Key Insights

The South America Hair Styling Products Market is projected for robust growth, anticipated to reach $8.64 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This expansion is fueled by evolving consumer preferences, rising disposable incomes, and a growing demand for personalized hair care. The market is significantly influenced by a focus on aesthetic appeal and social media trends that promote diverse styling techniques and products. Enhanced product accessibility via online retail and traditional channels is a key growth driver across the region. Diverse consumer needs, catering to various hair types and styling requirements, further stimulate market dynamism.

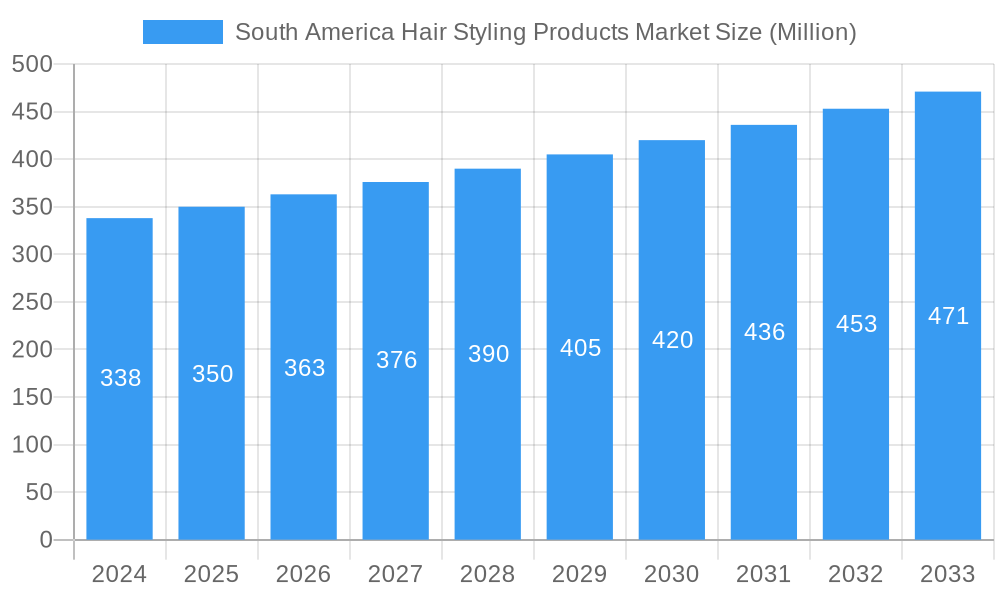

South America Hair Styling Products Market Market Size (In Billion)

Innovative product formulations and sustainable offerings are capturing the attention of environmentally conscious consumers. Key growth drivers include increased consumer spending on personal grooming and new product launches from major companies such as Unilever, Procter & Gamble, and L'Oreal SA. However, intense price competition and economic fluctuations present market restraints. Strategic portfolio expansion, targeted marketing, and the growth of organized retail and e-commerce are expected to overcome these challenges. Hair gels, mousses, and styling creams are expected to be high-demand segments, with specialist stores and online retail poised for significant market share.

South America Hair Styling Products Market Company Market Share

This report provides a comprehensive analysis of the South America Hair Styling Products Market, detailing market dynamics, growth trends, regional influence, and future prospects. Covering 2019-2033, with a base and forecast year of 2025, this study offers critical data for industry professionals and stakeholders.

South America Hair Styling Products Market Market Dynamics & Structure

The South America Hair Styling Products Market exhibits a moderate concentration, with key players like Unilever, Procter & Gamble, and L'Oreal SA holding significant market shares. Technological innovation is a crucial driver, with an increasing demand for natural and sustainable ingredients, alongside advancements in product formulations offering enhanced performance and ease of use. Regulatory frameworks, particularly concerning ingredient safety and labeling, are becoming more stringent across the region, influencing product development and market entry strategies. Competitive product substitutes, including DIY styling solutions and professional salon treatments, present a dynamic competitive landscape. End-user demographics are shifting, with a growing middle class and an increasing emphasis on personal grooming and appearance driving demand. Merger and acquisition (M&A) trends are evident as larger players seek to expand their product portfolios and geographic reach. The market is characterized by a constant drive for product differentiation through innovative packaging and specialized formulations catering to diverse hair types and styling needs.

- Market Concentration: Moderate to high, with key multinational corporations dominating market share.

- Technological Innovation Drivers: Demand for natural ingredients, advanced formulations, sustainable packaging, and personalized styling solutions.

- Regulatory Frameworks: Increasing emphasis on ingredient safety, environmental impact, and ethical sourcing across major South American economies.

- Competitive Product Substitutes: DIY styling, professional salon services, and emerging beauty tech solutions.

- End-User Demographics: Growing disposable incomes, increased awareness of personal grooming, and a desire for trend-driven styling.

- M&A Trends: Strategic acquisitions to broaden product offerings and gain market access, particularly in niche segments.

South America Hair Styling Products Market Growth Trends & Insights

The South America Hair Styling Products Market is poised for robust growth, driven by a confluence of socio-economic factors and evolving consumer preferences. The market size is projected to witness a significant expansion from an estimated $3,500 Million units in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033. Adoption rates for premium and specialized styling products are on the rise, fueled by increasing disposable incomes and a greater emphasis on personal appearance and self-expression across the continent. Technological disruptions are playing a pivotal role, with brands investing in research and development to introduce innovative formulations such as heat-protectant sprays, anti-frizz serums, and styling products with added haircare benefits. Consumer behavior shifts are also paramount; individuals are increasingly seeking multi-functional products that offer styling hold, nourishment, and protection. The influence of social media and beauty influencers continues to shape purchasing decisions, driving demand for trending styles and products that enable their creation. Furthermore, a growing awareness of hair health and the long-term effects of styling is prompting consumers to opt for products with gentler ingredients and added protective properties. The convenience and accessibility offered by various distribution channels, particularly online retail, are further accelerating market penetration. The demand for styling products that cater to specific hair types, including curly, fine, and color-treated hair, is also a significant growth driver, pushing manufacturers to diversify their product lines and target specific consumer segments with tailored solutions. The impact of globalization and the introduction of international beauty trends are also contributing to the overall expansion of the market, as consumers become more exposed to and desirous of a wider range of styling options.

Dominant Regions, Countries, or Segments in South America Hair Styling Products Market

Brazil stands out as the dominant country within the South America Hair Styling Products Market, consistently leading in terms of market size and growth potential. This dominance is attributed to its large and diverse population, coupled with a strong cultural emphasis on fashion and personal grooming. The economic policies in Brazil, though subject to fluctuations, generally support consumer spending on discretionary items like beauty products. Infrastructure development has also facilitated wider distribution of hair styling products across urban and increasingly rural areas. Within Brazil and the broader South American region, Styling Creams and Waxes are emerging as a high-growth segment under the Product Type umbrella, reflecting a global trend towards natural-looking, textured hairstyles and the demand for versatile styling solutions that offer hold without stiffness. This segment is experiencing a significant CAGR of approximately 7.5%. The Online Retail Stores distribution channel is also witnessing exponential growth, projected to capture a substantial market share of 28% by 2033, driven by the increasing internet penetration, e-commerce adoption, and the convenience of online shopping. This channel offers a vast selection of products, competitive pricing, and home delivery, appealing to a wide demographic.

- Dominant Country: Brazil, owing to its substantial population, strong beauty culture, and evolving consumer spending habits.

- High-Growth Product Type Segment: Styling Creams and Waxes, driven by demand for natural textures and versatile hold.

- Market Share for Styling Creams and Waxes: Projected to reach 35% by 2033.

- CAGR for Styling Creams and Waxes: Approximately 7.5%.

- Dominant Distribution Channel: Online Retail Stores, benefiting from digital adoption and convenience.

- Projected Market Share for Online Retail Stores: 28% by 2033.

- Growth Rate for Online Retail Stores: Exceeding 12% annually.

- Key Drivers of Dominance in Brazil: Large consumer base, high disposable income (relative to other South American nations), widespread social media influence on beauty trends, and a robust retail infrastructure.

- Factors Contributing to Online Retail Growth: Increased smartphone penetration, development of secure payment gateways, expansion of logistics networks, and a growing consumer preference for convenience and wider product selection.

South America Hair Styling Products Market Product Landscape

The South America Hair Styling Products Market is characterized by a dynamic product landscape, with continuous innovation focused on efficacy, sustainability, and consumer experience. Unilever is a key player, known for its extensive range of hair styling products under brands like Dove and TRESemmé, emphasizing moisture and frizz control. Conair Corporation (Aquage), while perhaps more niche, focuses on professional-grade styling tools and complementary styling products that cater to salon-quality results. Procter & Gamble’s brands, such as Pantene and Head & Shoulders, are integrating styling benefits with haircare, offering products that provide hold while also treating scalp and hair health. L'Oreal SA is a frontrunner in research and development, introducing advanced formulations in its various brands, including Garnier and Matrix, with a focus on long-lasting hold, heat protection, and volumizing effects. Revlon Inc. and John Paul Mitchell Systems contribute with their distinct offerings, catering to different consumer needs from drugstore accessibility to premium salon exclusive products. Henkel Corporation also plays a significant role, particularly with brands like Schwarzkopf Professional, known for its innovative styling solutions. The market is seeing a rise in water-based, alcohol-free formulations, and products enriched with natural oils and botanical extracts, addressing consumer demand for gentler and more nourishing styling options.

Key Drivers, Barriers & Challenges in South America Hair Styling Products Market

Key Drivers:

- Rising Disposable Incomes: Increased consumer spending power fuels demand for beauty and personal care products.

- Growing Fashion Consciousness: A strong cultural emphasis on appearance and trend adoption drives the use of styling products.

- Influence of Social Media: Influencers and online platforms promote new styles and product usage, boosting sales.

- Product Innovation: Development of multi-functional, natural, and sustainable styling solutions appeals to evolving consumer preferences.

- Expanding Distribution Networks: Wider availability through online channels and modern retail formats increases accessibility.

Barriers & Challenges:

- Economic Volatility: Fluctuations in national economies can impact consumer purchasing power and discretionary spending.

- Regulatory Hurdles: Stringent regulations on product ingredients and labeling can increase compliance costs and time-to-market.

- Counterfeit Products: The presence of counterfeit goods erodes brand trust and market share, particularly in developing regions.

- Supply Chain Disruptions: Geopolitical events, logistical issues, and raw material availability can affect production and distribution.

- Price Sensitivity: A significant portion of the market remains price-sensitive, creating challenges for premium product penetration.

- Competition: Intense competition from both global brands and local manufacturers necessitates continuous innovation and marketing efforts.

Emerging Opportunities in South America Hair Styling Products Market

Emerging opportunities in the South America Hair Styling Products Market lie in the increasing demand for sustainable and eco-friendly product lines, with consumers actively seeking brands that prioritize ethical sourcing and recyclable packaging. The growing popularity of personalized styling solutions presents a significant avenue, with opportunities in custom formulations or products catering to specific hair types and desired looks. Furthermore, the expansion of e-commerce platforms into Tier 2 and Tier 3 cities unlocks untapped markets with a growing digitally connected population eager for diverse product offerings. The rise of men's grooming is another substantial opportunity, with a dedicated segment for men's styling products experiencing rapid growth. Developing travel-sized and multi-functional styling kits can also cater to the mobile lifestyles of consumers.

Growth Accelerators in the South America Hair Styling Products Market Industry

Growth accelerators in the South America Hair Styling Products Market are being propelled by significant technological breakthroughs in formulation science, enabling the creation of products with superior hold, heat protection, and hair health benefits. Strategic partnerships between ingredient suppliers and product manufacturers are fostering innovation in natural and organic ingredients. Market expansion strategies, including aggressive digital marketing campaigns and the penetration of previously underserved regions, are crucial catalysts. The increasing focus on inclusive beauty and the development of products catering to all hair types and textures are also significant growth accelerators, ensuring broader market appeal and accessibility.

Key Players Shaping the South America Hair Styling Products Market Market

- Unilever

- Conair Corporation (Aquage)

- Vogue International LLC

- Procter & Gamble

- L'Oreal SA

- Revlon Inc.

- John Paul Mitchell Systems

- Henkel Corporation

Notable Milestones in South America Hair Styling Products Market Sector

- 2021/06: Unilever launches a new line of plant-based styling products across key South American markets, responding to growing consumer demand for sustainable options.

- 2022/03: L'Oreal SA announces significant investment in its Brazilian manufacturing facilities to increase production capacity for its popular styling product ranges.

- 2022/11: Procter & Gamble expands its e-commerce strategy in Argentina, partnering with major online retailers to enhance product accessibility.

- 2023/01: Revlon Inc. introduces a new range of styling creams and waxes formulated with natural ingredients, targeting a younger, trend-conscious demographic in Chile.

- 2023/07: John Paul Mitchell Systems launches an educational initiative across Colombia focused on advanced hair styling techniques, indirectly boosting product sales.

- 2024/02: Henkel Corporation acquires a regional specialist in hair serums and treatments, aiming to bolster its portfolio in the premium styling segment.

In-Depth South America Hair Styling Products Market Market Outlook

The South America Hair Styling Products Market is on an upward trajectory, with future growth fueled by sustained consumer interest in personal grooming and evolving style trends. The increasing adoption of digital platforms for both product discovery and purchase will continue to be a major growth accelerator, enabling brands to reach a wider audience more effectively. The ongoing demand for natural and sustainable ingredients, coupled with technological advancements in product formulation, will drive product innovation and create new market niches. Strategic collaborations and the continuous expansion of distribution networks, particularly into emerging urban and semi-urban areas, will further solidify market growth. The market is expected to witness sustained growth, driven by a combination of increasing disposable incomes, a strong beauty culture, and the innovative strategies of key industry players.

South America Hair Styling Products Market Segmentation

-

1. Product Type

- 1.1. Hair Gel

- 1.2. Hair Mousse & Hairspray

- 1.3. Styling Creams and Waxes

- 1.4. Other Styling Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retail Stores

- 2.5. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Hair Styling Products Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Hair Styling Products Market Regional Market Share

Geographic Coverage of South America Hair Styling Products Market

South America Hair Styling Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Hair Gel in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Hair Styling Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hair Gel

- 5.1.2. Hair Mousse & Hairspray

- 5.1.3. Styling Creams and Waxes

- 5.1.4. Other Styling Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Hair Styling Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hair Gel

- 6.1.2. Hair Mousse & Hairspray

- 6.1.3. Styling Creams and Waxes

- 6.1.4. Other Styling Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Hair Styling Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hair Gel

- 7.1.2. Hair Mousse & Hairspray

- 7.1.3. Styling Creams and Waxes

- 7.1.4. Other Styling Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Hair Styling Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hair Gel

- 8.1.2. Hair Mousse & Hairspray

- 8.1.3. Styling Creams and Waxes

- 8.1.4. Other Styling Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Unilever

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Conair Corporation (Aquage)

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Vogue International LLC *List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Procter & Gamble

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 L'Oreal SA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Revlon Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 John Paul Mitchell Systems

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Henkel Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Unilever

List of Figures

- Figure 1: South America Hair Styling Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Hair Styling Products Market Share (%) by Company 2025

List of Tables

- Table 1: South America Hair Styling Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Hair Styling Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: South America Hair Styling Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Hair Styling Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Hair Styling Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Hair Styling Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: South America Hair Styling Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America Hair Styling Products Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: South America Hair Styling Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Hair Styling Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: South America Hair Styling Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Hair Styling Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Hair Styling Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America Hair Styling Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: South America Hair Styling Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Hair Styling Products Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: South America Hair Styling Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: South America Hair Styling Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: South America Hair Styling Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Hair Styling Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Hair Styling Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Hair Styling Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: South America Hair Styling Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Hair Styling Products Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: South America Hair Styling Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: South America Hair Styling Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: South America Hair Styling Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Hair Styling Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Hair Styling Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: South America Hair Styling Products Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: South America Hair Styling Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America Hair Styling Products Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Hair Styling Products Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the South America Hair Styling Products Market?

Key companies in the market include Unilever, Conair Corporation (Aquage), Vogue International LLC *List Not Exhaustive, Procter & Gamble, L'Oreal SA, Revlon Inc, John Paul Mitchell Systems, Henkel Corporation.

3. What are the main segments of the South America Hair Styling Products Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands.

6. What are the notable trends driving market growth?

Increasing Demand for Hair Gel in the Region.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Hair Styling Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Hair Styling Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Hair Styling Products Market?

To stay informed about further developments, trends, and reports in the South America Hair Styling Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence