Key Insights

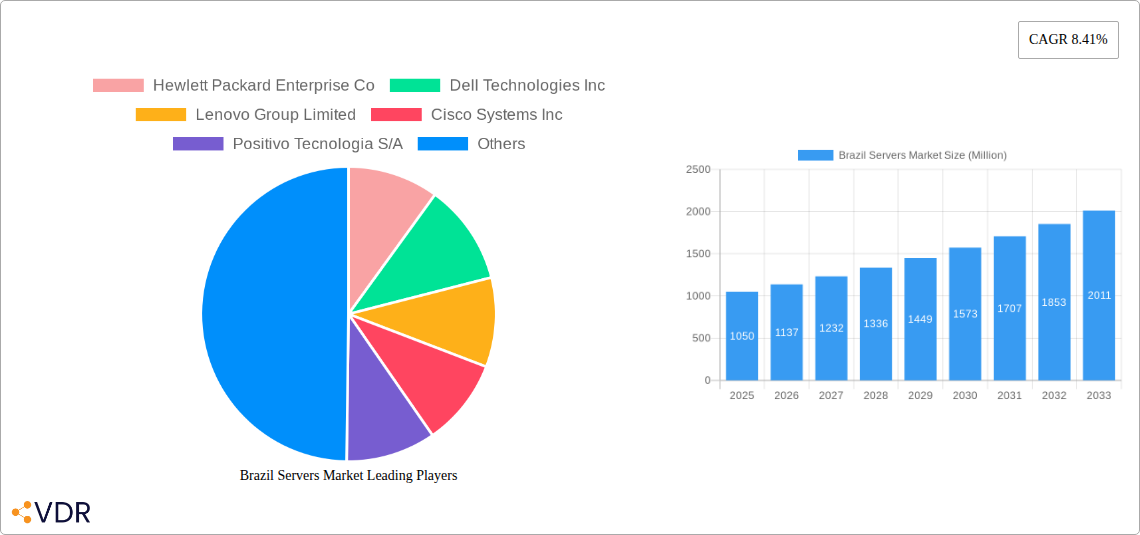

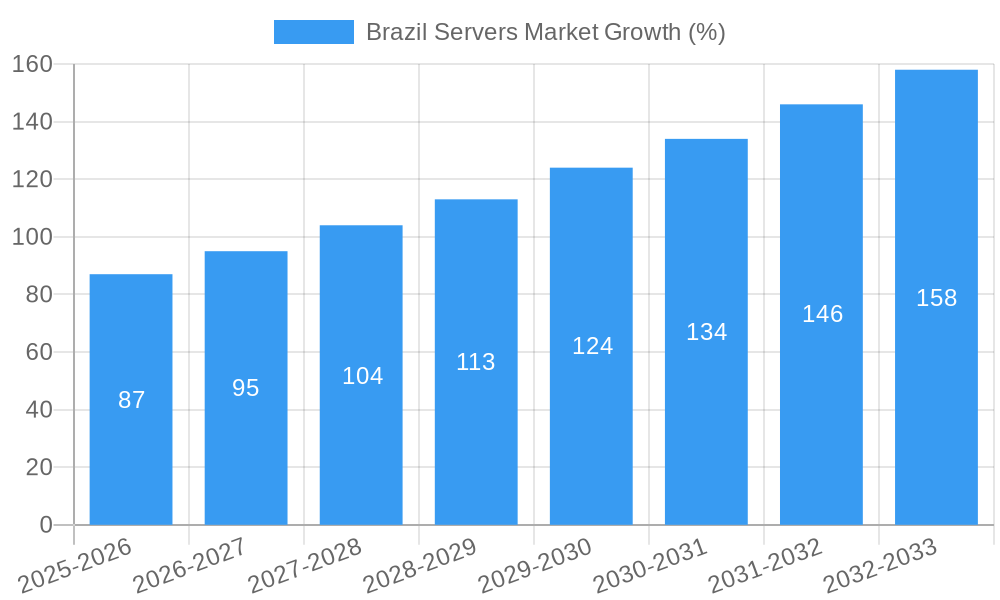

The Brazil Servers Market, valued at $1.05 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.41% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of cloud computing and data center infrastructure within Brazil's burgeoning digital economy fuels demand for high-performance servers. Secondly, government initiatives promoting digital transformation and technological advancements across various sectors, including finance, healthcare, and education, create a favorable environment for server market expansion. Furthermore, the growing need for robust IT infrastructure to support the expansion of e-commerce and digital services in the country significantly contributes to this market's growth trajectory. Competition within the market is fierce, with major players like Hewlett Packard Enterprise, Dell Technologies, Lenovo, Cisco, and others vying for market share through innovation and strategic partnerships.

However, certain restraints could potentially hinder market growth. These include fluctuating currency exchange rates impacting import costs, the economic climate's influence on IT spending, and the ongoing global chip shortage, which might cause supply chain disruptions. Despite these challenges, the long-term outlook for the Brazil Servers Market remains positive, fueled by Brazil's expanding digital ecosystem and the persistent demand for advanced computing solutions. Market segmentation likely includes various server types (rack, tower, blade), based on application (enterprise, cloud), and by end-user industry (finance, government, telecommunications). Further research into these segments will yield more precise insights into specific growth drivers and market dynamics.

Brazil Servers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil servers market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is crucial for IT professionals, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The report also includes a detailed import and export analysis of the Brazilian server market. Market values are presented in million units.

Brazil Servers Market Dynamics & Structure

The Brazilian servers market exhibits a moderately concentrated structure, with key players like Hewlett Packard Enterprise Co, Dell Technologies Inc, and Lenovo Group Limited holding significant market share. Technological innovation, particularly in areas like AI and edge computing, is a major driver, while regulatory frameworks and import/export policies significantly influence market dynamics. Competitive pressure from cloud services acts as a substitute, impacting on-premise server deployments.

- Market Concentration: xx% market share held by top 5 players (2024).

- Technological Innovation: Focus on AI, edge computing, and high-performance computing drives demand.

- Regulatory Framework: Import tariffs and local content requirements influence pricing and availability.

- Competitive Substitutes: Cloud computing services pose a significant challenge to traditional server deployments.

- End-User Demographics: Large enterprises, government agencies, and SMEs constitute the primary user base.

- M&A Trends: Consolidation within the industry has been moderate, with xx M&A deals recorded between 2019-2024.

Brazil Servers Market Growth Trends & Insights

The Brazilian servers market experienced robust growth during the historical period (2019-2024), driven by increasing digital transformation initiatives across various sectors and rising demand for data processing and storage capabilities. Adoption rates have seen a significant upward trend, particularly in sectors like finance, telecommunications, and government. Technological disruptions, including the rise of AI and IoT, fueled market expansion, while shifts in consumer behavior toward cloud-based services posed a moderate challenge. We project a CAGR of xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

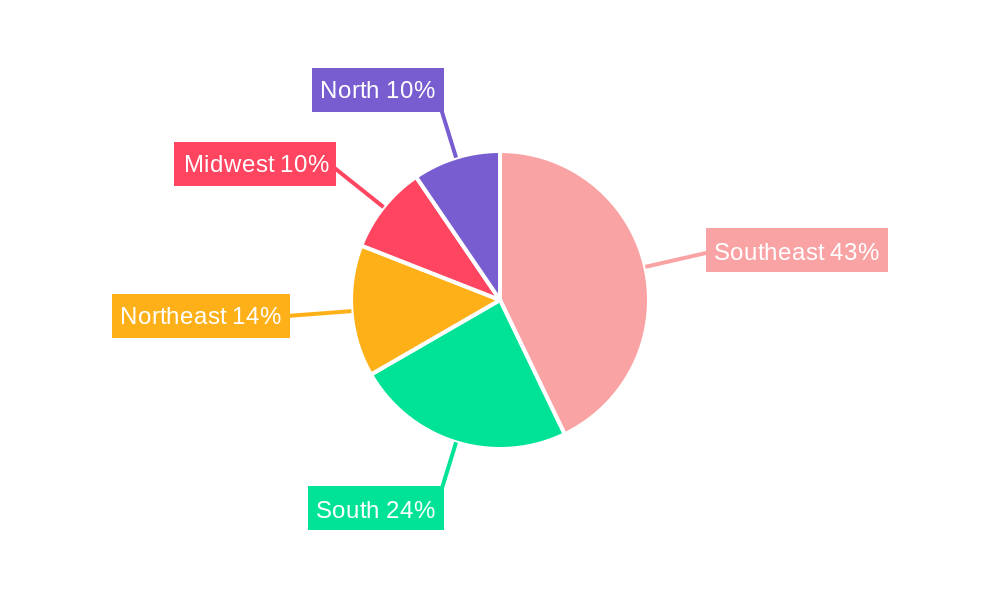

Dominant Regions, Countries, or Segments in Brazil Servers Market

São Paulo and Rio de Janeiro are the dominant regions, accounting for xx% of the total market in 2024, due to their robust IT infrastructure and concentration of large enterprises. This dominance is reinforced by factors including favorable economic policies, substantial government investments in digital infrastructure, and a higher concentration of skilled IT professionals. The growth potential is especially high in less-developed regions as investment in infrastructure increases and the demand for digital services rises.

- Key Drivers:

- Strong IT infrastructure in São Paulo and Rio de Janeiro.

- Government initiatives promoting digitalization.

- Growing adoption of cloud-based solutions.

- Investments in data centers.

- Dominance Factors: High concentration of large enterprises and government bodies.

- Growth Potential: Expansion into less developed regions offers significant growth opportunities.

Brazil Servers Market Product Landscape

The Brazilian market offers a diverse range of server products, from entry-level systems to high-performance computing solutions. Innovation focuses on increased processing power, enhanced energy efficiency, and improved scalability. Unique selling propositions include tailored solutions for specific industry needs and cloud-optimized architectures. Technological advancements in areas such as NVMe storage and AI-accelerated processors continue to shape the product landscape.

Key Drivers, Barriers & Challenges in Brazil Servers Market

Key Drivers:

- Growing demand for data processing and storage.

- Digital transformation across various sectors.

- Increasing adoption of cloud computing services (albeit impacting on-premise deployments).

- Government initiatives promoting digital infrastructure.

Key Challenges:

- Economic volatility and fluctuating currency exchange rates.

- Import tariffs and trade restrictions.

- Competition from international cloud service providers.

- Infrastructure limitations in some regions.

Emerging Opportunities in Brazil Servers Market

The market presents significant opportunities in areas like edge computing, AI-powered solutions, and specialized servers for high-performance computing applications. Untapped potential lies in expanding server adoption in smaller cities and the increasing demand from government initiatives for advanced digital infrastructure. The growing adoption of IoT devices will further fuel the demand for servers that are optimized for processing and managing large volumes of data.

Growth Accelerators in the Brazil Servers Market Industry

Technological advancements in processor and storage technologies, coupled with increasing cloud adoption (despite impacting on-premise), are major growth drivers. Strategic partnerships between server vendors and cloud providers are facilitating market expansion. Government initiatives aimed at improving digital infrastructure are also accelerating market growth, particularly outside major metropolitan areas.

Key Players Shaping the Brazil Servers Market Market

- Hewlett Packard Enterprise Co

- Dell Technologies Inc

- Lenovo Group Limited

- Cisco Systems Inc

- Positivo Tecnologia S/A

- Oracle Corporation

- Super Micro Computer Inc

- IBM Corporation

- Fujitsu Limited

- Huawei Technologies Co Ltd

Notable Milestones in Brazil Servers Market Sector

- May 2024: IBM launched the IBM Power S1012 server, boasting a 3X performance boost compared to its predecessor.

- October 2023: BWS IoT partnered with Emnify to scale IoT connections to one million devices by 2024.

In-Depth Brazil Servers Market Market Outlook

The Brazil servers market is poised for continued growth, driven by ongoing digital transformation and expanding technological capabilities. Opportunities abound for players who can effectively address the challenges of infrastructure limitations and economic volatility while capitalizing on the increasing demand for advanced computing solutions. Strategic partnerships, product innovation, and effective market penetration strategies will be crucial for success in this dynamic market.

Brazil Servers Market Segmentation

-

1. Operating System

- 1.1. Linux

- 1.2. Windows

- 1.3. UNIX

- 1.4. Other Operating Systems ((i5/OS, z/OS, etc.)

-

2. Server Class

- 2.1. High-end Server

- 2.2. Mid-range Server

- 2.3. Volume Server

-

3. Server Type

- 3.1. Blade

- 3.2. Multi-node

- 3.3. Tower

- 3.4. Rack Optimized

-

4. End-user Industry

- 4.1. IT and Telecommunications

- 4.2. BFSI

- 4.3. Manufacturing

- 4.4. Retail

- 4.5. Healthcare

- 4.6. Media and Entertainment

- 4.7. Other End-user Verticals

Brazil Servers Market Segmentation By Geography

- 1. Brazil

Brazil Servers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry

- 3.4. Market Trends

- 3.4.1. IT and Telecommunications Industry to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Servers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Linux

- 5.1.2. Windows

- 5.1.3. UNIX

- 5.1.4. Other Operating Systems ((i5/OS, z/OS, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Server Class

- 5.2.1. High-end Server

- 5.2.2. Mid-range Server

- 5.2.3. Volume Server

- 5.3. Market Analysis, Insights and Forecast - by Server Type

- 5.3.1. Blade

- 5.3.2. Multi-node

- 5.3.3. Tower

- 5.3.4. Rack Optimized

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. IT and Telecommunications

- 5.4.2. BFSI

- 5.4.3. Manufacturing

- 5.4.4. Retail

- 5.4.5. Healthcare

- 5.4.6. Media and Entertainment

- 5.4.7. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett Packard Enterprise Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lenovo Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Positivo Tecnologia S/A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Super Micro Computer Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IBM Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fujitsu Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huawei Technologies Co Ltd7 3 Import and Export Analysis in Brazi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hewlett Packard Enterprise Co

List of Figures

- Figure 1: Brazil Servers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Servers Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Servers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Servers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Brazil Servers Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 4: Brazil Servers Market Volume Billion Forecast, by Operating System 2019 & 2032

- Table 5: Brazil Servers Market Revenue Million Forecast, by Server Class 2019 & 2032

- Table 6: Brazil Servers Market Volume Billion Forecast, by Server Class 2019 & 2032

- Table 7: Brazil Servers Market Revenue Million Forecast, by Server Type 2019 & 2032

- Table 8: Brazil Servers Market Volume Billion Forecast, by Server Type 2019 & 2032

- Table 9: Brazil Servers Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Brazil Servers Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 11: Brazil Servers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Brazil Servers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Brazil Servers Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 14: Brazil Servers Market Volume Billion Forecast, by Operating System 2019 & 2032

- Table 15: Brazil Servers Market Revenue Million Forecast, by Server Class 2019 & 2032

- Table 16: Brazil Servers Market Volume Billion Forecast, by Server Class 2019 & 2032

- Table 17: Brazil Servers Market Revenue Million Forecast, by Server Type 2019 & 2032

- Table 18: Brazil Servers Market Volume Billion Forecast, by Server Type 2019 & 2032

- Table 19: Brazil Servers Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Brazil Servers Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 21: Brazil Servers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Servers Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Servers Market?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Brazil Servers Market?

Key companies in the market include Hewlett Packard Enterprise Co, Dell Technologies Inc, Lenovo Group Limited, Cisco Systems Inc, Positivo Tecnologia S/A, Oracle Corporation, Super Micro Computer Inc, IBM Corporation, Fujitsu Limited, Huawei Technologies Co Ltd7 3 Import and Export Analysis in Brazi.

3. What are the main segments of the Brazil Servers Market?

The market segments include Operating System, Server Class, Server Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.05 Million as of 2022.

5. What are some drivers contributing to market growth?

The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry.

6. What are the notable trends driving market growth?

IT and Telecommunications Industry to Witness Major Growth.

7. Are there any restraints impacting market growth?

The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry.

8. Can you provide examples of recent developments in the market?

May 2024: IBM unveiled its latest addition to its server lineup, the IBM Power S1012. This new system, powered by the cutting-edge Power10 processor, boasts a 1-socket, half-wide design. It is a performance powerhouse, offering a remarkable 3X boost in performance per core compared to its predecessor, the Power S812. This enhancement amplifies AI workloads and seamlessly extends its reach from the core to the cloud and even the edge, promising heightened business value across diverse industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Servers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Servers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Servers Market?

To stay informed about further developments, trends, and reports in the Brazil Servers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence