Key Insights

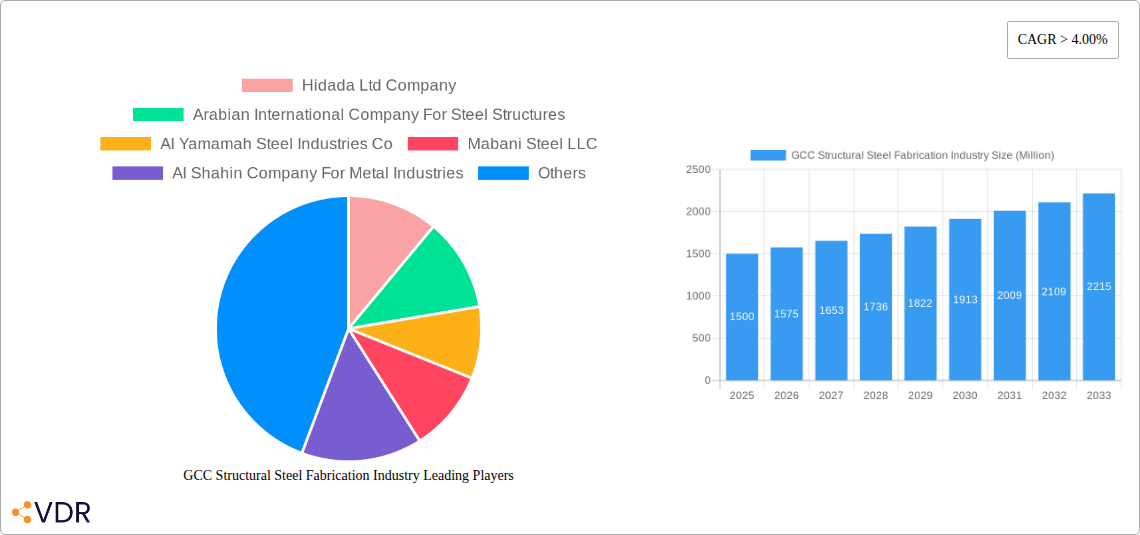

The GCC Structural Steel Fabrication market is projected to experience significant growth, driven by sustained demand from key industries and extensive infrastructure development across the region. With a projected Compound Annual Growth Rate (CAGR) of 5.1%, the market is estimated to reach 43.4 billion by 2025. This expansion is fueled by ongoing mega-projects in construction, oil & gas, and the rapidly growing power and energy sectors. Heavy sectional steel fabrication is expected to lead product types, essential for large-scale infrastructure and industrial facilities. The manufacturing and construction sectors are the primary end-users, utilizing structural steel for commercial and residential buildings, industrial plants, and renewable energy infrastructure. Emerging trends include the adoption of sustainable, high-strength steel alloys and advancements in fabrication technologies, further stimulating market growth. The GCC's economic diversification and ambitious vision plans are fostering increased infrastructure investment, directly boosting demand for structural steel fabrication services.

GCC Structural Steel Fabrication Industry Market Size (In Billion)

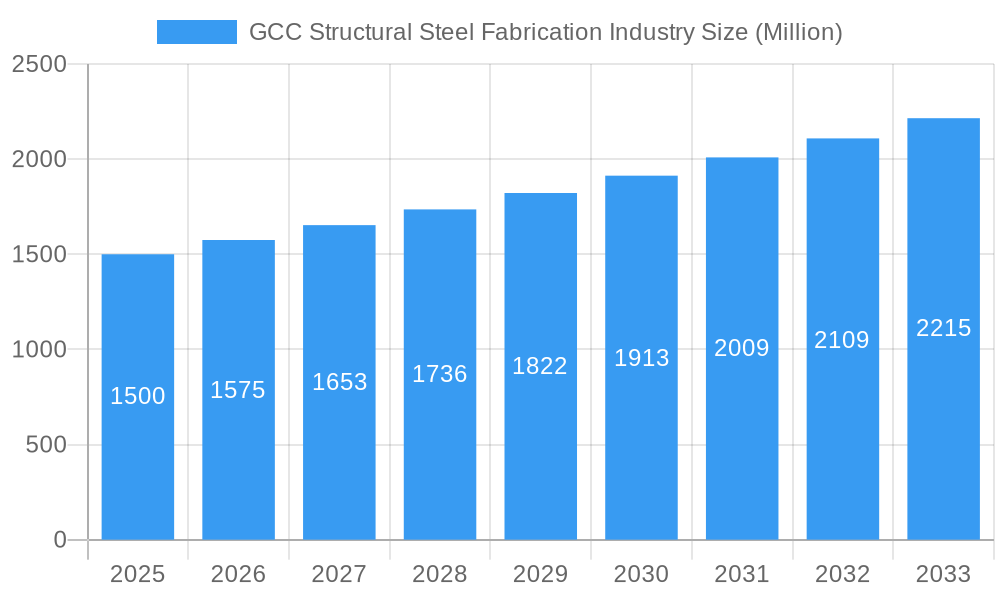

Challenges include raw material price volatility, particularly for steel, which can affect profitability and project timelines. Global steel price fluctuations, influenced by geopolitical factors and supply chain disruptions, pose a significant hurdle. The increasing complexity of project requirements and the need for specialized fabrication skills also present challenges in meeting demand. Despite these constraints, robust demand from large-scale infrastructure projects, including smart cities, transportation networks, and energy sector expansion, is expected to drive market expansion. Key market players, such as Hidada Ltd Company, Arabian International Company For Steel Structures, and Al Yamamah Steel Industries Co, are actively contributing to innovation and capacity expansion. Strategic regional development and large-scale construction endeavors will remain primary catalysts for the GCC Structural Steel Fabrication market's growth.

GCC Structural Steel Fabrication Industry Company Market Share

GCC Structural Steel Fabrication Industry Market Insights: Comprehensive 2019-2033 Analysis

This in-depth report provides a panoramic view of the GCC Structural Steel Fabrication industry, a critical sector underpinning the region's rapid infrastructure development and industrial expansion. Spanning the historical period from 2019 to 2024, a base and estimated year of 2025, and a robust forecast period extending to 2033, this research delves into market dynamics, growth trends, dominant segments, product landscapes, key drivers, challenges, opportunities, and the strategic moves of leading players. With a focus on quantitative analysis and actionable insights, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the GCC structural steel fabrication market.

GCC Structural Steel Fabrication Industry Market Dynamics & Structure

The GCC structural steel fabrication industry exhibits a moderately consolidated market structure, driven by a mix of large-scale fabricators and specialized niche players. Technological innovation plays a pivotal role, with advancements in welding techniques, automated cutting, and advanced design software significantly enhancing efficiency and product quality. Regulatory frameworks, particularly those promoting local content and manufacturing excellence, are shaping market entry and operational strategies. Competitive pressures are present, but the demand from burgeoning sectors like construction and oil & gas provides ample room for growth. End-user demographics are increasingly sophisticated, demanding higher precision, faster turnaround times, and sustainable fabrication practices. Mergers and acquisitions (M&A) are a growing trend as established companies seek to expand their capabilities, geographical reach, and market share. The parent market, encompassing the entire steel fabrication ecosystem, benefits from the robust growth of its child market, structural steel fabrication, which is directly influenced by major capital expenditure projects.

- Market Concentration: Moderately consolidated with key players holding significant market share, but ample room for specialized fabricators.

- Technological Innovation Drivers: Automation, advanced welding, digital design, and prefabrication technologies.

- Regulatory Frameworks: Growing emphasis on local content mandates and stringent quality control standards.

- Competitive Product Substitutes: While steel remains dominant, advanced composite materials are emerging as niche alternatives in specific applications.

- End-User Demographics: Increasing demand for complex designs, higher strength-to-weight ratios, and faster project delivery.

- M&A Trends: Strategic acquisitions aimed at consolidating market position and enhancing technological capabilities.

GCC Structural Steel Fabrication Industry Growth Trends & Insights

The GCC structural steel fabrication market is on an upward trajectory, fueled by ambitious infrastructure development plans, significant investments in the energy sector, and a strong push towards economic diversification across the region. The market size has witnessed consistent growth, projected to accelerate further due to ongoing mega-projects and the increasing adoption of pre-fabricated steel structures for faster construction timelines. Technological disruptions are a key theme, with the integration of Building Information Modeling (BIM), AI-powered design optimization, and advanced robotic fabrication transforming the industry's operational landscape. Consumer behavior is shifting towards a preference for sustainable and cost-effective building solutions, making precisely engineered structural steel an attractive option. The CAGR for the structural steel fabrication sector is estimated to be around 6.5% during the forecast period, with market penetration steadily increasing as awareness and acceptance of pre-fabricated solutions grow. The parent market, encompassing all steel fabrication, is expected to grow in tandem, with structural steel forming a significant and high-value segment.

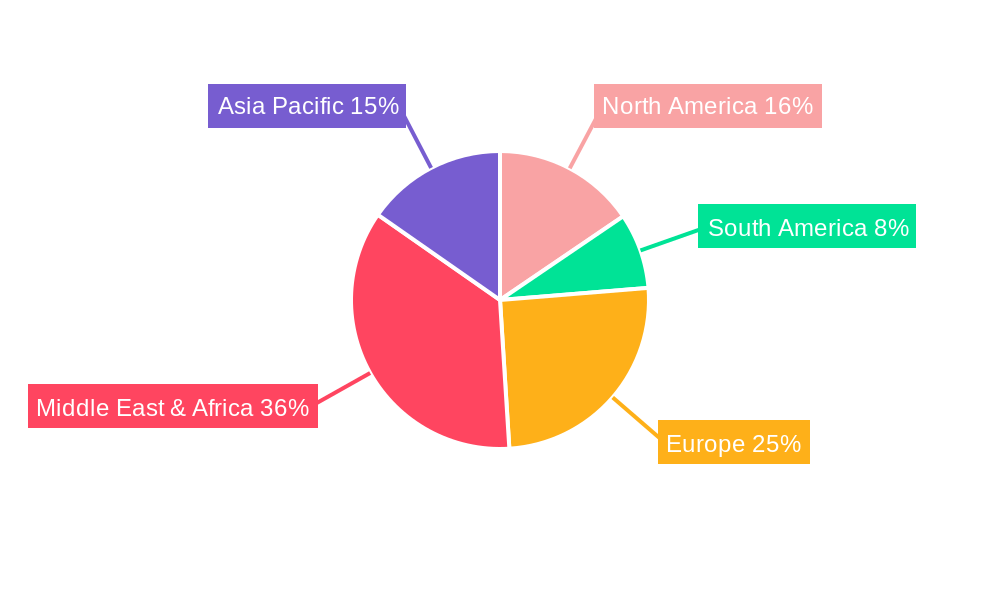

Dominant Regions, Countries, or Segments in GCC Structural Steel Fabrication Industry

The Construction end-user industry stands as the dominant force driving growth in the GCC structural steel fabrication market. This segment's supremacy is intrinsically linked to the region's aggressive infrastructure development agenda, encompassing the construction of iconic skyscrapers, state-of-the-art transportation networks, and expansive residential and commercial complexes. Saudi Arabia, with its Vision 2030 initiatives, and the UAE, particularly Dubai and Abu Dhabi, are leading the charge with massive construction pipelines that demand colossal volumes of fabricated structural steel. Oil and Gas remains a cornerstone, with ongoing upstream and downstream projects requiring robust and specialized steel structures for exploration, production, refining, and petrochemical facilities. The Power and Energy sector, driven by investments in renewable energy projects and traditional power generation, also presents substantial demand for structural steel for solar panel mounts, wind turbine towers, and power plant infrastructure.

- Dominant End-User Industry: Construction, accounting for an estimated 45% of the market share, followed by Oil and Gas (30%) and Power and Energy (15%).

- Leading Countries: Saudi Arabia and the United Arab Emirates, collectively holding over 70% of the regional market share.

- Key Drivers in Construction:

- Massive urban development and giga-projects.

- Government focus on diversifying economies and attracting foreign investment through improved infrastructure.

- Increased use of pre-fabricated steel for faster project execution.

- Key Drivers in Oil and Gas:

- Continued exploration and production activities.

- Investments in downstream refining and petrochemical expansion.

- Retrofitting and upgrading of existing facilities.

- Key Drivers in Power and Energy:

- Expansion of renewable energy capacity (solar and wind).

- Development of new conventional power plants.

- Grid modernization projects.

- Dominant Product Type: Heavy Sectional Steel, essential for large-scale infrastructure and industrial projects, holds a significant market share, estimated at around 55%, while Light Sectional Steel caters to smaller constructions and specialized applications, comprising approximately 35%.

GCC Structural Steel Fabrication Industry Product Landscape

The product landscape in GCC structural steel fabrication is characterized by a strong emphasis on delivering high-performance and application-specific solutions. Innovations focus on enhancing material strength, improving corrosion resistance, and optimizing structural integrity for diverse environmental conditions. Applications range from the foundational elements of towering skyscrapers and sprawling industrial complexes to the critical components of offshore oil rigs and sophisticated power generation facilities. Performance metrics are rigorously evaluated, with a constant drive to meet and exceed international standards for load-bearing capacity, durability, and safety. Unique selling propositions often lie in the precision of fabrication, the ability to handle complex geometries, and the adherence to stringent project timelines. Technological advancements are seen in the use of advanced alloys, sophisticated coatings, and cutting-edge manufacturing processes that enable the creation of lighter yet stronger steel components, leading to cost efficiencies and improved structural designs.

Key Drivers, Barriers & Challenges in GCC Structural Steel Fabrication Industry

The GCC structural steel fabrication industry is propelled by several key drivers. Foremost among these are the region's ambitious government-led infrastructure development initiatives, exemplified by Saudi Vision 2030 and similar economic diversification programs across the GCC. These initiatives fuel demand for large-scale construction projects, directly benefiting the structural steel sector. Furthermore, significant investments in the oil and gas industry, coupled with a growing focus on renewable energy projects, create substantial demand for specialized and heavy-duty steel structures. Technological advancements in fabrication processes, such as automation and prefabrication, also act as growth accelerators by enhancing efficiency and reducing project costs.

Conversely, the industry faces several barriers and challenges. Volatility in raw material prices, particularly steel billets and iron ore, can impact profitability and project costing. Intense competition, both from local and international players, puts pressure on margins. Stringent quality control and certification requirements, while ensuring safety, can increase operational costs and lead times. Supply chain disruptions, as witnessed in recent global events, can affect the timely procurement of raw materials and equipment. Furthermore, the availability of skilled labor for specialized fabrication tasks and the adoption of advanced technologies can pose challenges in certain markets.

Emerging Opportunities in GCC Structural Steel Fabrication Industry

Emerging opportunities within the GCC structural steel fabrication industry are diverse and promising. The burgeoning renewable energy sector, particularly solar and wind power, presents a significant avenue for growth, with increasing demand for custom-fabricated support structures. The ongoing development of smart cities and sustainable urban infrastructure opens up new markets for innovative steel solutions. Furthermore, the push for localization and increased in-country value across various industries, including oil & gas and manufacturing, creates opportunities for domestic fabricators to supply critical components. The adoption of modular construction techniques and pre-fabricated elements is also gaining traction, offering opportunities for companies that can deliver integrated solutions efficiently.

Growth Accelerators in the GCC Structural Steel Fabrication Industry Industry

Several catalysts are accelerating the long-term growth of the GCC structural steel fabrication industry. Foremost is the sustained commitment to economic diversification and infrastructure development across GCC nations, ensuring a continuous pipeline of large-scale projects. Technological breakthroughs in areas like advanced steel alloys with higher strength-to-weight ratios, 3D printing for complex components, and AI-driven design optimization are enhancing capabilities and creating new applications. Strategic partnerships between fabrication companies, engineering firms, and end-users are crucial for innovation and market penetration. Moreover, the increasing adoption of digital fabrication technologies and smart factory concepts is driving operational efficiency and cost-effectiveness, making structural steel a more competitive choice.

Key Players Shaping the GCC Structural Steel Fabrication Industry Market

- Hidada Ltd Company

- Arabian International Company For Steel Structures

- Al Yamamah Steel Industries Co

- Mabani Steel LLC

- Al Shahin Company For Metal Industries

- IMCC

- Standard Steel Fabrication Co LLC

- Techno Steel

- Aarya Engineering

- Vogue Steel LLC

- 53 Other Companies

Notable Milestones in GCC Structural Steel Fabrication Industry Sector

- February 2024: Saudi-based steelmaker Bena Steel Industries extended its Memorandum of Understanding (MoU) with UK energy solutions provider Alderley to advance energy transition initiatives in the kingdom. The MoU focuses on enhancing in-country capabilities, supply chains, and energy solutions to support Saudi Arabia's efforts to ensure energy security globally. This includes the exploration of cleaner technologies such as hydrogen.

- February 2024: Tenaris, a manufacturer of steel pipe products headquartered in Luxembourg, opened an industrial facility in Abu Dhabi Industrial City. The Etihad Tubulars industrial complex, valued at USD 60 million (AED 220 million), spans over 200,000 sq. m and is set to become a hub for enhancing the technical expertise of ADNOC engineers, local talents, and partners through a dedicated training center. The complex will feature a pipe service yard designed for storing, inspecting, and preparing pipe products.

In-Depth GCC Structural Steel Fabrication Industry Market Outlook

The future outlook for the GCC structural steel fabrication industry is exceptionally bright, driven by a confluence of factors that promise sustained growth and evolving market dynamics. Continued government investment in mega-projects, particularly in construction and infrastructure, will remain a primary growth engine. The industry's adaptation to and adoption of cutting-edge technologies, from AI-driven design to advanced robotic manufacturing, will further enhance its competitiveness and capability to deliver complex, high-value projects. Emerging opportunities in the renewable energy sector and the increasing demand for sustainable building materials will also play a significant role in shaping the market's trajectory. Strategic collaborations and a focus on innovation will be critical for companies to capitalize on these opportunities and solidify their positions in this dynamic and expanding market.

GCC Structural Steel Fabrication Industry Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Energy

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

GCC Structural Steel Fabrication Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Structural Steel Fabrication Industry Regional Market Share

Geographic Coverage of GCC Structural Steel Fabrication Industry

GCC Structural Steel Fabrication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Spending in Emerging Economies

- 3.3. Market Restrains

- 3.3.1. Increasing Construction Spending in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Construction Industry is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Energy

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Manufacturing

- 6.1.2. Power and Energy

- 6.1.3. Construction

- 6.1.4. Oil and Gas

- 6.1.5. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Heavy Sectional Steel

- 6.2.2. Light Sectional Steel

- 6.2.3. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. South America GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Manufacturing

- 7.1.2. Power and Energy

- 7.1.3. Construction

- 7.1.4. Oil and Gas

- 7.1.5. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Heavy Sectional Steel

- 7.2.2. Light Sectional Steel

- 7.2.3. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Manufacturing

- 8.1.2. Power and Energy

- 8.1.3. Construction

- 8.1.4. Oil and Gas

- 8.1.5. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Heavy Sectional Steel

- 8.2.2. Light Sectional Steel

- 8.2.3. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Middle East & Africa GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Manufacturing

- 9.1.2. Power and Energy

- 9.1.3. Construction

- 9.1.4. Oil and Gas

- 9.1.5. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Heavy Sectional Steel

- 9.2.2. Light Sectional Steel

- 9.2.3. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Asia Pacific GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Manufacturing

- 10.1.2. Power and Energy

- 10.1.3. Construction

- 10.1.4. Oil and Gas

- 10.1.5. Other End-user Industries

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Heavy Sectional Steel

- 10.2.2. Light Sectional Steel

- 10.2.3. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hidada Ltd Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arabian International Company For Steel Structures

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Yamamah Steel Industries Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mabani Steel LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Al Shahin Company For Metal Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IMCC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Standard Steel Fabrication Co LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Techno Steel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aarya Engineering

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vogue Steel LLC*5 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hidada Ltd Company

List of Figures

- Figure 1: Global GCC Structural Steel Fabrication Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: North America GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 9: South America GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: South America GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Europe GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 21: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 23: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 27: Asia Pacific GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 39: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Structural Steel Fabrication Industry?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the GCC Structural Steel Fabrication Industry?

Key companies in the market include Hidada Ltd Company, Arabian International Company For Steel Structures, Al Yamamah Steel Industries Co, Mabani Steel LLC, Al Shahin Company For Metal Industries, IMCC, Standard Steel Fabrication Co LLC, Techno Steel, Aarya Engineering, Vogue Steel LLC*5 3 Other Companie.

3. What are the main segments of the GCC Structural Steel Fabrication Industry?

The market segments include End-user Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Spending in Emerging Economies.

6. What are the notable trends driving market growth?

Construction Industry is Dominating the Market.

7. Are there any restraints impacting market growth?

Increasing Construction Spending in Emerging Economies.

8. Can you provide examples of recent developments in the market?

February 2024: Saudi-based steelmaker Bena Steel Industries has extended its Memorandum of Understanding (MoU) with UK energy solutions provider Alderley to advance energy transition initiatives in the kingdom. The MoU focuses on enhancing in-country capabilities, supply chains, and energy solutions to support Saudi Arabia's efforts to ensure energy security globally. This includes the exploration of cleaner technologies such as hydrogen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Structural Steel Fabrication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Structural Steel Fabrication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Structural Steel Fabrication Industry?

To stay informed about further developments, trends, and reports in the GCC Structural Steel Fabrication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence