Key Insights

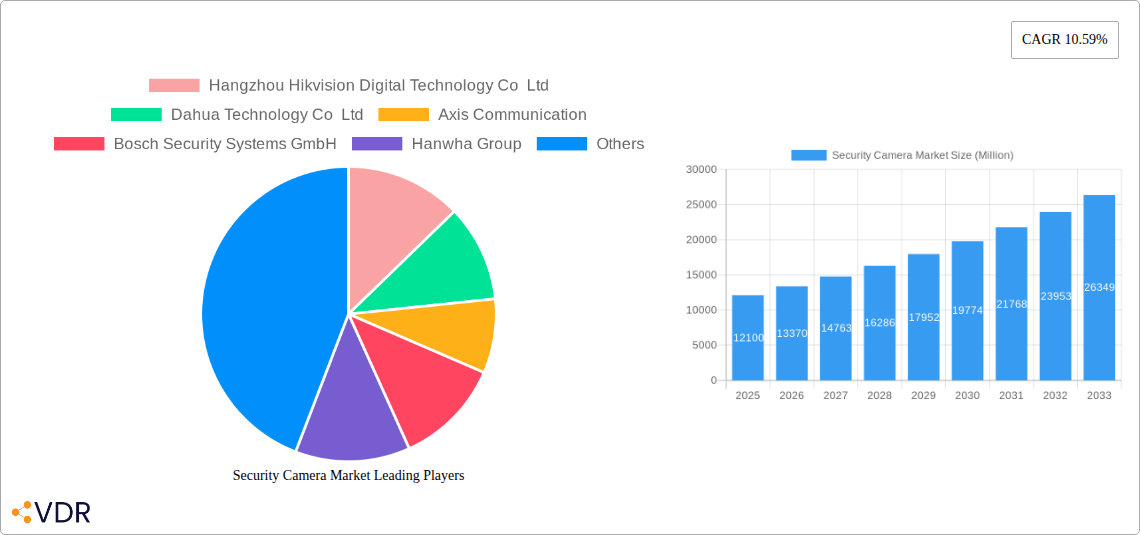

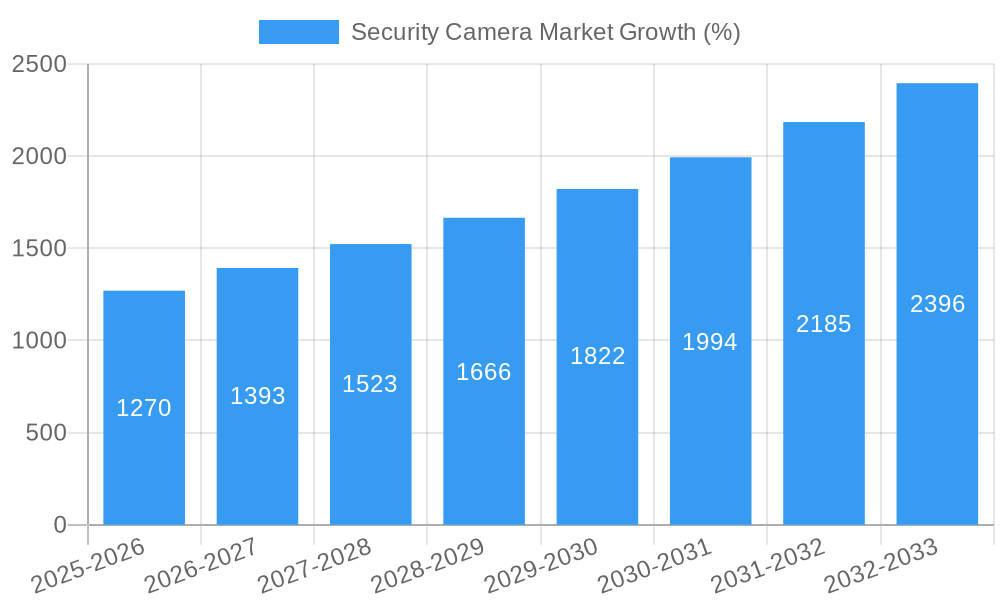

The global security camera market, valued at $12.10 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.59% from 2025 to 2033. This surge is driven by several key factors. Increasing concerns about security and safety, both in residential and commercial settings, are fueling demand for advanced surveillance solutions. Technological advancements, such as the rise of high-definition cameras, intelligent video analytics (IVA), cloud-based storage, and the integration of AI-powered features like facial recognition and object detection, are enhancing the capabilities and appeal of security camera systems. Furthermore, the growing adoption of smart home technologies and the increasing affordability of these systems are broadening their reach across various consumer segments. The market's expansion is also influenced by government initiatives promoting public safety and infrastructure development in many regions globally, particularly in rapidly urbanizing areas.

The competitive landscape is dominated by established players such as Hangzhou Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems, but the market also features numerous smaller, innovative companies focusing on niche segments or specific technologies. Future growth will likely be influenced by several factors. The increasing adoption of Internet of Things (IoT) technologies and the growing demand for cybersecurity solutions for connected devices will shape the direction of the market. The development and wider availability of 5G network infrastructure will play a critical role in supporting the transmission and storage of high-resolution video data from connected cameras. Furthermore, regulatory changes and privacy concerns related to data collection and usage will influence market strategies and product development. The market's future trajectory will depend on successfully balancing technological innovation with responsible data management and consumer privacy.

Security Camera Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global security camera market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report utilizes data from the historical period of 2019-2024 and leverages extensive market research to deliver valuable insights for industry professionals. The report segments the market into various categories, offering a granular understanding of the parent market (Security Systems) and its child market (Security Cameras). Market values are presented in million units.

Security Camera Market Dynamics & Structure

The security camera market is characterized by intense competition, with a few major players holding significant market share. Market concentration is high, particularly amongst the top 5 manufacturers, who collectively hold approximately xx% of the global market. Technological innovation is a key driver, with advancements in areas such as AI, deep learning, and higher resolutions pushing market growth. Regulatory frameworks, varying across regions, impact market access and adoption rates. Furthermore, the existence of competitive product substitutes, such as drones and other surveillance technologies, presents challenges to the industry.

- Market Concentration: High, with top 5 players holding xx% market share (2025).

- Technological Drivers: AI-powered analytics, higher resolution imaging, improved IR technology.

- Regulatory Framework: Regional variations impact adoption and market access.

- Competitive Substitutes: Drones, other surveillance technologies.

- End-User Demographics: Strong growth driven by increasing adoption across residential, commercial, and government sectors.

- M&A Trends: xx M&A deals recorded in the last 5 years, primarily focusing on technological integration and market expansion.

Security Camera Market Growth Trends & Insights

The global security camera market experienced significant growth during the historical period (2019-2024), exhibiting a CAGR of xx%. This growth is primarily driven by increasing security concerns, technological advancements, and the growing adoption of smart security systems. Market size is projected to reach xx million units by 2025, further expanding to xx million units by 2033, with a projected CAGR of xx% during the forecast period. Increased penetration in emerging markets, coupled with the rising demand for high-resolution and AI-enabled cameras, will contribute significantly to this growth. Consumer behavior shows a clear shift towards smart, integrated security solutions that offer remote monitoring and advanced analytics. Technological disruptions, such as the introduction of 5G and edge computing, are further accelerating market expansion. Market penetration has increased from xx% in 2019 to xx% in 2024, and is expected to reach xx% by 2033.

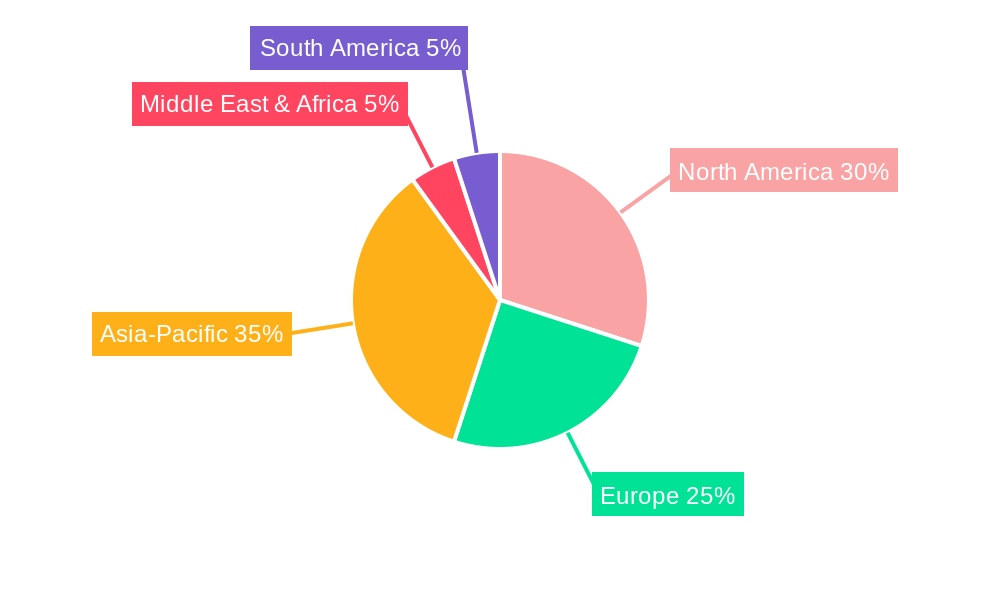

Dominant Regions, Countries, or Segments in Security Camera Market

North America and Asia-Pacific currently dominate the security camera market, holding xx% and xx% of the global market share respectively (2025). This dominance is fueled by factors such as robust infrastructure, high technological adoption rates, and favorable government regulations. North America benefits from a strong focus on security, while Asia-Pacific showcases rapid economic growth and increasing urbanization, driving demand for security solutions. Europe shows considerable growth potential, driven by strengthening security infrastructure and regulations, and is expected to increase its share to xx% by 2033.

- North America: High security consciousness, advanced technology adoption.

- Asia-Pacific: Rapid urbanization, economic growth, rising middle class.

- Europe: Strengthening security infrastructure, favorable government regulations.

- Other Regions: Growing adoption rates, albeit at a slower pace.

Security Camera Market Product Landscape

The security camera market offers a diverse range of products, including IP cameras, analog cameras, PTZ cameras, dome cameras, bullet cameras, and thermal cameras. Each type caters to specific needs and applications. Recent innovations focus on improved image quality (higher resolutions), enhanced analytics capabilities using AI and deep learning, and more compact designs for ease of installation. Unique selling propositions include features like advanced analytics, integrated cloud storage, and robust cybersecurity measures.

Key Drivers, Barriers & Challenges in Security Camera Market

Key Drivers:

- Increasing security concerns across residential, commercial, and government sectors.

- Technological advancements such as AI, deep learning, and higher resolutions.

- Government initiatives promoting security infrastructure development.

- Growing adoption of IoT and smart security systems.

Key Challenges and Restraints:

- High initial investment costs for advanced security systems.

- Cybersecurity vulnerabilities and data privacy concerns.

- Supply chain disruptions impacting component availability and costs.

- Stringent regulatory requirements and compliance challenges. Estimated impact on market growth: xx%.

Emerging Opportunities in Security Camera Market

- Growing demand for AI-powered video analytics for enhanced security.

- Expansion into untapped markets in developing economies.

- Development of specialized cameras for specific applications (e.g., traffic monitoring, environmental surveillance).

- Increasing integration with other smart home and building automation systems.

Growth Accelerators in the Security Camera Market Industry

The long-term growth of the security camera market will be driven by several factors, including ongoing technological advancements (particularly AI-driven solutions), strategic partnerships between camera manufacturers and software/service providers, and expansion into new applications and markets. Government initiatives promoting smart cities and enhanced security infrastructure will also contribute significantly to sustained growth.

Key Players Shaping the Security Camera Market Market

- Hangzhou Hikvision Digital Technology Co Ltd

- Dahua Technology Co Ltd

- Axis Communication

- Bosch Security Systems GmbH

- Hanwha Group

- Avigilon Corporation

- Tyco (A Johnson Controls Brand)

- Infinova Corporation

- Uniview Technologies Co Ltd

- Vivotek Inc (A Delta Group Company)

- Lorex Corporation

- Shenzhen TVT Digital Technology Co Ltd

- Shenzhen Sunell Technology Corporation

- CP PLUS

- JER TECHNOLOGY CO LTD

- Pelco (Motorola Solutions Inc )

- Honeywell Security (Honeywell International Inc )

- Canon USA Inc (Cannon Inc )

- Sony Group Corporation

- Panasonic Holdings Corporation

- *List Not Exhaustive

Notable Milestones in Security Camera Market Sector

- September 2024: Axis Communications launched the next-generation AXIS M31 Series turret-style cameras, featuring AI-powered edge analytics and improved resolution. This launch expands the company’s product portfolio and reinforces its position in the high-resolution camera market.

- March 2024: Dahua Technology introduced the X-Spans series, a panoramic camera with integrated PTZ and tracking capabilities. This innovative product offers a cost-effective solution for large-area surveillance, potentially disrupting the market by reducing the need for multiple cameras.

In-Depth Security Camera Market Market Outlook

The future of the security camera market looks promising, with continued growth driven by technological advancements, increasing demand for smart security solutions, and expansion into new applications. Strategic partnerships and mergers and acquisitions will further accelerate market consolidation and innovation. The market’s potential lies in leveraging AI and deep learning to offer enhanced analytics and improved security, ultimately leading to more efficient and effective surveillance systems across various sectors.

Security Camera Market Segmentation

-

1. Type

- 1.1. Analog Cameras

- 1.2. IP Cameras

-

2. End-User Industry

- 2.1. Banking and Financial Institutions

- 2.2. Transportation and Infrastructure

- 2.3. Government and Defense

- 2.4. Healthcare

- 2.5. Industrial

- 2.6. Retail

- 2.7. Enterprises

- 2.8. Residential

- 2.9. Others

Security Camera Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Security Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Initiatives for Public Safety and Security; Advancements in Security Camera Technologies

- 3.3. Market Restrains

- 3.3.1. Increasing Government Initiatives for Public Safety and Security; Advancements in Security Camera Technologies

- 3.4. Market Trends

- 3.4.1. Enterprise End-User Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog Cameras

- 5.1.2. IP Cameras

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Banking and Financial Institutions

- 5.2.2. Transportation and Infrastructure

- 5.2.3. Government and Defense

- 5.2.4. Healthcare

- 5.2.5. Industrial

- 5.2.6. Retail

- 5.2.7. Enterprises

- 5.2.8. Residential

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Security Camera Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Analog Cameras

- 6.1.2. IP Cameras

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Banking and Financial Institutions

- 6.2.2. Transportation and Infrastructure

- 6.2.3. Government and Defense

- 6.2.4. Healthcare

- 6.2.5. Industrial

- 6.2.6. Retail

- 6.2.7. Enterprises

- 6.2.8. Residential

- 6.2.9. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Security Camera Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Analog Cameras

- 7.1.2. IP Cameras

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Banking and Financial Institutions

- 7.2.2. Transportation and Infrastructure

- 7.2.3. Government and Defense

- 7.2.4. Healthcare

- 7.2.5. Industrial

- 7.2.6. Retail

- 7.2.7. Enterprises

- 7.2.8. Residential

- 7.2.9. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Security Camera Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Analog Cameras

- 8.1.2. IP Cameras

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Banking and Financial Institutions

- 8.2.2. Transportation and Infrastructure

- 8.2.3. Government and Defense

- 8.2.4. Healthcare

- 8.2.5. Industrial

- 8.2.6. Retail

- 8.2.7. Enterprises

- 8.2.8. Residential

- 8.2.9. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Security Camera Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Analog Cameras

- 9.1.2. IP Cameras

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Banking and Financial Institutions

- 9.2.2. Transportation and Infrastructure

- 9.2.3. Government and Defense

- 9.2.4. Healthcare

- 9.2.5. Industrial

- 9.2.6. Retail

- 9.2.7. Enterprises

- 9.2.8. Residential

- 9.2.9. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Security Camera Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Analog Cameras

- 10.1.2. IP Cameras

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Banking and Financial Institutions

- 10.2.2. Transportation and Infrastructure

- 10.2.3. Government and Defense

- 10.2.4. Healthcare

- 10.2.5. Industrial

- 10.2.6. Retail

- 10.2.7. Enterprises

- 10.2.8. Residential

- 10.2.9. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Security Camera Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Analog Cameras

- 11.1.2. IP Cameras

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Banking and Financial Institutions

- 11.2.2. Transportation and Infrastructure

- 11.2.3. Government and Defense

- 11.2.4. Healthcare

- 11.2.5. Industrial

- 11.2.6. Retail

- 11.2.7. Enterprises

- 11.2.8. Residential

- 11.2.9. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Dahua Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Axis Communication

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bosch Security Systems GmbH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hanwha Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Avigilon Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Tyco (A Johnson Controls Brand)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Infinova Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Uniview Technologies Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Vivotek Inc (A Delta Group Company)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Lorex Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Shenzhen TVT Digital Technology Co Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Shenzhen Sunell Technology Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 CP PLUS

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 JER TECHNOLOGY CO LTD

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Pelco (Motorola Solutions Inc )

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Honeywell Security (Honeywell International Inc )

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Canon USA Inc (Cannon Inc )

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Sony Group Corporation

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Panasonic Holdings Corporation*List Not Exhaustive

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: Global Security Camera Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Security Camera Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Security Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Security Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Security Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Security Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Security Camera Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 8: North America Security Camera Market Volume (Billion), by End-User Industry 2024 & 2032

- Figure 9: North America Security Camera Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 10: North America Security Camera Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 11: North America Security Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Security Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Security Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Security Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Security Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 16: Europe Security Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 17: Europe Security Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Security Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 19: Europe Security Camera Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 20: Europe Security Camera Market Volume (Billion), by End-User Industry 2024 & 2032

- Figure 21: Europe Security Camera Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 22: Europe Security Camera Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 23: Europe Security Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Security Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Security Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Security Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Security Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 28: Asia Security Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 29: Asia Security Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Security Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 31: Asia Security Camera Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 32: Asia Security Camera Market Volume (Billion), by End-User Industry 2024 & 2032

- Figure 33: Asia Security Camera Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 34: Asia Security Camera Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 35: Asia Security Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Security Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Security Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Security Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia and New Zealand Security Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 40: Australia and New Zealand Security Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 41: Australia and New Zealand Security Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Australia and New Zealand Security Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 43: Australia and New Zealand Security Camera Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 44: Australia and New Zealand Security Camera Market Volume (Billion), by End-User Industry 2024 & 2032

- Figure 45: Australia and New Zealand Security Camera Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 46: Australia and New Zealand Security Camera Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 47: Australia and New Zealand Security Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia and New Zealand Security Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Australia and New Zealand Security Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Security Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Security Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Latin America Security Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 53: Latin America Security Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Latin America Security Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Latin America Security Camera Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 56: Latin America Security Camera Market Volume (Billion), by End-User Industry 2024 & 2032

- Figure 57: Latin America Security Camera Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 58: Latin America Security Camera Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 59: Latin America Security Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Latin America Security Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Latin America Security Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Latin America Security Camera Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Middle East and Africa Security Camera Market Revenue (Million), by Type 2024 & 2032

- Figure 64: Middle East and Africa Security Camera Market Volume (Billion), by Type 2024 & 2032

- Figure 65: Middle East and Africa Security Camera Market Revenue Share (%), by Type 2024 & 2032

- Figure 66: Middle East and Africa Security Camera Market Volume Share (%), by Type 2024 & 2032

- Figure 67: Middle East and Africa Security Camera Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 68: Middle East and Africa Security Camera Market Volume (Billion), by End-User Industry 2024 & 2032

- Figure 69: Middle East and Africa Security Camera Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 70: Middle East and Africa Security Camera Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 71: Middle East and Africa Security Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East and Africa Security Camera Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Middle East and Africa Security Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East and Africa Security Camera Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Security Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Security Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Security Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Security Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Security Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Global Security Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: Global Security Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Security Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Security Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Global Security Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Global Security Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Global Security Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: Global Security Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Security Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Global Security Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Security Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Global Security Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 22: Global Security Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 23: Global Security Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Security Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Kingdom Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Germany Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: France Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Global Security Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Security Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 33: Global Security Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 34: Global Security Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 35: Global Security Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Security Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 37: China Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: China Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: India Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: India Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Japan Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: South Korea Security Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Security Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Global Security Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Global Security Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 47: Global Security Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 48: Global Security Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 49: Global Security Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Security Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 51: Global Security Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Security Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 53: Global Security Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 54: Global Security Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 55: Global Security Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Security Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 57: Global Security Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Security Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 59: Global Security Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 60: Global Security Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 61: Global Security Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Security Camera Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Camera Market?

The projected CAGR is approximately 10.59%.

2. Which companies are prominent players in the Security Camera Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology Co Ltd, Axis Communication, Bosch Security Systems GmbH, Hanwha Group, Avigilon Corporation, Tyco (A Johnson Controls Brand), Infinova Corporation, Uniview Technologies Co Ltd, Vivotek Inc (A Delta Group Company), Lorex Corporation, Shenzhen TVT Digital Technology Co Ltd, Shenzhen Sunell Technology Corporation, CP PLUS, JER TECHNOLOGY CO LTD, Pelco (Motorola Solutions Inc ), Honeywell Security (Honeywell International Inc ), Canon USA Inc (Cannon Inc ), Sony Group Corporation, Panasonic Holdings Corporation*List Not Exhaustive.

3. What are the main segments of the Security Camera Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Initiatives for Public Safety and Security; Advancements in Security Camera Technologies.

6. What are the notable trends driving market growth?

Enterprise End-User Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Government Initiatives for Public Safety and Security; Advancements in Security Camera Technologies.

8. Can you provide examples of recent developments in the market?

September 2024: Axis Communications unveiled the next generation of its AXIS M31 Series turret-style cameras. These compact and discreet cameras are designed for flexible installation in both indoor and outdoor settings. The AXIS M3125-LVE boasts a 2 MP resolution, while its counterparts, the AXIS M3126-LVE and AXIS M3128-LVE, offer enhanced 4 MP and 8 MP resolutions, respectively. The cameras feature WDR technology, preserve details in scenes with light and dark areas, and Optimized IR, enabling effective surveillance in complete darkness. Equipped with a deep learning processing unit (DLPU), these AI-powered cameras facilitate robust edge analytics.March 2024: Dahua Technology has launched its latest innovation, the X-Spans series. This advanced camera unit seamlessly integrates panoramic scene overviews with PTZ and tracking capabilities. The series features two unique modes: Combined Mode, where panoramic and detail sensors work together for intelligent tracking, and Independent Mode, allowing channels to function separately with different AI features. This dual-mode configuration broadens coverage for large areas and various viewing angles, potentially reducing the need for additional cameras and cabling. Consequently, it offers a budget-friendly monitoring solution adaptable to multiple environments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security Camera Market?

To stay informed about further developments, trends, and reports in the Security Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence