Key Insights

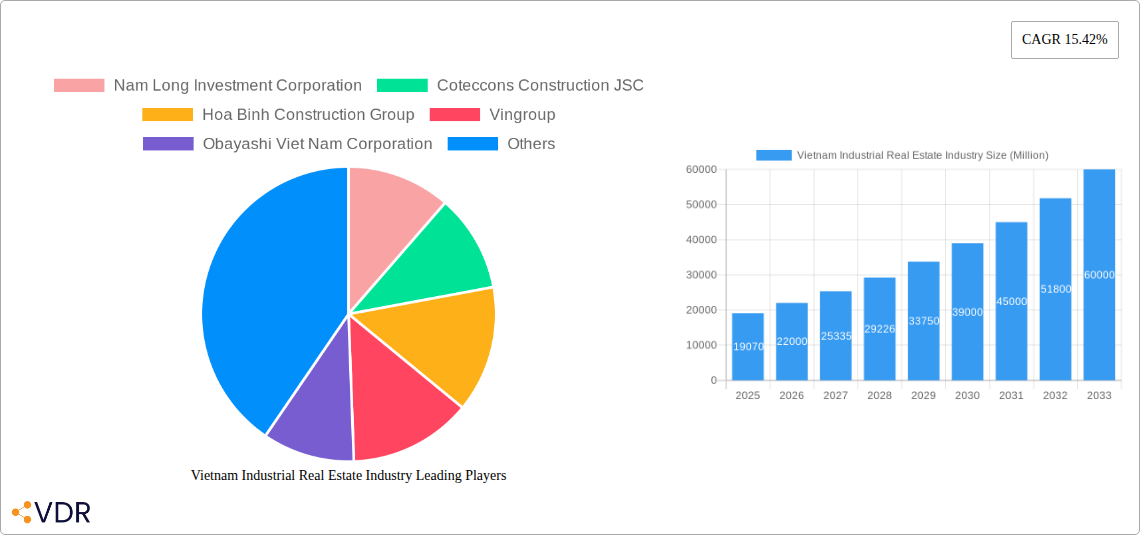

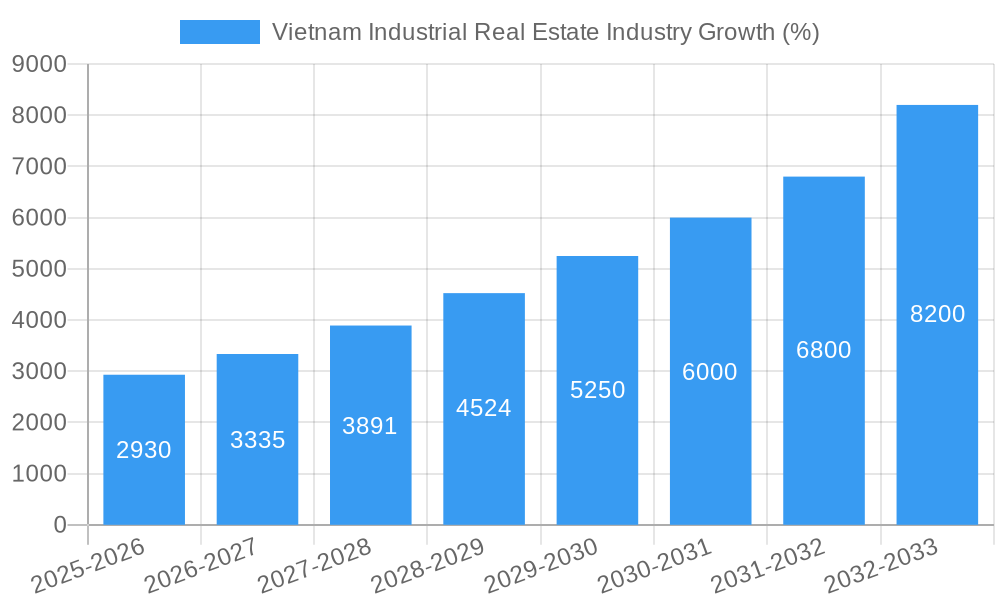

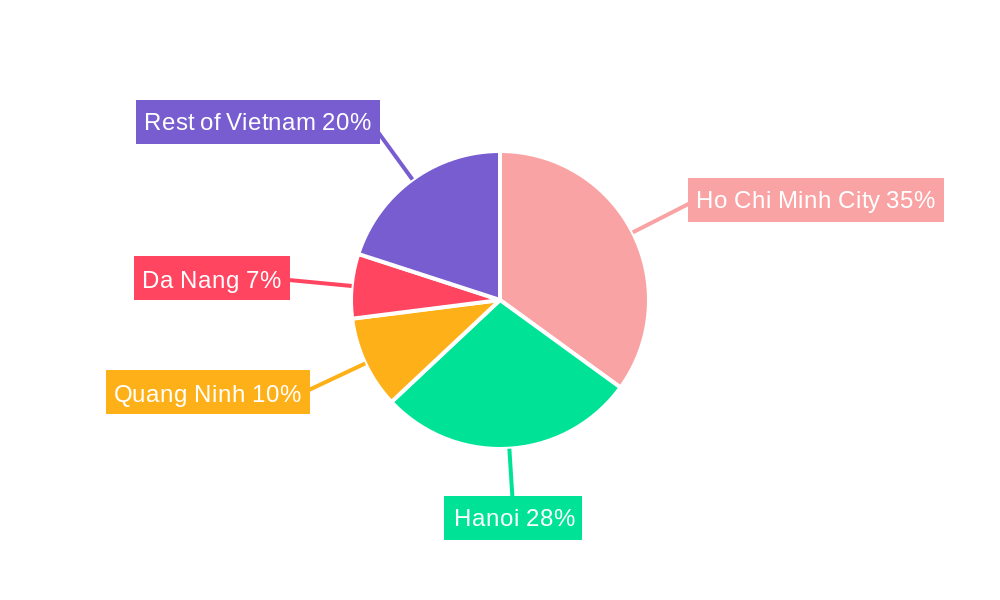

The Vietnam industrial real estate market is experiencing robust growth, projected to reach $19.07 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.42% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Vietnam's burgeoning manufacturing sector, attracting significant foreign direct investment (FDI), necessitates increased warehousing and factory space. Secondly, the rise of e-commerce is creating a surge in demand for logistics facilities and distribution centers. Thirdly, government initiatives promoting industrial park development and infrastructure improvements are further stimulating market growth. The segments showing the most promise include logistics and industrial properties, driven by the aforementioned factors. Key cities like Ho Chi Minh City and Hanoi are expected to dominate the market due to their established infrastructure and proximity to major ports. However, secondary cities like Quang Ninh and Da Nang are also experiencing growth, indicating a geographical diversification of the sector. Competition is fierce, with both established domestic players like Nam Long Investment Corporation, Coteccons Construction JSC, and Vingroup, and international companies like Obayashi Viet Nam Corporation vying for market share. While the market presents considerable opportunities, challenges remain, including land scarcity in prime locations and the need for consistent infrastructure development to support the growing demand.

The forecast period (2025-2033) anticipates continued expansion, though at a potentially slightly moderated pace in the latter years as market saturation in some areas might begin to emerge. The ongoing global economic uncertainties could also impact FDI flows, slightly influencing the growth trajectory. Nevertheless, the long-term prospects for the Vietnam industrial real estate market remain highly positive, underpinned by the country's sustained economic development and its strategic position in global supply chains. The diverse range of companies operating in this market reflects its dynamism and attractiveness to both local and international investors. Further analysis into specific sub-segments within logistics, such as cold storage and specialized warehousing, would provide even more granular insights into the future growth potential.

Vietnam Industrial Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Vietnam industrial real estate market, covering the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report delves into market dynamics, growth trends, dominant segments, key players, and emerging opportunities within the rapidly evolving Vietnamese industrial real estate landscape. This detailed analysis is essential for investors, developers, and industry professionals seeking to navigate this dynamic market.

Vietnam Industrial Real Estate Industry Market Dynamics & Structure

The Vietnam industrial real estate market is experiencing significant growth, driven by robust economic expansion, FDI inflows, and increasing manufacturing activity. Market concentration is moderate, with several large players alongside numerous smaller firms. Technological innovations, such as smart building technologies and automated logistics systems, are steadily transforming the industry, although adoption rates vary. The regulatory framework is generally supportive of development, though complexities exist. Competitive substitutes include traditional warehouse spaces and alternative logistics solutions. The end-user demographics encompass a diverse range of manufacturing, logistics, and e-commerce companies. M&A activity has increased recently, with deal volumes reaching xx Million USD in 2024.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Strong drivers include automation and smart building technologies, facing challenges related to initial investment costs and skilled labor availability.

- Regulatory Framework: Generally supportive, but navigating bureaucratic processes remains a challenge.

- Competitive Substitutes: Traditional warehouses, third-party logistics providers, and alternative leasing models.

- End-User Demographics: Diverse range of industries including manufacturing, logistics, and e-commerce, with a growing presence of foreign companies.

- M&A Trends: Increasing activity, with xx Million USD in deal value recorded in 2024.

Vietnam Industrial Real Estate Industry Growth Trends & Insights

Vietnam's industrial real estate market has exhibited robust growth throughout the historical period (2019-2024). Driven by strong economic growth, foreign direct investment (FDI), and burgeoning manufacturing and e-commerce sectors, the market size expanded significantly. The Compound Annual Growth Rate (CAGR) during 2019-2024 reached xx%, reaching a market value of xx Million USD in 2024. This growth is expected to continue, albeit at a slightly moderated pace, with a projected CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly in logistics and supply chain management, are significantly influencing market dynamics. A shift toward more sophisticated and efficient warehousing and logistics solutions is evident in consumer behavior. The rising demand for high-quality, strategically located industrial properties further underscores the ongoing positive growth trajectory. The market penetration of modern industrial spaces continues to rise, currently estimated at xx% in 2024 and projected to reach xx% by 2033. This signifies a strong potential for further expansion and investment in the sector.

Dominant Regions, Countries, or Segments in Vietnam Industrial Real Estate Industry

Ho Chi Minh City and Hanoi remain the dominant regions for industrial real estate in Vietnam, fueled by robust economic activity, established infrastructure, and a concentration of manufacturing and logistics hubs. The industrial segment and logistics sub-segment are leading market growth, driven by increased manufacturing activity and the expansion of e-commerce.

- Key Drivers in Ho Chi Minh City & Hanoi:

- Well-developed infrastructure (ports, roads, airports)

- Skilled labor pool

- Proximity to key markets

- Government support for industrial development

- Growth Potential: High growth potential exists in secondary cities like Da Nang and Quang Ninh as these regions attract significant foreign investment and manufacturing facilities.

- Market Share: Ho Chi Minh City holds the largest market share (approximately xx%), followed by Hanoi (xx%). The industrial segment holds the largest market share (xx%) amongst the types followed by logistics (xx%).

Vietnam Industrial Real Estate Industry Product Landscape

The industrial real estate product landscape encompasses a spectrum of facilities tailored to diverse needs, including standard warehouses, modern logistics centers equipped with advanced technology, and specialized manufacturing facilities. Innovations in building design and technology enhance efficiency and sustainability. Key performance metrics encompass occupancy rates, rental yields, and asset values. The unique selling propositions often revolve around strategic location, modern amenities, superior infrastructure, and enhanced security features. Recent advancements include the integration of smart building technologies, renewable energy solutions, and optimized logistics systems.

Key Drivers, Barriers & Challenges in Vietnam Industrial Real Estate Industry

Key Drivers:

- Strong economic growth and FDI inflows.

- Expansion of manufacturing and e-commerce sectors.

- Government initiatives to improve infrastructure and attract foreign investment.

- Rising demand for modern, efficient industrial facilities.

Key Challenges:

- Land scarcity and high land prices in key cities.

- Infrastructure limitations in some regions.

- Regulatory complexities and bureaucratic procedures.

- Competition from established players and foreign investors.

- Supply chain disruptions, particularly felt during the pandemic, leading to a xx% increase in rental costs in 2022.

Emerging Opportunities in Vietnam Industrial Real Estate Industry

- Development of specialized industrial parks catering to specific sectors like high-tech manufacturing and pharmaceuticals.

- Investment in sustainable and green building technologies to reduce environmental impact and improve operational efficiency.

- Expansion into secondary cities with untapped potential.

- Leverage of digital technologies to enhance property management and tenant engagement.

Growth Accelerators in the Vietnam Industrial Real Estate Industry Industry

Long-term growth will be fueled by ongoing investments in infrastructure, government support for industrial development, and the increasing adoption of advanced technologies. Strategic partnerships between local and foreign investors will further enhance market development. Expansion into emerging markets and diversification of product offerings will unlock new opportunities.

Key Players Shaping the Vietnam Industrial Real Estate Market

- Nam Long Investment Corporation

- Coteccons Construction JSC

- Hoa Binh Construction Group

- Vingroup

- Obayashi Viet Nam Corporation

- Toong

- Construction Corporation No 1 JSC

- Dat Xanh Group

- Thai Son Construction Co Ltd

- Ricons Construction Investment JSC

- FLC Group

- NEWTECONS Investment Construction JSC

Notable Milestones in Vietnam Industrial Real Estate Industry Sector

- 2021 Q4: Launch of the first LEED-certified industrial park in Northern Vietnam.

- 2022 Q2: Significant increase in FDI investment in industrial real estate projects.

- 2023 Q1: Completion of a major infrastructure project connecting key industrial zones to ports.

In-Depth Vietnam Industrial Real Estate Industry Market Outlook

The Vietnam industrial real estate market presents substantial long-term growth potential. Continued economic expansion, supportive government policies, and increasing foreign investment will drive demand. Strategic partnerships, technological advancements, and expansion into new markets will be crucial for success. The market is poised for significant expansion, presenting attractive opportunities for investors and developers alike.

Vietnam Industrial Real Estate Industry Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key Cities

- 2.1. Ho Chi Minh City

- 2.2. Hanoi

- 2.3. Quang Ninh

- 2.4. Da Nang

- 2.5. Rest of Vietnam

Vietnam Industrial Real Estate Industry Segmentation By Geography

- 1. Vietnam

Vietnam Industrial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and Infrastructure Development; Sustainable Construction Practices

- 3.3. Market Restrains

- 3.3.1. Labor Shortages and Costs

- 3.4. Market Trends

- 3.4.1. Growth in Vietnamese E-commerce to Drive the Industrial Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Industrial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Ho Chi Minh City

- 5.2.2. Hanoi

- 5.2.3. Quang Ninh

- 5.2.4. Da Nang

- 5.2.5. Rest of Vietnam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nam Long Investment Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coteccons Construction JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hoa Binh Construction Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vingroup

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Obayashi Viet Nam Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toong

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Construction Corporation No 1 JSC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dat Xanh Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thai Son Construction Co Ltd**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ricons Construction Investment JSC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 FLC Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 NEWTECONS Investment Construction JSC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nam Long Investment Corporation

List of Figures

- Figure 1: Vietnam Industrial Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Industrial Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Vietnam Industrial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Industrial Real Estate Industry?

The projected CAGR is approximately 15.42%.

2. Which companies are prominent players in the Vietnam Industrial Real Estate Industry?

Key companies in the market include Nam Long Investment Corporation, Coteccons Construction JSC, Hoa Binh Construction Group, Vingroup, Obayashi Viet Nam Corporation, Toong, Construction Corporation No 1 JSC, Dat Xanh Group, Thai Son Construction Co Ltd**List Not Exhaustive, Ricons Construction Investment JSC, FLC Group, NEWTECONS Investment Construction JSC.

3. What are the main segments of the Vietnam Industrial Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and Infrastructure Development; Sustainable Construction Practices.

6. What are the notable trends driving market growth?

Growth in Vietnamese E-commerce to Drive the Industrial Real Estate Market.

7. Are there any restraints impacting market growth?

Labor Shortages and Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Industrial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Industrial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Industrial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Vietnam Industrial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence