Key Insights

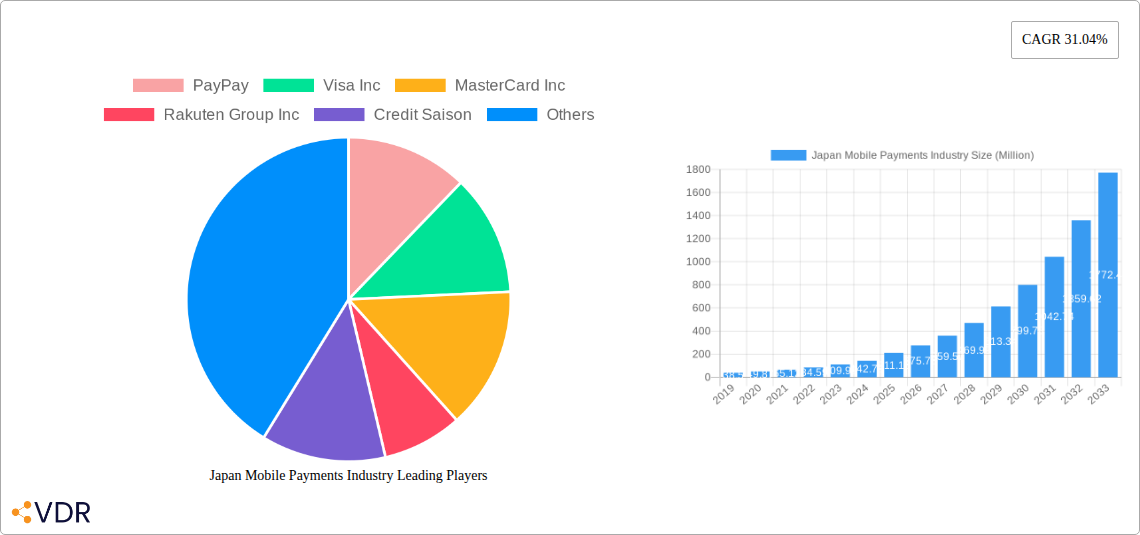

The Japanese mobile payments market is poised for exceptional growth, projected to reach 211.13 million in value by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 31.04% over the forecast period of 2025-2033. This rapid expansion is primarily fueled by a confluence of evolving consumer behaviors, technological advancements, and supportive government initiatives aimed at fostering a cashless society. The increasing penetration of smartphones, coupled with a growing comfort level among Japanese consumers for digital transactions, is a significant driver. Furthermore, the convenience and speed offered by mobile payment solutions in everyday purchases, from retail to entertainment, are compelling users to adopt these methods. The robust infrastructure development by key players like PayPay, Visa Inc., and MasterCard Inc., alongside partnerships with financial institutions such as Mitsubishi UFJ Financial Group and Rakuten Group Inc., is also instrumental in solidifying the market's trajectory. This dynamic ecosystem ensures a seamless and secure payment experience, further accelerating adoption.

Japan Mobile Payments Industry Market Size (In Million)

The market's segmentation reveals a strong emphasis on both Point of Sale (POS) and Online Sale channels, with digital wallets and card payments dominating the former, and card payments leading the latter. The retail and entertainment sectors are expected to be major beneficiaries and contributors to this growth, driven by impulse purchases and the demand for frictionless checkout experiences. While the market faces minor restraints such as occasional network disruptions and the lingering preference for cash in certain demographics and rural areas, these are outweighed by the overwhelming positive trends. The presence of established and emerging players actively innovating and expanding their service offerings underscores the competitive yet collaborative nature of the Japanese mobile payments landscape, promising continued innovation and enhanced user experiences that will sustain the high growth momentum.

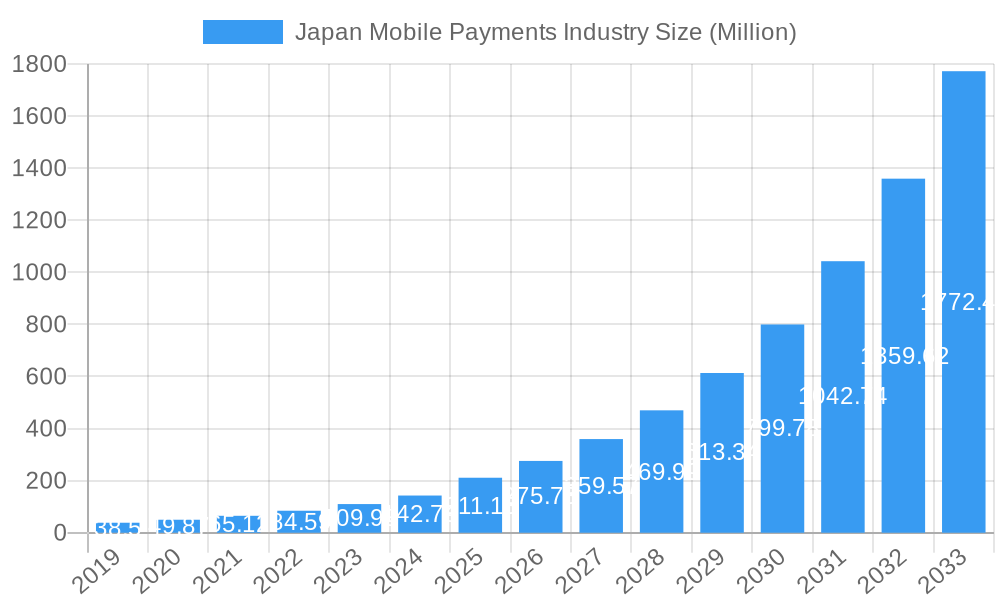

Japan Mobile Payments Industry Company Market Share

Comprehensive Report: Japan Mobile Payments Industry Outlook 2025-2033

Unlock critical insights into the burgeoning Japan mobile payments market. This in-depth report analyzes market dynamics, growth trends, regional dominance, and the competitive landscape, providing essential intelligence for stakeholders navigating this rapidly evolving sector. With a focus on both parent and child markets, this analysis equips you with the data and foresight needed to capitalize on emerging opportunities and overcome challenges.

Japan Mobile Payments Industry Market Dynamics & Structure

The Japan mobile payments industry is characterized by a dynamic interplay of technological innovation, evolving consumer behavior, and a supportive regulatory environment. Market concentration is notably high, with dominant players like PayPay and Rakuten Group Inc. leveraging extensive user bases and strategic partnerships to solidify their positions. Technological innovation is a primary driver, with continuous advancements in secure authentication methods, such as the April 2023 launch of face biometrics payments by PayPay and Yahoo Japan at convenience stores, enhancing user experience and security. Regulatory frameworks, while generally supportive of digital transformation, continue to adapt to new payment technologies and data privacy concerns. Competitive product substitutes include traditional card payments and cash, but the convenience and integrated loyalty programs offered by mobile wallets are steadily eroding their market share. End-user demographics are broad, encompassing all age groups, with a particular surge in adoption among younger, tech-savvy consumers and increasing penetration into the older demographic. Merger and acquisition trends are expected to continue as larger entities seek to expand their digital payment ecosystems and smaller innovators aim for broader market reach. The market is projected to see substantial M&A activity, with an estimated xx deal volumes during the forecast period, driven by the pursuit of market consolidation and technological integration. Innovation barriers, such as the cost of integrating new technologies and the need for robust cybersecurity infrastructure, remain important considerations for market participants.

- Market Concentration: Dominated by a few key players, fostering intense competition and strategic alliances.

- Technological Innovation: Driven by advancements in biometrics, NFC, and QR code technologies.

- Regulatory Environment: Supportive of digitalization, with ongoing adaptations to emerging payment methods.

- Competitive Landscape: Mobile wallets increasingly outcompeting traditional payment methods due to convenience and integrated benefits.

- End-User Adoption: Broad demographic appeal with accelerating growth across all age segments.

- M&A Trends: Anticipated to increase as companies seek strategic growth and market consolidation.

Japan Mobile Payments Industry Growth Trends & Insights

The Japan mobile payments industry is poised for significant expansion, driven by a confluence of factors including a digitally adept population, a robust technological infrastructure, and a government push towards cashless societies. The market size evolution is expected to be substantial, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by increasing consumer comfort with digital transactions and the expanding acceptance of mobile payments across various retail and service sectors. Adoption rates are steadily climbing, with mobile wallet penetration anticipated to reach xx% by the end of the forecast period. Technological disruptions, such as the integration of artificial intelligence for personalized payment experiences and enhanced security features, will further accelerate this adoption. Consumer behavior shifts are a critical component of this growth trajectory. Japanese consumers are increasingly prioritizing convenience, speed, and seamless integration of payment options within their daily lives. This is evident in the rising popularity of contactless payments at point-of-sale terminals and the growing preference for in-app purchases for online goods and services. The shift away from traditional cash transactions is becoming more pronounced, driven by the perceived hygiene benefits and the efficiency offered by mobile payment solutions. Furthermore, the increasing availability of diverse mobile payment platforms, each offering unique rewards and benefits, incentivizes further adoption and encourages deeper engagement with the digital payment ecosystem. The ongoing development of open banking initiatives and the proliferation of e-commerce platforms will also play a pivotal role in shaping the future growth of the mobile payments market in Japan. The integration of mobile payments into loyalty programs and e-commerce platforms is creating a more holistic and attractive consumer experience, driving repeat usage and expanding the overall market. The market is estimated to reach approximately ¥xx trillion by 2033.

Dominant Regions, Countries, or Segments in Japan Mobile Payments Industry

Within the Japan mobile payments industry, the Digital Wallet segment, encompassing mobile wallets, stands out as the dominant force driving market growth. This dominance is particularly pronounced within the Point of Sale mode of payment, where its convenience and speed are rapidly displacing traditional methods. The Retail end-user industry further amplifies this trend, acting as a primary adoption ground for mobile payment solutions. The sheer volume of transactions and the constant drive for enhanced customer experience in retail create a fertile ground for mobile payment proliferation.

- Digital Wallets Dominance: Mobile wallets, including those integrated into smartphones and dedicated apps, are revolutionizing transaction methods. Their widespread acceptance and user-friendly interfaces have made them the preferred choice for many consumers.

- Market Share: Digital wallets are projected to capture over xx% of the Point of Sale payment market share by 2033.

- Consumer Preference: Growing preference for contactless and app-based payment solutions for everyday purchases.

- Point of Sale (POS) Transformation: The shift from traditional POS methods to digital wallets is a key growth driver.

- Card Pay vs. Digital Wallet: While Card Pay still holds a significant share, Digital Wallets are experiencing faster growth rates.

- Technological Integration: Increased adoption of NFC and QR code technology at POS terminals facilitates seamless mobile payments.

- Retail Sector as a Catalyst: The retail industry is a primary beneficiary and driver of mobile payment adoption.

- Convenience for Consumers: Reduced checkout times and enhanced shopping experiences.

- Data and Loyalty Programs: Retailers leverage mobile payments for customer data collection and personalized loyalty programs, fostering repeat business.

- Influence of Economic Policies and Infrastructure: Government initiatives promoting cashless transactions and the widespread availability of high-speed internet and smartphone penetration create a conducive environment for mobile payment growth.

- Growth Potential: The continued evolution of mobile payment functionalities, such as integrated budgeting tools and peer-to-peer transfers, promises sustained growth in the Digital Wallet segment.

Japan Mobile Payments Industry Product Landscape

The Japan mobile payments product landscape is characterized by rapid innovation and a diverse array of offerings designed to cater to various consumer needs. Key product innovations include the integration of advanced security features like biometric authentication and tokenization, enhancing user trust and transaction security. Mobile payment applications are increasingly offering comprehensive features beyond simple transactions, such as loyalty program integration, bill payment services, and peer-to-peer money transfer capabilities. Performance metrics like transaction speed, reliability, and ease of use are crucial differentiators. Unique selling propositions often revolve around exclusive merchant partnerships, attractive reward programs, and seamless integration with e-commerce platforms and in-app purchases. Technological advancements in areas like Near Field Communication (NFC) and QR code technology continue to improve the user experience, making payments faster and more intuitive. The development of wearable payment devices also represents a growing segment, offering further convenience. The market is witnessing a trend towards integrated financial super-apps, consolidating multiple financial services within a single mobile interface.

Key Drivers, Barriers & Challenges in Japan Mobile Payments Industry

Key Drivers:

- Technological Advancements: The continuous innovation in mobile technology, including smartphones, NFC, and QR codes, directly fuels the adoption of mobile payments. Biometric authentication (e.g., face and fingerprint scans) enhances security and user experience.

- Government Initiatives: The Japanese government's drive towards a cashless society, aiming to boost efficiency and transparency, provides a strong policy tailwind.

- Consumer Convenience: The unparalleled convenience of making payments anytime, anywhere, with a device consumers already carry, is a primary driver. Integrated loyalty programs and discounts further incentivize usage.

- E-commerce Growth: The burgeoning e-commerce sector inherently relies on efficient and secure online payment methods, with mobile payments playing a pivotal role.

Barriers & Challenges:

- Cybersecurity Concerns: Despite advancements, concerns about data breaches and fraud persist, acting as a restraint for some segments of the population. Maintaining robust security infrastructure is a significant ongoing challenge, estimated to cost the industry ¥xx million annually in security investments.

- Regulatory Evolution: While generally supportive, evolving regulations concerning data privacy and financial technology can create compliance hurdles and impact the pace of innovation.

- Cash Preference in Certain Demographics: A portion of the older population still prefers cash for its tangibility and perceived simplicity, requiring targeted strategies to encourage adoption.

- Interoperability Issues: Lack of seamless interoperability between different mobile payment platforms can sometimes create friction for users, although industry-wide efforts are underway to address this.

- Infrastructure Development in Rural Areas: While urban areas are well-covered, ensuring consistent and reliable mobile payment infrastructure in all regions remains a developmental challenge.

Emerging Opportunities in Japan Mobile Payments Industry

Emerging opportunities in the Japan mobile payments industry lie in the continued expansion into under-penetrated sectors and the development of innovative, value-added services. The Healthcare and Hospitality sectors represent significant untapped markets where mobile payments can streamline operations and enhance customer experience. For instance, implementing contactless payments for hotel bookings, restaurant bills, and medical consultations can significantly improve efficiency. Furthermore, the development of integrated financial super-apps that offer not just payments but also budgeting tools, investment options, and insurance products presents a substantial opportunity to deepen customer engagement and capture a larger share of their financial lives. The rise of the gig economy also presents an opportunity for specialized payment solutions catering to freelancers and on-demand workers, ensuring swift and secure payment for their services. The increasing focus on sustainability and ethical consumption could also drive demand for payment solutions that integrate carbon footprint tracking or support for socially responsible businesses.

Growth Accelerators in the Japan Mobile Payments Industry Industry

Several key growth accelerators are poised to propel the Japan mobile payments industry forward. Technological breakthroughs in areas like decentralized finance (DeFi) and blockchain integration hold the potential to introduce more secure, transparent, and efficient payment systems. Strategic partnerships between mobile payment providers, telecommunication companies, and financial institutions will be crucial for expanding reach and offering bundled services. For example, collaborations between mobile wallets and mobile network operators can lead to attractive data-based offers and simplified onboarding processes. Market expansion strategies, particularly focusing on rural areas and older demographics through user-friendly interfaces and extensive educational campaigns, will unlock new user segments. The increasing adoption of contactless payment technology in public transportation and vending machines further solidifies mobile payments as a ubiquitous transaction method.

Key Players Shaping the Japan Mobile Payments Industry Market

- PayPay

- Visa Inc

- MasterCard Inc

- Rakuten Group Inc

- Credit Saison

- Mitsubishi UFJ Financial Group

- JCB

- PayPal

- Aeon Credit Service

- Resona Holdings

Notable Milestones in Japan Mobile Payments Industry Sector

- April 2023: PayPay and Yahoo Japan launched face biometrics payments at convenience stores. This pilot, a collaboration with e-commerce company Z Holdings Group ASKUL and its subsidiary Demae-can, a food delivery service platform, demonstrated a significant advancement in secure and convenient payment methods, mirroring earlier innovations in self-service POS cash registers.

- February 2023: MUFG, Japan’s largest bank, announced the launch of a USD100 million fund focused on Indonesian startups. This initiative, a collaboration between MUFG subsidiaries MUFG Innovation Partners, MUFG Bank, and Indonesian commercial bank Danamon, underscores the growing international investment and strategic expansion activities of major Japanese financial institutions within the broader fintech landscape.

In-Depth Japan Mobile Payments Industry Market Outlook

The future of the Japan mobile payments industry is exceptionally bright, with robust growth accelerators set to redefine the transactional landscape. Continued investment in cutting-edge technologies such as AI-powered fraud detection and hyper-personalized payment experiences will enhance security and user engagement. The strategic expansion of partnerships between FinTech innovators, traditional banks, and major retailers will broaden accessibility and create synergistic ecosystems, leading to integrated financial services. The focus on user experience and convenience, driven by evolving consumer preferences, will ensure that mobile payments become an even more integral part of daily life. Addressing the remaining challenges in financial inclusion and cybersecurity will be paramount to unlocking the full potential of this dynamic market. The industry is poised for substantial growth, with projected market size reaching ¥xx trillion by 2033, presenting significant strategic opportunities for both established players and new entrants.

Japan Mobile Payments Industry Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Other Points of Sale

-

1.2. Online Sale

- 1.2.1. Card Pay

- 1.2.2. Other On

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

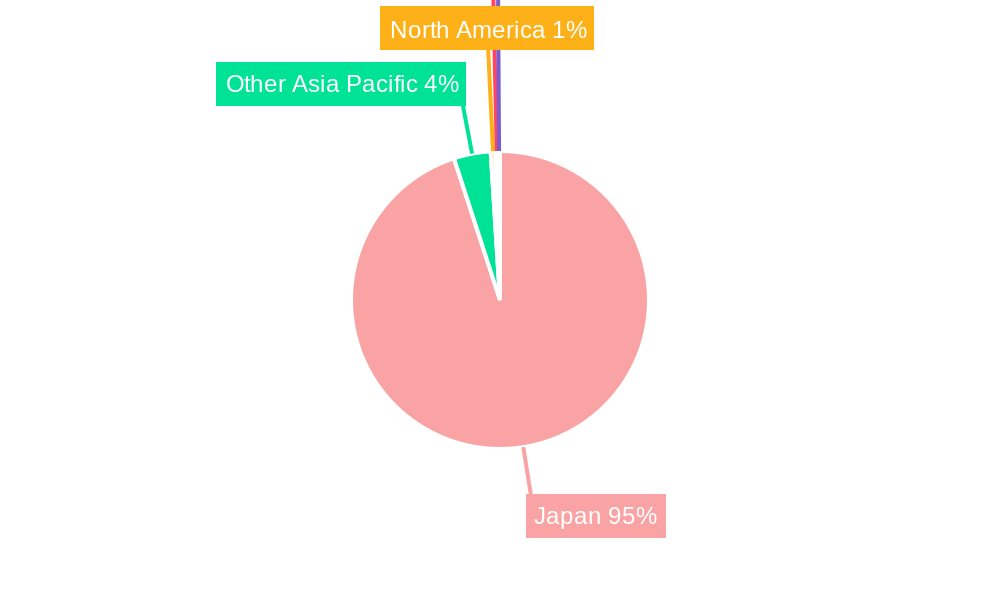

Japan Mobile Payments Industry Segmentation By Geography

- 1. Japan

Japan Mobile Payments Industry Regional Market Share

Geographic Coverage of Japan Mobile Payments Industry

Japan Mobile Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Proliferation of E-commerce

- 3.2.2 including the rise of m-commerce and cross-border e-commerce supported by the increase in purchasing power andand Increasing Internet Penetration in Japan Driving the Market

- 3.3. Market Restrains

- 3.3.1. Lack of a standard legislative policy remains especially in the case of cross-border transactions

- 3.4. Market Trends

- 3.4.1. Development of M-Commerce Platforms and Increasing Internet Penetration in Japan Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Mobile Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Other Points of Sale

- 5.1.2. Online Sale

- 5.1.2.1. Card Pay

- 5.1.2.2. Other On

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PayPay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Visa Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MasterCard Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rakuten Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Credit Saison

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi UFJ Financial Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JCB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PayPal*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aeon Credit Service

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Resona Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PayPay

List of Figures

- Figure 1: Japan Mobile Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Mobile Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Mobile Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: Japan Mobile Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Japan Mobile Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Mobile Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 5: Japan Mobile Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Japan Mobile Payments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Mobile Payments Industry?

The projected CAGR is approximately 31.04%.

2. Which companies are prominent players in the Japan Mobile Payments Industry?

Key companies in the market include PayPay, Visa Inc, MasterCard Inc, Rakuten Group Inc, Credit Saison, Mitsubishi UFJ Financial Group, JCB, PayPal*List Not Exhaustive, Aeon Credit Service, Resona Holdings.

3. What are the main segments of the Japan Mobile Payments Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 211.13 Million as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of E-commerce. including the rise of m-commerce and cross-border e-commerce supported by the increase in purchasing power andand Increasing Internet Penetration in Japan Driving the Market.

6. What are the notable trends driving market growth?

Development of M-Commerce Platforms and Increasing Internet Penetration in Japan Driving the Market.

7. Are there any restraints impacting market growth?

Lack of a standard legislative policy remains especially in the case of cross-border transactions.

8. Can you provide examples of recent developments in the market?

April 2023 - PayPay and Yahoo Japan have launched face biometrics payments at convenience stores. The self-service POS cash register pilot, similar to the one unveiled by Glory in Niigata City last year, also saw the collaboration of e-commerce company Z Holdings Group ASKUL and its subsidiary Demae-can, a food delivery service platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Mobile Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Mobile Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Mobile Payments Industry?

To stay informed about further developments, trends, and reports in the Japan Mobile Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence