Key Insights

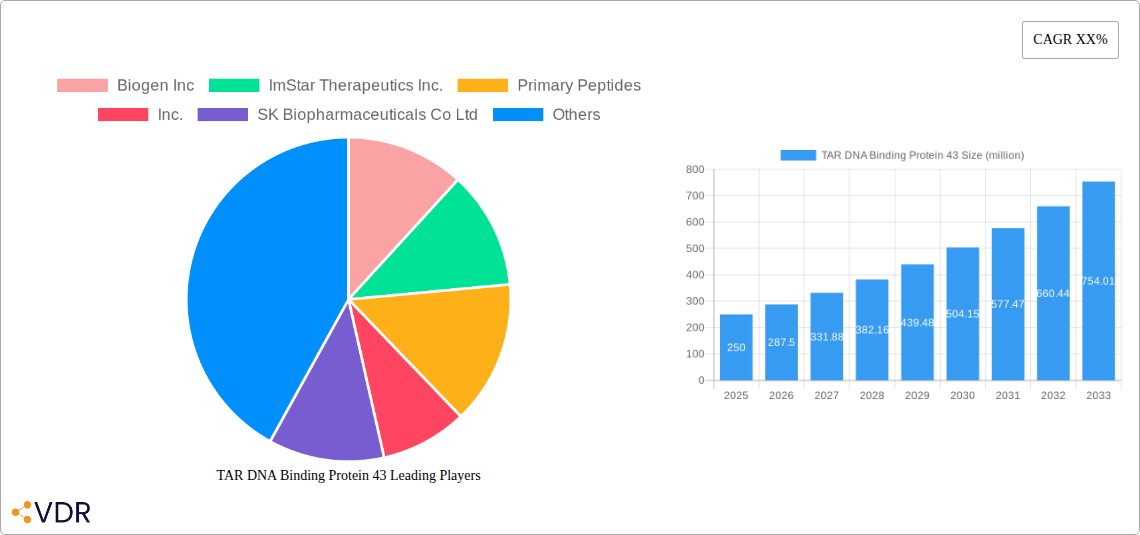

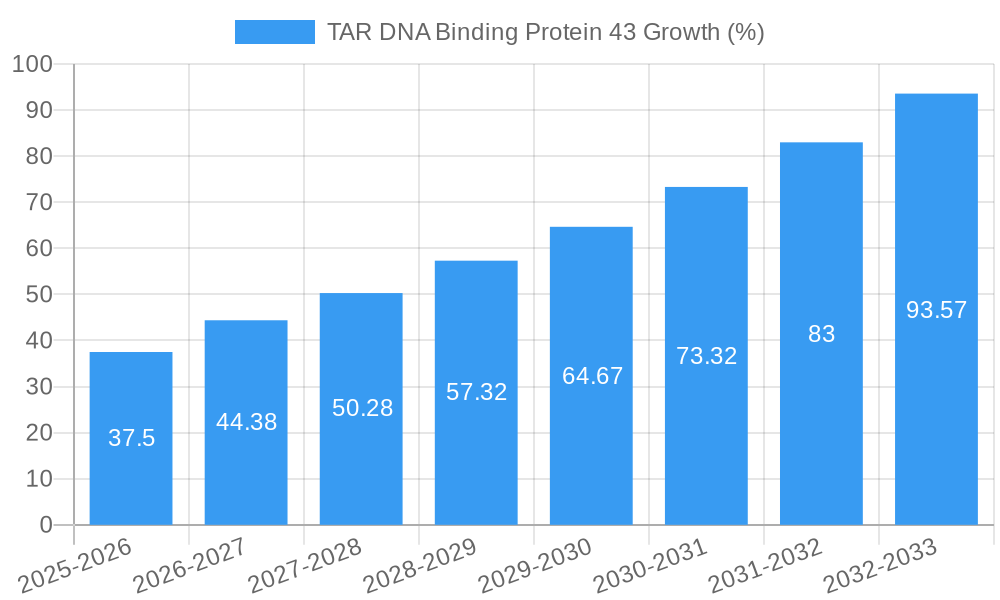

The TAR DNA-binding protein 43 (TDP-43) therapeutics market is poised for significant growth, driven by the increasing prevalence of neurodegenerative diseases like amyotrophic lateral sclerosis (ALS) and frontotemporal dementia (FTD), where TDP-43 pathology plays a crucial role. While precise market sizing data is unavailable, considering the substantial unmet medical need and the intense research activity focused on TDP-43, a conservative estimate places the 2025 market value at approximately $250 million. The compound annual growth rate (CAGR) is projected to be robust, potentially exceeding 15% between 2025 and 2033, reflecting the anticipated influx of novel therapies entering various stages of clinical development. Key drivers include the rising global geriatric population, heightened awareness of neurodegenerative diseases, and substantial investments in research and development by both large pharmaceutical companies and smaller biotech firms. However, challenges remain, including the complexities inherent in developing effective treatments for these intricate diseases, the need for robust clinical trial designs to demonstrate efficacy, and potential regulatory hurdles. Successful navigation of these challenges will be critical in unlocking the substantial market potential.

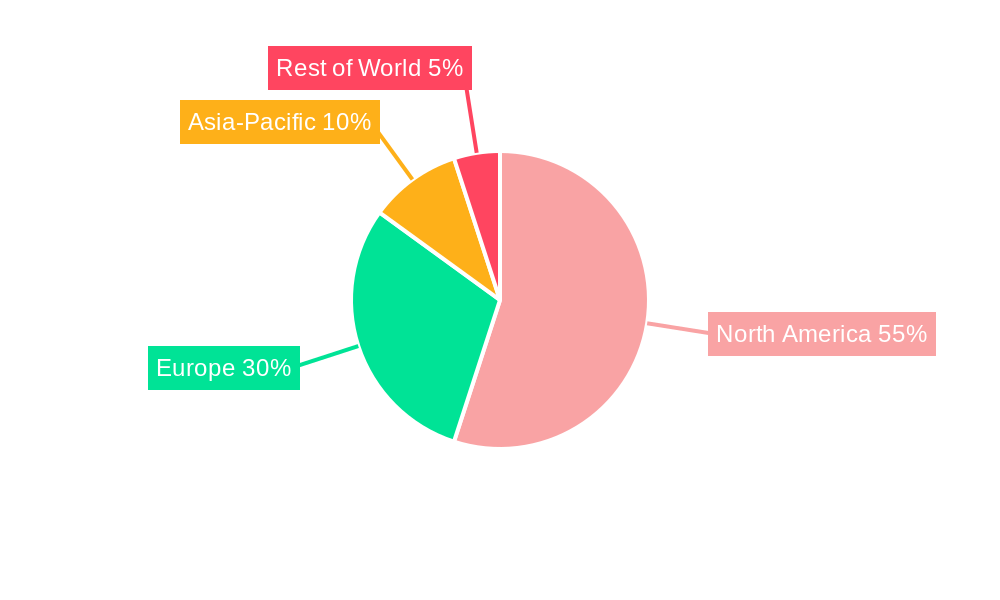

The market segmentation will likely be driven by the specific therapeutic modalities, with potential segments including small molecule inhibitors, gene therapies, and antibody-based approaches. Companies like Biogen, ImStar Therapeutics, Primary Peptides, SK Biopharmaceuticals, and TauRx Therapeutics are actively engaged in this space, contributing to a competitive landscape marked by both established players and emerging innovative companies. Regional variations will likely reflect the prevalence of TDP-43 related diseases and healthcare infrastructure; North America and Europe are expected to dominate the market initially, followed by gradual expansion into Asia-Pacific and other regions. The long-term forecast hinges on the successful translation of preclinical findings into effective and safe therapies that can demonstrably improve patient outcomes, creating a significant commercial opportunity for companies at the forefront of TDP-43 research.

TAR DNA Binding Protein 43 (TDP-43) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global TAR DNA Binding Protein 43 (TDP-43) market, offering invaluable insights for industry professionals, investors, and researchers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report leverages extensive primary and secondary research to provide a thorough understanding of market dynamics, growth trends, and future opportunities within the neurodegenerative disease therapeutics market (parent market) and the TDP-43 focused therapeutics sub-segment (child market).

TAR DNA Binding Protein 43 Market Dynamics & Structure

The TDP-43 market, a segment within the larger neurodegenerative disease therapeutics market (valued at xx million in 2024), exhibits a moderately consolidated structure. Several key players are driving innovation, while smaller companies focus on niche applications. The market is influenced by stringent regulatory frameworks, particularly in the pharmaceutical sector. Competitive pressures arise from substitute therapies targeting similar neurodegenerative conditions. M&A activity within the TDP-43 space has been moderate (xx deals in the historical period), with larger companies acquiring smaller biotech firms to expand their pipelines. End-user demographics are primarily focused on patients diagnosed with amyotrophic lateral sclerosis (ALS) and frontotemporal dementia (FTD).

- Market Concentration: Moderately Consolidated (Top 5 players hold xx% market share in 2024).

- Technological Innovation Drivers: Next-generation sequencing, CRISPR-Cas9 gene editing, and advanced drug delivery systems.

- Regulatory Framework: Stringent approvals for novel therapeutics, impacting time-to-market and development costs.

- Competitive Product Substitutes: Existing treatments for ALS and FTD, including Riluzole and other supportive care options.

- M&A Trends: Moderate activity, driven by strategic acquisitions of early-stage companies possessing promising TDP-43 targeted therapies.

- Innovation Barriers: High R&D costs, complex disease mechanisms, and challenges in achieving clinical efficacy.

TAR DNA Binding Protein 43 Growth Trends & Insights

The TDP-43 market is projected to experience significant growth during the forecast period, driven by a rising prevalence of ALS and FTD, coupled with increased investment in research and development of targeted therapies. The market size is expected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period. Adoption rates are influenced by factors like efficacy, safety profiles, and reimbursement policies. Technological advancements, such as improved diagnostic tools and biomarker identification, are contributing to early detection and more targeted treatment approaches. Consumer behavior is shifting towards personalized medicine, fueling demand for therapies tailored to specific patient subgroups.

Dominant Regions, Countries, or Segments in TAR DNA Binding Protein 43

North America currently dominates the TDP-43 market, driven by higher healthcare expenditure, robust regulatory frameworks supporting clinical trials, and a large patient pool. Europe follows closely, with significant contributions from Western European nations. The Asia-Pacific region is projected to witness the fastest growth, fueled by increasing healthcare investments and rising disease prevalence.

- Key Drivers (North America): Strong research infrastructure, high healthcare expenditure, and advanced healthcare systems.

- Key Drivers (Europe): Established pharmaceutical industry, governmental funding for research, and growing awareness of TDP-43-related diseases.

- Key Drivers (Asia-Pacific): Increasing healthcare spending, rising disease prevalence, and expanding pharmaceutical markets.

TAR DNA Binding Protein 43 Product Landscape

The TDP-43 product landscape comprises a range of therapeutic modalities, including small molecules, antibody-based therapies, and gene therapies. These products are designed to either directly target TDP-43 protein aggregation or modulate downstream pathways contributing to neurodegeneration. Technological advancements are focused on improving drug delivery systems to enhance efficacy and reducing side effects. Unique selling propositions often emphasize the potential to slow disease progression or improve patient outcomes.

Key Drivers, Barriers & Challenges in TAR DNA Binding Protein 43

Key Drivers:

- Growing prevalence of ALS and FTD.

- Increased research funding and investment.

- Technological advancements in drug discovery and development.

Challenges & Restraints:

- High R&D costs and lengthy clinical trials.

- Complex disease mechanisms and challenges in translating pre-clinical findings to clinical success.

- Potential for adverse effects and safety concerns.

Emerging Opportunities in TAR DNA Binding Protein 43

- Development of novel diagnostic tools for early disease detection.

- Exploration of combination therapies targeting multiple pathways involved in TDP-43-mediated neurodegeneration.

- Expansion into underserved markets with limited access to current therapies.

Growth Accelerators in the TAR DNA Binding Protein 43 Industry

Strategic partnerships between pharmaceutical companies and academic institutions are accelerating innovation and driving the development of novel therapies. Technological breakthroughs in gene editing and targeted drug delivery are improving treatment efficacy and reducing adverse effects. Expanding clinical trial networks are increasing patient access to investigational therapies, creating opportunities for data collection and improved understanding of the disease process.

Key Players Shaping the TAR DNA Binding Protein 43 Market

- Biogen Inc

- ImStar Therapeutics Inc.

- Primary Peptides, Inc.

- SK Biopharmaceuticals Co Ltd

- TauRx Therapeutics Ltd

Notable Milestones in TAR DNA Binding Protein 43 Sector

- 2022 Q4: Biogen announced initiation of Phase II clinical trial for a novel TDP-43 inhibitor.

- 2023 Q1: ImStar Therapeutics secured Series A funding to advance its TDP-43-targeted therapy.

- 2024 Q2: SK Biopharmaceuticals partnered with a research institution to explore new drug targets related to TDP-43 aggregation.

In-Depth TAR DNA Binding Protein 43 Market Outlook

The TDP-43 market holds significant long-term growth potential, driven by unmet medical needs, technological advancements, and expanding research efforts. Strategic collaborations, focused on developing next-generation therapies and expanding into new markets, represent significant strategic opportunities for companies operating in this space. The future holds promise for the development of effective and targeted therapies that improve the lives of patients affected by ALS and FTD.

TAR DNA Binding Protein 43 Segmentation

-

1. Application

- 1.1. Research Center

- 1.2. Hospital

- 1.3. Clinic

- 1.4. Others

-

2. Types

- 2.1. TRx-0237

- 2.2. IMS-088

- 2.3. NI-205

- 2.4. Others

TAR DNA Binding Protein 43 Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

TAR DNA Binding Protein 43 REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TAR DNA Binding Protein 43 Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Research Center

- 5.1.2. Hospital

- 5.1.3. Clinic

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. TRx-0237

- 5.2.2. IMS-088

- 5.2.3. NI-205

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America TAR DNA Binding Protein 43 Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Research Center

- 6.1.2. Hospital

- 6.1.3. Clinic

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. TRx-0237

- 6.2.2. IMS-088

- 6.2.3. NI-205

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America TAR DNA Binding Protein 43 Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Research Center

- 7.1.2. Hospital

- 7.1.3. Clinic

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. TRx-0237

- 7.2.2. IMS-088

- 7.2.3. NI-205

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe TAR DNA Binding Protein 43 Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Research Center

- 8.1.2. Hospital

- 8.1.3. Clinic

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. TRx-0237

- 8.2.2. IMS-088

- 8.2.3. NI-205

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa TAR DNA Binding Protein 43 Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Research Center

- 9.1.2. Hospital

- 9.1.3. Clinic

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. TRx-0237

- 9.2.2. IMS-088

- 9.2.3. NI-205

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific TAR DNA Binding Protein 43 Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Research Center

- 10.1.2. Hospital

- 10.1.3. Clinic

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. TRx-0237

- 10.2.2. IMS-088

- 10.2.3. NI-205

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Biogen Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ImStar Therapeutics Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Primary Peptides

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SK Biopharmaceuticals Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TauRx Therapeutics Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Biogen Inc

List of Figures

- Figure 1: Global TAR DNA Binding Protein 43 Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America TAR DNA Binding Protein 43 Revenue (million), by Application 2024 & 2032

- Figure 3: North America TAR DNA Binding Protein 43 Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America TAR DNA Binding Protein 43 Revenue (million), by Types 2024 & 2032

- Figure 5: North America TAR DNA Binding Protein 43 Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America TAR DNA Binding Protein 43 Revenue (million), by Country 2024 & 2032

- Figure 7: North America TAR DNA Binding Protein 43 Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America TAR DNA Binding Protein 43 Revenue (million), by Application 2024 & 2032

- Figure 9: South America TAR DNA Binding Protein 43 Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America TAR DNA Binding Protein 43 Revenue (million), by Types 2024 & 2032

- Figure 11: South America TAR DNA Binding Protein 43 Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America TAR DNA Binding Protein 43 Revenue (million), by Country 2024 & 2032

- Figure 13: South America TAR DNA Binding Protein 43 Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe TAR DNA Binding Protein 43 Revenue (million), by Application 2024 & 2032

- Figure 15: Europe TAR DNA Binding Protein 43 Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe TAR DNA Binding Protein 43 Revenue (million), by Types 2024 & 2032

- Figure 17: Europe TAR DNA Binding Protein 43 Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe TAR DNA Binding Protein 43 Revenue (million), by Country 2024 & 2032

- Figure 19: Europe TAR DNA Binding Protein 43 Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa TAR DNA Binding Protein 43 Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa TAR DNA Binding Protein 43 Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa TAR DNA Binding Protein 43 Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa TAR DNA Binding Protein 43 Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa TAR DNA Binding Protein 43 Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa TAR DNA Binding Protein 43 Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific TAR DNA Binding Protein 43 Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific TAR DNA Binding Protein 43 Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific TAR DNA Binding Protein 43 Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific TAR DNA Binding Protein 43 Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific TAR DNA Binding Protein 43 Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific TAR DNA Binding Protein 43 Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global TAR DNA Binding Protein 43 Revenue million Forecast, by Country 2019 & 2032

- Table 41: China TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific TAR DNA Binding Protein 43 Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TAR DNA Binding Protein 43?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the TAR DNA Binding Protein 43?

Key companies in the market include Biogen Inc, ImStar Therapeutics Inc., Primary Peptides, Inc., SK Biopharmaceuticals Co Ltd, TauRx Therapeutics Ltd.

3. What are the main segments of the TAR DNA Binding Protein 43?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TAR DNA Binding Protein 43," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TAR DNA Binding Protein 43 report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TAR DNA Binding Protein 43?

To stay informed about further developments, trends, and reports in the TAR DNA Binding Protein 43, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence