Key Insights

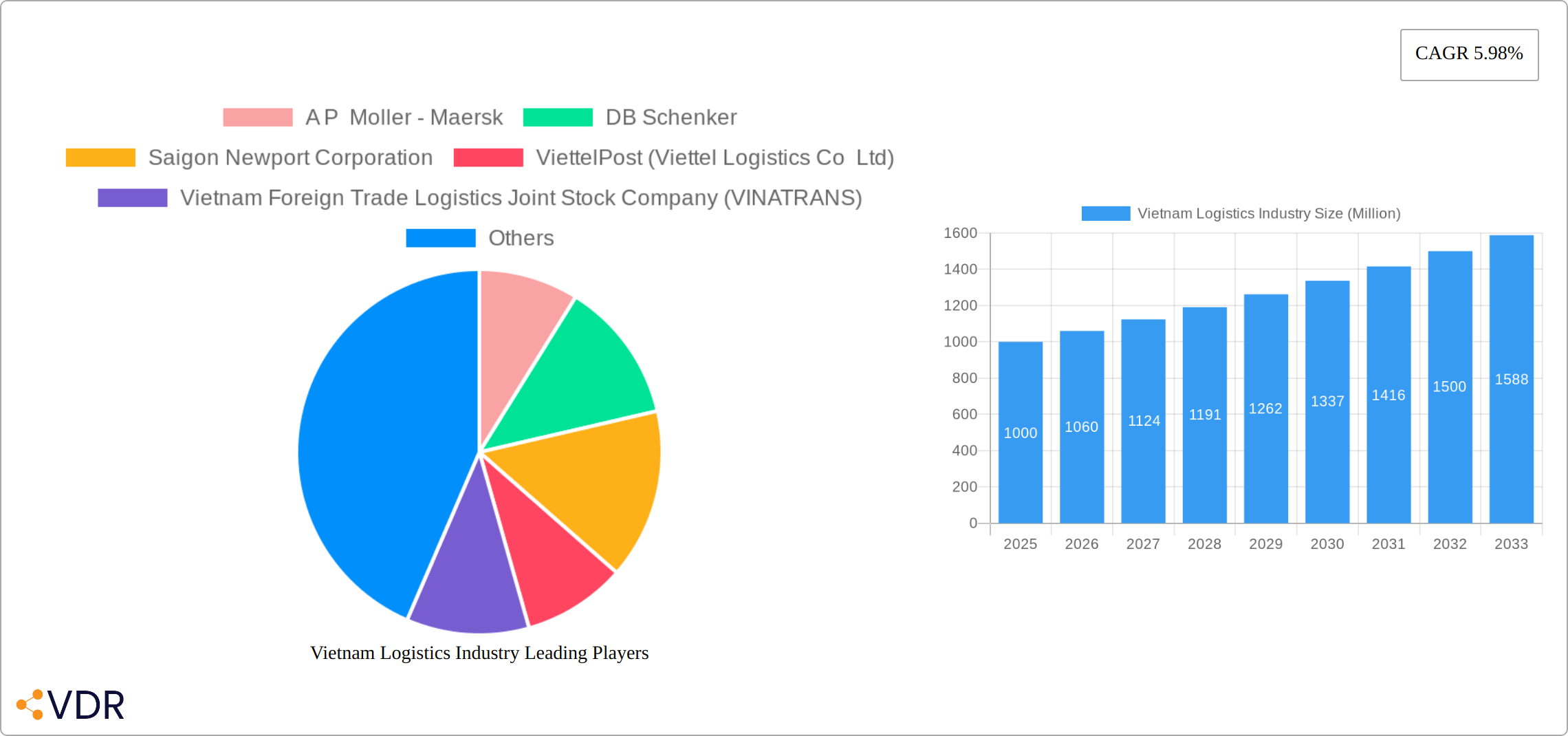

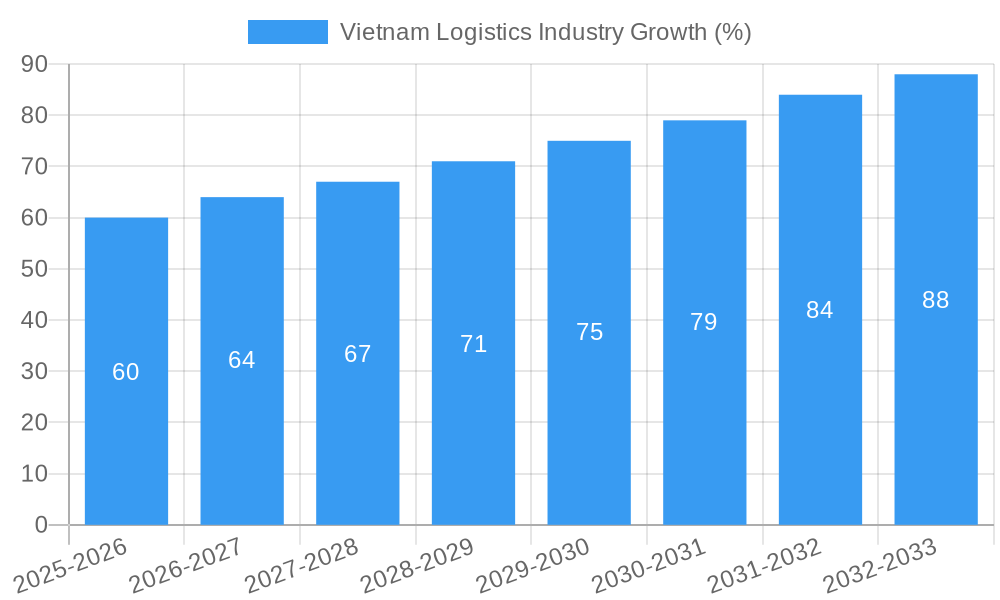

The Vietnam logistics market, valued at approximately $XX million in 2025 (estimated based on provided CAGR and market size), is experiencing robust growth, projected at a 5.98% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. Firstly, Vietnam's burgeoning manufacturing sector, particularly in electronics and textiles, fuels a significant demand for efficient and reliable logistics services. Secondly, the rise of e-commerce is creating a surge in last-mile delivery needs, further stimulating market growth. Thirdly, government initiatives aimed at improving infrastructure, such as port modernization and road network development, are enhancing logistical capabilities and attracting foreign investment. The expansion of industrial zones and special economic zones further contribute to this growth. Key segments driving this growth are Courier, Express, and Parcel (CEP) services, followed by temperature-controlled logistics, crucial for the country's agricultural and pharmaceutical exports.

While the market presents significant opportunities, certain challenges persist. These include infrastructure limitations in certain regions, particularly in rural areas, leading to higher transportation costs and delivery times. Furthermore, a shortage of skilled labor within the logistics sector poses a constraint on operational efficiency. Competition is intense, with both domestic and international players vying for market share. However, the overall outlook remains positive, indicating continued growth and potential for significant market expansion throughout the forecast period. The dominance of key players such as Maersk, DB Schenker, and DHL, alongside the emergence of strong domestic players, reflects a dynamic and competitive market environment. The continued focus on improving efficiency and expanding into underserved regions will be crucial for success in this rapidly evolving landscape.

This comprehensive report provides an in-depth analysis of the Vietnam logistics industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and businesses seeking to understand and capitalize on the opportunities within Vietnam's dynamic logistics sector. The report segments the market by Logistics Function (Courier, Express, and Parcel (CEP); Temperature Controlled; Other Services) and End-User Industry (Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others).

Vietnam Logistics Industry Market Dynamics & Structure

The Vietnam logistics market is characterized by a moderately concentrated structure with several large multinational and domestic players vying for market share. Technological advancements, particularly in e-commerce and digitalization, are significant drivers of industry transformation. A supportive regulatory framework, while evolving, fosters growth. However, challenges exist, including infrastructure limitations and the need for greater standardization across logistics operations. Competition from substitute services and the increasing importance of sustainability are also key considerations. The market witnessed xx Million USD worth of M&A activity in 2024, indicating ongoing consolidation.

- Market Concentration: The top 5 players hold approximately xx% of the market share.

- Technological Innovation: Adoption of technologies like AI, IoT, and blockchain is accelerating efficiency and transparency. However, barriers include high initial investment costs and a skills gap.

- Regulatory Framework: Government initiatives to improve infrastructure and streamline regulations are positive, but inconsistencies across regions remain a challenge.

- Competitive Substitutes: The emergence of alternative transportation modes and service providers presents ongoing competitive pressure.

- End-User Demographics: The growth of e-commerce and rising consumer spending are driving demand for faster and more reliable logistics services.

- M&A Trends: Consolidation is evident, with larger players acquiring smaller companies to expand their market reach and service offerings.

Vietnam Logistics Industry Growth Trends & Insights

The Vietnam logistics market experienced robust growth during the historical period (2019-2024), primarily fueled by the country's expanding economy, burgeoning e-commerce sector, and rising foreign direct investment. The market size, valued at xx Million USD in 2024, is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx%. This growth is driven by factors such as increasing manufacturing activity, expansion of the retail sector, and the government's focus on improving infrastructure. Technological disruptions, including the increasing adoption of automated systems and digital platforms, are further streamlining operations and enhancing efficiency. Shifting consumer behavior, reflected in the rising demand for faster and more reliable delivery services, fuels this growth. Market penetration of advanced logistics technologies is projected to increase from xx% in 2025 to xx% by 2033.

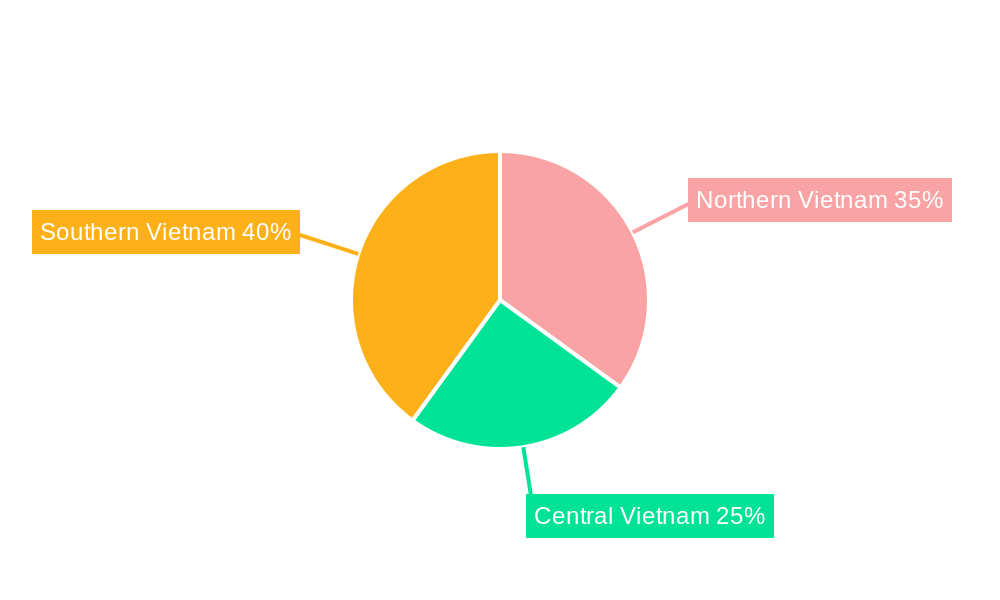

Dominant Regions, Countries, or Segments in Vietnam Logistics Industry

Southern Vietnam commands the lion's share of the logistics market, leveraging its well-established port infrastructure and strategic proximity to major manufacturing centers. The Courier, Express, and Parcel (CEP) segment exhibits the most rapid growth, fueled by the explosive expansion of e-commerce. While precise figures are unavailable for public sources, the manufacturing sector remains the largest end-user, consuming a substantial portion of market demand. Ho Chi Minh City and Hanoi function as pivotal regional hubs, acting as gateways for both domestic and international trade.

- Key Drivers: Government initiatives focused on infrastructure development, including substantial investments in port expansion and the modernization of road networks, are key catalysts for growth. Supportive economic policies and the robust growth of key sectors, particularly manufacturing and e-commerce, significantly contribute to market expansion. Furthermore, Vietnam's strategic geographical location facilitates its role as a crucial link in regional and global supply chains.

- Dominance Factors: The high concentration of manufacturing activities and a significant portion of the population in Southern Vietnam, coupled with its superior infrastructure compared to other regions, underpins its market dominance. The remarkable growth of the CEP segment directly reflects the increasing reliance on e-commerce for both business-to-business (B2B) and business-to-consumer (B2C) transactions.

Vietnam Logistics Industry Product Landscape

The Vietnam logistics industry is witnessing the introduction of advanced technologies like automated warehousing systems, real-time tracking solutions, and sophisticated route optimization software. These innovations are enhancing efficiency, improving delivery times, and reducing costs. Companies are increasingly focusing on developing specialized solutions to meet the demands of various industry segments, including temperature-controlled transportation for pharmaceuticals and perishable goods. The unique selling proposition lies in the integration of cutting-edge technologies with established expertise and regional knowledge.

Key Drivers, Barriers & Challenges in Vietnam Logistics Industry

Key Drivers: The phenomenal growth of e-commerce and the manufacturing sector, combined with continuous government investment in infrastructure upgrades, are propelling significant market expansion. The increasing adoption of cutting-edge technologies further enhances operational efficiency and transparency, leading to improved service delivery and cost optimization. Furthermore, Vietnam's participation in various free trade agreements is opening up new opportunities for international trade and logistics.

Key Challenges: Infrastructure limitations, especially in less developed regions, and a persistent shortage of skilled labor remain significant hurdles. Inconsistencies in regulatory frameworks and elevated transportation costs can impede growth. Intense competition from both domestic and international players necessitates a focus on differentiation and strategic partnerships. The need for greater sustainability in logistics operations, including reducing carbon emissions and waste, is also gaining prominence. These challenges collectively exert downward pressure on market growth, potentially resulting in a reduced compound annual growth rate (CAGR).

Emerging Opportunities in Vietnam Logistics Industry

The burgeoning demand for specialized logistics services, particularly in temperature-controlled transportation for pharmaceuticals and perishable goods, and efficient last-mile delivery solutions, presents lucrative opportunities. The expanding reach of e-commerce into rural areas unlocks considerable potential for market penetration. Investing in sustainable and eco-friendly logistics practices, such as adopting electric vehicles, optimizing fuel efficiency, and employing innovative route planning technologies, can provide a significant competitive advantage and enhance brand reputation.

Growth Accelerators in the Vietnam Logistics Industry

The ongoing development of smart logistics infrastructure, coupled with government incentives for technological adoption, will significantly accelerate growth. Strategic partnerships between logistics companies and technology providers are creating innovative solutions, further propelling market expansion.

Key Players Shaping the Vietnam Logistics Industry Market

- A P Moller - Maersk

- DB Schenker

- Saigon Newport Corporation

- ViettelPost (Viettel Logistics Co Ltd)

- Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- NYK (Nippon Yusen Kaisha) Line

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Phuong Trang Bus Joint Stock Company - FUTA Bus Lines

- Aviation Logistics Corporation

- Samsung SDS

- MACS Maritime Joint Stock Company

- Hop Nhat International Joint Stock Company

- FedEx

- Kuehne + Nagel

- United Parcel Service of America Inc (UPS)

- ZIM Integrated Shipping Services Ltd

- PetroVietnam Transport Corporation

- Giao Hang Nhanh

- Gemadept Corporation

- Hai Minh Corporation

- Indo Trans Logistics Corporation

- Voltrans Logistics

- Transimex Corporation

- Sojitz Corporation

- Bee Logistics Corporation

- U&I Logistics Corporation

- Noi Bai Express and Trading Joint Stock Company

- Vietnam Maritime Corporation

- Expeditors International of Washington Inc

- Vietnam Transport & Chartering Corporation

Notable Milestones in Vietnam Logistics Industry Sector

- January 2024: DHL Express deployed its final Boeing 777 freighter in Singapore, boosting Asia-Pacific to Americas connectivity.

- January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles, enhancing decarbonization efforts.

- October 2024: Gemadept Corporation expanded its fleet with the Super Ship ONE INTELLIGENCE (400m length, 24,136 TEU capacity, 223,200 DWT tonnage), joining THE Alliance's FE3 service line.

In-Depth Vietnam Logistics Industry Market Outlook

The Vietnamese logistics market is poised for continued robust growth, propelled by the sustained expansion of e-commerce, ongoing government investments in infrastructure modernization, and the widespread adoption of innovative technologies. Strategic collaborations, mergers and acquisitions, and substantial investments in sustainable practices will further accelerate this expansion. The market's long-term success hinges on adapting to the ever-evolving demands of businesses and consumers, embracing technological advancements to enhance efficiency and transparency, and capitalizing on Vietnam's advantageous geographic position to solidify its status as a prominent regional logistics hub within the Asia-Pacific region and beyond.

Vietnam Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Vietnam Logistics Industry Segmentation By Geography

- 1. Vietnam

Vietnam Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saigon Newport Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ViettelPost (Viettel Logistics Co Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NYK (Nippon Yusen Kaisha) Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DHL Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Phuong Trang Bus Joint Stock Company - FUTA Bus Lines

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aviation Logistics Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Samsung SDS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MACS Maritime Joint Stock Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hop Nhat International Joint Stock Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 FedEx

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kuehne + Nagel

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 United Parcel Service of America Inc (UPS)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ZIM Integrated Shipping Services Ltd

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 PetroVietnam Transport Corporation

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Giao Hang Nhanh

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Gemadept Corporation

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Hai Minh Corporation

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Indo Trans Logistics Corporation

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Voltrans Logistics

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Transimex Corporation

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Sojitz Corporation

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Bee Logistics Corporation

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 U&I Logistics Corporation

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 Noi Bai Express and Trading Joint Stock Company

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.29 Vietnam Maritime Corporation

- 6.2.29.1. Overview

- 6.2.29.2. Products

- 6.2.29.3. SWOT Analysis

- 6.2.29.4. Recent Developments

- 6.2.29.5. Financials (Based on Availability)

- 6.2.30 Expeditors International of Washington Inc

- 6.2.30.1. Overview

- 6.2.30.2. Products

- 6.2.30.3. SWOT Analysis

- 6.2.30.4. Recent Developments

- 6.2.30.5. Financials (Based on Availability)

- 6.2.31 Vietnam Transport & Chartering Corporation

- 6.2.31.1. Overview

- 6.2.31.2. Products

- 6.2.31.3. SWOT Analysis

- 6.2.31.4. Recent Developments

- 6.2.31.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Vietnam Logistics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Logistics Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Vietnam Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Vietnam Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Vietnam Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 8: Vietnam Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Logistics Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Vietnam Logistics Industry?

Key companies in the market include A P Moller - Maersk, DB Schenker, Saigon Newport Corporation, ViettelPost (Viettel Logistics Co Ltd), Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS), NYK (Nippon Yusen Kaisha) Line, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Phuong Trang Bus Joint Stock Company - FUTA Bus Lines, Aviation Logistics Corporation, Samsung SDS, MACS Maritime Joint Stock Company, Hop Nhat International Joint Stock Company, FedEx, Kuehne + Nagel, United Parcel Service of America Inc (UPS), ZIM Integrated Shipping Services Ltd, PetroVietnam Transport Corporation, Giao Hang Nhanh, Gemadept Corporation, Hai Minh Corporation, Indo Trans Logistics Corporation, Voltrans Logistics, Transimex Corporation, Sojitz Corporation, Bee Logistics Corporation, U&I Logistics Corporation, Noi Bai Express and Trading Joint Stock Company, Vietnam Maritime Corporation, Expeditors International of Washington Inc, Vietnam Transport & Chartering Corporation.

3. What are the main segments of the Vietnam Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

October 2024: Gemadept Corporation had expanded its fleet by adding the Super Ship ONE INTELLIGENCE ship(Length: 400m; Carrying capacity: 24,136 TEU, Tonnage: 223,200 DWT). ONE INTELLIGENCE belongs to the FE3 service line of the shipping line alliance THE Alliance (Hapag-Lloyd, ONE, HMM, Yang Ming). By leveraging economies of scale and integrating innovative technologies, ONE aims to significantly reduce carbon emissions.January 2024: DHL Express has commenced services for the final Boeing 777 freighter deployed at the South Asia Hub in Singapore. With a payload capability of 102 tons, the aircraft joins the four other Boeing 777 freighters already deployed in Singapore to boost inter-continental connectivity between the Asia Pacific and the Americas. Sporting a dual DHL-Singapore Airlines (SIA) livery, these five freighters provide a total of 1,224 tons of payload capacity to meet growing customer demand for international express shipping services.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Logistics Industry?

To stay informed about further developments, trends, and reports in the Vietnam Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence