Key Insights

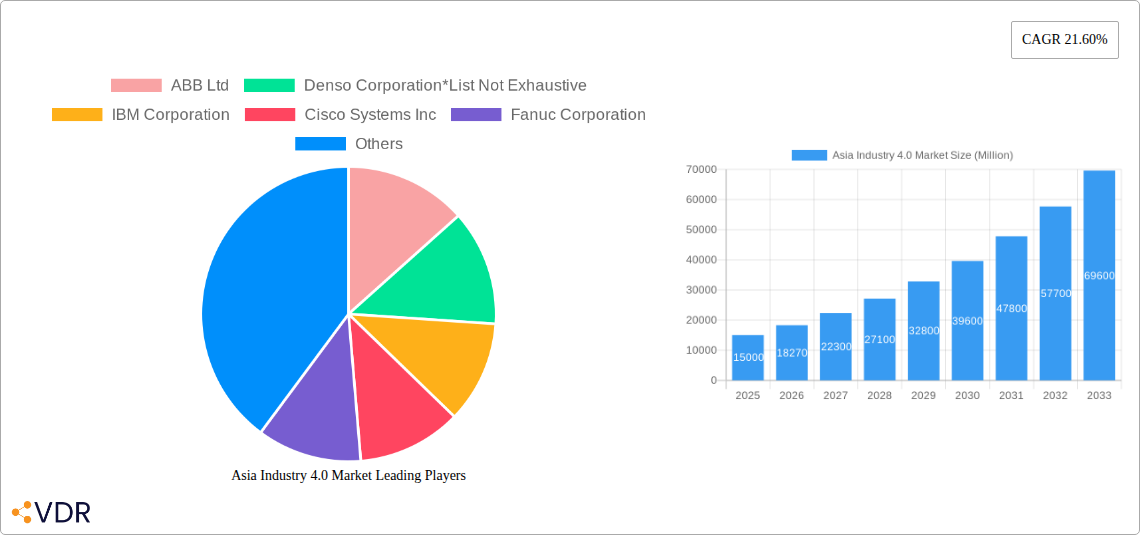

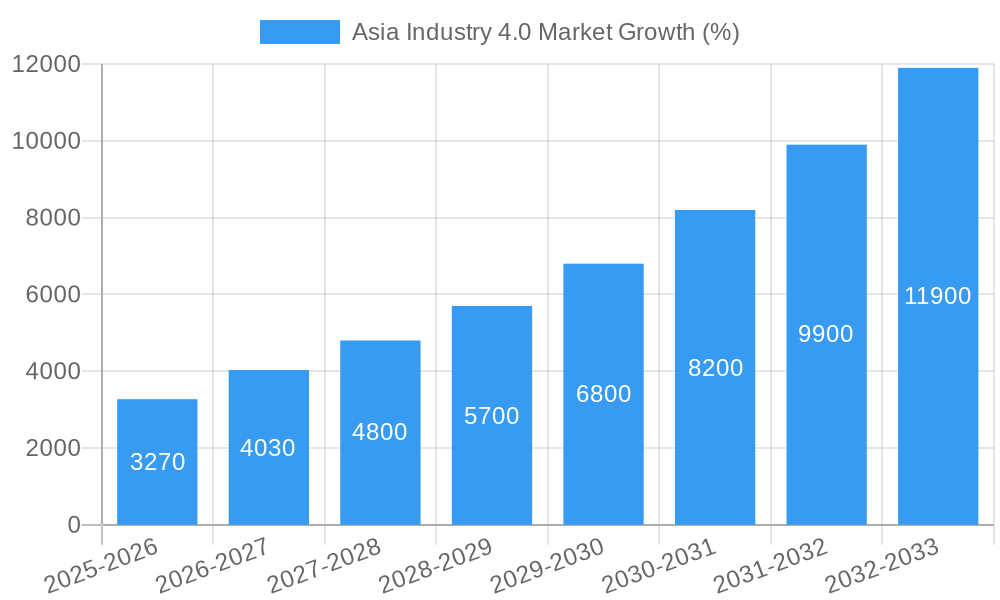

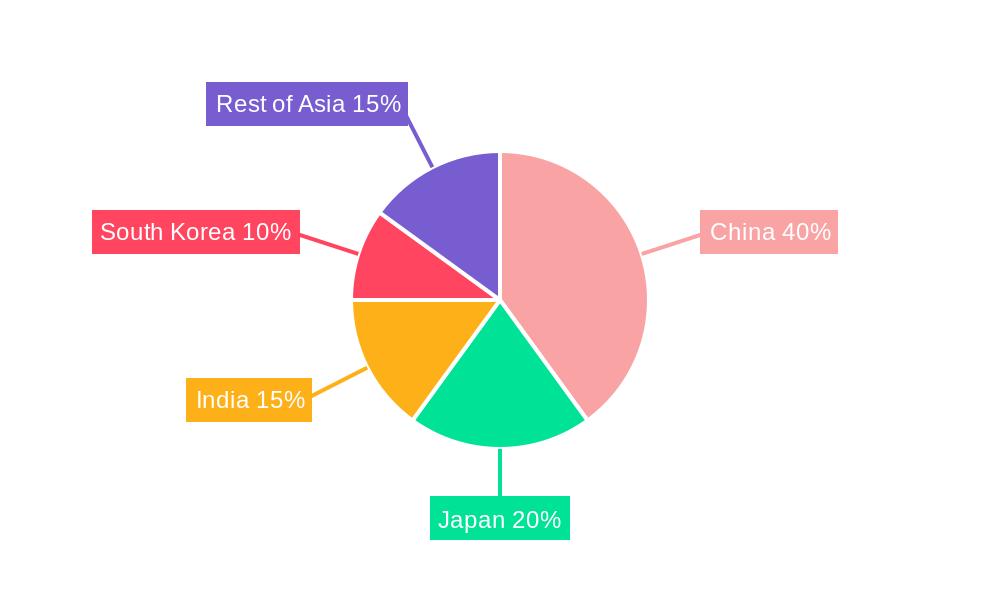

The Asia Industry 4.0 market is experiencing robust growth, driven by increasing government initiatives promoting digital transformation across various sectors and the region's large manufacturing base. A CAGR of 21.60% from 2019-2033 signifies significant investment in technologies like Industrial Robotics, IIoT, AI/ML, and digital twins, transforming manufacturing, automotive, and energy sectors. China, Japan, South Korea, and India are key contributors, with China likely holding the largest market share due to its massive manufacturing sector and proactive government policies. The adoption of Industry 4.0 technologies is streamlining operations, enhancing productivity, and improving supply chain efficiency across these industries. While the initial investment costs present a restraint, the long-term benefits of automation, data-driven decision-making, and improved product quality are compelling businesses to embrace these technologies. The increasing adoption of cloud computing and edge computing solutions further fuels this growth by providing scalable and reliable infrastructure for managing and analyzing the vast amounts of data generated by Industry 4.0 technologies. Growth is further fueled by the increasing demand for customized products and the need for enhanced flexibility in manufacturing processes.

The market segmentation highlights the diverse technological landscape. Industrial Robotics currently holds a significant share, but technologies like AI/ML and IIoT are rapidly gaining traction, enabling predictive maintenance, real-time monitoring, and improved process optimization. The Manufacturing and Automotive sectors are leading adopters, but sectors like Energy and Utilities are rapidly increasing their investments, driving the adoption of smart grids and predictive maintenance for infrastructure. The competitive landscape is dynamic, with global tech giants like ABB, IBM, and Cisco alongside established automation players such as Fanuc and Yaskawa driving innovation and competition. Looking forward, the continued expansion of 5G networks and the increasing availability of skilled labor will be crucial in sustaining this high growth trajectory. Continued government support and investment in digital infrastructure will be key to ensuring the long-term success of the Industry 4.0 transformation across Asia.

Asia Industry 4.0 Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Industry 4.0 market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategists seeking to navigate this rapidly evolving landscape. The market is segmented by technology type, end-user industry, and country, offering a granular view of growth opportunities across various sectors. The report's projected market size for 2025 is xx Million units.

Asia Industry 4.0 Market Dynamics & Structure

The Asia Industry 4.0 market exhibits a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is relatively high, with several multinational corporations holding significant market share. However, the emergence of innovative startups and the increasing adoption of open-source technologies are gradually fostering a more competitive environment. Technological innovation, driven by advancements in AI, ML, IoT, and robotics, is a key driver, while regulatory frameworks, particularly concerning data privacy and cybersecurity, play a significant role in shaping market dynamics. The substitution of traditional manufacturing processes with Industry 4.0 solutions is accelerating, while end-user demographics, particularly the rise of digitally-savvy younger generations in the workforce, are influencing adoption rates. M&A activity is also significant, with larger companies acquiring smaller firms to enhance their technology portfolios and expand their market reach. In 2024, approximately xx M&A deals were recorded in the Asia Industry 4.0 market, resulting in a xx% increase in market concentration.

- High Market Concentration: Dominated by major players, with smaller companies facing challenges in market penetration.

- Rapid Technological Advancements: Constant innovation in AI, IoT, robotics, and other Industry 4.0 technologies drives market expansion.

- Stringent Regulatory Frameworks: Data privacy and cybersecurity regulations significantly influence market practices and adoption.

- Increasing Substitution of Traditional Methods: Industry 4.0 technologies are replacing legacy systems at an accelerating pace.

- Growing M&A Activity: Strategic acquisitions drive consolidation and technological advancements within the industry.

Asia Industry 4.0 Market Growth Trends & Insights

The Asia Industry 4.0 market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is driven by factors such as increasing government initiatives promoting digital transformation, rising investments in R&D, and the growing adoption of Industry 4.0 technologies across various industries. The market is expected to continue its growth trajectory in the forecast period (2025-2033), reaching xx Million units by 2033. Technological disruptions, particularly the convergence of AI, IoT, and cloud computing, are creating new opportunities and altering consumer behavior in terms of demand for more efficient and connected manufacturing solutions. The increasing focus on smart factories and the adoption of predictive maintenance are key factors influencing market growth. The market penetration rate for Industry 4.0 technologies in the Asia Pacific region is projected to reach xx% by 2033, driven by increasing digitalization and automation across industries. Consumer behavior is shifting towards demand for greater transparency, customization, and real-time visibility in the manufacturing process, impacting the growth of Industry 4.0 related technologies.

Dominant Regions, Countries, or Segments in Asia Industry 4.0 Market

China, followed by Japan and South Korea, are the dominant countries in the Asia Industry 4.0 market. These countries possess advanced technological infrastructure, strong government support for digital transformation, and a large manufacturing base. Within technology types, Industrial Robotics and IIoT currently hold the largest market share, although AI and ML are experiencing rapid growth. Manufacturing and Automotive sectors are the leading end-user industries, demonstrating substantial adoption of Industry 4.0 technologies.

- China: Strong government support, large manufacturing sector, and significant investments in technological infrastructure fuel market growth.

- Japan: Advanced technological capabilities, robust R&D, and focus on automation drive high adoption rates.

- South Korea: Similar to Japan in terms of technology and automation focus.

- India: Rapidly developing economy and increasing government initiatives are driving market expansion.

- Industrial Robotics & IIoT: Mature technologies with widespread adoption across multiple sectors.

- Manufacturing & Automotive: Strong demand driven by high production volumes and automation requirements.

Asia Industry 4.0 Market Product Landscape

The Asia Industry 4.0 market offers a diverse range of products and solutions, including advanced robotics, sophisticated IIoT platforms, AI-powered analytics tools, blockchain-based supply chain management systems, and immersive extended reality applications for training and simulation. These products are characterized by improved efficiency, enhanced data analytics capabilities, and increased automation levels, leading to significant cost reductions and productivity improvements for businesses. Key product innovations include collaborative robots (cobots), edge computing solutions for real-time data processing, and AI-driven predictive maintenance algorithms.

Key Drivers, Barriers & Challenges in Asia Industry 4.0 Market

Key Drivers:

- Government initiatives promoting digital transformation

- Rising investments in R&D and technological advancements

- Growing demand for automation and increased efficiency

- Expanding adoption of cloud computing and big data analytics

Key Challenges:

- High implementation costs and lack of skilled workforce

- Cybersecurity threats and data privacy concerns

- Integration complexities across different systems and technologies

- Supply chain disruptions and global economic uncertainties (estimated xx% impact on market growth in 2024).

Emerging Opportunities in Asia Industry 4.0 Market

Emerging opportunities include the expanding adoption of 5G technology to support real-time data transmission, the growing interest in sustainable manufacturing practices, and the increasing demand for customized and personalized products. Untapped markets in smaller Asian economies present significant potential, as does the development of Industry 4.0 solutions tailored to specific industry needs.

Growth Accelerators in the Asia Industry 4.0 Market Industry

Long-term growth is propelled by the continuous innovation in artificial intelligence, machine learning, and other enabling technologies. Strategic partnerships between technology providers and industry players are further accelerating adoption. Expansion into previously underserved markets within Asia, along with increasing government support for digital transformation, will continue to fuel the growth of this dynamic sector.

Key Players Shaping the Asia Industry 4.0 Market Market

- ABB Ltd

- Denso Corporation

- IBM Corporation

- Cisco Systems Inc

- Fanuc Corporation

- Omron Corporation

- Robert Bosch GmbH

- Yokogawa Electric Corporation

- Mitsubishi Electric

- General Electric Company

- Intel Corporation

- Yaskawa Electric Corporation

Notable Milestones in Asia Industry 4.0 Market Sector

- June 2022: Yokogawa Electric Corporation launched OpreX asset health insights, a cloud-based plant asset monitoring service leveraging AI and ML for enhanced asset management.

- February 2022: Mitsubishi Electric Corporation received the SAP Japan Customer Award 2021 for its leadership in digital transformation, showcasing IT/OT integration at Industry 4.0 HUB TOKYO.

In-Depth Asia Industry 4.0 Market Market Outlook

The future of the Asia Industry 4.0 market is bright, with continued growth driven by technological advancements, strategic partnerships, and government support. Significant opportunities exist in leveraging AI and ML for predictive maintenance, optimizing supply chains through blockchain technology, and expanding the adoption of Industry 4.0 solutions across various industries. The market's potential for innovation and growth is vast, offering considerable returns for early adopters and strategic investors.

Asia Industry 4.0 Market Segmentation

-

1. Technology Type

- 1.1. Industrial Robotics

- 1.2. IIoT

- 1.3. AI and ML

- 1.4. Blockchain

- 1.5. Extended Reality

- 1.6. Digital Twin

- 1.7. 3D Printing

- 1.8. Other Technology Types

-

2. End-user Industry

- 2.1. Manufacturing

- 2.2. Automotive

- 2.3. Oil and Gas

- 2.4. Energy and Utilities

- 2.5. Electronics and Foundry

- 2.6. Food and Beverage

- 2.7. Aerospace and Defense

- 2.8. Other End-user Industries

Asia Industry 4.0 Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Industry 4.0 Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs

- 3.3. Market Restrains

- 3.3.1. Sluggish Adoption of New Technologies

- 3.4. Market Trends

- 3.4.1. Manufacturing Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Industrial Robotics

- 5.1.2. IIoT

- 5.1.3. AI and ML

- 5.1.4. Blockchain

- 5.1.5. Extended Reality

- 5.1.6. Digital Twin

- 5.1.7. 3D Printing

- 5.1.8. Other Technology Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Manufacturing

- 5.2.2. Automotive

- 5.2.3. Oil and Gas

- 5.2.4. Energy and Utilities

- 5.2.5. Electronics and Foundry

- 5.2.6. Food and Beverage

- 5.2.7. Aerospace and Defense

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. China Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Denso Corporation*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cisco Systems Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fanuc Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Omron Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Robert Bosch GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yokogawa Electric Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitsubishi Electric

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 General Electric Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Intel Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Yaskawa Electric Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Asia Industry 4.0 Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Industry 4.0 Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 3: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 14: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Bangladesh Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Pakistan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Industry 4.0 Market?

The projected CAGR is approximately 21.60%.

2. Which companies are prominent players in the Asia Industry 4.0 Market?

Key companies in the market include ABB Ltd, Denso Corporation*List Not Exhaustive, IBM Corporation, Cisco Systems Inc, Fanuc Corporation, Omron Corporation, Robert Bosch GmbH, Yokogawa Electric Corporation, Mitsubishi Electric, General Electric Company, Intel Corporation, Yaskawa Electric Corporation.

3. What are the main segments of the Asia Industry 4.0 Market?

The market segments include Technology Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs.

6. What are the notable trends driving market growth?

Manufacturing Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Sluggish Adoption of New Technologies.

8. Can you provide examples of recent developments in the market?

June 2022: Yokogawa Electric Corporation released OpreX asset health insights. OpreX is a cloud-based plant asset monitoring service that refines, collects, and aggregates operational technology data from distributed assets. Asset Health Insights Oprex powered by Yokogawa Cloud is equipped with ML and AI analytics capability. As the adoption of Industry 4.0 technologies continues to pace in the region, companies are changing the way they do asset management by introducing cloud-based technologies that can monitor assets from anywhere in the world and optimize their performance in real-time. Driven by customers' focus on integrated, remote, and increasingly autonomous operations, Yokogawa Electric developed Asset Health Insights to make data more visible, integrated, and actionable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Industry 4.0 Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Industry 4.0 Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Industry 4.0 Market?

To stay informed about further developments, trends, and reports in the Asia Industry 4.0 Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence