Key Insights

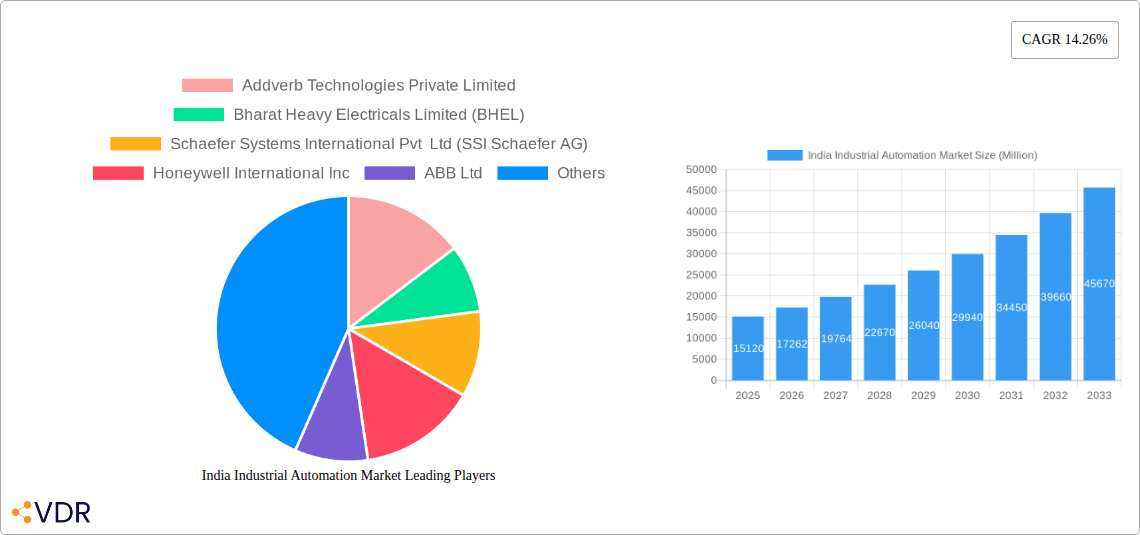

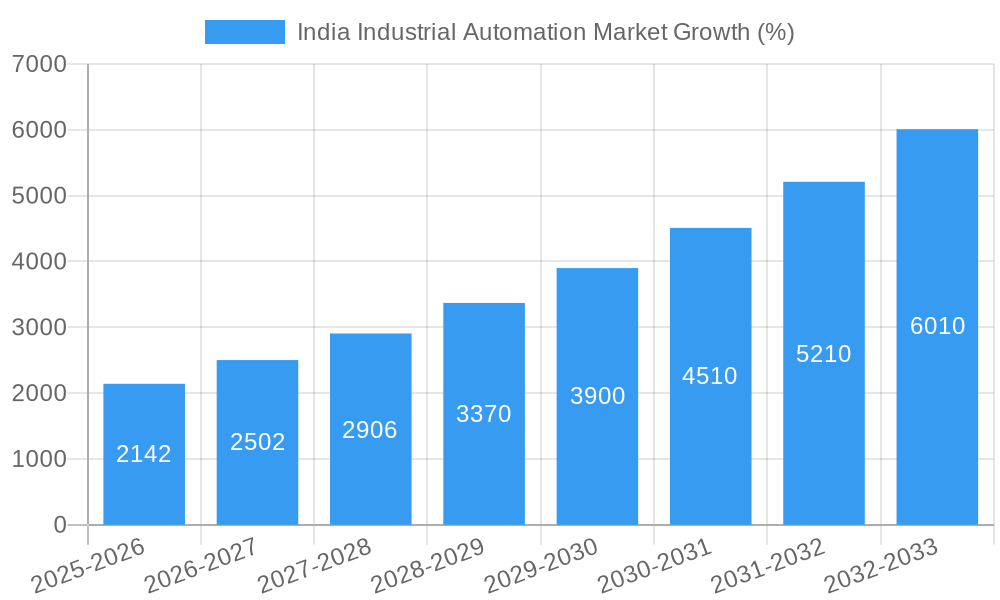

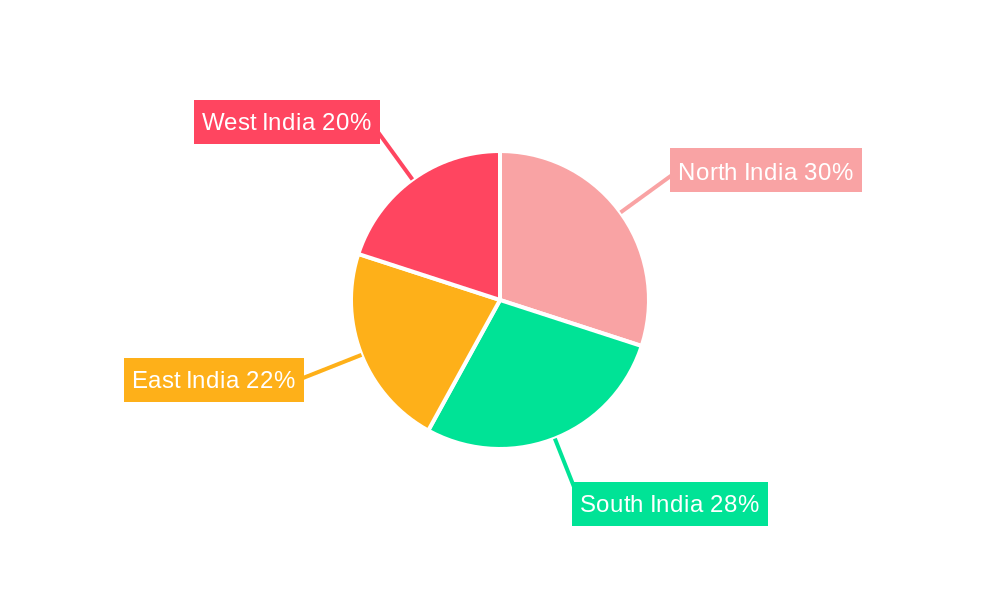

The India Industrial Automation Market is experiencing robust growth, projected to reach \$15.12 billion in 2025 and expand significantly over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 14.26% signifies substantial market dynamism, driven by several key factors. Increased automation across manufacturing sectors like FMCG, healthcare, and general merchandise is a primary driver, alongside the government's "Make in India" initiative, which promotes domestic manufacturing and technological adoption. Furthermore, the rising need for enhanced efficiency, improved product quality, and reduced operational costs is fueling the demand for advanced automation solutions, including robotics, industrial control systems (DCS, SCADA, PLC, HMI), and sophisticated software like MES and PLM. The market is segmented by field devices (sensors, drives, robots, CNC machines), software solutions (MES, PLM, WMS), and end-user industries. While challenges remain, such as the high initial investment costs associated with automation technologies and the need for skilled labor, these are outweighed by the long-term benefits of increased productivity and competitiveness. The strong growth trajectory is expected to continue, with significant opportunities for both domestic and international players across various segments and geographical regions within India. The North, South, East, and West regions each contribute uniquely to the market's overall expansion, driven by varying degrees of industrial activity and technological adoption within these areas.

The market's robust expansion is further fueled by several trends. The increasing adoption of Industry 4.0 technologies, including the Internet of Things (IoT), cloud computing, and artificial intelligence (AI), is enabling smarter and more efficient automation solutions. This trend is also coupled with rising investments in R&D, leading to advancements in areas such as collaborative robotics and predictive maintenance, driving efficiency and reducing downtime. The market is also witnessing a strong shift towards customized automation solutions tailored to specific industry needs, as businesses seek improved operational flexibility and scalability. This increased focus on customization is creating new opportunities for companies that can offer tailored solutions and comprehensive support services. Competitive pricing strategies, coupled with supportive government policies, are also contributing to the market’s acceleration. However, the market's growth is not without its restraints. Concerns regarding data security and cyber threats associated with connected devices need to be addressed through robust security measures. Similarly, the lack of skilled workforce to operate and maintain these advanced systems presents a key challenge that needs to be mitigated through targeted training and education initiatives.

India Industrial Automation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Industrial Automation Market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by field devices, software, end-user, and type of solution, offering granular insights into this rapidly evolving sector. Valuations are presented in million units.

India Industrial Automation Market Dynamics & Structure

The Indian industrial automation market is characterized by increasing market concentration amongst major players, significant technological innovation, evolving regulatory frameworks, and the emergence of competitive product substitutes. The market is witnessing a surge in mergers and acquisitions (M&A) activity as companies strategize for growth.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, indicating a moderately concentrated market. This is expected to increase to xx% by 2033.

- Technological Innovation: The adoption of Industry 4.0 technologies, including AI, IoT, and cloud computing, is a primary driver of market growth. However, integration complexities and skills gaps pose significant innovation barriers.

- Regulatory Framework: Government initiatives like "Make in India" and "Digital India" are fostering automation adoption. However, inconsistent regulatory standards across states can create challenges.

- Competitive Product Substitutes: The emergence of cost-effective and energy-efficient alternatives continues to impact the competitiveness of certain automation technologies.

- End-User Demographics: The manufacturing sector dominates the market, with significant growth potential in non-manufacturing sectors such as healthcare and FMCG.

- M&A Trends: The number of M&A deals in the Indian industrial automation sector increased by xx% between 2019 and 2024, reflecting the strategic importance of consolidation and expansion.

India Industrial Automation Market Growth Trends & Insights

The India Industrial Automation Market exhibits robust growth, driven by factors including rising labor costs, increasing demand for improved productivity and efficiency, and government initiatives promoting automation. The market size, currently valued at xx million units in 2025, is projected to reach xx million units by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by technological disruptions, including the increasing adoption of advanced robotics, AI-powered solutions, and cloud-based platforms. Consumer behavior shifts towards customized products and faster delivery times further incentivize automation investments. Market penetration is currently at xx% in the manufacturing sector and is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in India Industrial Automation Market

The industrial automation market in India is experiencing significant growth across various segments and regions. While the manufacturing sector holds the largest market share, the non-manufacturing sectors are witnessing considerable expansion. Within field devices, industrial robots and sensors and transmitters are driving growth, while the software segment is experiencing rapid adoption of MES and PLM solutions.

Dominant Segment: The Factory Automation Market segment is the dominant sector, accounting for xx% of the market in 2025, followed by Automated Material Handling Solutions with xx%.

Key Regional Growth: Maharashtra and Gujarat are leading regions, driven by robust manufacturing activity and supportive government policies. Southern India is also emerging as a significant market due to growth in the automotive and electronics industries.

Growth Drivers:

- Government initiatives focused on infrastructure development and industrial modernization.

- Increasing foreign direct investment in the manufacturing sector.

- Growing demand for automation in labor-intensive industries.

- The rising need for enhanced productivity and operational efficiency.

The detailed breakdown of growth across each segment and region is included in the full report.

India Industrial Automation Market Product Landscape

The Indian industrial automation market is witnessing rapid product innovation, with manufacturers constantly striving to improve performance, reduce costs, and enhance efficiency. New product developments focus on increasing levels of connectivity, integration, and intelligence, utilizing AI and Machine Learning. Key innovations include advanced robotics with improved dexterity and adaptability, intelligent sensors with predictive maintenance capabilities, and cloud-based platforms enabling remote monitoring and control. The unique selling propositions emphasize cost-effectiveness, ease of integration, and advanced functionalities, catering to various industrial needs and specific applications.

Key Drivers, Barriers & Challenges in India Industrial Automation Market

Key Drivers:

- Government initiatives promoting industrial automation (e.g., Make in India).

- Rising labor costs and the need to improve productivity.

- Growing demand for higher quality and efficiency in manufacturing.

- Technological advancements in robotics, AI, and IoT.

Key Barriers & Challenges:

- High initial investment costs associated with automation solutions.

- Lack of skilled workforce capable of operating and maintaining advanced automation systems.

- Supply chain disruptions and the availability of key components.

- Cybersecurity concerns related to the increasing connectivity of industrial systems. The estimated cost of these challenges is xx million units annually.

Emerging Opportunities in India Industrial Automation Market

- Untapped potential in the non-manufacturing sector (e.g., healthcare, logistics).

- Growing demand for customized automation solutions tailored to specific industry needs.

- Opportunities in the development and implementation of AI-powered solutions for predictive maintenance and optimization.

- Expansion of automation solutions in small and medium-sized enterprises (SMEs).

Growth Accelerators in the India Industrial Automation Market Industry

Several factors are poised to accelerate the growth of the Indian industrial automation market in the coming years. These include the continued expansion of the manufacturing sector, the increasing adoption of Industry 4.0 technologies, and strategic partnerships between domestic and international players. Furthermore, government initiatives aimed at promoting digitalization and technological advancement will significantly impact market expansion. Strategic investments in R&D and innovative product development are also expected to drive long-term growth.

Key Players Shaping the India Industrial Automation Market Market

- Addverb Technologies Private Limited

- Bharat Heavy Electricals Limited (BHEL)

- Schaefer Systems International Pvt Ltd (SSI Schaefer AG)

- Honeywell International Inc (https://www.honeywell.com/)

- ABB Ltd (https://new.abb.com/)

- Kardex India Storage Solutions Private Limited (Kardex Holding AG)

- Godrej Koerber Supply Chain Limited

- Larsen & Toubro Ltd (https://www.larsentoubro.com/)

- Crompton Greaves Ltd

- Space Magnum Equipment Pvt Ltd

- Fuji Electric Co Ltd (https://www.fujielectric.com/en/)

- Hinditron Group

- Armstrong Ltd

- Emerson Electric Co (https://www.emerson.com/)

- Mitsubishi Electric Corporation (https://www.mitsubishielectric.com/)

- Siemens AG (https://www.siemens.com/)

- Bastian Solution Private Limited (Toyota Industries)

- ATS Conveyors India Pvt Ltd (ATS Group)

- Schneider Electric (https://www.se.com/ww/en/)

- Falcon Autotech Private Limited

- Robert Bosch GmbH (https://www.bosch.com/)

- Bain & Company Inc (https://www.bain.com/)

- The Hi-Tech Robotic Systemz Limited

- Rockwell Automation Inc (https://www.rockwellautomation.com/)

- Yokogawa Electric Corporation (https://www.yokogawa.com/)

- Danfoss A/S (https://www.danfoss.com/)

- Daifuku India Private Limited (Daifuku Co Ltd)

- Grey Orange Pte Ltd

- Boston Consulting Group (https://www.bcg.com/)

- Kuka India Private Limited (Kuka AG)

Notable Milestones in India Industrial Automation Market Sector

- June 2023: ABB India secured a contract to supply ArcelorMittal Nippon Steel India's cold rolling mill with automation systems, highlighting the growing demand for advanced solutions in the steel industry.

- March 2023: Bastian Solutions showcased integrated automation technologies at ProMat, demonstrating advancements in autonomous vehicles and warehouse automation.

In-Depth India Industrial Automation Market Market Outlook

The Indian industrial automation market is poised for sustained growth, driven by technological advancements, favorable government policies, and a burgeoning manufacturing sector. Strategic investments in R&D, coupled with increasing collaborations between domestic and international players, are creating significant opportunities for market expansion. The focus on Industry 4.0 technologies, including AI, IoT, and cloud computing, will further enhance productivity and efficiency, driving long-term growth and market expansion across diverse industries.

India Industrial Automation Market Segmentation

-

1. Type of Solution

-

1.1. Automated Material Handling Solutions

-

1.1.1. Hardware

- 1.1.1.1. Conveyor/Sortation Systems

- 1.1.1.2. Automated Storage and Retrieval System (AS/RS)

- 1.1.1.3. Mobile R

- 1.1.1.4. Automatic Identification and Data Capture (AIDC)

- 1.1.2. Software

-

1.1.1. Hardware

-

1.2. Factory Automation Solutions

-

1.2.1. Industrial Control Systems

- 1.2.1.1. DCS

- 1.2.1.2. SCADA

- 1.2.1.3. PLC

- 1.2.1.4. HMI

- 1.2.1.5. Other Control Systems

-

1.2.2. Field Devices

- 1.2.2.1. Sensors and Transmitters

- 1.2.2.2. Electric AC Drives

- 1.2.2.3. Servo Motors

- 1.2.2.4. Computer Numerical Control (CNC) Machines

- 1.2.2.5. Inverters

- 1.2.2.6. Industrial Robots

- 1.2.2.7. Other Factory Automation Solutions

- 1.2.3. Manufacturing Execution System (MES)

- 1.2.4. Product Lifecycle Management (PLM)

- 1.2.5. Other Types

-

1.2.1. Industrial Control Systems

-

1.1. Automated Material Handling Solutions

-

2. End-user

-

2.1. Automated Material Handling Market

- 2.1.1. Manufacturing

-

2.1.2. Non-manufacturing

- 2.1.2.1. General Merchandise

- 2.1.2.2. Healthcare

- 2.1.2.3. FMCG/Non-durable Goods

- 2.1.2.4. Other End-Users

-

2.2. Factory Automation Market

- 2.2.1. Food and Beverage

- 2.2.2. Pharmaceutical

- 2.2.3. Automotive

- 2.2.4. Textiles

- 2.2.5. Power

- 2.2.6. Oil and Gas

- 2.2.7. Petrochemicals and Fertilizers

-

2.1. Automated Material Handling Market

India Industrial Automation Market Segmentation By Geography

- 1. India

India Industrial Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetic Segment

- 3.3. Market Restrains

- 3.3.1. Lack of Products with the Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. HMI to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 5.1.1. Automated Material Handling Solutions

- 5.1.1.1. Hardware

- 5.1.1.1.1. Conveyor/Sortation Systems

- 5.1.1.1.2. Automated Storage and Retrieval System (AS/RS)

- 5.1.1.1.3. Mobile R

- 5.1.1.1.4. Automatic Identification and Data Capture (AIDC)

- 5.1.1.2. Software

- 5.1.1.1. Hardware

- 5.1.2. Factory Automation Solutions

- 5.1.2.1. Industrial Control Systems

- 5.1.2.1.1. DCS

- 5.1.2.1.2. SCADA

- 5.1.2.1.3. PLC

- 5.1.2.1.4. HMI

- 5.1.2.1.5. Other Control Systems

- 5.1.2.2. Field Devices

- 5.1.2.2.1. Sensors and Transmitters

- 5.1.2.2.2. Electric AC Drives

- 5.1.2.2.3. Servo Motors

- 5.1.2.2.4. Computer Numerical Control (CNC) Machines

- 5.1.2.2.5. Inverters

- 5.1.2.2.6. Industrial Robots

- 5.1.2.2.7. Other Factory Automation Solutions

- 5.1.2.3. Manufacturing Execution System (MES)

- 5.1.2.4. Product Lifecycle Management (PLM)

- 5.1.2.5. Other Types

- 5.1.2.1. Industrial Control Systems

- 5.1.1. Automated Material Handling Solutions

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automated Material Handling Market

- 5.2.1.1. Manufacturing

- 5.2.1.2. Non-manufacturing

- 5.2.1.2.1. General Merchandise

- 5.2.1.2.2. Healthcare

- 5.2.1.2.3. FMCG/Non-durable Goods

- 5.2.1.2.4. Other End-Users

- 5.2.2. Factory Automation Market

- 5.2.2.1. Food and Beverage

- 5.2.2.2. Pharmaceutical

- 5.2.2.3. Automotive

- 5.2.2.4. Textiles

- 5.2.2.5. Power

- 5.2.2.6. Oil and Gas

- 5.2.2.7. Petrochemicals and Fertilizers

- 5.2.1. Automated Material Handling Market

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 6. North India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Industrial Automation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Addverb Technologies Private Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bharat Heavy Electricals Limited (BHEL)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Schaefer Systems International Pvt Ltd (SSI Schaefer AG)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Honeywell International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ABB Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kardex India Storage Solutions Private Limited (Kardex Holding AG)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Godrej Koerber Supply Chain Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Larsen & Toubro Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Crompton Greaves Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Space Magnum Equipment Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Fuji Electric Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hinditron Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Armstrong Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Emerson Electric Co

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Mitsubishi Electric Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Siemens AG

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Bastian Solution Private Limited (Toyota Industries)

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 ATS Conveyors India Pvt Ltd (ATS Group)

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Schneider Electric

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Falcon Autotech Private Limited

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 Robert Bosch GmbH

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 Bain & Company Inc

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.23 The Hi-Tech Robotic Systemz Limited

- 10.2.23.1. Overview

- 10.2.23.2. Products

- 10.2.23.3. SWOT Analysis

- 10.2.23.4. Recent Developments

- 10.2.23.5. Financials (Based on Availability)

- 10.2.24 Rockwell Automation Inc

- 10.2.24.1. Overview

- 10.2.24.2. Products

- 10.2.24.3. SWOT Analysis

- 10.2.24.4. Recent Developments

- 10.2.24.5. Financials (Based on Availability)

- 10.2.25 Yokogawa Electric Corporation

- 10.2.25.1. Overview

- 10.2.25.2. Products

- 10.2.25.3. SWOT Analysis

- 10.2.25.4. Recent Developments

- 10.2.25.5. Financials (Based on Availability)

- 10.2.26 Danfoss A/S

- 10.2.26.1. Overview

- 10.2.26.2. Products

- 10.2.26.3. SWOT Analysis

- 10.2.26.4. Recent Developments

- 10.2.26.5. Financials (Based on Availability)

- 10.2.27 Daifuku India Private Limited (Daifuku Co Ltd)

- 10.2.27.1. Overview

- 10.2.27.2. Products

- 10.2.27.3. SWOT Analysis

- 10.2.27.4. Recent Developments

- 10.2.27.5. Financials (Based on Availability)

- 10.2.28 Grey Orange Pte Ltd

- 10.2.28.1. Overview

- 10.2.28.2. Products

- 10.2.28.3. SWOT Analysis

- 10.2.28.4. Recent Developments

- 10.2.28.5. Financials (Based on Availability)

- 10.2.29 Boston Consulting Grou

- 10.2.29.1. Overview

- 10.2.29.2. Products

- 10.2.29.3. SWOT Analysis

- 10.2.29.4. Recent Developments

- 10.2.29.5. Financials (Based on Availability)

- 10.2.30 Kuka India Private Limited (Kuka AG)

- 10.2.30.1. Overview

- 10.2.30.2. Products

- 10.2.30.3. SWOT Analysis

- 10.2.30.4. Recent Developments

- 10.2.30.5. Financials (Based on Availability)

- 10.2.1 Addverb Technologies Private Limited

List of Figures

- Figure 1: India Industrial Automation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Industrial Automation Market Share (%) by Company 2024

List of Tables

- Table 1: India Industrial Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Industrial Automation Market Revenue Million Forecast, by Type of Solution 2019 & 2032

- Table 3: India Industrial Automation Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: India Industrial Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Industrial Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Industrial Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Industrial Automation Market Revenue Million Forecast, by Type of Solution 2019 & 2032

- Table 11: India Industrial Automation Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 12: India Industrial Automation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Automation Market?

The projected CAGR is approximately 14.26%.

2. Which companies are prominent players in the India Industrial Automation Market?

Key companies in the market include Addverb Technologies Private Limited, Bharat Heavy Electricals Limited (BHEL), Schaefer Systems International Pvt Ltd (SSI Schaefer AG), Honeywell International Inc, ABB Ltd, Kardex India Storage Solutions Private Limited (Kardex Holding AG), Godrej Koerber Supply Chain Limited, Larsen & Toubro Ltd, Crompton Greaves Ltd, Space Magnum Equipment Pvt Ltd, Fuji Electric Co Ltd, Hinditron Group, Armstrong Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Bastian Solution Private Limited (Toyota Industries), ATS Conveyors India Pvt Ltd (ATS Group), Schneider Electric, Falcon Autotech Private Limited, Robert Bosch GmbH, Bain & Company Inc, The Hi-Tech Robotic Systemz Limited, Rockwell Automation Inc, Yokogawa Electric Corporation, Danfoss A/S, Daifuku India Private Limited (Daifuku Co Ltd), Grey Orange Pte Ltd, Boston Consulting Grou, Kuka India Private Limited (Kuka AG).

3. What are the main segments of the India Industrial Automation Market?

The market segments include Type of Solution, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetic Segment.

6. What are the notable trends driving market growth?

HMI to Witness the Growth.

7. Are there any restraints impacting market growth?

Lack of Products with the Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

June 2023 - ABB India has been contracted to supply ArcelorMittal Nippon Steel India's (AM/NS India) advanced steel cold rolling mill (CRM) in Hazira, Gujarat, with electrification and automation systems, including the ABB Ability System 800xA distributed control system (DCS) and related machinery and supplies. The original equipment manufacturer (OEM) for the project, John Cockerill India Limited (JCIL), is responsible for the contract at the flagship manufacturing facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Automation Market?

To stay informed about further developments, trends, and reports in the India Industrial Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence