Key Insights

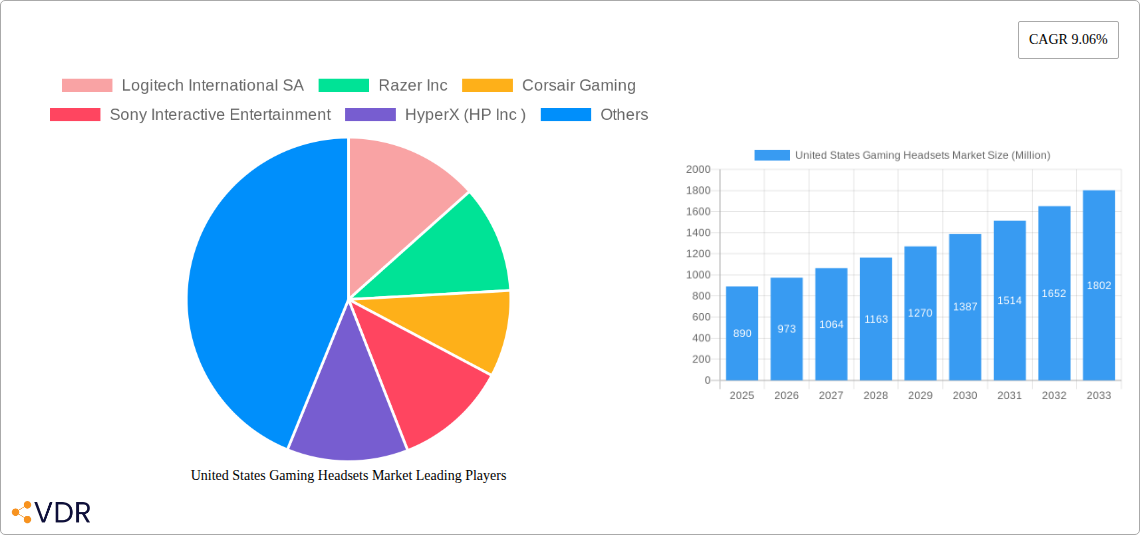

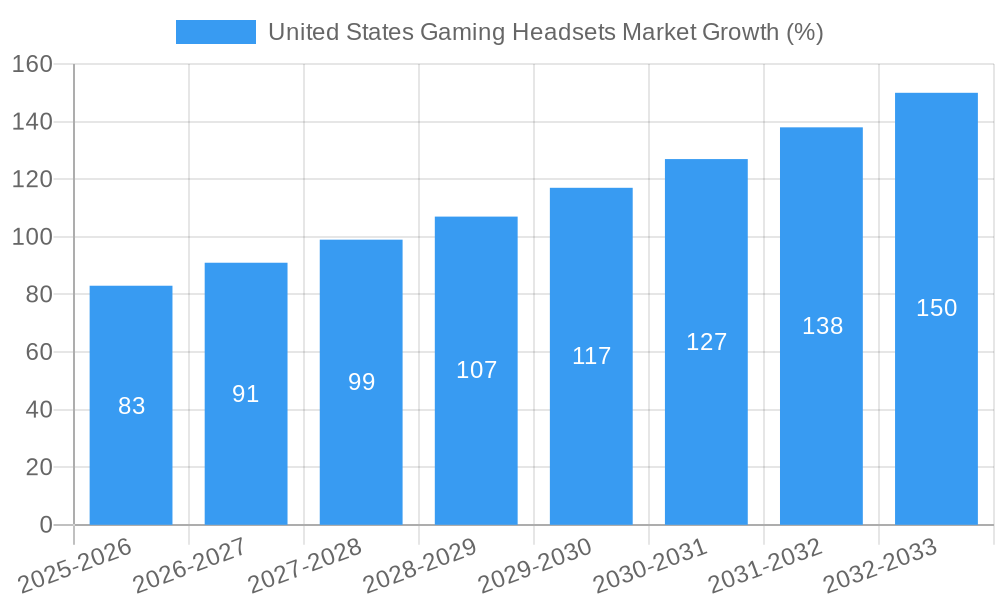

The United States gaming headset market, currently valued at approximately $890 million (based on the provided 0.89 billion value unit and assuming "million" as the unit), is experiencing robust growth. A Compound Annual Growth Rate (CAGR) of 9.06% from 2019 to 2024 indicates a significant expansion driven by several factors. The rising popularity of esports, coupled with increasing accessibility of high-speed internet and powerful gaming PCs/consoles, fuels demand for high-quality audio peripherals. The trend towards immersive gaming experiences, including virtual reality (VR) and augmented reality (AR), further contributes to market growth, as these technologies necessitate superior audio capabilities for enhanced realism and gameplay. Technological advancements, such as improved noise cancellation, spatial audio, and customizable sound profiles, are also driving market expansion. However, potential restraints include price sensitivity among budget-conscious gamers, the emergence of alternative audio solutions (like built-in console audio), and the cyclical nature of gaming hardware upgrades. The market is segmented by various factors, including headset type (wired, wireless), connectivity (USB, Bluetooth), platform compatibility (PC, console), and price range. Major players like Logitech, Razer, Corsair, and Sony dominate the market, leveraging brand recognition and technological innovation to maintain their market share.

The forecast period (2025-2033) anticipates continued growth, though the pace might slightly moderate. Increased competition and market saturation could contribute to this moderation. Nevertheless, ongoing innovation in audio technology, the expansion of the gaming community, and the continued growth of esports are likely to ensure steady market expansion. The continued success of key players hinges on their ability to adapt to evolving consumer preferences, deliver innovative features, and maintain a competitive pricing strategy. Regional variations within the US market are anticipated, with potentially higher growth rates in areas with strong gaming cultures and higher levels of disposable income. Further market segmentation, considering factors like age demographics and gaming preferences, can offer deeper insights into growth potential across different consumer groups.

United States Gaming Headsets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States gaming headsets market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by various factors, offering valuable insights for industry professionals, investors, and stakeholders. Market size is presented in million units.

United States Gaming Headsets Market Dynamics & Structure

The US gaming headsets market is characterized by a moderately concentrated landscape, with key players like Logitech International SA, Razer Inc, and Corsair Gaming holding significant market share (estimated at xx% combined in 2025). Technological innovation, particularly in areas like surround sound, noise cancellation, and haptic feedback, is a major driver. Regulatory frameworks surrounding data privacy and product safety also play a significant role. Competitive substitutes include traditional headphones and earphones, while the emergence of virtual reality (VR) and augmented reality (AR) headsets presents both opportunities and challenges. End-user demographics are skewed towards younger generations (18-35 years), with a growing segment of female gamers. M&A activity in the sector has been moderate in recent years, with xx deals recorded between 2019-2024.

- Market Concentration: Moderately concentrated, with top 3 players holding xx% market share in 2025.

- Technological Innovation: Focus on surround sound, noise cancellation, haptic feedback, and wireless connectivity.

- Regulatory Framework: Compliance with data privacy regulations (e.g., CCPA, GDPR) and product safety standards.

- Competitive Substitutes: Traditional headphones, earphones, and emerging VR/AR headsets.

- End-User Demographics: Predominantly 18-35 years old, with increasing female participation.

- M&A Activity: xx deals between 2019-2024.

United States Gaming Headsets Market Growth Trends & Insights

The US gaming headsets market experienced robust growth during the historical period (2019-2024), driven by rising gaming popularity, increasing disposable incomes, and technological advancements. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. Adoption rates have significantly increased, particularly amongst console and PC gamers. Technological disruptions, such as the introduction of next-generation consoles and high-fidelity audio technologies, have fueled market expansion. Consumer behavior shifts towards premium products with advanced features are also observed. The market is projected to maintain a healthy growth trajectory during the forecast period (2025-2033), reaching xx million units by 2033, with a projected CAGR of xx%. Market penetration is expected to increase across various gaming platforms.

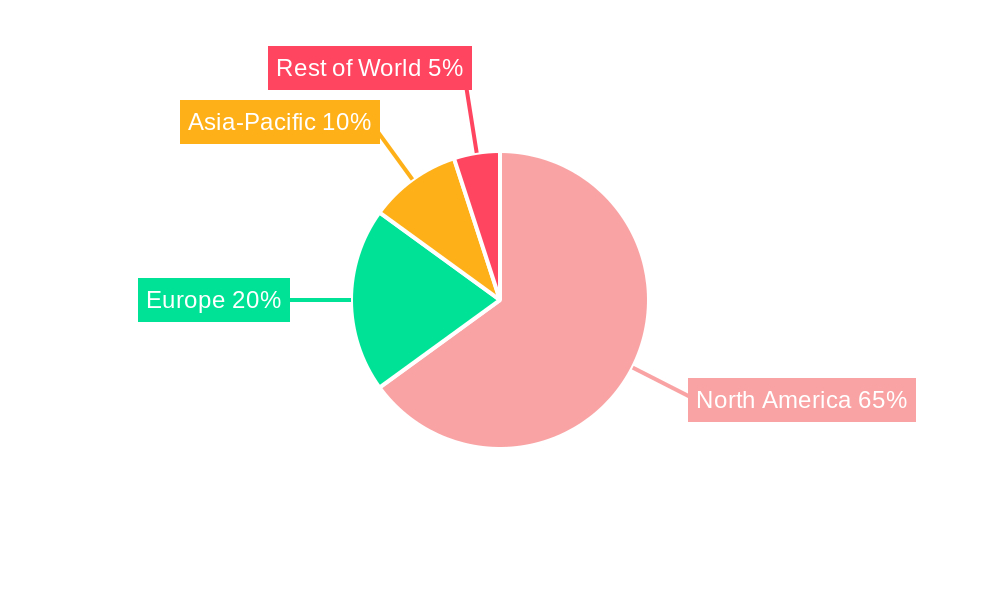

Dominant Regions, Countries, or Segments in United States Gaming Headsets Market

California and New York, driven by significant gamer populations and technological hubs, represent dominant regions within the US gaming headsets market. These states showcase high per capita gaming headset ownership and strong demand for premium products. The PC gaming segment holds the largest market share, followed by console gaming.

- Key Drivers: High concentration of gamers, strong technological infrastructure, high disposable income.

- Dominance Factors: High market share, robust growth potential, presence of major gaming companies.

United States Gaming Headsets Market Product Landscape

The US gaming headsets market offers a diverse range of products, from basic wired headsets to high-end wireless models with advanced features like surround sound, noise cancellation, and customizable EQ settings. Innovation focuses on improved comfort, enhanced audio fidelity, and seamless integration with gaming platforms. Unique selling propositions include immersive audio experiences, ergonomic designs, and durable construction. Technological advancements are constantly driving the development of lighter, more comfortable, and feature-rich headsets.

Key Drivers, Barriers & Challenges in United States Gaming Headsets Market

Key Drivers: The growing popularity of esports, increasing demand for immersive gaming experiences, and technological advancements in audio technology are key drivers. Government initiatives promoting digital literacy and the expansion of high-speed internet access further contribute to market growth.

Challenges: Intense competition among established and emerging players, supply chain disruptions affecting component availability, and fluctuating raw material prices pose significant challenges. Regulatory hurdles related to product safety and data privacy also present obstacles.

Emerging Opportunities in United States Gaming Headsets Market

Emerging opportunities lie in the integration of advanced technologies like AI and haptic feedback for enhanced gaming immersion. The growing popularity of cloud gaming offers potential for new headset designs optimized for this platform. Further market penetration within untapped segments, such as casual gamers and mobile gamers, offers significant growth potential. Personalized audio profiles and customizable features cater to individual preferences.

Growth Accelerators in the United States Gaming Headsets Market Industry

Technological breakthroughs in audio processing, miniaturization, and battery technology are accelerating market growth. Strategic partnerships between headset manufacturers and game developers create synergistic opportunities. Market expansion strategies focusing on emerging gaming platforms and international markets also contribute to market expansion.

Key Players Shaping the United States Gaming Headsets Market Market

- Logitech International SA

- Razer Inc

- Corsair Gaming

- Sony Interactive Entertainment

- HyperX (HP Inc)

- ASUS Computer International

- Microsoft Corporation

- Harman International Industries Incorporated

- SteelSeries

- Turtle Beach Corporation

Notable Milestones in United States Gaming Headsets Market Sector

- May 2024: JBL launched its 'Quantum' line of gaming headphones, introducing advanced sound technology.

- July 2024: Beats by Dre collaborated with Minecraft to release a limited-edition headset.

In-Depth United States Gaming Headsets Market Market Outlook

The US gaming headsets market is poised for sustained growth driven by technological innovation, expanding gamer demographics, and the increasing popularity of esports. Strategic partnerships, product diversification, and the development of innovative audio technologies will shape future market dynamics. The market presents attractive opportunities for companies focused on delivering high-quality, immersive gaming experiences.

United States Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

United States Gaming Headsets Market Segmentation By Geography

- 1. United States

United States Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Console Headset Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sony Interactive Entertainment

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (HP Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASUS Computer International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harman International Industries Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SteelSeries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turtle Beach Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: United States Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Gaming Headsets Market Share (%) by Company 2024

List of Tables

- Table 1: United States Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: United States Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 5: United States Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: United States Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 7: United States Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: United States Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 9: United States Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: United States Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: United States Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 13: United States Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: United States Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 15: United States Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: United States Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 17: United States Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Gaming Headsets Market?

The projected CAGR is approximately 9.06%.

2. Which companies are prominent players in the United States Gaming Headsets Market?

Key companies in the market include Logitech International SA, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUS Computer International, Microsoft Corporation, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the United States Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Console Headset Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

July 2024: Beats by Dre recently announced a significant collaboration, teaming up with Minecraft to launch a limited edition of Beats Solo 4 headphones. These headphones, inspired by Minecraft's Creepers, boast a bold neon green and black design, complete with a block pattern.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the United States Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence