Key Insights

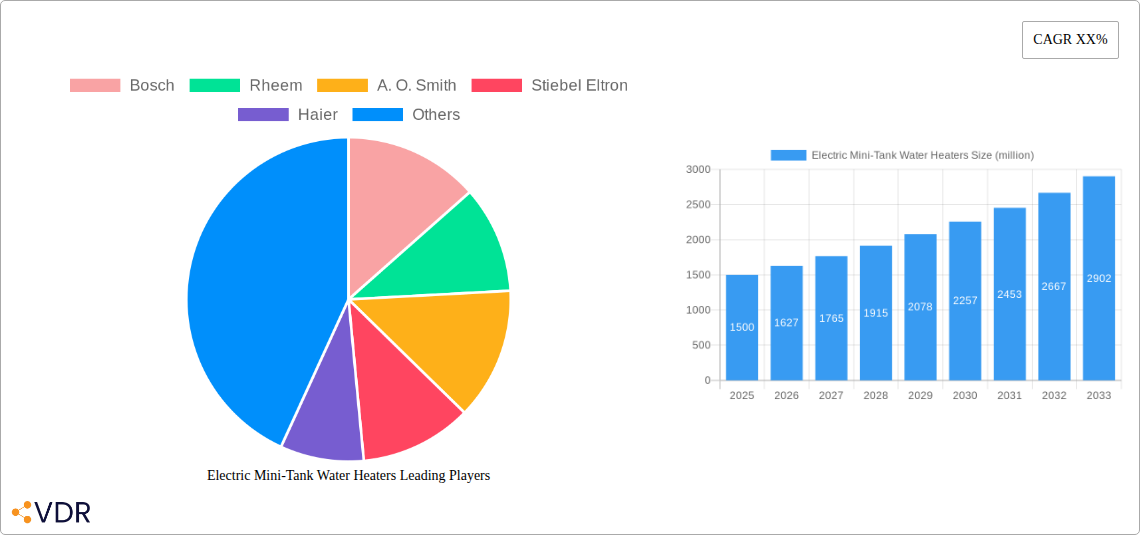

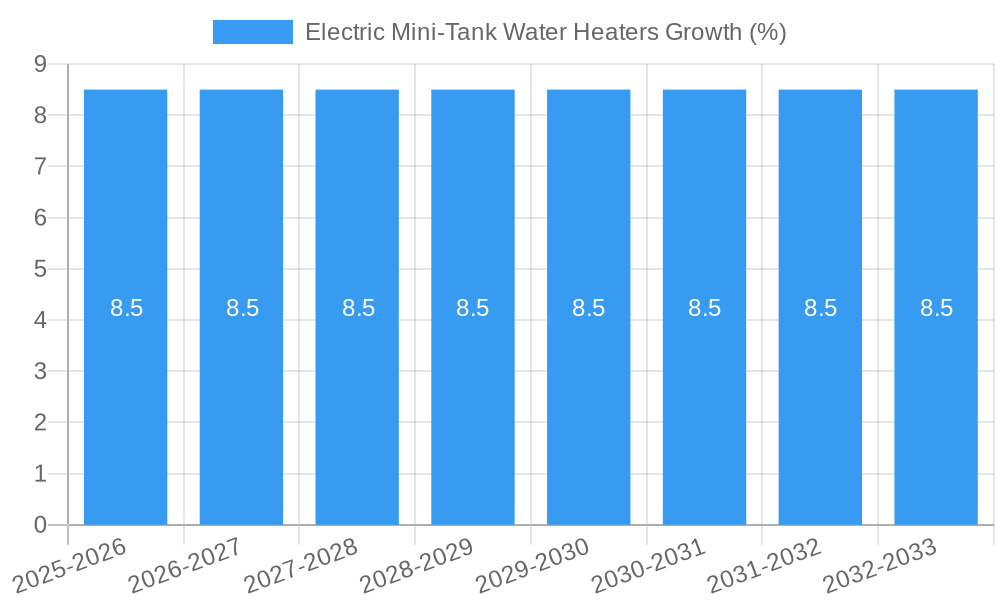

The global Electric Mini-Tank Water Heater market is poised for significant expansion, projected to reach an estimated market size of $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% forecast through 2033. This growth is propelled by a confluence of factors, primarily the increasing demand for on-demand hot water solutions in both residential and commercial settings. The compact nature and energy efficiency of mini-tank water heaters make them ideal for point-of-use applications, reducing water wastage and energy consumption compared to larger, centralized systems. This trend is further amplified by a growing consumer awareness of energy conservation and the associated cost savings. The market is also benefiting from increasing disposable incomes and urbanization, particularly in emerging economies, where space optimization is a key consideration for new constructions and renovations. The convenience of instant hot water for sinks, faucets, and small appliances, coupled with relatively low installation costs, makes these units an attractive option for a wide range of consumers.

Key drivers fueling this market include the rising adoption of smart home technologies, which integrate seamlessly with energy-efficient appliances, and a growing preference for localized heating solutions. The market is segmented by application into Commercial and Residential, with both segments experiencing healthy growth. Residential applications are particularly strong due to the increasing number of single-family homes and apartments requiring dedicated hot water solutions. In terms of type, the 2 to 5 Gallon and 5.1 to 7 Gallon segments are expected to dominate, catering to the typical needs of smaller households and individual fixtures. However, the Less than 2 Gallon segment is also gaining traction for niche applications like handwashing stations and RVs. Despite the positive outlook, potential restraints such as fluctuating electricity prices and the availability of alternative heating technologies like tankless gas water heaters could pose challenges. Nonetheless, the inherent advantages of electric mini-tank water heaters, including ease of installation and suitability for smaller spaces, are expected to ensure their continued market prominence.

Electric Mini-Tank Water Heaters Market Dynamics & Structure

The electric mini-tank water heater market is characterized by a moderately consolidated structure, with key players like Bosch, Rheem, A. O. Smith, Stiebel Eltron, Haier, and Vanward holding significant shares. Technological innovation is a primary driver, with ongoing advancements in energy efficiency, smart connectivity, and compact design enhancing product appeal for both commercial application and residential application segments. Regulatory frameworks, particularly those promoting energy conservation and reducing carbon footprints, are increasingly influencing product development and market adoption. Competitive product substitutes, including larger tankless water heaters and central heating systems, present a nuanced competitive landscape. End-user demographics highlight a growing demand from younger, tech-savvy homeowners seeking convenient and on-demand hot water solutions, alongside a steady demand from the commercial sector for point-of-use applications. Mergers and acquisitions (M&A) trends are expected to see moderate activity as larger players aim to consolidate market share and acquire innovative technologies.

- Market Concentration: Moderate, with dominant global and regional players.

- Technological Innovation Drivers: Energy efficiency standards, IoT integration, compact designs, faster heating elements.

- Regulatory Frameworks: Energy Star certifications, local building codes, environmental impact regulations.

- Competitive Product Substitutes: Tankless water heaters, larger storage tank water heaters, central heating systems.

- End-User Demographics: Homeowners (especially in apartments and renovations), small businesses (restaurants, retail), healthcare facilities.

- M&A Trends: Strategic acquisitions for technology or market expansion.

Electric Mini-Tank Water Heaters Growth Trends & Insights

The electric mini-tank water heater market is poised for robust growth, driven by an increasing demand for localized and on-demand hot water solutions across residential application and commercial application sectors. The market size is projected to expand significantly from an estimated $X.X billion in 2025 to $Y.Y billion by 2033, exhibiting a compound annual growth rate (CAGR) of approximately Z.Z% during the forecast period of 2025–2033. This expansion is fueled by escalating urbanization, a rise in small living spaces such as apartments and studios where traditional large water heaters are impractical, and a growing preference for energy-efficient appliances.

Technological disruptions are playing a pivotal role. Mini-tank water heaters are increasingly incorporating advanced features like precise temperature control, Wi-Fi connectivity for remote operation and monitoring, and enhanced safety mechanisms. These innovations cater to a discerning consumer base that values convenience, efficiency, and smart home integration. Furthermore, the growing awareness regarding environmental sustainability and rising energy costs are compelling consumers and businesses to opt for smaller, more energy-efficient water heating solutions, leading to higher adoption rates. The market penetration for electric mini-tank water heaters is expected to deepen, especially in regions with strong electrical infrastructure and a focus on reducing reliance on fossil fuels.

Consumer behavior is also shifting, with a greater emphasis on point-of-use heating to minimize heat loss from long pipe runs and reduce water wastage. This trend is particularly prevalent in commercial settings like washrooms in offices, hotels, and retail spaces, as well as in residential kitchens and bathrooms where immediate hot water is desired. The ease of installation and relatively lower upfront cost compared to larger systems also contributes to their attractiveness, particularly for retrofitting and smaller-scale projects. The evolution of the product landscape, with manufacturers focusing on sleek designs and compact footprints, further aligns with modern aesthetic preferences and space constraints.

- Market Size Evolution: Projected growth from an estimated $X.X billion in 2025 to $Y.Y billion by 2033.

- CAGR: Approximately Z.Z% during the forecast period (2025–2033).

- Adoption Rates: Increasing due to energy efficiency, space-saving designs, and convenience.

- Technological Disruptions: Smart features, IoT integration, precise temperature control, rapid heating.

- Consumer Behavior Shifts: Preference for point-of-use heating, reduced water wastage, demand for convenience and energy savings.

- Market Penetration: Expected to rise in urban areas and regions with favorable energy policies.

Dominant Regions, Countries, or Segments in Electric Mini-Tank Water Heaters

The Residential Application segment, particularly the 2 to 5 Gallon capacity type, is emerging as the dominant force driving growth in the global electric mini-tank water heater market. This dominance is underpinned by a confluence of factors catering to modern living and evolving consumer needs. The increasing trend of urbanization globally has led to a surge in smaller living spaces, such as apartments, condominiums, and studio units, where space is at a premium. Electric mini-tank water heaters, with their compact design, are perfectly suited for installation under sinks or in tight utility closets, making them an ideal solution for these confined environments.

The 2 to 5 Gallon capacity range specifically strikes a balance between providing sufficient hot water for immediate needs (e.g., handwashing, dishwashing) and maintaining an energy-efficient profile. This size is often preferred for point-of-use applications, eliminating the energy and water waste associated with heating and transporting water from a central unit over long distances. The convenience of having hot water readily available at the faucet or appliance significantly enhances user experience, contributing to its widespread adoption in residential settings.

Furthermore, economic policies in many developed and developing nations are encouraging the adoption of energy-efficient appliances to reduce household energy consumption and carbon emissions. Electric mini-tank water heaters often meet stringent energy efficiency standards, making them an attractive choice for environmentally conscious consumers and those looking to reduce their utility bills. Infrastructure development in these regions, characterized by robust electrical grids and increasing availability of electricity as a primary energy source, further supports the growth of electric water heating solutions.

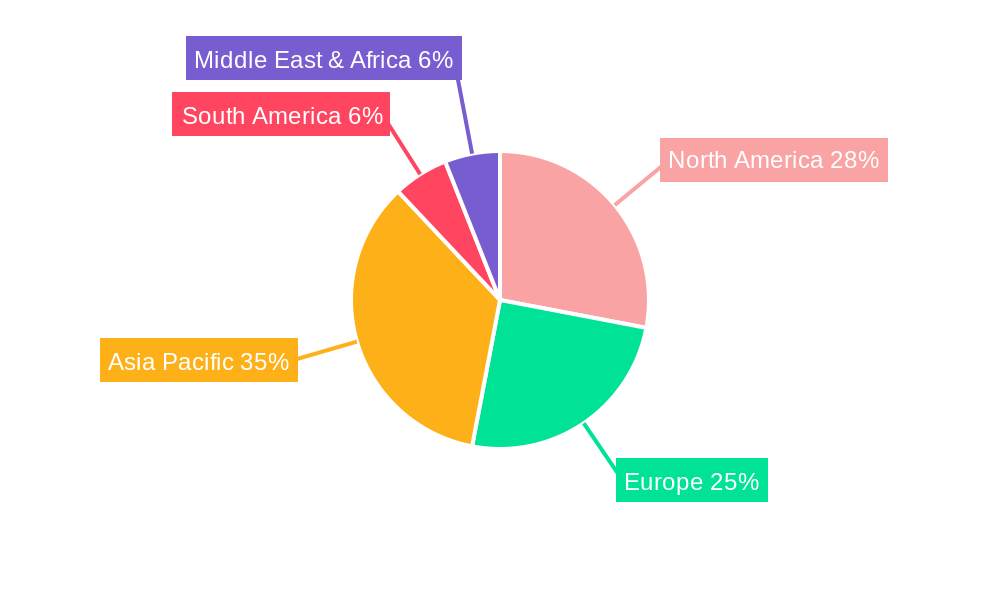

In terms of regional dominance, North America and Europe are currently leading the market. North America benefits from a mature market for tankless and compact water heating solutions, coupled with a strong emphasis on smart home technology adoption. Europe, with its stringent energy efficiency regulations and a growing focus on sustainability, presents a fertile ground for mini-tank water heaters. Asia-Pacific is rapidly emerging as a key growth region, driven by rapid urbanization, rising disposable incomes, and a burgeoning middle class keen on adopting modern, convenient, and energy-efficient appliances.

- Dominant Segment: Residential Application.

- Dominant Type: 2 to 5 Gallon capacity.

- Key Drivers (Residential): Urbanization, smaller living spaces, demand for on-demand hot water, ease of installation, energy efficiency.

- Key Drivers (Commercial): Point-of-use applications in offices, retail, hospitality; supplementary heating.

- Regional Dominance: North America and Europe currently lead; Asia-Pacific showing rapid growth.

- Market Share (Estimated): Residential Application Segment accounts for approximately XX% of the total market share. The 2 to 5 Gallon capacity type holds an estimated YY% of the mini-tank segment.

- Growth Potential: Asia-Pacific region expected to witness the highest growth rate due to rapid industrialization and increasing consumer spending.

Electric Mini-Tank Water Heaters Product Landscape

The electric mini-tank water heater product landscape is characterized by ongoing innovation focused on enhancing user experience and operational efficiency. Manufacturers are prioritizing compact designs that seamlessly integrate into various spaces, from under-sink installations to wall-mounted solutions. Product advancements include the integration of digital thermostats for precise temperature control, rapid heating elements for on-demand hot water, and improved insulation for minimized standby heat loss. Smart connectivity features, enabling users to monitor and control water temperature remotely via smartphone applications, are becoming increasingly prevalent, catering to the demand for connected homes. Performance metrics are continuously being optimized, with a focus on achieving higher energy efficiency ratings (e.g., Energy Factor) and reducing the time required to reach target temperatures. These innovations are driving adoption across both residential application and commercial application segments.

Key Drivers, Barriers & Challenges in Electric Mini-Tank Water Heaters

Key Drivers:

The electric mini-tank water heater market is propelled by several key drivers. Firstly, the escalating demand for on-demand hot water solutions in both residential application and commercial application settings, particularly for point-of-use applications, is a significant catalyst. Secondly, the increasing focus on energy efficiency and sustainability globally, driven by government regulations and consumer awareness, favors compact and energy-saving appliances. Thirdly, the growing trend of urbanization and smaller living spaces makes these compact units an ideal fit. Finally, technological advancements in smart connectivity and precise temperature control are enhancing product appeal and convenience.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces certain barriers and challenges. A primary challenge is the perceived limitation in hot water capacity for larger households or high-demand commercial settings, leading some consumers to opt for larger tankless or storage water heaters. Competition from established tankless water heater manufacturers also poses a challenge. Furthermore, higher upfront electricity costs compared to natural gas in some regions can deter adoption, despite long-term operational savings. Supply chain disruptions and the availability of skilled installers can also impact market expansion. The initial cost of some smart-enabled models may also present a barrier for price-sensitive consumers.

Emerging Opportunities in Electric Mini-Tank Water Heaters

Emerging opportunities for electric mini-tank water heaters lie in several key areas. The untapped potential within the renovation and remodeling market presents a significant avenue for growth, as homeowners seek to upgrade existing plumbing with more efficient and space-saving solutions. The increasing adoption of accessory dwelling units (ADUs) and tiny homes also creates a dedicated market for these compact water heaters. Furthermore, there is a growing opportunity in commercial sectors beyond traditional office spaces, such as RV parks, modular construction, and remote work sites requiring localized hot water. Innovative applications, such as integration into multi-dwelling unit (MDU) plumbing systems for individualized control, and evolving consumer preferences for eco-friendly and connected home appliances, will further drive market expansion.

Growth Accelerators in the Electric Mini-Tank Water Heaters Industry

Several catalysts are accelerating long-term growth in the electric mini-tank water heater industry. Technological breakthroughs in heating element efficiency and insulation materials are leading to superior energy performance and reduced operating costs, making them more competitive. Strategic partnerships between manufacturers and smart home technology providers are enhancing product integration and offering a more comprehensive user experience. Market expansion strategies targeting developing economies with growing disposable incomes and increasing electrification are opening up new consumer bases. Furthermore, government incentives and rebates for energy-efficient appliances continue to play a crucial role in driving consumer adoption and market penetration.

Key Players Shaping the Electric Mini-Tank Water Heaters Market

- Bosch

- Rheem

- A. O. Smith

- Stiebel Eltron

- Haier

- Vanward

- EcoSmart

- Atmor

- Eccotemp

- Marey

Notable Milestones in Electric Mini-Tank Water Heaters Sector

- 2019: Increased adoption of Wi-Fi enabled mini-tank water heaters with app control.

- 2020: Focus on improved energy efficiency ratings in response to stricter regulations.

- 2021: Introduction of ultra-compact models for niche applications.

- 2022: Expansion of product lines by key manufacturers into higher capacity ranges within the mini-tank segment.

- 2023: Growing consumer preference for point-of-use solutions driving market growth.

- 2024: Advancements in faster heating technologies and user-friendly interfaces.

In-Depth Electric Mini-Tank Water Heaters Market Outlook

The future outlook for the electric mini-tank water heater market remains exceptionally bright, fueled by sustained demand for convenience, energy efficiency, and space-saving solutions. Growth accelerators, including technological advancements in heating efficiency and smart integration, alongside strategic market expansion, are poised to drive significant market penetration. The increasing global focus on sustainability and reduced carbon footprints will continue to favor electric heating technologies. Manufacturers are expected to further innovate, offering more diversified product portfolios that cater to a broader range of applications and consumer needs. Strategic opportunities in emerging markets and the renovation sector present substantial potential for long-term expansion, positioning the electric mini-tank water heater as a vital component of modern, efficient, and sustainable living.

Electric Mini-Tank Water Heaters Segmentation

-

1. Application

- 1.1. Commercial Application

- 1.2. Residential Application

-

2. Types

- 2.1. Less than 2 Gallon

- 2.2. 2. to 5 Gallon

- 2.3. 5.1 to 7 Gallon

Electric Mini-Tank Water Heaters Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Mini-Tank Water Heaters REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Mini-Tank Water Heaters Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Application

- 5.1.2. Residential Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Less than 2 Gallon

- 5.2.2. 2. to 5 Gallon

- 5.2.3. 5.1 to 7 Gallon

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electric Mini-Tank Water Heaters Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Application

- 6.1.2. Residential Application

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Less than 2 Gallon

- 6.2.2. 2. to 5 Gallon

- 6.2.3. 5.1 to 7 Gallon

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electric Mini-Tank Water Heaters Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Application

- 7.1.2. Residential Application

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Less than 2 Gallon

- 7.2.2. 2. to 5 Gallon

- 7.2.3. 5.1 to 7 Gallon

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electric Mini-Tank Water Heaters Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Application

- 8.1.2. Residential Application

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Less than 2 Gallon

- 8.2.2. 2. to 5 Gallon

- 8.2.3. 5.1 to 7 Gallon

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electric Mini-Tank Water Heaters Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Application

- 9.1.2. Residential Application

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Less than 2 Gallon

- 9.2.2. 2. to 5 Gallon

- 9.2.3. 5.1 to 7 Gallon

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electric Mini-Tank Water Heaters Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Application

- 10.1.2. Residential Application

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Less than 2 Gallon

- 10.2.2. 2. to 5 Gallon

- 10.2.3. 5.1 to 7 Gallon

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bosch

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rheem

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A. O. Smith

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stiebel Eltron

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Haier

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vanward

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Bosch

List of Figures

- Figure 1: Global Electric Mini-Tank Water Heaters Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Electric Mini-Tank Water Heaters Revenue (million), by Application 2024 & 2032

- Figure 3: North America Electric Mini-Tank Water Heaters Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Electric Mini-Tank Water Heaters Revenue (million), by Types 2024 & 2032

- Figure 5: North America Electric Mini-Tank Water Heaters Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Electric Mini-Tank Water Heaters Revenue (million), by Country 2024 & 2032

- Figure 7: North America Electric Mini-Tank Water Heaters Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Electric Mini-Tank Water Heaters Revenue (million), by Application 2024 & 2032

- Figure 9: South America Electric Mini-Tank Water Heaters Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Electric Mini-Tank Water Heaters Revenue (million), by Types 2024 & 2032

- Figure 11: South America Electric Mini-Tank Water Heaters Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Electric Mini-Tank Water Heaters Revenue (million), by Country 2024 & 2032

- Figure 13: South America Electric Mini-Tank Water Heaters Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Electric Mini-Tank Water Heaters Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Electric Mini-Tank Water Heaters Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Electric Mini-Tank Water Heaters Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Electric Mini-Tank Water Heaters Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Electric Mini-Tank Water Heaters Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Electric Mini-Tank Water Heaters Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Electric Mini-Tank Water Heaters Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Electric Mini-Tank Water Heaters Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Electric Mini-Tank Water Heaters Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Electric Mini-Tank Water Heaters Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Electric Mini-Tank Water Heaters Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Electric Mini-Tank Water Heaters Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Electric Mini-Tank Water Heaters Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Electric Mini-Tank Water Heaters Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Electric Mini-Tank Water Heaters Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Electric Mini-Tank Water Heaters Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Electric Mini-Tank Water Heaters Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Electric Mini-Tank Water Heaters Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Electric Mini-Tank Water Heaters Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Electric Mini-Tank Water Heaters Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Mini-Tank Water Heaters?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Electric Mini-Tank Water Heaters?

Key companies in the market include Bosch, Rheem, A. O. Smith, Stiebel Eltron, Haier, Vanward.

3. What are the main segments of the Electric Mini-Tank Water Heaters?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Mini-Tank Water Heaters," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Mini-Tank Water Heaters report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Mini-Tank Water Heaters?

To stay informed about further developments, trends, and reports in the Electric Mini-Tank Water Heaters, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence