Key Insights

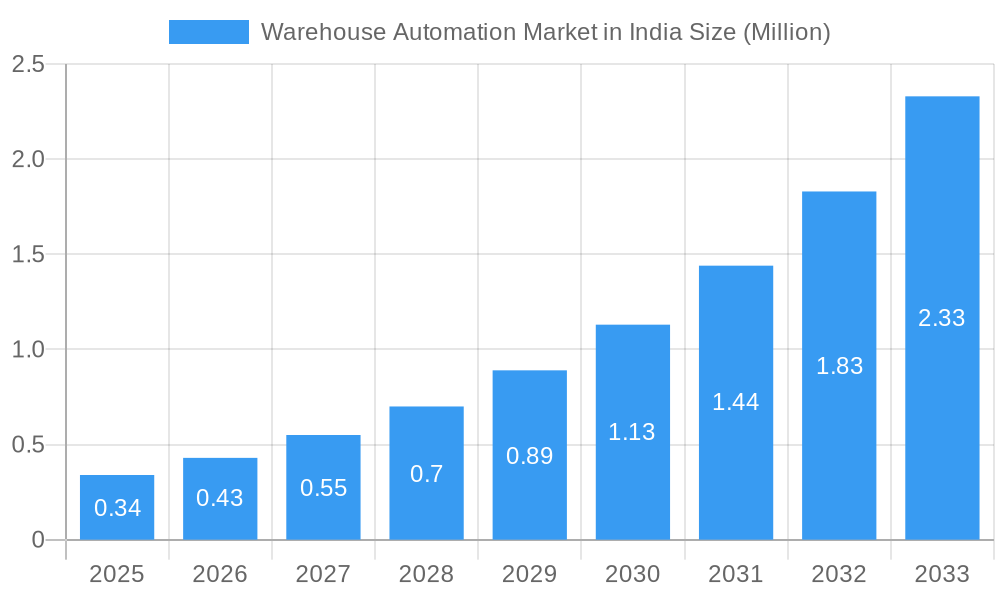

The Indian warehouse automation market is poised for exceptional growth, projected to reach a USD 0.34 Million by 2025, driven by a remarkable Compound Annual Growth Rate (CAGR) of 26.96%. This rapid expansion is primarily fueled by the escalating demands of e-commerce, the need for enhanced operational efficiency in traditional retail and manufacturing, and the growing adoption of advanced technologies. Key drivers include the imperative to reduce labor costs, minimize errors, and accelerate order fulfillment cycles. The surge in online retail, coupled with government initiatives promoting domestic manufacturing and logistics infrastructure development, further bolsters market confidence. The market is segmented across various technologies, with Palletizers, Conveyors and Sorting Systems, and Mobile Robots (AGV/AMR) leading the adoption curve due to their immediate impact on streamlining warehouse operations. Vision Inspection Equipment and Labelling Equipment are also gaining traction as businesses focus on quality control and supply chain visibility.

Warehouse Automation Market in India Market Size (In Million)

Looking ahead, the forecast period (2025-2033) anticipates sustained high growth, as more Indian businesses embrace automation to stay competitive in a globalized economy. Emerging trends include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and optimized inventory management, as well as the increasing deployment of IoT-enabled devices for real-time monitoring and control. While the initial investment cost and the need for skilled labor to manage and maintain automated systems remain potential restraints, the long-term benefits in terms of productivity, accuracy, and cost savings are compelling. Major players like Keyence Corporation, Addverb Technologies, and Omron Corporation are actively investing in research and development, introducing innovative solutions tailored to the Indian market's specific needs, thus accelerating the adoption of warehouse automation across diverse industries.

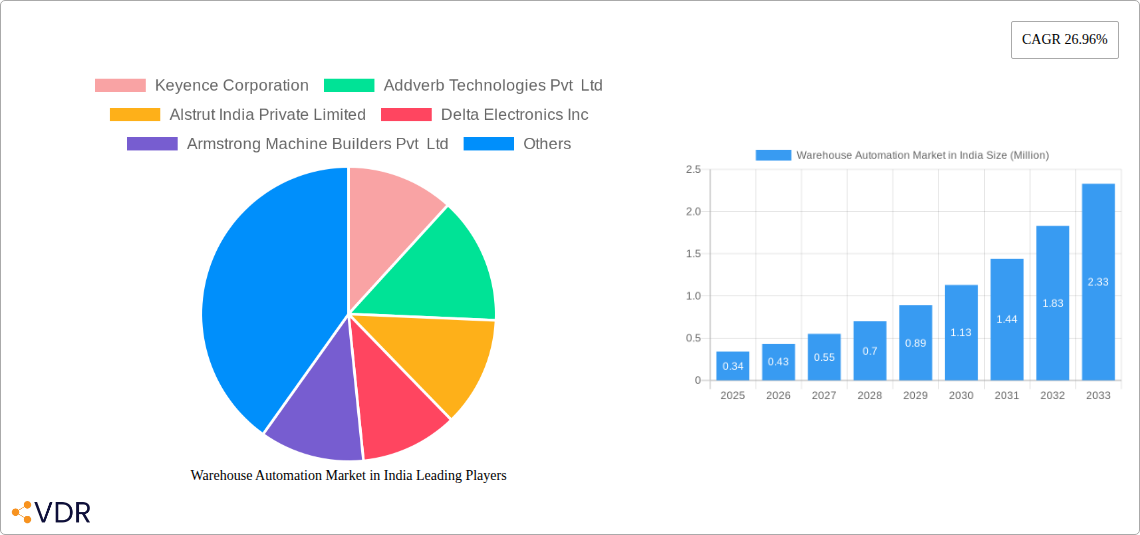

Warehouse Automation Market in India Company Market Share

Unlocking Efficiency: Comprehensive Report on India's Warehouse Automation Market (2019–2033)

Dive deep into the dynamic warehouse automation market in India, a rapidly expanding sector driven by the need for enhanced operational efficiency, reduced costs, and improved supply chain resilience. This in-depth report, covering the study period of 2019–2033 with 2025 as the base and estimated year, provides unparalleled insights into market dynamics, growth trends, dominant segments, key players, and future opportunities.

The Indian warehouse automation landscape is experiencing a significant surge, fueled by the burgeoning e-commerce sector, the imperative for modernizing logistics infrastructure, and government initiatives like "Make in India." This report meticulously analyzes the parent market and its crucial child markets, including a detailed breakdown of segmentation by Type: Palletizers, Conveyors and Sorting Systems, Mobile Robots (AGV/AMR), Vision Inspection Equipment, and Labelling Equipment. Discover how these sub-segments are collectively shaping the future of Indian warehousing.

With a forecast period extending from 2025 to 2033, this report leverages robust data and expert analysis to predict market evolution, technological adoption rates, and strategic imperatives for stakeholders. Whether you are a manufacturer, technology provider, investor, or industry professional, this report is your essential guide to navigating and capitalizing on the immense potential of India's warehouse automation revolution.

Warehouse Automation Market in India Market Dynamics & Structure

The warehouse automation market in India is characterized by a moderately concentrated structure, with a few prominent global and domestic players holding significant market shares. Technological innovation is a primary driver, propelled by the relentless pursuit of operational efficiency, reduced labor costs, and enhanced accuracy in fulfillment processes. The growing adoption of Industry 4.0 principles and the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) are further accelerating innovation. Regulatory frameworks, while still evolving, are increasingly supportive of automation initiatives aimed at improving manufacturing and logistics competitiveness.

Key factors shaping market dynamics include:

- Market Concentration: Dominated by a mix of established international automation solution providers and rapidly growing Indian companies. Companies like Keyence Corporation, Addverb Technologies Pvt Ltd, and Falcon Autotech are key contributors to this landscape.

- Technological Innovation Drivers: The burgeoning e-commerce sector's demand for faster order fulfillment, the need for improved inventory management accuracy, and the increasing labor costs are significant catalysts. The development of advanced robotics, AI-powered software, and IoT-enabled systems are at the forefront.

- Regulatory Frameworks: Government policies aimed at promoting manufacturing, boosting exports, and improving logistics efficiency, such as the National Logistics Policy, indirectly support the adoption of warehouse automation. However, standardization and safety regulations are areas of ongoing development.

- Competitive Product Substitutes: While direct substitutes are limited within advanced automation, inefficiencies in manual processes and traditional warehousing methods serve as indirect competitive pressures driving automation adoption.

- End-User Demographics: The primary end-users are rapidly expanding sectors such as e-commerce, third-party logistics (3PL), retail, automotive, pharmaceuticals, and food & beverages, all seeking to optimize their supply chain operations.

- M&A Trends: Mergers and acquisitions are observed as larger players seek to expand their technological capabilities, market reach, and product portfolios. Strategic partnerships are also crucial for technology integration and market penetration. For instance, the September 2022 partnership between Falcon Autotech and Alstef Group for parcel sorting solutions signifies this trend.

Warehouse Automation Market in India Growth Trends & Insights

The warehouse automation market in India is poised for exceptional growth, driven by a confluence of economic, technological, and operational factors. Over the historical period of 2019–2024, the market has witnessed a steady increase in adoption, transitioning from niche applications to mainstream integration across various industries. The base year 2025 is expected to mark a significant acceleration, with the forecast period of 2025–2033 projecting a robust Compound Annual Growth Rate (CAGR) of approximately 18-22%, a testament to the transformative impact of automation. This impressive trajectory is fueled by the increasing size of the Indian logistics market, estimated to reach over $300 billion by 2025, with a substantial portion allocated to warehousing and material handling.

Market penetration of warehouse automation solutions, while still lower than developed economies, is rapidly increasing. In 2024, market penetration was estimated to be around 15-20%, projected to climb to over 45-50% by 2033. This surge is underpinned by evolving consumer behavior, particularly the exponential growth of e-commerce, which demands faster delivery times and more efficient order fulfillment. The average order fulfillment time in India, which was around 72 hours in 2020, is targeted to reduce to under 24 hours for major urban centers by 2028, a goal heavily reliant on automation.

Technological disruptions are at the heart of this growth. The increasing affordability and sophistication of Mobile Robots (AGV/AMR) are revolutionizing intra-warehouse transportation and picking processes, with their market share expected to grow from 10% in 2024 to over 30% by 2030. Similarly, advancements in Conveyors and Sorting Systems continue to enhance throughput and accuracy in distribution centers, with their share projected to remain dominant, around 35-40%. The integration of AI for predictive maintenance, inventory optimization, and robotic path planning is further enhancing the value proposition of automated solutions.

Consumer behavior shifts are profoundly influencing the demand for automated warehouses. The expectation of same-day or next-day deliveries, coupled with a preference for personalized product offerings, necessitates highly agile and responsive warehousing operations. This has spurred investment in automated storage and retrieval systems (AS/RS), automated guided vehicles (AGVs), and collaborative robots (cobots). Furthermore, the increasing emphasis on supply chain visibility and resilience, highlighted by global disruptions, is pushing businesses to adopt technologies that offer real-time data insights and minimize human error. The perceived return on investment (ROI) for warehouse automation projects in India is also decreasing, with payback periods now averaging 3-5 years, down from 5-7 years a decade ago, making automation a more attractive proposition for businesses of all sizes.

Dominant Regions, Countries, or Segments in Warehouse Automation Market in India

The warehouse automation market in India is witnessing a pronounced dominance by its child market segment: Conveyors and Sorting Systems. This segment consistently represents the largest share of the overall market, estimated at approximately 35-40% in the base year 2025, and is projected to maintain its leading position throughout the forecast period. The sheer volume of goods movement across the vast Indian supply chain, coupled with the need for efficient sorting and routing in distribution centers, makes sophisticated conveyor and sorting solutions indispensable. The growth of e-commerce and the increasing complexity of retail logistics, with a higher number of Stock Keeping Units (SKUs) and personalized orders, further amplify the demand for these systems.

Key drivers contributing to the dominance of Conveyors and Sorting Systems include:

- E-commerce Boom: The exponential growth of online retail necessitates high-throughput, automated sorting and movement of parcels. This has led to substantial investments in advanced cross-belt sorters, tilt-tray sorters, and high-speed conveyor networks.

- Logistics Infrastructure Development: Government initiatives and private investments in developing modern warehousing facilities across major consumption hubs are driving the adoption of integrated conveyor systems.

- Industry-Specific Demands: Sectors like food & beverage, pharmaceuticals, and manufacturing require precise and high-volume material handling, where conveyors play a crucial role in maintaining product integrity and operational efficiency.

- Technological Advancements: Continuous innovation in conveyor belt materials, motor efficiency, and integrated sensor technology is enhancing the performance and reliability of these systems. The September 2022 strategic partnership between Falcon Autotech and Alstef Group for parcel sorting solutions exemplifies the focus on advancing this segment.

- Cost-Effectiveness for High Throughput: For large-scale operations, the long-term cost-effectiveness of conveyor systems in handling massive volumes of goods makes them a preferred choice.

While Conveyors and Sorting Systems lead, other segments are showing significant growth potential. Mobile Robots (AGV/AMR) are rapidly gaining traction, projected to grow at a CAGR of over 25% from 2025 to 2033, driven by their flexibility and scalability for picking and goods-to-person operations. Palletizers are essential for optimizing storage and movement in traditional warehousing and are expected to maintain a steady growth rate. Vision Inspection Equipment and Labelling Equipment are crucial for quality control and supply chain traceability, experiencing increasing demand as companies focus on data accuracy and regulatory compliance. The overall market growth is also significantly influenced by major consumption hubs like Maharashtra, Delhi NCR, and Tamil Nadu, which are investing heavily in advanced logistics infrastructure.

Warehouse Automation Market in India Product Landscape

The warehouse automation market in India is witnessing a surge in sophisticated product innovations designed to enhance efficiency and accuracy. Palletizers are evolving with advanced robotic arms and AI-powered path planning for faster and more precise stacking. Conveyors and Sorting Systems are becoming smarter with integrated sensors and vision systems for real-time monitoring and dynamic routing, exemplified by Falcon Autotech's advanced sorter technologies. The Mobile Robots (AGV/AMR) segment is characterized by increased payload capacities, enhanced navigation capabilities, and collaborative functionalities with human workers. Vision Inspection Equipment is incorporating higher resolution cameras and AI algorithms for defect detection and quality assurance with unparalleled accuracy. Labelling Equipment is integrating smart printing and application technologies for seamless data integration and compliance. These product advancements are directly addressing the need for higher throughput, reduced errors, and improved operational visibility in the Indian logistics sector.

Key Drivers, Barriers & Challenges in Warehouse Automation Market in India

The warehouse automation market in India is propelled by several key drivers, including the escalating demand from the booming e-commerce sector requiring faster fulfillment, the persistent need to reduce operational costs and labor expenses, and the growing adoption of Industry 4.0 technologies. Government initiatives promoting manufacturing and logistics upgrades also play a crucial role. Furthermore, the desire for enhanced inventory accuracy and improved supply chain visibility are significant motivators for automation adoption.

However, the market faces significant barriers and challenges:

- High Initial Investment Costs: The upfront capital expenditure for advanced automation systems can be a deterrent, especially for small and medium-sized enterprises (SMEs).

- Skill Gap and Training Needs: A shortage of skilled personnel to operate, maintain, and program sophisticated automation equipment poses a considerable challenge.

- Infrastructure Limitations: Inadequate power supply reliability and digital infrastructure in certain regions can hinder the effective deployment of automated solutions.

- Integration Complexity: Integrating new automation systems with existing legacy infrastructure can be technically challenging and time-consuming.

- Resistance to Change: Organizational inertia and resistance from the workforce to adopt new technologies can slow down implementation.

- Scalability Concerns: Ensuring that automation solutions can scale effectively with fluctuating business demands can be a concern for some businesses.

- Return on Investment (ROI) Justification: While ROI is improving, demonstrating a clear and rapid ROI can still be a hurdle for some companies, especially those with lower volume operations.

Emerging Opportunities in Warehouse Automation Market in India

Emerging opportunities in the warehouse automation market in India lie in the expansion of automation solutions to Tier 2 and Tier 3 cities, catering to the growing logistics needs of these regions. The increasing adoption of AGVs and AMRs for last-mile delivery hubs and within smaller fulfillment centers presents a significant growth avenue. Furthermore, the development of specialized automation solutions for niche industries like cold chain logistics, pharmaceuticals, and agriculture is a promising area. The integration of advanced AI and machine learning for predictive analytics and autonomous decision-making within warehouses offers further potential for optimization and value creation. The increasing focus on sustainability is also creating opportunities for energy-efficient automation solutions and robotic systems designed for waste reduction.

Growth Accelerators in the Warehouse Automation Market in India Industry

Several catalysts are accelerating the long-term growth of the warehouse automation market in India. Technological breakthroughs in robotics, AI, and IoT are continuously making solutions more affordable, versatile, and intelligent. Strategic partnerships between global technology providers and local integrators are crucial for expanding market reach and tailoring solutions to the Indian context. Government policies supporting manufacturing automation and logistics modernization, alongside increased private investment in warehousing infrastructure, are providing a fertile ground for growth. The ongoing digitalization of businesses across sectors is also creating a strong demand for integrated, automated supply chain solutions, ensuring that businesses remain competitive in an increasingly globalized market.

Key Players Shaping the Warehouse Automation Market in India Market

- Keyence Corporation

- Addverb Technologies Pvt Ltd

- Alstrut India Private Limited

- Delta Electronics Inc

- Armstrong Machine Builders Pvt Ltd

- Win Automation (Wipro Limited)

- Alligator Automations

- World Pack Automation Systems Private Limited

- Omron Corporation

- Titan Engineering and Automation Limited

- Sick AG

- Falcon Autotech

- Signode India Ltd

- ClearPack India Pvt Ltd

Notable Milestones in Warehouse Automation Market in India Sector

- September 2022: Falcon Autotech and Alstef Group announced a strategic technology partnership for parcel sorting solutions. Alstef Group will exclusively expand Falcon Autotech's Cross-belt sorter range deployment to specific geographies as part of an exclusive distribution agreement, significantly bolstering the capabilities in the parcel automation sector.

- June 2022: Clearpack was awarded the Excellence in Packaging Automation award at Innopack, India packaging awards. Furthermore, the company also won the Packaging Company of the Year 2022 award at the India F&B pack summit and awards, highlighting advancements in packaging automation and its recognition within the industry.

In-Depth Warehouse Automation Market in India Market Outlook

The warehouse automation market in India is on an upward trajectory, fueled by the transformative potential of technological advancements and the imperative for operational excellence. The integration of AI-powered analytics, sophisticated robotics, and IoT-enabled systems will continue to drive efficiency, accuracy, and cost savings across the supply chain. Strategic collaborations and the increasing availability of flexible financing options are expected to democratize access to automation for a wider range of businesses. The market is poised to witness significant growth, particularly in the e-commerce, retail, and third-party logistics sectors, as companies increasingly prioritize agility and resilience in their operations, thereby unlocking substantial future market potential and creating new avenues for innovation and investment.

Warehouse Automation Market in India Segmentation

-

1. Type

- 1.1. Palletizers

- 1.2. Conveyors and Sorting Systems

- 1.3. Mobile Robots (AGV/AMR)

- 1.4. Vision Inspection Equipment

- 1.5. Labelling Equipment

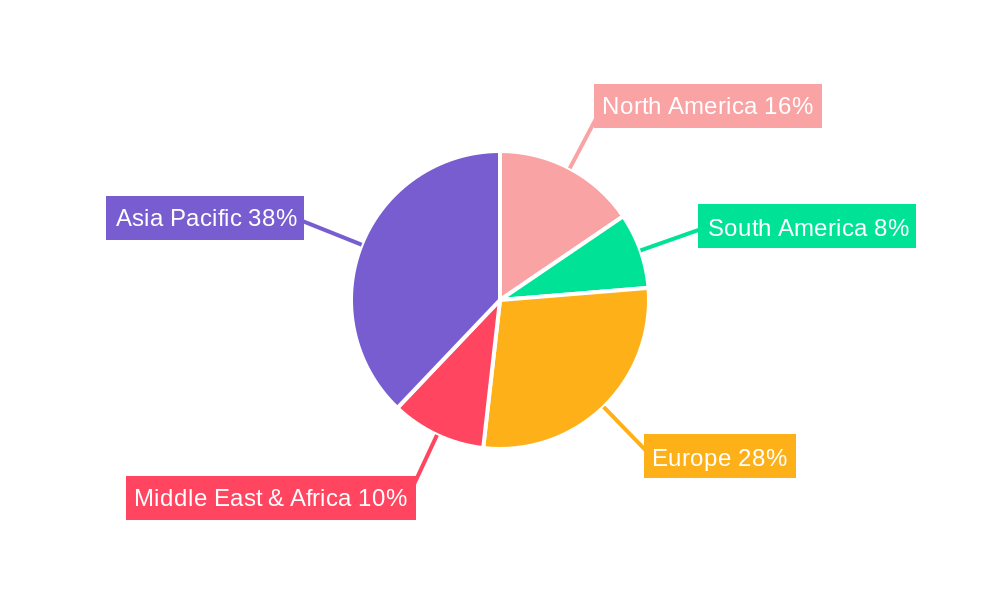

Warehouse Automation Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Warehouse Automation Market in India Regional Market Share

Geographic Coverage of Warehouse Automation Market in India

Warehouse Automation Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of E-commerce in India; Increasing Need for Better Inventory Management and Control; Increasing Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of SWIR Cameras and Detectors

- 3.4. Market Trends

- 3.4.1. Exponential Growth of E-commerce in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Warehouse Automation Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Palletizers

- 5.1.2. Conveyors and Sorting Systems

- 5.1.3. Mobile Robots (AGV/AMR)

- 5.1.4. Vision Inspection Equipment

- 5.1.5. Labelling Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Warehouse Automation Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Palletizers

- 6.1.2. Conveyors and Sorting Systems

- 6.1.3. Mobile Robots (AGV/AMR)

- 6.1.4. Vision Inspection Equipment

- 6.1.5. Labelling Equipment

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Warehouse Automation Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Palletizers

- 7.1.2. Conveyors and Sorting Systems

- 7.1.3. Mobile Robots (AGV/AMR)

- 7.1.4. Vision Inspection Equipment

- 7.1.5. Labelling Equipment

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Warehouse Automation Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Palletizers

- 8.1.2. Conveyors and Sorting Systems

- 8.1.3. Mobile Robots (AGV/AMR)

- 8.1.4. Vision Inspection Equipment

- 8.1.5. Labelling Equipment

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Warehouse Automation Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Palletizers

- 9.1.2. Conveyors and Sorting Systems

- 9.1.3. Mobile Robots (AGV/AMR)

- 9.1.4. Vision Inspection Equipment

- 9.1.5. Labelling Equipment

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Warehouse Automation Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Palletizers

- 10.1.2. Conveyors and Sorting Systems

- 10.1.3. Mobile Robots (AGV/AMR)

- 10.1.4. Vision Inspection Equipment

- 10.1.5. Labelling Equipment

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Keyence Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Addverb Technologies Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alstrut India Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Delta Electronics Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Armstrong Machine Builders Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Win Automation (Wipro Limited)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alligator Automations

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 World Pack Automation Systems Private Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Omron Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Titan Engineering and Automation Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sick AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Falcon Autotech

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Signode India Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ClearPack India Pvt Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Warehouse Automation Market in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Warehouse Automation Market in India Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Warehouse Automation Market in India Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Warehouse Automation Market in India Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Warehouse Automation Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Warehouse Automation Market in India Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Warehouse Automation Market in India Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Warehouse Automation Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Warehouse Automation Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Warehouse Automation Market in India Volume Share (%), by Country 2025 & 2033

- Figure 11: South America Warehouse Automation Market in India Revenue (Million), by Type 2025 & 2033

- Figure 12: South America Warehouse Automation Market in India Volume (K Unit), by Type 2025 & 2033

- Figure 13: South America Warehouse Automation Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Warehouse Automation Market in India Volume Share (%), by Type 2025 & 2033

- Figure 15: South America Warehouse Automation Market in India Revenue (Million), by Country 2025 & 2033

- Figure 16: South America Warehouse Automation Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 17: South America Warehouse Automation Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Warehouse Automation Market in India Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Warehouse Automation Market in India Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Warehouse Automation Market in India Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Warehouse Automation Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Warehouse Automation Market in India Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Warehouse Automation Market in India Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Warehouse Automation Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Warehouse Automation Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Warehouse Automation Market in India Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa Warehouse Automation Market in India Revenue (Million), by Type 2025 & 2033

- Figure 28: Middle East & Africa Warehouse Automation Market in India Volume (K Unit), by Type 2025 & 2033

- Figure 29: Middle East & Africa Warehouse Automation Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa Warehouse Automation Market in India Volume Share (%), by Type 2025 & 2033

- Figure 31: Middle East & Africa Warehouse Automation Market in India Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa Warehouse Automation Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East & Africa Warehouse Automation Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa Warehouse Automation Market in India Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Warehouse Automation Market in India Revenue (Million), by Type 2025 & 2033

- Figure 36: Asia Pacific Warehouse Automation Market in India Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Warehouse Automation Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Warehouse Automation Market in India Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Warehouse Automation Market in India Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific Warehouse Automation Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 41: Asia Pacific Warehouse Automation Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Warehouse Automation Market in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Warehouse Automation Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Warehouse Automation Market in India Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Warehouse Automation Market in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Warehouse Automation Market in India Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Warehouse Automation Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Warehouse Automation Market in India Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Warehouse Automation Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Warehouse Automation Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Warehouse Automation Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Warehouse Automation Market in India Volume K Unit Forecast, by Type 2020 & 2033

- Table 17: Global Warehouse Automation Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Warehouse Automation Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Brazil Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Argentina Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global Warehouse Automation Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Warehouse Automation Market in India Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Warehouse Automation Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Warehouse Automation Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Spain Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Russia Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Benelux Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Nordics Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Warehouse Automation Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Warehouse Automation Market in India Volume K Unit Forecast, by Type 2020 & 2033

- Table 49: Global Warehouse Automation Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Warehouse Automation Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Turkey Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Israel Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: GCC Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: North Africa Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Warehouse Automation Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Warehouse Automation Market in India Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Global Warehouse Automation Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Warehouse Automation Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: China Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: India Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Japan Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Korea Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: ASEAN Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Oceania Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific Warehouse Automation Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific Warehouse Automation Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Warehouse Automation Market in India?

The projected CAGR is approximately 26.96%.

2. Which companies are prominent players in the Warehouse Automation Market in India?

Key companies in the market include Keyence Corporation, Addverb Technologies Pvt Ltd, Alstrut India Private Limited, Delta Electronics Inc, Armstrong Machine Builders Pvt Ltd, Win Automation (Wipro Limited), Alligator Automations, World Pack Automation Systems Private Limited, Omron Corporation, Titan Engineering and Automation Limited, Sick AG, Falcon Autotech, Signode India Ltd, ClearPack India Pvt Ltd.

3. What are the main segments of the Warehouse Automation Market in India?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of E-commerce in India; Increasing Need for Better Inventory Management and Control; Increasing Technological Advancements.

6. What are the notable trends driving market growth?

Exponential Growth of E-commerce in India.

7. Are there any restraints impacting market growth?

High Cost of SWIR Cameras and Detectors.

8. Can you provide examples of recent developments in the market?

September 2022 - Falcon Autotech, a most significant provider of Intralogistics automation solutions, and Alstef Group, a provider of comprehensive baggage handling solutions and parcel automation integration, announced a strategic technology partnership for parcel sorting solutions. Alstef Group will exclusively expand Falcon Autotech's Cross-belt sorter range deployment to specific geographies as part of an exclusive distribution agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Warehouse Automation Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Warehouse Automation Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Warehouse Automation Market in India?

To stay informed about further developments, trends, and reports in the Warehouse Automation Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence