Key Insights

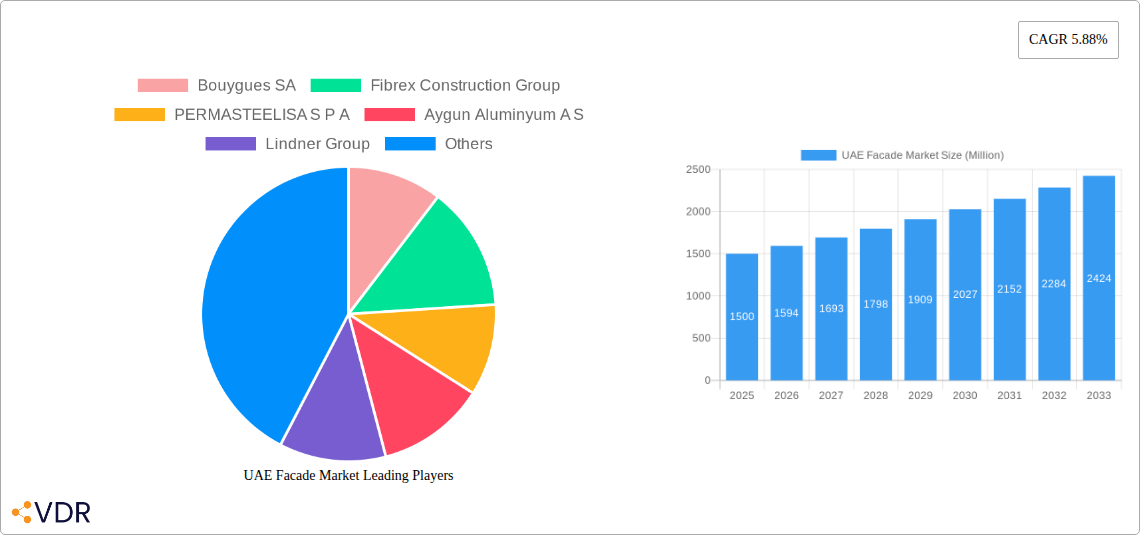

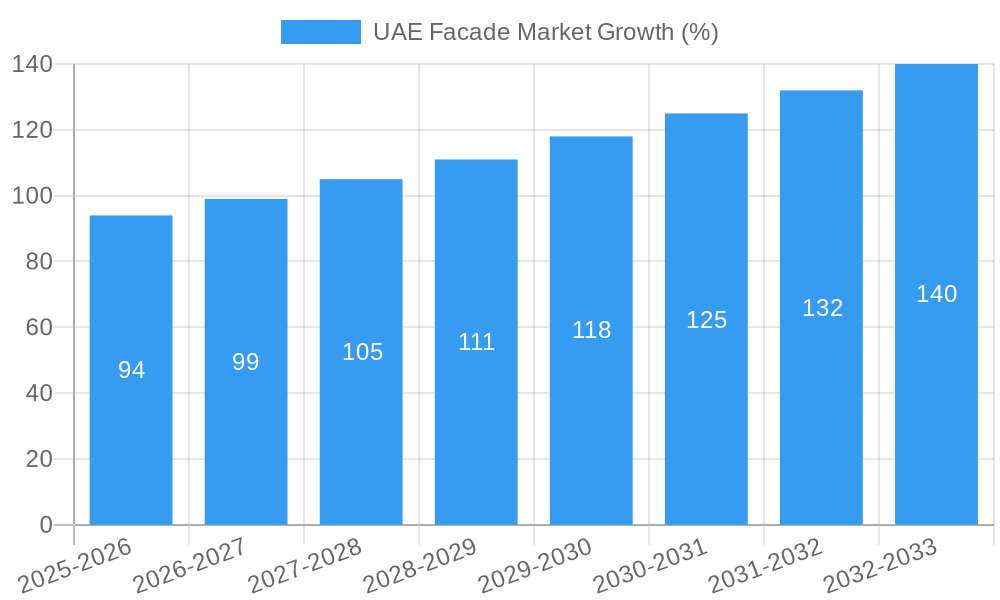

The UAE facade market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.88% from 2025 to 2033. This expansion is driven by several key factors. The UAE's booming construction industry, fueled by large-scale infrastructure projects and a burgeoning real estate sector, significantly contributes to the high demand for aesthetically pleasing and high-performance facades. Furthermore, the increasing adoption of sustainable building practices, a focus on energy efficiency, and the growing preference for innovative facade materials like glass and metal are major market drivers. Government initiatives promoting green building technologies and advancements in facade design and engineering further propel market growth. The market is segmented by type (ventilated, non-ventilated, others), material (glass, metal, plastic and fibres, stones, others), and end-user (commercial, residential, others). While the commercial sector currently dominates, the residential segment is expected to witness significant growth driven by increasing urbanization and luxury housing projects. Competition in the market is intense, with both international and local players vying for market share. Key players such as Bouygues SA, Fibrex Construction Group, and others are continuously innovating and expanding their product offerings to cater to evolving customer needs and preferences. Challenges include fluctuating raw material prices and potential supply chain disruptions, requiring companies to adopt resilient sourcing strategies.

The forecast period (2025-2033) anticipates continued market expansion, although the growth rate may slightly fluctuate due to economic conditions and global events. However, the long-term outlook remains positive given the UAE's ongoing development plans and commitment to sustainable urban development. The market will likely see increased adoption of smart building technologies integrated into facades, further enhancing energy efficiency and building management capabilities. The continued focus on architectural innovation and the demand for customized facade solutions will drive specialization and niche market development within the sector. Companies will need to focus on technological advancements, sustainable solutions, and efficient project management to succeed in this competitive and dynamic environment. The segmentation analysis reveals opportunities for growth across all material and end-user segments, particularly in the residential and sustainable building sectors.

UAE Facade Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE facade market, encompassing market dynamics, growth trends, key players, and future projections. With a focus on the parent market (Construction) and child market (Building Facades), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is projected in Million units.

UAE Facade Market Dynamics & Structure

The UAE facade market is characterized by a moderately concentrated landscape, with several large multinational players competing alongside regional specialists. Technological innovation, driven by the demand for energy-efficient and aesthetically pleasing facades, is a key driver. Stringent building codes and sustainability regulations influence material selection and construction practices. Competitive substitutes, such as traditional cladding materials, are gradually losing market share to advanced facade systems. The end-user demographics are heavily influenced by the construction boom in commercial and residential sectors. M&A activity is moderate, driven by consolidation efforts and expansion strategies among key players.

- Market Concentration: Moderately concentrated, with a xx% market share held by the top 5 players.

- Technological Innovation: Significant focus on sustainable materials, energy-efficient designs, and smart building technologies.

- Regulatory Framework: Strict building codes and environmental regulations promote the use of high-performance facades.

- Competitive Substitutes: Traditional cladding materials facing increasing competition from advanced facade systems.

- End-User Demographics: High demand from commercial and residential construction projects, with a growing focus on sustainability.

- M&A Trends: Moderate level of mergers and acquisitions, aimed at market consolidation and expansion. xx M&A deals recorded between 2019 and 2024.

UAE Facade Market Growth Trends & Insights

The UAE facade market has experienced robust growth over the past few years, fueled by significant investments in infrastructure development and a booming construction sector. The market size is estimated to reach xx Million units in 2025, with a projected CAGR of xx% from 2025 to 2033. Adoption rates of advanced facade systems are increasing, driven by technological advancements and the rising demand for sustainable building solutions. Technological disruptions, such as the integration of smart technologies and Building Information Modeling (BIM), are transforming the industry, improving efficiency and performance. Consumer behavior is shifting towards aesthetically pleasing and sustainable facade solutions, influencing design preferences and material choices.

Dominant Regions, Countries, or Segments in UAE Facade Market

The UAE's major urban centers, including Dubai and Abu Dhabi, dominate the facade market due to ongoing infrastructure development and large-scale construction projects. Within the segments, the ventilated facade type holds the largest market share, driven by its energy efficiency and aesthetic advantages. Glass remains the leading material, owing to its versatility and modern appeal. The commercial sector accounts for a significant portion of the market, driven by the construction of high-rise buildings and large-scale developments.

- Dominant Region: Dubai and Abu Dhabi

- Leading Segment (By Type): Ventilated facades, accounting for xx% of the market in 2025.

- Leading Segment (By Material): Glass, holding xx% of market share in 2025.

- Leading Segment (By End-User): Commercial sector, representing xx% of market demand in 2025.

- Key Drivers: Government investments in infrastructure, economic growth, and increasing adoption of sustainable building practices.

UAE Facade Market Product Landscape

The UAE facade market offers a diverse range of products, from traditional cladding systems to advanced, high-performance facades incorporating smart technologies. Products are differentiated by material, design, energy efficiency, and sustainability features. Innovative features, such as self-cleaning glass and integrated solar panels, are gaining traction. Performance metrics, including thermal insulation, soundproofing, and durability, are key factors influencing purchasing decisions. Unique selling propositions often revolve around energy savings, aesthetic appeal, and ease of maintenance.

Key Drivers, Barriers & Challenges in UAE Facade Market

Key Drivers:

- Rapid urbanization and infrastructure development in the UAE.

- Growing demand for energy-efficient and sustainable buildings.

- Technological advancements in facade materials and design.

- Increasing government initiatives promoting sustainable construction practices.

Key Challenges & Restraints:

- Fluctuations in construction activity and commodity prices.

- Competition from low-cost imports.

- Skilled labor shortages in the construction sector.

- Regulatory compliance requirements and building code complexities. Estimated cost of compliance xx Million units per year.

Emerging Opportunities in UAE Facade Market

- Growing demand for sustainable and eco-friendly facade solutions.

- Increasing adoption of smart building technologies and IoT integration in facades.

- Expansion into niche markets, such as modular and prefabricated facades.

- Focus on improving the aesthetic appeal and design of building facades.

Growth Accelerators in the UAE Facade Market Industry

Technological breakthroughs in materials science and design are accelerating growth. Strategic partnerships between facade manufacturers and construction companies are improving efficiency and quality. Market expansion strategies, including diversification into new segments and regions, are enhancing reach and market penetration. The ongoing focus on sustainable construction is creating new opportunities for energy-efficient and environmentally friendly facade systems.

Key Players Shaping the UAE Facade Market Market

- Bouygues SA

- Fibrex Construction Group

- PERMASTEELISA S P A

- Aygun Aluminyum A S

- Lindner Group

- Ramboll Group A/S

- Meinhardt group

- AFS International BV

- Koltay Facades

- Seele Middle East FZE

Notable Milestones in UAE Facade Market Sector

- July 2022: Completion of the Uptown Tower facade installation in Dubai, showcasing the scale of projects in the market.

- November 2022: Red Sea Global's contract award for the Red Sea International Airport facade highlights the focus on sustainable and energy-efficient designs.

In-Depth UAE Facade Market Market Outlook

The UAE facade market is poised for continued growth, driven by sustained investments in infrastructure, a focus on sustainable construction, and technological advancements. Strategic opportunities exist in developing innovative facade systems, expanding into niche markets, and forging strategic partnerships to capitalize on the region's ongoing construction boom and commitment to sustainable development. The market is expected to experience significant expansion in the coming years, reaching xx Million units by 2033.

UAE Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastic and Fibres

- 2.4. Stones and Others

-

3. End Users

- 3.1. Commercial

- 3.2. Residential

- 3.3. Others

UAE Facade Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Increase in real estate construction throughout the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Facade Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastic and Fibres

- 5.2.4. Stones and Others

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Facade Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ventilated

- 6.1.2. Non-Ventilated

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Glass

- 6.2.2. Metal

- 6.2.3. Plastic and Fibres

- 6.2.4. Stones and Others

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Commercial

- 6.3.2. Residential

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Facade Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ventilated

- 7.1.2. Non-Ventilated

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Glass

- 7.2.2. Metal

- 7.2.3. Plastic and Fibres

- 7.2.4. Stones and Others

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Commercial

- 7.3.2. Residential

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Facade Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ventilated

- 8.1.2. Non-Ventilated

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Glass

- 8.2.2. Metal

- 8.2.3. Plastic and Fibres

- 8.2.4. Stones and Others

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Commercial

- 8.3.2. Residential

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Facade Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ventilated

- 9.1.2. Non-Ventilated

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Glass

- 9.2.2. Metal

- 9.2.3. Plastic and Fibres

- 9.2.4. Stones and Others

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Commercial

- 9.3.2. Residential

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Facade Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ventilated

- 10.1.2. Non-Ventilated

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Glass

- 10.2.2. Metal

- 10.2.3. Plastic and Fibres

- 10.2.4. Stones and Others

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Commercial

- 10.3.2. Residential

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bouygues SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fibrex Construction Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PERMASTEELISA S P A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aygun Aluminyum A S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lindner Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ramboll Group A/S

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Meinhardt group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AFS International BV**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koltay Facades

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seele Middle East FZE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bouygues SA

List of Figures

- Figure 1: Global UAE Facade Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Facade Market Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Facade Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Facade Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UAE Facade Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UAE Facade Market Revenue (Million), by Material 2024 & 2032

- Figure 7: North America UAE Facade Market Revenue Share (%), by Material 2024 & 2032

- Figure 8: North America UAE Facade Market Revenue (Million), by End Users 2024 & 2032

- Figure 9: North America UAE Facade Market Revenue Share (%), by End Users 2024 & 2032

- Figure 10: North America UAE Facade Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America UAE Facade Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America UAE Facade Market Revenue (Million), by Type 2024 & 2032

- Figure 13: South America UAE Facade Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America UAE Facade Market Revenue (Million), by Material 2024 & 2032

- Figure 15: South America UAE Facade Market Revenue Share (%), by Material 2024 & 2032

- Figure 16: South America UAE Facade Market Revenue (Million), by End Users 2024 & 2032

- Figure 17: South America UAE Facade Market Revenue Share (%), by End Users 2024 & 2032

- Figure 18: South America UAE Facade Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America UAE Facade Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe UAE Facade Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe UAE Facade Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe UAE Facade Market Revenue (Million), by Material 2024 & 2032

- Figure 23: Europe UAE Facade Market Revenue Share (%), by Material 2024 & 2032

- Figure 24: Europe UAE Facade Market Revenue (Million), by End Users 2024 & 2032

- Figure 25: Europe UAE Facade Market Revenue Share (%), by End Users 2024 & 2032

- Figure 26: Europe UAE Facade Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe UAE Facade Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa UAE Facade Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East & Africa UAE Facade Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East & Africa UAE Facade Market Revenue (Million), by Material 2024 & 2032

- Figure 31: Middle East & Africa UAE Facade Market Revenue Share (%), by Material 2024 & 2032

- Figure 32: Middle East & Africa UAE Facade Market Revenue (Million), by End Users 2024 & 2032

- Figure 33: Middle East & Africa UAE Facade Market Revenue Share (%), by End Users 2024 & 2032

- Figure 34: Middle East & Africa UAE Facade Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa UAE Facade Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific UAE Facade Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Asia Pacific UAE Facade Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific UAE Facade Market Revenue (Million), by Material 2024 & 2032

- Figure 39: Asia Pacific UAE Facade Market Revenue Share (%), by Material 2024 & 2032

- Figure 40: Asia Pacific UAE Facade Market Revenue (Million), by End Users 2024 & 2032

- Figure 41: Asia Pacific UAE Facade Market Revenue Share (%), by End Users 2024 & 2032

- Figure 42: Asia Pacific UAE Facade Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific UAE Facade Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UAE Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Global UAE Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 5: Global UAE Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UAE Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global UAE Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global UAE Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 9: Global UAE Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 10: Global UAE Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global UAE Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global UAE Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 16: Global UAE Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 17: Global UAE Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global UAE Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global UAE Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 23: Global UAE Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 24: Global UAE Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global UAE Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global UAE Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 36: Global UAE Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 37: Global UAE Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UAE Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global UAE Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 46: Global UAE Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 47: Global UAE Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific UAE Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Facade Market?

The projected CAGR is approximately 5.88%.

2. Which companies are prominent players in the UAE Facade Market?

Key companies in the market include Bouygues SA, Fibrex Construction Group, PERMASTEELISA S P A, Aygun Aluminyum A S, Lindner Group, Ramboll Group A/S, Meinhardt group, AFS International BV**List Not Exhaustive, Koltay Facades, Seele Middle East FZE.

3. What are the main segments of the UAE Facade Market?

The market segments include Type, Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Increase in real estate construction throughout the country.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

November 2022 - Red Sea Global (RSG), the developer behind the world's most ambitious regenerative tourism destinations, The Red Sea and Amaala, has awarded a major contract to Reem Emirates Saudi for the construction of the façade and roof shell of the Red Sea International (RSI) airport's landside facilities. The new Red Sea airport will include shaded areas and natural ventilation, reducing the need for air conditioning. It will have five mini-terminals, which will allow areas to be closed during slower activity periods, reducing the need for air conditioning in all sections and wasting energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Facade Market?

To stay informed about further developments, trends, and reports in the UAE Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence