Key Insights

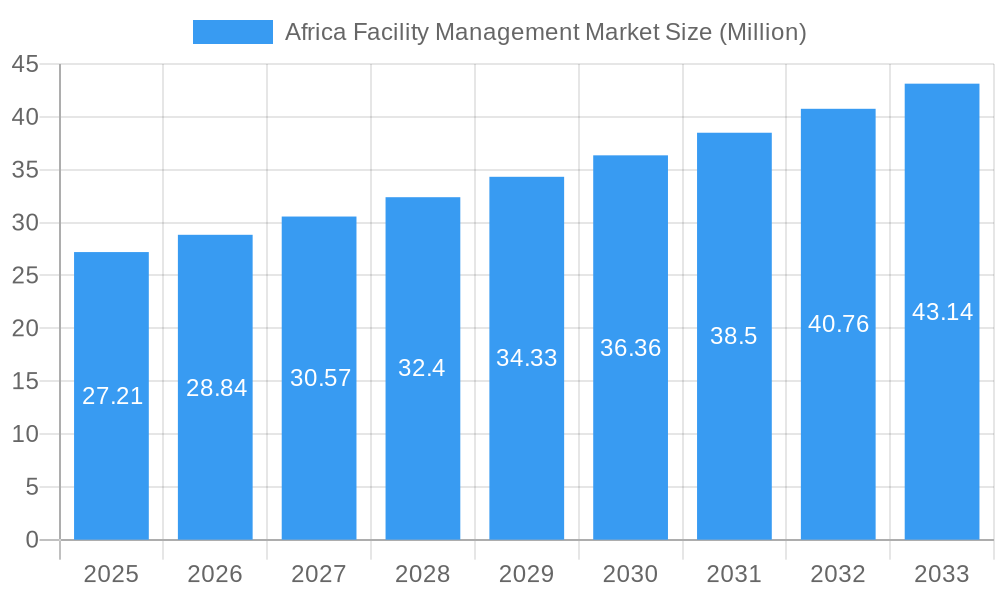

The Africa Facility Management market is poised for substantial expansion, projected to reach $27.21 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 6.06% through 2033. This upward trajectory is propelled by a confluence of driving forces, including increasing urbanization and a growing demand for professionalized facility management services across diverse sectors. The expanding commercial real estate landscape, coupled with significant investments in infrastructural development, particularly in burgeoning economies like Nigeria, South Africa, and Egypt, are key catalysts. Furthermore, the rising adoption of bundled and integrated facility management solutions over single-service offerings reflects a market maturity, as businesses seek comprehensive and efficient operational management. Institutional and industrial segments are also contributing significantly to this growth, driven by the need for enhanced operational efficiency, cost optimization, and compliance with evolving regulatory standards. The focus on sustainability and smart building technologies is also emerging as a prominent trend, encouraging the adoption of advanced facility management practices.

Africa Facility Management Market Market Size (In Million)

Despite this promising outlook, certain restraints could temper the pace of growth. These include a shortage of skilled professionals capable of managing complex integrated systems, and varying levels of adoption of modern facility management practices across different regions and sectors. The initial investment cost for advanced technology solutions can also pose a barrier for smaller enterprises. However, the long-term potential remains strong, with significant opportunities in emerging markets within Africa. Key players are actively expanding their presence and service portfolios to capture this growth. The market's segmentation reveals a strong preference for bundled and integrated facility management services, indicating a shift towards strategic outsourcing of operational complexities. Regional market dynamics highlight Nigeria, South Africa, and Egypt as key growth hubs, with substantial contributions also expected from Kenya, Ethiopia, and Morocco. The study period, from 2019 to 2033, with a base year of 2025, provides a comprehensive view of the market's evolution and future potential.

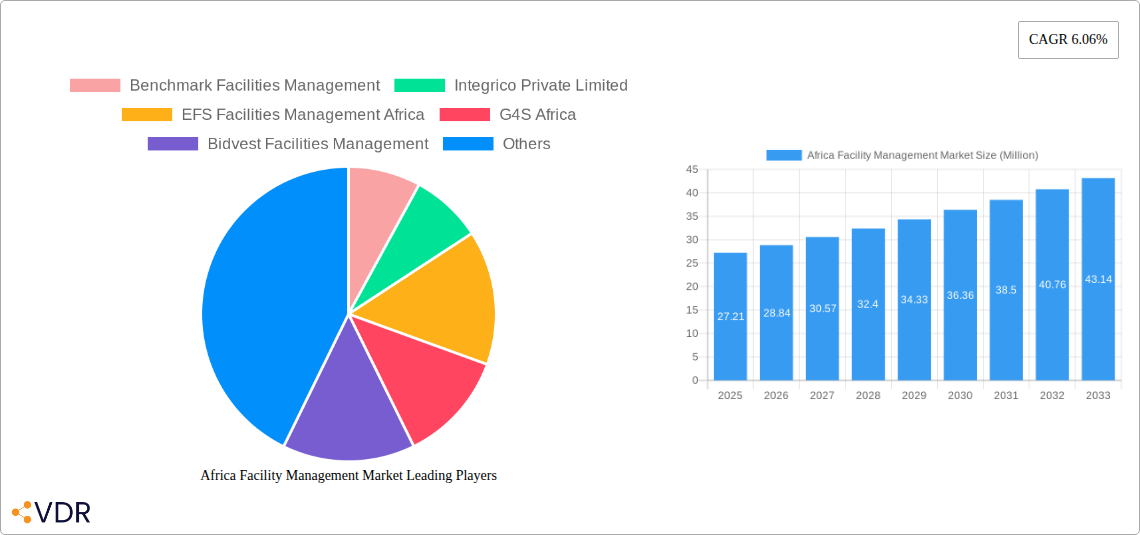

Africa Facility Management Market Company Market Share

Unlocking Growth: The Africa Facility Management Market Report 2019–2033

This comprehensive report offers an in-depth analysis of the Africa Facility Management Market, meticulously dissecting growth trajectories, key dynamics, and future opportunities. Spanning from 2019 to 2033, with a deep dive into the Base Year 2025 and the Forecast Period 2025–2033, this report provides actionable insights for stakeholders seeking to capitalize on the burgeoning African FM services market. Explore parent and child market segments including Single Facility Management, Bundled Facility Management, and Integrated Facility Management, alongside critical end-user industries such as Commercial, Infrastructural, Institutional, Industrial, and Other End-users. With a focus on facility management solutions Africa and commercial facility management Africa, this report is your essential guide to navigating this dynamic landscape. All values are presented in Million units.

Africa Facility Management Market Market Dynamics & Structure

The Africa Facility Management Market is characterized by a moderately fragmented structure, with a mix of global players and increasingly capable local providers. Market concentration is gradually evolving as larger companies expand their footprint and local enterprises consolidate. Technological innovation drivers are primarily centered on the adoption of digital tools for enhanced efficiency, predictive maintenance, and sustainable practices, including IoT integration and AI-powered analytics. Regulatory frameworks across African nations are becoming more refined, impacting service delivery standards and compliance requirements. Competitive product substitutes are emerging, particularly in the form of in-house facility management teams driven by cost-saving initiatives, though the complexity and scale of modern facilities often necessitate specialized external expertise. End-user demographics are shifting towards a greater demand for sophisticated, integrated solutions that optimize operational costs and improve occupant experiences. M&A trends are on an upward trajectory, as established players seek to acquire local expertise and market share, and specialized service providers aim for scale.

- Market Concentration: Moderate fragmentation with increasing consolidation.

- Technological Drivers: IoT, AI, predictive maintenance, digital platforms.

- Regulatory Landscape: Evolving standards and compliance mandates.

- Substitution Threats: In-house FM teams for specific operational needs.

- End-User Demand: Growing preference for integrated and cost-efficient solutions.

- M&A Activity: Strategic acquisitions and partnerships driving market consolidation.

Africa Facility Management Market Growth Trends & Insights

The Africa Facility Management Market is poised for robust expansion, driven by increasing urbanization, significant infrastructure development, and a growing recognition of the strategic importance of efficient facility operations. The market size evolution indicates a steady upward trend, with forecasts suggesting a substantial increase in value over the forecast period. Adoption rates for advanced FM technologies are accelerating, influenced by a need to optimize operational expenditures and enhance sustainability across diverse business sectors. Technological disruptions, such as the integration of Building Information Modeling (BIM) and the increasing use of data analytics for operational insights, are reshaping service delivery models. Consumer behavior shifts are evident in the growing demand for flexible, customized FM solutions that cater to specific organizational needs, from energy management to security and maintenance. The CAGR for the African FM services market is projected to be a healthy xx%, reflecting the immense growth potential. Market penetration of outsourced FM services is expected to rise as businesses, particularly SMEs, increasingly recognize the cost-effectiveness and expertise offered by specialized providers. The shift towards green building certifications and sustainable operations further fuels the demand for specialized facility management solutions Africa.

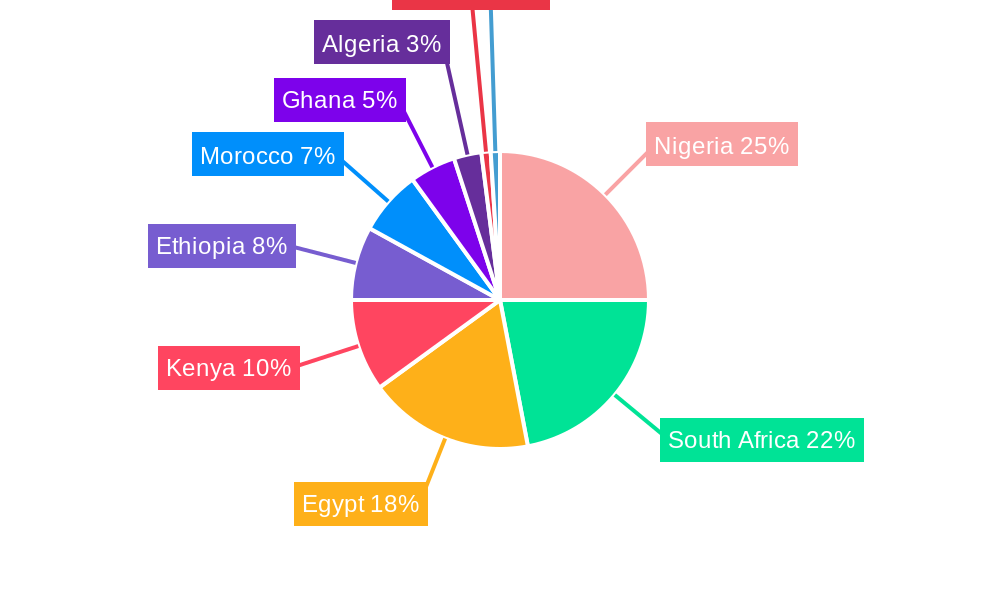

Dominant Regions, Countries, or Segments in Africa Facility Management Market

Within the Africa Facility Management Market, the Commercial end-user segment consistently emerges as a dominant force, fueled by extensive development in retail spaces, office buildings, and hospitality sectors across key African economies. Integrated Facility Management is rapidly gaining traction, moving beyond traditional single-service offerings to encompass a holistic approach to building operations, maintenance, and occupant services. This shift is driven by a desire for streamlined management, cost efficiencies, and improved operational synergy.

Several regions and countries are at the forefront of this growth. South Africa continues to be a mature market, with a well-established FM industry and significant investment in commercial and infrastructural projects. The Boardwalk Mall development in Port Elizabeth, with an investment of USD 36.2 million, exemplifies the ongoing growth in the retail infrastructure sector, directly benefiting commercial facility management Africa. Nigeria, Kenya, and Egypt are also exhibiting strong growth, driven by rapid urbanization and increasing foreign direct investment in commercial real estate and industrial zones.

- Dominant End-User Segment: Commercial, driven by retail, office, and hospitality expansion.

- Growing Service Model: Integrated Facility Management, offering holistic operational solutions.

- Leading Countries: South Africa, Nigeria, Kenya, Egypt.

- Key Growth Drivers:

- Urbanization and rapid city development.

- Increased foreign direct investment in commercial and industrial sectors.

- Government initiatives promoting infrastructure development.

- Growing awareness of the benefits of outsourced and integrated FM services.

- Demand for energy-efficient and sustainable building operations.

Africa Facility Management Market Product Landscape

The Africa Facility Management Market is witnessing a surge in product and service innovation, moving beyond basic maintenance to sophisticated, technology-driven solutions. Innovations focus on enhancing operational efficiency, sustainability, and occupant well-being. Key advancements include smart building technologies, integrated software platforms for service management, and specialized green cleaning and energy management solutions. The performance metrics are increasingly centered on cost savings, uptime maximization, and adherence to environmental standards. Unique selling propositions often lie in the ability of providers to offer tailored packages that address the specific challenges of diverse African markets, from extreme weather conditions to unique logistical complexities. Technological advancements are enabling predictive maintenance, remote monitoring, and enhanced security systems, setting new benchmarks for service delivery.

Key Drivers, Barriers & Challenges in Africa Facility Management Market

Key Drivers:

- Infrastructure Development: Significant investments in new commercial, residential, and industrial infrastructure are creating substantial demand for FM services.

- Urbanization: Rapid migration to cities is driving the growth of commercial and residential complexes requiring professional management.

- Cost Optimization: Businesses are increasingly outsourcing FM to reduce operational costs and focus on core competencies.

- Technological Adoption: The integration of IoT, AI, and FM software platforms is enhancing efficiency and service quality.

Barriers & Challenges:

- Skilled Labor Shortage: A persistent lack of adequately trained and skilled FM professionals across the continent poses a significant challenge.

- Regulatory Fragmentation: Varying regulations and standards across different African countries can complicate service delivery for multinational corporations.

- Economic Volatility: Fluctuations in economic conditions and currency instability can impact investment in FM services and operational budgets.

- Infrastructure Deficiencies: In some regions, unreliable power and internet connectivity can hinder the effective deployment of advanced FM technologies.

Emerging Opportunities in Africa Facility Management Market

Emerging opportunities within the Africa Facility Management Market are abundant, particularly in the realm of sustainable and smart building solutions. There is a growing demand for green facility management services, driven by environmental concerns and corporate social responsibility initiatives. The increasing adoption of renewable energy sources presents opportunities for FM providers to offer specialized energy management and optimization services. Furthermore, the development of smart cities and integrated infrastructure projects across the continent opens avenues for advanced building management systems and data-driven operational solutions. The IntegriCo's innovative use of recycled plastics for railroad ties showcases a broader trend towards sustainable material usage, which FM providers can leverage in their material sourcing and waste management strategies.

Growth Accelerators in the Africa Facility Management Market Industry

Long-term growth in the Africa Facility Management Market is being significantly accelerated by ongoing technological breakthroughs, strategic partnerships, and ambitious market expansion strategies. The increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into FM operations is enabling predictive maintenance, real-time monitoring, and enhanced energy efficiency, driving demand for these advanced services. Strategic partnerships between global FM leaders and local African companies are crucial for navigating diverse market landscapes and expanding service offerings. Furthermore, governments across the continent are increasingly recognizing the importance of professional facility management for national development, leading to favorable policies and increased investment in large-scale infrastructure projects, which directly fuels FM market growth.

Key Players Shaping the Africa Facility Management Market Market

- Benchmark Facilities Management

- Integrico Private Limited

- EFS Facilities Management Africa

- G4S Africa

- Bidvest Facilities Management

- Apleona GmbH

- Emdad Facility Management

- Contrack Facilities Management S A E

- Broll Nigeria

Notable Milestones in Africa Facility Management Market Sector

- September 2022: Construction of the new Boardwalk Mall in Port Elizabeth, South Africa, commencing with an investment of USD 36.2 million. This development is expected to boost the economy and create growth prospects for facility management services.

- September 2022: IntegriCo announced advancements in sustainable railroad tie production using recycled plastics, demonstrating an innovative approach to infrastructure materials that could influence facility maintenance and construction practices.

In-Depth Africa Facility Management Market Market Outlook

The future outlook for the Africa Facility Management Market is exceptionally promising, fueled by a confluence of macro-economic growth, ongoing urbanization, and a heightened focus on operational efficiency and sustainability. Key growth accelerators include the continued expansion of commercial real estate, the critical need for efficient management of burgeoning infrastructural projects, and the increasing adoption of integrated facility management solutions. Emerging opportunities lie in the provision of smart building technologies and eco-friendly FM practices. As African economies mature and diversify, the demand for specialized, technology-enabled, and cost-effective facility management services is set to escalate, positioning the market for sustained and significant expansion.

Africa Facility Management Market Segmentation

-

1. Type of Facility Management

- 1.1. Single Facility Management

- 1.2. Bundled Facility Management

- 1.3. Integrated Facility Management

-

2. End User

- 2.1. Commercial

- 2.2. Infrastructural

- 2.3. Institutional

- 2.4. Industrial

- 2.5. Other End-users

Africa Facility Management Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Facility Management Market Regional Market Share

Geographic Coverage of Africa Facility Management Market

Africa Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for outsourced FM in Africa; Infrastructural development in the region continue to open up new opportunities for FM vendors; Investments in the Private sector to drive growth

- 3.3. Market Restrains

- 3.3.1. High license Fees and time taking procedure; Strict regulations regarding gateways and landing stations

- 3.4. Market Trends

- 3.4.1. Infrastructural Development Continue to Open Up new Opportunities for FM Vendors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. Single Facility Management

- 5.1.2. Bundled Facility Management

- 5.1.3. Integrated Facility Management

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Infrastructural

- 5.2.3. Institutional

- 5.2.4. Industrial

- 5.2.5. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Benchmark Facilities Management

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Integrico Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EFS Facilities Management Africa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 G4S Africa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bidvest Facilities Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apleona GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emdad Facility Management

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Contrack Facilities Management S A E

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Broll Nigeria

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Benchmark Facilities Management

List of Figures

- Figure 1: Africa Facility Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Facility Management Market Revenue Million Forecast, by Type of Facility Management 2020 & 2033

- Table 2: Africa Facility Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Africa Facility Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Africa Facility Management Market Revenue Million Forecast, by Type of Facility Management 2020 & 2033

- Table 5: Africa Facility Management Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Africa Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Facility Management Market?

The projected CAGR is approximately 6.06%.

2. Which companies are prominent players in the Africa Facility Management Market?

Key companies in the market include Benchmark Facilities Management, Integrico Private Limited, EFS Facilities Management Africa, G4S Africa, Bidvest Facilities Management, Apleona GmbH, Emdad Facility Management, Contrack Facilities Management S A E, Broll Nigeria.

3. What are the main segments of the Africa Facility Management Market?

The market segments include Type of Facility Management, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for outsourced FM in Africa; Infrastructural development in the region continue to open up new opportunities for FM vendors; Investments in the Private sector to drive growth.

6. What are the notable trends driving market growth?

Infrastructural Development Continue to Open Up new Opportunities for FM Vendors .

7. Are there any restraints impacting market growth?

High license Fees and time taking procedure; Strict regulations regarding gateways and landing stations.

8. Can you provide examples of recent developments in the market?

September 2022: A brand-new shopping center called the Boardwalk Mall is being built within the Boardwalk district of Port Elizabeth, South Africa. A total of USD 36.2 million is being invested in the development of the new shopping center over two phases. Such advances are strengthening the nation's economy and are critical in creating growth prospects for facility management services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Facility Management Market?

To stay informed about further developments, trends, and reports in the Africa Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence