Key Insights

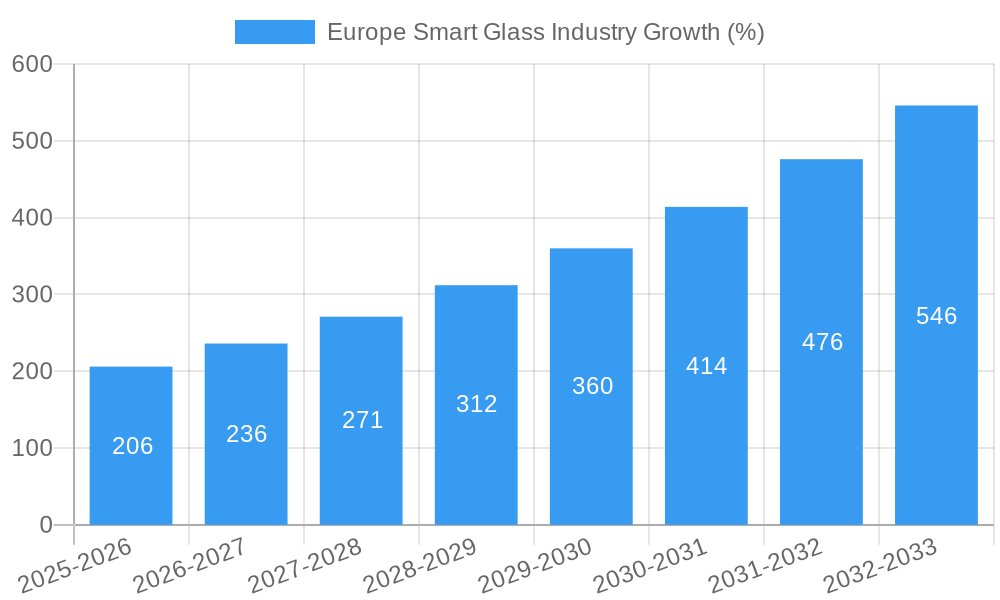

The European smart glass market is experiencing robust growth, driven by increasing demand across diverse sectors. The market, valued at approximately €XX million in 2025 (assuming a logical estimation based on the provided CAGR of 13.90% and the stated market size), is projected to witness a significant expansion throughout the forecast period (2025-2033). Key drivers include the rising adoption of energy-efficient building technologies, a growing focus on sustainable construction practices, and the increasing popularity of smart homes and buildings. Technological advancements in electro-chromic glass, suspended particle devices, and liquid crystals are further fueling market expansion, providing enhanced functionalities like light control, privacy, and thermal management. The construction and commercial building sectors are major consumers, with significant demand anticipated from transportation and energy applications. Germany, France, and the United Kingdom represent the largest national markets within Europe, benefiting from strong government initiatives promoting green building technologies and a robust construction industry. However, high initial investment costs associated with smart glass installation and potential supply chain disruptions can act as restraints on market growth. The market segmentation showcases a diversified application landscape with strong future growth potential, especially in newer application areas such as consumer electronics and others. This growth is likely driven by the need for innovative solutions to improve energy efficiency, building design, and functionality.

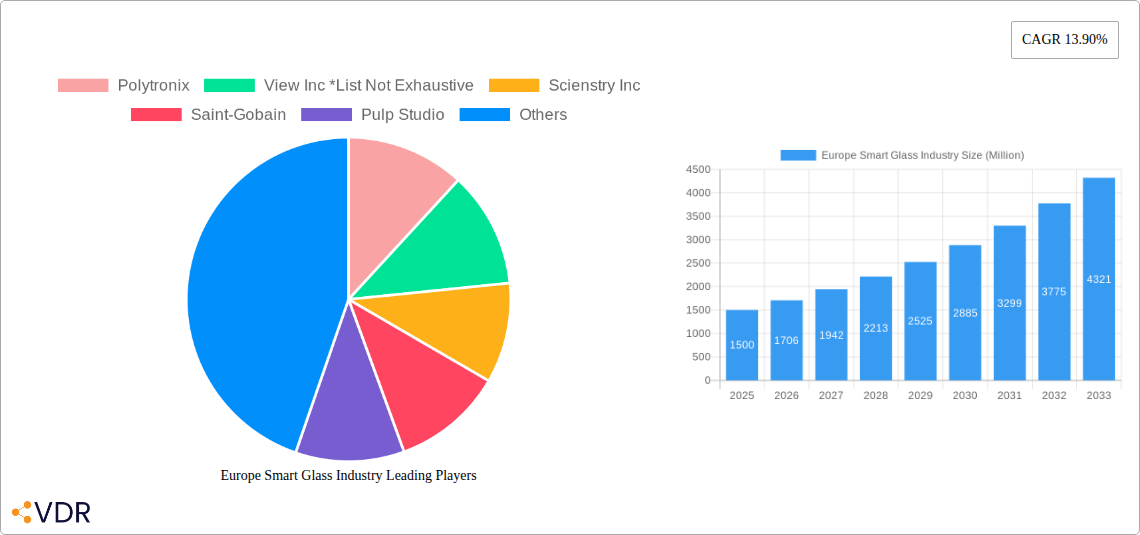

The competitive landscape is dynamic, featuring both established players like Saint-Gobain, Asahi Glass Corporation, and PPG Industries, alongside innovative startups like Polytronix and View Inc. These companies are actively engaged in research and development, focusing on improving product functionalities, reducing costs, and expanding their product portfolios to cater to the evolving market needs. The diverse technological offerings, coupled with the increasing emphasis on sustainability and smart building technologies, position the European smart glass market for continued, substantial growth over the coming years. This growth will likely be fueled by the increasing demand in the commercial and residential sectors and adoption of the technology in innovative applications, despite facing some challenges around costs and supply chains.

Europe Smart Glass Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe smart glass industry, covering market dynamics, growth trends, regional performance, product landscape, and key players. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The report examines key segments including Construction, Commercial Buildings, Transportation, Energy, Consumer Electronics, and others across major European countries: United Kingdom, Germany, Italy, France, and the Rest of Europe. Technological advancements in Suspended Particle Devices, Liquid Crystals, Electro-chromic Glass, Passive Smart Glass, Active Smart Glass, and other technologies are also analyzed.

Europe Smart Glass Industry Market Dynamics & Structure

The European smart glass market is characterized by moderate concentration, with key players like Saint-Gobain, Asahi Glass Corporation, and PPG Industries holding significant market share, but also featuring numerous smaller, specialized companies. Technological innovation, particularly in electrochromic and suspended particle devices, is a major driver, while regulatory frameworks related to energy efficiency and building codes influence adoption rates. Competitive substitutes include traditional glazing and other energy-efficient solutions. End-user demographics, especially in the commercial building sector, are crucial, reflecting a growing demand for smart, energy-efficient solutions. The M&A landscape has witnessed xx deals in the past five years, indicating consolidation within the industry.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Electrochromic glass and suspended particle devices are leading innovation drivers.

- Regulatory Framework: Energy efficiency standards are key market influencers.

- Competitive Substitutes: Traditional glazing materials pose a significant competitive challenge.

- M&A Activity: xx deals recorded between 2019-2024, indicating a trend towards consolidation.

- Innovation Barriers: High R&D costs and complexity in manufacturing processes.

Europe Smart Glass Industry Growth Trends & Insights

The European smart glass market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue throughout the forecast period (2025-2033), reaching a market size of xx million units by 2033. The increasing adoption of smart glass in commercial buildings, driven by energy efficiency requirements and aesthetic preferences, is a primary growth driver. Technological advancements, such as the development of more energy-efficient and cost-effective smart glass solutions, are further fueling market expansion. Shifting consumer behavior toward sustainable building practices and a greater emphasis on technological integration within homes and offices also contributes to market growth. Market penetration is projected to increase from xx% in 2024 to xx% in 2033.

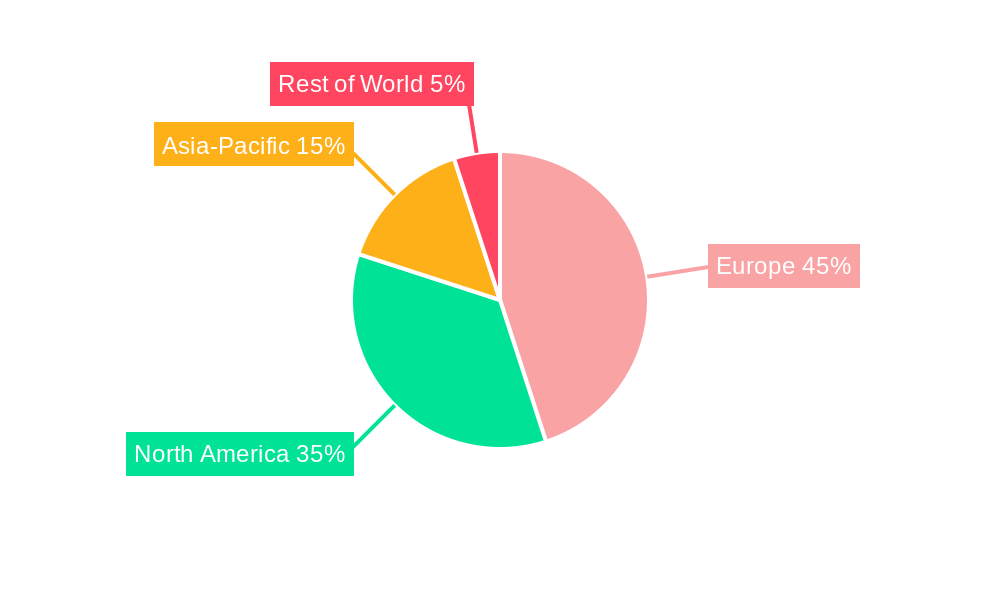

Dominant Regions, Countries, or Segments in Europe Smart Glass Industry

The UK currently holds the largest market share in Europe for smart glass, driven by strong government support for energy efficiency initiatives and a robust construction sector. Germany and France follow closely, representing significant growth potential due to their sizable commercial building markets. Within application segments, the construction industry is the largest consumer of smart glass, followed by commercial buildings and transportation. Electrochromic glass technology currently dominates the market share, offering superior performance and aesthetics.

- Key Drivers:

- Strong government support for green building initiatives in the UK.

- Significant investment in infrastructure projects in Germany and France.

- Growing demand for energy-efficient solutions across all sectors.

- Dominant Regions: UK, Germany, France.

- Dominant Segments: Construction, Commercial Buildings, Electrochromic Glass.

Europe Smart Glass Industry Product Landscape

Smart glass products are increasingly sophisticated, offering a range of functionalities beyond basic light control. Electrochromic glass stands out for its energy efficiency and sleek aesthetics, while suspended particle devices provide dynamic privacy control. Key performance metrics include light transmission, solar heat gain coefficient, and switching speed. Unique selling propositions often include customizable light control, enhanced privacy features, and integration with building management systems. Technological advancements focus on improving energy efficiency, reducing costs, and expanding functionalities.

Key Drivers, Barriers & Challenges in Europe Smart Glass Industry

Key Drivers:

- Growing demand for energy-efficient buildings.

- Increasing adoption of smart technologies in buildings and transportation.

- Favorable government policies and incentives.

Key Challenges:

- High initial investment costs.

- Supply chain disruptions impacting raw material availability and manufacturing timelines.

- Intense competition from established players and emerging companies.

Emerging Opportunities in Europe Smart Glass Industry

Untapped markets exist in the residential sector and smaller commercial buildings. Innovative applications, such as smart windows for automobiles and electronic devices, present substantial growth potential. Evolving consumer preferences for personalized and automated control over lighting and privacy are also creating new opportunities.

Growth Accelerators in the Europe Smart Glass Industry Industry

Technological breakthroughs in material science and manufacturing processes will drive cost reductions and performance enhancements. Strategic partnerships between smart glass manufacturers and building technology companies are crucial for expanding market reach and integrating smart glass solutions into wider building management systems. Market expansion strategies focused on emerging markets and untapped applications will further accelerate growth.

Key Players Shaping the Europe Smart Glass Industry Market

- Polytronix

- View Inc

- Scienstry Inc

- Saint-Gobain

- Pulp Studio

- Smartglass International

- Citala

- Pro Display

- Asahi Glass Corporation

- Gentex Corporation

- Nippon

- Ravenbrick

- Hitachi Chemical

- LTI Smart Glass

- PPG Industries

Notable Milestones in Europe Smart Glass Industry Sector

- September 2021: Xiaomi launched smart glasses with photo, messaging, call, navigation, and real-time translation capabilities.

- September 2021: Facebook and Ray-Ban launched "Ray-Ban Stories" smart glasses for music, calls, photos, and video sharing.

In-Depth Europe Smart Glass Industry Market Outlook

The future of the European smart glass market is bright, driven by sustained demand for energy-efficient and smart building technologies. Strategic investments in R&D and expanding into new markets will be key factors in shaping future growth. The focus on sustainability and technological innovation will continue to drive the adoption of smart glass solutions across various sectors, leading to considerable market expansion in the coming years.

Europe Smart Glass Industry Segmentation

-

1. Technology

- 1.1. Suspended Particle Devices

- 1.2. Liquid Crystals

- 1.3. Electro-chromic Glass

- 1.4. Passive Smart glass

- 1.5. Active Smart glass

- 1.6. Others

-

2. Applications

-

2.1. Construction

- 2.1.1. Residential Buildings

- 2.1.2. Commercial Buildings

-

2.2. Transportation

- 2.2.1. Aerospace

- 2.2.2. Rail

- 2.2.3. Automotive

- 2.2.4. Others

- 2.3. Energy

- 2.4. Consumer Electronics

-

2.1. Construction

Europe Smart Glass Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Smart Glass Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing focus on Energy Conservation and Environment Friendly Technologies; Government Regulations; Increasing demand for energy savings techniques

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of Smart Glass Benefits; Technical Issues with the Usage of Large Size Smart Glass

- 3.4. Market Trends

- 3.4.1. Transportation industry is expected to have further growth opportunities in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Suspended Particle Devices

- 5.1.2. Liquid Crystals

- 5.1.3. Electro-chromic Glass

- 5.1.4. Passive Smart glass

- 5.1.5. Active Smart glass

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Construction

- 5.2.1.1. Residential Buildings

- 5.2.1.2. Commercial Buildings

- 5.2.2. Transportation

- 5.2.2.1. Aerospace

- 5.2.2.2. Rail

- 5.2.2.3. Automotive

- 5.2.2.4. Others

- 5.2.3. Energy

- 5.2.4. Consumer Electronics

- 5.2.1. Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Smart Glass Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Polytronix

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 View Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Scienstry Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Saint-Gobain

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Pulp Studio

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Smartglass International

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Citala

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pro Display

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Asahi Glass Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Gentex Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Nippon

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Ravenbrick

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Hitachi Chemical

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 LTI Smart Glass

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 PPG Industries

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Polytronix

List of Figures

- Figure 1: Europe Smart Glass Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Smart Glass Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Smart Glass Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Smart Glass Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Europe Smart Glass Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 4: Europe Smart Glass Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Smart Glass Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Smart Glass Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 14: Europe Smart Glass Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 15: Europe Smart Glass Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Smart Glass Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Glass Industry?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the Europe Smart Glass Industry?

Key companies in the market include Polytronix, View Inc *List Not Exhaustive, Scienstry Inc, Saint-Gobain, Pulp Studio, Smartglass International, Citala, Pro Display, Asahi Glass Corporation, Gentex Corporation, Nippon, Ravenbrick, Hitachi Chemical, LTI Smart Glass, PPG Industries.

3. What are the main segments of the Europe Smart Glass Industry?

The market segments include Technology, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing focus on Energy Conservation and Environment Friendly Technologies; Government Regulations; Increasing demand for energy savings techniques.

6. What are the notable trends driving market growth?

Transportation industry is expected to have further growth opportunities in the market.

7. Are there any restraints impacting market growth?

Lack of Awareness of Smart Glass Benefits; Technical Issues with the Usage of Large Size Smart Glass.

8. Can you provide examples of recent developments in the market?

September 2021: Xiaomi launched its own smart glasses, which are capable of taking photos, displaying messages and notifications, making calls, providing navigation, and translating text right in real-time in front of eyes. The glasses also have an indicator light that shows when the 5-megapixel camera is in use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Glass Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Glass Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Glass Industry?

To stay informed about further developments, trends, and reports in the Europe Smart Glass Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence