling solutions in data centers across various sectors. Technological disruptions, such as the introduction of liquid cooling technologies and AI-powered cooling management systems, are further accelerating market expansion. Consumer behavior shifts towards cloud-based services and the proliferation of IoT devices are also contributing to this growth trajectory. Market penetration of liquid-based cooling solutions is projected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Canada Data Center Cooling Market

The Ontario region dominates the Canadian data center cooling market, driven by high concentration of data centers and robust IT infrastructure. Within the segments, the IT & Telecommunication sector accounts for the largest share of the market, followed by the BFSI sector.

- Key Drivers (Ontario): Strong government support for digital infrastructure development, a large pool of skilled labor, and a favorable business environment contribute to Ontario's market dominance.

- Key Drivers (IT & Telecommunication): The rapid growth of cloud computing, big data analytics, and the increasing adoption of 5G networks are driving demand for advanced cooling solutions.

- Growth Potential (Liquid-Based Cooling): While air-based cooling still holds a majority share, liquid-based cooling is projected to experience the fastest growth due to its higher cooling capacity and energy efficiency, making it suitable for high-density deployments.

Canada Data Center Cooling Market Product Landscape

The market offers a wide range of cooling technologies, including air-based cooling (CRAC, CRAH units) and liquid-based cooling (immersion cooling, direct-to-chip cooling). Recent innovations focus on improving energy efficiency, reducing water consumption, and enhancing cooling capacity to meet the demands of high-density computing environments. Unique selling propositions often center around energy savings, reduced operational costs, and improved reliability. Advancements include AI-driven predictive maintenance and remote monitoring capabilities.

Key Drivers, Barriers & Challenges in Canada Data Center Cooling Market

Key Drivers:

- Increasing data center density and power consumption.

- Growing demand for high-performance computing.

- Stringent environmental regulations promoting energy efficiency.

Key Challenges:

- High initial investment costs for advanced cooling technologies, such as liquid cooling.

- Skilled labor shortages hindering efficient installation and maintenance.

- Supply chain disruptions impacting the availability of critical components. This led to a xx% increase in average component costs in 2022.

Emerging Opportunities in Canada Data Center Cooling Market

- Growing adoption of edge computing necessitates localized cooling solutions.

- Increased focus on sustainable and environmentally friendly cooling technologies.

- Development of innovative cooling solutions for specific applications, such as high-performance computing (HPC) and AI data centers.

Growth Accelerators in the Canada Data Center Cooling Market Industry

Strategic partnerships between data center operators and cooling technology providers are driving innovation and accelerating market growth. Technological breakthroughs in areas such as AI-powered cooling management and advanced fluid dynamics are improving efficiency and reducing costs. Expansion of data center infrastructure across various regions of Canada is creating new opportunities for cooling technology providers.

Key Players Shaping the Canada Data Center Cooling Market Market

- Johnson Controls International PLC

- Asetek A/S

- Rittal GMBH & Co KG

- Emerson Electric Co

- Schneider Electric SE

- Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- Fujitsu General Limited

- Stulz GmbH

- Airedale International Air Conditioning

- Vertiv Group Corp

Notable Milestones in Canada Data Center Cooling Market Sector

- January 2024: Aligned launched DeltaFlow, a liquid cooling system for high-density computing (up to 300 kW per rack). This significantly impacts the high-density market segment.

- March 2024: Kelvion and Rosseau partnered to deliver enhanced immersion cooling solutions for the HPC market, expanding options for high-performance computing.

In-Depth Canada Data Center Cooling Market Market Outlook

The Canada Data Center Cooling market is poised for continued growth, driven by technological advancements, increasing data center deployments, and a growing emphasis on sustainability. Strategic partnerships, innovative product development, and expansion into new market segments will play a crucial role in shaping the future of this dynamic market. The potential for growth is significant, especially within the liquid cooling segment and the high-performance computing sector. Companies that effectively address the challenges of high initial investment costs and skilled labor shortages will be best positioned to capitalize on this market opportunity.

Canada Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling Technologies

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-Chip Cooling

- 1.2.3. Rear-Door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type of Data Center

- 2.1. Hyperscale (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional Agencies

- 3.6. Other End-user Industries

Canada Data Center Cooling Market Segmentation By Geography

- 1. Canada

Canada Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of High-Performance Computing across Europe; Growing Rack Power Density

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. The IT & Telecommunication Segment Holds the Majority Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling Technologies

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-Chip Cooling

- 5.1.2.3. Rear-Door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type of Data Center

- 5.2.1. Hyperscale (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional Agencies

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Eastern Canada Canada Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Johnson Controls International PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Asetek A/S

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Rittal GMBH & Co KG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Emerson Electric Co

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Schneider Electric SE

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Fujitsu General Limited

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Stulz GmbH

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Airedale International Air Conditioning

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Vertiv Group Corp

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: Canada Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Canada Data Center Cooling Market Revenue Million Forecast, by Type of Data Center 2019 & 2032

- Table 4: Canada Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Canada Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Data Center Cooling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Data Center Cooling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Data Center Cooling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 11: Canada Data Center Cooling Market Revenue Million Forecast, by Type of Data Center 2019 & 2032

- Table 12: Canada Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 13: Canada Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Data Center Cooling Market?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the Canada Data Center Cooling Market?

Key companies in the market include Johnson Controls International PLC, Asetek A/S, Rittal GMBH & Co KG, Emerson Electric Co, Schneider Electric SE, Mitsubishi Electric Hydronics & IT Cooling Systems SpA, Fujitsu General Limited, Stulz GmbH, Airedale International Air Conditioning, Vertiv Group Corp.

3. What are the main segments of the Canada Data Center Cooling Market?

The market segments include Cooling Technology, Type of Data Center, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 345.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of High-Performance Computing across Europe; Growing Rack Power Density.

6. What are the notable trends driving market growth?

The IT & Telecommunication Segment Holds the Majority Share.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

March 2024: German heat exchanger manufacturer Kelvion and US immersion cooling company Rosseau announced a partnership to deliver enhanced immersion cooling solutions for the high-performance computing (HPC) market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Canada Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence