Key Insights

The Chinese road freight logistics market, a critical component of the national economy, is forecast for significant expansion. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.86% from 2025 to 2033. This upward trajectory is driven by several key factors. The rapid growth of the e-commerce sector directly translates to increased demand for efficient last-mile delivery, a domain heavily reliant on road freight. Furthermore, China's substantial manufacturing and industrial output necessitates extensive goods transportation, a trend that continues to fuel market expansion. Ongoing infrastructure development, including enhancements to highway networks and logistics hubs, is improving transportation efficiency and reducing operational costs. While government initiatives focused on safety and environmental standards contribute to market stability, they also present compliance-related challenges for operators. Market segmentation highlights distinct demands, with full-truckload (FTL) shipments maintaining dominance. However, less-than-truckload (LTL) services are experiencing robust growth, particularly driven by small businesses and e-commerce fulfillment. Temperature-controlled logistics, essential for perishable goods like food and pharmaceuticals, represents a rapidly expanding and vital segment. Geographically, the market exhibits a strong concentration in eastern coastal regions, aligning with high manufacturing and consumption activity. Nevertheless, inland regions present substantial growth potential as infrastructure development progresses and economic engagement deepens.

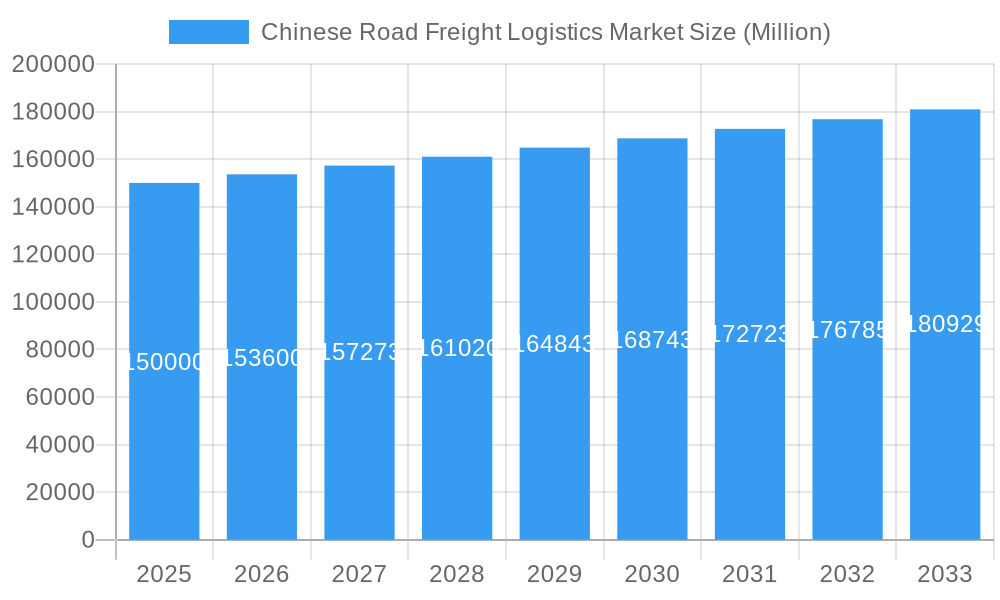

Chinese Road Freight Logistics Market Market Size (In Billion)

The competitive environment features a mix of established market leaders and innovative new entrants. Global logistics providers engage with domestic leaders, fostering a dynamic landscape characterized by consolidation and technological advancement. The widespread adoption of advanced technologies, such as sophisticated route optimization software, real-time shipment tracking, and integrated logistics management systems, is enhancing operational efficiency and transparency. Despite prevailing challenges, including volatile fuel prices, driver shortages, and intense market competition, the long-term outlook for the Chinese road freight logistics market remains highly favorable. Continuous economic growth, strategic infrastructure investments, and ongoing technological innovations are expected to propel this sector, creating substantial opportunities for both incumbent and emerging businesses. The estimated market size is $8.64 billion.

Chinese Road Freight Logistics Market Company Market Share

Chinese Road Freight Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Chinese road freight logistics market, encompassing market dynamics, growth trends, key players, and future prospects. With a focus on both domestic and international segments, this report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic landscape. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Chinese Road Freight Logistics Market Dynamics & Structure

The Chinese road freight logistics market is characterized by intense competition, rapid technological advancements, and evolving regulatory frameworks. Market concentration is moderate, with several large players dominating alongside numerous smaller, regional operators. The market is segmented by goods configuration (fluid and solid goods), temperature control (temperature controlled and non-temperature controlled), end-user industry (agriculture, construction, manufacturing, oil & gas, mining, wholesale & retail, and others), destination (domestic and international), truckload specification (FTL and LTL), containerization (containerized and non-containerized), and distance (long haul and short haul).

- Market Concentration: The top 5 players hold approximately xx% market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: Autonomous driving, IoT, and big data analytics are driving efficiency and cost reductions. Barriers to innovation include high initial investment costs and a lack of standardized infrastructure.

- Regulatory Framework: Government regulations focused on safety, environmental protection, and driver welfare are constantly evolving, impacting operational costs and strategies.

- Competitive Substitutes: Rail freight and air freight present alternatives for certain goods and distances.

- M&A Trends: The past five years have witnessed xx M&A deals, primarily focused on consolidating market share and expanding service offerings. This trend is expected to continue, driven by the need for scale and technological integration.

- End-User Demographics: The market is driven by the growth of e-commerce, manufacturing, and urbanization, leading to increased demand for efficient and reliable logistics solutions.

Chinese Road Freight Logistics Market Growth Trends & Insights

The Chinese road freight logistics market has experienced significant growth over the historical period (2019-2024), driven by robust economic growth, expanding e-commerce, and increasing industrial activity. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. This growth trajectory is projected to continue in the forecast period (2025-2033), albeit at a slightly moderated pace, with an anticipated CAGR of xx%, reaching xx million units by 2033. Technological disruptions, such as the adoption of autonomous trucking and advanced logistics management systems, are further accelerating efficiency and creating new opportunities. Consumer behavior shifts towards faster delivery times and increased transparency are also driving demand for innovative solutions. The market penetration of technology-enabled logistics solutions remains relatively low, presenting significant growth potential.

Dominant Regions, Countries, or Segments in Chinese Road Freight Logistics Market

The eastern coastal regions of China, including provinces like Guangdong, Jiangsu, and Zhejiang, dominate the road freight logistics market due to their high concentration of manufacturing, warehousing, and port facilities. The manufacturing segment, particularly electronics and consumer goods, accounts for the largest share of the market, followed by the wholesale and retail trade segments. Domestic freight accounts for a significantly larger share than international freight, reflecting the vast size and complexity of the domestic market. The Full-Truck-Load (FTL) segment is dominant, driven by large-scale manufacturing and distribution needs.

- Key Drivers: Rapid industrialization, booming e-commerce, strong government infrastructure investment, and favorable economic policies.

- Dominance Factors: High economic activity, developed infrastructure, access to major ports, and a large pool of skilled labor.

- Growth Potential: Expansion into less-developed regions, technological advancements, and growing cross-border e-commerce.

Chinese Road Freight Logistics Market Product Landscape

The Chinese road freight logistics market offers a wide range of services, from traditional trucking and warehousing to advanced solutions leveraging technology such as IoT sensors, real-time tracking systems, and route optimization software. These solutions offer improved efficiency, transparency, and security. The focus is shifting towards sustainable solutions, incorporating electric vehicles and greener fuels to meet growing environmental concerns. Unique selling propositions often revolve around speed, reliability, specialized handling (e.g., temperature-sensitive goods), and technological integration for enhanced visibility and control throughout the supply chain.

Key Drivers, Barriers & Challenges in Chinese Road Freight Logistics Market

Key Drivers: The expanding e-commerce sector, increasing industrial output, government initiatives promoting logistics infrastructure development, and the rising adoption of technology are key drivers. Furthermore, the Belt and Road Initiative has opened new avenues for international trade, boosting the demand for cross-border logistics services.

Key Challenges: Driver shortages, escalating fuel costs, stringent environmental regulations, and intense competition are major hurdles. Supply chain disruptions, exacerbated by geopolitical events and pandemics, have also created significant challenges. The need for robust infrastructure development in less-developed regions continues to be a bottleneck. Regulatory complexities and compliance costs also pose significant obstacles.

Emerging Opportunities in Chinese Road Freight Logistics Market

Emerging opportunities include the expansion of last-mile delivery services, particularly in rural areas, the increasing adoption of autonomous trucking technologies, and the growth of specialized logistics solutions for specific industries (e.g., cold chain logistics for pharmaceuticals). The integration of blockchain technology for enhanced supply chain transparency and security presents further opportunities. Growth in cross-border e-commerce is opening up new market segments for international freight services.

Growth Accelerators in the Chinese Road Freight Logistics Market Industry

Technological breakthroughs, particularly in autonomous driving and data analytics, are significantly accelerating growth. Strategic partnerships between logistics providers and technology companies are fostering innovation and improving operational efficiency. Government initiatives aimed at enhancing logistics infrastructure and promoting sustainable practices are creating a favorable environment for long-term expansion.

Key Players Shaping the Chinese Road Freight Logistics Market Market

- A P Moller - Maersk (Maersk)

- Sinotrans Limited

- STO Express

- DHL Group (DHL)

- ZTO Express

- Shanghai Yunda Freight Co Ltd

- YTO Express

- China Post Group Corporation Ltd

- Changjiu Logistics

- Deppon Express

- Shanghai Aneng Juchuang Supply Chain Management Co Ltd

- SF Express (KEX-SF) (SF Express)

- CMA CGM Group (CMA CGM)

Notable Milestones in Chinese Road Freight Logistics Market Sector

- October 2023: Volvo, Renault, and CMA CGM launch a joint venture to develop electric vans for urban logistics, promoting decarbonization.

- October 2023: SF Express launches SFBuy, a one-stop cross-border cargo platform to cater to growing demand from e-commerce.

- September 2023: STO Express orders 500 autonomous trucks from Inceptio Technology, accelerating the adoption of autonomous driving in the sector.

In-Depth Chinese Road Freight Logistics Market Market Outlook

The Chinese road freight logistics market is poised for continued robust growth, driven by technological innovation, expanding e-commerce, and government support. Strategic partnerships and investments in infrastructure will further accelerate this growth. Opportunities exist in expanding into less-developed regions, developing specialized logistics solutions, and embracing sustainable practices. The market's future is bright, with substantial potential for both domestic and international players.

Chinese Road Freight Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Chinese Road Freight Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Road Freight Logistics Market Regional Market Share

Geographic Coverage of Chinese Road Freight Logistics Market

Chinese Road Freight Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations4.; Higher Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 6.3.1. Full-Truck-Load (FTL)

- 6.3.2. Less than-Truck-Load (LTL)

- 6.4. Market Analysis, Insights and Forecast - by Containerization

- 6.4.1. Containerized

- 6.4.2. Non-Containerized

- 6.5. Market Analysis, Insights and Forecast - by Distance

- 6.5.1. Long Haul

- 6.5.2. Short Haul

- 6.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 6.6.1. Fluid Goods

- 6.6.2. Solid Goods

- 6.7. Market Analysis, Insights and Forecast - by Temperature Control

- 6.7.1. Non-Temperature Controlled

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 7.3.1. Full-Truck-Load (FTL)

- 7.3.2. Less than-Truck-Load (LTL)

- 7.4. Market Analysis, Insights and Forecast - by Containerization

- 7.4.1. Containerized

- 7.4.2. Non-Containerized

- 7.5. Market Analysis, Insights and Forecast - by Distance

- 7.5.1. Long Haul

- 7.5.2. Short Haul

- 7.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 7.6.1. Fluid Goods

- 7.6.2. Solid Goods

- 7.7. Market Analysis, Insights and Forecast - by Temperature Control

- 7.7.1. Non-Temperature Controlled

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 8.3.1. Full-Truck-Load (FTL)

- 8.3.2. Less than-Truck-Load (LTL)

- 8.4. Market Analysis, Insights and Forecast - by Containerization

- 8.4.1. Containerized

- 8.4.2. Non-Containerized

- 8.5. Market Analysis, Insights and Forecast - by Distance

- 8.5.1. Long Haul

- 8.5.2. Short Haul

- 8.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 8.6.1. Fluid Goods

- 8.6.2. Solid Goods

- 8.7. Market Analysis, Insights and Forecast - by Temperature Control

- 8.7.1. Non-Temperature Controlled

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 9.3.1. Full-Truck-Load (FTL)

- 9.3.2. Less than-Truck-Load (LTL)

- 9.4. Market Analysis, Insights and Forecast - by Containerization

- 9.4.1. Containerized

- 9.4.2. Non-Containerized

- 9.5. Market Analysis, Insights and Forecast - by Distance

- 9.5.1. Long Haul

- 9.5.2. Short Haul

- 9.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 9.6.1. Fluid Goods

- 9.6.2. Solid Goods

- 9.7. Market Analysis, Insights and Forecast - by Temperature Control

- 9.7.1. Non-Temperature Controlled

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 10.3.1. Full-Truck-Load (FTL)

- 10.3.2. Less than-Truck-Load (LTL)

- 10.4. Market Analysis, Insights and Forecast - by Containerization

- 10.4.1. Containerized

- 10.4.2. Non-Containerized

- 10.5. Market Analysis, Insights and Forecast - by Distance

- 10.5.1. Long Haul

- 10.5.2. Short Haul

- 10.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 10.6.1. Fluid Goods

- 10.6.2. Solid Goods

- 10.7. Market Analysis, Insights and Forecast - by Temperature Control

- 10.7.1. Non-Temperature Controlled

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sinotrans Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STO Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DHL Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ZTO Expres

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shanghai Yunda Freight Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 YTO Express

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Post Group Corporation Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Changjiu Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Deppon Express

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shanghai Aneng Juchuang Supply Chain Management Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SF Express (KEX-SF)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CMA CGM Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global Chinese Road Freight Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: North America Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 5: North America Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 7: North America Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 8: North America Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 9: North America Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 10: North America Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 11: North America Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 12: North America Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 13: North America Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 14: North America Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 15: North America Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 16: North America Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 19: South America Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: South America Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 21: South America Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 22: South America Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 23: South America Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 24: South America Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 25: South America Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 26: South America Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 27: South America Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 28: South America Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 29: South America Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 30: South America Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 31: South America Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 32: South America Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 35: Europe Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 36: Europe Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 37: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Europe Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 39: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 40: Europe Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 41: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 42: Europe Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 43: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 44: Europe Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 45: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 46: Europe Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 47: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 48: Europe Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 51: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 52: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 53: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 54: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 55: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 56: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 57: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 58: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 59: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 60: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 61: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 62: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 63: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 64: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 67: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 68: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 69: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 70: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 71: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 72: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 73: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 74: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 75: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 76: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 77: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 78: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 79: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 80: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 81: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United States Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Canada Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Mexico Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 21: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 22: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 23: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 24: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 25: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 26: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 27: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Argentina Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 32: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 33: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 34: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 35: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 36: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 37: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 38: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: United Kingdom Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: France Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Italy Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Spain Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Russia Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Benelux Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Nordics Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 49: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 50: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 51: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 52: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 53: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 54: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 55: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Turkey Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Israel Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: GCC Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: North Africa Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 63: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 64: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 65: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 66: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 67: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 68: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 69: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 70: China Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 71: India Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 73: South Korea Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: ASEAN Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 75: Oceania Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Road Freight Logistics Market?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the Chinese Road Freight Logistics Market?

Key companies in the market include A P Moller - Maersk, Sinotrans Limited, STO Express, DHL Group, ZTO Expres, Shanghai Yunda Freight Co Ltd, YTO Express, China Post Group Corporation Ltd, Changjiu Logistics, Deppon Express, Shanghai Aneng Juchuang Supply Chain Management Co Ltd, SF Express (KEX-SF), CMA CGM Group.

3. What are the main segments of the Chinese Road Freight Logistics Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.64 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations4.; Higher Costs.

8. Can you provide examples of recent developments in the market?

October 2023: Truck and industrial equipment maker Volvo, auto maker Renault, and shipping giant CMA CGM unveiled a joint venture that would create a company aimed at developing a new series of electric vans. The partnership would provide electric urban transportation for companies in the logistics and transportation sector seeking to decarbonize their fleets.October 2023: In response to growing demand for cross-border shipping when shopping on mainland e-commerce platforms, SF Express has launched, SF Express Container Line (SFBuy), one-stop cargo transportation platform specially built for global overseas shopping users, providing safe, efficient and convenient cross-border parcel transportation services.September 2023: STO Express has entered into a strategic collaboration with Inceptio Technology, a Chinese developer of autonomous driving technologies for heavy-duty trucks. STO Express has ordered 500 Inceptio autonomous trucks jointly developed with Dongfeng Commercial Vehicle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Road Freight Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Road Freight Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Road Freight Logistics Market?

To stay informed about further developments, trends, and reports in the Chinese Road Freight Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence