Key Insights

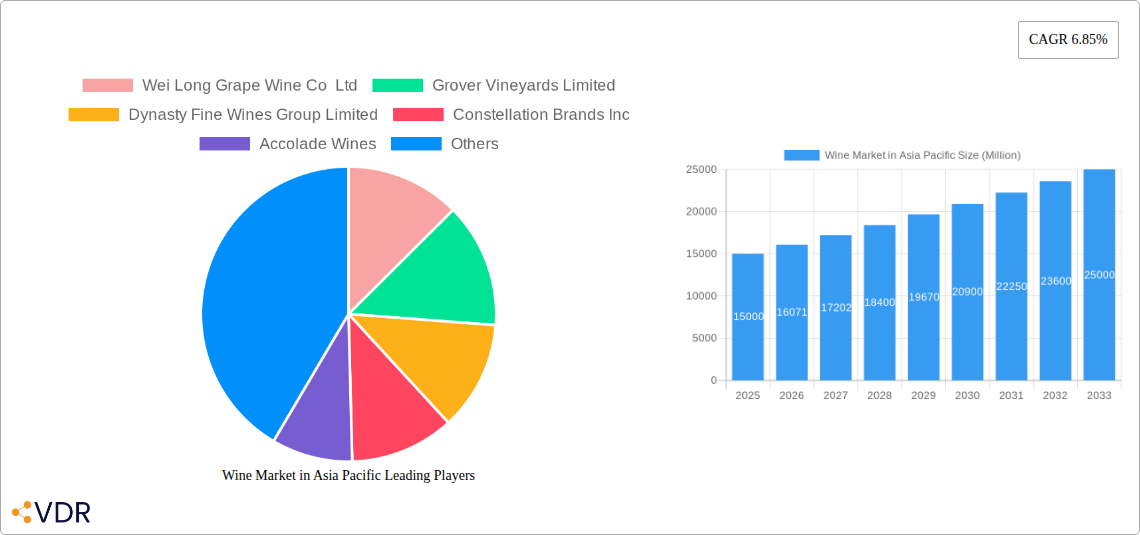

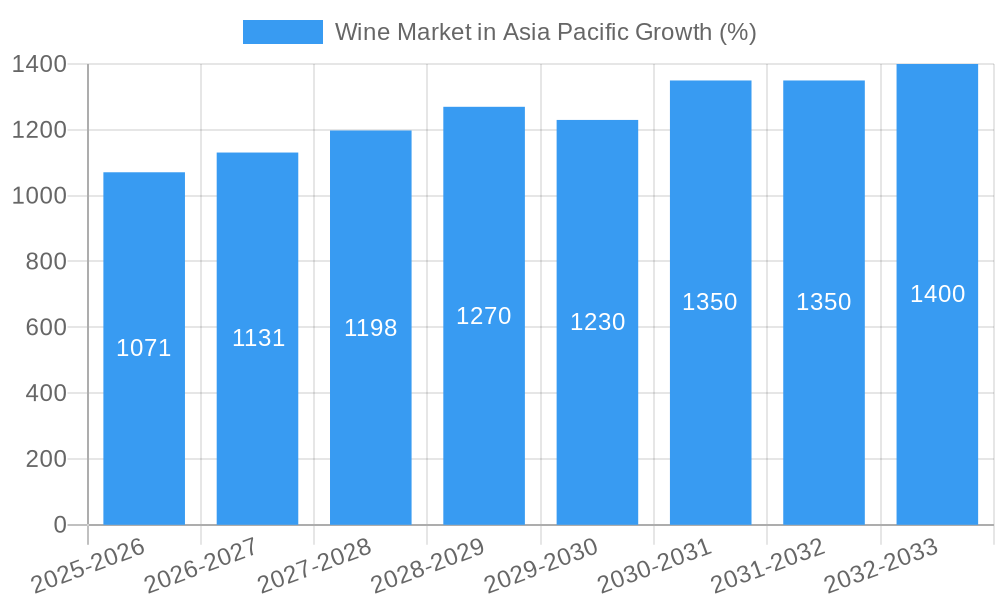

The Asia-Pacific wine market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) of 6.85% from 2025 to 2033. This expansion is driven by several factors. Rising disposable incomes, particularly in emerging economies like China and India, are fueling increased consumer spending on premium goods, including wine. A burgeoning middle class with a growing appreciation for Western lifestyles and culinary trends contributes significantly to this demand. Furthermore, the increasing popularity of wine tourism and the expansion of sophisticated wine distribution channels within the region are creating further opportunities for market penetration. The preference for specific wine types varies across the region; red wine remains popular, but the demand for rosé and white wines is also increasing, reflecting evolving consumer tastes.

However, challenges remain. The market is susceptible to fluctuations in global grape harvests and economic downturns. Moreover, competition from established local alcoholic beverage industries and ingrained cultural preferences for traditional drinks in certain areas pose obstacles to consistent growth. While China is a major growth driver, its regulatory environment and import tariffs can impact market access. The segmentation of the market by product type (still, sparkling, fortified) and distribution channel (on-trade, off-trade) reveals varying growth trajectories, offering opportunities for targeted marketing strategies. Successful players are focusing on brand building, strategic partnerships, and catering to evolving consumer preferences to secure market share. The continued expansion into e-commerce and online retail channels further accelerates market growth and increases accessibility. Overall, the Asia-Pacific wine market presents a dynamic landscape with substantial growth potential despite existing challenges. Understanding regional nuances and adapting to shifting consumer demand are key to success in this competitive yet rewarding market.

Wine Market in Asia Pacific: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Asia Pacific wine market, covering the period 2019-2033. With a focus on market size, growth trends, key players, and future opportunities, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this lucrative market. The report leverages extensive data analysis to provide actionable insights into the parent market and its key child segments, including by product type, color, and distribution channel. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033.

Wine Market in Asia Pacific Market Dynamics & Structure

The Asia Pacific wine market is characterized by a complex interplay of factors shaping its structure and growth trajectory. Market concentration varies significantly across countries, with some dominated by a few large players, while others exhibit a more fragmented landscape. Technological innovation, particularly in winemaking techniques and distribution channels (e.g., e-commerce), is a key driver. Regulatory frameworks, including import tariffs and alcohol regulations, differ across the region, impacting market access and pricing. Competitive product substitutes, such as beer and spirits, pose an ongoing challenge. End-user demographics, encompassing evolving consumer preferences and purchasing power, play a crucial role. Finally, mergers and acquisitions (M&A) activity is reshaping the market, with larger players consolidating their positions.

- Market Concentration: Highly fragmented in several smaller markets; concentrated in others, particularly in larger economies like China and Japan. xx% market share held by top 5 players in 2024.

- Technological Innovation: Increased adoption of precision viticulture, improved winemaking techniques, and sophisticated packaging solutions. However, high initial investment costs present a barrier for smaller producers.

- Regulatory Frameworks: Vary significantly by country and region, impacting import duties, labeling requirements, and distribution channels. Significant regulatory uncertainty exists in some emerging markets.

- Competitive Substitutes: The availability of alternative beverages including beer, spirits, and non-alcoholic drinks creates competition. Consumer preferences are subject to cultural influences and trends.

- End-User Demographics: Rising disposable incomes in many APAC countries and changing consumer preferences are driving growth. Younger demographics show an increasing preference for premium wines.

- M&A Trends: Consolidation activity among key players is leading to increased market share for larger firms and an increase in international brands. xx M&A deals were recorded in the Asia Pacific wine sector from 2019 to 2024, with a significant increase in the last 2 years.

Wine Market in Asia Pacific Growth Trends & Insights

The Asia Pacific wine market has experienced robust growth over the past few years, fueled by factors such as rising disposable incomes, changing consumer preferences toward premiumization, and increased tourism. The market size has expanded significantly during the historical period (2019-2024), and this growth is expected to continue through the forecast period (2025-2033). Adoption rates of wine consumption are increasing, particularly in emerging markets. Technological disruptions, such as online wine sales and the use of AI in vineyard management are transforming the industry. Shifts in consumer behavior, including a greater interest in organic and sustainable wines, are also impacting market dynamics. The CAGR for the Asia Pacific wine market during the forecast period is projected to be xx%. Market penetration remains relatively low in several key markets, suggesting significant future potential.

(Note: The XXX placeholder here requires further data to produce a meaningful 600-word analysis. This section will be populated with relevant data and insights based on available information.)

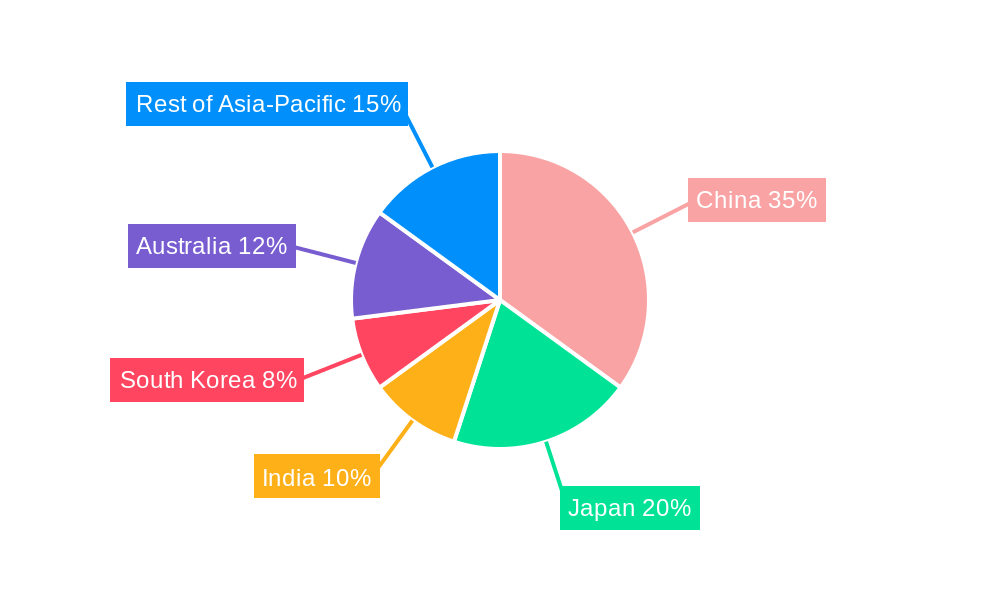

Dominant Regions, Countries, or Segments in Wine Market in Asia Pacific

China and Japan dominate the Asia Pacific wine market in terms of consumption volume, followed by Australia, South Korea, and other countries in Southeast Asia. Within the product landscape, still wines constitute the largest segment by volume, followed by sparkling wines. Red wine is the most popular colour variant, reflecting traditional preferences. However, white and rosé wines are experiencing increased demand, particularly among younger consumers. The off-trade channel (retail sales) represents a larger share of total sales compared to the on-trade channel (restaurants and bars).

- Key Drivers of Growth:

- China: Rising middle class, increased disposable income, and a growing appreciation for Western-style lifestyles.

- Japan: Established wine culture, high per capita disposable income, and strong import infrastructure.

- Australia: Domestic production capabilities, supportive government policies, and strong export markets.

- South Korea: Increasing popularity of Western food and beverage options among younger generation.

- Market Share and Growth Potential:

- Still wine holds the largest market share (xx%), with a projected CAGR of xx% during the forecast period.

- Red wine accounts for xx% of total wine consumption, while white and rosé wines are expected to experience faster growth rates.

- The off-trade channel is projected to remain the dominant distribution channel, with a substantial growth potential in e-commerce.

Wine Market in Asia Pacific Product Landscape

The Asia Pacific wine market features a diverse range of products, reflecting the varied tastes and preferences of the regional consumer base. Product innovation focuses on premiumization, with a strong emphasis on organic, biodynamic, and sustainable wines. Winemakers are increasingly experimenting with new grape varietals and blending techniques to cater to evolving palates. Performance metrics like sales volume, average selling price, and brand awareness are constantly monitored and analyzed. The introduction of new technologies in viticulture and winemaking contributes to enhancing wine quality and production efficiency. Unique selling propositions (USPs) for individual wine brands focus on origin, sustainability, rarity, and storytelling.

Key Drivers, Barriers & Challenges in Wine Market in Asia Pacific

Key Drivers: Rising disposable incomes across the region, a growing middle class with increased spending power, changing consumer preferences (premiumization and health consciousness), growing tourism, and government initiatives to support the wine industry are all crucial drivers of market growth.

Challenges & Restraints: High import tariffs and taxes in some countries, fluctuating currency exchange rates, strong competition from domestic alcoholic beverage producers, supply chain disruptions, and the varying level of consumer awareness about wine characteristics, and complexities concerning authenticity and quality create challenges for market expansion. These factors could potentially impact the market growth trajectory by xx% over the forecast period.

Emerging Opportunities in Wine Market in Asia Pacific

Untapped markets within Southeast Asia represent a significant growth opportunity. Increased focus on health-conscious wine consumption is creating demand for organic, low-alcohol, and low-sugar options. E-commerce and direct-to-consumer (DTC) sales channels offer considerable growth potential. Consumer preference for experiences and authenticity drives demand for unique varietals and wines with compelling stories.

Growth Accelerators in the Wine Market in Asia Pacific Industry

Technological advancements such as precision viticulture, AI-driven vineyard management, and improved packaging enhance efficiency and sustainability. Strategic alliances between wine producers and distributors expand market reach and brand visibility. Increased government investments in the wine industry promote local production and boost export capabilities.

Key Players Shaping the Wine Market in Asia Pacific Market

- Wei Long Grape Wine Co Ltd

- Grover Vineyards Limited

- Dynasty Fine Wines Group Limited

- Constellation Brands Inc

- Accolade Wines

- Yantai Changyu Pioneer Wine Co Ltd

- Tonghuagrape Wine Co Ltd

- Sula Vineyards Limited

- Treasury Wine Estates

- The Wine Group LLC

Notable Milestones in Wine Market in Asia Pacific Sector

- July 2022: Milestone Beverages relaunches Blowfish Australian wine in China with a new design.

- May 2022: Juvé Camps partners with Nimbility to expand in Greater China and South Korea.

- March 2022: Mercian Corporation launches a new wine brand, Mercian Wines, featuring multi-country blends.

In-Depth Wine Market in Asia Pacific Market Outlook

The Asia Pacific wine market is poised for continued growth, driven by a combination of factors including rising disposable incomes, changing consumer preferences, and technological advancements. Strategic investments in sustainable viticulture practices, the expansion of e-commerce channels, and the development of innovative product offerings are crucial for capitalizing on future market potential. The opportunities for premiumization and diversification within the product range are expected to drive substantial growth, further enhanced by strategic partnerships and effective branding.

Wine Market in Asia Pacific Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Fortified Wine and Vermouth

- 1.4. Others

-

2. Colour

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

-

3. Distibution Channel

- 3.1. On-Trade

- 3.2. Off-Trade

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

Wine Market in Asia Pacific Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Wine Market in Asia Pacific REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies

- 3.3. Market Restrains

- 3.3.1. Volatility in Imports and Supply Chain of Oils

- 3.4. Market Trends

- 3.4.1. Increase in the Frequency of Wine Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Fortified Wine and Vermouth

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Colour

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. On-Trade

- 5.3.2. Off-Trade

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Fortified Wine and Vermouth

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Colour

- 6.2.1. Red Wine

- 6.2.2. Rose Wine

- 6.2.3. White Wine

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. On-Trade

- 6.3.2. Off-Trade

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Fortified Wine and Vermouth

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Colour

- 7.2.1. Red Wine

- 7.2.2. Rose Wine

- 7.2.3. White Wine

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. On-Trade

- 7.3.2. Off-Trade

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Fortified Wine and Vermouth

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Colour

- 8.2.1. Red Wine

- 8.2.2. Rose Wine

- 8.2.3. White Wine

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. On-Trade

- 8.3.2. Off-Trade

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Still Wine

- 9.1.2. Sparkling Wine

- 9.1.3. Fortified Wine and Vermouth

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Colour

- 9.2.1. Red Wine

- 9.2.2. Rose Wine

- 9.2.3. White Wine

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. On-Trade

- 9.3.2. Off-Trade

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Still Wine

- 10.1.2. Sparkling Wine

- 10.1.3. Fortified Wine and Vermouth

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Colour

- 10.2.1. Red Wine

- 10.2.2. Rose Wine

- 10.2.3. White Wine

- 10.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.3.1. On-Trade

- 10.3.2. Off-Trade

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. China Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 12. Japan Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 13. India Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 16. Australia Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Wine Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Wei Long Grape Wine Co Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Grover Vineyards Limited

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Dynasty Fine Wines Group Limited

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Constellation Brands Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Accolade Wines

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Yantai Changyu Pioneer Wine Co Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Tonghuagrape Wine Co Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Sula Vineyards Limited

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Treasury Wine Estates*List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 The Wine Group LLC

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Wei Long Grape Wine Co Ltd

List of Figures

- Figure 1: Wine Market in Asia Pacific Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Wine Market in Asia Pacific Share (%) by Company 2024

List of Tables

- Table 1: Wine Market in Asia Pacific Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Wine Market in Asia Pacific Volume K Liters Forecast, by Region 2019 & 2032

- Table 3: Wine Market in Asia Pacific Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2019 & 2032

- Table 5: Wine Market in Asia Pacific Revenue Million Forecast, by Colour 2019 & 2032

- Table 6: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2019 & 2032

- Table 7: Wine Market in Asia Pacific Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 8: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2019 & 2032

- Table 9: Wine Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2019 & 2032

- Table 11: Wine Market in Asia Pacific Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Wine Market in Asia Pacific Volume K Liters Forecast, by Region 2019 & 2032

- Table 13: Wine Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2019 & 2032

- Table 15: China Wine Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Wine Market in Asia Pacific Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 17: Japan Wine Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Wine Market in Asia Pacific Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 19: India Wine Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Wine Market in Asia Pacific Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 21: South Korea Wine Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Wine Market in Asia Pacific Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 23: Taiwan Wine Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Taiwan Wine Market in Asia Pacific Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 25: Australia Wine Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Wine Market in Asia Pacific Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 27: Rest of Asia-Pacific Wine Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific Wine Market in Asia Pacific Volume (K Liters) Forecast, by Application 2019 & 2032

- Table 29: Wine Market in Asia Pacific Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2019 & 2032

- Table 31: Wine Market in Asia Pacific Revenue Million Forecast, by Colour 2019 & 2032

- Table 32: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2019 & 2032

- Table 33: Wine Market in Asia Pacific Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 34: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2019 & 2032

- Table 35: Wine Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2019 & 2032

- Table 37: Wine Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2019 & 2032

- Table 39: Wine Market in Asia Pacific Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2019 & 2032

- Table 41: Wine Market in Asia Pacific Revenue Million Forecast, by Colour 2019 & 2032

- Table 42: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2019 & 2032

- Table 43: Wine Market in Asia Pacific Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 44: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2019 & 2032

- Table 45: Wine Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2019 & 2032

- Table 47: Wine Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2019 & 2032

- Table 49: Wine Market in Asia Pacific Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2019 & 2032

- Table 51: Wine Market in Asia Pacific Revenue Million Forecast, by Colour 2019 & 2032

- Table 52: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2019 & 2032

- Table 53: Wine Market in Asia Pacific Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 54: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2019 & 2032

- Table 55: Wine Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2019 & 2032

- Table 57: Wine Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2019 & 2032

- Table 59: Wine Market in Asia Pacific Revenue Million Forecast, by Product Type 2019 & 2032

- Table 60: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2019 & 2032

- Table 61: Wine Market in Asia Pacific Revenue Million Forecast, by Colour 2019 & 2032

- Table 62: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2019 & 2032

- Table 63: Wine Market in Asia Pacific Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 64: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2019 & 2032

- Table 65: Wine Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 66: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2019 & 2032

- Table 67: Wine Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2019 & 2032

- Table 69: Wine Market in Asia Pacific Revenue Million Forecast, by Product Type 2019 & 2032

- Table 70: Wine Market in Asia Pacific Volume K Liters Forecast, by Product Type 2019 & 2032

- Table 71: Wine Market in Asia Pacific Revenue Million Forecast, by Colour 2019 & 2032

- Table 72: Wine Market in Asia Pacific Volume K Liters Forecast, by Colour 2019 & 2032

- Table 73: Wine Market in Asia Pacific Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 74: Wine Market in Asia Pacific Volume K Liters Forecast, by Distibution Channel 2019 & 2032

- Table 75: Wine Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 76: Wine Market in Asia Pacific Volume K Liters Forecast, by Geography 2019 & 2032

- Table 77: Wine Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Wine Market in Asia Pacific Volume K Liters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wine Market in Asia Pacific?

The projected CAGR is approximately 6.85%.

2. Which companies are prominent players in the Wine Market in Asia Pacific?

Key companies in the market include Wei Long Grape Wine Co Ltd, Grover Vineyards Limited, Dynasty Fine Wines Group Limited, Constellation Brands Inc, Accolade Wines, Yantai Changyu Pioneer Wine Co Ltd, Tonghuagrape Wine Co Ltd, Sula Vineyards Limited, Treasury Wine Estates*List Not Exhaustive, The Wine Group LLC.

3. What are the main segments of the Wine Market in Asia Pacific?

The market segments include Product Type, Colour, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies.

6. What are the notable trends driving market growth?

Increase in the Frequency of Wine Consumption.

7. Are there any restraints impacting market growth?

Volatility in Imports and Supply Chain of Oils.

8. Can you provide examples of recent developments in the market?

In July 2022, Milestone Beverages has planned to relaunch Blowfish Australian wine with an all-new design in China. Blowfish is Milestone's first-born brand, created by founder and managing director Joe Milner in homage to his part Australian heritage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wine Market in Asia Pacific," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wine Market in Asia Pacific report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wine Market in Asia Pacific?

To stay informed about further developments, trends, and reports in the Wine Market in Asia Pacific, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence