Key Insights

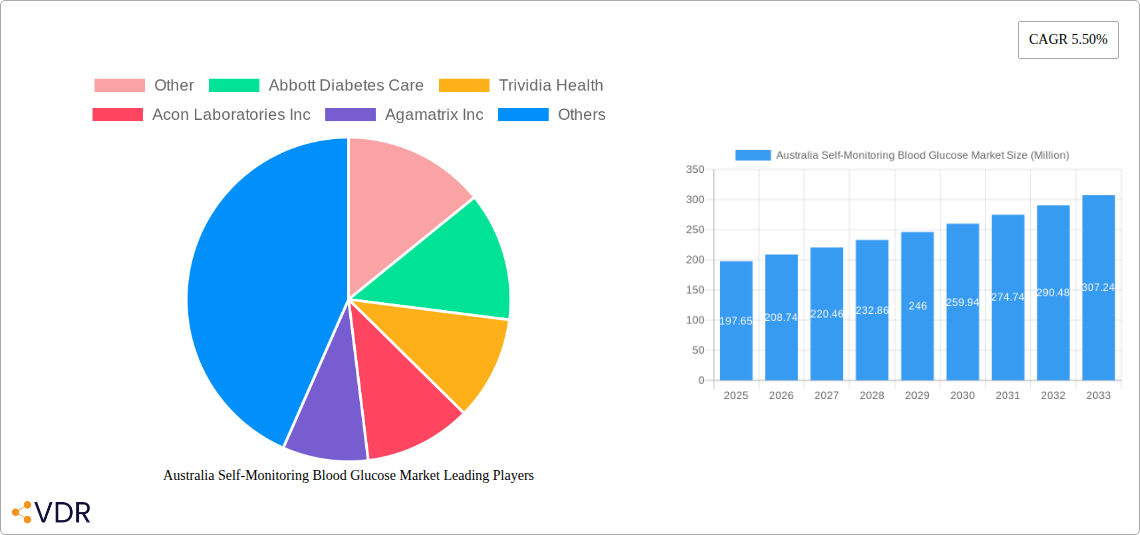

The Australian self-monitoring blood glucose (SMBG) market is poised for robust growth, driven by an increasing prevalence of diabetes and a growing awareness of proactive diabetes management. Currently valued at approximately $197.65 million, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.50% over the forecast period of 2025-2033. This sustained growth is fueled by several key factors. The rising incidence of type 1 and type 2 diabetes in Australia, exacerbated by lifestyle changes and an aging population, directly translates to a higher demand for SMBG devices and consumables. Furthermore, government initiatives and healthcare provider recommendations are increasingly emphasizing regular blood glucose monitoring to prevent complications and improve patient outcomes, thereby stimulating market adoption. The market is segmented into Glucometer Devices, Test Strips, and Lancets, with test strips representing a significant recurring revenue stream due to their disposable nature. Companies are investing in technological advancements, offering user-friendly, connected devices that integrate with mobile applications, enhancing patient engagement and data tracking capabilities.

The market's upward trajectory is further supported by a growing trend towards personalized and connected healthcare solutions. As Australians become more health-conscious and technologically adept, demand for smart glucometers that offer features like data logging, trend analysis, and remote sharing with healthcare professionals is on the rise. These devices empower individuals to take greater control of their diabetes management, leading to improved glycemic control and reduced long-term healthcare costs. While the market faces some restraints, such as the increasing adoption of continuous glucose monitoring (CGM) systems for certain patient populations, the affordability, accessibility, and established familiarity of SMBG devices ensure their continued dominance in the broader market. The presence of established players like Abbott Diabetes Care, Roche Holding AG, and LifeScan, alongside emerging innovators, fosters a competitive landscape that drives product innovation and quality improvements, ultimately benefiting Australian consumers managing their diabetes.

Australia Self-Monitoring Blood Glucose Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Australian Self-Monitoring Blood Glucose (SMBG) market, offering critical insights for stakeholders. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, product landscapes, key players, and emerging opportunities. We meticulously analyze parent and child market segments, integrating high-traffic SEO keywords such as "blood glucose monitoring Australia," "diabetes management devices," "SMBG market trends," "glucose meters," "test strips Australia," and "lancets for diabetes." All quantitative values are presented in Million units for clarity and comparability.

Australia Self-Monitoring Blood Glucose Market Market Dynamics & Structure

The Australian Self-Monitoring Blood Glucose (SMBG) market exhibits a dynamic and evolving structure, characterized by increasing technological integration and a growing emphasis on patient-centric diabetes management. Market concentration remains moderately fragmented, with key global players vying for dominance alongside a growing presence of local and specialized manufacturers. Technological innovation is a primary driver, fueled by the demand for more accurate, user-friendly, and connected SMBG devices. The regulatory framework, overseen by bodies like the Therapeutic Goods Administration (TGA), ensures product safety and efficacy, though it can also present barriers to market entry for novel technologies.

- Market Concentration: Dominated by a few large international corporations but with opportunities for niche players.

- Technological Innovation Drivers: Miniaturization of devices, enhanced connectivity (Bluetooth, NFC), improved accuracy, reduced sample size requirements, and integration with mobile health applications.

- Regulatory Frameworks: TGA approval processes, compliance with medical device standards.

- Competitive Product Substitutes: Continuous Glucose Monitoring (CGM) systems are emerging as a significant substitute, offering a more comprehensive glycemic overview.

- End-User Demographics: Growing prevalence of Type 1 and Type 2 diabetes, an aging population, and increasing health consciousness among individuals at risk.

- M&A Trends: Expect continued consolidation as larger companies seek to acquire innovative technologies or expand their product portfolios.

Australia Self-Monitoring Blood Glucose Market Growth Trends & Insights

The Australian Self-Monitoring Blood Glucose (SMBG) market is poised for sustained growth, driven by an escalating diabetes prevalence and a proactive approach to chronic disease management within the nation. This growth trajectory is significantly influenced by increasing healthcare awareness, technological advancements in SMBG devices, and the growing demand for home-based health monitoring solutions. The market is witnessing a substantial shift towards connected devices and digital health platforms, enabling seamless data tracking, sharing, and analysis, thereby empowering both patients and healthcare providers in optimizing diabetes care.

The market size evolution is marked by a consistent upward trend, projected to expand at a healthy Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is underpinned by robust adoption rates of modern SMBG technologies, which offer enhanced convenience and precision compared to traditional methods. The increasing penetration of smartphones and the widespread availability of mobile diabetes management applications are acting as significant catalysts, fostering greater patient engagement and adherence to self-monitoring regimens. These applications, often integrated with Bluetooth-enabled glucometers, simplify the process of recording and interpreting blood glucose readings, leading to more informed clinical decisions and personalized treatment plans.

Furthermore, technological disruptions, such as the development of non-invasive or minimally invasive glucose monitoring techniques, although still in nascent stages for widespread SMBG adoption, are contributing to the overall innovative landscape and driving research and development investments. Consumer behavior shifts are also playing a crucial role. There's a noticeable inclination among individuals with diabetes, and those at risk, to take a more proactive role in managing their health, spurred by educational initiatives and the accessibility of advanced monitoring tools. This burgeoning demand for personalized health management solutions directly translates into increased market penetration for SMBG devices and associated consumables. The continuous drive for improved glycemic control, aiming to mitigate long-term complications associated with diabetes, further solidifies the importance and demand for reliable SMBG systems in Australia.

Dominant Regions, Countries, or Segments in Australia Self-Monitoring Blood Glucose Market

Within the Australian Self-Monitoring Blood Glucose (SMBG) market, the Component: Test Strips segment emerges as a dominant force, driving both value and volume. This dominance is intrinsically linked to the fundamental nature of test strips as the consumable backbone of SMBG, requiring continuous replenishment for effective blood glucose monitoring. The increasing prevalence of diabetes across Australia directly translates into a higher demand for test strips, making it the most voluminous segment by a significant margin.

- Dominant Segment: Test Strips (Volume and Value)

- Rationale: As the primary consumable, test strips are purchased repeatedly by a vast number of individuals with diabetes.

- Market Share Contribution: Constitute a substantial portion of the overall SMBG market revenue due to their recurring purchase nature.

- Growth Potential: Directly correlated with the growing diabetes patient population and the adoption of SMBG devices.

- Key Drivers for Test Strip Dominance:

- High Diabetes Prevalence: Australia faces a significant and growing burden of diabetes, necessitating regular blood glucose testing.

- Device Independence: While glucometer devices represent an initial capital investment, test strips are a consistent operational expenditure.

- Technological Advancements: Development of more accurate and efficient test strips that require smaller blood samples.

- Reimbursement Policies: Availability of government subsidies or insurance coverage for test strips further bolsters their accessibility and demand.

- Regional Dominance: While the report focuses on Australia as a whole, within the country, major urban centers such as New South Wales (NSW) and Victoria are anticipated to lead in terms of both volume and value for SMBG devices and consumables. This is attributed to:

- Higher Population Density: These states have the largest populations, leading to a greater number of individuals diagnosed with diabetes.

- Advanced Healthcare Infrastructure: Better access to healthcare professionals, specialized diabetes clinics, and pharmacies.

- Greater Health Awareness: Higher levels of health consciousness and adoption of new technologies.

- Economic Factors: Higher disposable incomes generally correlate with a greater ability to invest in advanced health monitoring solutions.

The Glucometer Devices segment, while crucial for the functionality of SMBG, represents a one-time or infrequent purchase. However, its growth is intrinsically tied to the expansion of the test strip market, as new device sales drive future consumable sales. Lancets, while essential, represent a smaller consumable market compared to test strips. The continuous innovation in biosensor technology and the shift towards smart devices are key factors influencing the evolution of all segments within the Australian SMBG market.

Australia Self-Monitoring Blood Glucose Market Product Landscape

The Australian Self-Monitoring Blood Glucose (SMBG) product landscape is characterized by rapid innovation aimed at enhancing user experience, accuracy, and connectivity. Modern glucometer devices are increasingly sophisticated, featuring smaller blood sample requirements, faster test times, and enhanced memory recall functions. Many now incorporate Bluetooth or NFC capabilities, allowing for seamless integration with smartphone applications. These connected devices facilitate the automatic logging of blood glucose readings, provide trend analysis, and enable data sharing with healthcare providers, thereby revolutionizing diabetes management. Furthermore, advancements in test strip technology are focusing on improved accuracy across a wider range of glucose concentrations and reduced interference from common substances.

Key Drivers, Barriers & Challenges in Australia Self-Monitoring Blood Glucose Market

Key Drivers:

- Rising Diabetes Prevalence: The increasing incidence and prevalence of diabetes in Australia is the primary growth driver.

- Technological Advancements: Development of more accurate, user-friendly, and connected SMBG devices.

- Growing Health Awareness: Increased patient engagement in proactive health management and chronic disease self-care.

- Government Initiatives & Reimbursement: Support for diabetes management and potential subsidies for monitoring supplies.

- Aging Population: An increasing elderly population prone to developing diabetes.

Key Barriers & Challenges:

- Competition from Continuous Glucose Monitoring (CGM): CGM systems offer an alternative, albeit more expensive, solution that provides real-time data and trend information, potentially impacting SMBG adoption for some users.

- Cost of Consumables: The recurring cost of test strips can be a barrier for some individuals, especially without adequate reimbursement.

- Technological Literacy: A segment of the population, particularly older adults, may face challenges adopting and utilizing complex connected devices.

- Data Security and Privacy Concerns: For connected devices, ensuring the secure transmission and storage of sensitive health data is paramount.

- Adherence to Monitoring Regimens: Despite technological advancements, ensuring consistent and correct usage of SMBG devices by patients remains a challenge.

Emerging Opportunities in Australia Self-Monitoring Blood Glucose Market

Emerging opportunities in the Australian SMBG market lie in the continued integration of artificial intelligence (AI) and machine learning (ML) into diabetes management platforms. This includes developing smart algorithms within mobile apps that can predict glycemic trends, offer personalized dietary and exercise recommendations, and alert users to potential hypoglycemia or hyperglycemia events. The expansion of telehealth services presents a significant avenue for growth, enabling remote patient monitoring and virtual consultations powered by SMBG data. Furthermore, there is an increasing demand for SMBG solutions tailored for specific demographic groups, such as pediatric patients or individuals with gestational diabetes, requiring specialized features and usability. Partnerships between SMBG manufacturers and insurance providers or corporate wellness programs could also unlock new market segments and promote preventative health measures.

Growth Accelerators in the Australia Self-Monitoring Blood Glucose Market Industry

Several key factors are accelerating long-term growth within the Australian SMBG industry. Firstly, the relentless pace of technological innovation, particularly in miniaturization and connectivity, is making devices more accessible, accurate, and integrated into daily life. The development of "smart" SMBG systems that seamlessly sync with a patient's smartphone and can communicate with healthcare providers is a major catalyst. Secondly, strategic partnerships between device manufacturers, software developers, and healthcare providers are fostering a more holistic approach to diabetes management. These collaborations are crucial for creating comprehensive ecosystems that support patients beyond just glucose measurement, including data analysis, personalized insights, and medication adherence. Thirdly, the growing emphasis on preventative healthcare and early intervention strategies by both government bodies and private insurers is driving demand for reliable monitoring tools among at-risk populations.

Key Players Shaping the Australia Self-Monitoring Blood Glucose Market Market

- Abbott Diabetes Care

- Roche Holding AG

- LifeScan

- Ascensia Diabetes Care

- Bionime Corporation

- Agamatrix Inc

- Acon Laboratories Inc

- Trividia Health

- Arkray Inc

- Other

Notable Milestones in Australia Self-Monitoring Blood Glucose Market Sector

- January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published "Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes," detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published. This highlights the growing importance of connected devices and real-world data in validating SMBG efficacy.

- February 2022: Zurich Australia launched an Australian-first pilot of a new mobile health app that enables life insurance customers with diabetes to monitor their blood sugar levels and self-manage their diabetes. Pops is a first-of-its-kind integrated health management system with a simple glucose meter attached to a smartphone. Paired with the Pops app and AI health coach, it wirelessly records blood sugar results, making it one of the most discreet and easy-to-use diabetes self-management tools available. This initiative underscores the integration of SMBG with broader health and wellness platforms and the increasing role of AI in diabetes care.

In-Depth Australia Self-Monitoring Blood Glucose Market Market Outlook

The future outlook for the Australian Self-Monitoring Blood Glucose (SMBG) market is exceptionally promising, driven by the persistent need for effective diabetes management and the continuous evolution of technology. Growth accelerators such as advanced connectivity, AI-driven analytics, and strategic healthcare partnerships will continue to shape the market. The increasing focus on personalized medicine and preventative care will further elevate the demand for sophisticated yet user-friendly SMBG solutions. Opportunities abound in leveraging digital health ecosystems, expanding into remote patient monitoring, and tailoring products for diverse patient needs. As the Australian population grows and the prevalence of diabetes continues its upward trend, the SMBG market is set to expand, offering significant potential for innovation and market penetration for companies that can deliver value, accuracy, and seamless integration into the lives of individuals managing diabetes.

Australia Self-Monitoring Blood Glucose Market Segmentation

-

1. Component (Value and Volume, 2017 - 2028)

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Australia Self-Monitoring Blood Glucose Market Segmentation By Geography

- 1. Australia

Australia Self-Monitoring Blood Glucose Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Australia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Self-Monitoring Blood Glucose Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component (Value and Volume, 2017 - 2028)

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Component (Value and Volume, 2017 - 2028)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Other

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Diabetes Care

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trividia Health

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Acon Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agamatrix Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bionime Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LifeScan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roche Holding AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascensia Diabetes Care

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arkray Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Other

List of Figures

- Figure 1: Australia Self-Monitoring Blood Glucose Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Self-Monitoring Blood Glucose Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Component (Value and Volume, 2017 - 2028) 2019 & 2032

- Table 4: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Component (Value and Volume, 2017 - 2028) 2019 & 2032

- Table 5: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Component (Value and Volume, 2017 - 2028) 2019 & 2032

- Table 10: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Component (Value and Volume, 2017 - 2028) 2019 & 2032

- Table 11: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Self-Monitoring Blood Glucose Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Australia Self-Monitoring Blood Glucose Market?

Key companies in the market include Other, Abbott Diabetes Care, Trividia Health, Acon Laboratories Inc, Agamatrix Inc, Bionime Corporation, LifeScan, Roche Holding AG, Ascensia Diabetes Care, Arkray Inc .

3. What are the main segments of the Australia Self-Monitoring Blood Glucose Market?

The market segments include Component (Value and Volume, 2017 - 2028).

4. Can you provide details about the market size?

The market size is estimated to be USD 197.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Australia.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Self-Monitoring Blood Glucose Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Self-Monitoring Blood Glucose Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Self-Monitoring Blood Glucose Market?

To stay informed about further developments, trends, and reports in the Australia Self-Monitoring Blood Glucose Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence