Key Insights

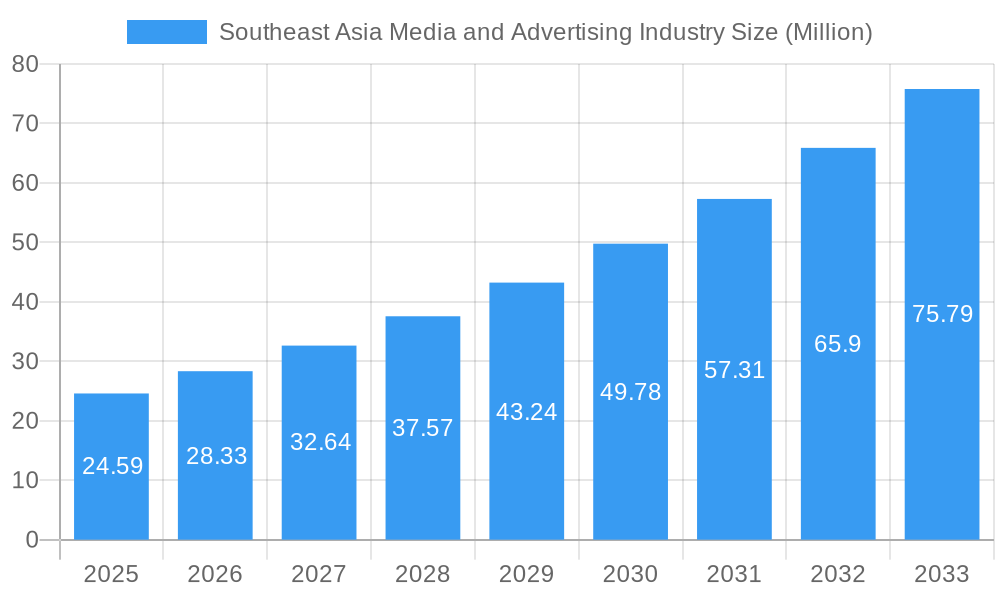

The Southeast Asia Media and Advertising Industry is poised for significant expansion, projected to reach a market size of $24.59 million by 2025, and is expected to grow at a robust Compound Annual Growth Rate (CAGR) of 15.30% through 2033. This surge is fueled by a dynamic interplay of factors, including a burgeoning digital economy, increasing internet penetration, and a growing middle class with rising disposable incomes. The region's youthful demographic, coupled with a high adoption rate of mobile devices and social media, creates fertile ground for innovative advertising strategies. Key drivers include the rapid growth of e-commerce, the increasing demand for personalized content, and the adoption of programmatic advertising to reach targeted audiences more effectively. The shift towards digital platforms is transforming traditional media landscapes, with out-of-home (OOH) advertising also seeing innovation through digital displays and data-driven targeting.

Southeast Asia Media and Advertising Industry Market Size (In Million)

Despite the immense growth potential, certain restraints may temper this trajectory. These include a fragmented regulatory landscape across different Southeast Asian nations, challenges in data privacy compliance, and the need for continuous investment in technological infrastructure to keep pace with evolving consumer behavior. However, emerging trends such as the rise of influencer marketing, the integration of augmented reality (AR) and virtual reality (VR) in advertising, and the increasing focus on data analytics for campaign optimization are expected to further propel the market forward. The competitive landscape is characterized by both established global players and agile local companies, all vying for a share of this lucrative market. Production and consumption analyses will be critical in understanding the nuances of local market demands, while import and export dynamics will highlight regional trade flows. Price trends will also be a significant factor for advertisers and consumers alike.

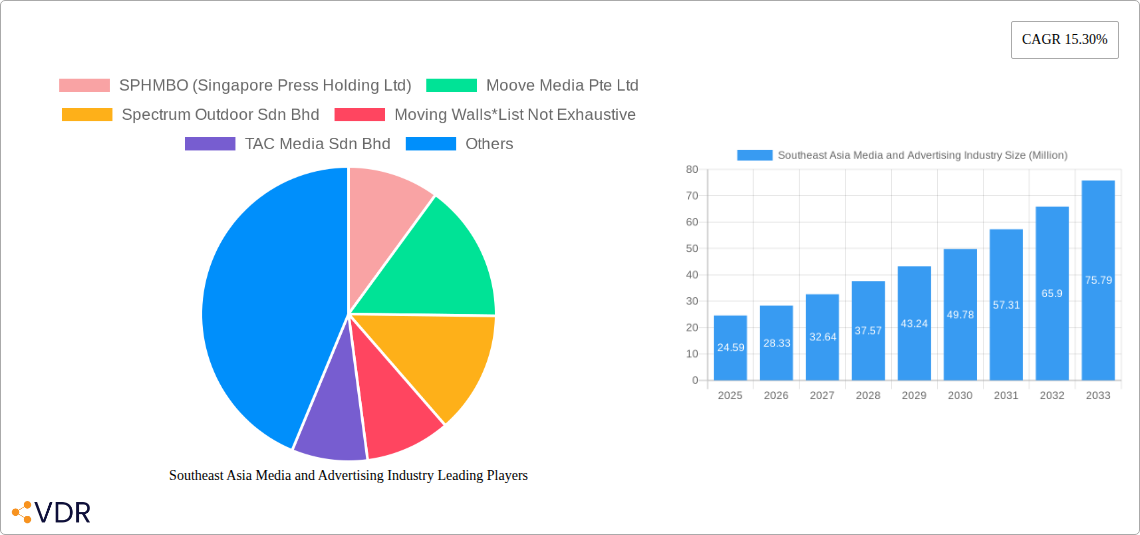

Southeast Asia Media and Advertising Industry Company Market Share

Southeast Asia Media and Advertising Industry Market Dynamics & Structure

The Southeast Asian media and advertising industry is a dynamic and evolving landscape, characterized by a moderate market concentration with key players like SPHMBO and Mediacorp holding significant influence. Technological innovation remains a primary driver, with the rapid adoption of digital advertising formats, programmatic buying, and data analytics reshaping campaign strategies. Regulatory frameworks vary across the region, impacting data privacy, content moderation, and foreign ownership rules, necessitating careful navigation by industry stakeholders. Competitive product substitutes are abundant, ranging from traditional print and broadcast to an ever-expanding array of digital channels and influencer marketing. End-user demographics are increasingly tech-savvy and mobile-first, demanding personalized and engaging advertising experiences. Mergers and acquisitions (M&A) are actively shaping the industry, with recent deals aimed at consolidating market share and expanding service portfolios. For instance, an estimated 15-20 M&A deals are anticipated within the forecast period, focusing on digital transformation and data integration. Innovation barriers include the high cost of advanced advertising technology and the need for skilled talent to manage complex digital campaigns.

- Market Concentration: Moderately concentrated with a few dominant players, but fragmented in niche segments.

- Technological Innovation: Driven by digital transformation, AI in ad targeting, and programmatic advertising.

- Regulatory Frameworks: Evolving data privacy laws (e.g., PDPA in Singapore) and content regulations create compliance challenges.

- Competitive Substitutes: Digital-first alternatives, social media advertising, and influencer marketing are challenging traditional media.

- End-User Demographics: Young, mobile-first population with high digital engagement and demand for personalized content.

- M&A Trends: Focus on acquiring digital capabilities, data analytics firms, and expanding regional reach. Estimated deal volume in the past year: ~8 deals.

Southeast Asia Media and Advertising Industry Growth Trends & Insights

The Southeast Asian media and advertising industry is poised for substantial growth, projected to expand from an estimated US$35,500 million in the base year of 2025 to a significant US$60,250 million by 2033. This impressive growth is fueled by a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period (2025-2033). The adoption rates of digital advertising channels are rapidly increasing, outpacing traditional media. This shift is primarily driven by a growing internet penetration rate across the region, estimated to reach 85% by 2025, and a corresponding surge in smartphone usage, which stands at 78%. Technological disruptions, particularly the rise of programmatic advertising and the integration of Artificial Intelligence (AI) in ad optimization and targeting, are revolutionizing campaign efficiency and effectiveness. Advertisers are increasingly leveraging data analytics to gain deeper insights into consumer behavior, enabling more personalized and impactful messaging. Consumer behavior shifts are evident, with a greater preference for on-demand content, interactive advertising experiences, and authentic brand storytelling. The burgeoning middle class, coupled with increasing disposable incomes, further fuels consumer spending and advertising expenditure. The transition from linear TV to streaming services, and from print to online news consumption, underscores the profound impact of digitalization on media habits. This evolution necessitates a recalibrated approach to media planning and buying, emphasizing cross-platform strategies and real-time campaign adjustments. The increased accessibility of digital advertising platforms, including the recent expansion of programmatic capabilities by companies like Vistar Media, has democratized advertising, allowing a wider range of businesses to participate in the market. The report will delve into these trends, quantifying market size evolution with historical data from 2019-2024 and projecting future trajectories based on robust market intelligence. The focus will be on how these shifts are redefining advertising effectiveness and driving revenue growth across diverse media segments.

Dominant Regions, Countries, or Segments in Southeast Asia Media and Advertising Industry

The Consumption Analysis segment is emerging as the dominant force driving growth within the Southeast Asian media and advertising industry. This dominance is underpinned by several key factors, including rapidly evolving consumer behaviors, a burgeoning digital population, and increasing disposable incomes across the region. Countries like Indonesia, the Philippines, and Vietnam, with their large and young populations, are exhibiting particularly strong consumption patterns, making them prime markets for advertisers.

Indonesia, in particular, stands out due to its sheer population size and the accelerated adoption of digital technologies. The country's internet penetration is projected to reach 75% by 2025, with a significant portion of this access occurring via mobile devices. This mobile-first approach directly influences advertising consumption, with a strong preference for short-form video content, social media engagement, and e-commerce-integrated advertising. The market share of digital advertising within Indonesia's total ad spend is expected to surpass 65% by 2028, indicating a significant shift away from traditional media. Economic policies that encourage digital transformation and support local tech startups also contribute to this growth.

- Key Drivers for Indonesia's Dominance:

- Massive Population: Over 270 million people, providing a vast consumer base.

- Mobile-First Internet Access: High smartphone penetration (estimated 80% by 2025) driving mobile advertising spend.

- E-commerce Growth: Rapid expansion of online retail fuels demand for performance-based advertising.

- Digital Content Consumption: High engagement with social media, video streaming, and online gaming.

- Government Support for Digital Economy: Initiatives promoting digital literacy and infrastructure development.

The Philippines follows closely, driven by a young, digitally active population and a resilient economy. The country's advertising market is witnessing a substantial increase in digital ad spend, with projections indicating a 58% market share by 2027. The growing influence of social media platforms for purchasing decisions and brand discovery solidifies the importance of this segment.

Vietnam presents another high-growth market, propelled by its rapidly expanding middle class and government initiatives to foster a digital economy. While traditional media still holds some sway, the trajectory clearly points towards digital dominance, with digital advertising expected to capture over 50% of the market share by 2026.

The dominance of Consumption Analysis is further amplified by the increasing sophistication of Production Analysis and Import Market Analysis which are catering to this demand. Advertising production capabilities are evolving to meet the requirements of digital formats, including interactive and video content. Import markets are seeing a rise in demand for advanced digital advertising technologies and platforms that enable data-driven campaigns, as evidenced by Vistar Media's expansion of programmatic capabilities in the region. The Price Trend Analysis within these consumption-driven markets is also becoming more dynamic, with a shift towards performance-based pricing models and a greater emphasis on return on ad spend (ROAS).

- Market Share & Growth Potential: Indonesia's digital ad market projected to grow at a CAGR of 12% over the forecast period. Philippines' digital ad market CAGR: 9.5%. Vietnam's digital ad market CAGR: 11%.

- Infrastructure: Improving internet infrastructure and increasing affordability of data plans.

- Consumer Preferences: Growing demand for personalized content, social commerce, and influencer marketing.

Southeast Asia Media and Advertising Industry Product Landscape

The product landscape within Southeast Asia's media and advertising industry is characterized by an accelerating shift towards integrated digital solutions. This includes a proliferation of programmatic advertising platforms like the Vistar Demand-Side Platform (DSP), which allows for data-driven campaign design, purchase, and evaluation across open exchanges and private marketplaces. Innovations in Out-of-Home (OOH) advertising are also prominent, with companies like Clear Channel Singapore and Moove Media Pte Ltd integrating digital screens and offering real-time, user-generated content executions, enhancing audience engagement. AI-powered analytics and personalization tools are becoming standard, optimizing ad placement and messaging for maximum impact. The performance metrics focus on engagement rates, conversion rates, and measurable return on ad spend, with unique selling propositions revolving around data intelligence, creative flexibility, and real-time campaign management.

Key Drivers, Barriers & Challenges in Southeast Asia Media and Advertising Industry

Key Drivers:

- Digital Transformation: Rapid adoption of smartphones, internet penetration, and digital platforms.

- Growing Middle Class: Increased disposable income and consumer spending.

- Young & Tech-Savvy Population: High engagement with digital content and social media.

- Programmatic Advertising Growth: Increased efficiency and targeting capabilities.

- E-commerce Boom: Driving demand for online advertising and performance marketing.

Key Barriers & Challenges:

- Fragmented Market: Diverse regulatory landscapes and consumer preferences across countries.

- Talent Shortage: Demand for skilled digital marketing and data analytics professionals.

- Ad Fraud: Ongoing concerns regarding click fraud and bot traffic impacting campaign ROI.

- Data Privacy Regulations: Navigating evolving data protection laws across the region.

- Economic Volatility: Potential impact of global economic slowdowns on advertising budgets.

Emerging Opportunities in Southeast Asia Media and Advertising Industry

Emerging opportunities lie in the rapid growth of influencer marketing, particularly micro and nano-influencers, offering authentic connections with niche audiences. The untapped potential of rural digital adoption presents a significant frontier for advertisers. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) in advertising campaigns offers immersive brand experiences. The increasing demand for sustainable and ethical advertising practices also opens doors for purpose-driven campaigns. Growth in over-the-top (OTT) streaming services provides new avenues for targeted video advertising.

Growth Accelerators in the Southeast Asia Media and Advertising Industry Industry

Long-term growth in the Southeast Asian media and advertising industry will be significantly accelerated by advancements in Artificial Intelligence (AI) for hyper-personalization and predictive analytics, enabling campaigns to anticipate consumer needs. Strategic partnerships between media owners, technology providers, and advertisers, such as the Foodpanda and Clear Channel Singapore collaboration, will foster innovative campaign executions. The expansion of programmatic capabilities into new markets, as seen with Vistar Media's move into Indonesia, Malaysia, and the Philippines, will democratize access to sophisticated advertising tools. Continued investment in digital infrastructure and the development of skilled talent will further fuel market expansion and drive increased advertising spend across the region.

Key Players Shaping the Southeast Asia Media and Advertising Industry Market

- SPHMBO (Singapore Press Holding Ltd)

- Moove Media Pte Ltd

- Spectrum Outdoor Sdn Bhd

- TAC Media Sdn Bhd

- XCO Media (SMRT Experience Pte Ltd)

- ActMedia Singapore Pte Ltd

- Clear Channel Singapore Pte Ltd

- Golden Village

- Mediatech Services Pte Ltd

- JCDecaux Singapore Pte Ltd

- Cornerstone Financial Holding Ltd

- OOH Media (Mediacorp Pte Ltd)

Notable Milestones in Southeast Asia Media and Advertising Industry Sector

- February 2023: Foodpanda Singapore announced a strategic partnership with Clear Channel Singapore to launch a real-time, user-generated, out-of-home execution across Clear Channel Singapore's digital screens, Play+Display, as part of its 360-media campaign.

- August 2022: Vistar Media announced the launch of complete programmatic capabilities in Indonesia, Malaysia, the Philippines, and Hong Kong, expanding its already established Asia-Pacific presence, which includes Singapore, Australia, and New Zealand. The Vistar Demand-Side Platform (DSP) is the primary source of programmatic demand transactions for digital out-of-home. Advertisers and agencies in Southeast Asia can now use the Vistar DSP to design, purchase, and evaluate data-driven out-of-home (ooH) campaigns through open exchange and private marketplace partnerships.

In-Depth Southeast Asia Media and Advertising Industry Market Outlook

The Southeast Asian media and advertising industry is set for robust future growth, propelled by continued digital acceleration and evolving consumer engagement. Key growth accelerators include the widespread adoption of AI-driven personalized advertising, enabling unprecedented levels of campaign precision and effectiveness. Strategic alliances between technology providers and media entities, exemplified by recent partnerships, will foster innovative advertising solutions and expand market reach. The ongoing expansion of programmatic advertising into more mature and emerging markets will democratize sophisticated campaign management and drive efficiency. Furthermore, the increasing demand for immersive advertising experiences, such as AR/VR integrations and interactive digital OOH, presents significant future market potential. Advertisers will increasingly focus on data-driven insights and measurable outcomes, driving demand for analytics-rich platforms and services. This dynamic environment promises substantial strategic opportunities for players adept at navigating technological advancements and evolving consumer preferences.

Southeast Asia Media and Advertising Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Southeast Asia Media and Advertising Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

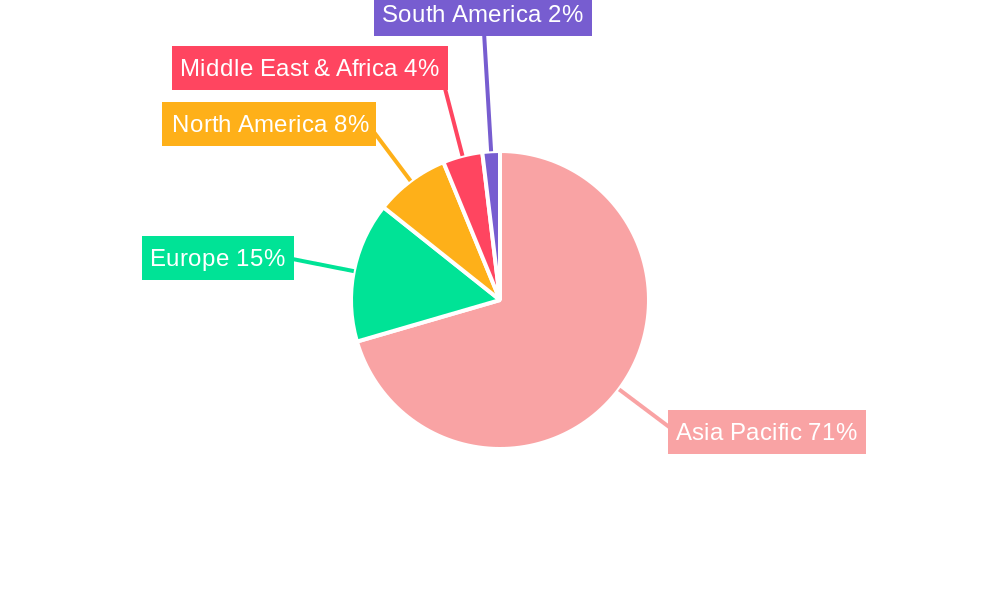

Southeast Asia Media and Advertising Industry Regional Market Share

Geographic Coverage of Southeast Asia Media and Advertising Industry

Southeast Asia Media and Advertising Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Public Transit Infrastructure; Increasing Adoption of Digital Screens

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Transit Application is Expected to Hold the Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Media and Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Southeast Asia Media and Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Southeast Asia Media and Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Southeast Asia Media and Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Southeast Asia Media and Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Southeast Asia Media and Advertising Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SPHMBO (Singapore Press Holding Ltd)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Moove Media Pte Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Spectrum Outdoor Sdn Bhd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Moving Walls*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TAC Media Sdn Bhd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 XCO Media (SMRT Experience Pte Ltd)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ActMedia Singapore Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clear Channel Singapore Pte Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Golden Village

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mediatech Services Pte Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JCDecaux Singapore Pte Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cornerstone Financial Holding Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 OOH Media (Mediacorp Pte Ltd)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 SPHMBO (Singapore Press Holding Ltd)

List of Figures

- Figure 1: Global Southeast Asia Media and Advertising Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Southeast Asia Media and Advertising Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Southeast Asia Media and Advertising Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Southeast Asia Media and Advertising Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Southeast Asia Media and Advertising Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Southeast Asia Media and Advertising Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Southeast Asia Media and Advertising Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Southeast Asia Media and Advertising Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Southeast Asia Media and Advertising Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Southeast Asia Media and Advertising Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Southeast Asia Media and Advertising Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Southeast Asia Media and Advertising Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Southeast Asia Media and Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Southeast Asia Media and Advertising Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Southeast Asia Media and Advertising Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Southeast Asia Media and Advertising Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Southeast Asia Media and Advertising Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Southeast Asia Media and Advertising Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Southeast Asia Media and Advertising Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Southeast Asia Media and Advertising Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Southeast Asia Media and Advertising Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Southeast Asia Media and Advertising Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Southeast Asia Media and Advertising Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Southeast Asia Media and Advertising Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Southeast Asia Media and Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Southeast Asia Media and Advertising Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Southeast Asia Media and Advertising Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Southeast Asia Media and Advertising Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Southeast Asia Media and Advertising Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Southeast Asia Media and Advertising Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Southeast Asia Media and Advertising Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Southeast Asia Media and Advertising Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Southeast Asia Media and Advertising Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Southeast Asia Media and Advertising Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Southeast Asia Media and Advertising Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Southeast Asia Media and Advertising Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Southeast Asia Media and Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Southeast Asia Media and Advertising Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Southeast Asia Media and Advertising Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Southeast Asia Media and Advertising Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Southeast Asia Media and Advertising Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Southeast Asia Media and Advertising Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Southeast Asia Media and Advertising Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Southeast Asia Media and Advertising Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Southeast Asia Media and Advertising Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Southeast Asia Media and Advertising Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Southeast Asia Media and Advertising Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Southeast Asia Media and Advertising Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Southeast Asia Media and Advertising Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Southeast Asia Media and Advertising Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Southeast Asia Media and Advertising Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Southeast Asia Media and Advertising Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Media and Advertising Industry?

The projected CAGR is approximately 15.30%.

2. Which companies are prominent players in the Southeast Asia Media and Advertising Industry?

Key companies in the market include SPHMBO (Singapore Press Holding Ltd), Moove Media Pte Ltd, Spectrum Outdoor Sdn Bhd, Moving Walls*List Not Exhaustive, TAC Media Sdn Bhd, XCO Media (SMRT Experience Pte Ltd), ActMedia Singapore Pte Ltd, Clear Channel Singapore Pte Ltd, Golden Village, Mediatech Services Pte Ltd, JCDecaux Singapore Pte Ltd, Cornerstone Financial Holding Ltd, OOH Media (Mediacorp Pte Ltd).

3. What are the main segments of the Southeast Asia Media and Advertising Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Public Transit Infrastructure; Increasing Adoption of Digital Screens.

6. What are the notable trends driving market growth?

Transit Application is Expected to Hold the Highest Market Share.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

February 2023: Foodpanda Singapore announced a strategic partnership with Clear Channel Singapore to launch a real-time, user-generated, out-of-home execution across Clear Channel Singapore's digital screens, Play+Display, as part of its 360-media campaign.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Media and Advertising Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Media and Advertising Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Media and Advertising Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Media and Advertising Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence