Key Insights

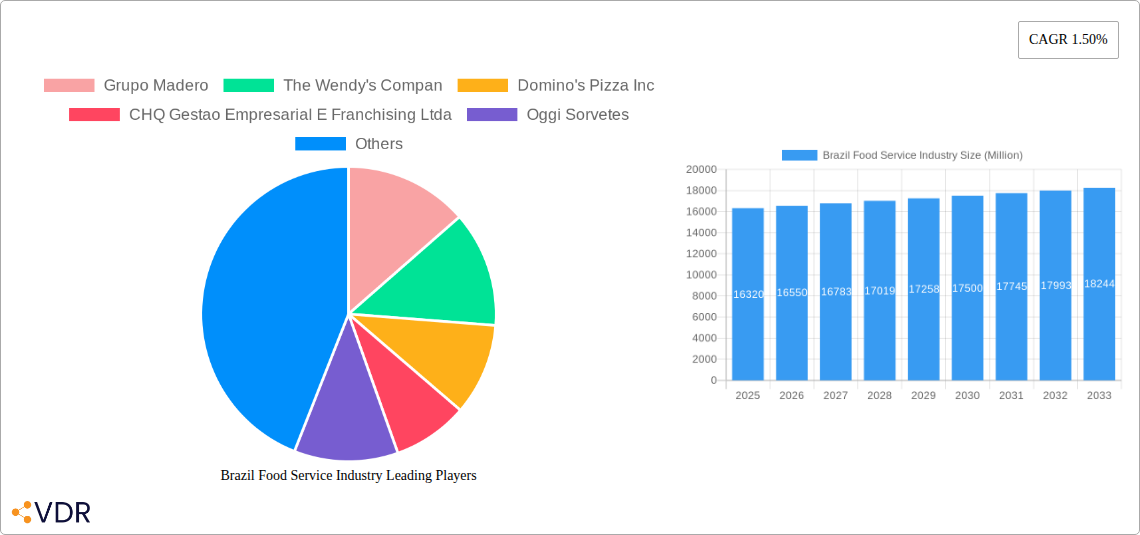

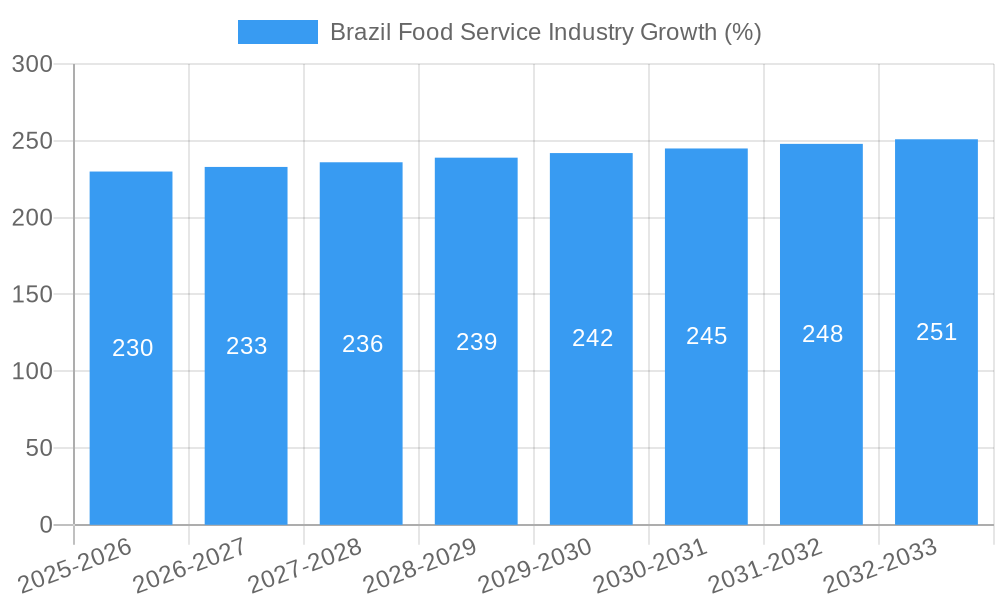

The Brazilian food service industry, valued at approximately 16,320 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 1.50% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes, particularly within the expanding middle class, are driving increased spending on dining out. A burgeoning tourism sector, especially in major cities and coastal regions, further contributes to the industry's expansion. The increasing popularity of quick-service restaurants (QSRs) catering to busy lifestyles and diverse culinary preferences adds to the market's dynamism. Furthermore, the rise of online food delivery platforms and the expansion of food chains are streamlining access and creating convenient consumption patterns, boosting overall market volume. However, economic fluctuations and inflation could pose challenges, impacting consumer spending on discretionary items like eating out. Competition remains fierce, especially within the QSR segment, necessitating innovation in menu offerings, service delivery, and branding to maintain a competitive edge. The industry’s segmentation highlights the dominance of chained outlets and cafes & bars, although independent outlets and diverse cuisines are experiencing growth. Geographic concentration within leisure, lodging, and retail locations also signifies opportunities for targeted expansion strategies.

The future of the Brazilian food service market hinges on effectively addressing consumer preferences and evolving market dynamics. Sustained growth will require adaptation to changing tastes, a focus on value for money, and strategic investments in technology and infrastructure. Companies like Grupo Madero, Wendy's, Domino's, and others will need to prioritize customer loyalty programs, robust online ordering systems, and efficient delivery networks to thrive in this competitive landscape. Expanding into underserved regions and offering tailored menus catering to specific demographic needs will be crucial for further penetration. The ongoing impact of macroeconomic factors needs continuous monitoring and adaptation to ensure business resilience and sustained growth throughout the forecast period. A deeper understanding of evolving consumer expectations and technological advancements will be paramount for success in the years to come.

Brazil Food Service Industry: Market Report 2019-2033

This comprehensive report provides a deep dive into the dynamic Brazil food service industry, analyzing market trends, key players, and future growth prospects from 2019 to 2033. With a focus on key segments – Cafes & Bars, Other QSR Cuisines, Chained Outlets, and Independent Outlets – across diverse locations (Leisure, Lodging, Retail, Standalone, Travel) – this report is an invaluable resource for industry professionals, investors, and anyone seeking to understand this lucrative market. The report uses 2025 as its base year, with data encompassing the historical period (2019-2024), the estimated year (2025), and a forecast period (2025-2033). Values are presented in millions of units unless otherwise specified.

Brazil Food Service Industry Market Dynamics & Structure

The Brazilian food service industry exhibits a complex interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a mix of large multinational chains and numerous smaller, independent businesses. Technological innovation, particularly in online ordering and delivery platforms, is a key driver. However, challenges remain in terms of regulatory frameworks and infrastructure limitations in certain regions. Competition is intense, with established players facing pressure from new entrants and evolving consumer preferences. The industry is witnessing considerable M&A activity, with larger chains consolidating their market share.

- Market Concentration: xx% dominated by top 5 players.

- Technological Innovation: Rapid adoption of online ordering, delivery apps, and POS systems.

- Regulatory Framework: Varied regulations across states impacting operations and licensing.

- Competitive Substitutes: Home meal delivery services, supermarket ready-to-eat meals pose a competitive threat.

- End-User Demographics: Growing middle class, increasing urbanization, and changing dietary habits are key drivers.

- M&A Trends: An average of xx M&A deals per year (2019-2024).

Brazil Food Service Industry Growth Trends & Insights

The Brazilian food service market has experienced significant growth over the past five years, driven by strong economic expansion, rising disposable incomes, and evolving consumer preferences. The market size expanded from xx million units in 2019 to xx million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This positive trajectory is expected to continue, with a projected CAGR of xx% during the forecast period (2025-2033), driven by factors like increasing urbanization, the rise of quick-service restaurants (QSRs), and the growing popularity of international cuisines. Technological disruptions, including online ordering and delivery platforms, have fundamentally reshaped consumer behavior, favoring convenience and speed. Market penetration of digital ordering is xx% and is expected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in Brazil Food Service Industry

The Southeast region of Brazil consistently dominates the food service market, accounting for approximately xx% of the total market value in 2024. This dominance is attributed to higher population density, greater disposable income, and advanced infrastructure. Within segments, Chained Outlets hold a significant market share, benefitting from economies of scale and brand recognition. The QSR segment, specifically Other QSR Cuisines showcasing diversity and adaptability to local tastes, also demonstrates strong growth.

- Key Drivers in Southeast Region: High population density, strong economic activity, advanced infrastructure, and high consumer spending.

- Chained Outlets Dominance: Economies of scale, established brand recognition, and efficient supply chains contribute to their market leadership.

- Growth Potential in Other QSR Cuisines: Adaptability to local tastes, diverse menu offerings, and increasing consumer demand for international cuisine.

Brazil Food Service Industry Product Landscape

Product innovation within the Brazilian food service industry is characterized by a focus on convenience, customization, and healthier options. Restaurants are increasingly incorporating technological advancements such as mobile ordering systems and customized meal preparation to enhance customer experience. The rise of plant-based alternatives and emphasis on locally sourced ingredients showcase changing consumer preferences and environmental awareness. Unique selling propositions include personalized menu options, loyalty programs and strategic delivery partnerships.

Key Drivers, Barriers & Challenges in Brazil Food Service Industry

Key Drivers:

- Rapid urbanization and population growth.

- Rising disposable incomes and changing consumer preferences.

- Technological advancements in online ordering and delivery.

- Government initiatives promoting tourism and food culture.

Challenges:

- High inflation and economic volatility impacting consumer spending.

- Supply chain disruptions and rising food costs.

- Intense competition and pressure on profit margins.

- Regulatory hurdles and bureaucratic processes. (xx% of businesses report significant regulatory challenges, impacting operational efficiency.)

Emerging Opportunities in Brazil Food Service Industry

- Growth of healthy and sustainable food options: Catering to health-conscious consumers.

- Expansion into underserved regions: Reaching beyond major urban centers.

- Leveraging technology for enhanced customer experience: Implementing AI-powered solutions and personalized offers.

- Exploring niche culinary offerings: Catering to specific dietary needs or preferences.

Growth Accelerators in the Brazil Food Service Industry

Technological advancements, strategic partnerships, and expansion into new markets are key growth catalysts. The adoption of innovative technologies such as AI-powered customer relationship management (CRM) systems, data analytics for demand forecasting and personalized menu suggestions and expanded delivery network capabilities will significantly impact operational efficiency and revenue growth. Strategic collaborations with delivery platforms and food technology companies enhance reach and service efficiency. Expansion into smaller cities and underserved regions unlocks significant untapped market potential.

Key Players Shaping the Brazil Food Service Industry Market

- Grupo Madero

- The Wendy's Company

- Domino's Pizza Inc

- CHQ Gestao Empresarial E Franchising Ltda

- Oggi Sorvetes

- Restaurant Brands International Inc

- Brazil Fast Food Corporation

- SouthRock

- Arcos Dorados Holdings Inc

- Halipar

- International Meal Company Alimentacao SA

Notable Milestones in Brazil Food Service Industry Sector

- July 2022: SouthRock announced its exclusive partnership with Eataly Brasil.

- August 2022: Chiquinho Sorvetes opened a new franchise in Campo Grande.

- April 2023: Burger King partnered with Bringg to enhance delivery operations.

In-Depth Brazil Food Service Industry Market Outlook

The Brazilian food service industry is poised for continued growth, driven by favorable demographics, technological advancements, and evolving consumer preferences. Strategic investments in technology, expansion into new markets, and a focus on providing diverse and customized food experiences will be crucial for success. The increasing adoption of online ordering and delivery services presents a significant opportunity for market expansion and customer engagement. Companies that successfully adapt to these trends and build strong brands are likely to achieve substantial growth in the coming years.

Brazil Food Service Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Brazil Food Service Industry Segmentation By Geography

- 1. Brazil

Brazil Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. Popular delivery apps innovating delivery experience are driving the popularity of cloud kitchens.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Grupo Madero

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Wendy's Compan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Domino's Pizza Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CHQ Gestao Empresarial E Franchising Ltda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oggi Sorvetes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Restaurant Brands International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Brazil Fast Food Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SouthRock

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arcos Dorados Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Halipar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 International Meal Company Alimentacao SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Grupo Madero

List of Figures

- Figure 1: Brazil Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Food Service Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Brazil Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 4: Brazil Food Service Industry Volume K Tons Forecast, by Foodservice Type 2019 & 2032

- Table 5: Brazil Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 6: Brazil Food Service Industry Volume K Tons Forecast, by Outlet 2019 & 2032

- Table 7: Brazil Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 8: Brazil Food Service Industry Volume K Tons Forecast, by Location 2019 & 2032

- Table 9: Brazil Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Food Service Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Brazil Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Food Service Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Brazil Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 14: Brazil Food Service Industry Volume K Tons Forecast, by Foodservice Type 2019 & 2032

- Table 15: Brazil Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Brazil Food Service Industry Volume K Tons Forecast, by Outlet 2019 & 2032

- Table 17: Brazil Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 18: Brazil Food Service Industry Volume K Tons Forecast, by Location 2019 & 2032

- Table 19: Brazil Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Food Service Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Food Service Industry?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the Brazil Food Service Industry?

Key companies in the market include Grupo Madero, The Wendy's Compan, Domino's Pizza Inc, CHQ Gestao Empresarial E Franchising Ltda, Oggi Sorvetes, Restaurant Brands International Inc, Brazil Fast Food Corporation, SouthRock, Arcos Dorados Holdings Inc, Halipar, International Meal Company Alimentacao SA.

3. What are the main segments of the Brazil Food Service Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 16320 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

Popular delivery apps innovating delivery experience are driving the popularity of cloud kitchens..

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

April 2023: Burger King partnered with Bringg, a delivery management platform provider, to help manage their last-mile operations and increase delivery channels across the region. Bringg's delivery management platform will be able to offer more delivery options for Burger King across the country while increasing efficiency and reducing last-mile costs.August 2022: Chiquinho Sorvetes opened its new franchise in Patio Central Shopping, Campo Grande.July 2022: SouthRock announced its exclusive partnership with Eataly Brasil to continue the operation and expansion of the brand in the Brazilian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Food Service Industry?

To stay informed about further developments, trends, and reports in the Brazil Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence