Key Insights

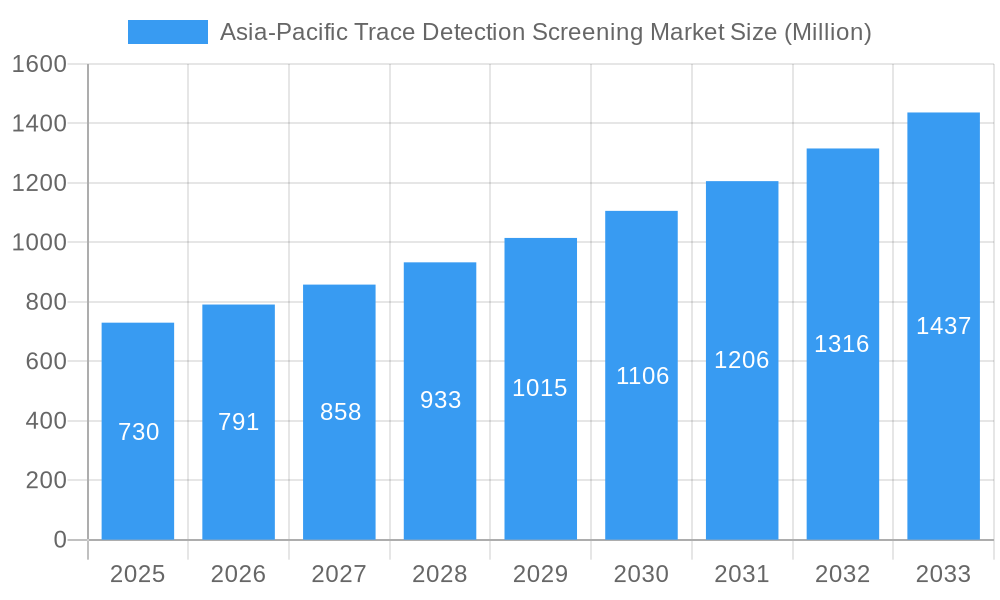

The Asia-Pacific trace detection screening market, valued at $0.73 billion in 2025, is projected to experience robust growth, driven by escalating security concerns across various sectors. A compound annual growth rate (CAGR) of 8.40% from 2025 to 2033 indicates a significant expansion, primarily fueled by increasing cross-border trade and heightened terrorism threats. Stringent government regulations mandating improved security measures at airports, ports, and border checkpoints are key catalysts. The rising adoption of advanced technologies like handheld and portable trace detection devices, offering enhanced portability and ease of use, further contributes to market expansion. Specific growth within the region is propelled by nations like China, India, and Japan, which are experiencing rapid economic development and consequently, increased passenger and cargo traffic. The market segmentation, encompassing explosives, narcotics detection and various product types (handheld, portable/movable, and fixed) tailored to commercial, military, law enforcement, and public safety end-users, further emphasizes the diverse applications driving this growth. The prevalence of sophisticated criminal activities and the need for timely threat neutralization significantly impact the market's trajectory.

Asia-Pacific Trace Detection Screening Market Market Size (In Million)

The market's growth trajectory is influenced by several factors. While the aforementioned drivers are significant, restraints like high initial investment costs associated with advanced equipment and the need for skilled personnel to operate and maintain these systems pose challenges. However, technological advancements leading to more user-friendly and cost-effective solutions are expected to mitigate these restraints. The increasing focus on research and development in trace detection technologies, combined with government initiatives aimed at improving security infrastructure, ensures sustained market growth throughout the forecast period. Competitive landscape analysis reveals a mix of established players and emerging companies, fostering innovation and enhancing the overall market dynamics. The Asia-Pacific region's unique characteristics, such as its diverse economies and population density, contribute to the region's importance in this global market.

Asia-Pacific Trace Detection Screening Market Company Market Share

Asia-Pacific Trace Detection Screening Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific trace detection screening market, encompassing market dynamics, growth trends, dominant segments, and key players. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by country (China, India, Japan, South Korea, Australia, and New Zealand), type (explosive, narcotics), product (handheld, portable/movable, fixed), and end-user industry (commercial, military & defense, law enforcement, ports & borders, public safety, other). The report offers valuable insights for industry professionals, investors, and strategic decision-makers.

Asia-Pacific Trace Detection Screening Market Dynamics & Structure

The Asia-Pacific trace detection screening market is characterized by a moderately consolidated structure, with several key players holding significant market share. The market is driven by technological advancements leading to more sensitive and efficient detection systems, stringent regulatory frameworks aimed at enhancing security, and increasing concerns about terrorism and illicit activities. The market is also influenced by the availability of competitive product substitutes and the evolving demographics of end-users. Mergers and acquisitions (M&A) activity has been moderate, primarily focused on enhancing technological capabilities and expanding market reach.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Continuous R&D efforts are focusing on miniaturization, improved sensitivity, and faster detection times.

- Regulatory Frameworks: Stricter security regulations in airports, ports, and public spaces drive market growth.

- Competitive Substitutes: Alternative screening technologies pose a challenge to market growth.

- End-User Demographics: Increasing urbanization and rising security concerns in densely populated areas fuel demand.

- M&A Trends: xx M&A deals were recorded between 2019 and 2024, primarily focused on technology integration and geographical expansion.

Asia-Pacific Trace Detection Screening Market Growth Trends & Insights

The Asia-Pacific trace detection screening market has witnessed significant growth during the historical period (2019-2024), driven by increasing security concerns and technological advancements. The market size is estimated at xx Million units in 2025 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. This growth is attributed to several factors, including rising adoption rates across various end-user industries, technological disruptions leading to improved detection capabilities, and evolving consumer behavior emphasizing enhanced security measures. The market penetration rate is expected to increase from xx% in 2025 to xx% by 2033. Specific growth trajectories vary based on country-specific regulations, economic conditions, and technological advancements. The demand for handheld and portable devices is expected to continue to outpace that of fixed systems, driven by the need for increased mobility and ease of deployment.

Dominant Regions, Countries, or Segments in Asia-Pacific Trace Detection Screening Market

China and India are the leading countries in the Asia-Pacific trace detection screening market, driven by factors such as rapid economic growth, increasing infrastructure development, and rising security concerns. Japan and South Korea also exhibit substantial market potential, with significant investments in security technologies and a focus on advanced detection systems. The explosive detection segment dominates the market due to the heightened threat of terrorism. The ports and borders segment is a key driver, showcasing significant growth due to increased international trade and stringent border security measures.

- China: Largest market share, driven by high population density, expanding infrastructure, and increased security investments.

- India: Rapid growth driven by economic expansion and increasing focus on security.

- Japan & South Korea: Significant market potential due to technological advancements and high security standards.

- Explosive Detection: Dominant segment due to the global threat of terrorism.

- Ports & Borders: High growth segment due to increasing international trade and stringent border security.

Asia-Pacific Trace Detection Screening Market Product Landscape

The Asia-Pacific trace detection screening market offers a diverse range of products, including handheld, portable/movable, and fixed systems. Handheld devices are preferred for their portability and ease of use in various settings, while larger, fixed systems are deployed in high-traffic areas like airports and borders. Recent innovations focus on improving sensitivity, reducing false positives, and incorporating advanced technologies like AI and machine learning for enhanced accuracy and speed. Unique selling propositions often include ease of use, rapid detection times, and minimal maintenance requirements.

Key Drivers, Barriers & Challenges in Asia-Pacific Trace Detection Screening Market

Key Drivers: Stringent government regulations, increasing security concerns due to terrorism and illicit activities, technological advancements, and rising investments in security infrastructure are key drivers. The increasing adoption of advanced technologies like AI and machine learning further accelerates market growth.

Key Challenges: High initial investment costs, complex integration with existing security systems, and the need for skilled personnel to operate the equipment pose significant challenges. Supply chain disruptions and regulatory hurdles further hinder market growth. Competition from established players and the emergence of new technologies also presents challenges. The potential for false positives remains a concern, impacting user confidence.

Emerging Opportunities in Asia-Pacific Trace Detection Screening Market

Untapped markets in smaller cities and rural areas present significant growth opportunities. The increasing adoption of cloud-based solutions for data management and analysis offers new avenues. Furthermore, the development of non-contact screening methods and the integration of trace detection with other security technologies create lucrative opportunities for market expansion.

Growth Accelerators in the Asia-Pacific Trace Detection Screening Market Industry

Technological breakthroughs, such as the development of more sensitive and faster detection technologies, are driving long-term growth. Strategic partnerships between technology providers and government agencies are accelerating market penetration. Market expansion strategies focused on emerging economies are crucial for sustained growth. The increasing focus on homeland security and border protection will continue to fuel market expansion.

Key Players Shaping the Asia-Pacific Trace Detection Screening Market Market

- Smiths Detection Group Ltd

- DetectaChem

- Teledyne Flir LLC

- Vehant Technologies Pvt Ltd

- HTDS - High Tech Detection Systems

- DSA Detection LLC

- Rapiscan Systems Inc

- Leidos Holdings Inc

- Westminster Group PL

- Autoclear LLC

- Bruker Corporation

- Mass Spec Analytical Ltd

Notable Milestones in Asia-Pacific Trace Detection Screening Market Sector

- May 2023: Jaipur International Airport opens a new domestic cargo unit equipped with explosive trace detection equipment, signaling increased investment in security infrastructure.

- February 2023: MIT Lincoln Laboratory researchers announce their pursuit of non-contact explosive detection methods, hinting at future technological advancements.

In-Depth Asia-Pacific Trace Detection Screening Market Market Outlook

The Asia-Pacific trace detection screening market is poised for significant growth in the coming years. Technological advancements, coupled with rising security concerns and increasing government investments, will drive market expansion. Strategic partnerships and the adoption of innovative technologies will create new opportunities for growth and market consolidation. The focus on enhancing the speed, accuracy, and ease of use of detection systems will play a critical role in shaping the future of this market.

Asia-Pacific Trace Detection Screening Market Segmentation

-

1. Type

- 1.1. Explosive

- 1.2. Narcotics

-

2. Product

- 2.1. Handheld

- 2.2. Portable/Movable

- 2.3. Fixed

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Military and Defense

- 3.3. Law Enforcement

- 3.4. Ports and Borders

- 3.5. Public Safety

- 3.6. Other End-user Industries

Asia-Pacific Trace Detection Screening Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Trace Detection Screening Market Regional Market Share

Geographic Coverage of Asia-Pacific Trace Detection Screening Market

Asia-Pacific Trace Detection Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Terrorist Attacks; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. The Law Enforcement Segment is Expected to Register a Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosive

- 5.1.2. Narcotics

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Handheld

- 5.2.2. Portable/Movable

- 5.2.3. Fixed

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Military and Defense

- 5.3.3. Law Enforcement

- 5.3.4. Ports and Borders

- 5.3.5. Public Safety

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smiths Detection Group Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DetectaChem

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Teledyne Flir LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vehant Technologies Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HTDS - High Tech Detection Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSA Detection LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rapiscan Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leidos Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Westminster Group PL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autoclear LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bruker Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mass Spec Analytical Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Smiths Detection Group Ltd

List of Figures

- Figure 1: Asia-Pacific Trace Detection Screening Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Trace Detection Screening Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Asia-Pacific Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Trace Detection Screening Market?

The projected CAGR is approximately 8.40%.

2. Which companies are prominent players in the Asia-Pacific Trace Detection Screening Market?

Key companies in the market include Smiths Detection Group Ltd, DetectaChem, Teledyne Flir LLC, Vehant Technologies Pvt Ltd, HTDS - High Tech Detection Systems, DSA Detection LLC, Rapiscan Systems Inc, Leidos Holdings Inc, Westminster Group PL, Autoclear LLC, Bruker Corporation, Mass Spec Analytical Ltd.

3. What are the main segments of the Asia-Pacific Trace Detection Screening Market?

The market segments include Type, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Terrorist Attacks; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening.

6. What are the notable trends driving market growth?

The Law Enforcement Segment is Expected to Register a Significant Growth in the Market.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

May 2023: The Jaipur International Airport announced the opening a domestic cargo unit adjacent to the Terminal 1 building. The cargo unit is built in an area of 550 sq. m and can handle 2,300 metric tons of cargo monthly. The cargo unit includes two 100 X 100 Ray baggage inspection systems and one explosive trace detection equipment to screen the goods received and dispatched.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Trace Detection Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Trace Detection Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Trace Detection Screening Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Trace Detection Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence