Key Insights

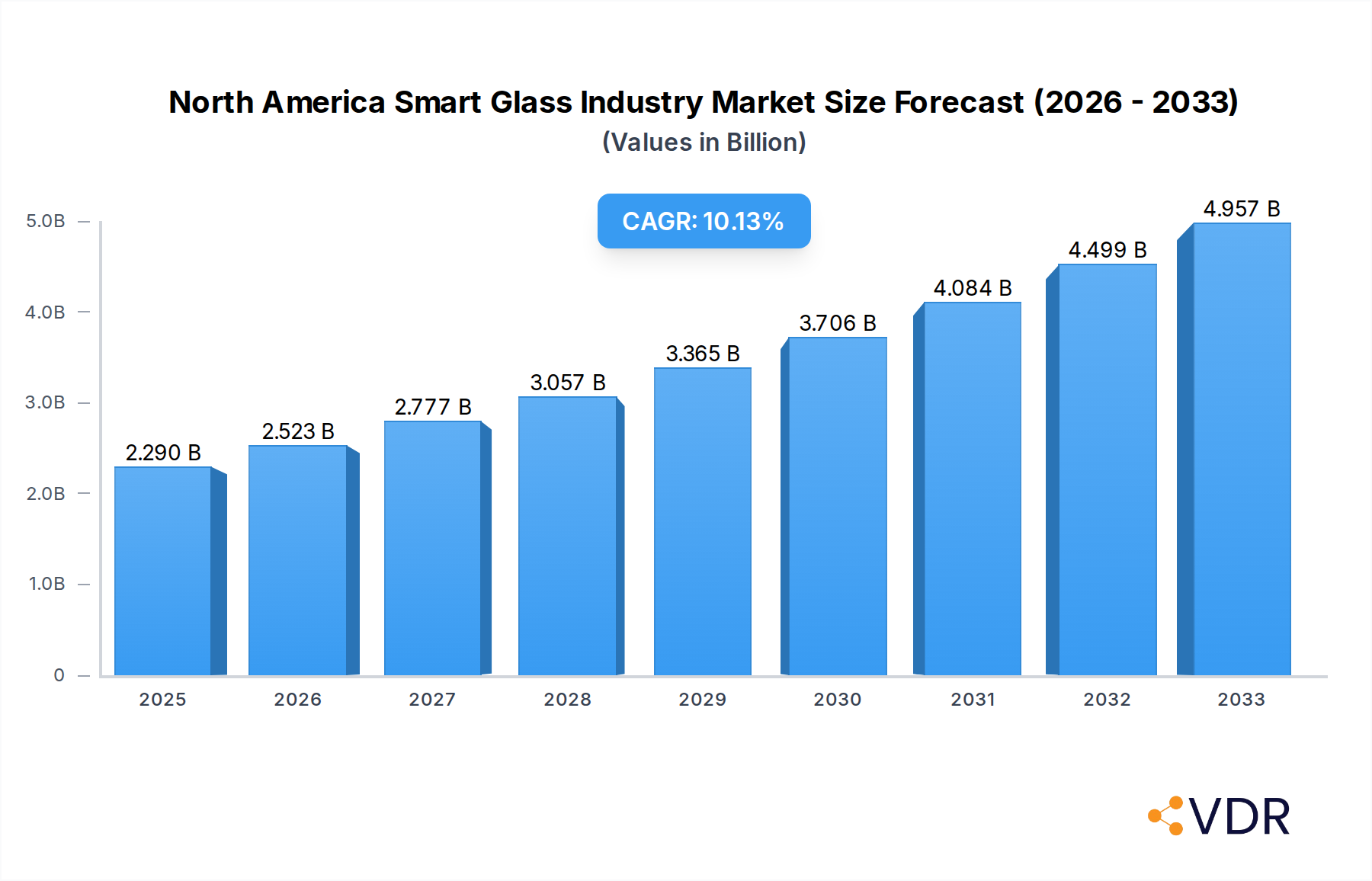

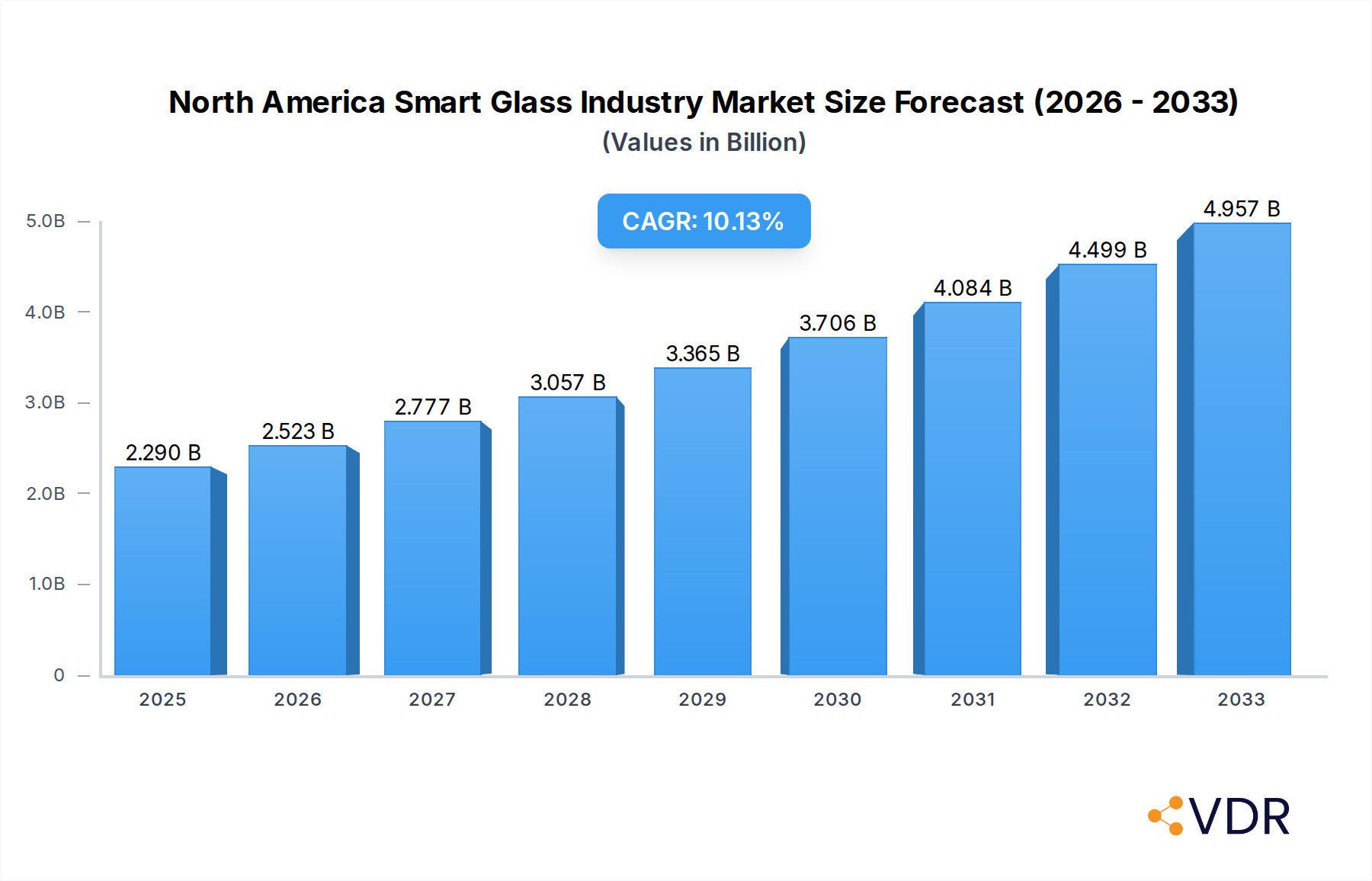

The North America Smart Glass Industry is poised for substantial growth, projected to reach a market size of USD 2.29 billion in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 10.2% through 2033. This expansion is fueled by increasing demand for energy-efficient solutions in construction and advancements in transportation technology. The integration of smart glass in residential and commercial buildings is a significant contributor, offering enhanced insulation, glare control, and privacy, thereby reducing energy consumption for heating, cooling, and lighting. Similarly, the automotive sector is increasingly adopting smart glass for sunroofs, windows, and rearview mirrors, enhancing user comfort and safety. The aerospace and rail industries are also exploring these technologies for improved passenger experience and operational efficiency. Emerging applications in consumer electronics and the broader energy sector further bolster market prospects. Key technological advancements in Suspended Particle Devices (SPDs) and Liquid Crystals are enabling more sophisticated functionalities, while Electro-chromic Glass and Passive/Active Smart Glass technologies continue to mature, offering a range of performance and cost benefits.

North America Smart Glass Industry Market Size (In Billion)

Leading companies such as View Inc., Saint-Gobain, and Gentex Corporation are at the forefront of innovation, investing heavily in research and development to introduce next-generation smart glass solutions. The market's trajectory is supported by supportive government regulations aimed at promoting energy efficiency and sustainable building practices across North America, particularly in the United States and Canada. While market growth is robust, potential restraints include the initial high cost of installation for some smart glass technologies and consumer awareness gaps regarding their long-term economic and environmental benefits. However, as manufacturing scales and technologies become more accessible, these challenges are expected to diminish, paving the way for widespread adoption. The market is characterized by a competitive landscape with continuous product development and strategic collaborations aimed at expanding market reach and application diversity.

North America Smart Glass Industry Company Market Share

This comprehensive report provides an in-depth analysis of the North America Smart Glass Industry, offering a detailed outlook for the period of 2019–2033. The study encompasses the historical performance (2019–2024), the base year (2025), and a detailed forecast period (2025–2033), with an estimated year of 2025. We explore market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, and growth accelerators. The report also highlights key players and notable milestones shaping this rapidly evolving sector. This report is meticulously designed for industry professionals seeking actionable insights and strategic guidance.

North America Smart Glass Industry Market Dynamics & Structure

The North America Smart Glass Industry is characterized by a dynamic and evolving market structure, driven by continuous technological innovation and increasing adoption across various applications. Market concentration is moderate, with several key players vying for market share while fostering a competitive environment. Technological innovation is a primary driver, with ongoing research and development in electrochromic, suspended particle devices (SPD), and liquid crystal technologies enhancing performance and reducing costs. Regulatory frameworks, particularly concerning energy efficiency and building codes, are increasingly favoring smart glass solutions, especially within the construction sector. Competitive product substitutes, such as traditional blinds and curtains, are gradually losing ground to the superior functionality and aesthetic appeal of smart glass. End-user demographics are shifting towards tech-savvy consumers and businesses prioritizing sustainability, comfort, and advanced functionality. Mergers and acquisitions (M&A) trends are notable, with larger conglomerates acquiring innovative startups to expand their product portfolios and market reach.

- Market Concentration: Moderate, with a blend of established players and emerging innovators.

- Technological Innovation Drivers: Increased demand for energy efficiency, enhanced occupant comfort, privacy control, and aesthetic customization.

- Regulatory Frameworks: Stringent energy efficiency standards for buildings and automotive applications are a significant catalyst.

- Competitive Product Substitutes: Traditional window coverings (blinds, curtains), static tinted glass.

- End-User Demographics: Growing interest from residential and commercial construction, automotive manufacturers, and consumer electronics companies.

- M&A Trends: Strategic acquisitions by larger material and technology companies to integrate smart glass capabilities.

North America Smart Glass Industry Growth Trends & Insights

The North America Smart Glass Industry is poised for significant growth, propelled by escalating demand for energy-efficient solutions, enhanced architectural aesthetics, and advanced functionalities across diverse applications. Market size evolution indicates a steady upward trajectory, with adoption rates accelerating as awareness of smart glass benefits, such as dynamic light and heat control, increases. Technological disruptions are continuously refining product capabilities, leading to wider acceptance and integration. Consumer behavior shifts are pivotal, with a growing preference for smart homes and buildings that offer convenience, energy savings, and a sophisticated living or working environment. The inherent advantages of smart glass in reducing HVAC loads and glare contribute to its expanding market penetration.

This industry is experiencing robust expansion, with an estimated market size evolution to reach $12.5 billion units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 18.2% during the forecast period of 2025–2033. The base year of 2025 sees the market valued at $6.8 billion units. Historical data from 2019–2024 shows a foundational growth phase, setting the stage for accelerated expansion.

Technological advancements are a cornerstone of this growth. The development of more cost-effective manufacturing processes for electrochromic and SPD technologies is democratizing access to smart glass solutions. Furthermore, the integration of smart glass with building management systems (BMS) and IoT platforms is enhancing its appeal in the construction sector, enabling seamless control and automation. In the automotive segment, the adoption of smart glass for sunroofs and windows contributes to improved fuel efficiency and passenger comfort. The growing emphasis on sustainable building practices and the desire for premium, customizable living spaces in residential construction are further fueling demand. The automotive industry's focus on lightweight materials and advanced driver-assistance systems (ADAS) also presents opportunities for integrated smart glass features, such as heads-up displays and camera integration. The consumer electronics segment, though nascent, holds immense potential with the increasing miniaturization and integration of smart glass in various devices.

The market penetration of smart glass is steadily increasing, moving beyond niche applications to mainstream adoption. This is supported by increasing consumer awareness campaigns, government incentives for energy-efficient buildings, and a growing portfolio of innovative products addressing diverse needs. The ability of smart glass to adapt to changing environmental conditions, providing dynamic shading and glare reduction, aligns perfectly with the global push for sustainability and occupant well-being. As the technology matures and production scales up, the cost-effectiveness of smart glass is expected to further drive its widespread adoption across all major segments.

Dominant Regions, Countries, or Segments in North America Smart Glass Industry

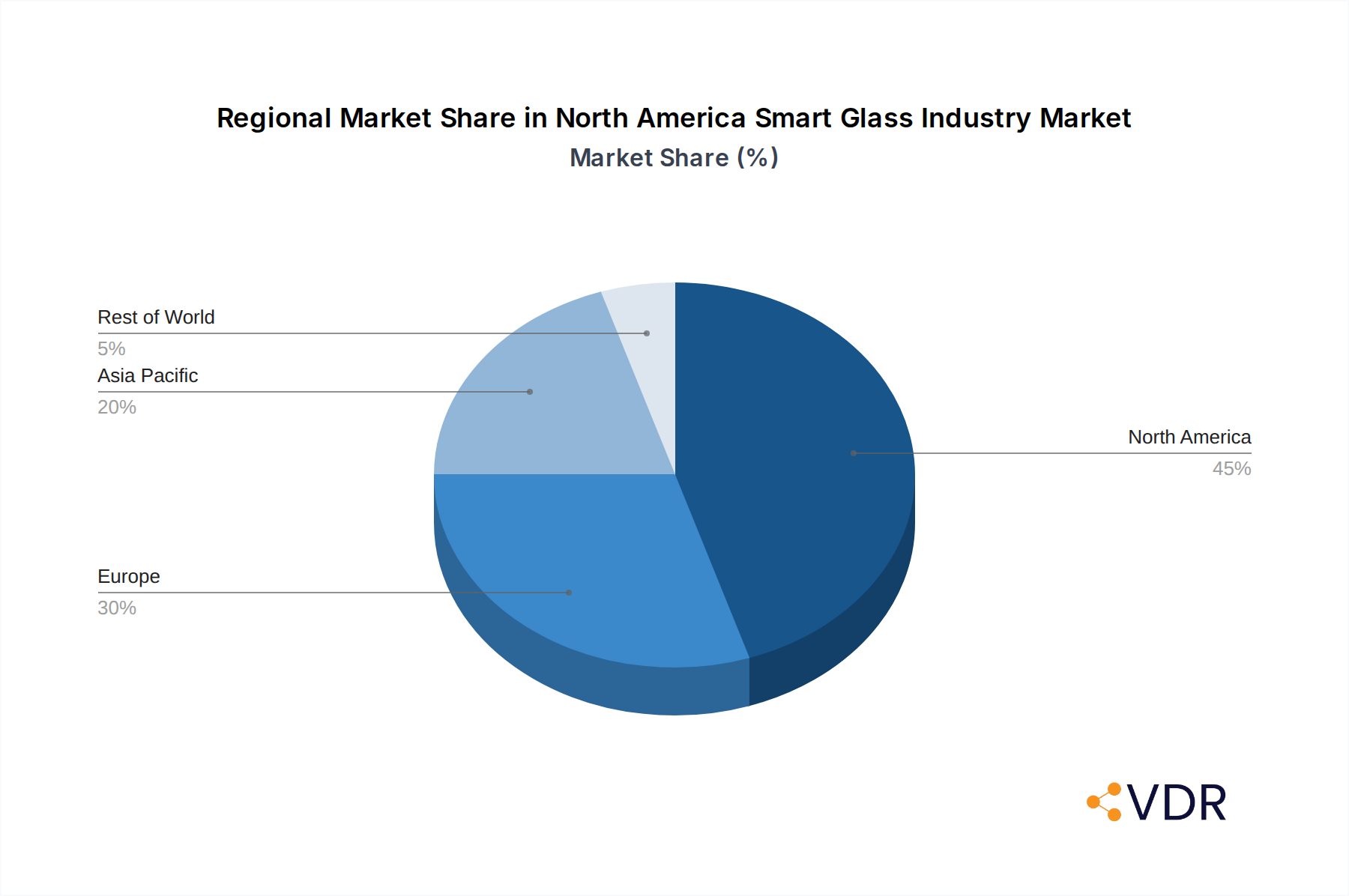

The North America Smart Glass Industry is significantly influenced by dominant regions, countries, and technological segments, each contributing uniquely to its growth trajectory. Within North America, the United States stands out as the dominant country, driven by its robust construction sector, advanced automotive industry, and significant investment in technological research and development. The sheer scale of infrastructure projects, coupled with stringent energy efficiency mandates, makes the U.S. a prime market for smart glass solutions.

Within the Technology segment, Electro-chromic Glass is emerging as a dominant force. Its ability to offer variable tinting, controlled by electrical voltage, provides superior energy management capabilities and privacy. This technology's increasing affordability and performance enhancements are driving its adoption in both large-scale commercial buildings and sophisticated residential projects.

Dominant Country: United States

- Key Drivers: High demand from commercial and residential construction, advanced automotive manufacturing, significant R&D investments, and strong government incentives for green buildings.

- Market Share Potential: Expected to hold over 60% of the North American market share within the forecast period.

Dominant Technology Segment: Electro-chromic Glass

- Key Drivers: Superior energy efficiency, dynamic tinting control, enhanced privacy features, and increasing cost-effectiveness compared to other technologies.

- Growth Potential: Forecasted to capture over 35% of the smart glass technology market in North America by 2033.

In terms of Applications, Construction is the largest and most influential segment, further segmented into Commercial Buildings and Residential Buildings. Commercial buildings, including offices, hospitals, and educational institutions, are prioritizing smart glass for its ability to reduce energy consumption, improve occupant comfort, and enhance building aesthetics. The growing trend of green building certifications and net-zero energy initiatives further bolsters the demand for smart glass in this sub-segment. Residential buildings are increasingly adopting smart glass for luxury homes and renovations, seeking enhanced privacy, energy savings, and a modern, high-tech living experience.

- Dominant Application Segment: Construction

- Sub-segment Dominance: Commercial Buildings

- Key Drivers: Focus on sustainability, LEED certifications, reduction in HVAC costs, glare control for office spaces, and architectural design flexibility.

- Market Share: Commercial buildings are projected to account for over 55% of the total smart glass application market in North America by 2033.

- Sub-segment Growth: Residential Buildings

- Key Drivers: Growing adoption of smart home technology, demand for enhanced privacy and security, desire for luxury and modern living spaces, and energy cost savings.

- Sub-segment Dominance: Commercial Buildings

The Transportation segment, particularly Automotive, is another significant driver of smart glass adoption. The integration of smart glass in vehicles for sunroofs, windows, and even windshields offers benefits such as reduced heat gain, improved fuel efficiency, and enhanced passenger comfort. The push for electric vehicles (EVs) also plays a role, as smart glass can help manage cabin temperature, thus extending battery range.

- Key Transportation Segment: Automotive

- Key Drivers: Lightweighting initiatives, improved fuel efficiency/EV range, enhanced passenger comfort and safety, integration of heads-up displays.

North America Smart Glass Industry Product Landscape

The North America Smart Glass Industry showcases a diverse and rapidly innovating product landscape, focusing on enhancing functionality, energy efficiency, and aesthetic appeal. Key innovations revolve around improving the speed of transition, color neutrality, durability, and cost-effectiveness of various smart glass technologies. Electrochromic glass products are now available with faster response times and a wider range of tinting options, catering to specific architectural and automotive needs. Suspended Particle Devices (SPD) are gaining traction for their ability to offer instant privacy and glare control, particularly in specialized applications. Liquid Crystal (LC) smart glass offers a dynamic switchable opacity, ideal for quick privacy solutions. Passive smart glass, which utilizes materials that respond to environmental changes without external power, is also seeing advancements in terms of efficiency and cost. Active smart glass, requiring external power, continues to evolve with integrated smart features and connectivity. Companies are also developing smart glass solutions with embedded functionalities, such as heating, defrosting, and even display capabilities, further blurring the lines between building materials and electronic devices.

Key Drivers, Barriers & Challenges in North America Smart Glass Industry

The North America Smart Glass Industry is propelled by several key drivers, including increasing global emphasis on energy efficiency and sustainability, leading to favorable government regulations and incentives for green buildings and vehicles. Technological advancements in electrochromic and SPD technologies are enhancing performance and reducing costs, making smart glass more accessible. The growing demand for enhanced comfort, privacy, and aesthetic appeal in both residential and commercial spaces further fuels market growth.

- Key Drivers:

- Energy Efficiency Mandates: Driving adoption in commercial and residential construction.

- Technological Advancements: Improved performance and cost-effectiveness of electrochromic and SPD glass.

- Consumer Demand for Comfort & Aesthetics: Increasing preference for smart homes and modern building designs.

- Automotive Industry Innovation: Integration for fuel efficiency and passenger experience.

However, the industry faces significant barriers and challenges. The initial high cost of smart glass compared to traditional windows remains a primary restraint, although this is gradually decreasing. Manufacturing complexity and the need for specialized installation expertise can also pose hurdles. Supply chain disruptions and the availability of raw materials can impact production volumes and lead times. Intense competition from established players and the emergence of new market entrants necessitate continuous innovation and cost optimization.

- Barriers & Challenges:

- High Initial Cost: Compared to conventional window solutions.

- Installation Complexity: Requiring specialized training and expertise.

- Supply Chain Vulnerabilities: Potential for material shortages and production delays.

- Scalability of Production: Meeting growing demand requires significant manufacturing investment.

- Consumer Awareness & Education: Need to further educate potential buyers about the long-term benefits.

Emerging Opportunities in North America Smart Glass Industry

Emerging opportunities in the North America Smart Glass Industry are ripe for exploration, particularly in the integration of smart glass with smart home ecosystems and advanced IoT platforms. The growing demand for personalized environments in both residential and commercial spaces presents a significant avenue. Untapped markets in retrofitting existing buildings with smart glass solutions offer substantial potential, moving beyond new constructions. The development of thinner, more flexible smart glass materials could unlock new applications in consumer electronics and wearable technology, such as integration into displays and eyewear. Furthermore, advancements in interoperability and standardization will pave the way for seamless integration into building automation systems, enhancing energy management and occupant experience.

Growth Accelerators in the North America Smart Glass Industry Industry

Several catalysts are accelerating the long-term growth of the North America Smart Glass Industry. Significant investments in research and development are continuously yielding breakthroughs in material science and manufacturing processes, leading to enhanced product performance and reduced costs. Strategic partnerships between smart glass manufacturers, construction firms, and automotive OEMs are crucial for streamlining product development, adoption, and integration. Market expansion strategies, including the exploration of new geographical regions within North America and diversification into emerging application areas, are also playing a vital role. The increasing focus on sustainability and circular economy principles is driving demand for smart glass as an enabler of energy-efficient buildings and a contributor to reduced carbon footprints.

Key Players Shaping the North America Smart Glass Industry Market

- Polytronix

- View Inc

- Scienstry Inc

- Saint-Gobain

- Pulp Studio

- Smartglass International

- Citala

- Pro Display

- Asahi Glass Corporation

- Gentex Corporation

- Nippon

- Ravenbrick

- Hitachi Chemical

- LTI Smart Glass

- PPG Industries

Notable Milestones in North America Smart Glass Industry Sector

- September 2021: Xiaomi launched its own smart glasses, which are capable of taking photos, displaying messages and notifications, making calls, providing navigation, and translating text right in real-time in front of eyes. The glasses also have an indicator light that shows when the 5-megapixel camera is in use.

- September 2021: Facebook Inc, in partnership with Ray-Ban, launched its first smart glasses named 'Ray-Ban Stories' that allow wearers to listen to music, take calls, or capture photos and short videos and share them across Facebook's services using a companion app.

In-Depth North America Smart Glass Industry Market Outlook

The North America Smart Glass Industry is on an upward trajectory, driven by a confluence of technological advancements, escalating environmental consciousness, and evolving consumer preferences. Future market potential is significantly amplified by the ongoing miniaturization of smart glass technologies and their increasing integration into a wider array of products, from advanced architectural components to sophisticated consumer electronics. Strategic opportunities lie in the continued development of cost-effective manufacturing processes, fostering wider adoption in the mid-market segment. Partnerships aimed at enhancing product interoperability with smart building and automotive systems will be crucial for unlocking new revenue streams. The growing demand for sustainable and energy-efficient solutions globally positions smart glass as a key enabler of future construction and transportation paradigms.

North America Smart Glass Industry Segmentation

-

1. Technology

- 1.1. Suspended Particle Devices

- 1.2. Liquid Crystals

- 1.3. Electro-chromic Glass

- 1.4. Passive Smart glass

- 1.5. Active Smart glass

- 1.6. Others

-

2. Applications

-

2.1. Construction

- 2.1.1. Residential Buildings

- 2.1.2. Commercial Buildings

-

2.2. Transportation

- 2.2.1. Aerospace

- 2.2.2. Rail

- 2.2.3. Automotive

- 2.2.4. Others

- 2.3. Energy

- 2.4. Consumer Electronics

-

2.1. Construction

North America Smart Glass Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Smart Glass Industry Regional Market Share

Geographic Coverage of North America Smart Glass Industry

North America Smart Glass Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing focus on Energy Conservation and Environment Friendly Technologies; Governmental Regulations; Increasing demand for energy savings techniques

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of Smart Glass Benefits; Technical Issues with the Usage of Large Size Smart Glass

- 3.4. Market Trends

- 3.4.1. Construction industry is expected to have further growth opportunities in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Smart Glass Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Suspended Particle Devices

- 5.1.2. Liquid Crystals

- 5.1.3. Electro-chromic Glass

- 5.1.4. Passive Smart glass

- 5.1.5. Active Smart glass

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Construction

- 5.2.1.1. Residential Buildings

- 5.2.1.2. Commercial Buildings

- 5.2.2. Transportation

- 5.2.2.1. Aerospace

- 5.2.2.2. Rail

- 5.2.2.3. Automotive

- 5.2.2.4. Others

- 5.2.3. Energy

- 5.2.4. Consumer Electronics

- 5.2.1. Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Polytronix

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 View Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Scienstry Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saint-Gobain

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pulp Studio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Smartglass International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Citala

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pro Display

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Asahi Glass Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gentex Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nippon

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ravenbrick

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hitachi Chemical

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 LTI Smart Glass

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 PPG Industries

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Polytronix

List of Figures

- Figure 1: North America Smart Glass Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Smart Glass Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Smart Glass Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: North America Smart Glass Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 3: North America Smart Glass Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Smart Glass Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: North America Smart Glass Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 6: North America Smart Glass Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Smart Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Smart Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Smart Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Smart Glass Industry?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the North America Smart Glass Industry?

Key companies in the market include Polytronix, View Inc *List Not Exhaustive, Scienstry Inc, Saint-Gobain, Pulp Studio, Smartglass International, Citala, Pro Display, Asahi Glass Corporation, Gentex Corporation, Nippon, Ravenbrick, Hitachi Chemical, LTI Smart Glass, PPG Industries.

3. What are the main segments of the North America Smart Glass Industry?

The market segments include Technology, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing focus on Energy Conservation and Environment Friendly Technologies; Governmental Regulations; Increasing demand for energy savings techniques.

6. What are the notable trends driving market growth?

Construction industry is expected to have further growth opportunities in the market.

7. Are there any restraints impacting market growth?

Lack of Awareness of Smart Glass Benefits; Technical Issues with the Usage of Large Size Smart Glass.

8. Can you provide examples of recent developments in the market?

September 2021: Xiaomi launched its own smart glasses, which are capable of taking photos, displaying messages and notifications, making calls, providing navigation, and translating text right in real-time in front of eyes. The glasses also have an indicator light that shows when the 5-megapixel camera is in use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Smart Glass Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Smart Glass Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Smart Glass Industry?

To stay informed about further developments, trends, and reports in the North America Smart Glass Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence