Key Insights

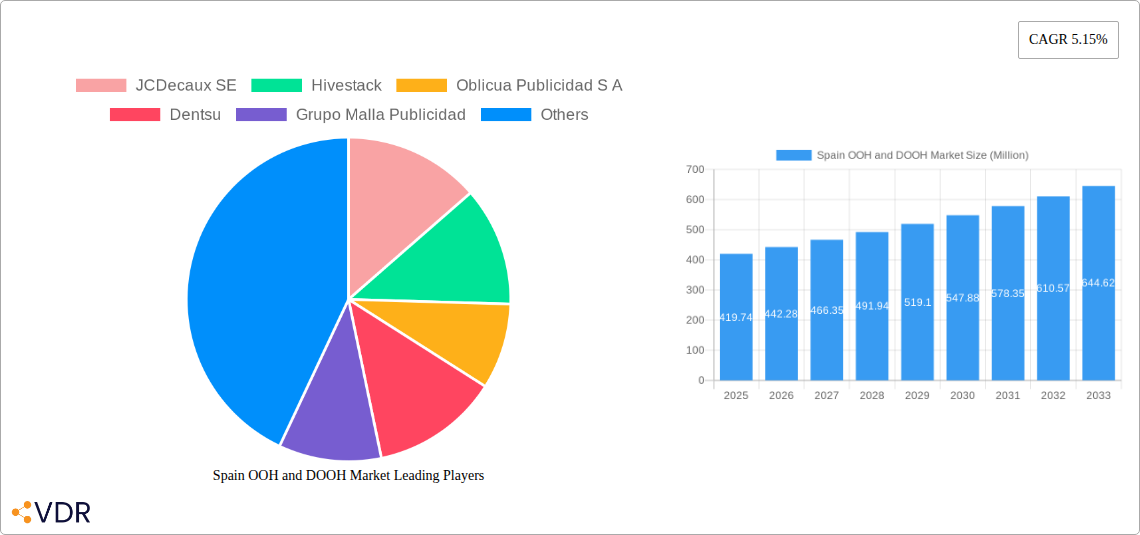

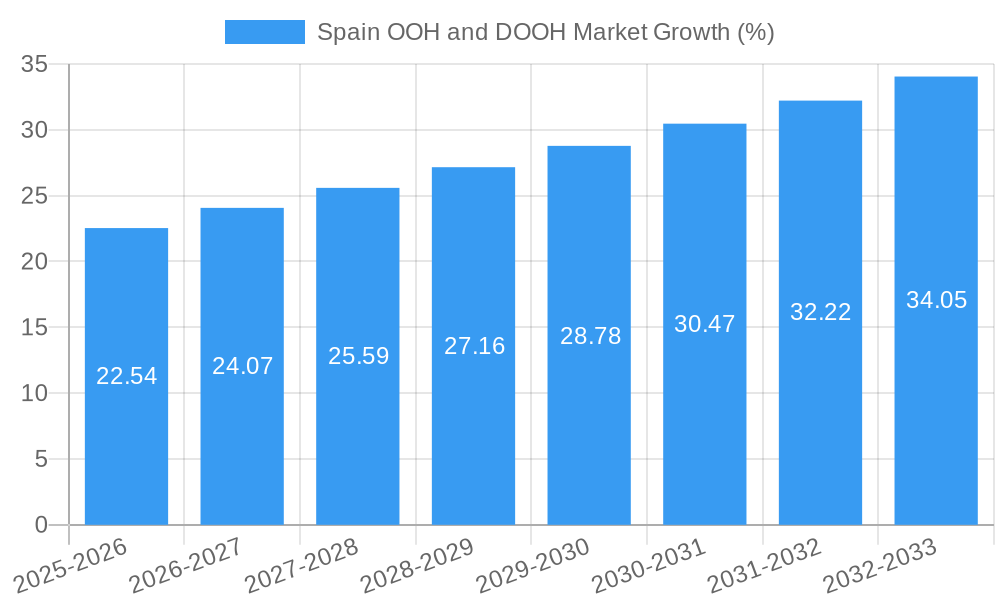

The Spain Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is experiencing robust growth, projected to reach €419.74 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.15% from 2025 to 2033. This expansion is fueled by several key factors. Increased investment in smart city infrastructure is creating more opportunities for DOOH installations, particularly in high-traffic areas like major urban centers and transportation hubs. The rising adoption of programmatic advertising within the OOH space allows for more targeted and data-driven campaigns, further enhancing the appeal to advertisers. Additionally, the increasing use of innovative technologies like augmented reality (AR) and interactive displays is adding a new dimension to OOH, improving engagement and attracting a younger demographic. The market's growth is also supported by the recovery of tourism and the resurgence of in-person events and activities post-pandemic, leading to increased foot traffic in public spaces. While the competitive landscape includes both large multinational companies like JCDecaux and Dentsu, and smaller, regional players such as Mugasa and Grupo Malla Publicidad, the overall market is characterized by a healthy level of competition and innovation.

However, the market faces certain challenges. The increasing cost of media inventory and production can restrict budget allocation for certain brands and agencies. Furthermore, the effectiveness of OOH campaigns can be affected by factors beyond advertisers’ control, such as weather conditions or unpredictable public events. While the sector is innovating to mitigate these through data-driven optimization, these challenges remain a significant consideration. The segmentation of the market is diverse, encompassing various formats like billboards, transit advertising, street furniture, and digital screens, each with its own unique target audience and pricing structure. This diversity is a key driver of continued growth and innovation as advertisers seek to find the most effective channels to connect with consumers in the dynamic Spanish market. The forecast period of 2025-2033 anticipates a steady and sustainable growth trajectory, driven by the aforementioned drivers and ongoing adaptation to market trends and technological advancements.

Spain OOH and DOOH Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spain Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, covering the period 2019-2033. It offers crucial insights into market dynamics, growth trends, key players, and emerging opportunities for industry professionals and investors. The report utilizes a robust methodology incorporating extensive primary and secondary research, providing accurate and reliable data for informed decision-making. The base year for this report is 2025, with estimations provided for the same year and forecasts spanning 2025-2033. The historical period covered is 2019-2024. The market is segmented into various sub-categories, and a detailed competitive landscape is presented. This report is invaluable for understanding the current state and future trajectory of the Spanish OOH and DOOH market.

Spain OOH and DOOH Market Dynamics & Structure

The Spanish OOH and DOOH market exhibits a moderately concentrated structure, with key players like JCDecaux SE, Clear Channel España, and Grupo Malla Publicidad holding significant market share. Technological innovation, particularly in programmatic DOOH, is a major driver. However, regulatory frameworks concerning advertising placement and data privacy pose challenges. The market faces competition from digital advertising channels, but OOH's unique ability to create impactful brand experiences ensures its continued relevance. Mergers and acquisitions (M&A) activity, as evidenced by Broadsign's acquisition of OutMoove in May 2024, is reshaping the competitive landscape, leading to increased consolidation and technological advancements.

- Market Concentration: Top 5 players hold approximately XX% market share (2024).

- Technological Innovation: Programmatic DOOH adoption is increasing, driven by improved targeting capabilities and data analytics.

- Regulatory Framework: Regulations related to advertising placement and data privacy are evolving, impacting market growth.

- Competitive Substitutes: Digital advertising channels, particularly online video and social media, present competition.

- End-User Demographics: The market caters to diverse businesses, including retail, FMCG, and entertainment sectors.

- M&A Trends: Increased M&A activity indicates a move towards consolidation and technological integration within the industry. The total value of M&A deals in the sector from 2019 to 2024 was approximately XX million.

Spain OOH and DOOH Market Growth Trends & Insights

The Spanish OOH and DOOH market witnessed significant growth between 2019 and 2024, driven by increasing digitalization and the adoption of innovative advertising formats. The market size reached XX million in 2024 and is projected to expand at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033), reaching XX million by 2033. This growth is attributed to the increasing adoption of programmatic DOOH, advancements in data analytics, and the ability of OOH to deliver highly targeted and impactful campaigns. Consumer behavior shifts towards increased outdoor mobility post-pandemic and a growing preference for engaging experiential advertising are further fueling this growth. Market penetration is expected to increase from XX% in 2024 to XX% by 2033. Technological disruptions, such as the rise of smart city infrastructure and the integration of IoT devices, are creating new opportunities for DOOH deployment and data-driven campaigns. The growing emphasis on data privacy, however, presents a key challenge that requires careful navigation by market players.

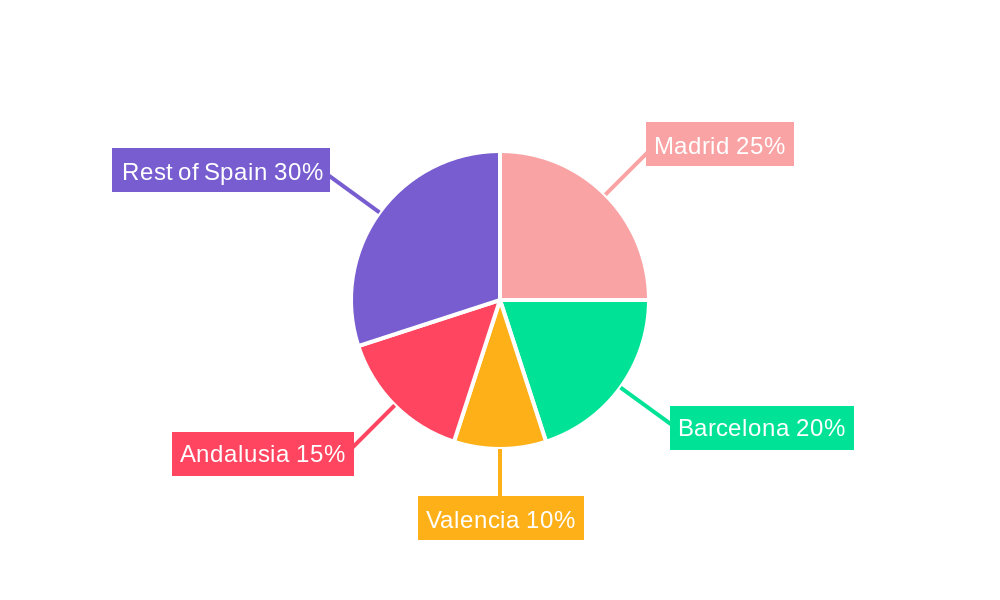

Dominant Regions, Countries, or Segments in Spain OOH and DOOH Market

Major metropolitan areas such as Madrid and Barcelona dominate the Spanish OOH and DOOH market, accounting for approximately XX% of the total market revenue in 2024. These regions benefit from high population density, robust infrastructure, and significant tourism activity. Strong economic activity in these areas contributes to higher advertising expenditure. The transportation segment (billboards near transit hubs) shows significant growth due to high visibility and targeted reach.

Key Drivers:

- High population density in Madrid and Barcelona.

- Well-developed transportation infrastructure.

- Significant tourism and economic activity.

- Government initiatives supporting urban development.

Dominance Factors:

- High concentration of businesses and consumers.

- Higher advertising expenditure compared to other regions.

- Increased availability of premium advertising locations.

- Strong presence of major OOH operators.

Spain OOH and DOOH Market Product Landscape

The Spanish OOH and DOOH market offers a diverse range of products, including traditional billboards, digital screens, street furniture, and transit advertising. Recent innovations focus on enhanced interactivity, improved data analytics, and programmatic buying options. These advancements offer advertisers greater precision in targeting and measuring campaign effectiveness, enabling more data-driven decision-making. The unique selling propositions of these solutions center around highly visible placements, targeted audience reach, and improved measurability compared to traditional OOH.

Key Drivers, Barriers & Challenges in Spain OOH and DOOH Market

Key Drivers:

- Increased adoption of programmatic DOOH.

- Growing demand for data-driven advertising solutions.

- Rising consumer engagement with OOH advertising.

- Investment in smart city infrastructure.

Challenges:

- Competition from other digital advertising channels.

- Data privacy concerns and regulations.

- High cost of installation and maintenance of DOOH infrastructure.

- Limited availability of premium advertising locations in certain areas.

Emerging Opportunities in Spain OOH and DOOH Market

- Expansion into smaller cities and towns.

- Development of innovative ad formats (e.g., interactive displays, AR/VR).

- Integration of DOOH with other marketing channels.

- Growing adoption of data-driven targeting and measurement.

Growth Accelerators in the Spain OOH and DOOH Market Industry

Technological advancements in DOOH, such as the integration of AI and machine learning for improved targeting and measurement, are expected to accelerate market growth. Strategic partnerships, like the Displayce-Echo Analytics collaboration, are driving innovation and enhancing capabilities. Further expansion into programmatic DOOH and the adoption of new technologies will propel the market towards a higher growth trajectory.

Key Players Shaping the Spain OOH and DOOH Market Market

- JCDecaux SE

- Hivestack

- Oblicua Publicidad S A

- Dentsu

- Grupo Malla Publicidad

- Clear Channel España

- wtm Outdoor advertising Europe

- Mugasa

- BigSizeMedia

- Broadsign

Notable Milestones in Spain OOH and DOOH Market Sector

- July 2024: Displayce partners with Echo Analytics, enhancing DOOH targeting precision with advanced geospatial data.

- May 2024: Broadsign acquires OutMoove, strengthening its DOOH technology and expanding its global reach.

In-Depth Spain OOH and DOOH Market Market Outlook

The Spanish OOH and DOOH market holds significant future potential, driven by continued technological innovation, increased adoption of programmatic buying, and the growing demand for data-driven advertising solutions. Strategic partnerships and acquisitions will further consolidate the market, creating opportunities for larger players. The expanding adoption of DOOH in smaller cities and towns presents a considerable avenue for growth. The integration of new technologies and creative ad formats will enhance the market's appeal and drive long-term expansion.

Spain OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-Based Media

-

3. End-User Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End Users

Spain OOH and DOOH Market Segmentation By Geography

- 1. Spain

Spain OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Towards Digital Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Towards Digital Advertising; Increasing Use of Recommendation Engines

- 3.4. Market Trends

- 3.4.1. Growing Demand of Digital OOH (LED Screens) in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-Based Media

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JCDecaux SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hivestack

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oblicua Publicidad S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dentsu

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grupo Malla Publicidad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Clear Channel Espana

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 wtm Outdoor advertising Europe

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mugasa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BigSizeMedia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Broadsig

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SE

List of Figures

- Figure 1: Spain OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain OOH and DOOH Market Share (%) by Company 2024

List of Tables

- Table 1: Spain OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Spain OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Spain OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Spain OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Spain OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 7: Spain OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Spain OOH and DOOH Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 9: Spain OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Spain OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Spain OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Spain OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: Spain OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Spain OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 15: Spain OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Spain OOH and DOOH Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Spain OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Spain OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain OOH and DOOH Market?

The projected CAGR is approximately 5.15%.

2. Which companies are prominent players in the Spain OOH and DOOH Market?

Key companies in the market include JCDecaux SE, Hivestack, Oblicua Publicidad S A, Dentsu, Grupo Malla Publicidad, Clear Channel Espana, wtm Outdoor advertising Europe, Mugasa, BigSizeMedia, Broadsig.

3. What are the main segments of the Spain OOH and DOOH Market?

The market segments include Type , Application , End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 419.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Towards Digital Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

Growing Demand of Digital OOH (LED Screens) in Spain.

7. Are there any restraints impacting market growth?

Ongoing Shift Towards Digital Advertising; Increasing Use of Recommendation Engines.

8. Can you provide examples of recent developments in the market?

July 2024: Displayce announced a strategic partnership with Echo Analytics, which provides geospatial data solutions. Through this collaboration, Displayce emerges as the pioneering DOOH DSP to seamlessly incorporate Echo Analytics' extensive points of interest (POI) library. This integration empowers Displayce's users with enhanced targeting precision, leveraging cutting-edge location intelligence.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Spain OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence