Key Insights

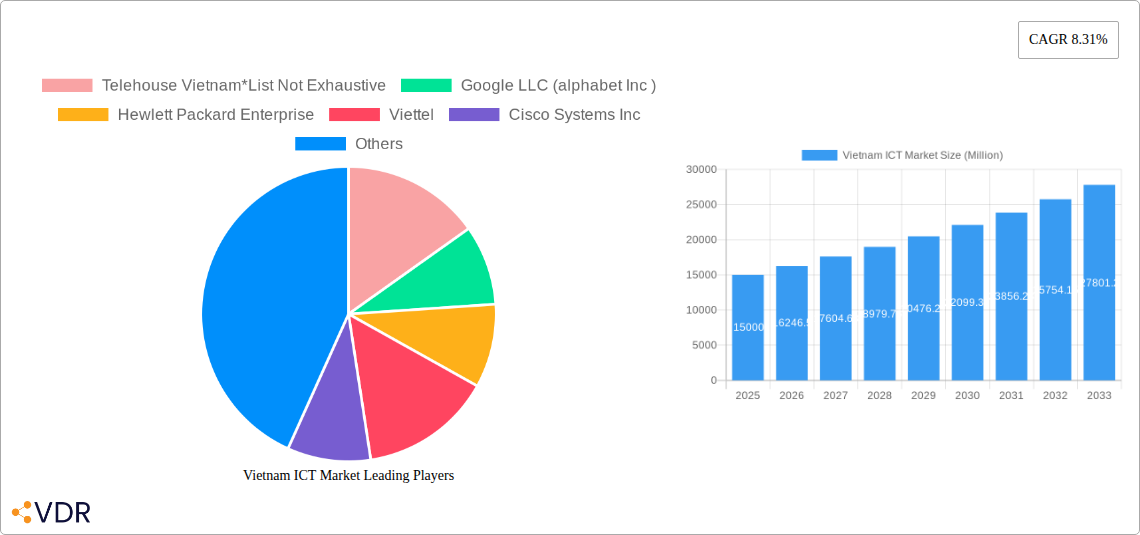

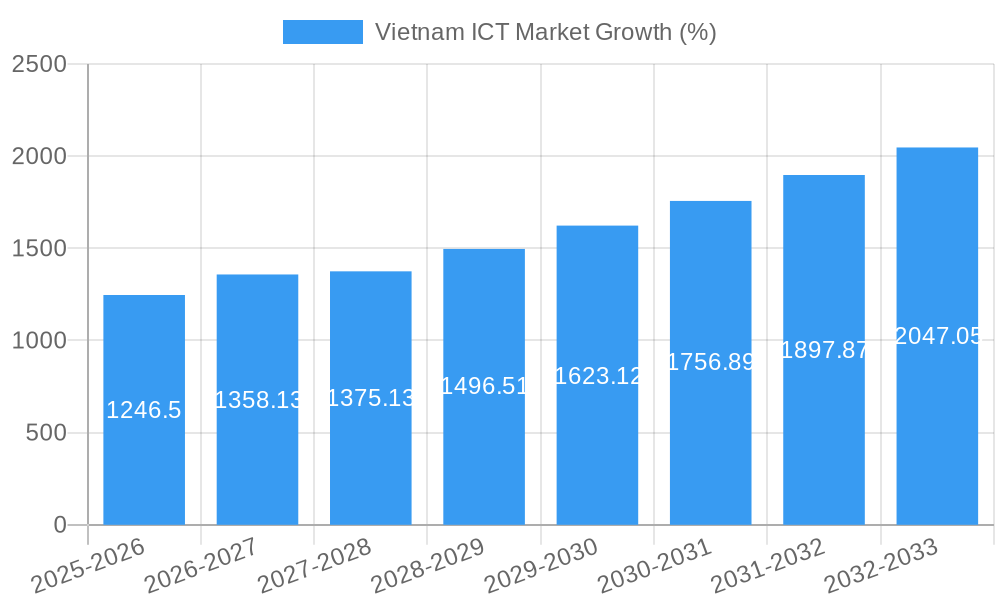

The Vietnam ICT market, currently experiencing robust growth, is projected to expand significantly over the forecast period (2025-2033). A CAGR of 8.31% indicates a healthy and dynamic sector driven by several key factors. Increasing government investment in digital infrastructure, a burgeoning e-commerce sector, and the rising adoption of cloud computing and other digital services are major contributors to this growth. Furthermore, the expansion of 5G networks and the increasing penetration of smartphones are fueling demand for advanced ICT solutions across various industry verticals. The BFSI, IT and Telecom, and Government sectors are leading adopters, driving substantial market share. While the market faces challenges such as infrastructure limitations in certain regions and a potential skills gap in the workforce, the overall outlook remains positive, driven by sustained economic growth and increasing digital literacy amongst the population. The market is segmented by industry vertical (BFSI, IT & Telecom, Government, Retail & E-commerce, Manufacturing, Energy & Utilities, and Others) and by type (Hardware, Software, IT & Infrastructure Services including Cloud, and Telecommunication Services). Competition is fierce, with both global giants like Google, Cisco, and Microsoft, and local players like Viettel, vying for market share. The market's ongoing expansion presents lucrative opportunities for both established players and new entrants.

The diverse segments within the Vietnamese ICT market offer specialized opportunities. The strong growth in e-commerce is directly impacting the demand for software solutions, cloud infrastructure, and robust telecommunication services. The Government's commitment to digital transformation initiatives fuels growth in IT and infrastructure services, especially within the cloud domain. Conversely, the manufacturing and energy sectors present opportunities in hardware solutions like industrial IoT devices and smart grid technologies. The sustained investment in digital infrastructure improvements will address existing restraints, further accelerating market growth. This holistic perspective underscores the potential of the Vietnamese ICT market as a significant investment hub in Southeast Asia.

Vietnam ICT Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Vietnam ICT market, covering the period from 2019 to 2033. It offers valuable insights into market size, growth trends, key players, and future opportunities, making it an essential resource for industry professionals, investors, and strategic decision-makers. The report segments the market by industry vertical (BFSI, IT & Telecom, Government, Retail & E-commerce, Manufacturing, Energy & Utilities, Other) and by type (Hardware, Software, IT & Infrastructure Services, Telecommunication Services), providing a granular understanding of the market landscape. The base year for this report is 2025, with data extending to the forecast period of 2025-2033.

Vietnam ICT Market Dynamics & Structure

The Vietnam ICT market is characterized by a complex interplay of factors, including increasing market concentration among major players, rapid technological innovation, evolving regulatory frameworks, and the emergence of competitive product substitutes. The market exhibits a dynamic landscape shaped by mergers and acquisitions (M&A) activity, with a notable increase in deal volumes in recent years (xx million deals in 2024). End-user demographics are shifting towards a younger, digitally savvy population, fueling demand for advanced ICT solutions.

- Market Concentration: The market is moderately concentrated, with a few dominant players (Viettel, for example, holds a significant market share – estimated at xx%) alongside a multitude of smaller, specialized companies.

- Technological Innovation: 5G deployment, cloud computing, and AI are key drivers of innovation, while challenges remain in the adoption of cutting-edge technologies due to infrastructure limitations and skills gaps.

- Regulatory Framework: Government initiatives to promote digital transformation and attract foreign investment are creating favorable conditions for growth, though regulatory clarity in specific areas remains an ongoing concern.

- Competitive Substitutes: The rise of open-source solutions and the increasing availability of affordable alternatives pose a competitive challenge to established players.

- M&A Trends: Strategic acquisitions are increasing, driven by a desire to expand market reach, gain access to new technologies, and consolidate market share.

Vietnam ICT Market Growth Trends & Insights

The Vietnam ICT market has witnessed significant growth over the historical period (2019-2024), expanding at a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by rising internet penetration, increasing smartphone adoption, and the government's commitment to digital transformation. The market size in 2024 was estimated to be xx million USD and is projected to reach xx million USD by 2033. Technological disruptions, such as the widespread adoption of cloud computing and the rollout of 5G networks, are further accelerating market expansion. Consumer behavior is shifting towards increased reliance on digital services, driving demand for innovative ICT solutions across various sectors. Market penetration for key technologies, such as cloud services, is expected to increase significantly over the forecast period.

Dominant Regions, Countries, or Segments in Vietnam ICT Market

The IT and Telecom segment dominates the Vietnam ICT market, driven by strong government support and the burgeoning demand for telecommunication services and related infrastructure. The BFSI sector is another key driver of growth, with banks and financial institutions investing heavily in digital transformation initiatives. Geographically, major cities like Hanoi and Ho Chi Minh City are leading market hubs due to concentrated infrastructure and a higher density of businesses.

- Key Drivers (IT & Telecom Segment):

- Strong government support for infrastructure development (e.g., 5G rollout)

- High demand for telecommunication services (mobile, broadband)

- Increasing adoption of cloud computing and other advanced technologies

- Key Drivers (BFSI Sector):

- Growing focus on digital banking and fintech solutions

- Regulatory changes fostering financial inclusion

- Demand for cybersecurity solutions to mitigate risks

Vietnam ICT Market Product Landscape

The Vietnam ICT market showcases a diverse range of products, including advanced hardware solutions, sophisticated software applications, and cutting-edge IT and infrastructure services. Cloud computing platforms, cybersecurity products, and AI-driven analytics solutions are witnessing rapid adoption. Key differentiators include enhanced security features, improved scalability, and cost-effectiveness. The market is characterized by continuous innovation, with new products and services being introduced regularly to cater to evolving customer needs and preferences.

Key Drivers, Barriers & Challenges in Vietnam ICT Market

Key Drivers:

- Increasing government investment in digital infrastructure.

- Growing demand for digital services across various sectors.

- Rise of e-commerce and digital payments.

- Expanding mobile penetration and internet access.

Key Challenges:

- Limited skilled workforce in certain specialized areas.

- Infrastructure gaps in remote areas.

- Cybersecurity threats and data privacy concerns.

- Regulatory complexities and bureaucratic hurdles. These constraints impact market growth by approximately xx% annually.

Emerging Opportunities in Vietnam ICT Market

The Vietnamese ICT market presents numerous opportunities for growth. The expansion of 5G networks opens doors for innovative applications in IoT, smart cities, and industry 4.0. The rising popularity of e-commerce and fintech creates demand for secure payment gateways and robust digital platforms. Untapped markets in rural areas present opportunities for extending ICT access and services. The government's focus on digital transformation initiatives creates a fertile ground for investment and innovation.

Growth Accelerators in the Vietnam ICT Market Industry

Long-term growth in the Vietnam ICT market is fueled by several key factors. Continuous technological advancements, strategic collaborations between domestic and international companies, and expanding government support for digital initiatives are creating a robust ecosystem for innovation and expansion. The growing adoption of cloud-based solutions and the increasing demand for cybersecurity services are further accelerating market growth. Furthermore, investments in digital talent development are strengthening the industry’s long-term capabilities.

Key Players Shaping the Vietnam ICT Market Market

- Telehouse Vietnam

- Google LLC (alphabet Inc)

- Hewlett Packard Enterprise

- Viettel

- Cisco Systems Inc

- Fortinet

- Microsoft Corporation

- Vietnamobile

- Qualcomm Technologies Inc

- Fujitsu

- D-Link Systems Inc

Notable Milestones in Vietnam ICT Market Sector

- August 2022: Amazon Web Services (AWS) expanded its presence in Vietnam by launching new edge networking services in Ho Chi Minh City and Hanoi.

- October 2022: The Viettel Group launched the Viettel Cloud Ecosystem, solidifying its position as the leading cloud computing provider in Vietnam.

- October 2022: K-One partnered with the Vietnam Distribution Joint Stock Company to expand its cloud computing business in Vietnam.

In-Depth Vietnam ICT Market Market Outlook

The Vietnam ICT market is poised for continued robust growth over the forecast period (2025-2033). The convergence of technological advancements, supportive government policies, and increasing digital adoption across various sectors creates a fertile ground for expansion. Strategic partnerships, investments in infrastructure, and the development of a skilled workforce will be crucial factors in realizing the market's full potential. The focus on digital transformation across key industries presents compelling opportunities for both domestic and international players.

Vietnam ICT Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. Network Switches

- 1.1.2. Routers and WLAN

- 1.1.3. Servers and Storage

- 1.1.4. Other Hardware (Fiber Optics solutions)

- 1.2. Software

- 1.3. IT and Infrastructure Services (includes Cloud)

- 1.4. Telecommunication Services

-

1.1. Hardware

-

2. Industry Vertical

- 2.1. BFSI

- 2.2. IT and Telecom

- 2.3. Government

- 2.4. Retail and E-commerce

- 2.5. Manufacturing

- 2.6. Energy and Utilities

- 2.7. Other Industry Verticals

Vietnam ICT Market Segmentation By Geography

- 1. Vietnam

Vietnam ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Smart City Initiatives Leading to Revamp of Technology Infrastructure; Digital Transformation and Industrial Automation; Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence)

- 3.3. Market Restrains

- 3.3.1. High Initial Cost for Infrastructure; Need for Technology-Specific Skillset and Awareness

- 3.4. Market Trends

- 3.4.1. Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence) is Expected to Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Network Switches

- 5.1.1.2. Routers and WLAN

- 5.1.1.3. Servers and Storage

- 5.1.1.4. Other Hardware (Fiber Optics solutions)

- 5.1.2. Software

- 5.1.3. IT and Infrastructure Services (includes Cloud)

- 5.1.4. Telecommunication Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.2.1. BFSI

- 5.2.2. IT and Telecom

- 5.2.3. Government

- 5.2.4. Retail and E-commerce

- 5.2.5. Manufacturing

- 5.2.6. Energy and Utilities

- 5.2.7. Other Industry Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Telehouse Vietnam*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (alphabet Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett Packard Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Viettel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fortinet

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vietnamobile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qualcomm Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fujitsu

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 D-Link Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Telehouse Vietnam*List Not Exhaustive

List of Figures

- Figure 1: Vietnam ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Vietnam ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 4: Vietnam ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Vietnam ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Vietnam ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam ICT Market?

The projected CAGR is approximately 8.31%.

2. Which companies are prominent players in the Vietnam ICT Market?

Key companies in the market include Telehouse Vietnam*List Not Exhaustive, Google LLC (alphabet Inc ), Hewlett Packard Enterprise, Viettel, Cisco Systems Inc, Fortinet, Microsoft Corporation, Vietnamobile, Qualcomm Technologies Inc, Fujitsu, D-Link Systems Inc.

3. What are the main segments of the Vietnam ICT Market?

The market segments include Type, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Smart City Initiatives Leading to Revamp of Technology Infrastructure; Digital Transformation and Industrial Automation; Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence).

6. What are the notable trends driving market growth?

Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence) is Expected to Drives the Market.

7. Are there any restraints impacting market growth?

High Initial Cost for Infrastructure; Need for Technology-Specific Skillset and Awareness.

8. Can you provide examples of recent developments in the market?

October 2022: The Viettel Group launched the Viettel Cloud Ecosystem, cementing its position as Vietnam's largest cloud computing service provider. This launch will enable enterprise clients worldwide to accelerate cloud-enabled transformations with personalized and specialized solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam ICT Market?

To stay informed about further developments, trends, and reports in the Vietnam ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence