Key Insights

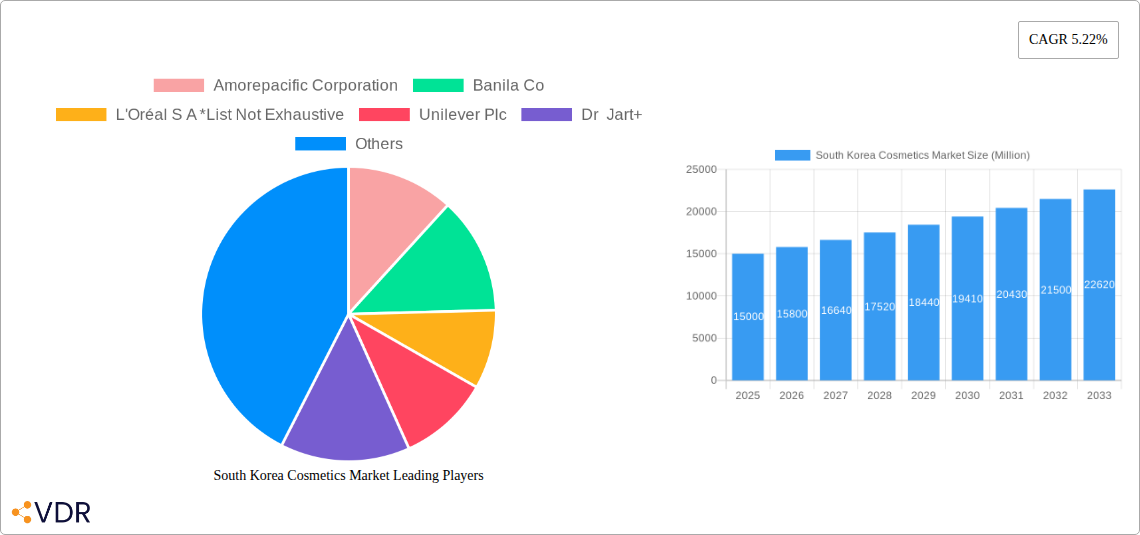

The South Korean cosmetics market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. A strong emphasis on skincare and innovative product development within the K-beauty sector fuels consumer demand, both domestically and internationally. The rising disposable incomes among South Korean consumers, coupled with a culture that prioritizes personal appearance and beauty, significantly contributes to market expansion. Furthermore, the increasing popularity of online retail channels and the widespread adoption of e-commerce platforms provide convenient access to a wider range of products, boosting sales. The market is segmented by product type (personal care, hair care, skincare, bath & shower, oral care, deodorants & antiperspirants), category (premium, mass), and distribution channel (specialty stores, supermarkets/hypermarkets, convenience stores, pharmacies, online retail). The prevalence of premium products reflects the high value placed on quality and efficacy within the South Korean consumer base. However, the market also sees significant sales within the mass product segment, indicating a broad appeal across various income levels. While the exact figures for each segment are unavailable, their relative sizes reflect established market trends. The strong presence of major international and domestic players such as Amorepacific, L'Oréal, and Unilever indicates a highly competitive landscape characterized by continuous innovation and brand loyalty.

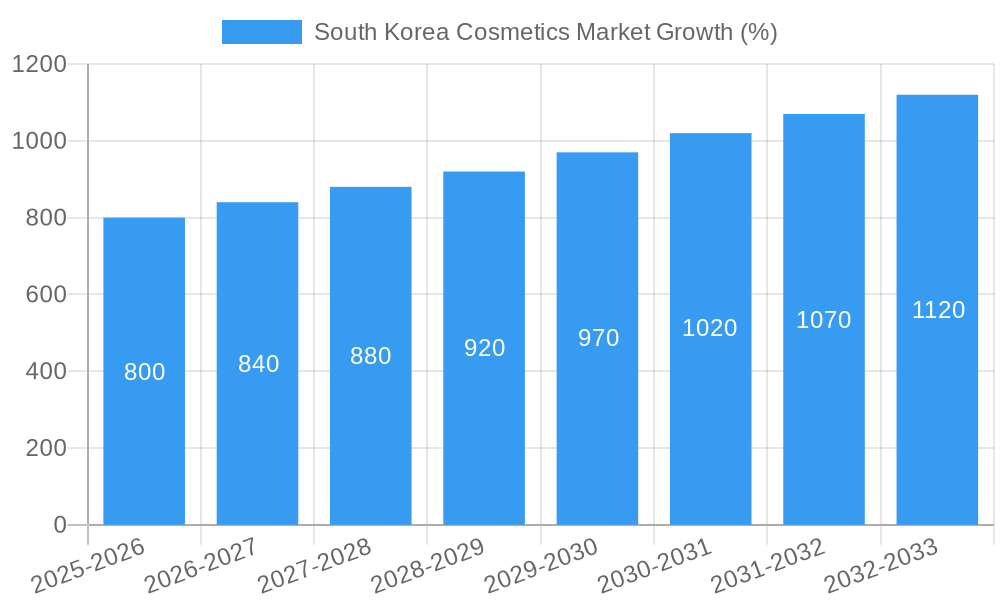

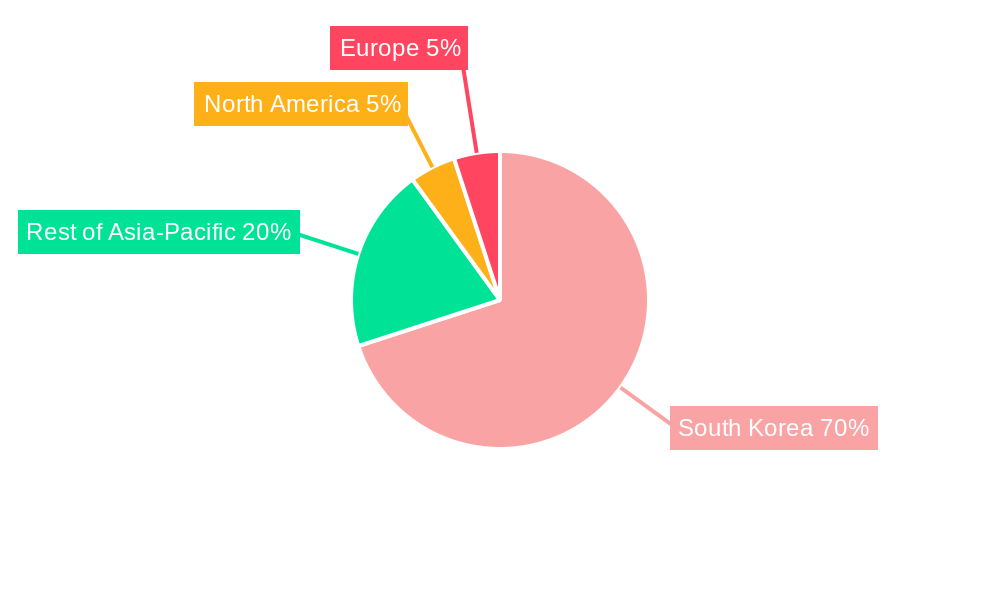

The projected Compound Annual Growth Rate (CAGR) of 5.22% from 2025 to 2033 suggests a sustained period of market expansion. This growth trajectory is likely to be influenced by ongoing trends such as the increasing integration of technology into the beauty industry (e.g., personalized skincare recommendations, virtual try-on tools), the rising popularity of natural and organic ingredients, and a growing focus on sustainability and ethical sourcing. Despite potential economic fluctuations and competitive pressures, the South Korean cosmetics market's inherent strengths, such as strong consumer demand and innovation within the K-beauty sector, are poised to ensure continued growth. The Asia-Pacific region, particularly China, Japan, and other markets in the region, offer significant opportunities for expansion through exports and international brand recognition.

South Korea Cosmetics Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the South Korea cosmetics market, covering the period 2019-2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering valuable insights for industry professionals, investors, and strategists. The report leverages extensive data analysis to forecast market growth and identify lucrative opportunities within this dynamic sector. The base year for this report is 2025, with estimates and forecasts extending to 2033.

South Korea Cosmetics Market Dynamics & Structure

The South Korean cosmetics market is characterized by a complex interplay of factors influencing its structure and growth. Market concentration is relatively high, with a few major players dominating the landscape. However, the presence of numerous smaller, specialized brands creates a vibrant and competitive environment. Technological innovation, particularly in areas like personalized skincare and advanced formulations, is a key driver, while stringent regulatory frameworks and evolving consumer preferences significantly shape market dynamics. The market also witnesses considerable M&A activity, as larger players strategically expand their product portfolios and market reach.

- Market Concentration: Amorepacific Corporation and LG Household & Health Care hold significant market share, but smaller players exhibit strong growth. The market share of top 5 players in 2024 is estimated at xx%.

- Technological Innovation: Focus on K-beauty trends, personalized cosmetics, and innovative ingredients. Barriers to innovation include high R&D costs and stringent regulatory approvals.

- Regulatory Framework: Stringent regulations regarding ingredient safety and labeling influence product development and marketing strategies.

- Competitive Substitutes: The market faces competition from other personal care categories, like natural remedies and traditional medicine.

- End-User Demographics: The market is driven by a young, tech-savvy, and highly discerning consumer base, particularly interested in innovative and personalized products.

- M&A Trends: The number of M&A deals in the South Korean cosmetics market from 2019-2024 is estimated at xx, reflecting strategic expansions and market consolidation.

South Korea Cosmetics Market Growth Trends & Insights

The South Korea cosmetics market experienced significant growth during the historical period (2019-2024), driven by factors such as increasing disposable incomes, rising consumer awareness of beauty and personal care, and the global popularity of K-beauty trends. The market exhibits a strong preference for premium and innovative products, with a growing demand for personalized skincare solutions. Technological disruptions, including the rise of e-commerce and personalized beauty tech, have further accelerated market growth. The CAGR for the market during 2019-2024 is estimated at xx%, and is projected to reach xx Million units by 2025, with a forecast CAGR of xx% from 2025 to 2033. This growth is fueled by the increasing adoption of innovative products, evolving consumer preferences, and the expansion of online retail channels. The market penetration of online cosmetics sales is expected to increase significantly in the forecast period. Consumer behavior shifts towards natural and organic products present both opportunities and challenges for brands.

Dominant Regions, Countries, or Segments in South Korea Cosmetics Market

The South Korean cosmetics market is largely concentrated within the country itself, with Seoul and other major metropolitan areas showing the highest consumption rates. The skincare segment, particularly facial care products, represents the largest portion of the market, followed by cosmetics/makeup products. Premium products enjoy higher price points and cater to the discerning consumer base. Online retail channels are experiencing rapid growth, surpassing traditional retail channels in terms of market share increase.

- Dominant Segment: Skincare (Facial Care Products) accounts for xx% of the market in 2025.

- Growth Drivers: Rising disposable income, increasing awareness of beauty and personal care, and the popularity of K-beauty globally.

- Distribution Channel Trends: Online retail is gaining dominance, though specialty stores maintain a significant share. Supermarkets/hypermarkets and pharmacies also contribute to overall market sales.

South Korea Cosmetics Market Product Landscape

The South Korean cosmetics market showcases a diverse range of products characterized by innovative formulations, unique textures, and advanced technologies. This includes high-performance skincare products, sophisticated makeup lines, and increasingly popular natural and organic options. Products emphasize efficacy, multi-functionality, and convenience, aligning with the fast-paced lifestyle of Korean consumers. Unique selling propositions often include advanced ingredient technologies, luxurious packaging, and strong brand storytelling. The market is witnessing the integration of beauty technology into products and services, such as personalized skincare recommendations and digitally enhanced makeup application tools.

Key Drivers, Barriers & Challenges in South Korea Cosmetics Market

Key Drivers:

- Strong K-beauty global influence

- High disposable income among Korean consumers

- Technological advancements in product formulation and delivery.

Challenges and Restraints:

- Intense competition from both domestic and international brands.

- Stringent regulatory environment impacting product development and launch timelines.

- Fluctuations in raw material prices influencing product costs.

Emerging Opportunities in South Korea Cosmetics Market

- Expanding into niche segments like personalized cosmetics and men's grooming.

- Leveraging the growth of online channels and social media for marketing and sales.

- Developing sustainable and ethically sourced products aligning with growing consumer demands.

Growth Accelerators in the South Korea Cosmetics Market Industry

Strategic partnerships between Korean and international brands will drive market growth, expanding product reach and introducing new technologies and formulations. Technological breakthroughs in areas like personalized skincare, AI-driven beauty solutions, and innovative packaging will further accelerate market growth, while expansion into new geographical markets and product categories will create fresh opportunities for both domestic and international players.

Key Players Shaping the South Korea Cosmetics Market Market

- Amorepacific Corporation

- Banila Co

- L'Oréal S A

- Unilever Plc

- Dr Jart+

- PFD Co Ltd

- The Face Shop (LG Household & Health Care)

- Clubclio Co Ltd

- Nature Republic

- SON&PARK

Notable Milestones in South Korea Cosmetics Market Sector

- May 2021: Amorepacific launched the 'Bathbot' customized bath bomb service.

- September 2022: Amorepacific acquired Tata Harper, expanding its luxury clean beauty portfolio.

- January 2022: L'Oréal introduced Colorsonic and Copyright, innovative beauty technology devices.

In-Depth South Korea Cosmetics Market Market Outlook

The South Korea cosmetics market holds significant future potential driven by ongoing innovation, evolving consumer preferences, and the continued global popularity of K-beauty. Strategic partnerships, expansion into new markets, and the adoption of cutting-edge technologies will shape market dynamics, creating attractive opportunities for both established players and new entrants. The market's ability to adapt to consumer trends and regulatory changes will be key to sustaining long-term growth and achieving market leadership.

South Korea Cosmetics Market Segmentation

-

1. Product Type

-

1.1. Personal Care Products

-

1.1.1. Hair Care

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioner

- 1.1.1.3. Others

-

1.1.2. Skin Care

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

-

1.1.3. Bath and Shower

- 1.1.3.1. Shower Gels

- 1.1.3.2. Soaps

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrush

- 1.1.4.2. Toothpaste

- 1.1.4.3. Mouthwashes and Rinses

- 1.1.5. Men's Grooming Products

- 1.1.6. Deodrants and Antiperspirants

-

1.1.1. Hair Care

-

1.2. Cosmetics/Make-up Products

- 1.2.1. Facial Cosmetics

- 1.2.2. Eye Cosmetics

- 1.2.3. Lip and Nail Make-up Products

- 1.2.4. Hair Styling and Coloring

-

1.1. Personal Care Products

-

2. Category

- 2.1. Premium Products

- 2.2. Mass Products

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience Stores

- 3.4. Pharmacies/Drug Stores

- 3.5. Online Retail Channels

- 3.6. Other Distribution Channels

South Korea Cosmetics Market Segmentation By Geography

- 1. South Korea

South Korea Cosmetics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Growing Demand for Halal Cosmetics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care Products

- 5.1.1.1. Hair Care

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioner

- 5.1.1.1.3. Others

- 5.1.1.2. Skin Care

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Shower Gels

- 5.1.1.3.2. Soaps

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrush

- 5.1.1.4.2. Toothpaste

- 5.1.1.4.3. Mouthwashes and Rinses

- 5.1.1.5. Men's Grooming Products

- 5.1.1.6. Deodrants and Antiperspirants

- 5.1.1.1. Hair Care

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Facial Cosmetics

- 5.1.2.2. Eye Cosmetics

- 5.1.2.3. Lip and Nail Make-up Products

- 5.1.2.4. Hair Styling and Coloring

- 5.1.1. Personal Care Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Premium Products

- 5.2.2. Mass Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience Stores

- 5.3.4. Pharmacies/Drug Stores

- 5.3.5. Online Retail Channels

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 8. India South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific South Korea Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Amorepacific Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Banila Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 L'Oréal S A *List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Unilever Plc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dr Jart+

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PFD Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Face Shop (LG Household & Health Care)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Clubclio Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nature Republic

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 SON&PARK

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Amorepacific Corporation

List of Figures

- Figure 1: South Korea Cosmetics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Cosmetics Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Cosmetics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Korea Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: South Korea Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: South Korea Cosmetics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Korea Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China South Korea Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan South Korea Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India South Korea Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea South Korea Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan South Korea Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia South Korea Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific South Korea Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Korea Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: South Korea Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 16: South Korea Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: South Korea Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Cosmetics Market?

The projected CAGR is approximately 5.22%.

2. Which companies are prominent players in the South Korea Cosmetics Market?

Key companies in the market include Amorepacific Corporation, Banila Co, L'Oréal S A *List Not Exhaustive, Unilever Plc, Dr Jart+, PFD Co Ltd, The Face Shop (LG Household & Health Care), Clubclio Co Ltd, Nature Republic, SON&PARK.

3. What are the main segments of the South Korea Cosmetics Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Growing Demand for Halal Cosmetics.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

January 2022: The L'Oréal Group introduced Colorsonic and Copyright, two cutting-edge innovations in beauty technology for customers and hairstylists. Both are portable, light devices with color applications. Colorsonic is for consumer use and Copyright for hair salons.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Cosmetics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Cosmetics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Cosmetics Market?

To stay informed about further developments, trends, and reports in the South Korea Cosmetics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence