Key Insights

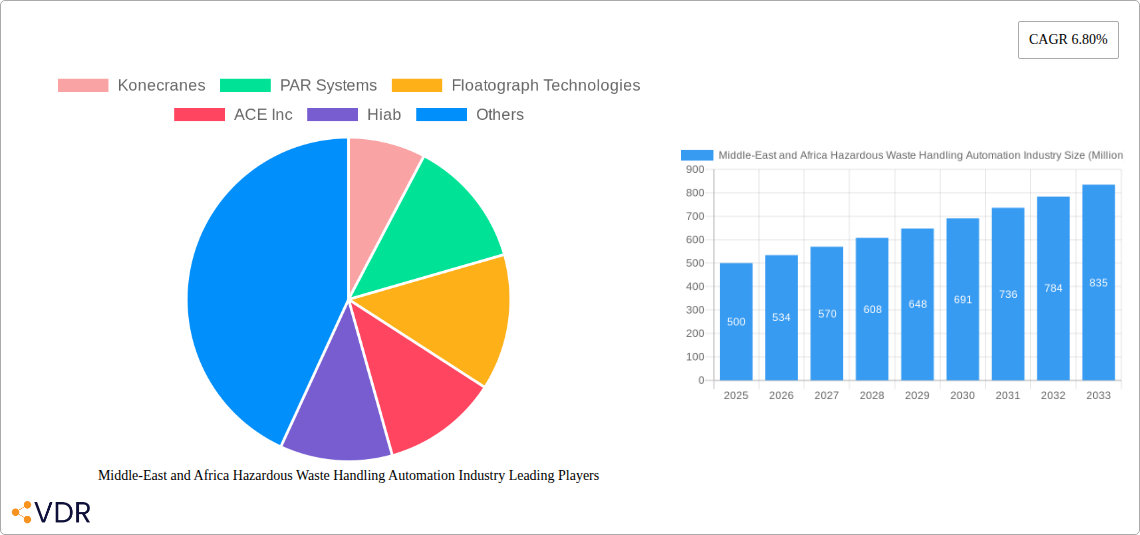

The Middle East and Africa Hazardous Waste Handling Automation market is experiencing robust growth, projected to reach a substantial size driven by increasing industrialization, stringent environmental regulations, and the rising awareness of occupational safety. The 6.80% CAGR indicates a significant expansion from 2019 to 2033, reflecting a strong demand for automated solutions across various sectors. Key drivers include the need to improve efficiency in waste management processes, minimize human exposure to hazardous materials, and enhance overall safety standards. The market is segmented by automation products (manipulator arms, telescoping masts, cranes, trusses, size reduction systems, and others), waste types (listed, characteristic, universal, and mixed wastes), and industries (manufacturing, chemical, energy, consumer care, and government). While the specific market size for the Middle East and Africa region isn't provided, considering the global CAGR and the significant industrial growth in the region, a conservative estimate suggests a substantial and rapidly expanding market. The adoption of automation technologies is likely to accelerate, particularly in countries with burgeoning manufacturing and energy sectors. The increased focus on sustainable waste management practices and the push for environmentally friendly solutions will further propel market growth. Challenges include high initial investment costs associated with automation technology, a lack of skilled workforce, and uneven infrastructure development across the region. However, the long-term benefits of improved efficiency, reduced operational costs, and enhanced safety outweigh these challenges, making automation an increasingly attractive investment for waste handling companies and government agencies. Key players, including Konecranes, PAR Systems, and others, are well-positioned to capitalize on this growing market opportunity.

The diverse nature of the waste streams in the Middle East and Africa poses both challenges and opportunities. The prevalence of mixed waste necessitates versatile automation solutions capable of handling diverse materials safely and efficiently. The market will see increased demand for advanced technologies such as AI-powered sorting systems and robotic arms with improved dexterity to effectively manage complex waste streams. Government initiatives promoting sustainable waste management and providing incentives for automation adoption will play a vital role in shaping market growth. Collaboration between technology providers, waste management companies, and regulatory bodies is essential to address the unique challenges and capitalize on the immense potential of this market. Future growth will likely be concentrated in countries with more developed infrastructure and stringent environmental regulations, although technological advancements will gradually make automation feasible in more remote and less developed areas. Further research focused on specific country-level data is needed to provide more granular insights into the regional dynamics of this market.

Middle East & Africa Hazardous Waste Handling Automation Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Middle East & Africa Hazardous Waste Handling Automation industry, offering invaluable insights for stakeholders seeking to capitalize on its significant growth potential. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. It segments the market by automation product (Manipulator Arms, Telescoping Masts, Cranes, Trusses, Size Reduction Systems, Other Automation Products), type of waste (Listed Wastes, Characteristic Wastes, Universal Waste, Mixed Waste), and industry (Manufacturing, Chemical, Energy, Consumer Care, Government, Other Industries). Key players like Konecranes, PAR Systems, and others are profiled, providing a holistic view of this dynamic market. The report’s detailed analysis and projections make it an essential resource for investors, industry professionals, and strategic decision-makers.

Middle-East and Africa Hazardous Waste Handling Automation Industry Market Dynamics & Structure

The Middle East & Africa hazardous waste handling automation market is experiencing significant growth driven by increasing environmental regulations, rising industrialization, and a growing focus on sustainable waste management practices. Market concentration is moderate, with a few major players holding substantial market share, but a significant number of smaller, specialized firms also contributing. Technological innovation is a key driver, with advancements in robotics, AI, and sensor technologies leading to more efficient and safer waste handling processes.

Market Structure Highlights:

- Market Size (2025): xx Million

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Strong emphasis on robotics, AI, and sensor integration for improved efficiency and safety. Key barriers include high initial investment costs and integration complexities.

- Regulatory Framework: Varying levels of regulatory stringency across countries, creating both opportunities and challenges for market participants. Stringent regulations in certain countries drive adoption, while inconsistencies create complexity.

- Competitive Product Substitutes: Manual handling remains a significant competitor, particularly in smaller operations or those with limited financial resources. However, automation's advantages in safety and efficiency are driving substitution.

- End-User Demographics: Manufacturing, chemical, and energy sectors are the primary end-users, with government and consumer care sectors showing growing demand.

- M&A Trends: A moderate number of M&A deals have been observed in recent years, with larger companies acquiring smaller, specialized firms to expand their product portfolios and market reach. xx M&A deals were recorded between 2019 and 2024.

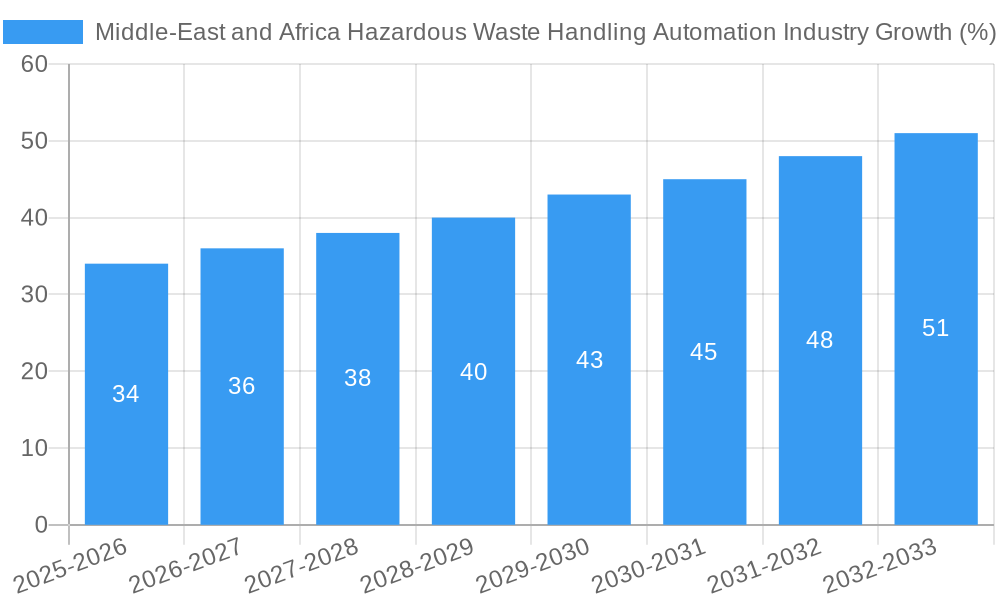

Middle-East and Africa Hazardous Waste Handling Automation Industry Growth Trends & Insights

The Middle East & Africa hazardous waste handling automation market exhibits robust growth, driven by a confluence of factors. Increasing awareness of environmental concerns, coupled with stringent government regulations promoting sustainable waste management, is fueling demand for automated solutions. This is further amplified by rapid industrialization and urbanization across the region, generating a significant volume of hazardous waste requiring efficient and safe handling. The adoption rate of automation technologies is steadily increasing, particularly in larger industrial facilities. Technological disruptions, such as the introduction of advanced robotics and AI-powered systems, are enhancing the efficiency and capabilities of waste handling automation. Furthermore, evolving consumer behavior towards environmentally responsible practices further bolsters the market's growth trajectory.

- Historical Market Size (2019): xx Million

- Market Size (2024): xx Million

- Projected Market Size (2033): xx Million

- CAGR (2025-2033): xx%

- Market Penetration (2025): xx%

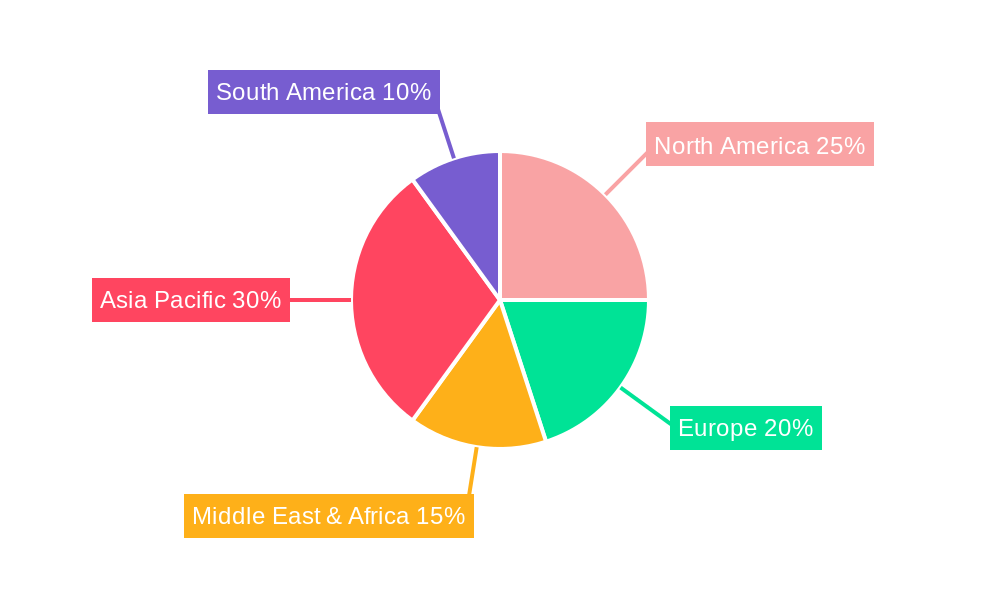

Dominant Regions, Countries, or Segments in Middle-East and Africa Hazardous Waste Handling Automation Industry

The Middle East region, particularly the Gulf Cooperation Council (GCC) countries, demonstrates the most significant growth within the hazardous waste handling automation market. This is driven by high levels of industrial activity, substantial government investments in infrastructure development, and strict environmental regulations. Within the automation product segment, cranes and manipulator arms show the highest demand, reflecting the need for efficient handling of large volumes of hazardous waste. The chemical and energy industries are the largest end-users, due to the inherently hazardous nature of their operations.

Key Drivers:

- Stringent Environmental Regulations: Growing emphasis on compliance with international environmental standards is driving adoption.

- Government Investments: Significant public investments in infrastructure projects and waste management initiatives are creating opportunities.

- High Industrial Activity: Rapid industrialization across the region generates a significant volume of hazardous waste.

Dominant Segments:

- Region: Middle East (GCC countries specifically)

- Automation Product: Cranes and Manipulator Arms

- Industry: Chemical and Energy

Middle-East and Africa Hazardous Waste Handling Automation Industry Product Landscape

The product landscape is characterized by a diverse range of automation solutions tailored to various waste types and industrial needs. Innovations focus on enhancing safety features, improving efficiency, and reducing operational costs. Manipulator arms offer precise handling capabilities, while cranes handle large volumes, and size reduction systems facilitate efficient waste processing. Unique selling propositions include advanced safety systems, remote operation capabilities, and data analytics for optimized performance. Recent advancements include AI-powered systems for automated waste sorting and real-time monitoring, leading to enhanced efficiency and reduced human intervention.

Key Drivers, Barriers & Challenges in Middle-East and Africa Hazardous Waste Handling Automation Industry

Key Drivers:

- Stringent environmental regulations driving compliance needs.

- Rising industrialization generating large volumes of hazardous waste.

- Government initiatives promoting sustainable waste management practices.

- Technological advancements offering increased efficiency and safety.

Challenges & Restraints:

- High initial investment costs for automation systems.

- Lack of skilled workforce for installation and maintenance.

- Supply chain disruptions affecting the availability of components.

- Varying regulatory frameworks across different countries in the region.

Emerging Opportunities in Middle-East and Africa Hazardous Waste Handling Automation Industry

Emerging opportunities lie in expanding automation adoption across smaller and medium-sized enterprises (SMEs), developing customized solutions for specific waste types, and leveraging AI and IoT for predictive maintenance and real-time monitoring. The untapped potential in waste-to-energy applications and the growing demand for sustainable waste management solutions present substantial opportunities for growth. Furthermore, focusing on developing robust and affordable solutions tailored to the unique challenges faced by different countries in the region will unlock further market expansion.

Growth Accelerators in the Middle-East and Africa Hazardous Waste Handling Automation Industry Industry

Long-term growth will be fueled by continued technological innovation, strategic partnerships between automation providers and waste management companies, and government support for sustainable waste management initiatives. Expansion into new markets, particularly in less developed areas of Africa, offers significant potential. Investment in research and development to develop more efficient and cost-effective automation solutions will further accelerate market growth.

Key Players Shaping the Middle-East and Africa Hazardous Waste Handling Automation Industry Market

- Konecranes

- PAR Systems

- Floatograph Technologies

- ACE Inc

- Hiab

- Hosokawa Micron Powder Systems

- DX Engineering

- Terex MHPS GmbH

- Ramky Enviro Engineers Ltd

- Pallmann Maschinenfabrik GmbH & Co KG

- PENZ Crane GmbH

Notable Milestones in Middle-East and Africa Hazardous Waste Handling Automation Industry Sector

- December 2021: Veolia awarded a management contract for water and wastewater services in Riyadh and 22 municipalities, further establishing its role in waste management within the region. This deal signaled a significant move towards larger scale waste management contracts and highlights the importance of efficient waste handling technologies. The additional 120,000 metric tons of hazardous waste slated for treatment in Jubail through Veolia's incinerator project underscores the growing need for effective and advanced waste processing solutions.

In-Depth Middle-East and Africa Hazardous Waste Handling Automation Industry Market Outlook

The future of the Middle East & Africa hazardous waste handling automation market is exceptionally bright. Continued urbanization, industrial growth, and stringent environmental regulations will drive sustained demand for advanced automation solutions. Strategic partnerships, technological advancements (particularly in AI and robotics), and a focus on sustainable practices will be key factors shaping the market's future trajectory. The expansion into underserved markets and the development of tailored solutions will unlock significant growth opportunities, creating a highly lucrative landscape for both established and emerging players in the industry.

Middle-East and Africa Hazardous Waste Handling Automation Industry Segmentation

-

1. Automation Product

- 1.1. Manipulator Arms

- 1.2. Telescoping Masts

- 1.3. Cranes

- 1.4. Trusses

- 1.5. Size Reduction Systems

- 1.6. Other Automation Products

-

2. Type of Waste

- 2.1. Listed Wastes

- 2.2. Charecteristic Wastes

- 2.3. Universal Waste

- 2.4. Mixed Waste

-

3. Industry

- 3.1. Manufacturing

- 3.2. Chemical

- 3.3. Energy

- 3.4. Consumer Care

- 3.5. Government

- 3.6. Other Industries

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Israel

- 4.4. South Africa

- 4.5. Rest of Middle-East and Africa

Middle-East and Africa Hazardous Waste Handling Automation Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Israel

- 4. South Africa

- 5. Rest of Middle East and Africa

Middle-East and Africa Hazardous Waste Handling Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government and Industry Regulations; Growing Concerns about Waste Management

- 3.3. Market Restrains

- 3.3.1. High Costs Involved

- 3.4. Market Trends

- 3.4.1. Demand for Automated Handling Solutions May Increase Safer Handling and Disposable of E-waste

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Automation Product

- 5.1.1. Manipulator Arms

- 5.1.2. Telescoping Masts

- 5.1.3. Cranes

- 5.1.4. Trusses

- 5.1.5. Size Reduction Systems

- 5.1.6. Other Automation Products

- 5.2. Market Analysis, Insights and Forecast - by Type of Waste

- 5.2.1. Listed Wastes

- 5.2.2. Charecteristic Wastes

- 5.2.3. Universal Waste

- 5.2.4. Mixed Waste

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. Manufacturing

- 5.3.2. Chemical

- 5.3.3. Energy

- 5.3.4. Consumer Care

- 5.3.5. Government

- 5.3.6. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Israel

- 5.4.4. South Africa

- 5.4.5. Rest of Middle-East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Israel

- 5.5.4. South Africa

- 5.5.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Automation Product

- 6. Saudi Arabia Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Automation Product

- 6.1.1. Manipulator Arms

- 6.1.2. Telescoping Masts

- 6.1.3. Cranes

- 6.1.4. Trusses

- 6.1.5. Size Reduction Systems

- 6.1.6. Other Automation Products

- 6.2. Market Analysis, Insights and Forecast - by Type of Waste

- 6.2.1. Listed Wastes

- 6.2.2. Charecteristic Wastes

- 6.2.3. Universal Waste

- 6.2.4. Mixed Waste

- 6.3. Market Analysis, Insights and Forecast - by Industry

- 6.3.1. Manufacturing

- 6.3.2. Chemical

- 6.3.3. Energy

- 6.3.4. Consumer Care

- 6.3.5. Government

- 6.3.6. Other Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Israel

- 6.4.4. South Africa

- 6.4.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Automation Product

- 7. United Arab Emirates Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Automation Product

- 7.1.1. Manipulator Arms

- 7.1.2. Telescoping Masts

- 7.1.3. Cranes

- 7.1.4. Trusses

- 7.1.5. Size Reduction Systems

- 7.1.6. Other Automation Products

- 7.2. Market Analysis, Insights and Forecast - by Type of Waste

- 7.2.1. Listed Wastes

- 7.2.2. Charecteristic Wastes

- 7.2.3. Universal Waste

- 7.2.4. Mixed Waste

- 7.3. Market Analysis, Insights and Forecast - by Industry

- 7.3.1. Manufacturing

- 7.3.2. Chemical

- 7.3.3. Energy

- 7.3.4. Consumer Care

- 7.3.5. Government

- 7.3.6. Other Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Israel

- 7.4.4. South Africa

- 7.4.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Automation Product

- 8. Israel Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Automation Product

- 8.1.1. Manipulator Arms

- 8.1.2. Telescoping Masts

- 8.1.3. Cranes

- 8.1.4. Trusses

- 8.1.5. Size Reduction Systems

- 8.1.6. Other Automation Products

- 8.2. Market Analysis, Insights and Forecast - by Type of Waste

- 8.2.1. Listed Wastes

- 8.2.2. Charecteristic Wastes

- 8.2.3. Universal Waste

- 8.2.4. Mixed Waste

- 8.3. Market Analysis, Insights and Forecast - by Industry

- 8.3.1. Manufacturing

- 8.3.2. Chemical

- 8.3.3. Energy

- 8.3.4. Consumer Care

- 8.3.5. Government

- 8.3.6. Other Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Israel

- 8.4.4. South Africa

- 8.4.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Automation Product

- 9. South Africa Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Automation Product

- 9.1.1. Manipulator Arms

- 9.1.2. Telescoping Masts

- 9.1.3. Cranes

- 9.1.4. Trusses

- 9.1.5. Size Reduction Systems

- 9.1.6. Other Automation Products

- 9.2. Market Analysis, Insights and Forecast - by Type of Waste

- 9.2.1. Listed Wastes

- 9.2.2. Charecteristic Wastes

- 9.2.3. Universal Waste

- 9.2.4. Mixed Waste

- 9.3. Market Analysis, Insights and Forecast - by Industry

- 9.3.1. Manufacturing

- 9.3.2. Chemical

- 9.3.3. Energy

- 9.3.4. Consumer Care

- 9.3.5. Government

- 9.3.6. Other Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Israel

- 9.4.4. South Africa

- 9.4.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Automation Product

- 10. Rest of Middle East and Africa Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Automation Product

- 10.1.1. Manipulator Arms

- 10.1.2. Telescoping Masts

- 10.1.3. Cranes

- 10.1.4. Trusses

- 10.1.5. Size Reduction Systems

- 10.1.6. Other Automation Products

- 10.2. Market Analysis, Insights and Forecast - by Type of Waste

- 10.2.1. Listed Wastes

- 10.2.2. Charecteristic Wastes

- 10.2.3. Universal Waste

- 10.2.4. Mixed Waste

- 10.3. Market Analysis, Insights and Forecast - by Industry

- 10.3.1. Manufacturing

- 10.3.2. Chemical

- 10.3.3. Energy

- 10.3.4. Consumer Care

- 10.3.5. Government

- 10.3.6. Other Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Israel

- 10.4.4. South Africa

- 10.4.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Automation Product

- 11. South Africa Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Middle-East and Africa Hazardous Waste Handling Automation Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Konecranes

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 PAR Systems

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Floatograph Technologies

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 ACE Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Hiab

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Hosokawa Micron Powder Systems

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 DX Engineering

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Terex MHPS GmbH

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Ramky Enviro Engineers Ltd*List Not Exhaustive

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Pallmann Maschinenfabrik GmbH & Co KG

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 PENZ Crane GmbH

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Konecranes

List of Figures

- Figure 1: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Hazardous Waste Handling Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Automation Product 2019 & 2032

- Table 3: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Type of Waste 2019 & 2032

- Table 4: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 5: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Automation Product 2019 & 2032

- Table 15: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Type of Waste 2019 & 2032

- Table 16: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 17: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Automation Product 2019 & 2032

- Table 20: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Type of Waste 2019 & 2032

- Table 21: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 22: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Automation Product 2019 & 2032

- Table 25: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Type of Waste 2019 & 2032

- Table 26: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 27: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Automation Product 2019 & 2032

- Table 30: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Type of Waste 2019 & 2032

- Table 31: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 32: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Automation Product 2019 & 2032

- Table 35: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Type of Waste 2019 & 2032

- Table 36: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Industry 2019 & 2032

- Table 37: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle-East and Africa Hazardous Waste Handling Automation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Hazardous Waste Handling Automation Industry?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Middle-East and Africa Hazardous Waste Handling Automation Industry?

Key companies in the market include Konecranes, PAR Systems, Floatograph Technologies, ACE Inc, Hiab, Hosokawa Micron Powder Systems, DX Engineering, Terex MHPS GmbH, Ramky Enviro Engineers Ltd*List Not Exhaustive, Pallmann Maschinenfabrik GmbH & Co KG, PENZ Crane GmbH.

3. What are the main segments of the Middle-East and Africa Hazardous Waste Handling Automation Industry?

The market segments include Automation Product, Type of Waste, Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government and Industry Regulations; Growing Concerns about Waste Management.

6. What are the notable trends driving market growth?

Demand for Automated Handling Solutions May Increase Safer Handling and Disposable of E-waste.

7. Are there any restraints impacting market growth?

High Costs Involved.

8. Can you provide examples of recent developments in the market?

In December 2021, the National Water Company awarded Veolia the Management Contract for water and wastewater services in Riyadh's capital and 22 outlying municipalities. Veolia is also becoming Saudi Aramco's exclusive partner for the treatment of its industrial and non-hazardous waste. These quantities are in addition to the 120,000 metric ton of hazardous waste that will soon be treated in Jubail, where Veolia is finalizing the construction of an incinerator for Sadara Chemical Company and other nearby industrial companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Hazardous Waste Handling Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Hazardous Waste Handling Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Hazardous Waste Handling Automation Industry?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Hazardous Waste Handling Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence