Key Insights

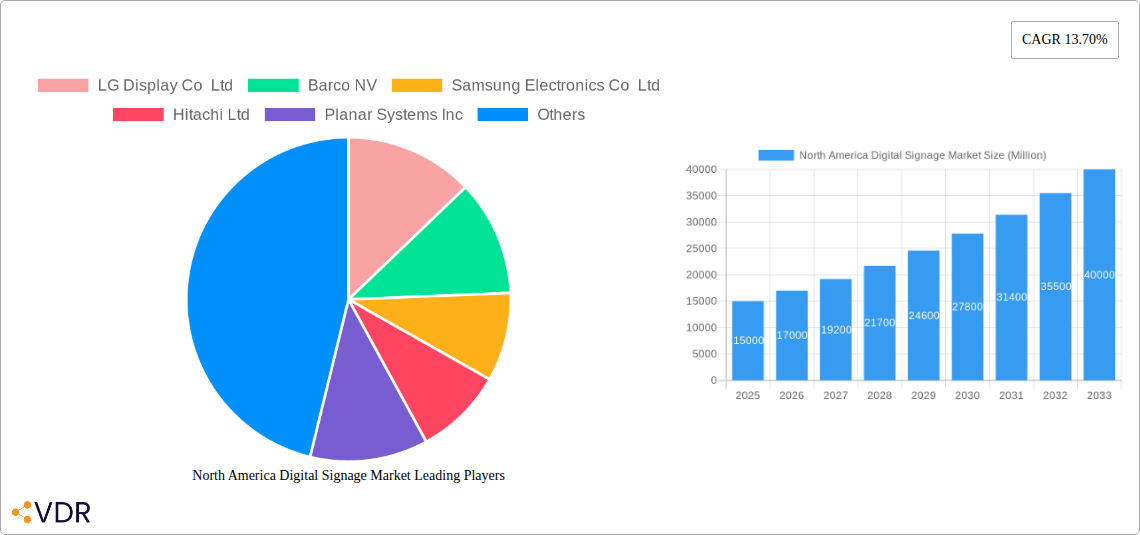

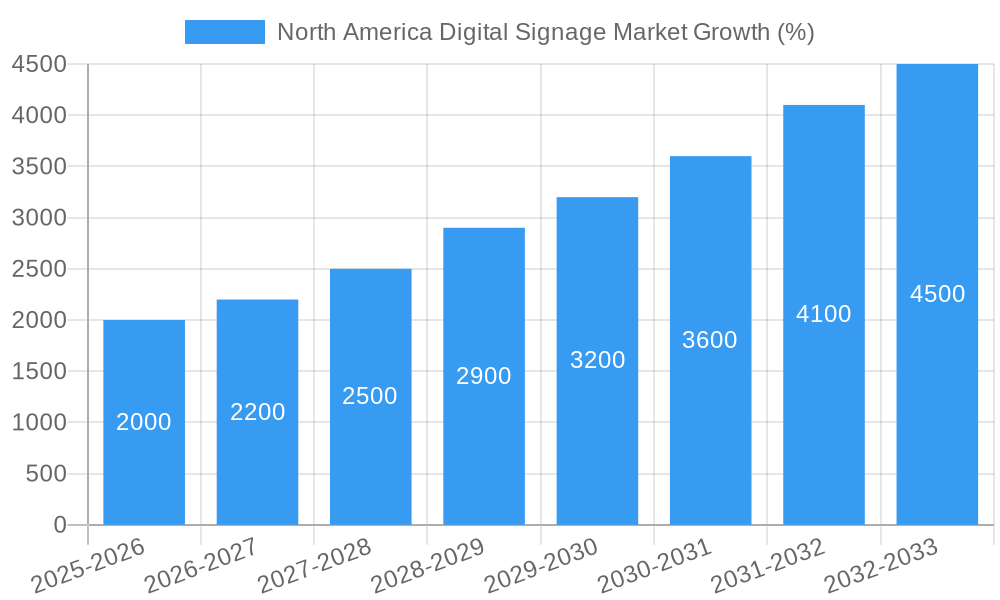

The North American digital signage market is experiencing robust growth, projected to reach a substantial size driven by increasing adoption across various sectors. The market's Compound Annual Growth Rate (CAGR) of 13.70% from 2019 to 2024 suggests a significant upward trajectory, continuing into the forecast period (2025-2033). Key drivers include the rising need for enhanced customer engagement in retail settings, the growing importance of wayfinding and information dissemination in transportation hubs, and the increasing demand for interactive and personalized communication in corporate and educational environments. Furthermore, technological advancements, such as the integration of artificial intelligence and improved display technologies (higher resolutions, better brightness, and more energy-efficient options), are fueling market expansion. The market is segmented by type (hardware, software, and services) and end-user vertical (retail, transportation, hospitality, corporate, education, government, and others). While hardware currently holds the largest market share, the software and services segments are experiencing rapid growth, indicating a shift towards integrated solutions that offer greater flexibility and functionality. The United States constitutes a major portion of the North American market, followed by Canada, with significant growth potential also foreseen in Mexico. Leading companies like LG Display, Samsung, and others are constantly innovating and expanding their product portfolios to cater to this expanding demand.

The competitive landscape is characterized by the presence of established players and emerging innovative companies. The market's continued growth will likely attract further investment and innovation, leading to the development of more sophisticated and user-friendly digital signage solutions. While challenges such as initial investment costs and the need for ongoing maintenance could potentially restrain market growth, the overall positive industry outlook suggests continued expansion across various sectors in the foreseeable future. The convenience and effectiveness of digital signage in delivering targeted messages, enhancing branding, and optimizing operational efficiencies will solidify its role in the modern business landscape. Expansion into emerging technologies like interactive displays and augmented reality experiences further amplify the market's future prospects.

North America Digital Signage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America digital signage market, covering the period 2019-2033. It offers valuable insights for industry professionals, investors, and strategists seeking to understand market dynamics, growth trends, and key players in this rapidly evolving sector. The report segments the market by type (Hardware, Software, Services), end-user vertical (Retail, Transportation, Hospitality, Corporate, Education, Government, Others), and country (United States, Canada). The base year for this analysis is 2025, with a forecast period extending to 2033. Key players analyzed include LG Display Co Ltd, Barco NV, Samsung Electronics Co Ltd, Hitachi Ltd, Planar Systems Inc, NEC Display Solutions Ltd, Cisco Systems Inc, Sharp Corporation, Goodview, Panasonic Corporation, and Sony Corporation.

North America Digital Signage Market Dynamics & Structure

The North American digital signage market exhibits a moderately consolidated structure, with several key players commanding significant market share. Technological innovation, particularly in areas like AI-powered content management and interactive displays, is a primary growth driver. Regulatory frameworks concerning data privacy and accessibility are increasingly influencing market practices. The market also faces competition from alternative communication methods, such as traditional print advertising and online media. The end-user demographics are diverse, with adoption rates varying across different verticals. The historical period (2019-2024) witnessed several mergers and acquisitions, contributing to market consolidation. The estimated market size in 2025 is projected at xx Million units.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: AI, interactive displays, and 8K resolution are key innovation drivers.

- Regulatory Landscape: Data privacy regulations (e.g., CCPA, GDPR) impact data collection and usage.

- Competitive Substitutes: Traditional print advertising and online media pose competitive challenges.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024.

North America Digital Signage Market Growth Trends & Insights

The North America digital signage market is experiencing robust growth, driven by increasing demand across diverse sectors. The market size has expanded significantly from xx Million units in 2019 to an estimated xx Million units in 2025, reflecting a CAGR of xx% during the historical period. This growth is fueled by the rising adoption of digital signage across retail, hospitality, and corporate settings. Technological advancements, such as the integration of interactive features and improved content management systems, are further accelerating market expansion. Consumer behavior shifts towards digital engagement and the need for personalized experiences are also contributing factors. Market penetration is expected to reach xx% by 2033, indicating substantial future growth potential. The forecast period (2025-2033) projects a CAGR of xx%, driven by continued technological advancements and expanding applications.

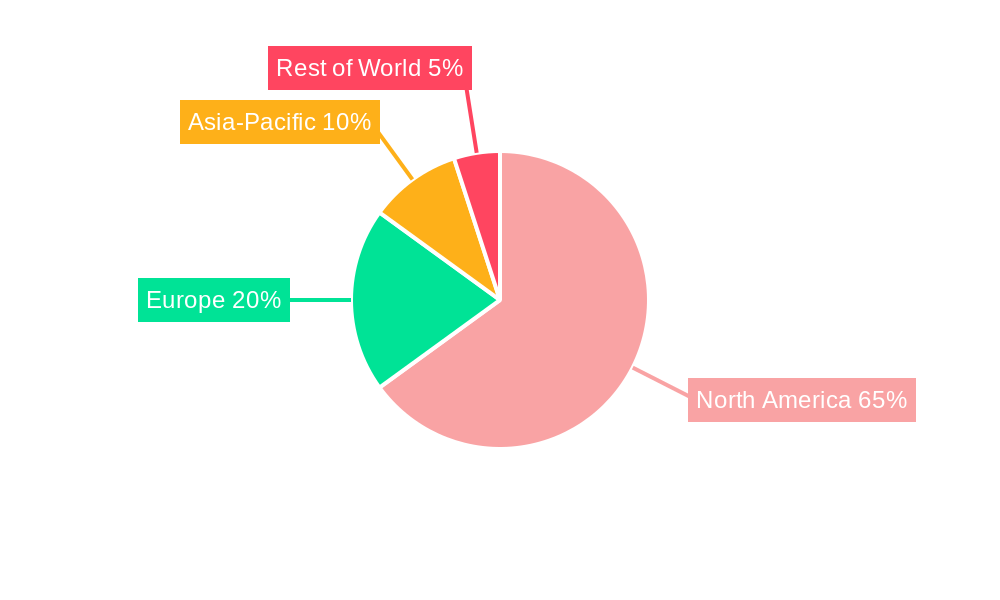

Dominant Regions, Countries, or Segments in North America Digital Signage Market

The United States is the dominant market within North America, accounting for approximately xx% of the total market share in 2025. This dominance is attributed to factors such as a large and developed retail sector, high technological adoption rates, and robust infrastructure. The retail segment is the largest end-user vertical, driven by the need for enhanced customer engagement and targeted advertising. Hardware constitutes the largest segment by type, followed by software and services. Canada exhibits significant growth potential, driven by increasing investments in digital infrastructure and expanding adoption across various sectors.

- United States: Large retail sector, high technological adoption, robust infrastructure.

- Canada: Growing investments in digital infrastructure, expanding adoption across sectors.

- Retail Segment: High demand for enhanced customer engagement and targeted advertising.

- Hardware Segment: Dominated by leading display manufacturers.

North America Digital Signage Market Product Landscape

The digital signage market offers a diverse range of products, including LED displays, LCD screens, projectors, and interactive kiosks. Recent innovations focus on improved resolution, enhanced brightness, and the integration of interactive features. Products are differentiated by size, resolution, brightness, interactivity, and content management capabilities. Key features include seamless content management systems, remote monitoring capabilities, and integration with analytics platforms for data-driven decision-making.

Key Drivers, Barriers & Challenges in North America Digital Signage Market

Key Drivers:

- Increasing demand for enhanced customer engagement and brand building.

- Technological advancements, including AI-powered content management and interactive displays.

- Growing adoption of digital signage across diverse sectors, including retail, hospitality, and transportation.

Challenges:

- High initial investment costs for hardware and software.

- Competition from alternative communication methods.

- Concerns about data privacy and security.

- Supply chain disruptions impacting component availability and costs.

Emerging Opportunities in North America Digital Signage Market

Emerging opportunities lie in the integration of advanced technologies such as augmented reality (AR) and virtual reality (VR) to create immersive customer experiences. The growing adoption of Internet of Things (IoT) enabled signage is also opening new avenues. Untapped markets in smaller towns and rural areas offer significant expansion potential. The development of tailored solutions for niche industries and the focus on sustainable and energy-efficient signage present exciting opportunities.

Growth Accelerators in the North America Digital Signage Market Industry

Strategic partnerships between hardware manufacturers and software providers are accelerating market growth. Technological breakthroughs in display technologies, such as mini-LED and micro-LED, are enhancing visual quality and energy efficiency. The growing emphasis on data analytics to measure the effectiveness of digital signage campaigns is further propelling market expansion. Expansion into new geographical areas and diversification into specialized segments are also expected to contribute to long-term growth.

Key Players Shaping the North America Digital Signage Market Market

- LG Display Co Ltd

- Barco NV

- Samsung Electronics Co Ltd

- Hitachi Ltd

- Planar Systems Inc

- NEC Display Solutions Ltd

- Cisco Systems Inc

- Sharp Corporation

- Goodview

- Panasonic Corporation

- Sony Corporation

Notable Milestones in North America Digital Signage Market Sector

- October 2021: L.B. Foster Company launched a new service providing sign language accessibility for its mobile Inform Media digital display units used in rail transit and air travel.

- July 2021: 22Miles Inc. announced Digital Signage Ready (DSR), a portfolio of software and service bundles for quick digital signage setup and deployment.

In-Depth North America Digital Signage Market Market Outlook

The North America digital signage market is poised for sustained growth, driven by continuous technological innovations, expanding applications across various sectors, and increasing demand for personalized customer experiences. Strategic partnerships, investments in R&D, and the adoption of data-driven strategies will play a crucial role in shaping future market dynamics. The market's long-term potential is significant, offering attractive opportunities for both established players and new entrants.

North America Digital Signage Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. LCD/LED Display

- 1.1.2. OLED Display

- 1.1.3. Media Players

- 1.1.4. Projectors/Projection Screens

- 1.1.5. Other Hardware

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Retail

- 2.2. Transportation

- 2.3. Hospitality

- 2.4. Corporate

- 2.5. Education

- 2.6. Government

- 2.7. Other End-user Verticals

North America Digital Signage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Digital Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Turnkey Solutions; Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising; Steady Increase in DOOH Spending in the North America to Continue to Supplement Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns Over Invasion of Customer Privacy

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. LCD/LED Display

- 5.1.1.2. OLED Display

- 5.1.1.3. Media Players

- 5.1.1.4. Projectors/Projection Screens

- 5.1.1.5. Other Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Retail

- 5.2.2. Transportation

- 5.2.3. Hospitality

- 5.2.4. Corporate

- 5.2.5. Education

- 5.2.6. Government

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 LG Display Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Barco NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samsung Electronics Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planar Systems Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NEC Display Solutions Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cisco Systems Inc *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sharp Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Goodview

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sony Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 LG Display Co Ltd

List of Figures

- Figure 1: North America Digital Signage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Digital Signage Market Share (%) by Company 2024

List of Tables

- Table 1: North America Digital Signage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Digital Signage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Digital Signage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: North America Digital Signage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Digital Signage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Digital Signage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America Digital Signage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: North America Digital Signage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Digital Signage Market?

The projected CAGR is approximately 13.70%.

2. Which companies are prominent players in the North America Digital Signage Market?

Key companies in the market include LG Display Co Ltd, Barco NV, Samsung Electronics Co Ltd, Hitachi Ltd, Planar Systems Inc, NEC Display Solutions Ltd, Cisco Systems Inc *List Not Exhaustive, Sharp Corporation, Goodview, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the North America Digital Signage Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Turnkey Solutions; Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising; Steady Increase in DOOH Spending in the North America to Continue to Supplement Market Growth.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Concerns Over Invasion of Customer Privacy.

8. Can you provide examples of recent developments in the market?

October 2021 - L.B. Foster Company launched a new service to provide sign language accessibility for its mobile. It fixed Inform Media digital display units currently offered to rail transits and air travel system operators throughout the Americas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Digital Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Digital Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Digital Signage Market?

To stay informed about further developments, trends, and reports in the North America Digital Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence