Key Insights

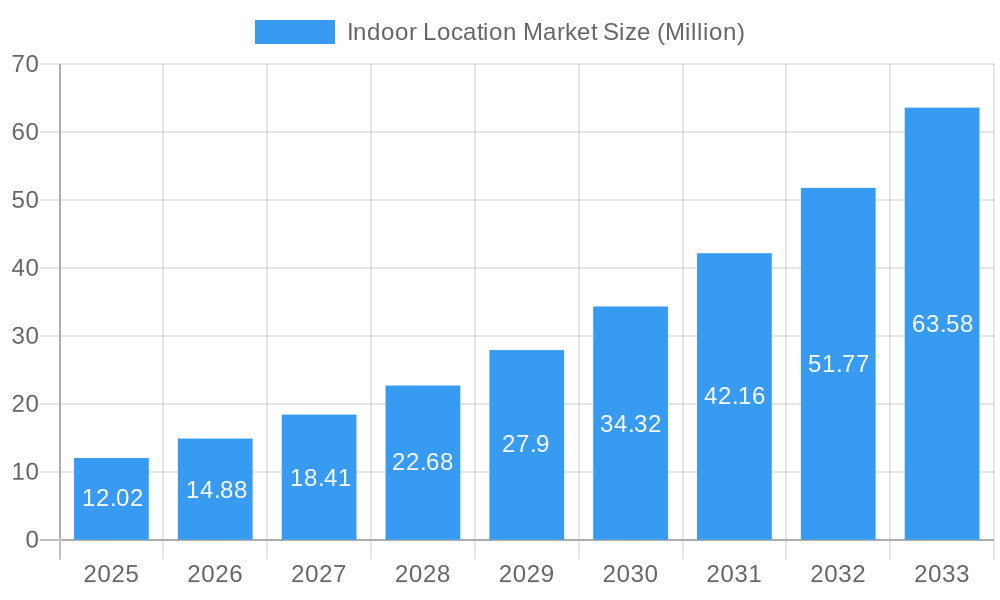

The global Indoor Location Market is experiencing robust expansion, projected to reach USD 12.02 Million with an impressive Compound Annual Growth Rate (CAGR) of 23.82% during the forecast period of 2025-2033. This significant growth is propelled by a convergence of factors, including the increasing demand for enhanced customer experiences in retail, the critical need for operational efficiency in logistics and supply chains, and the growing adoption of advanced safety and monitoring systems across various industries. The market is segmented into key components, with "Solutions" and "Services" playing pivotal roles in enabling sophisticated indoor positioning capabilities. "Indoor Navigation & Maps" and "Tracking and Tracing Applications" are emerging as dominant application segments, driven by the desire to optimize movement within complex environments and ensure asset visibility. Furthermore, the integration of indoor location technologies into "Remote Monitoring and Emergency Management" is a significant trend, bolstering safety protocols and response times.

Indoor Location Market Market Size (In Million)

The market's trajectory is further influenced by several key drivers. The proliferation of smart devices and the Internet of Things (IoT) infrastructure provides the foundational technology for accurate indoor positioning. Advancements in technologies like Bluetooth Low Energy (BLE), Wi-Fi triangulation, and ultra-wideband (UWB) are continuously improving precision and reducing costs. The growing adoption of location-based services in sectors such as retail for personalized marketing and inventory management, transportation and logistics for real-time asset tracking, and healthcare for patient and equipment management, are significantly contributing to market growth. While the market exhibits strong upward momentum, potential restraints such as high initial implementation costs and concerns regarding data privacy and security need to be strategically addressed by market players to ensure sustained and widespread adoption of indoor location technologies. The market's expansion is expected to be pronounced across North America and Europe, with the Asia-Pacific region poised for substantial growth due to rapid digital transformation initiatives.

Indoor Location Market Company Market Share

Indoor Location Market: Comprehensive Analysis and Future Outlook (2019–2033)

Gain unparalleled insights into the rapidly evolving Indoor Location Market with this in-depth report. We deliver a comprehensive analysis of market dynamics, growth trends, regional dominance, product landscape, key players, and emerging opportunities. This report is crucial for industry professionals seeking to understand market concentration, technological innovation drivers, regulatory frameworks, and competitive landscapes. Our analysis covers the Study Period: 2019–2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, building upon Historical Period data from 2019–2024. All values are presented in Million units for clarity.

Indoor Location Market Market Dynamics & Structure

The Indoor Location Market is characterized by a moderate to high level of fragmentation, with key players like Google LLC, Microsoft Corporation, and Cisco Systems Inc. exhibiting significant influence. Technological innovation serves as a primary driver, fueled by advancements in Wi-Fi, Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), and the integration of Artificial Intelligence (AI) for enhanced accuracy and predictive capabilities. Regulatory frameworks, while nascent in some regions, are increasingly focused on data privacy and security, impacting the deployment of indoor location solutions. Competitive product substitutes, such as advanced sensor technologies and improved mapping software, continuously challenge existing solutions. End-user demographics are diverse, spanning retail, healthcare, transportation, and industrial sectors, each with unique location-based needs. Mergers and acquisitions (M&A) are a notable trend, with companies like Hewlett Packard Enterprise Development LP and Zebra Technologies Corporation actively consolidating their market positions to expand their portfolios and technological reach. For instance, recent M&A activities have seen the integration of specialized indoor positioning technologies into broader enterprise solutions, aiming to offer a more comprehensive value proposition to end-users. The market's growth is also shaped by the adoption of parent and child market strategies, where established indoor location providers are extending their reach into niche applications and specific industry verticals, creating new avenues for growth and market penetration.

Indoor Location Market Growth Trends & Insights

The Indoor Location Market is poised for substantial growth, driven by an escalating demand for real-time, precise location data within enclosed environments. The market size is projected to expand significantly, moving from an estimated $xx Million in 2025 to $xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Adoption rates for indoor location technologies are accelerating across various end-user industries, propelled by the tangible benefits of enhanced operational efficiency, improved customer experiences, and advanced safety protocols. Technological disruptions, particularly the maturation of UWB technology for superior accuracy and the widespread integration of AI and machine learning algorithms for predictive analytics, are reshaping the market. These advancements enable sophisticated applications such as hyper-personalized retail experiences, optimized asset tracking in complex industrial settings, and critical emergency response management. Consumer behavior shifts are also playing a pivotal role; as consumers become more accustomed to location-aware services outdoors, their expectations for similar seamless experiences within indoor spaces, such as shopping malls, airports, and hospitals, are increasing. Market penetration is deepening as businesses recognize the return on investment (ROI) offered by indoor location solutions, leading to increased deployment in both new and existing infrastructure. The synergy between parent and child market development is evident, with a broader adoption of foundational indoor location platforms (parent market) enabling the proliferation of specialized, application-specific solutions (child market). This intricate relationship fosters a dynamic ecosystem where innovation in one area directly fuels growth in others, creating a virtuous cycle of market expansion and technological advancement.

Dominant Regions, Countries, or Segments in Indoor Location Market

North America currently stands as the dominant region in the Indoor Location Market, driven by a confluence of factors including early adoption of advanced technologies, significant investment in smart infrastructure, and a mature retail and healthcare sector actively seeking efficiency gains. The United States, in particular, plays a pivotal role due to the presence of major technology giants and a strong enterprise demand for sophisticated indoor positioning systems. The Component: Solutions segment, encompassing hardware like sensors and beacons, and software platforms for data analysis and visualization, is experiencing the highest growth within the North American market. Within applications, Indoor Navigation & Maps is a key driver, particularly in retail environments where personalized wayfinding and in-store analytics are crucial. The End-user Industry: Retail sector continues to be a primary adopter, leveraging indoor location for inventory management, foot traffic analysis, and enhanced customer engagement, projecting substantial market share. Furthermore, the Healthcare sector's increasing reliance on asset tracking for medical equipment and patient flow management contributes significantly to market dominance.

Key drivers for this regional dominance include:

- Robust technological infrastructure: Widespread availability of Wi-Fi and cellular networks provides a strong foundation for indoor location deployment.

- Government initiatives and funding: Investments in smart city projects and public safety infrastructure indirectly support the adoption of indoor location technologies.

- High consumer spending and adoption of new technologies: A consumer base receptive to location-aware services fuels demand for enhanced indoor experiences.

- Presence of leading technology companies: Key players like Broadcom Corporation, Google LLC, and Microsoft Corporation are headquartered or have significant operations in the region, driving innovation and market development.

The growth potential within North America remains exceptionally high, particularly as the integration of AI and machine learning into indoor location solutions becomes more pervasive, enabling predictive analytics and automation. The parent market of enterprise-wide indoor positioning infrastructure is expanding, facilitating the growth of numerous child markets focused on specific industry needs, such as smart retail analytics or hospital asset management.

Indoor Location Market Product Landscape

The Indoor Location Market's product landscape is characterized by a diverse array of innovative solutions designed to meet the precise needs of various industries. Technologies such as Wi-Fi fingerprinting, Bluetooth beacons, Ultra-Wideband (UWB) transmitters, and radio-frequency identification (RFID) tags form the foundational hardware. These are complemented by sophisticated software platforms that integrate data from multiple sources, offering features like real-time tracking, indoor navigation, geofencing, and detailed analytics. Unique selling propositions often lie in the accuracy of positioning (down to centimeter-level for UWB), the ease of integration with existing infrastructure, and the scalability of solutions. Technological advancements are continuously pushing the boundaries, with solutions now offering enhanced power efficiency for beacons, improved algorithms for handling signal interference, and seamless indoor-outdoor transition capabilities. Companies like Inpixon and HID Global Corporation are at the forefront, offering comprehensive suites that combine hardware, software, and services for a complete indoor location ecosystem.

Key Drivers, Barriers & Challenges in Indoor Location Market

Key Drivers:

- Demand for Enhanced Customer Experience: Retailers and public venues are deploying indoor location for personalized marketing and navigation.

- Operational Efficiency and Asset Management: Industries like logistics and manufacturing leverage indoor location for real-time tracking of assets and personnel.

- Improved Safety and Security: Critical for healthcare and government sectors for emergency response and personnel tracking.

- Advancements in IoT and Sensor Technology: Integration of more accurate, cost-effective, and power-efficient sensors.

- Growth of Smart Infrastructure: Expansion of smart buildings and connected environments fuels demand for indoor positioning.

Barriers & Challenges:

- High Initial Deployment Costs: Installation of beacons, sensors, and supporting infrastructure can be substantial.

- Data Privacy and Security Concerns: Strict regulations and user apprehension regarding the collection and use of location data.

- Integration Complexity: Interoperability issues with legacy systems and diverse hardware can be a hurdle.

- Accuracy Limitations in Complex Environments: Signal interference and multipath effects can impact precision in certain areas.

- Lack of Standardization: Diverse technological approaches can lead to fragmentation and vendor lock-in concerns. Supply chain disruptions for specialized components could also pose a challenge, impacting deployment timelines and costs.

Emerging Opportunities in Indoor Location Market

Emerging opportunities in the Indoor Location Market are centered around the fusion of indoor positioning with artificial intelligence and the Internet of Things (IoT). The development of predictive analytics for consumer behavior in retail, proactive maintenance in manufacturing, and optimized patient care pathways in healthcare presents significant untapped markets. The increasing demand for enhanced indoor safety solutions, especially in public spaces and educational institutions, is creating new avenues for growth. Furthermore, the expansion of the parent market for foundational indoor location platforms is enabling the rise of specialized child markets focused on niche applications like smart sports venues, augmented reality experiences within museums, and highly precise indoor navigation for the visually impaired. The evolving consumer preference for hyper-personalized experiences is also driving innovation in how indoor location data is utilized for targeted services and engagement.

Growth Accelerators in the Indoor Location Market Industry

Several catalysts are accelerating long-term growth in the Indoor Location Market. Technological breakthroughs in Ultra-Wideband (UWB) for superior accuracy and real-time kinematics are expanding the scope of feasible applications. Strategic partnerships, such as the collaboration between GeoComm and ELi Technology, are crucial for integrating specialized location services into broader safety and mapping solutions. The increasing adoption of AI and machine learning for data interpretation and predictive insights is transforming raw location data into actionable intelligence. Furthermore, market expansion strategies by key players, including acquiring niche technology providers and entering new geographical regions, are broadening the market's reach and adoption. The growing focus on creating seamless indoor-outdoor location experiences will also be a significant growth accelerator, catering to user expectations for continuous connectivity and location awareness.

Key Players Shaping the Indoor Location Market Market

Broadcom Corporation Google LLC Cisco Systems Inc Microsoft Corporation Hewlett Packard Enterprise Development LP Inpixon HID Global Corporation Sonitor Technologies AS Acuity Brands Inc AiRISTA Mist Systems Inc Zebra Technologies Corporation Ubisense Limited CenTrak HERE Global BV Tack On

Notable Milestones in Indoor Location Market Sector

- March 2024: GeoComm and ELi Technology announced their partnership, aiming to enhance school safety with the ATLS Location Service, integrating ELi Technology's EML with GeoComm's technology for accurate indoor location mapping via Wi-Fi access points.

- October 2023: Sensative and Combain announced their strategic collaboration to develop AI-powered seamless indoor/outdoor location solutions, leveraging AI algorithms and deep learning techniques for comprehensive geolocation.

In-Depth Indoor Location Market Market Outlook

The future outlook for the Indoor Location Market is exceptionally bright, driven by continued technological innovation and expanding application diversity. Growth accelerators such as the refinement of UWB technology, the increasing integration of AI for predictive analytics, and the formation of strategic partnerships will continue to propel market expansion. The development of comprehensive parent market platforms will foster the growth of specialized child markets across various industries, from hyper-personalized retail to advanced healthcare management. As businesses and consumers increasingly demand location-aware services within enclosed environments, the market is set to witness sustained growth. Strategic opportunities lie in addressing the evolving needs for data privacy, interoperability, and cost-effectiveness, ensuring that indoor location solutions become even more accessible and impactful across the global landscape.

Indoor Location Market Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Application

- 2.1. Indoor Navigation & Maps

- 2.2. Tracking and Tracing Application

- 2.3. Remote Monitoring and Emergency Management

- 2.4. Other Applications

-

3. End-user Industry

- 3.1. Retail

- 3.2. Transportation and Logistics

- 3.3. Healthcare

- 3.4. Telecom

- 3.5. Oil and Gas and Mining

- 3.6. Government and Public Sector

- 3.7. Manufacturing

- 3.8. Other End-user Industries

Indoor Location Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Indoor Location Market Regional Market Share

Geographic Coverage of Indoor Location Market

Indoor Location Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Number of Applications Powered by Beacons and BLE Tags; Inefficiency of the GPS Technology in Indoor Premises; Growth of Connected Devices

- 3.2.2 Smartphones

- 3.2.3 and Location-based Applications

- 3.3. Market Restrains

- 3.3.1. Data and security related Issues; Deployment and Maintenance Challenges; Strict Rules and Regulations by Government

- 3.4. Market Trends

- 3.4.1. Transportation and Logistics Vertical to Hold a Dominant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Indoor Location Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Indoor Navigation & Maps

- 5.2.2. Tracking and Tracing Application

- 5.2.3. Remote Monitoring and Emergency Management

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Retail

- 5.3.2. Transportation and Logistics

- 5.3.3. Healthcare

- 5.3.4. Telecom

- 5.3.5. Oil and Gas and Mining

- 5.3.6. Government and Public Sector

- 5.3.7. Manufacturing

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Indoor Location Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Indoor Navigation & Maps

- 6.2.2. Tracking and Tracing Application

- 6.2.3. Remote Monitoring and Emergency Management

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Retail

- 6.3.2. Transportation and Logistics

- 6.3.3. Healthcare

- 6.3.4. Telecom

- 6.3.5. Oil and Gas and Mining

- 6.3.6. Government and Public Sector

- 6.3.7. Manufacturing

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Indoor Location Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Indoor Navigation & Maps

- 7.2.2. Tracking and Tracing Application

- 7.2.3. Remote Monitoring and Emergency Management

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Retail

- 7.3.2. Transportation and Logistics

- 7.3.3. Healthcare

- 7.3.4. Telecom

- 7.3.5. Oil and Gas and Mining

- 7.3.6. Government and Public Sector

- 7.3.7. Manufacturing

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Indoor Location Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Indoor Navigation & Maps

- 8.2.2. Tracking and Tracing Application

- 8.2.3. Remote Monitoring and Emergency Management

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Retail

- 8.3.2. Transportation and Logistics

- 8.3.3. Healthcare

- 8.3.4. Telecom

- 8.3.5. Oil and Gas and Mining

- 8.3.6. Government and Public Sector

- 8.3.7. Manufacturing

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Indoor Location Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Indoor Navigation & Maps

- 9.2.2. Tracking and Tracing Application

- 9.2.3. Remote Monitoring and Emergency Management

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Retail

- 9.3.2. Transportation and Logistics

- 9.3.3. Healthcare

- 9.3.4. Telecom

- 9.3.5. Oil and Gas and Mining

- 9.3.6. Government and Public Sector

- 9.3.7. Manufacturing

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Indoor Location Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Indoor Navigation & Maps

- 10.2.2. Tracking and Tracing Application

- 10.2.3. Remote Monitoring and Emergency Management

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Retail

- 10.3.2. Transportation and Logistics

- 10.3.3. Healthcare

- 10.3.4. Telecom

- 10.3.5. Oil and Gas and Mining

- 10.3.6. Government and Public Sector

- 10.3.7. Manufacturing

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Indoor Location Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Solutions

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Indoor Navigation & Maps

- 11.2.2. Tracking and Tracing Application

- 11.2.3. Remote Monitoring and Emergency Management

- 11.2.4. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Retail

- 11.3.2. Transportation and Logistics

- 11.3.3. Healthcare

- 11.3.4. Telecom

- 11.3.5. Oil and Gas and Mining

- 11.3.6. Government and Public Sector

- 11.3.7. Manufacturing

- 11.3.8. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Broadcom Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Google LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cisco Systems Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Microsoft Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hewlett Packard Enterprise Development LP

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Inpixon

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 HID Global Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sonitor Technologies AS

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Acuity Brands Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AiRISTA

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Mist Systems Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Zebra Technologies Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Ubisense Limited

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 CenTrak

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 HERE Global BV

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Tack On

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.1 Broadcom Corporation

List of Figures

- Figure 1: Global Indoor Location Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Indoor Location Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Indoor Location Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Indoor Location Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Indoor Location Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Indoor Location Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Indoor Location Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Indoor Location Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Indoor Location Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Indoor Location Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Indoor Location Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Indoor Location Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Indoor Location Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Indoor Location Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Indoor Location Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Indoor Location Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Indoor Location Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Indoor Location Market Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia Indoor Location Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Indoor Location Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Indoor Location Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Indoor Location Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Indoor Location Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Indoor Location Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Indoor Location Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Indoor Location Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Australia and New Zealand Indoor Location Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Australia and New Zealand Indoor Location Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Australia and New Zealand Indoor Location Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Australia and New Zealand Indoor Location Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Australia and New Zealand Indoor Location Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Australia and New Zealand Indoor Location Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Indoor Location Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Indoor Location Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Latin America Indoor Location Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Latin America Indoor Location Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Latin America Indoor Location Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Latin America Indoor Location Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Indoor Location Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Indoor Location Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Indoor Location Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Indoor Location Market Revenue (Million), by Component 2025 & 2033

- Figure 43: Middle East and Africa Indoor Location Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Middle East and Africa Indoor Location Market Revenue (Million), by Application 2025 & 2033

- Figure 45: Middle East and Africa Indoor Location Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Indoor Location Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 47: Middle East and Africa Indoor Location Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Middle East and Africa Indoor Location Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Indoor Location Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Indoor Location Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Indoor Location Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Indoor Location Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Indoor Location Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Indoor Location Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Indoor Location Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Indoor Location Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Indoor Location Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Indoor Location Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Indoor Location Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Indoor Location Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Indoor Location Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Indoor Location Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Indoor Location Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Indoor Location Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Indoor Location Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Indoor Location Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Indoor Location Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Indoor Location Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Indoor Location Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Indoor Location Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Indoor Location Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Indoor Location Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Indoor Location Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Indoor Location Market Revenue Million Forecast, by Component 2020 & 2033

- Table 26: Global Indoor Location Market Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Indoor Location Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Indoor Location Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indoor Location Market?

The projected CAGR is approximately 23.82%.

2. Which companies are prominent players in the Indoor Location Market?

Key companies in the market include Broadcom Corporation, Google LLC, Cisco Systems Inc, Microsoft Corporation, Hewlett Packard Enterprise Development LP, Inpixon, HID Global Corporation, Sonitor Technologies AS, Acuity Brands Inc, AiRISTA, Mist Systems Inc, Zebra Technologies Corporation, Ubisense Limited, CenTrak, HERE Global BV, Tack On.

3. What are the main segments of the Indoor Location Market?

The market segments include Component, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Applications Powered by Beacons and BLE Tags; Inefficiency of the GPS Technology in Indoor Premises; Growth of Connected Devices. Smartphones. and Location-based Applications.

6. What are the notable trends driving market growth?

Transportation and Logistics Vertical to Hold a Dominant Market Share.

7. Are there any restraints impacting market growth?

Data and security related Issues; Deployment and Maintenance Challenges; Strict Rules and Regulations by Government.

8. Can you provide examples of recent developments in the market?

March 2024: GeoComm and ELi Technology announced their partnership, which aims at enhancing school safety with the ATLS Location Service, where ATLS is an innovative, easily integrated location and mapping service, combining ELi Technology's patented EML with GeoComm's technology, enabling accurate indoor location mapping via Wi-Fi access points.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indoor Location Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indoor Location Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indoor Location Market?

To stay informed about further developments, trends, and reports in the Indoor Location Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence