Key Insights

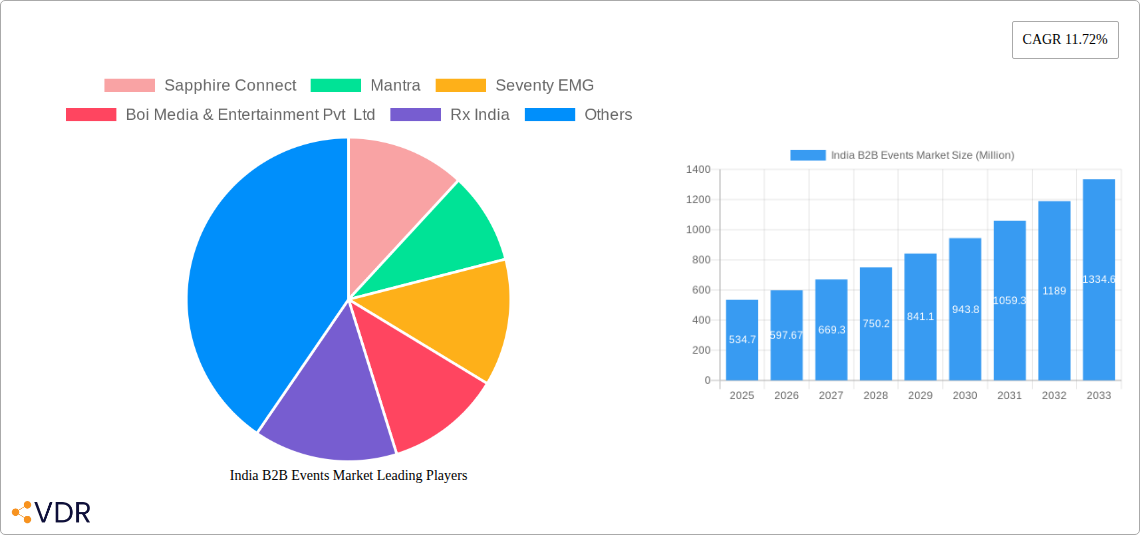

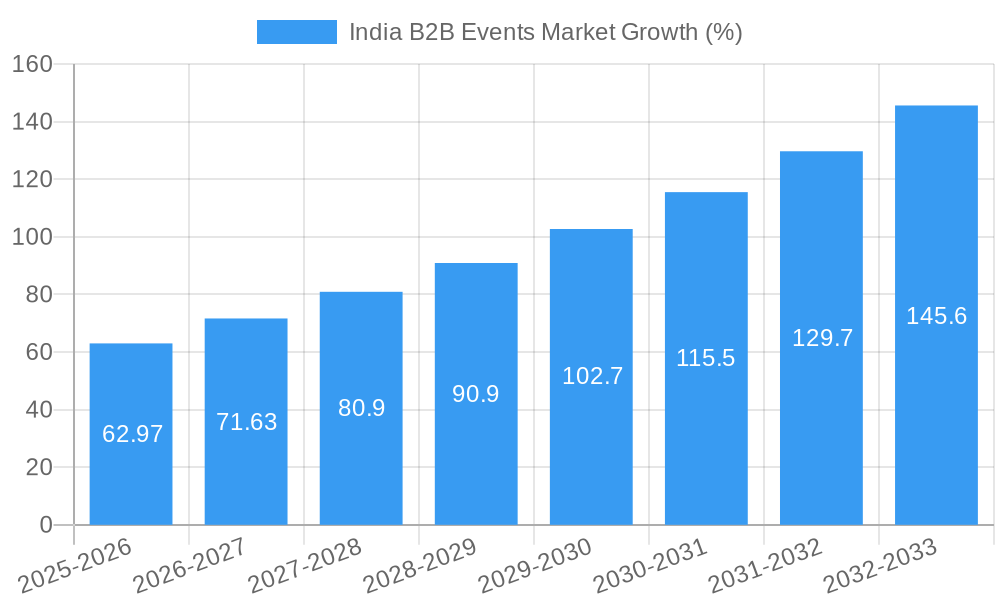

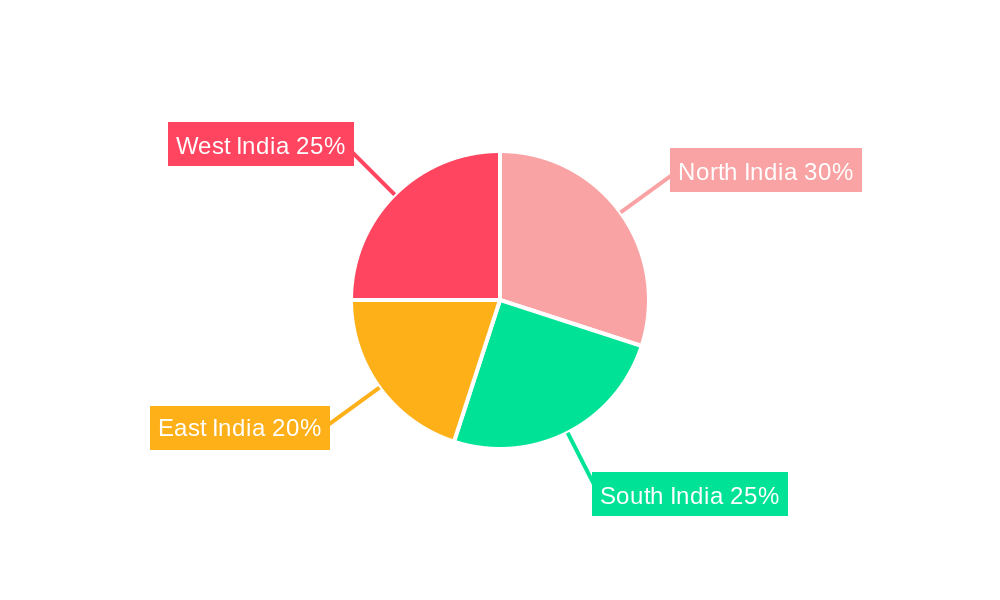

The India B2B events market, valued at ₹534.70 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.72% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of digital marketing strategies by businesses necessitates more effective networking opportunities, driving demand for both physical and virtual B2B events. Furthermore, the growing focus on relationship building and lead generation within diverse sectors like BFSI (Banking, Financial Services, and Insurance), FMCG (Fast-Moving Consumer Goods), and the burgeoning Indian automotive industry are significant contributors. A rise in disposable incomes and a young, increasingly professional demographic are also boosting participation and sponsorship in these events. While data on specific restraints is absent, potential challenges could include fluctuating economic conditions, competition from digital marketing alternatives, and the ongoing impact of global events on business travel. The market's segmentation across platforms (physical and virtual) and end-user verticals allows for targeted strategies and showcases diverse opportunities for event organizers and sponsors. The regional distribution, with data available for North, East, South, and West India, highlights potential for geographical-specific marketing and event planning.

The market segmentation offers crucial insights into specific growth areas. For example, the BFSI and FMCG sectors, characterized by their high-volume transaction requirements and extensive sales networks, likely represent substantial portions of the market. Similarly, the growing adoption of hybrid event models (combining physical and virtual elements) likely reflects a key trend, maximizing reach and engagement. The success of major players like Sapphire Connect and Wizcraft Entertainment Agency Pvt Ltd underscores the importance of experience and expertise in navigating the nuances of the B2B event landscape. The continued market penetration of virtual event platforms can be expected, offering scalability and cost-effectiveness. However, future growth will depend on factors like macroeconomic stability and the evolution of technological advancements within the event industry. Further research on the specific contributions of each segment and region would yield a more granular understanding of the market’s future trajectory.

India B2B Events Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the dynamic India B2B events market, encompassing its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report provides crucial insights for businesses operating within or considering entry into this lucrative sector. The market is segmented by platform (physical and virtual events), end-user verticals (Food and Beverage, PSU, Luxury, BFSI, FMCG, Retail, Healthcare, Automotive, and Other End-user Verticals), and region (North, East, West, and South). The report's value is in Million units.

India B2B Events Market Dynamics & Structure

The India B2B events market exhibits a moderately concentrated structure, with key players like Sapphire Connect, Mantra, Seventy EMG, and Wizcraft Entertainment Agency Pvt Ltd holding significant market share. Technological innovations, particularly in virtual event platforms and event management software, are reshaping the landscape. Government regulations concerning event permits and safety standards influence market operations. While virtual events are emerging as a strong substitute, the preference for in-person networking continues to drive physical event demand. End-user demographics are diverse, with significant participation across various sectors. M&A activity has been moderate in recent years, with approximately xx deals completed in the historical period (2019-2024), resulting in a xx% market share shift.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Rise of virtual event platforms and AI-powered event management tools. Innovation barriers include high initial investment costs and resistance to adopting new technologies.

- Regulatory Framework: Government regulations impacting event permits and safety standards.

- Competitive Product Substitutes: Virtual events are increasingly competing with physical events.

- End-User Demographics: Diverse participation across various industries, with BFSI and FMCG showing strong growth.

- M&A Trends: Moderate M&A activity (xx deals, 2019-2024), driven by market consolidation and expansion strategies.

India B2B Events Market Growth Trends & Insights

The India B2B events market has witnessed significant growth during the historical period (2019-2024), expanding from xx Million in 2019 to xx Million in 2024, achieving a CAGR of xx%. This growth is attributable to the rising number of businesses in India, increased focus on networking and brand building, and the government's support for various industries. Technological disruptions, particularly the rise of virtual events, have altered consumer behavior, leading to increased demand for hybrid event formats. Market penetration of virtual events is estimated at xx% in 2025, expected to reach xx% by 2033. The market is projected to reach xx Million in 2025 and xx Million by 2033, with a forecasted CAGR of xx% during the forecast period (2025-2033). This continued growth is expected due to increasing investments in infrastructure, the expansion of various industries, and favourable government policies.

Dominant Regions, Countries, or Segments in India B2B Events Market

The North region currently dominates the India B2B events market, accounting for xx% of the total market share in 2024, driven by established infrastructure, higher business density, and proactive government support. However, other regions are experiencing substantial growth. The Food and Beverage and BFSI segments are showing the strongest growth, driven by increased investment and innovation within these industries. Physical events still command a larger market share (xx%) compared to virtual events (xx%), though the latter is showing a faster growth rate.

- North Region: Dominant due to established infrastructure and higher business density.

- Food & Beverage Segment: Strong growth driven by rising consumer spending and industry innovation.

- BFSI Segment: High growth attributed to increased investment in financial technology and expansion of financial services.

- Physical Events: Maintain a larger market share, but virtual events are rapidly gaining traction.

India B2B Events Market Product Landscape

The India B2B events market offers a diverse range of products and services, including event planning, venue sourcing, technology solutions (virtual platforms, registration software), marketing and promotion, and logistical support. Key innovations include the integration of AI and VR/AR technologies for enhanced engagement and analytics. The increasing adoption of sustainable practices adds a unique selling proposition. Product performance is measured by attendance rates, lead generation, brand awareness, and return on investment (ROI) for event organizers and participants.

Key Drivers, Barriers & Challenges in India B2B Events Market

Key Drivers:

- Growing business activities and investment across various sectors.

- Increased focus on brand building and networking.

- Government initiatives to promote industries and events.

- Technological advancements in event management tools.

Key Barriers and Challenges:

- High infrastructure costs, particularly for large-scale physical events.

- Competition from virtual event platforms and reduced in-person event attendance.

- Regulatory hurdles and bureaucratic procedures for event approvals.

- Dependence on skilled workforce and potential talent shortages.

- The market share of virtual events is growing slowly which can be a challenge.

Emerging Opportunities in India B2B Events Market

- Growing demand for hybrid events and innovative formats.

- Untapped potential in Tier 2 and Tier 3 cities.

- Opportunities in niche industry-specific events.

- Expanding use of data analytics and personalized event experiences.

Growth Accelerators in the India B2B Events Market Industry

Strategic partnerships between event organizers, technology providers, and government agencies are driving long-term growth. Technological breakthroughs are enabling greater efficiency, engagement, and data-driven insights. Market expansion into less-developed regions and diversification into niche segments are key growth strategies.

Key Players Shaping the India B2B Events Market Market

- Sapphire Connect

- Mantra

- Seventy EMG

- Boi Media & Entertainment Pvt Ltd

- Rx India

- TechnologyCounter

- CAB

- Hexagon Events Private Limited

- Wizcraft Entertainment Agency Pvt Ltd

- Neoniche Integrated Solutions Pvt Ltd

- Craftworld Events Management Company

- Seventy Seven Entertainment Pvt Ltd

- Experiential Marketing Solutions Pvt Ltd (Collective Heads)

- Toast

- Blackboard Communications

- Laqshya Group (Event Capital)

- XP&D (XP and Land)

Notable Milestones in India B2B Events Market Sector

- March 2024: Bharat Tex 2024 in New Delhi attracted 100,000 visitors and 3,500 exhibitors, showcasing India's textile capabilities.

- November 2023: A mega B2B food event in Delhi drew 1208 exhibitors, 715 foreign buyers, and 218 domestic buyers, highlighting the country's food processing sector.

In-Depth India B2B Events Market Market Outlook

The India B2B events market is poised for sustained growth, driven by increasing business activity, technological innovation, and supportive government policies. Strategic investments in infrastructure, expansion into new geographic markets, and the adoption of innovative event formats will shape future market dynamics. The market presents significant opportunities for both established players and new entrants to capitalize on evolving consumer preferences and technological advancements.

India B2B Events Market Segmentation

-

1. Platform

- 1.1. Physical Events

- 1.2. Virtual Events

-

2. End-user Verticals

- 2.1. Food and Beverage

- 2.2. PSU

- 2.3. Luxury

- 2.4. BFSI

- 2.5. FMCG

- 2.6. Retail

- 2.7. Healthcare

- 2.8. Automotive

- 2.9. Other End-user Verticals

India B2B Events Market Segmentation By Geography

- 1. India

India B2B Events Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Among Government Organizations About New Technologies

- 3.4. Market Trends

- 3.4.1. Retail Sector to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Physical Events

- 5.1.2. Virtual Events

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Food and Beverage

- 5.2.2. PSU

- 5.2.3. Luxury

- 5.2.4. BFSI

- 5.2.5. FMCG

- 5.2.6. Retail

- 5.2.7. Healthcare

- 5.2.8. Automotive

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Sapphire Connect

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mantra

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Seventy EMG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Boi Media & Entertainment Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rx India

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 TechnologyCounter

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 CAB

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hexagon Events Private Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wizcraft Entertainment Agency Pvt Lt

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Neoniche Integrated Solutions Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 CraftworldEvents Management Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Seventy Seven Entertainment Pvt Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Experential Marketing Solutions Pvt Ltd (Collective Heads)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Toast

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Blackboard Communications

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Laqshya Group(Event Capital)

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 XP&D (XP and Land)

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Sapphire Connect

List of Figures

- Figure 1: India B2B Events Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India B2B Events Market Share (%) by Company 2024

List of Tables

- Table 1: India B2B Events Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India B2B Events Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 3: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 4: India B2B Events Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India B2B Events Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India B2B Events Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 11: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 12: India B2B Events Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India B2B Events Market?

The projected CAGR is approximately 11.72%.

2. Which companies are prominent players in the India B2B Events Market?

Key companies in the market include Sapphire Connect, Mantra, Seventy EMG, Boi Media & Entertainment Pvt Ltd, Rx India, TechnologyCounter, CAB, Hexagon Events Private Limited, Wizcraft Entertainment Agency Pvt Lt, Neoniche Integrated Solutions Pvt Ltd, CraftworldEvents Management Company, Seventy Seven Entertainment Pvt Ltd, Experential Marketing Solutions Pvt Ltd (Collective Heads), Toast, Blackboard Communications, Laqshya Group(Event Capital), XP&D (XP and Land).

3. What are the main segments of the India B2B Events Market?

The market segments include Platform, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers.

6. What are the notable trends driving market growth?

Retail Sector to be the Largest End User.

7. Are there any restraints impacting market growth?

; Lack of Awareness Among Government Organizations About New Technologies.

8. Can you provide examples of recent developments in the market?

In March 2024, by bringing together 3,500 exhibitors from across the entire value chain under one roof for the first time, the theme of Bharat Tex 2024 emphasized India’s capability to provide end-to-end textile solutions. Spread across nearly two million square feet and attracting 100,000 visitors, this huge event, staged in New Delhi, was organized by a consortium of 11 textile export promotion councils and sponsored by the country’s Ministry of Textile.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India B2B Events Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India B2B Events Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India B2B Events Market?

To stay informed about further developments, trends, and reports in the India B2B Events Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence