Key Insights

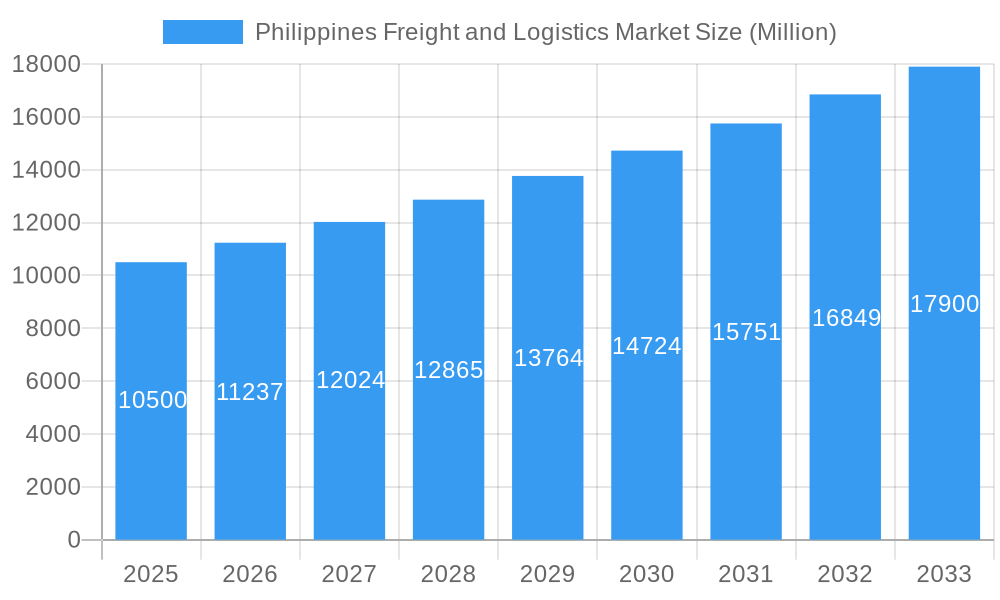

The Philippines freight and logistics market is poised for robust expansion, projected to reach a substantial market size of approximately $10,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.08% anticipated between 2025 and 2033. This growth trajectory is largely fueled by the burgeoning domestic and international trade activities, driven by an expanding manufacturing sector and increasing consumer demand. The nation's strategic archipelagic location also presents unique opportunities and challenges, necessitating efficient and multimodal transportation solutions. Key drivers include government initiatives aimed at improving infrastructure, such as ports and road networks, alongside the growing adoption of e-commerce, which has significantly boosted demand for last-mile delivery and efficient warehousing services. The manufacturing and automotive industries are expected to be dominant end-users, leveraging logistics for supply chain optimization and timely delivery of goods.

Philippines Freight and Logistics Market Market Size (In Billion)

Furthermore, the market is witnessing a notable shift towards integrated logistics solutions, encompassing not just freight transport but also value-added services like warehousing, customs brokerage, and cold chain management. Technological advancements, including digitalization and automation within warehouses and transport operations, are becoming increasingly critical for enhancing efficiency, reducing costs, and improving service reliability. However, certain restraints, such as the existing infrastructure gaps in some regions, logistical complexities due to geographical dispersion, and fluctuating fuel prices, could pose challenges to sustained growth. Nevertheless, the overall outlook remains exceptionally positive, with opportunities for innovation and strategic investment in a market that is fundamental to the Philippines' economic development and global trade integration.

Philippines Freight and Logistics Market Company Market Share

This in-depth report provides an indispensable analysis of the Philippines Freight and Logistics Market, encompassing a detailed breakdown of market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and future outlook. Designed for industry professionals, investors, and stakeholders, this report leverages high-traffic keywords such as "Philippines logistics," "Philippine freight transport," "supply chain Philippines," and "warehousing Philippines" to maximize search engine visibility. It offers critical insights into the parent and child market segments, providing a holistic view of this rapidly evolving sector. All quantitative values are presented in Million Units.

Philippines Freight and Logistics Market Market Dynamics & Structure

The Philippines Freight and Logistics Market is characterized by a moderate level of market concentration, with key players like Deutsche Post DHL Group, Nippon Express, and DB Schenker holding significant shares. Technological innovation is a primary driver, fueled by advancements in automation, artificial intelligence for route optimization, and the increasing adoption of cloud-based logistics management systems. Regulatory frameworks, while evolving, present both opportunities and challenges, particularly concerning trade facilitation and infrastructure development. Competitive product substitutes are emerging, primarily through digital platforms that offer on-demand shipping solutions and greater transparency. End-user demographics are shifting, with a growing demand for efficient and cost-effective logistics solutions from the manufacturing, e-commerce, and healthcare sectors. Mergers and acquisitions (M&A) trends indicate consolidation and strategic alliances aimed at expanding service offerings and geographical reach. For instance, acquisitions of smaller regional players by larger international entities are common, allowing for rapid market penetration. The market share of top 5 players is approximately 55 million, with a CAGR of xx% in the historical period. Barriers to innovation include high capital investment for advanced technologies and the need for skilled labor.

- Market Concentration: Moderate, with top 5 players holding ~55 million in market value.

- Technological Innovation Drivers: Automation, AI for route optimization, cloud-based systems.

- Regulatory Frameworks: Evolving trade facilitation policies and infrastructure investment initiatives.

- Competitive Product Substitutes: Digital platforms for on-demand shipping and real-time tracking.

- End-User Demographics: Growing demand from manufacturing, e-commerce, and healthcare.

- M&A Trends: Consolidation and strategic alliances for market expansion.

- Innovation Barriers: High capital investment and skilled labor requirements.

Philippines Freight and Logistics Market Growth Trends & Insights

The Philippines Freight and Logistics Market is poised for significant expansion, projected to grow at a robust Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is underpinned by several key trends and insights. The increasing adoption of e-commerce is a primary catalyst, driving demand for efficient last-mile delivery solutions and warehousing services. Technological disruptions, such as the integration of the Internet of Things (IoT) for real-time cargo tracking and predictive maintenance, are revolutionizing operational efficiency. Consumer behavior shifts, including a preference for faster delivery times and transparent tracking, are compelling logistics providers to invest in advanced technologies and optimize their networks. The Base Year 2025, the market size was xx million, and it is projected to reach xx million by 2033. Market penetration for specialized logistics services, such as cold chain logistics for pharmaceuticals and perishable goods, is steadily increasing. The government's focus on infrastructure development, including ports, roads, and airports, is further facilitating smoother cargo movement. The demand for integrated logistics solutions, encompassing freight transport, warehousing, and value-added services, is on the rise as businesses seek to streamline their supply chains. This integrated approach allows for greater control, reduced lead times, and enhanced cost-efficiency. The adoption rate of digital freight platforms is also accelerating, connecting shippers and carriers more effectively and improving price discovery. The historical period (2019-2024) saw an average CAGR of xx%.

Dominant Regions, Countries, or Segments in Philippines Freight and Logistics Market

The Philippines Freight and Logistics Market is witnessing dominant growth driven by specific segments and regions, primarily influenced by economic policies and infrastructure development. Distributive Trade emerges as a leading end-user segment, driven by the booming e-commerce sector and the increasing consumption patterns across the archipelago. The Road Freight Transport function is paramount due to the geographical nature of the Philippines, connecting islands and urban centers. Metro Manila and its surrounding regions are the dominant geographical areas, benefiting from extensive infrastructure and a high concentration of businesses and consumers. The market share for Distributive Trade is approximately 28 million, with a projected CAGR of xx% during the forecast period.

- Dominant End User Segment: Distributive Trade, fueled by e-commerce and consumer spending.

- Dominant Freight Transport Function: Road Freight Transport, critical for inter-island connectivity and last-mile delivery.

- Dominant Geographical Region: Metro Manila and surrounding provinces, due to high economic activity and infrastructure.

- Key Drivers: Government investment in infrastructure (ports, roads, expressways), increasing foreign direct investment in manufacturing, and the expansion of the business process outsourcing (BPO) sector.

- Growth Potential: Significant potential in developing secondary cities and remote areas as e-commerce penetration increases nationwide.

- Market Share Analysis: Distributive Trade segment holds a significant market share of around 28 million in the base year, expected to grow at xx% CAGR. Road freight transport accounts for roughly 40% of the total freight transport market value.

Philippines Freight and Logistics Market Product Landscape

The Philippines Freight and Logistics Market product landscape is characterized by a diversification of services, moving beyond basic freight movement to encompass integrated supply chain solutions. Innovations are focused on enhancing visibility, efficiency, and customer experience. This includes advanced tracking systems utilizing GPS and IoT devices for real-time cargo monitoring, sophisticated warehouse management systems (WMS) for optimized inventory control, and temperature-controlled logistics for sensitive goods like pharmaceuticals and perishables. Value-added services such as kitting, assembly, and reverse logistics are also gaining traction, catering to the specific needs of industries like manufacturing and e-commerce. The adoption of digitalization platforms for booking, payment, and shipment management streamlines operations and improves service delivery.

Key Drivers, Barriers & Challenges in Philippines Freight and Logistics Market

Key Drivers:

- Economic Growth: A robust Philippine economy fuels demand for goods and services, directly increasing freight and logistics requirements.

- E-commerce Expansion: The rapid growth of online retail necessitates efficient and widespread delivery networks.

- Government Infrastructure Investment: Projects like the Build, Build, Build program and ongoing port development enhance connectivity and reduce transit times.

- Technological Advancements: Adoption of automation, AI, and digital platforms improves operational efficiency and service quality.

- Foreign Direct Investment: Influx of FDI into manufacturing and other sectors creates increased demand for inbound and outbound logistics.

Barriers & Challenges:

- Geographical Dispersion: The archipelagic nature of the Philippines presents logistical complexities and higher transportation costs.

- Infrastructure Deficiencies: Despite improvements, certain areas still suffer from inadequate road networks and port facilities.

- Regulatory Hurdles: Bureaucratic processes and varying local regulations can impact the ease of doing business.

- Skilled Labor Shortage: A lack of trained personnel in specialized logistics roles can hinder operational efficiency.

- Fuel Price Volatility: Fluctuations in fuel costs directly impact transportation expenses, affecting profitability.

- Competition: Intense competition among both domestic and international players can lead to price wars and pressure on margins. The estimated impact of fuel price volatility on operational costs can range from 5-10%.

Emerging Opportunities in Philippines Freight and Logistics Market

Emerging opportunities within the Philippines Freight and Logistics Market are centered on addressing unmet needs and leveraging evolving consumer demands. The burgeoning e-commerce sector in provincial areas presents a significant untapped market for last-mile delivery solutions. Furthermore, the growing demand for specialized logistics, such as cold chain solutions for the expanding healthcare and pharmaceutical industries, offers substantial growth potential. The development of smart warehousing, incorporating automation and IoT for increased efficiency and reduced errors, is another key area. The rise of sustainable logistics practices, including the adoption of electric vehicles for urban deliveries and optimized route planning to reduce emissions, aligns with global environmental concerns and can create a competitive advantage.

Growth Accelerators in the Philippines Freight and Logistics Market Industry

Several key catalysts are accelerating the growth of the Philippines Freight and Logistics Market. Technological breakthroughs, particularly in artificial intelligence for demand forecasting and route optimization, are significantly improving efficiency and reducing costs. Strategic partnerships between logistics providers and e-commerce platforms are creating seamless integration for faster and more reliable deliveries. Market expansion strategies, including the development of new distribution hubs and the enhancement of intermodal connectivity, are crucial for reaching a wider customer base. The increasing adoption of digital freight marketplaces is also a significant accelerator, fostering transparency and connecting more businesses with available shipping capacity.

Key Players Shaping the Philippines Freight and Logistics Market Market

- PHL Post

- DB Schenker

- JRS Express

- 2GO Express

- LBC Express

- FedEx Corporation

- Nippon Express

- United Parcel Service (UPS)

- CJ Logistics

- Kuehne + Nagel International AG

- Nippon Yusen NYK (Yusen Logistics)

- Deutsche Post DHL Group

- 6 3 Other Companies

Notable Milestones in Philippines Freight and Logistics Market Sector

- 2019: Launch of new express delivery routes by JRS Express to expand reach in Luzon.

- 2020: LBC Express enhances its digital platform with advanced tracking and customer service features amidst the pandemic surge in e-commerce.

- 2021: DB Schenker inaugurates a new logistics hub in the Philippines to support growing regional demand.

- 2022: PHL Post partners with government agencies to improve postal infrastructure and service delivery nationwide.

- 2023: 2GO Express invests in a fleet modernization program focusing on fuel-efficient vehicles.

- 2024: FedEx Corporation expands its network of collection points and service offerings in key Philippine cities.

- 2025: Nippon Express announces plans for a new integrated logistics facility in the Visayas region.

- 2025: UPS intensifies its focus on cold chain logistics to cater to the pharmaceutical sector.

- 2026: CJ Logistics explores expansion of its warehousing solutions in Mindanao.

- 2027: Deutsche Post DHL Group commits to increasing its sustainability initiatives within its Philippine operations.

In-Depth Philippines Freight and Logistics Market Market Outlook

The Philippines Freight and Logistics Market is projected for sustained and robust growth through 2033. Growth accelerators, including technological advancements in AI and IoT, strategic partnerships with e-commerce giants, and government-led infrastructure development, are poised to redefine operational efficiencies and market reach. The market's outlook is highly positive, driven by an expanding economy, increasing consumer demand for faster deliveries, and a growing emphasis on integrated supply chain solutions. Opportunities abound in expanding services to underserved provincial areas, developing specialized cold chain logistics, and adopting sustainable transportation practices. Stakeholders can anticipate continued investment in digital transformation and the expansion of warehousing capabilities to meet the dynamic needs of businesses and consumers alike. The market is expected to reach xx million by 2033, with a projected CAGR of xx% for the forecast period.

Philippines Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Sea and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Others

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade

- 2.6. Healthcare and Pharmaceuticals

- 2.7. Other End Users

Philippines Freight and Logistics Market Segmentation By Geography

- 1. Philippines

Philippines Freight and Logistics Market Regional Market Share

Geographic Coverage of Philippines Freight and Logistics Market

Philippines Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing E-commerce Sales

- 3.3. Market Restrains

- 3.3.1. 4.; High Shipping Costs

- 3.4. Market Trends

- 3.4.1. Growth in e-Commerce to Drive the Logistics Market in Philippines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Freight and Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Sea and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Others

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade

- 5.2.6. Healthcare and Pharmaceuticals

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PHL Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JRS Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2GO Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LBC Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service (UPS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CJ Logistics**List Not Exhaustive 6 3 Other Companie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kuehne + Nagel International AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nippon Yusen NYK (Yusen Logistics)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Deutsche Post DHL Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 PHL Post

List of Figures

- Figure 1: Philippines Freight and Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Freight and Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Freight and Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Philippines Freight and Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Philippines Freight and Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Philippines Freight and Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Philippines Freight and Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Philippines Freight and Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Freight and Logistics Market?

The projected CAGR is approximately 7.08%.

2. Which companies are prominent players in the Philippines Freight and Logistics Market?

Key companies in the market include PHL Post, DB Schenker, JRS Express, 2GO Express, LBC Express, FedEx Corporation, Nippon Express, United Parcel Service (UPS), CJ Logistics**List Not Exhaustive 6 3 Other Companie, Kuehne + Nagel International AG, Nippon Yusen NYK (Yusen Logistics), Deutsche Post DHL Group.

3. What are the main segments of the Philippines Freight and Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing E-commerce Sales.

6. What are the notable trends driving market growth?

Growth in e-Commerce to Drive the Logistics Market in Philippines.

7. Are there any restraints impacting market growth?

4.; High Shipping Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the Philippines Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence