Key Insights

The European Winter Sports Equipment Market is projected to experience robust expansion, reaching approximately $17.78 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.87% through 2033. This growth is propelled by the escalating popularity of winter sports, fueled by increased engagement in outdoor recreational pursuits and rising consumer disposable income. Significant market size indicates a strong existing landscape poised to benefit from these macroeconomic trends. Key drivers include technological advancements in equipment enhancing performance and safety, alongside the influence of social media in promoting winter sports lifestyles. Additionally, the development of winter sports tourism infrastructure across Europe is a major contributor to market demand.

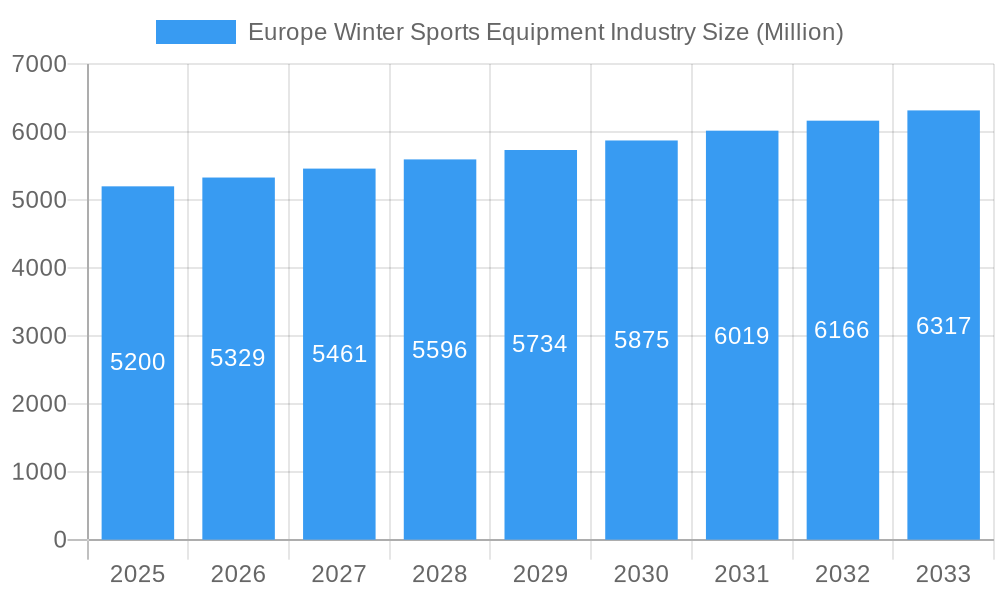

Europe Winter Sports Equipment Industry Market Size (In Billion)

Market segmentation shows balanced demand across various sports, with skiing and snowboarding segments holding substantial shares. The "Skis and Poles" and "Ski Boots" segments are anticipated to maintain dominance within the ski category due to consistent replacement needs and ongoing technological innovation for improved performance and comfort. The "Other Protective Gear and Accessories" segment is also expected to grow significantly, driven by heightened safety awareness and the demand for personalized equipment. Key end-user demographics include men, women, and children, with a notable focus on specialized gear for women and children. Distribution channels are shifting, with online retail experiencing accelerated growth due to convenience and wider product selection, while brick-and-mortar stores continue to serve consumers who value in-person fitting and expert consultation. The "Rest of Europe" region, encompassing developing winter sports destinations, is identified as a crucial growth area.

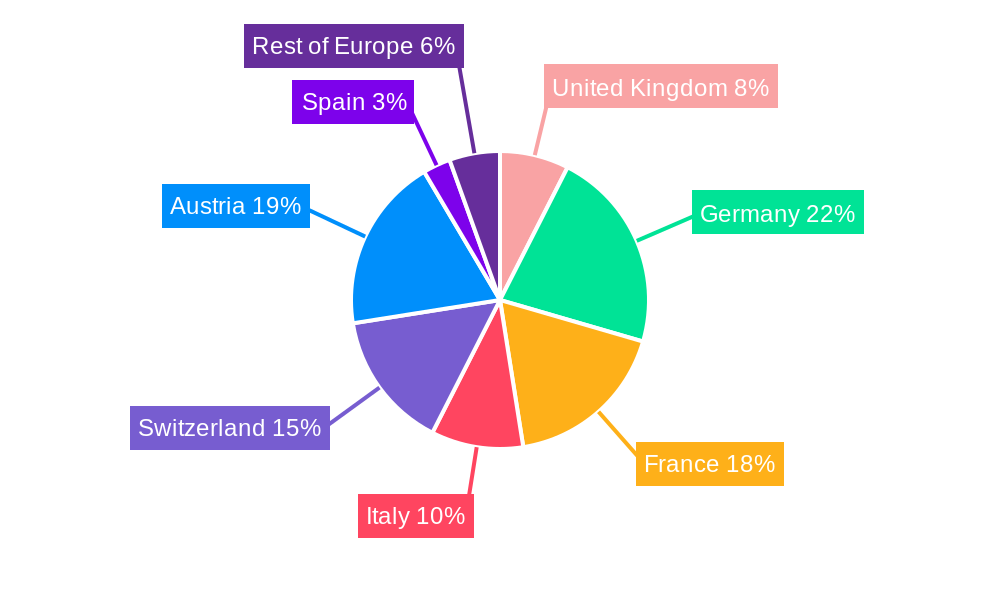

Europe Winter Sports Equipment Industry Company Market Share

Europe Winter Sports Equipment Industry Market Dynamics & Structure

The Europe Winter Sports Equipment Industry is characterized by a moderate level of market concentration, with several key players vying for market share. Technological innovation is a significant driver, with companies continuously investing in research and development to enhance product performance, safety, and sustainability. This includes advancements in material science for lighter and more durable skis and snowboards, as well as sophisticated boot fitting technologies and advanced protective gear. Regulatory frameworks, particularly those related to safety standards for equipment and environmental impact, also shape market dynamics. Competitive product substitutes, such as advancements in outdoor apparel offering enhanced warmth and protection, pose an indirect challenge. End-user demographics are evolving, with a growing interest in adaptive sports equipment and a sustained demand from younger generations. Mergers and acquisitions (M&A) are a notable trend, with larger entities acquiring smaller, innovative companies to expand their product portfolios and market reach.

- Market Concentration: Moderate, with top players holding significant but not dominant market share.

- Technological Innovation: Driven by material science, smart technologies, and enhanced user experience.

- Regulatory Impact: Focus on safety standards and environmental sustainability.

- Competitive Landscape: Includes advancements in related outdoor apparel and equipment.

- End-User Demographics: Growing interest in inclusivity and youth engagement.

- M&A Trends: Strategic acquisitions to consolidate market position and acquire innovative technologies.

Europe Winter Sports Equipment Industry Growth Trends & Insights

The Europe Winter Sports Equipment Industry is poised for significant expansion, driven by a confluence of evolving consumer behaviors, technological advancements, and a renewed appreciation for outdoor recreational activities. Market size is projected to grow from an estimated value of USD 15,500 million in 2025 to USD 20,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 3.7% during the forecast period (2025-2033). This growth trajectory is underpinned by increased disposable incomes across key European nations, coupled with a growing health and wellness consciousness that encourages participation in outdoor pursuits.

Technological disruptions are playing a pivotal role in shaping consumer preferences and driving adoption rates. The integration of smart technologies into winter sports equipment, such as GPS tracking in helmets and performance monitoring in skis, is gaining traction. Furthermore, advancements in sustainable materials and manufacturing processes are appealing to an increasingly environmentally conscious consumer base. The adoption rate of technologically advanced equipment is projected to rise steadily as consumers become more aware of the performance and safety benefits.

Consumer behavior shifts are also significant. There's a discernible trend towards experiential travel and adventure tourism, with winter sports holidays forming a core component for many. This is driving demand for rental equipment, as well as the purchase of personal gear. Moreover, the rise of social media and influencer marketing has democratized winter sports, making them appear more accessible and aspirational to a wider audience, including novice participants. The market penetration of specialized winter sports equipment is expected to deepen, particularly in regions with emerging winter tourism infrastructure. The forecast period will witness a greater emphasis on personalized equipment fitting and customized product offerings, catering to the specific needs and skill levels of individual consumers.

Dominant Regions, Countries, or Segments in Europe Winter Sports Equipment Industry

The Europe Winter Sports Equipment Industry is a dynamic landscape, with distinct regional strengths and segment leadership contributing to its overall growth. Among the key segments, the Sport: Ski category, encompassing Skis and Poles and Ski Boots, is anticipated to maintain its dominant position throughout the forecast period. This dominance is driven by a combination of deep-rooted cultural traditions, extensive alpine infrastructure, and a mature consumer base with a high propensity for investing in premium ski equipment. Countries like Switzerland, Austria, France, and Italy, renowned for their world-class ski resorts and long-standing skiing heritage, represent the core markets for this segment. These nations benefit from favorable economic policies that support tourism, significant investment in snowmaking and lift infrastructure, and a consistently high volume of both domestic and international ski tourists.

Within the broader Ski segment, Skis and Poles are expected to exhibit robust growth, fueled by continuous innovation in materials like carbon fiber and graphene, leading to lighter, more responsive, and more durable products. Similarly, Ski Boots are witnessing a surge in demand due to advancements in custom fitting technologies, heat-moldable liners, and innovative closure systems, enhancing comfort and performance for skiers of all levels. Market share within this segment is distributed among established brands, but the emphasis on performance and individualization is creating opportunities for niche manufacturers.

While Snowboard equipment is experiencing steady growth, particularly among younger demographics and in specific resort areas, it is yet to surpass the established market share of the Ski segment. The End-User: Men segment historically holds the largest market share, reflecting traditional participation rates and purchasing power. However, the End-User: Women segment is demonstrating a faster growth rate, driven by increased female participation in winter sports and the development of specialized, high-performance women's equipment. The End-User: Children segment is also a crucial growth driver, as families increasingly invest in introducing their children to winter sports from a young age, leading to a consistent demand for durable and safe junior equipment.

The Distribution Channel: Offline Retail Stores continue to be a primary channel, offering customers the opportunity for in-person trials, expert advice, and immediate purchase. However, Online Retail Stores are rapidly gaining market share due to their convenience, wider product selection, and competitive pricing. This dual-channel approach is essential for manufacturers to reach a broad consumer base effectively. Infrastructure development, such as improved transportation links to ski resorts and the expansion of snow-sure areas, further bolsters the dominance of established winter sports regions and, by extension, the equipment catering to them.

Europe Winter Sports Equipment Industry Product Landscape

The Europe Winter Sports Equipment Industry is witnessing a surge in product innovation, with a focus on enhancing performance, safety, and user experience. Advanced materials such as carbon fiber composites and novel foam technologies are enabling the creation of lighter, stronger, and more responsive skis and snowboards. Ski boot technology is evolving with customizable liners, advanced closure systems, and integrated heating elements for unparalleled comfort and fit. Protective gear is becoming more sophisticated, incorporating impact-absorbing technologies and ergonomic designs for improved safety without compromising mobility. Unique selling propositions often revolve around personalized fit solutions, eco-friendly material sourcing, and the integration of smart technologies for performance tracking and data analysis, appealing to both elite athletes and recreational enthusiasts seeking to optimize their winter sports adventures.

Key Drivers, Barriers & Challenges in Europe Winter Sports Equipment Industry

Key Drivers:

- Growing Popularity of Winter Tourism: Increased global interest in skiing, snowboarding, and other snow-based activities drives demand for equipment.

- Technological Advancements: Innovations in materials, design, and smart features enhance product performance and appeal.

- Health and Wellness Trends: A rising focus on outdoor recreation and physical fitness encourages participation in winter sports.

- Economic Growth and Disposable Income: Higher incomes in key European markets enable greater spending on recreational equipment.

- Infrastructure Development: Investments in ski resorts and snow-making facilities expand accessibility and appeal.

Barriers & Challenges:

- Seasonality and Weather Dependency: Demand is intrinsically linked to winter conditions, leading to cyclical sales patterns.

- High Cost of Equipment: Premium winter sports gear can be a significant financial investment, limiting accessibility for some consumers.

- Environmental Concerns: The environmental impact of manufacturing and resort operations is facing increasing scrutiny, potentially leading to stricter regulations.

- Competition from Emerging Destinations: Growth in winter sports in other global regions can divert some market share from Europe.

- Supply Chain Volatility: Global events and logistical challenges can disrupt the availability and pricing of raw materials and finished goods.

Emerging Opportunities in Europe Winter Sports Equipment Industry

Emerging opportunities in the Europe Winter Sports Equipment Industry lie in the burgeoning adaptive winter sports segment, catering to individuals with disabilities. This includes the development of specialized skis, sleds, and adapted gear, offering significant growth potential as inclusivity in sports gains momentum. Another key opportunity is the increasing demand for sustainable and eco-friendly equipment, prompting innovation in biodegradable materials and environmentally conscious manufacturing processes. Furthermore, the rental and subscription models for winter sports equipment are gaining traction, offering consumers a more flexible and cost-effective way to access high-quality gear, particularly for occasional participants. Tapping into the "experiential" travel market by offering bundled equipment and activity packages also presents a lucrative avenue.

Growth Accelerators in the Europe Winter Sports Equipment Industry Industry

Several catalysts are accelerating growth in the Europe Winter Sports Equipment Industry. Technological breakthroughs, such as advanced material science leading to lighter and more durable equipment, and the integration of AI for personalized gear recommendations, are key accelerators. Strategic partnerships between equipment manufacturers, resort operators, and tourism bodies can create synergistic growth opportunities by promoting winter sports destinations and offering integrated packages. Furthermore, market expansion strategies targeting new demographics, including older adults and urban populations seeking weekend getaways, are crucial. The growing emphasis on experiential marketing and digital engagement is also vital in reaching and converting potential consumers.

Key Players Shaping the Europe Winter Sports Equipment Industry Market

- Vista Outdoor Inc

- Marker Dalbello Volkl (International) GmbH

- Åre Skidfabrik AB

- Burton Snowboards

- Tecnica Group SpA

- Groupe Rossignol

- Amer Sports Oyj

- UVEX group

- Alpina d o o

- Clarus Corporation

- Fischer Beteiligungsverwaltungs GmbH

Notable Milestones in Europe Winter Sports Equipment Industry Sector

- 2021: Amer Sports Oyj's acquisition of several smaller niche winter sports brands, enhancing its product portfolio in specialized categories.

- 2022: Groupe Rossignol's launch of a new line of skis featuring recycled materials, responding to growing consumer demand for sustainable products.

- 2023: Tecnica Group SpA's introduction of advanced 3D scanning technology for personalized ski boot fitting, significantly improving customer experience and product performance.

- 2023: Burton Snowboards' increased investment in direct-to-consumer online channels, demonstrating a strategic shift towards digital retail.

- 2024: Vista Outdoor Inc's continued focus on product innovation in protective gear, with a new range of helmets incorporating advanced impact absorption technology.

- 2024: UVEX group's expansion into the North American market, indicating a growing global footprint and ambition.

- 2024: Fischer Beteiligungsverwaltungs GmbH's enhanced R&D efforts in lightweight ski construction, aiming for a competitive edge in performance.

In-Depth Europe Winter Sports Equipment Industry Market Outlook

The Europe Winter Sports Equipment Industry is set for sustained and robust growth, driven by ongoing innovation and evolving consumer preferences. Future market potential is significantly influenced by the continued embrace of sustainability, with a strong emphasis on eco-friendly materials and production processes, which will resonate with a conscientious consumer base. Strategic alliances and partnerships between manufacturers, resorts, and tourism bodies will be crucial in creating integrated experiences and driving market penetration. The industry's ability to cater to diverse needs, including the growing adaptive sports sector and the increasing participation of women and children, will further accelerate growth. Investments in digital transformation, from e-commerce to virtual try-on technologies, will be paramount in enhancing customer engagement and accessibility. Overall, the outlook is optimistic, with ample opportunities for companies that prioritize innovation, sustainability, and customer-centric strategies.

Europe Winter Sports Equipment Industry Segmentation

-

1. Sport

-

1.1. Ski

- 1.1.1. Skis and Poles

- 1.1.2. Ski Boots

- 1.1.3. Other Protective Gear and Accessories

- 1.2. Snowboard

-

1.1. Ski

-

2. End-User

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Online Retail Stores

- 3.2. Offline Retail Stores

Europe Winter Sports Equipment Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Switzerland

- 6. Austria

- 7. Spain

- 8. Rest of Europe

Europe Winter Sports Equipment Industry Regional Market Share

Geographic Coverage of Europe Winter Sports Equipment Industry

Europe Winter Sports Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Growing Number Of Ski Destinations Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 5.1.1. Ski

- 5.1.1.1. Skis and Poles

- 5.1.1.2. Ski Boots

- 5.1.1.3. Other Protective Gear and Accessories

- 5.1.2. Snowboard

- 5.1.1. Ski

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Switzerland

- 5.4.6. Austria

- 5.4.7. Spain

- 5.4.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 6. United Kingdom Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 6.1.1. Ski

- 6.1.1.1. Skis and Poles

- 6.1.1.2. Ski Boots

- 6.1.1.3. Other Protective Gear and Accessories

- 6.1.2. Snowboard

- 6.1.1. Ski

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 7. Germany Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 7.1.1. Ski

- 7.1.1.1. Skis and Poles

- 7.1.1.2. Ski Boots

- 7.1.1.3. Other Protective Gear and Accessories

- 7.1.2. Snowboard

- 7.1.1. Ski

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 8. France Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 8.1.1. Ski

- 8.1.1.1. Skis and Poles

- 8.1.1.2. Ski Boots

- 8.1.1.3. Other Protective Gear and Accessories

- 8.1.2. Snowboard

- 8.1.1. Ski

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 9. Italy Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 9.1.1. Ski

- 9.1.1.1. Skis and Poles

- 9.1.1.2. Ski Boots

- 9.1.1.3. Other Protective Gear and Accessories

- 9.1.2. Snowboard

- 9.1.1. Ski

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 10. Switzerland Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 10.1.1. Ski

- 10.1.1.1. Skis and Poles

- 10.1.1.2. Ski Boots

- 10.1.1.3. Other Protective Gear and Accessories

- 10.1.2. Snowboard

- 10.1.1. Ski

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Children

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online Retail Stores

- 10.3.2. Offline Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 11. Austria Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 11.1.1. Ski

- 11.1.1.1. Skis and Poles

- 11.1.1.2. Ski Boots

- 11.1.1.3. Other Protective Gear and Accessories

- 11.1.2. Snowboard

- 11.1.1. Ski

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Men

- 11.2.2. Women

- 11.2.3. Children

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online Retail Stores

- 11.3.2. Offline Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 12. Spain Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 12.1.1. Ski

- 12.1.1.1. Skis and Poles

- 12.1.1.2. Ski Boots

- 12.1.1.3. Other Protective Gear and Accessories

- 12.1.2. Snowboard

- 12.1.1. Ski

- 12.2. Market Analysis, Insights and Forecast - by End-User

- 12.2.1. Men

- 12.2.2. Women

- 12.2.3. Children

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Online Retail Stores

- 12.3.2. Offline Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 13. Rest of Europe Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 13.1.1. Ski

- 13.1.1.1. Skis and Poles

- 13.1.1.2. Ski Boots

- 13.1.1.3. Other Protective Gear and Accessories

- 13.1.2. Snowboard

- 13.1.1. Ski

- 13.2. Market Analysis, Insights and Forecast - by End-User

- 13.2.1. Men

- 13.2.2. Women

- 13.2.3. Children

- 13.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.3.1. Online Retail Stores

- 13.3.2. Offline Retail Stores

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Vista Outdoor Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Marker Dalbello Volkl (International) GmbH

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Åre Skidfabrik AB

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Burton Snowboards

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Tecnica Group SpA*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Groupe Rossignol

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Amer Sports Oyj

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 UVEX group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Alpina d o o

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Clarus Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Fischer Beteiligungsverwaltungs GmbH

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Vista Outdoor Inc

List of Figures

- Figure 1: Europe Winter Sports Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Winter Sports Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 2: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 3: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 5: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 10: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 11: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 13: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 18: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 19: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 21: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 26: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 27: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 29: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 34: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 35: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 37: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 42: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 43: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 45: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 50: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 51: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 52: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 53: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 54: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 55: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 57: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 58: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 59: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 60: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 61: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 62: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 63: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 64: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 65: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 66: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 67: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 68: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 69: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 71: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Winter Sports Equipment Industry?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the Europe Winter Sports Equipment Industry?

Key companies in the market include Vista Outdoor Inc, Marker Dalbello Volkl (International) GmbH, Åre Skidfabrik AB, Burton Snowboards, Tecnica Group SpA*List Not Exhaustive, Groupe Rossignol, Amer Sports Oyj, UVEX group, Alpina d o o, Clarus Corporation, Fischer Beteiligungsverwaltungs GmbH.

3. What are the main segments of the Europe Winter Sports Equipment Industry?

The market segments include Sport, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Growing Number Of Ski Destinations Drives the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Winter Sports Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Winter Sports Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Winter Sports Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Winter Sports Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence