Key Insights

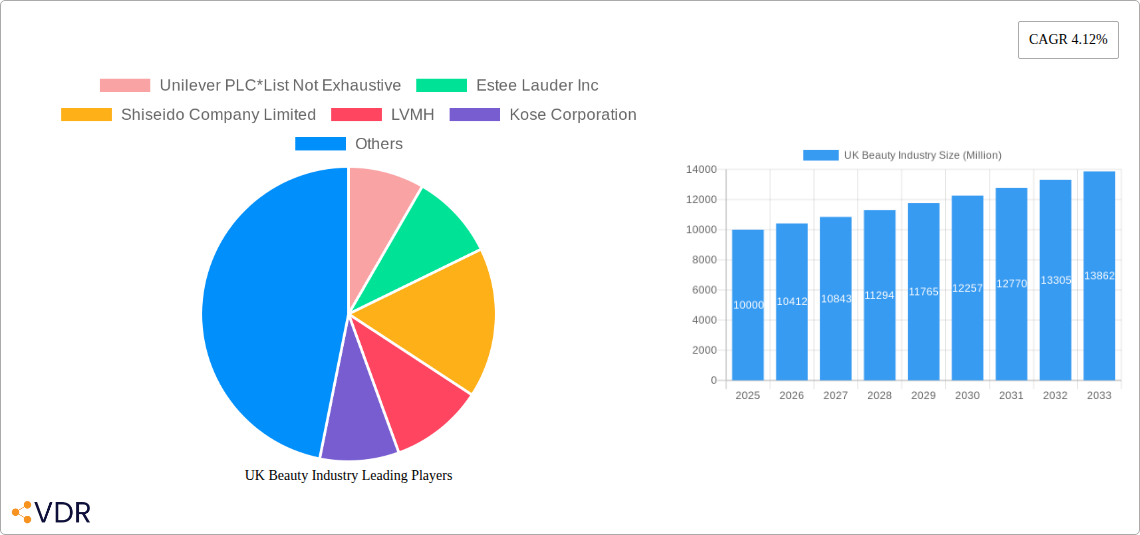

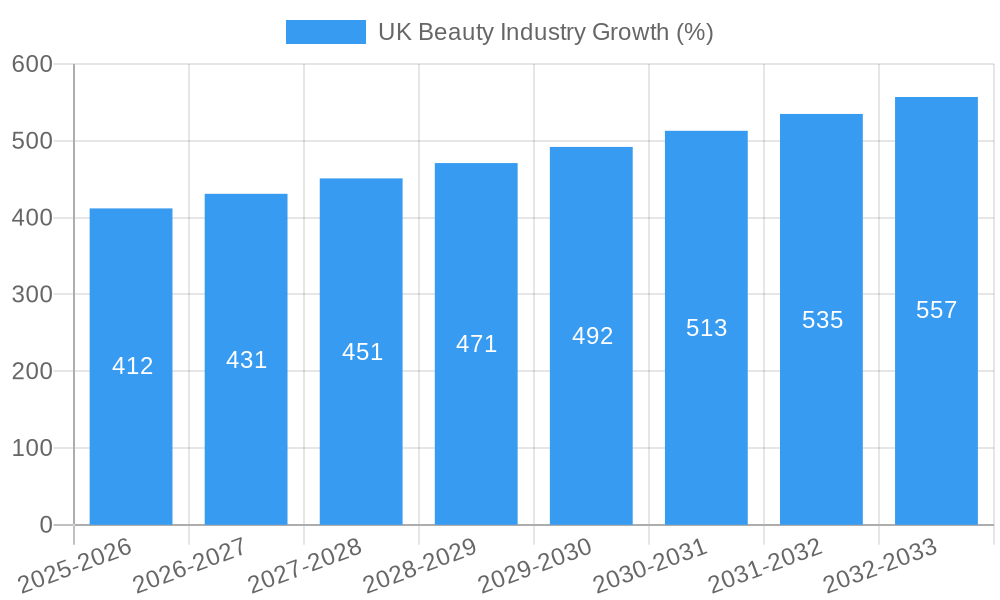

The UK beauty industry, valued at approximately £10 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 4.12% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing disposable incomes among young consumers coupled with a rising trend towards self-care and personal expression are significantly boosting demand for a wide array of products, from color cosmetics and skincare to hair care. The proliferation of social media influencers and beauty bloggers further fuels this trend, creating a constant cycle of new product launches and heightened consumer interest. Premium brands are witnessing particularly strong growth, driven by consumers' willingness to invest in higher-quality, innovative products offering enhanced performance and experience. The shift towards online retail channels is also a notable trend, offering convenience and access to a wider range of products than traditional brick-and-mortar stores. However, economic downturns, fluctuating consumer confidence, and increasing competition from both established players and emerging brands present challenges to sustained growth. Furthermore, growing awareness of sustainability and ethical sourcing is impacting consumer choices, pushing brands to adopt more environmentally friendly practices.

The segmentation of the UK beauty market reveals diverse growth patterns. While mass-market products continue to dominate sales volume, the premium segment is exhibiting a higher growth rate, reflecting the increasing willingness of consumers to spend more on premium products. Within product types, color cosmetics and skincare consistently maintain high demand. However, segments like hair styling and coloring products are also witnessing significant growth, driven by changing trends in hairstyles and hair care routines. Distribution channels show a clear trend towards online retail; however, hypermarkets, supermarkets, and specialty stores still maintain a considerable share of the market. Key players like Unilever, L'Oréal, Estée Lauder, and Shiseido continue to dominate, employing strategies of product innovation, strategic acquisitions, and strong branding to maintain market share. The competitive landscape is, however, intensifying with the emergence of smaller, niche brands focusing on specific consumer needs and ethical sourcing.

UK Beauty Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK beauty industry, covering market dynamics, growth trends, key players, and future opportunities. With a focus on the period 2019-2033 (Base Year: 2025), this report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the evolving UK beauty landscape. The report delves into parent markets (personal care) and child markets (color cosmetics, skincare, haircare), providing granular insights across various segments. The total market size in 2025 is estimated at £xx Billion.

UK Beauty Industry Market Dynamics & Structure

The UK beauty market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is relatively high, with a few multinational giants holding significant shares. Technological innovation, particularly in areas like personalized skincare and sustainable packaging, is a key driver. Stringent regulatory frameworks, including those related to product safety and labeling, shape the competitive landscape. The emergence of natural and organic beauty products presents a significant challenge to traditional players, while e-commerce continues to disrupt traditional distribution channels. Mergers and acquisitions (M&A) activity remains robust, with larger players seeking to expand their portfolios and market reach.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Technological Innovation: AI-powered skincare analysis and personalized product recommendations are gaining traction.

- Regulatory Framework: Compliance with EU cosmetics regulations remains paramount.

- Competitive Substitutes: Natural and organic products pose a growing challenge.

- End-User Demographics: The market is diverse, catering to various age groups, genders, and ethnicities.

- M&A Trends: Consolidation is expected to continue, driving further market concentration. xx M&A deals were recorded between 2019-2024.

UK Beauty Industry Growth Trends & Insights

The UK beauty industry has experienced robust growth over the past few years, driven by several factors including rising disposable incomes, increasing awareness of personal care, and the growing popularity of online retail. The market is expected to maintain a healthy growth trajectory throughout the forecast period. The adoption of innovative technologies, such as augmented reality (AR) and virtual reality (VR) for product try-ons, is further accelerating growth. Changing consumer preferences towards sustainability and ethical sourcing are influencing product development and marketing strategies.

- Market Size Evolution: Market size increased from £xx billion in 2019 to an estimated £xx billion in 2025.

- CAGR (2019-2025): xx%

- Market Penetration: High penetration in urban areas, with increasing penetration in rural areas.

- Technological Disruptions: E-commerce and personalized beauty solutions are reshaping the market.

- Consumer Behavior Shifts: Growing preference for natural, organic, and sustainable products.

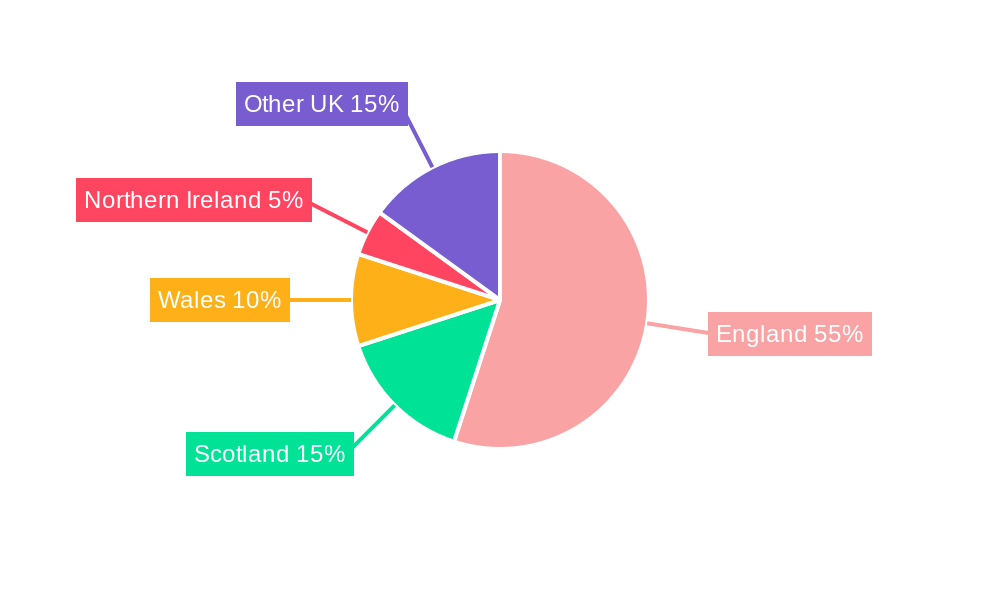

Dominant Regions, Countries, or Segments in UK Beauty Industry

London and other major metropolitan areas dominate the UK beauty market, exhibiting higher purchasing power and greater exposure to new trends. The Premium segment shows strong growth driven by increasing demand for high-quality, luxury products. Online retail channels are experiencing rapid expansion, driven by convenience and wider product selection. Within product types, color cosmetics and hair styling and coloring products remain significant drivers, with lip and nail products showing consistent demand.

- Leading Region: London and other major metropolitan areas.

- Leading Segment (By Category): Premium segment.

- Leading Segment (By Product Type): Color cosmetics and Hair styling & coloring products.

- Leading Segment (By Distribution Channel): Online retail stores.

- Key Drivers: Rising disposable incomes, increased consumer spending on beauty products, and the growing popularity of online shopping.

UK Beauty Industry Product Landscape

The UK beauty market showcases a diverse range of products, from mass-market to premium offerings. Innovations focus on natural ingredients, ethical sourcing, personalized formulations, and advanced technologies for enhanced efficacy and convenience. Unique selling propositions encompass eco-friendly packaging, clinically proven results, and personalized experiences. Technological advancements in product formulation, delivery systems, and packaging are transforming the industry.

Key Drivers, Barriers & Challenges in UK Beauty Industry

Key Drivers:

- Rising Disposable Incomes: Increased consumer spending on discretionary items.

- E-commerce Growth: Convenience and wider product selection drive online sales.

- Technological Advancements: Personalized products and innovative formulations.

Key Challenges:

- Supply Chain Disruptions: Global events and economic uncertainty impact sourcing and distribution.

- Regulatory Compliance: Strict regulations increase compliance costs and complexities.

- Intense Competition: Large multinational players dominate the market, increasing competitive pressure. The market share of the top 5 players is expected to remain xx% in 2033.

Emerging Opportunities in UK Beauty Industry

- Sustainable and Ethical Beauty: Growing consumer demand for eco-friendly and responsibly sourced products.

- Personalized Beauty: Tailored products and services based on individual needs and preferences.

- Men's Grooming: Increasing market segment with significant growth potential.

- Inclusivity and Diversity: Brands that cater to a broader range of skin tones and hair types.

Growth Accelerators in the UK Beauty Industry Industry

Technological advancements such as AI-driven personalization, AR/VR for virtual try-ons, and sustainable packaging are major growth drivers. Strategic partnerships between brands and retailers enhance distribution and market reach. Market expansion into underserved segments and geographical areas contributes to overall market growth.

Key Players Shaping the UK Beauty Industry Market

- Unilever PLC

- Estee Lauder Inc

- Shiseido Company Limited

- LVMH

- Kose Corporation

- Coty Inc

- L'Oreal SA

- Revlon Inc

- Kao Corporation

- Oriflame Cosmetics Global SA

Notable Milestones in UK Beauty Industry Sector

- June 2021: Sephora acquired Feelunique, expanding its online presence in the UK prestige beauty market.

- August 2022: Ariana Grande launched her R.E.M. beauty brand in the UK, boosting the celebrity beauty segment.

- November 2022: Forest Essentials opened its first standalone store in London, marking the expansion of the Indian luxury ayurvedic beauty brand in the UK.

In-Depth UK Beauty Industry Market Outlook

The UK beauty industry is poised for continued growth, driven by ongoing technological innovation, changing consumer preferences, and increasing market penetration in both urban and rural areas. Strategic investments in sustainable practices and personalized beauty solutions will be critical for success. The market is projected to reach £xx billion by 2033, presenting significant opportunities for established players and new entrants alike.

UK Beauty Industry Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Makeup Products

- 1.1.2. Eye Makeup Products

- 1.1.3. Lip and Nail Makeup Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair Colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Hypermarkets/Supermarkets

- 3.2. Specialty Stores

- 3.3. Pharmacy and Drug Stores

- 3.4. Online Retail Stores

- 3.5. Convenience Stores

- 3.6. Other Distribution Channels

UK Beauty Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Beauty Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vegan and Organic Cosmetic Products; Growing Consumer Inclination Towards Grooming and Appearance

- 3.3. Market Restrains

- 3.3.1. High Import Dependency Leading to High Price of the Final Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic Cosmetic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Makeup Products

- 5.1.1.2. Eye Makeup Products

- 5.1.1.3. Lip and Nail Makeup Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair Colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets/Supermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Pharmacy and Drug Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Convenience Stores

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Color Cosmetics

- 6.1.1.1. Facial Makeup Products

- 6.1.1.2. Eye Makeup Products

- 6.1.1.3. Lip and Nail Makeup Products

- 6.1.2. Hair Styling and Coloring Products

- 6.1.2.1. Hair Colors

- 6.1.2.2. Hair Styling Products

- 6.1.1. Color Cosmetics

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass

- 6.2.2. Premium

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets/Supermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Pharmacy and Drug Stores

- 6.3.4. Online Retail Stores

- 6.3.5. Convenience Stores

- 6.3.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Color Cosmetics

- 7.1.1.1. Facial Makeup Products

- 7.1.1.2. Eye Makeup Products

- 7.1.1.3. Lip and Nail Makeup Products

- 7.1.2. Hair Styling and Coloring Products

- 7.1.2.1. Hair Colors

- 7.1.2.2. Hair Styling Products

- 7.1.1. Color Cosmetics

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass

- 7.2.2. Premium

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets/Supermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Pharmacy and Drug Stores

- 7.3.4. Online Retail Stores

- 7.3.5. Convenience Stores

- 7.3.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Color Cosmetics

- 8.1.1.1. Facial Makeup Products

- 8.1.1.2. Eye Makeup Products

- 8.1.1.3. Lip and Nail Makeup Products

- 8.1.2. Hair Styling and Coloring Products

- 8.1.2.1. Hair Colors

- 8.1.2.2. Hair Styling Products

- 8.1.1. Color Cosmetics

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass

- 8.2.2. Premium

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets/Supermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Pharmacy and Drug Stores

- 8.3.4. Online Retail Stores

- 8.3.5. Convenience Stores

- 8.3.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Color Cosmetics

- 9.1.1.1. Facial Makeup Products

- 9.1.1.2. Eye Makeup Products

- 9.1.1.3. Lip and Nail Makeup Products

- 9.1.2. Hair Styling and Coloring Products

- 9.1.2.1. Hair Colors

- 9.1.2.2. Hair Styling Products

- 9.1.1. Color Cosmetics

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass

- 9.2.2. Premium

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets/Supermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Pharmacy and Drug Stores

- 9.3.4. Online Retail Stores

- 9.3.5. Convenience Stores

- 9.3.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Color Cosmetics

- 10.1.1.1. Facial Makeup Products

- 10.1.1.2. Eye Makeup Products

- 10.1.1.3. Lip and Nail Makeup Products

- 10.1.2. Hair Styling and Coloring Products

- 10.1.2.1. Hair Colors

- 10.1.2.2. Hair Styling Products

- 10.1.1. Color Cosmetics

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass

- 10.2.2. Premium

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarkets/Supermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Pharmacy and Drug Stores

- 10.3.4. Online Retail Stores

- 10.3.5. Convenience Stores

- 10.3.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. England UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Unilever PLC*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Estee Lauder Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Shiseido Company Limited

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 LVMH

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kose Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Coty Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 L'Oreal SA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Revlon Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Kao Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Oriflame Cosmetics Global SA

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Unilever PLC*List Not Exhaustive

List of Figures

- Figure 1: Global UK Beauty Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Beauty Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Beauty Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Beauty Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America UK Beauty Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America UK Beauty Industry Revenue (Million), by Category 2024 & 2032

- Figure 7: North America UK Beauty Industry Revenue Share (%), by Category 2024 & 2032

- Figure 8: North America UK Beauty Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America UK Beauty Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America UK Beauty Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America UK Beauty Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America UK Beauty Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: South America UK Beauty Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: South America UK Beauty Industry Revenue (Million), by Category 2024 & 2032

- Figure 15: South America UK Beauty Industry Revenue Share (%), by Category 2024 & 2032

- Figure 16: South America UK Beauty Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America UK Beauty Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America UK Beauty Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America UK Beauty Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe UK Beauty Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe UK Beauty Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe UK Beauty Industry Revenue (Million), by Category 2024 & 2032

- Figure 23: Europe UK Beauty Industry Revenue Share (%), by Category 2024 & 2032

- Figure 24: Europe UK Beauty Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe UK Beauty Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe UK Beauty Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe UK Beauty Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa UK Beauty Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Middle East & Africa UK Beauty Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Middle East & Africa UK Beauty Industry Revenue (Million), by Category 2024 & 2032

- Figure 31: Middle East & Africa UK Beauty Industry Revenue Share (%), by Category 2024 & 2032

- Figure 32: Middle East & Africa UK Beauty Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa UK Beauty Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa UK Beauty Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa UK Beauty Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific UK Beauty Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Asia Pacific UK Beauty Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Asia Pacific UK Beauty Industry Revenue (Million), by Category 2024 & 2032

- Figure 39: Asia Pacific UK Beauty Industry Revenue Share (%), by Category 2024 & 2032

- Figure 40: Asia Pacific UK Beauty Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific UK Beauty Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific UK Beauty Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific UK Beauty Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Beauty Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Beauty Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global UK Beauty Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Global UK Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global UK Beauty Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UK Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: England UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Wales UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Scotland UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Ireland UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UK Beauty Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global UK Beauty Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 14: Global UK Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global UK Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global UK Beauty Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global UK Beauty Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 21: Global UK Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Global UK Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global UK Beauty Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Global UK Beauty Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 28: Global UK Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Global UK Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Beauty Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global UK Beauty Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 41: Global UK Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global UK Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global UK Beauty Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Global UK Beauty Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 51: Global UK Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global UK Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific UK Beauty Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Beauty Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the UK Beauty Industry?

Key companies in the market include Unilever PLC*List Not Exhaustive, Estee Lauder Inc, Shiseido Company Limited, LVMH, Kose Corporation, Coty Inc, L'Oreal SA, Revlon Inc, Kao Corporation, Oriflame Cosmetics Global SA.

3. What are the main segments of the UK Beauty Industry?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vegan and Organic Cosmetic Products; Growing Consumer Inclination Towards Grooming and Appearance.

6. What are the notable trends driving market growth?

Increasing Demand for Organic Cosmetic Products.

7. Are there any restraints impacting market growth?

High Import Dependency Leading to High Price of the Final Products.

8. Can you provide examples of recent developments in the market?

November 2022: Indian luxury ayurvedic beauty brand Forest Essentials strengthened its presence in the United Kingdom by launching its first standalone store in London. Last year, Forest Essentials entered the United Kingdom market by partnering with online beauty retailer Lookfantastic to sell its products online in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Beauty Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Beauty Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Beauty Industry?

To stay informed about further developments, trends, and reports in the UK Beauty Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence