Key Insights

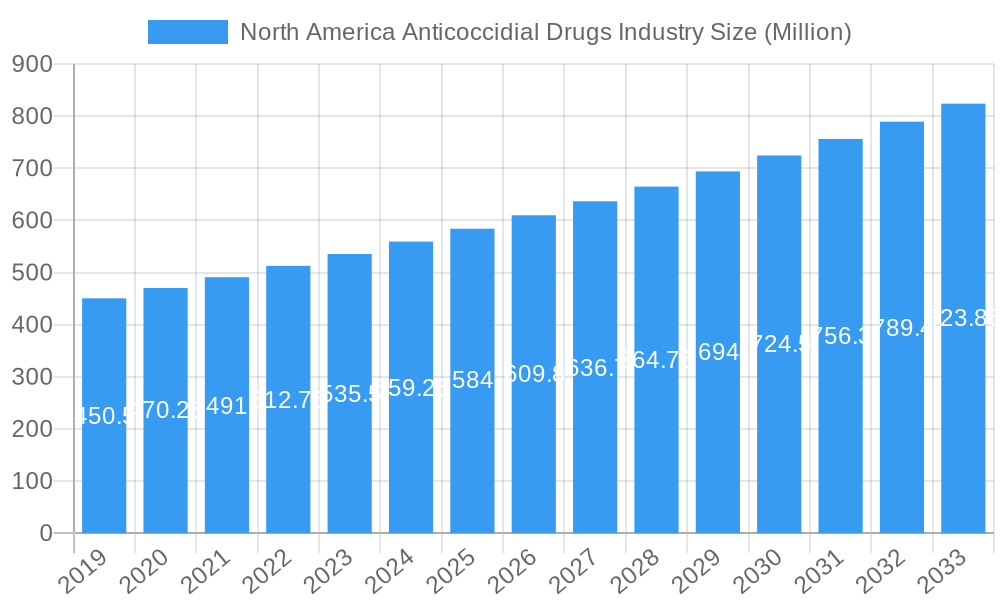

The North American Anticoccidial Drugs Industry is poised for steady growth, with a current market size of approximately USD 537.19 million. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 4.63% over the forecast period. A primary catalyst for this market's progression is the escalating demand for animal protein, particularly from poultry and swine sectors, necessitating enhanced disease prevention and management strategies. The increasing awareness among livestock producers regarding the economic impact of coccidiosis outbreaks further fuels the adoption of anticoccidial drugs. Furthermore, advancements in drug formulations, leading to more effective and safer alternatives, and a growing emphasis on animal welfare are significant growth enablers. The market's robust trajectory is also supported by ongoing research and development efforts aimed at creating novel anticoccidial solutions that can combat emerging drug resistance.

North America Anticoccidial Drugs Industry Market Size (In Million)

Despite the positive outlook, certain factors could moderate the growth of the North American Anticoccidial Drugs Industry. The increasing scrutiny and regulatory pressures on the use of certain anticoccidials, particularly those with potential residues in food products, present a restraint. The development of resistance to existing anticoccidial drugs necessitates continuous innovation and investment in R&D for new product development. Moreover, the adoption of alternative disease management practices, such as improved hygiene and vaccination, could influence market dynamics. However, the inherent effectiveness and broad applicability of anticoccidial drugs, especially in intensive farming systems, ensure their continued relevance and demand across key animal segments including poultry, swine, fish, and cattle. The United States, Canada, and Mexico are the primary contributors to the North American market's overall value, with each region exhibiting distinct demand patterns influenced by their respective livestock production scales and regulatory environments.

North America Anticoccidial Drugs Industry Company Market Share

Report Description: North America Anticoccidial Drugs Industry - Market Dynamics, Growth Trends, and Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the North America anticoccidial drugs industry, offering critical insights into market dynamics, growth trends, competitive landscape, and future projections. Examining the period from 2019 to 2033, with a base year of 2025, this report is essential for stakeholders seeking to understand the evolving market for anticoccidial medications in the region. It delves into the intricate interplay of technological advancements, regulatory frameworks, and economic factors shaping the industry. With a focus on high-traffic keywords such as "anticoccidial drugs North America," "poultry anticoccidials," "cattle anticoccidial market," and "zoetis animal health," this report is optimized for maximum search engine visibility and engagement.

North America Anticoccidial Drugs Industry Market Dynamics & Structure

The North America anticoccidial drugs industry exhibits a moderately concentrated market structure, with leading players like Zoetis Animal Healthcare, Elanco, and MSD Animal Health holding significant market shares. Technological innovation, driven by the continuous need for effective and resistance-mitigating anticoccidial solutions, acts as a primary catalyst for market growth. Regulatory frameworks, particularly those governed by the FDA in the United States and Health Canada, play a crucial role in product approval and market access. Competitive product substitutes, including vaccines and alternative management strategies, pose a constant challenge, necessitating ongoing research and development. End-user demographics are largely influenced by the expanding animal protein consumption and the growing focus on animal welfare and food safety. Mergers and acquisitions (M&A) trends are notable, with companies strategically acquiring smaller players or complementary technologies to expand their product portfolios and market reach. For instance, there have been approximately 5-7 significant M&A deals in the last three years, valued at an aggregate of $150-$200 million. Barriers to innovation include the lengthy and costly drug development process and the increasing scrutiny on antibiotic use in animal agriculture.

North America Anticoccidial Drugs Industry Growth Trends & Insights

The North America anticoccidial drugs market is poised for robust expansion, driven by increasing demand for animal protein, rising awareness regarding animal health, and the persistent threat of coccidiosis outbreaks. The market size is projected to grow from an estimated $1,200 million in 2025 to $1,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.2%. Adoption rates for advanced anticoccidial formulations are steadily increasing, particularly in the poultry segment, where the economic impact of coccidiosis is most pronounced. Technological disruptions, such as the development of novel drug delivery systems and combination therapies, are reshaping the market. Consumer behavior shifts towards higher quality and safer animal products are indirectly fueling the demand for effective disease prevention measures, including anticoccidial treatments. Market penetration of ionophore anticoccidials remains high, but there is a growing interest in chemical derivative anticoccidials due to concerns about resistance development. The increasing prevalence of intensive farming practices across North America further amplifies the need for proactive disease management solutions, positioning anticoccidial drugs as an indispensable component of modern livestock management. The growing adoption of precision animal farming technologies also contributes to better monitoring and timely intervention strategies for coccidiosis, thereby supporting market growth.

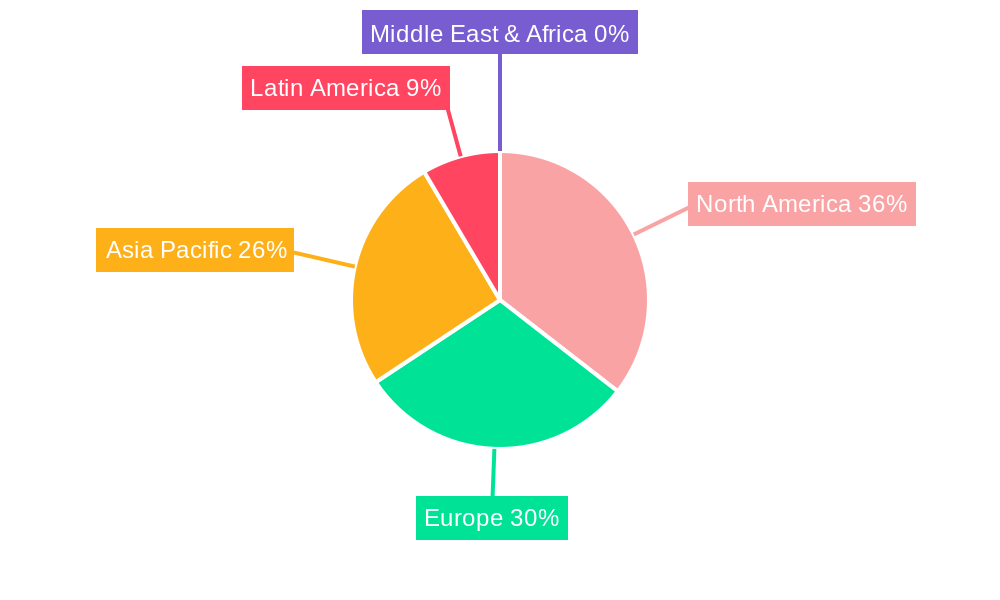

Dominant Regions, Countries, or Segments in North America Anticoccidial Drugs Industry

Within the North America anticoccidial drugs industry, the Poultry segment emerges as the dominant force, driven by its substantial contribution to animal protein production and the high susceptibility of poultry to coccidiosis. The United States leads the market in terms of both consumption and production of anticoccidial drugs, owing to its vast poultry and cattle populations and significant agricultural output.

Poultry Segment Dominance:

- High disease incidence of coccidiosis in intensive poultry farming operations.

- Significant economic impact of coccidiosis on broiler and layer production.

- Widespread use of ionophore anticoccidials and emerging chemical derivatives for prevention and control.

- Projected to account for over 65% of the total North America anticoccidial drug market by 2033.

United States Market Leadership:

- Largest animal population, particularly poultry and cattle.

- Strong regulatory support for animal health products, alongside stringent food safety standards.

- Extensive research and development infrastructure driving innovation in anticoccidial therapies.

- Estimated market share of approximately 75% within North America.

Ionophore Anticoccidials' Continued Relevance:

- Established efficacy and cost-effectiveness in poultry.

- Dominant drug type, representing over 60% of the market revenue.

- Ongoing use, despite emerging concerns about resistance.

Growth Potential in Cattle Segment:

- Increasing focus on preventing bovine coccidiosis, especially in feedlots.

- Growing demand for chemical derivative anticoccidials in this segment.

- Represents a significant, albeit smaller, market share compared to poultry.

The dominance of the poultry segment and the United States market is underscored by substantial investments in animal agriculture, coupled with stringent regulations that prioritize animal health and food safety. The ongoing economic policies supporting agricultural exports further bolster the demand for effective disease management solutions.

North America Anticoccidial Drugs Industry Product Landscape

The product landscape of the North America anticoccidial drugs industry is characterized by a dual approach, encompassing both established ionophore anticoccidials and evolving chemical derivative anticoccidials. Innovations are focused on improving efficacy, reducing resistance development, and enhancing animal welfare. Key product applications include the prophylactic and therapeutic treatment of coccidiosis in poultry, cattle, and to a lesser extent, swine and companion animals. Performance metrics are closely tied to reduced lesion scores, improved feed conversion ratios, and overall mortality reduction. Unique selling propositions often revolve around specific modes of action, compatibility with other feed additives, and ease of administration. Technological advancements are leading to the development of novel formulations and combination products that offer broader spectrum activity and better resistance management strategies, such as incorporating DNA-based diagnostics for more targeted treatment approaches.

Key Drivers, Barriers & Challenges in North America Anticoccidial Drugs Industry

The North America anticoccidial drugs industry is propelled by several key drivers.

- Key Drivers:

- Growing demand for animal protein: Increasing global population and rising disposable incomes in North America are driving the consumption of meat, eggs, and dairy, necessitating efficient livestock production.

- Prevalence of Coccidiosis: Coccidiosis remains a significant parasitic disease in livestock, leading to substantial economic losses for farmers.

- Technological advancements: Development of new, more effective, and resistance-mitigating anticoccidial drugs.

- Strict regulations on animal health: Government initiatives and industry standards aimed at improving animal welfare and food safety indirectly support the use of effective disease prevention tools.

Conversely, the industry faces significant barriers and challenges.

- Key Barriers & Challenges:

- Antimicrobial resistance: Growing concerns about resistance to anticoccidial drugs, particularly ionophores, leading to increased regulatory scrutiny and a push for alternative solutions. This resistance can reduce drug efficacy by up to 15-20%.

- Stringent regulatory approvals: The lengthy and costly process of obtaining regulatory approval for new anticoccidial drugs.

- Fluctuations in raw material prices: Volatility in the cost of key ingredients for drug manufacturing can impact profitability.

- Consumer perception and demand for "antibiotic-free" products: Growing consumer preference for animal products raised without routine antibiotic use, though anticoccidials are not typically classified as antibiotics, this perception can create market pressure.

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability of raw materials and finished products, with potential delays of 2-4 weeks impacting market supply.

Emerging Opportunities in North America Anticoccidial Drugs Industry

Emerging opportunities in the North America anticoccidial drugs industry lie in the development and adoption of next-generation anticoccidial solutions. The increasing focus on sustainable and integrated parasite management strategies presents a significant avenue for growth. This includes the development of precisely targeted therapies, novel drug delivery systems that minimize environmental impact, and the integration of anticoccidial treatments with vaccination programs. Furthermore, the expanding aquaculture sector offers untapped potential for anticoccidial drug applications, as fish are also susceptible to parasitic infections. The demand for natural and plant-based anticoccidial alternatives, though nascent, is also an area to watch.

Growth Accelerators in North America Anticoccidial Drugs Industry

Several catalysts are accelerating the long-term growth of the North America anticoccidial drugs industry. These include breakthrough innovations in drug discovery and development, leading to novel molecules with improved efficacy and reduced resistance potential. Strategic partnerships and collaborations between pharmaceutical companies, research institutions, and veterinary professionals are fostering a more dynamic innovation ecosystem. Market expansion strategies, such as targeting emerging applications in aquaculture and companion animals, alongside a continued focus on optimizing existing products for poultry and cattle, are further fueling growth. The increasing adoption of data analytics and precision farming technologies allows for more targeted and effective use of anticoccidial drugs, enhancing their overall value proposition and driving market penetration.

Key Players Shaping the North America Anticoccidial Drugs Industry Market

- Ceva Animal Health Inc

- Elanco

- Impextraco NV

- Zoetis Animal Healthcare

- Vetoquinol SA

- MSD Animal Health

- Phibro Animal Health Corporation

- Huvepharma

Notable Milestones in North America Anticoccidial Drugs Industry Sector

- 2019: Zoetis launches a new formulation of a chemical derivative anticoccidial, addressing specific resistance concerns.

- 2020: Elanco acquires Bayer's Animal Health business, significantly expanding its portfolio and market presence in anticoccidials.

- 2021: MSD Animal Health introduces an integrated approach for coccidiosis control, combining anticoccidial drugs with other management strategies.

- 2022: Phibro Animal Health Corporation reports strong sales growth for its ionophore anticoccidial products, indicating continued market demand.

- 2023: Ceva Animal Health Inc. announces advancements in research for novel anticoccidial compounds with improved safety profiles.

- Q1 2024: Vetoquinol SA expands its distribution network for anticoccidial drugs in the US cattle market.

In-Depth North America Anticoccidial Drugs Industry Market Outlook

The North America anticoccidial drugs industry is characterized by a promising outlook, driven by ongoing demand for animal protein and the persistent threat of coccidiosis. Growth accelerators such as advancements in biotechnology leading to more targeted and effective anticoccidial therapies, coupled with strategic market expansion into aquaculture and companion animals, will shape the future. The increasing adoption of sustainable farming practices and a focus on preventative healthcare in animal agriculture will further bolster the market. Strategic alliances and acquisitions are expected to continue, consolidating market power and fostering innovation. The industry is poised for sustained growth, with a strong emphasis on developing solutions that balance efficacy with resistance management and environmental sustainability.

North America Anticoccidial Drugs Industry Segmentation

-

1. Drug Type

- 1.1. Ionophore Anticoccidials

- 1.2. Chemical Derivative Anticoccidials

-

2. Animal

- 2.1. Poultry

- 2.2. Swine

- 2.3. Fish

- 2.4. Cattle

- 2.5. Companion Animals

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

-

3.1. North America

North America Anticoccidial Drugs Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Anticoccidial Drugs Industry Regional Market Share

Geographic Coverage of North America Anticoccidial Drugs Industry

North America Anticoccidial Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Incidence of Coccidiosis; Advancements in Veterinary Healthcare

- 3.3. Market Restrains

- 3.3.1. ; Availability of Alternative Treatment Options in the Market

- 3.4. Market Trends

- 3.4.1. The Ionophore Anticoccidial segment dominates the North America Anticoccidial Drugs Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Anticoccidial Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Ionophore Anticoccidials

- 5.1.2. Chemical Derivative Anticoccidials

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Poultry

- 5.2.2. Swine

- 5.2.3. Fish

- 5.2.4. Cattle

- 5.2.5. Companion Animals

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ceva Animal Health Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elanco

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Impextraco NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zoetis Animal Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vetoquinol SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MSD Animal Health

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Phibro Animal Health Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huvepharma

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Ceva Animal Health Inc

List of Figures

- Figure 1: North America Anticoccidial Drugs Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Anticoccidial Drugs Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 2: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Drug Type 2020 & 2033

- Table 3: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Animal 2020 & 2033

- Table 4: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Animal 2020 & 2033

- Table 5: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Geography 2020 & 2033

- Table 7: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Region 2020 & 2033

- Table 9: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 10: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Drug Type 2020 & 2033

- Table 11: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Animal 2020 & 2033

- Table 12: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Animal 2020 & 2033

- Table 13: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Geography 2020 & 2033

- Table 15: North America Anticoccidial Drugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Anticoccidial Drugs Industry Volume Dosage Forecast, by Country 2020 & 2033

- Table 17: United States North America Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Anticoccidial Drugs Industry?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the North America Anticoccidial Drugs Industry?

Key companies in the market include Ceva Animal Health Inc, Elanco, Impextraco NV, Zoetis Animal Healthcare, Vetoquinol SA, MSD Animal Health, Phibro Animal Health Corporation, Huvepharma.

3. What are the main segments of the North America Anticoccidial Drugs Industry?

The market segments include Drug Type, Animal, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 537.19 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Incidence of Coccidiosis; Advancements in Veterinary Healthcare.

6. What are the notable trends driving market growth?

The Ionophore Anticoccidial segment dominates the North America Anticoccidial Drugs Market.

7. Are there any restraints impacting market growth?

; Availability of Alternative Treatment Options in the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Dosage.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Anticoccidial Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Anticoccidial Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Anticoccidial Drugs Industry?

To stay informed about further developments, trends, and reports in the North America Anticoccidial Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence