Key Insights

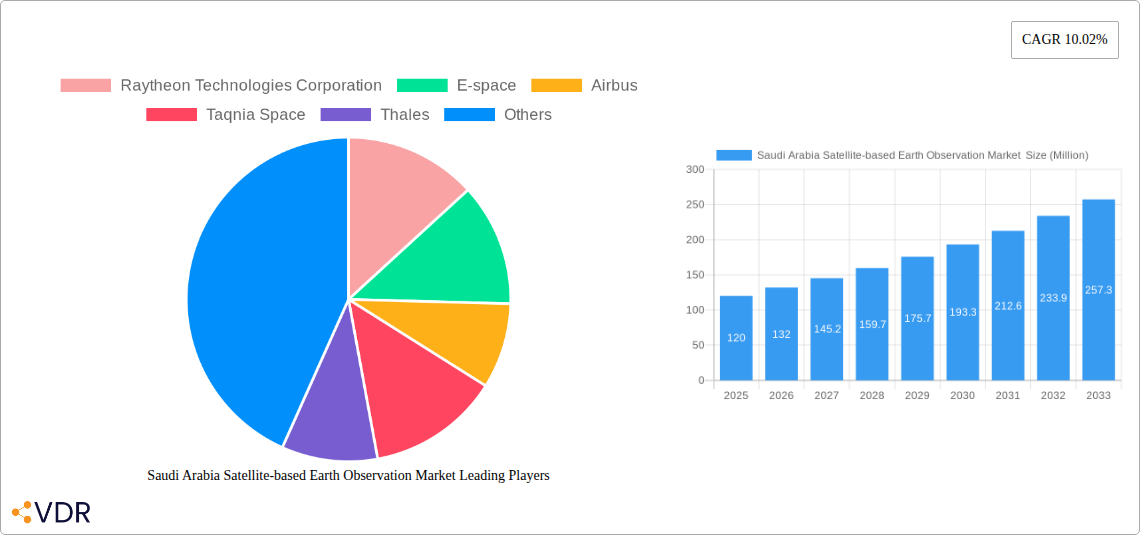

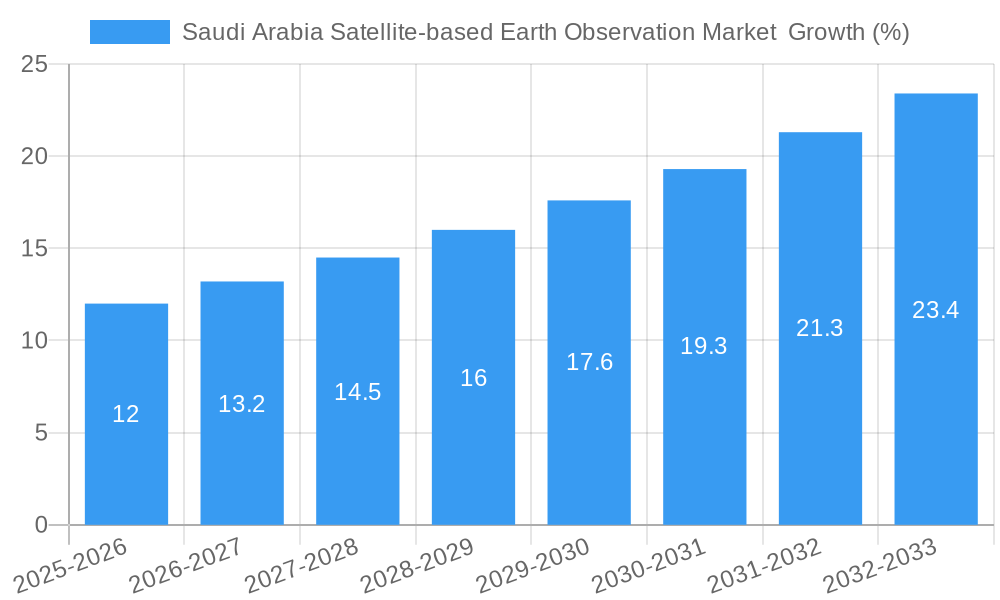

The Saudi Arabian satellite-based Earth observation market is poised for substantial growth, projected to reach a value significantly exceeding its current size. With a Compound Annual Growth Rate (CAGR) of 10.02% from 2025 to 2033, and a 2025 market size of $120 million (estimated based on the given 0.12 value unit million), the market is anticipated to experience a considerable expansion over the forecast period. This robust growth is driven by several key factors. The Kingdom's ambitious Vision 2030 initiative, focused on economic diversification and sustainable development, necessitates advanced geospatial intelligence for effective urban planning, infrastructure development, and resource management. Furthermore, the increasing adoption of precision agriculture techniques and the need for accurate climate monitoring are fueling demand for high-resolution satellite imagery and value-added services. The diverse segments within the market—including earth observation data, value-added services, and various satellite orbits catering to applications in urban development, agriculture, and energy—further contribute to its expanding scope. The presence of key players like Raytheon Technologies, Airbus, and Thales signifies the market's attractiveness and potential for technological advancements. However, challenges remain, including the potential for regulatory hurdles and the need for skilled professionals to fully leverage the potential of this technology.

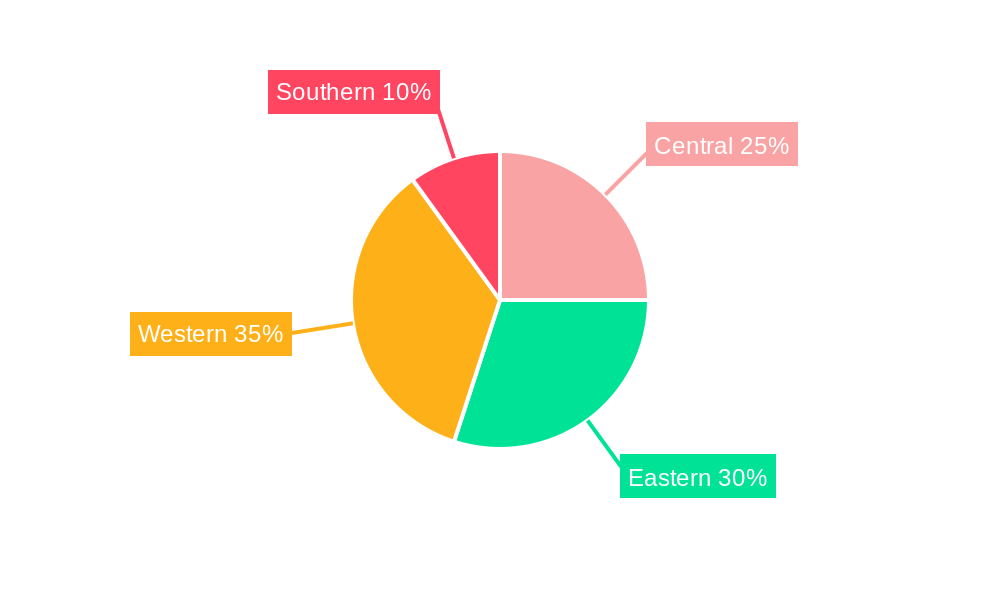

The regional segmentation within Saudi Arabia itself, encompassing Central, Eastern, Western, and Southern regions, presents unique opportunities. Specific regional needs and infrastructural priorities influence the demand for satellite-based solutions. For example, the Eastern region's focus on oil and gas extraction may necessitate enhanced monitoring for environmental impact and infrastructure security. Similarly, the Western region's growing urban centers may prioritize satellite data for city planning and efficient resource allocation. Addressing these regional variations with tailored solutions will be crucial for sustained market growth and successful market penetration by existing and new players. The historical period (2019-2024) offers valuable insights into market trends and helps refine future projections, ensuring a robust and informed understanding of market dynamics.

Saudi Arabia Satellite-based Earth Observation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the burgeoning Saudi Arabia satellite-based Earth observation market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. It segments the market by type (Earth Observation Data, Value-Added Services), satellite orbit (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit), and end-use (Urban Development & Cultural Heritage, Agriculture, Climate Services, Energy & Raw Materials, Infrastructure, Others). The market is projected to reach xx Million by 2033.

Saudi Arabia Satellite-based Earth Observation Market Market Dynamics & Structure

The Saudi Arabian satellite-based Earth observation market is characterized by a moderate level of concentration, with several key international and domestic players vying for market share. Technological innovation, particularly in high-resolution imagery and advanced analytics, is a significant growth driver. The regulatory framework, while evolving, is generally supportive of the sector's growth, aligning with Vision 2030's focus on diversification and technological advancement. The market witnesses limited competitive substitution from alternative technologies, although drone-based solutions are emerging as a potential complement. The end-user demographic is diverse, encompassing government agencies, private companies, and research institutions. M&A activity remains relatively low, but strategic partnerships are increasing.

- Market Concentration: Moderately concentrated, with a few dominant players and several smaller niche players. Market share for the top three players is estimated at xx%.

- Technological Innovation: Key drivers include advancements in sensor technology, satellite constellations, and data analytics. Barriers include high initial investment costs and data processing complexities.

- Regulatory Framework: Supportive, with government initiatives encouraging the adoption of satellite-based technologies. Potential challenges include evolving data privacy and security regulations.

- Competitive Substitutes: Limited direct substitution, but complementary technologies like drones are emerging.

- End-User Demographics: Diverse, encompassing government, private sector, and research institutions. Government accounts for xx% of the market.

- M&A Trends: Relatively low M&A activity, with strategic alliances and joint ventures more prevalent. xx M&A deals were recorded between 2019 and 2024.

Saudi Arabia Satellite-based Earth Observation Market Growth Trends & Insights

The Saudi Arabian satellite-based Earth observation market is experiencing robust growth, driven by Vision 2030's emphasis on sustainable development and diversification. The market size expanded from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. This growth is fuelled by increasing demand for high-resolution imagery across various sectors, including urban planning, agriculture, and environmental monitoring. Technological disruptions, like the emergence of small satellite constellations and advanced analytics, are accelerating market adoption. Consumer behavior is shifting towards cloud-based data services and value-added solutions. Market penetration is currently estimated at xx%, with significant potential for future expansion.

Dominant Regions, Countries, or Segments in Saudi Arabia Satellite-based Earth Observation Market

The Saudi Arabian satellite-based Earth observation market shows strong growth across all segments, although certain areas demonstrate more significant momentum. The Earth Observation Data segment dominates, representing xx% of the market, followed by Value-Added Services at xx%. Within satellite orbits, Low Earth Orbit (LEO) is the leading segment owing to its high-resolution capabilities. The most significant end-use segments include Urban Development & Cultural Heritage, driven by Vision 2030's focus on smart cities and preserving cultural sites. Agriculture and Climate Services are also crucial segments exhibiting significant growth potential.

- Key Drivers:

- Government initiatives aligning with Vision 2030.

- Increased investments in infrastructure development.

- Growing awareness of the importance of sustainable practices.

- Dominance Factors:

- High demand for high-resolution imagery in urban planning.

- Strategic government support for agricultural modernization and environmental monitoring.

- Advantages of LEO satellites for high-resolution data acquisition.

Saudi Arabia Satellite-based Earth Observation Market Product Landscape

The Saudi Arabian market showcases a diverse range of satellite-based Earth observation products, including high-resolution imagery, LiDAR data, and advanced analytical services. Products are tailored to meet specific end-user needs, encompassing customized solutions for urban planning, agricultural monitoring, and environmental management. Key innovations include the integration of AI and machine learning for improved data analysis and automated reporting. Unique selling propositions are centered on data accuracy, processing speed, and customized solutions.

Key Drivers, Barriers & Challenges in Saudi Arabia Satellite-based Earth Observation Market

Key Drivers:

- Government support for technological advancement under Vision 2030.

- Growing demand for high-resolution imagery in multiple sectors.

- Advancement in satellite technology and data analytics.

Key Challenges:

- High initial investment costs associated with satellite technology.

- Potential data security and privacy concerns.

- Dependence on foreign technology providers.

Emerging Opportunities in Saudi Arabia Satellite-based Earth Observation Market

The Saudi Arabian market presents numerous opportunities, particularly in precision agriculture, disaster response, and environmental monitoring. Untapped markets exist in smaller municipalities and private sector adoption. Innovative applications include integrating Earth observation data with other datasets for comprehensive analytics and decision-making.

Growth Accelerators in the Saudi Arabia Satellite-based Earth Observation Market Industry

Continued government investment, technological advancements, and increased private sector engagement are key accelerators for long-term growth. Strategic partnerships between international and local players can leverage global expertise to foster market development.

Key Players Shaping the Saudi Arabia Satellite-based Earth Observation Market Market

- Raytheon Technologies Corporation

- E-space

- Airbus

- Taqnia Space

- Thales

- SARsat Arabia

- Arabsat

- Leonardo S p A

- Serco

- NOVAsat

Notable Milestones in Saudi Arabia Satellite-based Earth Observation Market Sector

- April 2023: KAUST successfully launched a Cubesat satellite with Spire Global, enhancing Earth observation capabilities and supporting Vision 2030 goals.

- March 2023: AALTO HAPS (an Airbus company) signed an MoU with stc Group to introduce HAPS-based solutions, expanding connectivity and providing Earth observation capabilities.

In-Depth Saudi Arabia Satellite-based Earth Observation Market Market Outlook

The Saudi Arabian satellite-based Earth observation market holds significant potential for continued growth. Strategic investments, technological innovation, and supportive government policies will drive market expansion. Opportunities abound in leveraging Earth observation data for sustainable development, enhancing infrastructure planning, and managing natural resources effectively.

Saudi Arabia Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

Saudi Arabia Satellite-based Earth Observation Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for the Environmental Monitoring; Growing Need to Generate Big Data to Offer Accurate Insights into Earth Observation

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Personnel

- 3.4. Market Trends

- 3.4.1. Energy and Raw Materials Segment is Anticipated to Grow at a Significant rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Raytheon Technologies Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 E-space

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Airbus

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Taqnia Space

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Thales

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SARsat Arabia

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arabsat

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Leonardo S p A

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Serco

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NOVAsat

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Raytheon Technologies Corporation

List of Figures

- Figure 1: Saudi Arabia Satellite-based Earth Observation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Satellite-based Earth Observation Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 4: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 5: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Saudi Arabia Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Saudi Arabia Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Saudi Arabia Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Saudi Arabia Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 13: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 14: Saudi Arabia Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Satellite-based Earth Observation Market ?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the Saudi Arabia Satellite-based Earth Observation Market ?

Key companies in the market include Raytheon Technologies Corporation, E-space, Airbus, Taqnia Space, Thales, SARsat Arabia, Arabsat, Leonardo S p A, Serco, NOVAsat.

3. What are the main segments of the Saudi Arabia Satellite-based Earth Observation Market ?

The market segments include Type, Satellite Orbit, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for the Environmental Monitoring; Growing Need to Generate Big Data to Offer Accurate Insights into Earth Observation.

6. What are the notable trends driving market growth?

Energy and Raw Materials Segment is Anticipated to Grow at a Significant rate.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Personnel.

8. Can you provide examples of recent developments in the market?

April 2023 - King Abdullah University of Science and Technology (KAUST) successfully launched a Cubesat satellite with its partner Spire Global on the SpaceX Transporter-7 mission from Vandenberg Space Force Base in the US. The satellite's mission is to capture high-quality, high-resolution data from worldwide terrestrial, coastal, and ocean ecosystems to assist Saudi Arabia in observing and characterizing its unique natural resources. Aside from improving Earth observation capabilities, the satellite will produce data to aid in advancing Vision 2030 goals, particularly those connected to environmental protection and restoration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Satellite-based Earth Observation Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Satellite-based Earth Observation Market ?

To stay informed about further developments, trends, and reports in the Saudi Arabia Satellite-based Earth Observation Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence