Key Insights

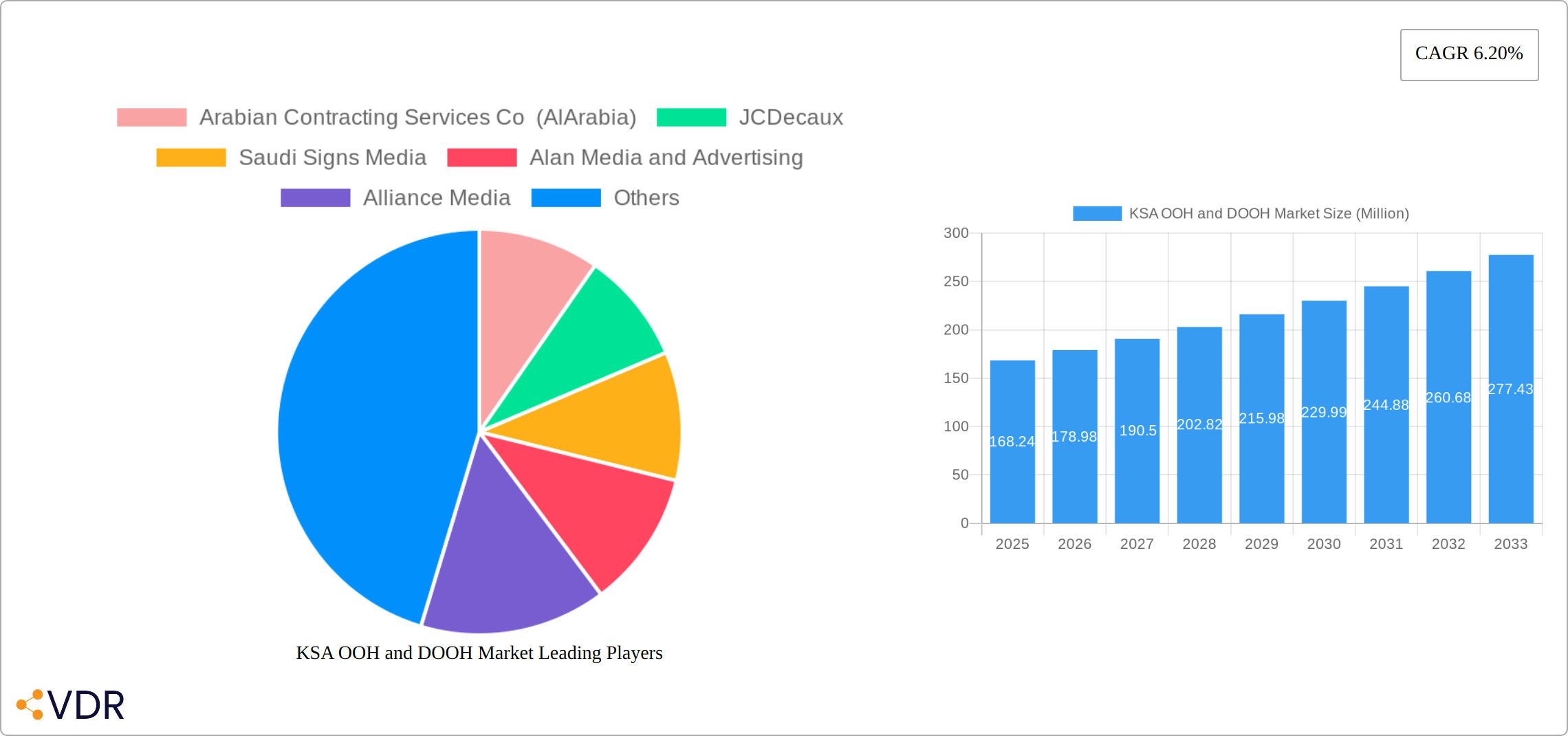

The Kingdom of Saudi Arabia (KSA) Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is experiencing robust growth, projected to reach a market size of $168.24 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant infrastructure development projects, including the ambitious Vision 2030 initiatives, are creating numerous new advertising spaces across the country. Secondly, the increasing adoption of digital technologies is driving the shift towards DOOH, offering advertisers greater targeting capabilities, measurability, and dynamic content delivery. Thirdly, a burgeoning young and digitally engaged population provides a receptive audience for OOH and DOOH campaigns. While regulatory frameworks and potential economic fluctuations represent potential restraints, the overall outlook remains positive, driven by the government's investment in urban development and the increasing sophistication of advertising strategies employed by both domestic and international brands. The market's segmentation likely encompasses various formats, including billboards, transit advertising, street furniture, and digital screens located in high-traffic areas like shopping malls and transportation hubs.

The competitive landscape is characterized by a mix of established local players like Arabian Contracting Services Co (AlArabia), JCDecaux, Saudi Signs Media, and Alan Media and Advertising, alongside international companies like Daktronics Inc and Alliance Media. This suggests a dynamic market with both local expertise and global innovation at play. Future growth will likely be shaped by technological advancements, such as programmatic DOOH advertising and the integration of data analytics to enhance campaign effectiveness. Furthermore, the increasing adoption of interactive and experiential OOH formats will likely play a pivotal role in shaping consumer engagement and further boosting market expansion. The competitive intensity will likely remain high, with companies striving for innovation and strategic partnerships to secure market share.

KSA OOH and DOOH Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Kingdom of Saudi Arabia's (KSA) Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, key players, and future opportunities, offering valuable insights for industry professionals, investors, and strategic planners. The report segments the market into its parent (OOH) and child (DOOH) categories, providing granular data and analysis for a clearer understanding of this rapidly evolving landscape. The market value is presented in millions of units.

KSA OOH and DOOH Market Dynamics & Structure

This section analyzes the KSA OOH and DOOH market structure, focusing on market concentration, technological advancements, regulatory aspects, competitive dynamics, end-user demographics, and M&A activity. The KSA OOH market is characterized by a relatively concentrated landscape with key players holding significant market shares. However, the DOOH segment displays faster growth and more fragmented competition, attracting new entrants and fostering innovation. Technological advancements, like programmatic DOOH and interactive displays, are major drivers, but regulatory frameworks, while evolving, sometimes create barriers to entry and rapid expansion. The report explores these dynamics with quantitative data and qualitative insights.

- Market Concentration: The top 5 players hold approximately xx% of the total OOH market, while the DOOH market is more fragmented with the top 5 holding approximately yy%.

- Technological Innovation: Programmatic DOOH, AI-powered targeting, and interactive displays are key innovation drivers.

- Regulatory Framework: Government policies on advertising and urban development significantly influence market growth.

- Competitive Landscape: Intense competition exists among established players and emerging technology companies.

- M&A Activity: The number of M&A deals in the period 2019-2024 totaled approximately zz deals, with an upward trend expected in the forecast period. This is driven by consolidation efforts and strategic expansion.

- End-User Demographics: The report analyzes the demographics of key advertising clients across various industries (Retail, FMCG, etc.).

KSA OOH and DOOH Market Growth Trends & Insights

The Kingdom of Saudi Arabia's Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is experiencing robust growth, fueled by rapid urbanization, a burgeoning middle class with increasing disposable incomes, and significant government investments in infrastructure development. From 2019 to 2024, the market witnessed substantial expansion, with the DOOH segment demonstrating a notably higher Compound Annual Growth Rate (CAGR) than traditional OOH, reflecting the widespread adoption of digital technologies and the shift in consumer preferences towards engaging and interactive advertising experiences. This trend is expected to continue, driven by a growing demand for data-driven, targeted advertising campaigns that offer measurable Return on Investment (ROI).

Consumer behavior is evolving, with audiences increasingly receptive to dynamic and interactive advertising formats. This preference is directly impacting the demand for sophisticated DOOH solutions. Our analysis, utilizing [Replace XXX with specific analytical tool or methodology, e.g., proprietary market modeling and industry expert interviews], projects continued upward trajectory for both OOH and DOOH segments.

- Market Size (2025): OOH: [Replace xxx with actual value] Million SAR; DOOH: [Replace yyy with actual value] Million SAR

- CAGR (2025-2033): OOH: [Replace xx with actual value]%; DOOH: [Replace yy with actual value]%

- Market Penetration: OOH: [Replace xx with actual value]%; DOOH: [Replace yy with actual value]% (2025)

Dominant Regions, Countries, or Segments in KSA OOH and DOOH Market

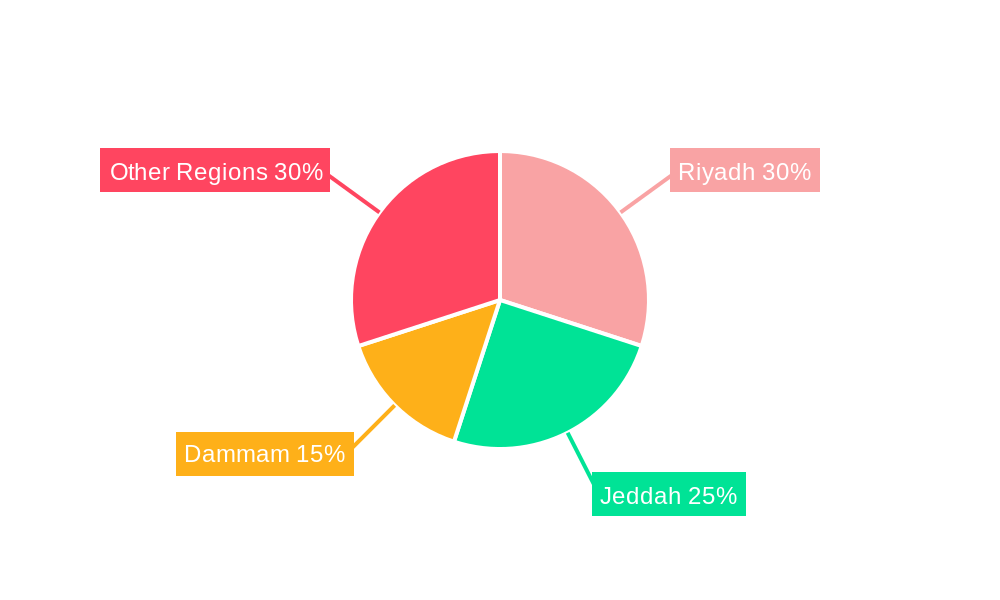

This section identifies the leading regions and segments driving market growth in KSA. Major metropolitan areas like Riyadh, Jeddah, and Dammam dominate the market due to higher population density, greater consumer spending, and advanced infrastructure. The retail and FMCG sectors are the key advertisers, leveraging OOH and DOOH for brand building and promotion.

- Key Drivers: Government initiatives promoting tourism and infrastructure development are propelling growth in specific regions.

- Dominant Regions: Riyadh and Jeddah account for approximately xx% of the total OOH/DOOH market.

- Dominant Segments: Retail and FMCG account for approximately yy% of ad spending in OOH/DOOH.

KSA OOH and DOOH Market Product Landscape

The KSA OOH and DOOH market showcases a dynamic product landscape characterized by continuous innovation. High-definition displays, interactive kiosks, sophisticated programmatic advertising platforms, and data-driven targeting solutions are transforming the industry. These advancements are not only enhancing the effectiveness of advertising campaigns but also providing clients with quantifiable ROI through precise campaign measurement and improved audience engagement. Key players are differentiating themselves through unique selling propositions (USPs) focusing on improved audience engagement, highly targeted reach, and precise campaign measurement capabilities, leveraging technologies like AI and machine learning to optimize ad delivery and performance.

Key Drivers, Barriers & Challenges in KSA OOH and DOOH Market

Key Drivers: The rapid urbanization in KSA, the burgeoning middle class, and government initiatives to promote tourism and diversify the economy significantly drive OOH and DOOH market growth. Technological innovations like programmatic DOOH and advanced analytics further amplify this growth.

Key Challenges & Restraints: Competition from digital channels, regulatory restrictions on advertising locations, and the cost of implementing advanced DOOH technologies present significant challenges. Supply chain disruptions and rising energy costs also contribute to market fluctuations.

Emerging Opportunities in KSA OOH and DOOH Market

Several key trends are shaping future growth opportunities within the KSA OOH and DOOH market. The integration of DOOH with mobile technologies, the innovative use of augmented reality (AR) in outdoor advertising experiences, and the expansion of DOOH into non-traditional locations such as airports, hospitals, and transportation hubs are creating exciting new avenues for advertisers. Furthermore, the untapped potential in smaller cities and towns, the rise of experiential marketing campaigns designed to create immersive and memorable brand experiences, and the ever-growing demand for data-driven insights present significant growth opportunities for market players.

Growth Accelerators in the KSA OOH and DOOH Market Industry

Several factors are acting as key growth accelerators for the KSA OOH and DOOH market. Significant technological advancements, strategic partnerships between established OOH companies and innovative technology providers, and proactive government initiatives aimed at improving infrastructure and attracting substantial foreign investment are all contributing to long-term market expansion. The increasing adoption of programmatic buying, advanced data analytics techniques, and the development of innovative ad formats further propel market growth. Furthermore, a supportive regulatory environment and increasing focus on digital transformation within the advertising sector are creating a positive ecosystem for market expansion.

Key Players Shaping the KSA OOH and DOOH Market Market

- Arabian Contracting Services Co (AlArabia)

- JCDecaux

- Saudi Signs Media

- Alan Media and Advertising

- Alliance Media

- Daktronics Inc

- Advertising Ways Company

- List Not Exhaustive

Notable Milestones in KSA OOH and DOOH Market Sector

- October 2023: Yazle partnered with Invenda, boosting programmatic DOOH access in KSA and the UAE.

- April 2024: Diriyah Season's "Out of Phone (OOP)" campaign integrated TikTok and OOH advertising, a regional first.

In-Depth KSA OOH and DOOH Market Market Outlook

The KSA OOH and DOOH market is poised for significant growth in the coming years, driven by continuous technological innovation, increasing ad spending, and supportive government policies. Strategic partnerships and expansion into untapped markets present lucrative opportunities for both established players and new entrants. The market’s future is bright, driven by the kingdom’s progressive vision and the increasing adoption of advanced advertising technologies.

KSA OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other Digital OOH Types

-

2. Application

- 2.1. Billboards

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Other Transportation Applications (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-based Media

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

KSA OOH and DOOH Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

KSA OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Growing Development of Public Transport Networks

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising; Growing Development of Public Transport Networks

- 3.4. Market Trends

- 3.4.1. Retail and Consumer Goods Segment Holds the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global KSA OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other Digital OOH Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboards

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Other Transportation Applications (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-based Media

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America KSA OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Static (Traditional) OOH

- 6.1.2. Digital OOH (LED Screens)

- 6.1.2.1. Programmatic OOH

- 6.1.2.2. Other Digital OOH Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Billboards

- 6.2.2. Transportation (Transit)

- 6.2.2.1. Airports

- 6.2.2.2. Other Transportation Applications (Buses, etc.)

- 6.2.3. Street Furniture

- 6.2.4. Other Place-based Media

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Retail and Consumer Goods

- 6.3.3. Healthcare

- 6.3.4. BFSI

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America KSA OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Static (Traditional) OOH

- 7.1.2. Digital OOH (LED Screens)

- 7.1.2.1. Programmatic OOH

- 7.1.2.2. Other Digital OOH Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Billboards

- 7.2.2. Transportation (Transit)

- 7.2.2.1. Airports

- 7.2.2.2. Other Transportation Applications (Buses, etc.)

- 7.2.3. Street Furniture

- 7.2.4. Other Place-based Media

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Retail and Consumer Goods

- 7.3.3. Healthcare

- 7.3.4. BFSI

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe KSA OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Static (Traditional) OOH

- 8.1.2. Digital OOH (LED Screens)

- 8.1.2.1. Programmatic OOH

- 8.1.2.2. Other Digital OOH Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Billboards

- 8.2.2. Transportation (Transit)

- 8.2.2.1. Airports

- 8.2.2.2. Other Transportation Applications (Buses, etc.)

- 8.2.3. Street Furniture

- 8.2.4. Other Place-based Media

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Retail and Consumer Goods

- 8.3.3. Healthcare

- 8.3.4. BFSI

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa KSA OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Static (Traditional) OOH

- 9.1.2. Digital OOH (LED Screens)

- 9.1.2.1. Programmatic OOH

- 9.1.2.2. Other Digital OOH Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Billboards

- 9.2.2. Transportation (Transit)

- 9.2.2.1. Airports

- 9.2.2.2. Other Transportation Applications (Buses, etc.)

- 9.2.3. Street Furniture

- 9.2.4. Other Place-based Media

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Retail and Consumer Goods

- 9.3.3. Healthcare

- 9.3.4. BFSI

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific KSA OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Static (Traditional) OOH

- 10.1.2. Digital OOH (LED Screens)

- 10.1.2.1. Programmatic OOH

- 10.1.2.2. Other Digital OOH Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Billboards

- 10.2.2. Transportation (Transit)

- 10.2.2.1. Airports

- 10.2.2.2. Other Transportation Applications (Buses, etc.)

- 10.2.3. Street Furniture

- 10.2.4. Other Place-based Media

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Retail and Consumer Goods

- 10.3.3. Healthcare

- 10.3.4. BFSI

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Arabian Contracting Services Co (AlArabia)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JCDecaux

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saudi Signs Media

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alan Media and Advertising

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alliance Media

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Daktronics Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Advertising Ways Company*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Arabian Contracting Services Co (AlArabia)

List of Figures

- Figure 1: Global KSA OOH and DOOH Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global KSA OOH and DOOH Market Volume Breakdown (Million, %) by Region 2024 & 2032

- Figure 3: North America KSA OOH and DOOH Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America KSA OOH and DOOH Market Volume (Million), by Type 2024 & 2032

- Figure 5: North America KSA OOH and DOOH Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America KSA OOH and DOOH Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America KSA OOH and DOOH Market Revenue (Million), by Application 2024 & 2032

- Figure 8: North America KSA OOH and DOOH Market Volume (Million), by Application 2024 & 2032

- Figure 9: North America KSA OOH and DOOH Market Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America KSA OOH and DOOH Market Volume Share (%), by Application 2024 & 2032

- Figure 11: North America KSA OOH and DOOH Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 12: North America KSA OOH and DOOH Market Volume (Million), by End-user Industry 2024 & 2032

- Figure 13: North America KSA OOH and DOOH Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America KSA OOH and DOOH Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 15: North America KSA OOH and DOOH Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America KSA OOH and DOOH Market Volume (Million), by Country 2024 & 2032

- Figure 17: North America KSA OOH and DOOH Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America KSA OOH and DOOH Market Volume Share (%), by Country 2024 & 2032

- Figure 19: South America KSA OOH and DOOH Market Revenue (Million), by Type 2024 & 2032

- Figure 20: South America KSA OOH and DOOH Market Volume (Million), by Type 2024 & 2032

- Figure 21: South America KSA OOH and DOOH Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America KSA OOH and DOOH Market Volume Share (%), by Type 2024 & 2032

- Figure 23: South America KSA OOH and DOOH Market Revenue (Million), by Application 2024 & 2032

- Figure 24: South America KSA OOH and DOOH Market Volume (Million), by Application 2024 & 2032

- Figure 25: South America KSA OOH and DOOH Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: South America KSA OOH and DOOH Market Volume Share (%), by Application 2024 & 2032

- Figure 27: South America KSA OOH and DOOH Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 28: South America KSA OOH and DOOH Market Volume (Million), by End-user Industry 2024 & 2032

- Figure 29: South America KSA OOH and DOOH Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: South America KSA OOH and DOOH Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 31: South America KSA OOH and DOOH Market Revenue (Million), by Country 2024 & 2032

- Figure 32: South America KSA OOH and DOOH Market Volume (Million), by Country 2024 & 2032

- Figure 33: South America KSA OOH and DOOH Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: South America KSA OOH and DOOH Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe KSA OOH and DOOH Market Revenue (Million), by Type 2024 & 2032

- Figure 36: Europe KSA OOH and DOOH Market Volume (Million), by Type 2024 & 2032

- Figure 37: Europe KSA OOH and DOOH Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Europe KSA OOH and DOOH Market Volume Share (%), by Type 2024 & 2032

- Figure 39: Europe KSA OOH and DOOH Market Revenue (Million), by Application 2024 & 2032

- Figure 40: Europe KSA OOH and DOOH Market Volume (Million), by Application 2024 & 2032

- Figure 41: Europe KSA OOH and DOOH Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Europe KSA OOH and DOOH Market Volume Share (%), by Application 2024 & 2032

- Figure 43: Europe KSA OOH and DOOH Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 44: Europe KSA OOH and DOOH Market Volume (Million), by End-user Industry 2024 & 2032

- Figure 45: Europe KSA OOH and DOOH Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 46: Europe KSA OOH and DOOH Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 47: Europe KSA OOH and DOOH Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Europe KSA OOH and DOOH Market Volume (Million), by Country 2024 & 2032

- Figure 49: Europe KSA OOH and DOOH Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Europe KSA OOH and DOOH Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Middle East & Africa KSA OOH and DOOH Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Middle East & Africa KSA OOH and DOOH Market Volume (Million), by Type 2024 & 2032

- Figure 53: Middle East & Africa KSA OOH and DOOH Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Middle East & Africa KSA OOH and DOOH Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Middle East & Africa KSA OOH and DOOH Market Revenue (Million), by Application 2024 & 2032

- Figure 56: Middle East & Africa KSA OOH and DOOH Market Volume (Million), by Application 2024 & 2032

- Figure 57: Middle East & Africa KSA OOH and DOOH Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: Middle East & Africa KSA OOH and DOOH Market Volume Share (%), by Application 2024 & 2032

- Figure 59: Middle East & Africa KSA OOH and DOOH Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 60: Middle East & Africa KSA OOH and DOOH Market Volume (Million), by End-user Industry 2024 & 2032

- Figure 61: Middle East & Africa KSA OOH and DOOH Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 62: Middle East & Africa KSA OOH and DOOH Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 63: Middle East & Africa KSA OOH and DOOH Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Middle East & Africa KSA OOH and DOOH Market Volume (Million), by Country 2024 & 2032

- Figure 65: Middle East & Africa KSA OOH and DOOH Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Middle East & Africa KSA OOH and DOOH Market Volume Share (%), by Country 2024 & 2032

- Figure 67: Asia Pacific KSA OOH and DOOH Market Revenue (Million), by Type 2024 & 2032

- Figure 68: Asia Pacific KSA OOH and DOOH Market Volume (Million), by Type 2024 & 2032

- Figure 69: Asia Pacific KSA OOH and DOOH Market Revenue Share (%), by Type 2024 & 2032

- Figure 70: Asia Pacific KSA OOH and DOOH Market Volume Share (%), by Type 2024 & 2032

- Figure 71: Asia Pacific KSA OOH and DOOH Market Revenue (Million), by Application 2024 & 2032

- Figure 72: Asia Pacific KSA OOH and DOOH Market Volume (Million), by Application 2024 & 2032

- Figure 73: Asia Pacific KSA OOH and DOOH Market Revenue Share (%), by Application 2024 & 2032

- Figure 74: Asia Pacific KSA OOH and DOOH Market Volume Share (%), by Application 2024 & 2032

- Figure 75: Asia Pacific KSA OOH and DOOH Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 76: Asia Pacific KSA OOH and DOOH Market Volume (Million), by End-user Industry 2024 & 2032

- Figure 77: Asia Pacific KSA OOH and DOOH Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 78: Asia Pacific KSA OOH and DOOH Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 79: Asia Pacific KSA OOH and DOOH Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Asia Pacific KSA OOH and DOOH Market Volume (Million), by Country 2024 & 2032

- Figure 81: Asia Pacific KSA OOH and DOOH Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Asia Pacific KSA OOH and DOOH Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global KSA OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global KSA OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Global KSA OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global KSA OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Global KSA OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global KSA OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 7: Global KSA OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Global KSA OOH and DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Global KSA OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global KSA OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Global KSA OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global KSA OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: Global KSA OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global KSA OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 15: Global KSA OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Global KSA OOH and DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global KSA OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global KSA OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

- Table 19: United States KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United States KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Mexico KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Global KSA OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global KSA OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 27: Global KSA OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global KSA OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 29: Global KSA OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 30: Global KSA OOH and DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global KSA OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global KSA OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

- Table 33: Brazil KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Brazil KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of South America KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of South America KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 39: Global KSA OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global KSA OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 41: Global KSA OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global KSA OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 43: Global KSA OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 44: Global KSA OOH and DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 45: Global KSA OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global KSA OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

- Table 47: United Kingdom KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: United Kingdom KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 49: Germany KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Germany KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 51: France KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Italy KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 55: Spain KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Spain KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 57: Russia KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Russia KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 59: Benelux KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Benelux KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 61: Nordics KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Nordics KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Europe KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Europe KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 65: Global KSA OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 66: Global KSA OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 67: Global KSA OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 68: Global KSA OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 69: Global KSA OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 70: Global KSA OOH and DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 71: Global KSA OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global KSA OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

- Table 73: Turkey KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Turkey KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 75: Israel KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Israel KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 77: GCC KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: GCC KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 79: North Africa KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: North Africa KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 81: South Africa KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: South Africa KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 83: Rest of Middle East & Africa KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Rest of Middle East & Africa KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 85: Global KSA OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 86: Global KSA OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 87: Global KSA OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 88: Global KSA OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 89: Global KSA OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 90: Global KSA OOH and DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 91: Global KSA OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 92: Global KSA OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

- Table 93: China KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: China KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 95: India KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: India KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 97: Japan KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Japan KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 99: South Korea KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: South Korea KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 101: ASEAN KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: ASEAN KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 103: Oceania KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Oceania KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 105: Rest of Asia Pacific KSA OOH and DOOH Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: Rest of Asia Pacific KSA OOH and DOOH Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the KSA OOH and DOOH Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the KSA OOH and DOOH Market?

Key companies in the market include Arabian Contracting Services Co (AlArabia), JCDecaux, Saudi Signs Media, Alan Media and Advertising, Alliance Media, Daktronics Inc, Advertising Ways Company*List Not Exhaustive.

3. What are the main segments of the KSA OOH and DOOH Market?

The market segments include Type , Application , End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 168.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Growing Development of Public Transport Networks.

6. What are the notable trends driving market growth?

Retail and Consumer Goods Segment Holds the Largest Market Share.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising; Growing Development of Public Transport Networks.

8. Can you provide examples of recent developments in the market?

April 2024: Diriyah Season partnered with advertising powerhouses UM and FP7 McCann KSA to launch a groundbreaking campaign. This campaign, named "Out of Phone (OOP)," was a regional first, bridging TikTok and out-of-home (OOH) advertising. The primary goal was to transcend TikTok's digital boundaries. The campaign showcased Diriyah Season’s experiences through OOH ads, echoing the magnetic appeal of TikTok content.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "KSA OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the KSA OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the KSA OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the KSA OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence