Key Insights

The US contract manufacturing services (CMS) industry is experiencing robust growth, fueled by several key factors. The increasing demand for outsourced manufacturing capabilities across various sectors, including food and beverage, cosmetics, and pharmaceuticals, is a primary driver. Companies are increasingly leveraging CMS providers to reduce operational costs, enhance efficiency, and gain access to specialized expertise and technologies they may lack internally. The industry's expansion is further bolstered by the rise of e-commerce and the need for agile and scalable manufacturing solutions to meet fluctuating consumer demand. A strong focus on innovation and technological advancements, such as automation and Industry 4.0 technologies, is also contributing to increased efficiency and capacity within the CMS sector. While potential supply chain disruptions and fluctuations in raw material prices present challenges, the overall industry outlook remains positive, driven by a continuous influx of new entrants and the ongoing consolidation among established players.

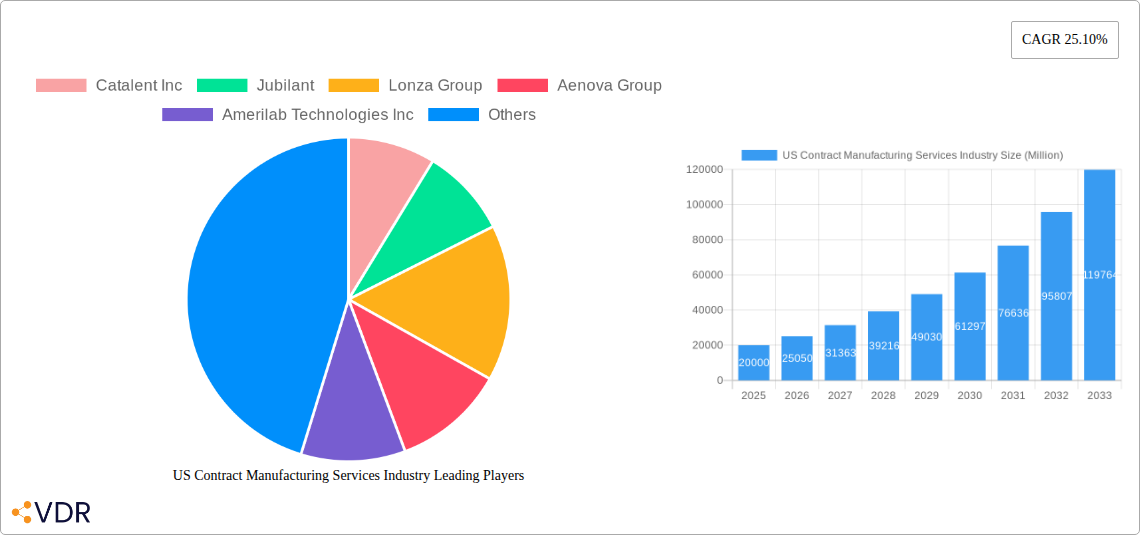

US Contract Manufacturing Services Industry Market Size (In Billion)

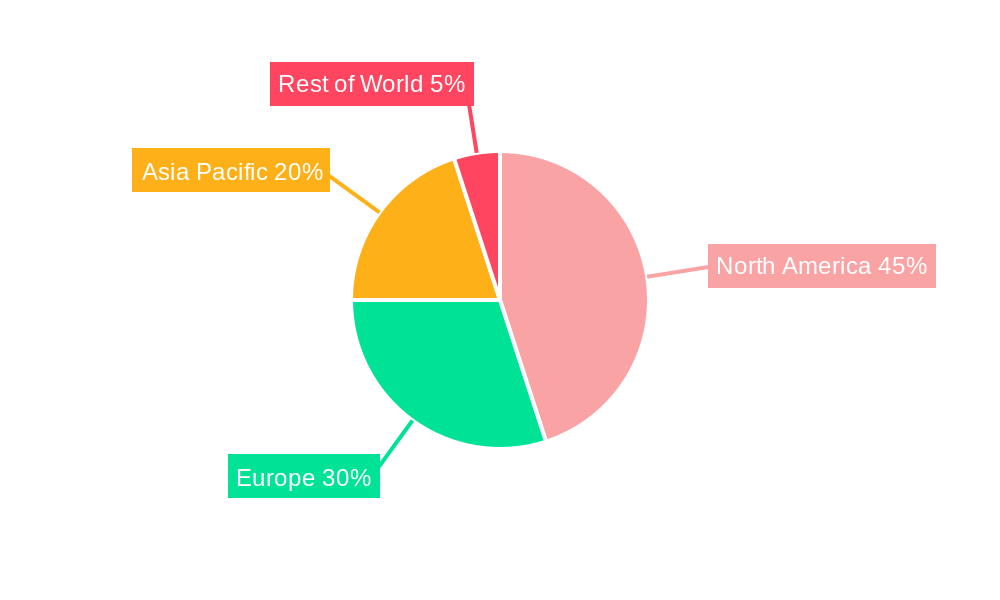

The market, estimated at $XX billion in 2025, exhibits a compound annual growth rate (CAGR) of 25.10%. This significant growth trajectory is projected to continue throughout the forecast period (2025-2033), driven by ongoing industry trends such as the increasing preference for customized products and personalized solutions, the growing demand for sustainable and ethically sourced materials, and a rising focus on regulatory compliance within diverse sectors. The fragmented nature of the market provides opportunities for both large multinational corporations and smaller specialized CMS providers to compete effectively. Successful companies are focusing on building strong client relationships, investing in advanced technologies, and expanding their service offerings to cater to the evolving needs of their diverse customer base. The geographical distribution of the market is likely concentrated in regions with established manufacturing infrastructure and access to skilled labor.

US Contract Manufacturing Services Industry Company Market Share

US Contract Manufacturing Services Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US Contract Manufacturing Services (CMS) industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report caters to industry professionals, investors, and strategic decision-makers seeking actionable insights into this dynamic sector. This report analyzes the parent market of Manufacturing Services and delves into the child market of Contract Manufacturing to provide a granular view of the market.

Keywords: US Contract Manufacturing, Contract Manufacturing Services, CMS, Pharmaceutical Manufacturing, Food & Beverage Manufacturing, Cosmetic Manufacturing, Market Size, Market Share, Growth Rate, CAGR, Industry Trends, Key Players, Market Analysis, Market Research, M&A, Technological Innovation.

US Contract Manufacturing Services Industry Market Dynamics & Structure

The US Contract Manufacturing Services industry is characterized by a moderately concentrated market structure, with several large players holding significant market share. Technological innovation, driven by advancements in automation, AI, and data analytics, is a primary growth driver. Stringent regulatory frameworks, particularly within the pharmaceutical and food & beverage sectors, significantly impact operational costs and compliance requirements. Competitive pressures from both domestic and international players, coupled with the availability of substitute products and services, create a dynamic landscape. The market witnesses frequent mergers and acquisitions (M&As), reflecting consolidation trends and the pursuit of scale and enhanced capabilities.

- Market Concentration: The top 5 players account for approximately xx% of the market (2025).

- Technological Innovation: Automation, AI, and digitalization are key drivers, boosting efficiency and reducing costs. However, high initial investment is a barrier.

- Regulatory Landscape: Stringent FDA and other regulatory guidelines necessitate significant compliance investments.

- M&A Activity: An average of xx M&A deals per year (2019-2024) were observed, indicative of market consolidation.

- Competitive Substitutes: Internal manufacturing capabilities and alternative CMS providers pose competitive challenges.

- End-User Demographics: Diverse end-user industries contribute to market growth, including pharmaceuticals, food & beverage, cosmetics, and consumer packaged goods.

US Contract Manufacturing Services Industry Growth Trends & Insights

The US Contract Manufacturing Services market has demonstrated robust and sustained growth over the historical period (2019-2024), fueled by a confluence of factors. The escalating trend of outsourcing, driven by companies seeking to optimize costs, streamline operations, and focus on core competencies, has been a primary catalyst. Furthermore, the increasing demand for specialized manufacturing capabilities, particularly in rapidly evolving sectors, coupled with significant technological advancements, has propelled the market forward. The market size is projected to reach approximately **[Insert Specific Market Size for 2025] Million** in 2025 and is forecast to experience a Compound Annual Growth Rate (CAGR) of **[Insert Specific CAGR Percentage for 2025-2033]%** from 2025 to 2033, ultimately reaching an estimated **[Insert Specific Market Size for 2033] Million** by 2033. This projected growth is underpinned by ongoing technological innovation, a rising consumer appetite for personalized and customized products, and evolving consumer preferences that favor unique and niche offerings. The accelerated adoption of cutting-edge technologies, including advanced automation, artificial intelligence (AI), and sophisticated data analytics, is significantly contributing to enhanced operational efficiency and market expansion. Consumer demand for a broader product diversity and a greater degree of customization is a powerful engine for market growth. Consequently, the industry is witnessing a pronounced shift towards specialized services, thereby creating heightened demand for highly focused and niche contract manufacturers capable of meeting precise requirements.

Dominant Regions, Countries, or Segments in US Contract Manufacturing Services Industry

Geographically, the Northeast and West Coast regions of the United States emerge as dominant players in the US Contract Manufacturing Services market. This dominance is largely attributed to the high concentration of leading pharmaceutical and technology companies in these areas, complemented by well-developed infrastructure, sophisticated logistics networks, and a readily available skilled workforce. States like California and New York are at the forefront, exhibiting substantial growth potential and attracting significant investment. Across industry segments, the pharmaceutical sector continues to command the largest market share, a testament to its stringent quality demands and the complex manufacturing processes involved. Following closely are the food and beverage, and cosmetics sectors, both of which are experiencing steady growth and increasing reliance on specialized contract manufacturing services.

-

Key Drivers in Dominant Regions:

- Highly developed infrastructure and efficient logistics networks facilitating seamless operations.

- Strategic presence of major global players in the pharmaceutical, food & beverage, and cosmetic industries.

- Abundant access to a highly skilled workforce and specialized talent pools crucial for complex manufacturing.

- Supportive government policies, tax incentives, and regulatory frameworks that foster industry growth.

-

Market Share and Growth Potential by Segment:

- The pharmaceutical segment currently holds an estimated **[Insert Specific Pharmaceutical Market Share]%** market share and is projected to expand at a CAGR of **[Insert Specific Pharmaceutical CAGR]%**.

- The food & beverage segment is anticipated to grow at a CAGR of **[Insert Specific Food & Beverage CAGR]%**, driven by consumer demand for innovative products.

- The cosmetics segment represents approximately **[Insert Specific Cosmetics Market Share]%** of the market, with potential for further expansion.

US Contract Manufacturing Services Industry Product Landscape

The US Contract Manufacturing Services (CMS) industry offers a comprehensive and evolving suite of services designed to meet diverse client needs. This landscape encompasses critical functions such as meticulous formulation development, advanced packaging solutions, precise labeling, and efficient fulfillment. Recent innovations are revolutionizing the sector, with a strong emphasis on the integration of advanced automation technologies to enhance precision and speed, the implementation of sophisticated quality control systems to ensure product integrity, and the development of highly personalized product offerings to cater to specific market demands. These advancements are instrumental in boosting operational efficiency, significantly reducing the likelihood of errors, and providing manufacturers with unparalleled flexibility to adapt to rapidly changing customer requirements and market dynamics. Leading companies are strategically focusing on delivering unique value propositions through the provision of highly specialized services and a commitment to achieving faster turnaround times, thereby enhancing client satisfaction and competitiveness.

Key Drivers, Barriers & Challenges in US Contract Manufacturing Services Industry

Key Drivers:

- The persistent and increasing trend of outsourcing among businesses worldwide, driven by the pursuit of cost optimization, enhanced operational efficiency, and the ability to concentrate on core competencies.

- A growing demand for highly specialized manufacturing capabilities and bespoke, customized solutions that address unique product requirements and market niches.

- The transformative impact of technological advancements, including sophisticated automation, the strategic integration of AI, and advanced data analytics, which collectively contribute to significant improvements in efficiency, quality, and scalability.

Key Challenges:

- Persistent supply chain disruptions, coupled with significant volatility in raw material costs, pose a considerable threat to profitability and operational stability.

- Navigating and adhering to increasingly stringent regulatory compliance requirements, which adds layers of complexity and elevates operational costs.

- Intense market competition and significant price pressures from both established domestic players and agile international competitors, necessitating continuous innovation and cost management.

Emerging Opportunities in US Contract Manufacturing Services Industry

Emerging opportunities lie in the growth of personalized medicine, increasing demand for sustainable and eco-friendly manufacturing processes, and expansion into untapped markets such as the cannabis industry. Further innovation in packaging and the use of digital technologies for enhanced supply chain management will shape future opportunities.

Growth Accelerators in the US Contract Manufacturing Services Industry Industry

Long-term growth will be propelled by the adoption of advanced technologies like artificial intelligence and machine learning in manufacturing processes, the expansion into new geographical markets, and strategic partnerships and acquisitions to expand service offerings and market reach.

Key Players Shaping the US Contract Manufacturing Services Industry Market

- Catalent Inc

- Jubilant

- Lonza Group

- Aenova Group

- Amerilab Technologies Inc

- Bernet Food & Beverage

- Big Brands LLC

- Delamaine Fine Foods Limited

- Brooklyn Bottling

- CSD Co-Packers

- Southeast Bottling & Beverages

- G3 Enterprises

- Western Innovations

- Niagara Bottling and Robinsons Breweries

- KIK Custom Products

- Sensible Organics

- Colep

- Cosmetic Essence LLC

- Formula Cap

Notable Milestones in US Contract Manufacturing Services Industry Sector

- July 2021: Catalent Inc launched GPEx lightning, a next-generation cell line technology, shortening drug development timelines by three months.

- May 2022: Lonza and the Israel Biotech Fund collaborated on a framework agreement to support biologics and small molecule development and manufacturing, expanding Lonza's access to the Israeli market.

In-Depth US Contract Manufacturing Services Industry Market Outlook

The US Contract Manufacturing Services market is poised for substantial and sustained long-term growth. This positive outlook is propelled by a dynamic interplay of factors, including relentless technological innovation that opens new avenues for efficiency and capability, the continuing and expanding trend of outsourcing across various industries, and the emergence of novel market segments demanding specialized manufacturing expertise. To achieve and maintain market leadership, strategic imperatives will include forging robust strategic partnerships, making significant and targeted investments in advanced automation and digital transformation, and actively expanding capabilities into high-growth areas such as personalized medicine and the development of sustainable manufacturing practices. Proactive adaptation to these trends will be essential for navigating the competitive landscape and capitalizing on future opportunities.

US Contract Manufacturing Services Industry Segmentation

-

1. pharmaceutical

- 1.1. Current Market Scenario and growth influencers

- 1.2. Market B

-

1.3. Active P

- 1.3.1. Small molecule

- 1.3.2. Large Molecule

- 1.3.3. High Potency API (HPAPI)

-

1.4. Finished

- 1.4.1. Solid Dose Formulation

- 1.4.2. Liquid Dose Formulation

- 1.4.3. Injectable Dose Formulation

- 1.5. Secondary Packaging

-

2. Food processing & manufacturing

- 2.1. Market Breakdown - by Service Type

- 2.2. Current Market Scenario and growth influencers

-

2.3. Food Manufacturing Services

- 2.3.1. Convenience Foods

- 2.3.2. Bakery Products

- 2.3.3. Confectionary Products

- 2.3.4. Dairy Products

- 2.3.5. Research & Development

- 2.3.6. Food Packaging Services

-

3. Beverage

- 3.1. Current Market Scenario and growth influencers

-

3.2. Market B

- 3.2.1. Beer

- 3.2.2. Carbonated Drinks & Fruit-based Beverages

- 3.2.3. Bottled Water

- 3.2.4. Others (Sport Drinks)

-

4. Personal Care

- 4.1. Current Market Scenario and growth influencers

-

4.2. Market Breakdown - by Type

- 4.2.1. Skin Care

- 4.2.2. Hair Care

- 4.2.3. Make up & Color Cosmetics

- 4.2.4. Others

US Contract Manufacturing Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Contract Manufacturing Services Industry Regional Market Share

Geographic Coverage of US Contract Manufacturing Services Industry

US Contract Manufacturing Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers

- 3.3. Market Restrains

- 3.3.1. Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers

- 3.4. Market Trends

- 3.4.1. Growth of Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 5.1.1. Current Market Scenario and growth influencers

- 5.1.2. Market B

- 5.1.3. Active P

- 5.1.3.1. Small molecule

- 5.1.3.2. Large Molecule

- 5.1.3.3. High Potency API (HPAPI)

- 5.1.4. Finished

- 5.1.4.1. Solid Dose Formulation

- 5.1.4.2. Liquid Dose Formulation

- 5.1.4.3. Injectable Dose Formulation

- 5.1.5. Secondary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 5.2.1. Market Breakdown - by Service Type

- 5.2.2. Current Market Scenario and growth influencers

- 5.2.3. Food Manufacturing Services

- 5.2.3.1. Convenience Foods

- 5.2.3.2. Bakery Products

- 5.2.3.3. Confectionary Products

- 5.2.3.4. Dairy Products

- 5.2.3.5. Research & Development

- 5.2.3.6. Food Packaging Services

- 5.3. Market Analysis, Insights and Forecast - by Beverage

- 5.3.1. Current Market Scenario and growth influencers

- 5.3.2. Market B

- 5.3.2.1. Beer

- 5.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 5.3.2.3. Bottled Water

- 5.3.2.4. Others (Sport Drinks)

- 5.4. Market Analysis, Insights and Forecast - by Personal Care

- 5.4.1. Current Market Scenario and growth influencers

- 5.4.2. Market Breakdown - by Type

- 5.4.2.1. Skin Care

- 5.4.2.2. Hair Care

- 5.4.2.3. Make up & Color Cosmetics

- 5.4.2.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 6. North America US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 6.1.1. Current Market Scenario and growth influencers

- 6.1.2. Market B

- 6.1.3. Active P

- 6.1.3.1. Small molecule

- 6.1.3.2. Large Molecule

- 6.1.3.3. High Potency API (HPAPI)

- 6.1.4. Finished

- 6.1.4.1. Solid Dose Formulation

- 6.1.4.2. Liquid Dose Formulation

- 6.1.4.3. Injectable Dose Formulation

- 6.1.5. Secondary Packaging

- 6.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 6.2.1. Market Breakdown - by Service Type

- 6.2.2. Current Market Scenario and growth influencers

- 6.2.3. Food Manufacturing Services

- 6.2.3.1. Convenience Foods

- 6.2.3.2. Bakery Products

- 6.2.3.3. Confectionary Products

- 6.2.3.4. Dairy Products

- 6.2.3.5. Research & Development

- 6.2.3.6. Food Packaging Services

- 6.3. Market Analysis, Insights and Forecast - by Beverage

- 6.3.1. Current Market Scenario and growth influencers

- 6.3.2. Market B

- 6.3.2.1. Beer

- 6.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 6.3.2.3. Bottled Water

- 6.3.2.4. Others (Sport Drinks)

- 6.4. Market Analysis, Insights and Forecast - by Personal Care

- 6.4.1. Current Market Scenario and growth influencers

- 6.4.2. Market Breakdown - by Type

- 6.4.2.1. Skin Care

- 6.4.2.2. Hair Care

- 6.4.2.3. Make up & Color Cosmetics

- 6.4.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 7. South America US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 7.1.1. Current Market Scenario and growth influencers

- 7.1.2. Market B

- 7.1.3. Active P

- 7.1.3.1. Small molecule

- 7.1.3.2. Large Molecule

- 7.1.3.3. High Potency API (HPAPI)

- 7.1.4. Finished

- 7.1.4.1. Solid Dose Formulation

- 7.1.4.2. Liquid Dose Formulation

- 7.1.4.3. Injectable Dose Formulation

- 7.1.5. Secondary Packaging

- 7.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 7.2.1. Market Breakdown - by Service Type

- 7.2.2. Current Market Scenario and growth influencers

- 7.2.3. Food Manufacturing Services

- 7.2.3.1. Convenience Foods

- 7.2.3.2. Bakery Products

- 7.2.3.3. Confectionary Products

- 7.2.3.4. Dairy Products

- 7.2.3.5. Research & Development

- 7.2.3.6. Food Packaging Services

- 7.3. Market Analysis, Insights and Forecast - by Beverage

- 7.3.1. Current Market Scenario and growth influencers

- 7.3.2. Market B

- 7.3.2.1. Beer

- 7.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 7.3.2.3. Bottled Water

- 7.3.2.4. Others (Sport Drinks)

- 7.4. Market Analysis, Insights and Forecast - by Personal Care

- 7.4.1. Current Market Scenario and growth influencers

- 7.4.2. Market Breakdown - by Type

- 7.4.2.1. Skin Care

- 7.4.2.2. Hair Care

- 7.4.2.3. Make up & Color Cosmetics

- 7.4.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 8. Europe US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 8.1.1. Current Market Scenario and growth influencers

- 8.1.2. Market B

- 8.1.3. Active P

- 8.1.3.1. Small molecule

- 8.1.3.2. Large Molecule

- 8.1.3.3. High Potency API (HPAPI)

- 8.1.4. Finished

- 8.1.4.1. Solid Dose Formulation

- 8.1.4.2. Liquid Dose Formulation

- 8.1.4.3. Injectable Dose Formulation

- 8.1.5. Secondary Packaging

- 8.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 8.2.1. Market Breakdown - by Service Type

- 8.2.2. Current Market Scenario and growth influencers

- 8.2.3. Food Manufacturing Services

- 8.2.3.1. Convenience Foods

- 8.2.3.2. Bakery Products

- 8.2.3.3. Confectionary Products

- 8.2.3.4. Dairy Products

- 8.2.3.5. Research & Development

- 8.2.3.6. Food Packaging Services

- 8.3. Market Analysis, Insights and Forecast - by Beverage

- 8.3.1. Current Market Scenario and growth influencers

- 8.3.2. Market B

- 8.3.2.1. Beer

- 8.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 8.3.2.3. Bottled Water

- 8.3.2.4. Others (Sport Drinks)

- 8.4. Market Analysis, Insights and Forecast - by Personal Care

- 8.4.1. Current Market Scenario and growth influencers

- 8.4.2. Market Breakdown - by Type

- 8.4.2.1. Skin Care

- 8.4.2.2. Hair Care

- 8.4.2.3. Make up & Color Cosmetics

- 8.4.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 9. Middle East & Africa US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 9.1.1. Current Market Scenario and growth influencers

- 9.1.2. Market B

- 9.1.3. Active P

- 9.1.3.1. Small molecule

- 9.1.3.2. Large Molecule

- 9.1.3.3. High Potency API (HPAPI)

- 9.1.4. Finished

- 9.1.4.1. Solid Dose Formulation

- 9.1.4.2. Liquid Dose Formulation

- 9.1.4.3. Injectable Dose Formulation

- 9.1.5. Secondary Packaging

- 9.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 9.2.1. Market Breakdown - by Service Type

- 9.2.2. Current Market Scenario and growth influencers

- 9.2.3. Food Manufacturing Services

- 9.2.3.1. Convenience Foods

- 9.2.3.2. Bakery Products

- 9.2.3.3. Confectionary Products

- 9.2.3.4. Dairy Products

- 9.2.3.5. Research & Development

- 9.2.3.6. Food Packaging Services

- 9.3. Market Analysis, Insights and Forecast - by Beverage

- 9.3.1. Current Market Scenario and growth influencers

- 9.3.2. Market B

- 9.3.2.1. Beer

- 9.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 9.3.2.3. Bottled Water

- 9.3.2.4. Others (Sport Drinks)

- 9.4. Market Analysis, Insights and Forecast - by Personal Care

- 9.4.1. Current Market Scenario and growth influencers

- 9.4.2. Market Breakdown - by Type

- 9.4.2.1. Skin Care

- 9.4.2.2. Hair Care

- 9.4.2.3. Make up & Color Cosmetics

- 9.4.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 10. Asia Pacific US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 10.1.1. Current Market Scenario and growth influencers

- 10.1.2. Market B

- 10.1.3. Active P

- 10.1.3.1. Small molecule

- 10.1.3.2. Large Molecule

- 10.1.3.3. High Potency API (HPAPI)

- 10.1.4. Finished

- 10.1.4.1. Solid Dose Formulation

- 10.1.4.2. Liquid Dose Formulation

- 10.1.4.3. Injectable Dose Formulation

- 10.1.5. Secondary Packaging

- 10.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 10.2.1. Market Breakdown - by Service Type

- 10.2.2. Current Market Scenario and growth influencers

- 10.2.3. Food Manufacturing Services

- 10.2.3.1. Convenience Foods

- 10.2.3.2. Bakery Products

- 10.2.3.3. Confectionary Products

- 10.2.3.4. Dairy Products

- 10.2.3.5. Research & Development

- 10.2.3.6. Food Packaging Services

- 10.3. Market Analysis, Insights and Forecast - by Beverage

- 10.3.1. Current Market Scenario and growth influencers

- 10.3.2. Market B

- 10.3.2.1. Beer

- 10.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 10.3.2.3. Bottled Water

- 10.3.2.4. Others (Sport Drinks)

- 10.4. Market Analysis, Insights and Forecast - by Personal Care

- 10.4.1. Current Market Scenario and growth influencers

- 10.4.2. Market Breakdown - by Type

- 10.4.2.1. Skin Care

- 10.4.2.2. Hair Care

- 10.4.2.3. Make up & Color Cosmetics

- 10.4.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Catalent Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jubilant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lonza Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aenova Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amerilab Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bernet Food & Beverage

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Big Brands LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Delamaine Fine Foods Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Brooklyn Bottling

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CSD Co-Packers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Southeast Bottling & Beverages

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 G3 Enterprises

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Western Innovations

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Niagara Bottling and Robinsons Breweries

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 KIK Custom Products

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sensible Organics

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Colep

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Cosmetic Essence LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Formula Cap*List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Catalent Inc

List of Figures

- Figure 1: Global US Contract Manufacturing Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 3: North America US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 4: North America US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 5: North America US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 6: North America US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 7: North America US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 8: North America US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 9: North America US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 10: North America US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 13: South America US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 14: South America US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 15: South America US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 16: South America US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 17: South America US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 18: South America US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 19: South America US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 20: South America US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 23: Europe US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 24: Europe US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 25: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 26: Europe US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 27: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 28: Europe US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 29: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 30: Europe US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 33: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 34: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 35: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 36: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 37: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 38: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 39: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 40: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 43: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 44: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 45: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 46: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 47: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 48: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 49: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 50: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 2: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 3: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 4: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 5: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 7: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 8: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 9: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 10: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 15: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 16: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 17: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 18: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 23: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 24: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 25: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 26: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 37: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 38: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 39: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 40: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 48: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 49: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 50: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 51: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Contract Manufacturing Services Industry?

The projected CAGR is approximately 25.10%.

2. Which companies are prominent players in the US Contract Manufacturing Services Industry?

Key companies in the market include Catalent Inc, Jubilant, Lonza Group, Aenova Group, Amerilab Technologies Inc, Bernet Food & Beverage, Big Brands LLC, Delamaine Fine Foods Limited, Brooklyn Bottling, CSD Co-Packers, Southeast Bottling & Beverages, G3 Enterprises, Western Innovations, Niagara Bottling and Robinsons Breweries, KIK Custom Products, Sensible Organics, Colep, Cosmetic Essence LLC, Formula Cap*List Not Exhaustive.

3. What are the main segments of the US Contract Manufacturing Services Industry?

The market segments include pharmaceutical, Food processing & manufacturing, Beverage, Personal Care.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers.

6. What are the notable trends driving market growth?

Growth of Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs.

7. Are there any restraints impacting market growth?

Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers.

8. Can you provide examples of recent developments in the market?

May 2022 - Lonza and Israel Biotech Fund Collaborated Framework Agreement to Support Biologics and Small Molecules Development and Manufacture for Portfolio Companies which Facilitate Access to Israeli Market for Lonza.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Contract Manufacturing Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Contract Manufacturing Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Contract Manufacturing Services Industry?

To stay informed about further developments, trends, and reports in the US Contract Manufacturing Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence